What's the Moving Average in forex

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Moving Average Forex trading mein Moving Averages (MA) aik ahem technical analysis tool hain jo market trends ko samajhne aur trading decisions banane mein madadgar hotay hain. Yeh ek simple lekin powerful indicator hai jo traders ke liye market ki direction ka andaza lagane mein istemal hota hai. Moving Averages (MA) woh statistical indicator hain jo market ke price data ko smooth aur trend mein dekhnay mein madadgar hotay hain. Yeh indicator aapko past price data ka average dikhata hai, aur isi average ko current price ke sath compare karke trend ka andaza lagaya jata hai. Moving Averages ke kuch ahem tareeqe hain: Simple Moving Average (SMA): Yeh MA aam taur par istemal hoti hai. Ismein aap specific time period ke price data ka average nikalte hain, jaise ke 10, 50, ya 200 dinon ka average. Agar SMA ka short-term average (jaise 10 din) long-term average (jaise 200 din) ko cross karta hai, to isse trend reversal ka signal mil sakta hai. Exponential Moving Average (EMA): EMA mein recent price data ko zyada weightage diya jata hai, isse iska response time SMA ke muqable kam hota hai. Traders isko short-term trends ko capture karne ke liye istemal karte hain. Weighted Moving Average (WMA): Ismein different weights assigned hotay hain recent price points ko. Isse recent price changes ka zyada asar hota hai. Moving Averages ke istemal se traders market ke trends aur reversals ko identify karte hain. Agar price MA ke upper hota hai, to yeh uptrend ki nishani ho sakti hai, jabke agar price MA ke neeche hota hai, to yeh downtrend ki taraf ishara kar sakta hai. Yeh important hai ke Moving Averages ko dusre technical indicators ke sath istemal karein aur sirf ek indicator par pura bharosa na karein. Market volatility, news, aur economic events bhi trading decisions par asar daal sakte hain. In conclusion, Moving Averages forex trading mein ahem hain kyunki yeh market trends ko samajhne aur trading strategies banane mein madadgar hote hain. Aapko samjhdar taur par inka istemal karna hoga aur risk management ke sath trading karna hoga taake aapko safalta mile. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Moving average ek technical indicator hai jo traders ko currency pair ki price action mein trends aur support aur resistance levels ko pehchanne mein madad karta hai. Isay ek khaas muddat ke liye average price nikal kar calculate kiya jata hai. Moving average ko alag-alag time frames, jaise ke 10 din, 20 din, 50 din, aur 200 din, istemal karke calculate kiya ja sakta hai.

Moving average ek trend-following indicator hai, jiska matlab hai ki ye traders ko currency pair ka overall trend pehchanne mein madad karta hai. Currency pair ki price hamesha badal rahi hoti hai, jiski wajah se ye mushkil ho jata hai ke ye upar ya niche ja rahi hai. Moving average traders ko price action mein shor ko filter karne aur trend par dhyan lagane mein madad karta hai.

Moving Averages Forex Trading Mein Kaise Kaam Karte Hain?

Moving averages kaam karte hain by ek currency pair ki price action ko ek muddat ke liye smooth banane se. Moving average ko calculate karne ke liye ek currency pair ke closing prices ko ek muddat ke liye jama karke usko us muddat ke number se divide kiya jata hai. For example, 20 din ka moving average calculate karne ke liye currency pair ke last 20 din ke closing prices ko jama karke 20 se divide kiya jata hai.

Moving average ek chart par ek line ke roop mein plot hota hai, jo traders ko currency pair ka trend pehchanne mein madad karta hai. Agar currency pair ki price moving average ke upar hai, to ye ek bullish signal hai, iska matlab hai ki trend upar ki taraf hai. Agar currency pair ki price moving average ke niche hai, to ye ek bearish signal hai, iska matlab hai ki trend niche ki taraf hai.

Moving averages traders ko support aur resistance levels pehchanne mein bhi madad kar sakte hain. Support levels wo price levels hote hain jahan ek currency pair ko buying pressure milne ki ummeed hoti hai, jo use aur niche girne se bachata hai. Resistance levels wo price levels hote hain jahan ek currency pair ko selling pressure milne ki ummeed hoti hai, jo use aur upar badhne se rokta hai. Moving averages traders ko in levels ko pehchanne mein madad karte hain kyunki ye price action ke liye ek rukawat ka kaam karte hain.

Moving Averages Ke Types

Forex trading mein traders different types ke moving averages istemal kar sakte hain. Sabse aam istemal hone wale moving averages hain:- Simple Moving Average: Ye moving average ka sabse basic type hai, jo ek currency pair ke closing prices ko ek muddat ke liye jama karke usko us muddat ke number se divide karke calculate kiya jata hai.

- Exponential Moving Average: Ye moving average sabse haal ke price action ko zyada weight deta hai, jisse ye price changes ke liye zyada sensitive hota hai.

- Weighted Moving Average: Ye moving average sabse haal ke price action ko zyada weight deta hai, lekin isme calculation mein muddat ke number ka bhi dhyan rakhta hai.

- Double Moving Average: Ye moving average do alag-alag moving averages ko combine karta hai, jaise ke 20 din ka aur 50 din ka moving average, ek zyada sahi signal dene ke liye.

Moving Averages Forex Trading Mein Istemal Kaise Hote Hain

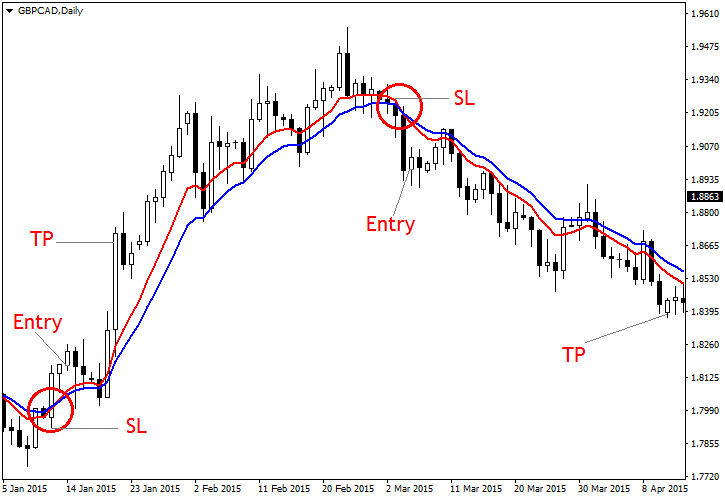

Moving averages ko forex trading mein kai tariko se istemal kiya ja sakta hai:- Trends Pehchanna: Moving averages traders ko currency pair ka overall trend pehchanne mein madad karte hain. Agar currency pair ki price moving average ke upar hai, to ye ek bullish signal hai, iska matlab hai ki trend upar ki taraf hai. Agar currency pair ki price moving average ke niche hai, to ye ek bearish signal hai, iska matlab hai ki trend niche ki taraf hai.

- Support aur Resistance Levels Pehchanna: Moving averages traders ko support aur resistance levels pehchanne mein madad karte hain. Agar currency pair ki price moving average ke kareeb hai, to ye ek ishara hai ki currency pair support ya resistance dhoondh raha hai.

- Trends Ko Confirm Karna: Moving averages trends ko confirm karne mein istemal ho sakte hain. Agar currency pair ki price dono short-term aur long-term moving averages ke upar hai, to ye ek ishara hai ki trend upar ki taraf hai. Agar currency pair ki price dono short-term aur long-term moving averages ke niche hai, to ye ek ishara hai ki trend niche ki taraf hai.

- Overbought aur Oversold Conditions Pehchanna: Moving averages traders ko overbought aur oversold conditions pehchanne mein madad karte hain. Agar currency pair ki price moving average ke upar hai aur moving average upar ki taraf slope kar raha hai, to ye ek ishara hai ki currency pair overbought hai. Agar currency pair ki price moving average ke niche hai aur moving average niche ki taraf slope kar raha hai, to ye ek ishara hai ki currency pair oversold hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

What's the Moving Average in forex

Forex men moving average ek technical indicator ha jo price action ko smooth karke trend ko identify karne men madad karta ha. Moving average ko price ki ek average value ke rup men define kiya jata ha.

Moving average ki 2 basic types hain:- Simple Moving Average (SMA)

- Exponential Moving Average (EMA)

SMA is the average price of a security over a defined number of time periods. The EMA gives greater weight to more recent prices.

Moving average ko forex trading men trend identification, support and resistance levels identification, entry and exit signals generation ke liye use kiya jata ha.

Yahan kuchh moving average trading strategies hain:- Crossing strategy

- Divergence strategy

- Multiple moving averages strategy

Crossing strategy men, 2 moving averages ki crossover points ko entry or exit signals ke rup men use kiya jata ha.

Divergence strategy men, price action aur moving averages ke bich ke divergence ko entry or exit signals ke rup men use kiya jata ha.

Multiple moving averages strategy men, 2 ya adhik moving averages ko combine karke trend ko identify karne men madad li jati ha.

Moving average ek powerful technical indicator ha jo forex trading men kafi effective ho sakta ha. Lekin, ise use karne se pehle iska proper analysis karna zaroori ha.

Yahan kuchh tips hain jo aapko moving average trading men help kar sakti hain:- Different time frames per moving averages ko test karein.

- Different moving averages per combinations ko test karein.

- Moving averages ko other technical indicators ke sath combine karke use karein.

Mujhe umeed hai ki yah jankari aapke liye helpful rahi hogi. Agar aapke koi aur sawal hain to mujhe bataiye.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:55 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим