flag chart pattern?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

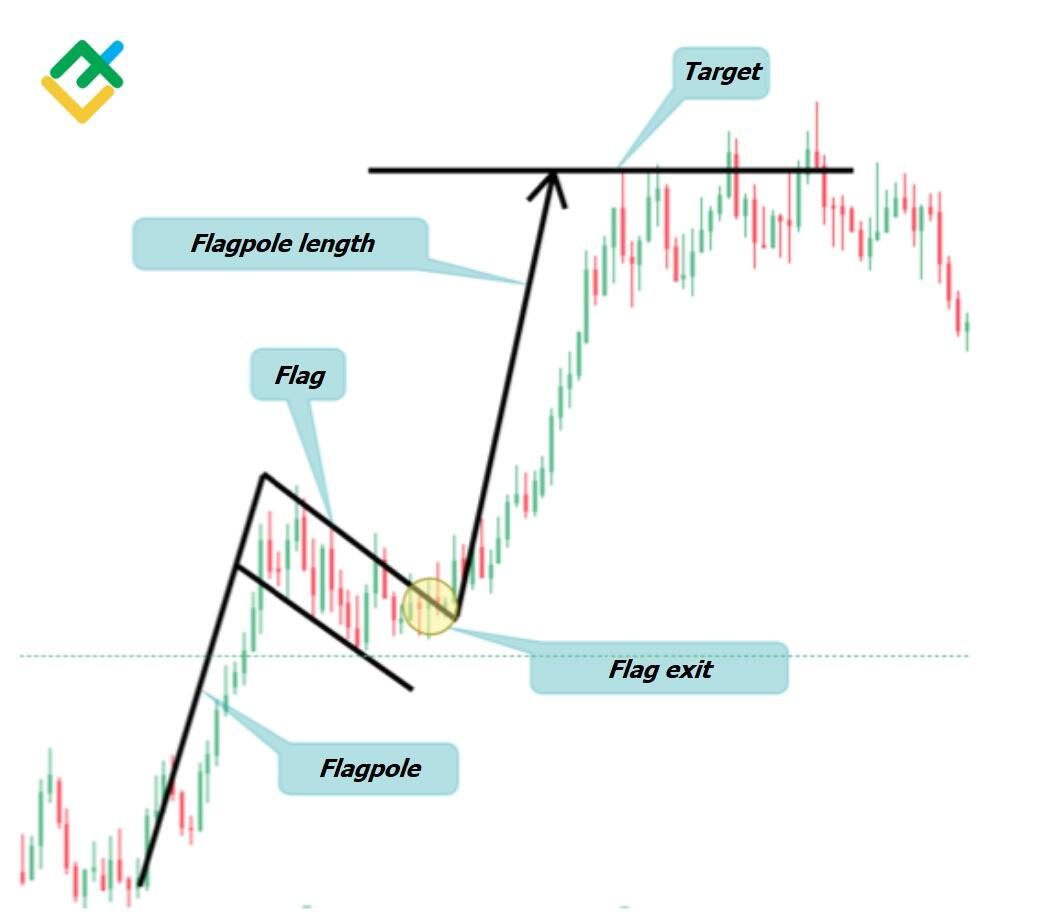

Flag chart pattern ek technical analysis tool hai jo price chart par dekhne ko milta hai. Ye pattern generally trend continuation ke signals provide karta hai. Flag pattern, price movement ke rectangular shape ki formation hoti hai, jahan price trend ke against ek chhota sa consolidation phase hota hai. flag chart pattern? Flag pattern ko identify karne ke liye, ek uptrend ya downtrend ke baad price ke consolidation phase ke dauran price ke do parallel trend lines draw ki jati hai. Uptrend ke case mein, upper trend line ko resistance line aur lower trend line ko support line kaha jata hai. Isi tarah, downtrend ke case mein upper trend line ko support line aur lower trend line ko resistance line kaha jata hai. Flag pattern mein price consolidation phase ke baad, price typically pichle trend ke direction mein move karta hai. Is movement ko "breakout" kaha jata hai. Agar price uptrend ke baad breakout karta hai, toh ye bullish flag pattern kehte hai aur agar price downtrend ke baad breakout karta hai, toh ye bearish flag pattern kehte hai.Flag pattern ka target price calculate karne ke liye, consolidation phase ki height ko breakout point se measure kiya jata hai. Is height ko flag pole kehte hai. Bullish flag pattern mein, target price flag pole ko upar move karke calculate kiya jata hai. Bearish flag pattern mein, target price flag pole ko neeche move karke calculate kiya jata hai.Flag pattern ko confirm karne ke liye, volume aur price movement ka analysis bhi kiya jata hai. Volume ki increase ya decrease aur breakout ke samay ki price movement ka dhyan rakhna important hai.Flag pattern ek popular technical analysis tool hai aur traders ise price movement ka direction aur target price ko identify karne ke liye istemaal karte hai. Lekin, jaise har technical indicator ka hai, flag pattern ka bhi istemaal karne se pehle dusre indicators aur analysis techniques ke saath confirm karna zaroori hai. -

#3 Collapse

Assalamu Alaikum Dosto!

Flag Chart Pattern

Flag pattern aik technical traders ke liye chart formation hai jisey potential trend continuations pehchanne ke liye istemal kiya jata hai. Traders aksar flag patterns ko pasand karte hain kyun ke ismein aane wale ahem trends ki khobeyan hoti hain. Flag patterns ke do main types hotey hain: bull flag aur bear flag.

Key Points- Flag pattern aur uski chart formation ko pehchanne ke liye pole ki taraf ka rukh dekh kar bull flag aur bear flag ko pehchanne ke liye breakout ki taraf ki ummid rakhi jati hai.

- Trade pattern ko jab price consolidation phase mein badhne par karein, aur yeh tafzilat ke saath ho to volume mein izafey ko dekhein.

- Dhyan dein ke flag patterns ko hamesha kaamyaab nahi hota hai, is liye trade mein hamesha ek stop loss shamil karain.

- Flag pattern aik technical analysis price pattern hai jo bataata hai ke mojooda trend ki jari rahein ka aagaaz hone wala hai. Isay badi trends ke hone ki mukhlis pasandidgi ke liye chuna jata hai kyun ke iske banne ke baad shaktishaali trends bhi nikal sakte hain.

Bullish Flag vs. Bearish Flag

Flag pattern ke do mukhya hisse hote hain, aik flagpole aur aik flag. Flagpole pehli keemat chali gayi price move hai, jo ke ya to bullish ho sakti hai ya bearish, aur ek mazboot aur tezi se price movement ko darust karti hai. Flagpole ke baad, flag banta hai. Yeh aam taur par rectangle ya parallelogram-shaped consolidation period ke roop mein aata hai, jismein aksar flagpole ki taraf ulatne wali trend lines hoti hain. Flag formation aam taur par thoda sa muddat tak hoti hai, jaise kuch din ya kuch hafton tak.

Bullish Flag Pattern

Bull flag pattern aik khaas qisam ki flag formation hai jo ek uptrend ki jari rahein ka aagaaz batata hai. Aam taur par yeh aik tazi uptrend ke baad aati hai, jise flagpole kehte hain, uske baad consolidation period hoti hai. Bull flag pattern mein flag, pehle ke uptrend ke ulte rukh mein hoti hai.

Bull flag banate waqt, volume kam hone lagega, jo ke kam bechne wale dabav ko darust karta hai. Yeh consolidation phase traders ki taraf se munafa ghatai ya aik waqt ki tawajjo ke doran hota hai, phir price upper trend line se bahar nikal kar badhne lagti hai, jo ke zyada volume ke sath hota hai, bullish trend ki jari rahein ke aagaaz ko darust karta hai.

[COLOR="#FF0000] Bear Flag Pattern [/COLOR]

Bear flag pattern bull flag ka ulta version hota hai. Bear flag pattern ek downtrend ki jari rahein ka aagaaz batata hai, aur bull flag pattern ke ulte rukh mein hota hai. Yeh aik ahem nichle price decline ke baad banta hai, uske baad consolidation period hoti hai. Bear flag pattern mein flag ko upper-sloping parallel trend lines se darust kiya jata hai.

Bear flag banate waqt, volume kam hone lagega, jo ke khareedne wale interest mein kami ko darust karta hai. Is consolidation phase mein, price aksar flag ki lower trend line ke nichay se bahar nikalta hai, jo ke zyada volume ke sath hota hai, aur yeh bearish trend ka jari rahein ka aagaaz darust karta hai.

Difference between Bullish & Bearish Flag Pattern

Bull flag aur bear flag patterns do alag continuation patterns hai jo traders forex market mein dekhte hain. Jabke in dono patterns mein unke structure aur formation mein kuch milta julta hota hai, in dono patterns ke darmiyan aham farq hai.

Iska pehla farq unke directional effects mein hota hai. Bull flag aik uptrend ki jari rahein ke baad dobara tijarat ko agahi dene wala hota hai, jisey ke khareedne wale dubara tayyar ho rahe hote hain aur dobara tezi se badhne ke liye. Iske opposite, bear flag, bhi ek continuation pattern hai, jo downward trend ko jari rakhne ka ishara deta hai, yani ke bechne wale control ko dobara hasil kar rahe hain aur price aur neeche girne ki zarori hai.

Ek aur ahem farq flag formation ki jhukav mein hota hai. Bull flag pattern mein flag aam taur par side mein hoti hai ya nichay ki taraf nahi hoti, jabke bear flag pattern mein parallel lines upper ki taraf hote hain. Ye mukhlis rukh bataate hain ya market mein rukawat ya ek moratorium se pehle price mein rukawat hai.

Bull aur bear flags ke beech ke farq ko samajh kar traders ko potential trading opportunities pehchanne mein madad milti hai. In patterns ko anya tafseelat ke sath jama karke inke ke jariye aane wale trades ki darustgi ko tasdiq karne aur safalta se trade karne ki imkan barhane mein madad milti hai.

Trading

Bull aur bear flags traders ke liye ahem trading patterns hain, jo potential trend trading opportunities mein insights pradan karte hain. Flag patterns ko kaise trade karna hai, is jankari ke sath traders in formations se fayda utha sakte hain. Neeche, hum dono bull aur bear flag patterns ko trade karne ke liye strategies ko explore karenge.

Bull Flag Trading

Bullish flag pattern consolidation phase pehchanne ke liye aik tijarat ko tarjih dene wala hota hai, jo aik upward trend ke andar hoti hai, aur bullish movement ki jari rahein ka jari rahein ka aagaaz hone ka intezar karta hai. Neeche chaliye, bullish flag pattern ko trade karne ke liye 4 ahem qadam dekhte hain.

- Bull Flag Ko Pehchanen: A sharp upward price movement (bullish pole) ke bad aik consolidation period (flag) ko dhundhein. Flag ko downward-sloping parallel trend lines ke upar rehne wale resistance line se bahar nikal kar trade karein. Agar flag side mein hai aur downward-sloping nahi hai, to flat top breakout par long position trade karein.

- Target Price: Bull flag price pole ki tarah rally dekh sakta hai. Pole ki lambai ko nap kar aur breakout point se upar ke taraf project karke yeh aapke price trend ke liye potential target ke taur par kaam kar sakta hai.

- Stop Loss: Bullish flag ke liye stop loss flag structure ke sabse niche point par rakha jayega. Jab price upar badhti hai, to lowest point par retest dusri pattern hone ki salahiyat deta hai.

Bear flags ko trade karna bull flag patterns ki tarah hota hai, lekin nichay ke rukh mein.

- Bear Flag Ko Pehchanen: Aik important downward price trend (bearish pole) ko dhoondhein, jise aik side range (flag) ke baad milta hai. Bearish flag consolidation ko upward-sloping ke taur par dikhayein.

- Entry Point: Jab price strong volume par support level ke nichay se breakout kare, to short position enter karein. Yeh breakdown pichli downtrend ki jari rahein ke aagaaz ka darust karne ki taraf ishara karta hai.

- Target Price: Pole ki lambai ko nap kar aur breakout entry point se niche ke taraf project karke yeh price depreciation ke liye potential target ke taur par kaam kar sakta hai.

- Stop Loss: Stop loss consolidation ki sabse oonchai point ke upar rakha jayega.

Benifits & Limitations/ Risks

Flag chart pattern ko trade karna traders ke liye kai fayde pesh karta hai. Yahan kuch fayde hain:

- Trend Continuation Signals: Bull aur bear flag patterns trend ki direction ki ahem batain pesh karte hain, jisse traders mojooda market trend ke saath apni positions ko milti hai.

- Defined Entry and Exit Points: In patterns mein breakout levels ke adhar par wazeh entry aur exit points pesh kiye jate hain, jo traders ko darust entry orders set up karne aur apni positions ko kamyab taur par manage karne mein madadgar hote hain.

- Risk-to-Reward Ratio: Flag patterns aksar breakout points ke adhar par mukhlis stop-loss levels rakhte hain, jo traders ko unke trades ke liye munafa-o-mazad karne aur faida uthane ke liye faizyab risk-to-reward ratios ka hissab lagane mein madadgar hote hain.

Bull aur bear flag patterns ke sath to unke fayde hain, lekin in patterns ke sath trading ke kuch risks bhi hote hain, jaise:

- False Breakouts: Kabhi-kabhi, flag patterns false breakouts ko dikhate hain jisme price pattern se bahar nikalta hai aur phir tezi se ulta ho jata hai, jo traders ke liye nuksan ka baiys ban sakta hai.

- Market Volatility: Flag patterns market ki high volatility ke doraan banti hain, jo aksar price fluctuations aur zyada risk ke level ko paida kar sakti hai, khaaskar jab leverage ka istemal hota hai.

- Failed Patterns: Sabhi flag patterns safalta se trade nahi hoti. Kabhi-kabhi, price breakout hone ke bawajood aashankayein puri nahi hoti hain.

Bull aur bear flag patterns ki fayde aur risk ko samajh kar traders behtar faislay lene aur apne risk ko effectively manage karne mein behtar tayyar hote hain, aur apni trading performance ko behtar banane mein madadgar hote hain.

Flags vs. Pennants

Kyunki bull aur bear flag patterns aksar technical analysis mein istemal ki jati hain, isliye inko ek dusre se mukhtalif pattern, jise pennant kehte hain, se alag pehchanne mein ahem hai. Neeche flags aur pennants ke darmiyan key farq diye gaye hain.

- Shape: Flags aur pennants dono consolidation patterns hain, lekin unke shakal mein farq hota hai. Flags rectangular ya parallelogram ke shakal mein hoti hain, jabke pennants ek chhote symmetrical triangle ke zyada nazdeek aati hain.

- Trend Lines ki Rukh: Bull aur bear flag patterns ke andar formation ke trend lines jo pichli price move ke opposite rukh mein hote hain. Mukhlis rukh mein, pennants ki trend lines ek-dusre ke nazdeek hote hain, aik symmetrical triangle banate hain.

- Duration: Flags typically short-term period ke liye hoti hain jabke pennants jaldi se banti hain.

Flags aur pennants ke darmiyan farq ko samajhna traders ko mukhtalif chart patterns ko sahi tarah se pehchanne aur samjne mein madad karta hai. Dono chart patterns ko unke technical analysis mein shamil karke, traders apni trading opportunities ko broad karte hain.

-

#4 Collapse

Introduce of Flag Chart Pattern

Aoa Ummid karta hon Sab Theek hon gy AJ Flag PATTERN aik technical traders ke liye chart formation hai jisey potentially Trending continuations pehchanne ke liye istemal kiya jata hai. Traders aksar flag patterns ko pasand karte hain kyun ke ismein aane wale ahem trends ki khobeyan hoti hain. Flag patterns ke do main types ko Yeah Trah hon gy

The Explanation of Flag Chart Pattern

Dear Jab bh Flag pattern aur uski chart formation ko pehchanne ke liye pole ki taraf ka rukh dekh kar bull flag aur bear flag ko pehchanne ke liye breakout ki taraf ki ummid rakhi jati hai.Trader Ess PATTERN ko jab price consolidation phase mein badhne par karein, aur yeh tafzilat ke saath ho to volume mein izafey ko dekhein.Dhyan dein ke flag patterns ko hamesha kaamyaab nahi hota hai, is liye trade mein hamesha ek stop loss shamil karain.

Flag pattern aik technically analysis price pattern hai jo bataata hai ke mojooda trend ki jari rahein ka aagaaz hone wala hai. Isay badi trends ke hone ki mukhlis pasandidgi ke liye chuna jata hai kyun ke iske banne ke baad shaktishaali trending Say Hi Possible hy...

Bullish Flag and Bearish Flag Pattern

Dear Friend's Jab bh FLAG PATTERN ke do mukhya hisse hote hain, aik flagpole aur aik flag. Flagpole pehli keemat chali gayi price move hai, jo ke ya to bullish ho sakti hai ya bearish, aur ek mazboot aur tezi se price Movement ko darust karti hai. Flagpole ke baad, FLAG banta hai. Yeh aam taur par rectangle ya parallelogram-shaped consolidation period ke roop mein aata hai, jismein aksar flagpole ki taraf ulatne wali trend lines hoti hain. Flag formation aam taur par thoda sa muddat tak hoti hai, jaise kuch din ya kuch week Mein Possible ho gy

Bullish Flag Pattern Formation

Sir, Ess Bull FLAG PATTERN aik khaas qisam ki flag formation hai jo ek uptrend ki jari rahein ka aagaaz batata hai. Aam taur par yeh aik tazi uptrend ke baad aati hai, jise flagpole kehte hain, uske baad consolidation periods hoti hai. Bull flag pattern mein flag, pehle ke uptrend ke ulte rukh mein hoti hai.

Bull flag banate waqt, volume kam hone lagega, jo ke kam bechne wale dabav ko darust karta hai. Yeh consolidation phase traders ki taraf se munafa ghatai ya aik waqt ki tawajjo ke doran hota hai, phir price upper trend line se bahar nikal kar badhne lagti hai, jo ke zyada volume ke sath hota hai, bullish trend ki jari rahein ke aagaaz hi Say Trade ho Jay

Bear Flag Chart Pattern

Dear Ess Bear FLAG pattern bull flag ka ulta version hota hai. Bear flag pattern ek downtrend ki jari rahein ka aagaaz batata hai, aur bull flag pattern ke ulte rukh mein hota hai. Yeh aik ahem nichle price decline ke baad banta hai, uske baad consolidation periods hoti hai. Bear flag pattern mein flag ko upper-sloping parallel Trending lines se darust kiya jata hai.

Bear FLAG banate waqt, volume kam hone lagega, jo ke khareedne wale interest mein kami ko darust karta hai. Is consolidation phase mein, price aksar flag ki lower trend line ke nichay se bahar nikalta hai, jo ke zyada volume ke sath hota hai, aur yeh bearish trend ka jari rahein Tu Hi Trade Len gy

Differences betweens Bullish & Bearish FLAG Patterns

Friend's Jab bh Bull FLAG aur bear flag patterns do alag continuation patterns hai jo traders forex market mein dekhte hain. Jabke in dono patterns mein unke structure aur formation mein kuch milta julta hota hai, in dono PATTERNS ke darmiyan aham farq hai.

Iska pehla farq unke directional effects mein hota hai. Bull flag aik uptrend ki jari rahein ke baad dobara tijarat ko agahi dene wala hota hai, jisey ke khareedne wale dubara tayyar ho rahe hote hain aur dobara tezi se badhne ke liye. Iske opposite, bear flag, bhi ek continuation pattern hai, jo downward trend ko jari rakhne ka ishara deta hai, yani ke bechne wale control ko dobara hasil kar rahe hain aur price aur neeche girne ki zarori hai.

Ek aur ahem farq flag formation ki jhukav mein hota hai. Bull flag pattern mein FLAG aam taur par side mein hoti hai ya nichay ki taraf nahi hoti, jabke bear flag pattern mein parallel lines upper ki taraf hote hain. Ye mukhlis rukh bataate hain ya market mein rukawat ya ek moratorium se pehle price mein rukawat hai.

Bull aur bear Flag's ke beech ke farq ko samajh kar traders ko potential trading opportunities pehchanne mein madad milti hai. In patterns ko anya tafseelat ke sath jama karke inke ke jariye asaani Say kar Rahy Hein

Trading Stradgies

Dear Ess Bull aur bear Flag's traders ke liye ahem trading patterns hain, jo potential trend trading opportunities mein insights pradan karte hain. Flag patterns ko kaise trade karna hai, is jankari ke sath traders in formations se fayda utha sakte hain. Neeche, hum dono bull aur bear flag patterns ko trade karne ke liye strategies ko explore karenge.

Bullishness flag pattern consolidation phase pehchanne ke liye aik tijarat ko tarjih dene wala hota hai, jo aik upward trend ke andar hoti hai, aur bullish movement ki jari rahein ka jari rahein ka aagaaz hone ka intezar karta hai. Neeche chaliye, bullish flag pattern ko trade karne ke liye 4 ahem qadam say Hi Faida Ho jay ga

Trading Ess Stop Loss BULLISH FLAG ke liye stop loss flag structure ke sabse niche point par rakha jayega. Jab price upar badhti hai, to lowest point par retest dusri pattern hone ki Trah Ho Jay

-

#5 Collapse

Introduction

Flag candlestick pattern trading mein ek continuation pattern hai jo aksar taqatwar price movement ke baad paya jata hai. Is pattern ki khasiyat hoti hai ke price mein chotey samay ka consolidation ya sideways movement hota hai, jisse chart par ek rectangular-shaped flag pattern ban jati hai.

explanation of the flag candlestick pattern in trading,

Flag candlestick pattern trading mein ek continuation pattern hai jo aksar taqatwar price movement ke baad paya jata hai. Is pattern ko flag kehte hain, kyun ki iski shape ek parcham ki tarah hoti hai.

Appearance Of Flag Pattern In Trading Chart.

Jab market mein ek taqatwar trend hota hai, jaise uptrend ya downtrend, to price mein ek sudden aur tezi se movement hota hai. Jab yeh strong movement hota hai, tab woh ek trend ki direction mein jari rehta hai. Lekin jab yeh taqatwar movement kuch time ke liye ruk jata hai aur price consolidate ya sideways move karta hai, tab hum flag candlestick pattern ko dekhte hain.

Flag pattern typically ek rectangular shape banata hai jismein price ek range mein consolidate hota hai. Yeh consolidation phase trend ki continuation ko dikhata hai aur traders ko indicate karta hai ke market ko thoda sa rest lena hai.

Important Components Of Flag Pattern.

Flag pattern mein do important components hote hain: pole aur flag. Pole woh initial taqatwar movement hota hai jo flag pattern se pahle hota hai. Ismein price tezi se upar ya neeche move karti hai. phir jab pole movement ruk jata hai, to flag banta hai. Flag rectangular shape ka hota hai jismein price consolidate hoti hai aur range-bound movement hota hai.

Flag pattern ke baad, price typically wapas pole ki direction mein move karti hai. Agar uptrend tha, to price wapas upar ki taraf move karti hai, aur agar downtrend tha, to price wapas neeche ki taraf move karti hai. Yeh trend continuation ke indication ko dikhata hai.

Trading Strategy For Flag Pattern.

Flag pattern ko trade karne ke liye, traders usually breakout ke wait karte hain. Breakout jab hota hai, jab price flag pattern se bahar nikalta hai aur trend ki direction mein move karta hai. Traders is breakout ke baad entry lete hain, stop-loss aur target levels set karte hain, aur trend ke sath chalne ki koshish karte hain.

Role Of Technical Analysis And Price action In Flag Pattern.

Flag candlestick pattern ko samajhna aur trade karna technical analysis aur price action ke concepts par based hota hai. Isliye, traders ko price movement ko closely observe karna chahiye aur dusre technical tools aur indicators ke sath confirmations ko dhyan mein rakhna chahiye, jaise ki trend lines, moving averages, aur volume.

- CL

- Mentions 0

-

سا0 like

-

#6 Collapse

Flag chart pattern?

\\\Flag chart pattern ek technical analysis ka ek prakar hai jo stock market ya anya financial markets mein use hota hai. Ye pattern ek continuation pattern hota hai, jo market trend ko confirm karta hai aur traders ko market direction ke bare mein hint deta hai.

Flag chart pattern ek price consolidation phase ko darust karti hai, jahan par market mein ek temporary pause hota hai, lekin existing trend ko confirm karta hai. Flag pattern ek flag ki tarah dikhta hai, isliye is

Flag chart pattern ek technical analysis ka ek prakar hai jo stock market ya anya financial markets mein use hota hai. Ye pattern ek continuation pattern hota hai, jo market trend ko confirm karta hai aur traders ko market direction ke bare mein hint deta hai.

Flag chart pattern ek price consolidation phase ko darust karti hai, jahan par market mein ek temporary pause hota hai, lekin existing trend ko confirm karta hai. Flag pattern ek flag ki tarah dikhta hai, isliye iska naam "Flag" rakha gaya hai.

Flag pattern do prakar ke hote hain:- Bullish Flag: Bullish flag pattern jab market uptrend mein hota hai, to ek flag jaise structure create hota hai, jisme price range kam hoti hai. Isse ye pata chalta hai ki market mein temporary profit booking ho rahi hai, lekin uptrend jari hai. Is pattern ko dekhte hue traders ko long position enter karne ka mauka mil sakta hai.

- Bearish Flag: Bearish flag pattern jab market downtrend mein hota hai, to bhi ek flag jaise structure create hotahai, jisme price range kam hoti hai. Isse ye pata chalta hai ki market mein temporary buying interest hai, lekin

- overall downtrend jari hai. Is pattern ko dekhte hue traders ko short position enter karne ka mauka mil sakta hai.

Flag pattern ka identification karna technical analysis mein mahatvapurna hota hai, kyun ki ye ek strong trend continuation

signal provide karta hai. Traders is pattern ko price chart par dekhkar trading decisions lete hain aur stop-loss aur target

levels set karte hain.

Yaad rahe ki kisi bhi technical analysis pattern ki 100% guarantee nahi hoti, isliye risk management bhi hamesha zaroori hoti

hai. Flag pattern ko samajhne ke liye, technical analysis ki acchi understanding aur practice ki jarurat hoti hai.

\\\Flag chart pattern ek technical analysis ka ek prakar hai jo stock market ya anya financial markets mein use hota hai. Ye pattern ek continuation pattern hota hai, jo market trend ko confirm karta hai aur traders ko market direction ke bare mein hint deta hai.

Flag chart pattern ek price consolidation phase ko darust karti hai, jahan par market mein ek temporary pause hota hai, lekin existing trend ko confirm karta hai. Flag pattern ek flag ki tarah dikhta hai, isliye is

Flag chart pattern ek technical analysis ka ek prakar hai jo stock market ya anya financial markets mein use hota hai. Ye pattern ek continuation pattern hota hai, jo market trend ko confirm karta hai aur traders ko market direction ke bare mein hint deta hai.

Flag chart pattern ek price consolidation phase ko darust karti hai, jahan par market mein ek temporary pause hota hai, lekin existing trend ko confirm karta hai. Flag pattern ek flag ki tarah dikhta hai, isliye iska naam "Flag" rakha gaya hai.

Flag pattern do prakar ke hote hain:- Bullish Flag: Bullish flag pattern jab market uptrend mein hota hai, to ek flag jaise structure create hota hai, jisme price range kam hoti hai. Isse ye pata chalta hai ki market mein temporary profit booking ho rahi hai, lekin uptrend jari hai. Is pattern ko dekhte hue traders ko long position enter karne ka mauka mil sakta hai.

- Bearish Flag: Bearish flag pattern jab market downtrend mein hota hai, to bhi ek flag jaise structure create hotahai, jisme price range kam hoti hai. Isse ye pata chalta hai ki market mein temporary buying interest hai, lekin

- overall downtrend jari hai. Is pattern ko dekhte hue traders ko short position enter karne ka mauka mil sakta hai.

Flag pattern ka identification karna technical analysis mein mahatvapurna hota hai, kyun ki ye ek strong trend continuation

signal provide karta hai. Traders is pattern ko price chart par dekhkar trading decisions lete hain aur stop-loss aur target

levels set karte hain.

Yaad rahe ki kisi bhi technical analysis pattern ki 100% guarantee nahi hoti, isliye risk management bhi hamesha zaroori hoti

hai. Flag pattern ko samajhne ke liye, technical analysis ki acchi understanding aur practice ki jarurat hoti hai.

-

#7 Collapse

Flag Chart Pattern: A Comprehensive Guide

1. Flag Chart Pattern Kya Hai?

Flag chart pattern ek technical analysis ka tool hai jo price movements ke doran banta hai. Ye pattern ek strong trend ke baad aata hai, aur isay aksar bullish ya bearish continuation pattern ke tor par samjha jata hai. Is pattern ka asal maqsad traders ko potential price reversals ya continuations ko pehchanne me madad dena hai.

2. Flag Pattern Ki Pehchaan

Flag pattern ko do major parts mein divide kiya jata hai: flag pole aur flag itself. Flag pole wo portion hota hai jahan price sharply move karta hai, jabke flag portion consolidation phase hota hai jahan price sideways ya slightly retrace karta hai.

3. Bullish Flag Pattern

Bullish flag pattern tab banta hai jab ek strong upward movement ke baad price thodi der ke liye consolidate hota hai. Is pattern ko dekhtay hue, traders expect karte hain ke price phir se upward movement shuru karegi.

4. Bearish Flag Pattern

Bearish flag pattern ka formation tab hota hai jab price ek strong downward movement ke baad consolidate hota hai. Is case mein traders ko ye umeed hoti hai ke price phir se neeche ki taraf move karegi.

5. Flag Pole Ka Concept

Flag pole ke concept ko samajhna is pattern ko pehchanne ke liye zaroori hai. Flag pole price ki wo sharp movement hai jo flag pattern se pehle hoti hai. Ye movement ek strong trend ko darshata hai aur iski length flag pattern ke potential breakout ko forecast karne me madadgar hoti hai.

6. Flag Ki Formation

Flag ki formation sideways movement hoti hai jo generally downward sloping trendline ke saath hoti hai. Ye consolidation phase price ki volatility ko darshata hai aur ye indicate karta hai ke market indecisive hai.

7. Volume Ka Role

Flag chart pattern ke formation me volume bhi ek ahmiyat rakhta hai. Jab price flag pole ki taraf move karta hai, toh volume zyada hona chahiye. Consolidation phase ke doran volume kam ho jata hai, aur jab price breakout karta hai toh volume phir se barh jata hai.

8. Breakout Point

Breakout point wo point hai jahan price flag pattern ko todta hai. Bullish flag ke liye ye point upper trendline ko break karna hota hai, jabke bearish flag ke liye ye lower trendline ko break karna hota hai. Breakout ke time pe volume ka badhna bhi is baat ki nishani hai ke trend continuation hone wala hai.

9. Target Price Ka Andaza

Target price ko calculate karne ke liye traders flag pole ki length ko measure karte hain aur is length ko breakout point se add ya subtract karte hain. Ye technique traders ko ek estimate deti hai ke price kitna move kar sakti hai.

10. Stop-Loss Ka Placement

Stop-loss ko set karna bhi flag pattern trading ka ek zaroori hissa hai. Bullish flag ke liye, stop-loss ko flag ke neeche set kiya jata hai, jabke bearish flag ke liye isay flag ke upar rakha jata hai. Is tarah se traders apne losses ko minimize kar sakte hain.

11. Market Sentiment

Flag pattern ka istemal karte waqt market sentiment ko samajhna bhi ahmiyat rakhta hai. Agar market bullish hai, toh bullish flag pattern zyada effective hota hai. Similarly, bearish market me bearish flag patterns ka zyada asar hota hai.

12. Risk Management

Risk management flag patterns ko trade karte waqt zaroori hai. Har trade me risk-reward ratio ka khayal rakhna chahiye. Aksar traders 1:2 ya 1:3 risk-reward ratio target karte hain taake wo apne losses ko cover kar sakein.

13. Practice Aur Experience

Flag patterns ko samajhne aur trade karne ke liye practice aur experience bhi zaroori hai. Traders ko chahiye ke wo charts ka analysis karein, aur different market scenarios me in patterns ko identify karne ki koshish karein.

14. Conclusion

Flag chart pattern trading ka ek important tool hai jo traders ko market ki direction ko samajhne me madad karta hai. Is pattern ko sahi tarike se pehchanna aur analyze karna aapki trading strategy ko behtar bana sakta hai. Sahi tools aur knowledge ke saath, aap in patterns ka faida utha sakte hain aur profitable trades kar sakte hain. Trading me success ke liye aapko consistency, discipline, aur knowledge ki zaroorat hoti hai.

-

#8 Collapse

Flag Chart Pattern

Flag chart pattern ek technical analysis ka tool hai jo price movement ke chhote periods mein consolidation ya sideways movement ko represent karta hai. Is pattern ka naam “flag” is liye rakha gaya hai kyun ke iska shape ek flag ki tarah nazar aata hai, jisme price ek sharp move ke baad thoda samay ke liye sideways ya chhoti range mein move karta hai.

Flag pattern aksar trending markets mein dekha jata hai, jahan pe price pehle ek strong move karta hai (ye move generally ek “flagpole” kehlata hai). Iske baad price mein consolidation hoti hai, jo ek rectangle ya parallelogram ki shape mein hoti hai. Yeh consolidation region ko "flag" kaha jata hai, jo flagpole ke upar ya neeche banata hai.

Flag pattern ko samajhna zaroori hota hai, kyun ke yeh ek continuation pattern hai, jo market ki current trend ko confirm karta hai. Agar flag pattern bullish hai, to price usually upar ki taraf break hoti hai, aur agar bearish hai to price neeche ki taraf break hoti hai.

Is pattern ke ban ne ke liye kuch specific criteria hote hain:- Flagpole: Flagpole ka matlab hota hai wo sharp price movement jo pattern ke pehle hoti hai. Yeh usually ek strong rally ya sharp decline hota hai.

- Flag: Flag pattern mein price ek narrow range mein sideways movement karti hai, jisme generally price lower highs aur higher lows banata hai.

- Breakout: Jab price flag ke range ko break karti hai, to yeh trend continue hone ka indication deta hai. Agar price upar break kare, to bullish trend ke continuation ka signal hota hai, jab ke neeche break karna bearish trend ka signal hota hai.

Traders flag pattern ko identify kar ke entry aur exit points ka decision lete hain. Agar aap is pattern ko sahi se samajh kar use karte hain, to aap market mein acha profit kama sakte hain. Lekin, har pattern ko confirm karna zaroori hota hai, aur iske saath volume ka analysis bhi important hota hai, ta ke aap confident ho sakain ke breakout real hai. -

#9 Collapse

-

#10 Collapse

Flag Chart Pattern

Flag chart pattern technical analysis ka ek ahem tool hai jo traders ko market ke short-term trends ko samajhne mein madad deta hai. Yeh pattern aksar strong price movements ke baad banata hai, jisme ek rapid price rise ya fall hota hai, aur phir price ek chhoti si consolidation phase (sideways movement) mein chala jata hai. Flag pattern ko samajhna trading mein faydemand ho sakta hai, lekin is pattern ki pehchan aur iske sahi use ke liye traders ko thodi practice ki zarurat hoti hai.

Flag chart pattern do major components par mabni hota hai: ek 'flag pole' aur ek 'flag'. Flag pole tab banata hai jab asset ka price rapid movement karta hai, jisme price short time mein achi khasai upar ya neeche chala jata hai. Iske baad price consolidation ke phase mein aata hai, jo flag ke roop mein nazar aata hai. Flag consolidation phase ek short-term retracement hota hai, jo price movement ko temporarily rokta hai.

Yeh flag pattern aksar ascending ya descending price channels ke andar banta hai. Agar price upward direction mein move kar raha ho, to flag upward-sloping hota hai. Agar price downward direction mein move kar raha ho, to flag downward-sloping hota hai. Yeh pattern usually consolidation ke baad price ke original direction mein continuation ko darshata hai, jise traders apni trading strategies mein istemal karte hain.

Flag pattern ko identify karna relatively aasan hota hai agar aap price action ko closely monitor karein. Flag pole ki formation ke baad, consolidation phase ko dekha jata hai, jisme price ek narrow range mein trade karta hai. Jab price consolidation ke phase se nikalta hai aur flag pole ki direction mein dobara se move karta hai, to yeh breakout ke signal ki tarah samjha jata hai. Yeh signal aksar traders ko opportunity deta hai ke woh apni position ko open karen aur price ke further movement ka fayda uthayein.

Flag chart pattern ko trading mein kaafi useful maana jata hai kyunki yeh short-term market trends ko predict karne mein madad karta hai. Lekin, is pattern ka use karte waqt risk management ka khayal rakhna bhi zaruri hai, taki market ki unexpected movements se bach sakein. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

**Flag Chart Pattern: Aek Strong Continuation Pattern**

Flag chart pattern Forex aur stock trading mein ek famous continuation pattern hai, jo market mein ek strong trend ke baad banta hai. Yeh pattern market ke movement ko ek flag ke shape mein dikhata hai, jisme ek sharp rally ke baad price thoda consolidate hota hai aur phir trend ko continue karta hai. Flag pattern kaafi reliable hota hai aur traders isse profit lene ke liye use karte hain.

**Flag Pattern Ka Structure**

Flag chart pattern do main components mein divide hota hai:

1. **Flagpole**: Flagpole pattern ka wo part hota hai jisme strong price movement hota hai. Jab market kisi direction mein sharply move karta hai, to us time jo price action hota hai usse flagpole kaha jata hai. Yeh part bohot steep aur significant hota hai aur trend ki strength ko dikhata hai.

2. **Flag**: Flagpole ke baad price consolidation mein enter karta hai, jo flag ke shape mein hota hai. Flag ek small rectangle shape ka consolidation zone hota hai, jisme price thoda range bound ho jata hai. Flag typically opposite direction mein slope karta hai, jo trend ke reversal ko nahi dikhata balkay temporary pause hoti hai.

**Flag Chart Pattern Kaise Kaam Karta Hai?**

Flag pattern market ke continuation ko indicate karta hai. Yeh tab banta hai jab price ek strong upward ya downward movement ke baad consolidate hota hai, aur phir phir usi direction mein move karne lagta hai. Flag pattern ko identify karte waqt aapko do key factors pe focus karna hota hai: flagpole ki strong movement aur flag ke consolidation ka shape.

Agar flag pattern upward trend ke baad ban raha ho, to yeh bullish signal hota hai. Aur agar flag downward trend ke baad banta hai, to yeh bearish signal hota hai. Jab flag ka breakout hota hai (yaani price flag ke boundary ko cross karta hai), to yeh ek confirmation signal hota hai ke market trend continue karega.

**Use Flag Pattern**

1. **Entry Point**: Jab flag pattern complete ho jata hai aur price breakout karta hai, to yeh entry ka best point hota hai. Agar aap bullish flag pattern dekh rahe hain, to aap buy order place kar sakte hain jab price flag ke upper boundary ko cross kare. Agar bearish flag pattern hai, to aap sell order place kar sakte hain jab price flag ke neeche break kare.

2. **Stop Loss**: Aap apna stop loss flag pattern ke opposite boundary ke thoda neeche ya upar set kar sakte hain. Isse aap risk ko control karte hain aur trade ko protect karte hain.

3. **Profit Target**: Profit target ka estimation flagpole ke length ke mutabiq hota hai. Aap apne profit target ko flagpole ke length se measure karke set kar sakte hain.

**Advantages of Flag Chart Pattern**

- **Clear Trend Continuation**: Flag pattern market ke continuation ko clearly indicate karta hai, jo traders ko trends ke sath rehne mein madad deta hai.

- **Good Risk-to-Reward Ratio**: Is pattern ke saath aap apni entry aur exit points clearly defined kar sakte hain, jo aapko achha risk-to-reward ratio de sakte hain.

- **Easy to Spot**: Flag pattern relatively easy hota hai spot karna, especially jab aap market mein strong trends dekh rahe hote hain.

**Disadvantages of Flag Chart Pattern**

- **False Breakouts**: Kabhi kabhi flag pattern ke breakouts fake hote hain, jo traders ke liye loss ka sabab ban sakte hain.

- **Consolidation Time**: Flag pattern banne mein time lag sakta hai, jo kabhi kabhi impatient traders ke liye mushkil hota hai.

**Conclusion**

Flag chart pattern ek powerful tool hai jo traders ko market trends ko follow karne mein madad deta hai. Agar aap is pattern ko sahi tareeqe se samajh kar apni strategy mein incorporate karte hain, to aap trend-following trades mein kaafi profit kama sakte hain. Lekin, hamesha yaad rakhein ke kisi bhi pattern ko use karte waqt risk management zaroori hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:45 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим