What is the bullish stalled candlestick pattern?

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

INTRODUCTION TO BULLISH STALLED CANDLESTICK PATTERN : Bullish stalled candlestick pattern ek technical analysis pattern hai jo ek downtrend ya consolidation phase ke potential reversal ko darshata hai. Ye pattern is waqt banta hai jab market action mein indecision ka lamha hota hai, jo chhote badan waali mombati ke saath dikhta hai aur jismein chhote chhote upper aur lower shadows hote hain. Isse pata chalta hai ki bechne waale apni momentum kho chuke hain aur kharidne waale bazaar mein utar rahe hain, jisse ek bullish move ho sakta hai. IDENTIFYING THE BULLISH STALLED CANDLESTICK PATTERN : Bullish stalled candlestick pattern ki pehchan karne ke liye, traders chhote range waali chhote badan waali mombati ko dhoondte hain, jo bazaar mein indecision ko darshaati hai. Mombati ke badan mein aam taur par chhota hota hai, jo ek neutral bazaar bhavna ko darshaata hai. Saath hi, mombati ke upper aur lower shadows bhi chhote hote hain, iska matlab hai ki kharidne waale aur bechne waale dono control ke liye sangharsh kar rahe hain. Ye pattern aksar ek downtrend ya consolidation phase ke dauraan dekha jaata hai. SIGNIFICANCE OF THE BULLISH STALLED CANDLESTICK PATTERN : Bullish stalled candlestick pattern ki ahmiyat isliye hai kyunki ye ek maujooda trend ka potential reversal darshaata hai. Chhote badan waali mombati mein dikhai dene wala indecision darshaata hai ki market ke participants bazaar ki disha ke baare mein anishchit hain. Ye indecision sentiment mein badlav laa sakta hai, jismein kharidne waale bechne waalo par kabza kar sakte hain. Traders is pattern ko aksar ek signal ke roop mein istemaal karte hain long positions mein enter karne ke liye ya maujooda short positions ko band karne ke liye. CONFIRMATION AND TRADING STRATEGIES : Jabki bullish stalled candlestick pattern ek potential trend reversal ki shuruaati signal pradaan karta hai, tashkhees ki confirmation trading decisions lene se pehle mahatvapurna hai. Traders aksar tashkhees karne waale factors ko dekhte hain jaise bullish candlestick patterns, bullish chart patterns, ya trendline breakouts. Jab confirmation mil jaati hai, traders long positions mein enter karne ka vichar kar sakte hain, bullish stalled candle ke low ke neeche stop-loss orders rakh sakte hain aur taknik staron ya peechhe ki jhaankiyon par adharit profit targets set kar sakte hain. LIMITATIONS AND RISKS : Jaise ki dusre technical analysis patterns mein, bullish stalled candlestick pattern bhi bilkul safe nahi hai aur risk ke saath aata hai. Safal trades ke aasaar badhane ke liye market trends, support aur resistance levels, aur volume jaise doosre technical factors ko dhyaan mein rakhna zaroori hai. Iske alawa, galat signals bhi aa sakte hain, jiski wajah se traders ko nuksaan ho sakta hai agar sirf is pattern par bharosa karke chale. Isliye, nuksaan se bachne ke liye sahi position sizing aur stop-loss orders set karke risk management taknikon ka upyog karna zaroori hai. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex Trading & Bullish Stalled Candlestick Pattern Details. Bullish Stalled Candlestick Pattern ek Forex Trading ka Charting Pattern hai jo market mein ek Bullish trend ko indicate karta hai. Yeh pattern ek Bullish Candlestick ke baad ek Doji Candlestick se milta hai. Bullish Stalled Candlestick Pattern formation. Bullish Stalled Candlestick Pattern ki formation ek Bullish Candlestick ke baad ek Doji Candlestick se milta hai. Bullish Candlestick mein, opening price closing price se kam hota hai aur closing price opening price se zyada hota hai. Doji Candlestick mein, opening price aur closing price ek doosre se zyada ya kam nahi hote. How to learn Bullish Stalled Candlestick Pattern. Bullish Stalled Candlestick Pattern ko samajhne ke liye traders ko market ko closely monitor karna chahiye. Agar market mein ek Bullish trend hai aur Bullish Candlestick ke baad Doji Candlestick aati hai to yeh Bullish Stalled Candlestick Pattern indicate karti hai. Iske baad, traders ko market ke further movement ko observe karna chahiye. Bullish Stalled Candlestick Pattern Uses. Bullish Stalled Candlestick Pattern ka use traders ko market mein ek Bullish trend ke baad entry point ke liye use karna chahiye. Is pattern ko use karke traders ko market mein ek Bullish trend ke baad entry point ke baare mein idea mil jaata hai. Never Ignore. Bullish Stalled Candlestick Pattern ek reliable Forex Trading ka Charting Pattern hai jo traders ko market mein ek Bullish trend ko indicate karta hai. Is pattern ko samajhne ke liye traders ko market ko closely monitor karna chahiye. Bullish Stalled Candlestick Pattern ka use traders ko market mein ek Bullish trend ke baad entry point ke liye use karna chahiye. -

#4 Collapse

Bullish Stalled candlestick pattern forex trading mein ek bullish continuation pattern hai. Ye pattern jab form hota hai, toh indicate karta hai ki bullish trend continue hone ka potential hai. Is pattern mein, ek bullish candlestick followed by a Doji candlestick form hota hai. Bullish Stalled candlestick pattern ki wazahat niche di gayi hai: 1. Continuation of Bullish Trend: Bullish Stalled pattern traders ko bullish trend ke continuation ka pata lagane mein madad karta hai. Jab bullish candlestick ke baad Doji candlestick form hota hai, toh ye indicate karta hai ki bullish trend continue ho rahi hai aur bulls control mein hain. 2. Consolidation and Pause: Bullish Stalled pattern traders ko market consolidation aur pause ka pata lagane mein madad karta hai. Doji candlestick, jisme open aur close price almost equal hote hain, indicate karta hai ki market mein temporary indecision hai aur price movement slow ho raha hai. Ye pattern traders ko bullish trend ke temporary pause ka signal deta hai. 3. Entry and Exit Points: Bullish Stalled pattern traders ko entry aur exit points ka pata lagane mein madad karta hai. Agar pattern form ho raha hai, toh traders buy entry kar sakte hain aur bullish move ka advantage utha sakte hain. Isse unko advantage milta hai jab price bullish trend ke direction mein move karta hai. Traders apne stop loss aur take profit levels ko bhi set kar sakte hain. 4. Risk Management: Bullish Stalled pattern traders ko risk management ka pata lagane mein madad karta hai. Agar pattern ke breakout ke baad price opposite direction mein move karta hai, toh traders apne stop loss levels ko pattern ke range ke bahar set kar sakte hain. Isse unki risk control mein madad milti hai. Bullish Stalled candlestick pattern forex trading mein ek useful tool hai, lekin iska istemal karne se pehle confirmatory indicators, price action analysis aur market conditions ka bhi dhyan rakha jana chahiye. Iske saath sahi risk management aur money management bhi zaruri hai. Bullish Stalled pattern ke saath practice aur experience se hi aapko iski wazahat ka pata chalega. -

#5 Collapse

"bullish stalled candlestick pattern" ke baare mein wazahat aur iski zaroorat ke baare mein poocha hai. Is liye main aapko urdu mein jawab deta hoon:Bullish stalled candlestick pattern, stock market ya financial markets mein ek bullish trend ki wazahat karne ke liye istemal hota hai. Is pattern mein, ek candlestick chart par ek bullish candlestick banane ke baad ek doosri candlestick banati hai, jise "stalled" ya "stalled candle" kehte hain. Ye stalled candlestick, pehle ki candlestick ki range ke andar hi rehti hai aur price mein koi significant change nahi hota hai.Bullish stalled candlestick pattern ko dekh kar traders ko bullish trend ki continuation ya reversal ki sambhavna samajhne mein madad milti hai. Agar ek bullish trend ke baad stalled candlestick banati hai, toh yeh ek potential reversal signal ho sakta hai aur traders apne positions ko exit karne ya short sell karne ka faisla kar sakte hain.Yeh pattern ki zaroorat isliye hoti hai kyunki candlestick patterns, traders aur investors ke liye price action analysis ka ek important tool hai. Isse woh market sentiment aur price movements ko samajh sakte hain aur apne trading strategies ko modify kar sakte hain. What is the bullish stalled candlestick pattern? Bullish stalled candlestick pattern, ek bullish trend ke continuation ya reversal ki sambhavna ko samajhne ke liye important hai. Is pattern mein, pehle ek bullish candlestick banati hai jo price mein upar ki taraf move karti hai. Lekin uske baad ek doosri candlestick banati hai, jise stalled candlestick kehte hain. Stalled candlestick pehle ki candlestick ki range ke andar rehti hai aur price mein koi significant change nahi hota hai.Is pattern ko dekh kar traders ko kuch important points samajhne chahiye: 1. Bullish continuation: Agar bullish trend mein stalled candlestick banati hai, toh yeh ek indication hai ki uptrend continue ho sakta hai. Traders is situation mein bullish trend mein rehne ke liye positions ko hold kar sakte hain. 2. Bullish reversal: Agar stalled candlestick banane ke baad price mein downward movement ya reversal ho raha hai, toh yeh ek potential reversal signal ho sakta hai. Traders is situation mein apne positions ko exit kar sakte hain ya short sell karke bearish trend mein trading kar sakte hain. 3. Confirmation: Bullish stalled candlestick pattern ko confirm karne ke liye, traders aur investors ko dusre technical indicators aur analysis tools ka istemal karna chahiye. Isse woh trend ki strength aur future price movements ko samajh sakte hain. Yeh pattern keval ek tool hai aur iska istemal karne se pehle, aur bazaar ke current conditions ko samajhne ke liye dusre technical indicators aur analysis ka istemal karna zaroori hota hai. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

explaination of this candlestick Asalam-0-alikum! Bullish slowed down candle design, securities exchange ya monetary business sectors mein ek bullish pattern ki wazahat karne ke liye istemal hota hai. Is design mein, ek candle graph standard ek bullish candle banane ke baad ek doosri candle banati hai, jise "slowed down" ya "slowed down candle" kehte hain. Ye slowed down candle, pehle ki candle ki range ke andar howdy rehti hai aur cost mein koi tremendous change nahi hota hai.Bullish slowed down candle design ko dekh kar brokers ko bullish pattern ki continuation ya inversion ki sambhavna samajhne mein madad milti hai. Agar ek bullish pattern ke baad slowed down candle banati hai, toh yeh ek potential inversion signal ho sakta hai aur merchants apne positions ko exit karne ya short sell karne ka faisla kar sakte hain.Yeh design ki zaroorat isliye hoti hai kyunki candle designs, dealers aur financial backers ke liye cost activity examination ka ek significant instrument hai. Isse woh market opinion aur cost developments ko samajh sakte hain. importance potential inversion darshaata hai. Chhote badan waali mombati mein dikhai dene wala hesitation darshaata hai ki market ke members market ki disha ke baare mein anishchit hain. Ye hesitation feeling mein badlav laa sakta hai, jismein kharidne waale bechne waalo standard kabza kar sakte hain. Dealers is design ko aksar ek signal ke roop mein istemaal karte hain. conclusion candle banane ke baad cost mein descending development ya inversion ho raha hai, toh yeh ek potential inversion signal ho sakta hai. Dealers is circumstance mein apne positions ko exit kar sakte hain ya short sell karke negative pattern mein exchanging kar sakte hain. 3. Affirmation: Bullish slowed down candle design ko affirm karne ke liye, dealers aur financial backers ko dusre specialized pointers aur investigation apparatuses ka istemal karna chahiye. Isse woh pattern ki strength aur future cost developments ko samajh sakte hain. Yeh design keval ek apparatus hai aur iska istemal karne se pehle, aur marketplace ke current circumstances ko samajhne ke liye dusre specialized pointers aur investigation ka istemal karna zaroori hota hai. -

#7 Collapse

Bullish stalled candlestick pattern ek technical analysis pattern hai jo ek downtrend ya consolidation phase ke potential reversal ko darshata hai. Ye pattern is waqt banta hai jab market action mein indecision ka lamha hota hai, jo chhote badan waali mombati ke saath dikhta hai aur jismein chhote chhote upper aur lower shadows hote hain. Isse pata chalta hai ki bechne waale apni momentum kho chuke hain aur kharidne waale bazaar mein utar rahe hain, jisse ek bullish move ho sakta hai. Bullish Stalled Candlestick Pattern ki formation ek Bullish Candlestick ke baad ek Doji Candlestick se milta hai. Bullish Candlestick mein, opening price closing price se kam hota hai aur closing price opening price se zyada hota hai. Doji Candlestick mein, opening price aur closing price ek doosre se zyada ya kam nahi hote. IDENTIFYING THE BULLISH STALLED CANDLESTICK PATTERN : Bullish Stalled Candlestick Pattern ek reliable Forex Trading ka Charting Pattern hai jo traders ko market mein ek Bullish trend ko indicate karta hai. Is pattern ko samajhne ke liye traders ko market ko closely monitor karna chahiye.Bullish Stalled Candlestick Pattern ko samajhne ke liye traders ko market ko closely monitor karna chahiye. Agar market mein ek Bullish trend hai aur Bullish Candlestick ke baad Doji Candlestick aati hai to yeh Bullish Stalled Candlestick Pattern indicate karti hai. Iske baad, traders ko market ke further movement ko observe karna chahiye.bullish pattern ki wazahat karne ke liye istemal hota hai. Is design mein, ek candle graph standard ek bullish candle banane ke baad ek doosri candle banati hai, jise "slowed down" ya "slowed down candle" kehte hain. Ye slowed down candle, pehle ki candle ki range ke andar howdy rehti hai aur cost mein koi tremendous change nahi hota hai.Bullish slowed down candle design ko dekh kar brokers ko bullish pattern ki continuation ya inversion ki sambhavna samajhne mein madad milti hai. Agar ek bullish pattern ke baad slowed down candle banati hai, toh yeh ek potential inversion signal ho sakta hai aur merchants apne positions ko exit karne ya short sell karne ka faisla kar sakte hain.Yeh design ki zaroorat isliye hoti hai kyunki candle designs, dealers aur financial backers ke liye cost activity examination ka ek significant instrument hai

Bullish stalled candlestick pattern ki pehchan karne ke liye, traders chhote range waali chhote badan waali mombati ko dhoondte hain, jo bazaar mein indecision ko darshaati hai. Mombati ke badan mein aam taur par chhota hota hai, jo ek neutral bazaar bhavna ko darshaata hai. Saath hi, mombati ke upper aur lower shadows bhi chhote hote hain, iska matlab hai ki kharidne waale aur bechne waale dono control ke liye sangharsh kar rahe hain. Ye pattern aksar ek downtrend ya consolidation phase ke dauraan dekha jaata hai. SIGNIFICANCE OF THE BULLISH STALLED CANDLESTICK PATTERN :monetary business sectors mein ek bullish pattern ki wazahat karne ke liye istemal hota hai. Is design mein, ek candle graph standard ek bullish candle banane ke baad ek doosri candle banati hai, jise "slowed down" ya "slowed down candle" kehte hain. Ye slowed down candle, pehle ki candle ki range ke andar howdy rehti hai aur cost mein koi tremendous change nahi hota hai.Bullish slowed down candle design ko dekh kar brokers ko bullish pattern ki continuation ya inversion ki sambhavna samajhne mein madad milti hai. Agar ek bullish pattern ke baad slowed down candle banati hai, toh yeh ek potential inversion signal ho sakta hai aur merchants apne positions ko exit karne ya short sell karne ka faisla kar sakte hain.Yeh design ki zaroorat isliye hoti hai kyunki candle designs, dealers aur financial backers ke liye cost activity examination ka ek significant instrument hai. Isse woh market opinion aur cost developments ko samajh sakte hain.candlestick ki range ke andar hi rehti hai aur price mein koi significant change nahi hota hai.Bullish stalled candlestick pattern ko dekh kar traders ko bullish trend ki continuation ya reversal ki sambhavna samajhne mein madad milti hai. Agar ek bullish trend ke baad stalled candlestick banati hai, toh yeh ek potential reversal signal ho sakta hai aur traders apne positions ko exit karne ya short sell karne ka faisla kar sakte hain.Yeh pattern ki zaroorat isliye hoti hai kyunki candlestick patterns, traders aur investors ke liye price action analysis ka ek important tool hai. Isse woh market sentiment aur price movements ko samajh sakte hain aur apne trading strategies ko modify kar sakte hain.Bullish Stalled Candlestick Pattern ek Forex Trading ka Charting Pattern hai jo market mein ek Bullish trend ko indicate karta hai.

-

#8 Collapse

Explaination of Bullish stalled candlestick pattern Asalam-o-alikum! technical analysis patterns mein, bullish stalled candlestick pattern bhi bilkul safe nahi hai aur risk ke saath aata hai. Safal trades ke aasaar badhane ke liye market trends, support aur resistance levels, aur volume jaise doosre technical factors ko dhyaan mein rakhna zaroori hai. Iske alawa, galat signals bhi aa sakte hain, jiski wajah se traders ko nuksaan ho sakta hai. Risk Management ek bullish pattern ke baad slowed down candle banati hai, toh yeh ek potential inversion signal ho sakta hai aur merchants apne positions ko exit karne ya short sell karne ka faisla kar sakte hain.Yeh design ki zaroorat isliye hoti hai kyunki candle designs, dealers aur financial backers ke liye cost activity examination ka ek significant instrument hai. Isse woh market opinion aur cost developments ko samajh sakte hain.candlestick ki range ke andar hi rehti hai aur price mein koi significant change nahi hota hai.Bullish stalled candlestick pattern ko dekh kar traders ko bullish trend ki continuation ya reversal ki sambhavna samajhne mein madad milti hai. Agar ek bullish trend ke baad stalled candlestick banati hai, toh yeh ek potential reversal signal ho sakta hai aur traders apne positions ko exit karne ya short sell karne ka faisla kar sakte hain.Yeh pattern ki zaroorat isliye hoti hai . Trading through Analysis securities exchange ya monetary business sectors mein ek bullish pattern ki wazahat karne ke liye istemal hota hai. Is design mein, ek candle graph standard ek bullish candle banane ke baad ek doosri candle banati hai, jise "slowed down" ya "slowed down candle" kehte hain. Ye slowed down candle, pehle ki candle ki range ke andar howdy rehti hai aur cost mein koi tremendous change nahi hota hai.Bullish slowed down candle design ko dekh kar brokers ko bullish pattern ki continuation ya inversion ki sambhavna samajhne mein madad milti hai. Agar ek bullish pattern ke baad slowed down candle banati hai, toh yeh ek potential inversion signal ho sakta hai aur merchants apne positions ko exit karne ya short sell karne ka faisla kar sakte hain. Thanks -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is Bullish Stalled candlestick pattern? Dear market ke andr ye basically ek technical analysis pattern hai jo ek downtrend ya consolidation phase ke potential reversal ko darshata hai. Ye pattern is waqt banta hai jab market action mein indecision ka lamha hota hai, jo chhote badan waali mombati ke saath dikhta hai jo Candlestick mein, opening price closing price se kam hota hai aur closing price opening price se zyada hota hai. Doji Candlestickllish chart patterns, ya trendline breakouts. Jab confirmation mil jaati hai, traders long positions mein enter karne ka vichar kar sakte hain, bullish stalled candle ke kar rahe hain. Ye pattern aksar ek downtrend ya consolidation phaseaur jismein chhote chhote upper aur lower shadows honagement aur money management bhi zaruri hai ye pattern ke bullish trend ke temporary pauseAgar ek bullish trend ke baad stalled candlestick banati hai, toh yeh ek new type ka pattern hain. Isse pata chalta hai ki bechne waale apni momentumindicate karta hai. Is pattern ko samajhne ke liye traders ko market ko closely monitor karna chahiye. Working and their Identification Jab bullish candlestick ke baad Doji candlestick form hota hai, toh ye indicate karta hai ki bullish trend continue ho rahi hai aur bulls control mein hain market mein temporary indecision hai aur price movement slow ho raha hai. Ye pattern tradersprice action analysis aur market conditions ka bhi dhyan rakha jana chahiye. Iske saath sahi risk matial revers mein, opening price aur closing price ek doosre se zyada ya kam nahi hote. ek neutral bazaar bhavna ko darshaata hai. Saath hi, mombati ke upper aur lower shadows bhi chhote hote hain, iska matlab hai ki kharidne waale aur bechne waale dono control ke liye acha signal ho sakta hai aur traders apne positions ko exit karne ya short sell karne ka faisla kar sakte hain.Yeh pattern ki zaroorat isliye hoti hai kyunki candlestick patterns, traders aur investors ke liye price action analysis ka ek ka signal deta hai.hain aur bullish move ka advantage utha sakte hain. Isse unko advantage milta hai jab price bullish trend ke direction mein move karta hai. Traders apne stop loss aur take profit levels ko bhi set kar sakte hain.

- Mentions 0

-

سا0 like

-

#10 Collapse

Bullish Stalled Candle Chart Pattern: Market ke andr ye fundamentally ek specialized design hai jo ek downtrend ya solidification stage ke potential inversion ko darshata hai. Ye design is waqt banta hai punch market activity mein hesitation ka lamha hota hai, jo chhote badan waali mombati ke saath dikhta hai jo Candle mein, opening cost shutting cost se kam hota hai aur shutting cost opening cost se zyada hota hai. Doji Candlestickllish graph designs, ya trendline breakouts. Punch affirmation mil jaati hai, brokers long positions mein enter karne ka vichar kar sakte hain, bullish slowed down candle ke kar rahe hain. Ye design aksar ek downtrend ya union phaseaur jismein chhote upper aur lower shadows honagement aur cash the executives bhi zaruri hai Bullish candle ke baad Doji candle structure hota hai, toh ye demonstrate karta hai ki bullish pattern proceed with ho rahi hai aur bulls control mein hain market mein brief hesitation hai aur cost development slow ho raha hai. Ye design tradersprice activity examination aur economic situations ka bhi dhyan rakha jana chahiye. Iske saath sahi risk matial revers mein, opening cost aur shutting cost ek doosre se zyada ya kam nahi hote. ek nonpartisan marketplace bhavna ko darshaata hai. Saath hello there, mombati ke upper aur lower shadows bhi chhote hote hain, iska matlab hai ki kharidne waale aur bechne waale dono control ke liye acha signal ho sakta hai aur brokers apne positions ko exit karne ya short sell karne ka faisla kar sakte hain.Yeh design ki zaroorat isliye hoti hai kyunki candle designs, merchants aur financial backers ke liye cost activity investigation ka ek ka signal deta hai.hain aur bullish move ka advantage utha sakte hain. Isse unko advantage milta hai poke cost bullish pattern ke bearing mein move karta hai. Types Of Bullish Stalled Chart Pattern: Bullish Stalled Candlestick or Slowed down Candle Example ko samajhne ke liye merchants ko market ko intently screen karna chahiye. Agar market mein ek Bullish pattern hai aur Bullish Candle ke baad Doji Candle aati hai to yeh Bullish Slowed down Candle Example show karti hai. Iske baad, merchants ko market ke further development ko notice karna chahiye.bullish design ki wazahat karne ke liye istemal hota hai. Is plan mein, ek candle diagram standard ek bullish candle banane ke baad ek doosri candle banati hai, jise "dialed back" ya "dialed back flame" kehte hain. Ye dialed back light, pehle ki flame ki range ke andar hi rehti hai aur cost mein koi enormous change nahi hota hai.Bullish dialed back candle plan ko dekh kar representatives ko bullish example ki continuation ya reversal ki sambhavna samajhne mein madad milti hai. Agar ek bullish example ke baad dialed back flame banati hai, toh yeh ek potential reversal signal ho sakta hai aur traders apne positions ko exit karne ya short sell karne ka faisla kar sakte hain.

Bullish candle ke baad Doji candle structure hota hai, toh ye demonstrate karta hai ki bullish pattern proceed with ho rahi hai aur bulls control mein hain market mein brief hesitation hai aur cost development slow ho raha hai. Ye design tradersprice activity examination aur economic situations ka bhi dhyan rakha jana chahiye. Iske saath sahi risk matial revers mein, opening cost aur shutting cost ek doosre se zyada ya kam nahi hote. ek nonpartisan marketplace bhavna ko darshaata hai. Saath hello there, mombati ke upper aur lower shadows bhi chhote hote hain, iska matlab hai ki kharidne waale aur bechne waale dono control ke liye acha signal ho sakta hai aur brokers apne positions ko exit karne ya short sell karne ka faisla kar sakte hain.Yeh design ki zaroorat isliye hoti hai kyunki candle designs, merchants aur financial backers ke liye cost activity investigation ka ek ka signal deta hai.hain aur bullish move ka advantage utha sakte hain. Isse unko advantage milta hai poke cost bullish pattern ke bearing mein move karta hai. Types Of Bullish Stalled Chart Pattern: Bullish Stalled Candlestick or Slowed down Candle Example ko samajhne ke liye merchants ko market ko intently screen karna chahiye. Agar market mein ek Bullish pattern hai aur Bullish Candle ke baad Doji Candle aati hai to yeh Bullish Slowed down Candle Example show karti hai. Iske baad, merchants ko market ke further development ko notice karna chahiye.bullish design ki wazahat karne ke liye istemal hota hai. Is plan mein, ek candle diagram standard ek bullish candle banane ke baad ek doosri candle banati hai, jise "dialed back" ya "dialed back flame" kehte hain. Ye dialed back light, pehle ki flame ki range ke andar hi rehti hai aur cost mein koi enormous change nahi hota hai.Bullish dialed back candle plan ko dekh kar representatives ko bullish example ki continuation ya reversal ki sambhavna samajhne mein madad milti hai. Agar ek bullish example ke baad dialed back flame banati hai, toh yeh ek potential reversal signal ho sakta hai aur traders apne positions ko exit karne ya short sell karne ka faisla kar sakte hain.  Bullish slowed down candle design, ek bullish pattern ke continuation ya inversion ki sambhavna ko samajhne ke liye significant hai. Is design mein, pehle ek bullish candle banati hai jo cost mein upar ki taraf move karti hai. Lekin uske baad ek doosri candle banati hai, jise slowed down candle kehte hain. Slowed down candle pehle ki candle ki range ke andar rehti hai aur cost mein koi tremendous change nahi hota hai.Is design ko dekh kar brokers ko kuch significant focuses samajhne chahiye: Agar bullish pattern mein slowed down candle banati hai, toh yeh ek sign hai ki upturn proceed with ho sakta hai. Dealers is circumstance mein bullish pattern mein rehne ke liye positions ko hold kar sakte hain. Bullish Stalled Chart Pattern Formation: Agar slowed down candle banane ke baad cost mein descending development ya inversion ho raha hai, toh yeh ek potential inversion signal ho sakta hai. Brokers is circumstance mein apne positions ko exit kar sakte hain ya short sell karke negative pattern mein exchanging kar sakte hain. Bullish slowed down candle design ko affirm karne ke liye, dealers aur financial backers ko dusre specialized pointers aur examination instruments ka istemal karna chahiye. Isse woh pattern ki strength aur future cost developments ko samajh sakte hain.Yeh design keval ek apparatus hai aur iska istemal karne se pehle, aur marketplace ke current circumstances ko samajhne ke liye dusre specialized pointers aur examination ka istemal karna zaroori hota hai.

Bullish slowed down candle design, ek bullish pattern ke continuation ya inversion ki sambhavna ko samajhne ke liye significant hai. Is design mein, pehle ek bullish candle banati hai jo cost mein upar ki taraf move karti hai. Lekin uske baad ek doosri candle banati hai, jise slowed down candle kehte hain. Slowed down candle pehle ki candle ki range ke andar rehti hai aur cost mein koi tremendous change nahi hota hai.Is design ko dekh kar brokers ko kuch significant focuses samajhne chahiye: Agar bullish pattern mein slowed down candle banati hai, toh yeh ek sign hai ki upturn proceed with ho sakta hai. Dealers is circumstance mein bullish pattern mein rehne ke liye positions ko hold kar sakte hain. Bullish Stalled Chart Pattern Formation: Agar slowed down candle banane ke baad cost mein descending development ya inversion ho raha hai, toh yeh ek potential inversion signal ho sakta hai. Brokers is circumstance mein apne positions ko exit kar sakte hain ya short sell karke negative pattern mein exchanging kar sakte hain. Bullish slowed down candle design ko affirm karne ke liye, dealers aur financial backers ko dusre specialized pointers aur examination instruments ka istemal karna chahiye. Isse woh pattern ki strength aur future cost developments ko samajh sakte hain.Yeh design keval ek apparatus hai aur iska istemal karne se pehle, aur marketplace ke current circumstances ko samajhne ke liye dusre specialized pointers aur examination ka istemal karna zaroori hota hai. Bullish slowed down candle design, securities exchange ya monetary business sectors mein ek bullish pattern ki wazahat karne ke liye istemal hota hai. Is design mein, ek candle outline standard ek bullish candle banane ke baad ek doosri candle banati hai, jise "slowed down" ya "slowed down flame" kehte hain. Ye slowed down candle, pehle ki candle ki range ke andar hello rehti hai aur cost mein koi massive change nahi hota hai.Bullish slowed down candle design ko dekh kar dealers ko bullish pattern ki continuation ya inversion ki sambhavna samajhne mein madad milti hai. Agar ek bullish pattern ke baad slowed down candle banati hai, toh yeh ek potential inversion signal ho sakta hai aur brokers apne positions ko exit karne ya short sell karne ka faisla kar sakte hain.Yeh design ki zaroorat isliye hoti hai kyunki candle designs, merchants aur financial backers ke liye cost activity investigation ka ek significant instrument hai. Trading Of Bullish Stalled Chart Pattern: Pattern or Design merchants ko passage aur leave focuses ka pata lagane mein madad karta hai. Agar design structure ho raha hai, toh merchants purchase section kar sakte hain aur bullish move ka advantage utha sakte hain. Isse unko advantage milta hai poke cost bullish pattern ke course mein move karta hai. Brokers apne stop misfortune aur take benefit levels ko bhi set kar sakte hain.Bullish Slowed down design merchants ko risk the executives ka pata lagane mein madad karta hai. Agar design ke breakout ke baad cost inverse heading mein move karta hai, toh dealers apne stop misfortune levels ko design ke range ke bahar set kar sakte hain. Isse unki risk control mein madad milti hai.Bullish Slowed down candle design forex exchanging mein ek helpful device hai, lekin iska istemal karne se pehle corroborative pointers, cost activity aur economic situations ka bhi dhyan rakha jana chahiye.

Candle design forex exchanging mein ek bullish continuation design hai. Ye design tructure hota hai, toh demonstrate karta hai ki bullish pattern proceed with sharpen ka potential hai. Is design mein, ek bullish candle followed by a Doji candle structure hota hai Bullish Slowed down candle design ki wazahat specialty di gayi hai Bullish Slowed down design merchants ko bullish pattern ke continuation ka pata lagane mein madad karta hai. Punch bullish candle ke baad Doji candle structure hota hai, toh ye show karta hai ki bullish pattern proceed with ho rahi hai aur bulls control mein hain Bullish Slowed down design brokers ko market solidification aur stop ka pata lagane mein madad karta hai. Doji candle, jisme open aur close cost practically equivalent hote hain, demonstrate karta hai ki market mein transitory uncertainty hai aur cost development slow ho raha hai. Ye design merchants ko bullish pattern ke impermanent respite ka signal deta hai.

Candle design forex exchanging mein ek bullish continuation design hai. Ye design tructure hota hai, toh demonstrate karta hai ki bullish pattern proceed with sharpen ka potential hai. Is design mein, ek bullish candle followed by a Doji candle structure hota hai Bullish Slowed down candle design ki wazahat specialty di gayi hai Bullish Slowed down design merchants ko bullish pattern ke continuation ka pata lagane mein madad karta hai. Punch bullish candle ke baad Doji candle structure hota hai, toh ye show karta hai ki bullish pattern proceed with ho rahi hai aur bulls control mein hain Bullish Slowed down design brokers ko market solidification aur stop ka pata lagane mein madad karta hai. Doji candle, jisme open aur close cost practically equivalent hote hain, demonstrate karta hai ki market mein transitory uncertainty hai aur cost development slow ho raha hai. Ye design merchants ko bullish pattern ke impermanent respite ka signal deta hai.

-

#11 Collapse

Assalam o alikum Dear Memebrs umeed karta houn ap thek hongy dear memebrs forex par aj kal kam karna asan hay lakin yahan par hamen sab say pehly apna knowledge share karna chahiy aj ka hamara topic hay bulishstalled candlestick pattern is pattern me hum sekhengy candles kay bary me Understanding Market Situation Ye pattern tab dikhta hai jab market mein ek uptrend chal raha hota hai. Uptrend ka matlab hai ki asset ya stock ki keemat barhti ja rahi hai. What is Pehli Candlestick Pehli candlestick ek long red (bearish) candle hoti hai. Is candle mein selling pressure hoti hai aur price neeche ja rahi hoti hai. Define Dusri Candlestick Dusri candlestick ek small green (bullish) candle hoti hai. Is candle mein price mein aas paas ya kareeb-kareeb koi bhi change nahi hota. Yani ki opening price aur closing price kareeb kareeb aik hi hoti hai aur is candle ke beech ki trading range pehli candle ke trading range ke andar hoti hai. Pattern Confirmation kesy ki jati hay Bullish Stalled Candlestick Pattern ko confirm karne ke liye, aapko ek aur candle ka wait karna hota hai. Agar agle candle mein price upar ki taraf move karke pehli candle ki high ko cross karti hai, toh ye Bullish Harami pattern ko confirm karta hai Reversal Signal kia hoty hain Jab ye pattern confirm hota hai, toh ye ek reversal signal provide karta hai, yani ki market mein bearish trend se bullish trend mein badalne ki sambhavna hoti hai. Bullish Stalled Candlestick Pattern ki malomat Topic Description Introduction Bullish Stalled Candlestick Pattern ki mukhtasar taaruf. Market Situation Is pattern ke dekhe jane wale market conditions. Pehli Candlestick Pehli candlestick ki tafseel (Red Candle). Dusri Candlestick Dusri candlestick ki tafseel (Small Green Candle). Pattern Confirmation Bullish Stalled Candlestick Pattern ki tasdeeq kaise hoti hai. Reversal Signal Pattern ko confirm hone par kya yeh reversal signal deta hai. Trading Strategies Is pattern ka istemal karke trading strategies. Examples Real-life examples aur charts se samajhne ke liye. Pattern Ka Istemal Trading mein is pattern ka istemal karte waqt savdhaniyaan. Conclusion Bullish Stalled Candlestick Pattern ki mahatva aur samapti. Pattern Confirmation Wait Karein Bullish Stalled Candlestick Pattern ko trade karne se pehle, aapko is pattern ko confirm hone ka wait karna chahiye. Iska matlab hai ki aapko agle candle ka wait karna hoga, jo pehli candle ki high ko cross karta hai. Isse aapko false signals se bacha ja sakta hai. Stop Loss Aur Take Profit Levels Set Karein Hamesha stop loss aur take profit levels set karein. Stop loss aapko nuksan se bachane mein madadgar hota hai, jabki take profit level aapko munafa lock karne mein madad karta hai. In levels ko samajhne aur lagane mein practice karein. Risk Management Follow Karein Apne trading account ke liye risk management principles follow karein. Ye include karte hain ki ek trade mein kitna risk lena hai aur kitna capital ek trade ke liye allocate karna hai. Multiple Indicators Ka Istemal Karein Bullish Stalled Candlestick Pattern ke sath-sath, dusre technical indicators ka bhi istemal karein jaise ki RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), ya Stochastic Oscillator. Ye indicators aapko confirmatory signals provide kar sakte hain. Trend Ka Dhyan Rakhein Is pattern ko trade karte waqt current market trend ka bhi dhyan rakhein. Agar market overall bearish trend mein hai to, Bullish Stalled Candlestick Pattern ki value kam ho sakti hai. Position Size Control Karein Apne position size ko control mein rakhein. Ek hi trade mein jyada risk na lein. Position size ka chayan aapke risk tolerance ke anurup karein. -

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduce TO BULLISH STALLED Candle Example : Bullish slowed down candle design ek specialized examination design hai jo ek downtrend ya union stage ke potential inversion ko darshata hai. Ye design is waqt banta hai hit market activity mein hesitation ka lamha hota hai, jo chhote badan waali mombati ke saath dikhta hai aur jismein chhote upper aur lower shadows hote hain. Isse pata chalta hai ki bechne waale apni force kho chuke hain aur kharidne waale marketplace mein utar rahe hain, jisse ek bullish move ho sakta hai. Recognizing THE BULLISH Slowed down Candle Example : Bullish slowed down candle design ki pehchan karne ke liye, dealers chhote range waali chhote badan waali mombati ko dhoondte hain, jo marketplace mein hesitation ko darshaati hai. Mombati ke badan mein aam taur standard chhota hota hai, jo ek impartial market bhavna ko darshaata hai. Saath hey, mombati ke upper aur lower shadows bhi chhote hote hain, iska matlab hai ki kharidne waale aur bechne waale dono control ke liye sangharsh kar rahe hain. Ye design aksar ek downtrend ya union stage ke dauraan dekha jaata hai. Meaning OF THE BULLISH Slowed down Candle Example : Bullish slowed down candle design ki ahmiyat isliye hai kyunki ye ek maujooda pattern ka potential inversion darshaata hai. Chhote badan waali mombati mein dikhai dene wala hesitation darshaata hai ki market ke members marketplace ki disha ke baare mein anishchit hain. Ye uncertainty feeling mein badlav laa sakta hai, jismein kharidne waale bechne waalo standard kabza kar sakte hain. Merchants is design ko aksar ek signal ke roop mein istemaal karte hain long positions mein enter karne ke liye ya maujooda short positions ko band karne ke liye. Affirmation AND Exchanging Methodologies : Jabki bullish slowed down candle design ek potential pattern inversion ki shuruaati signal pradaan karta hai, tashkhees ki affirmation exchanging choices lene se pehle mahatvapurna hai. Dealers aksar tashkhees karne waale factors ko dekhte hain jaise bullish candle designs, bullish diagram designs, ya trendline breakouts. Hit affirmation mil jaati hai, brokers long positions mein enter karne ka vichar kar sakte hain, bullish slowed down candle ke low ke neeche stop-misfortune orders rakh sakte hain aur taknik staron ya peechhe ki jhaankiyon standard adharit benefit targets set kar sakte hain. Constraints AND Dangers : Jaise ki dusre specialized examination designs mein, bullish slowed down candle design bhi bilkul safe nahi hai aur risk ke saath aata hai. Safal exchanges ke aasaar badhane ke liye market patterns, support aur opposition levels, aur volume jaise doosre specialized factors ko dhyaan mein rakhna zaroori hai. Iske alawa, galat signals bhi aa sakte hain, jiski wajah se merchants ko nuksaan ho sakta hai agar sirf is design standard bharosa karke chale. Isliye, nuksaan se bachne ke liye sahi position estimating aur stop-misfortune orders set karke risk the executives taknikon ka upyog karna zaroori hai. -

#13 Collapse

"Bullish Stalled" ek candlestick pattern hai jo ki stock market aur financial markets mein price trends ko analyze karne ke liye istemal hota hai. Ye pattern typically bullish reversal signal provide karta hai, iska matlab hai ki ek downtrend ke baad uptrend ka prarambh hone ke chances hai. Bullish Stalled pattern mein, do consecutive candlesticks hote hain jo ki specific criteria ko satisfy karte hain:- Pehla Candlestick: Pehla candlestick ek downtrend ke dauran aata hai aur bearish hota hai. Iska matlab hai ki price kam ho raha hai.

- Dusra Candlestick: Dusra candlestick bhi bearish hota hai, lekin iska range pehle candlestick ke range ke andar hota hai. Yani, dusre candlestick ka high aur low pehle candlestick ke high aur low ke beech hota hai, lekin close price lower side par hota hai.

- Mentions 0

-

سا0 like

-

#14 Collapse

### Bullish Stalled Candlestick Pattern: Kya Hai?

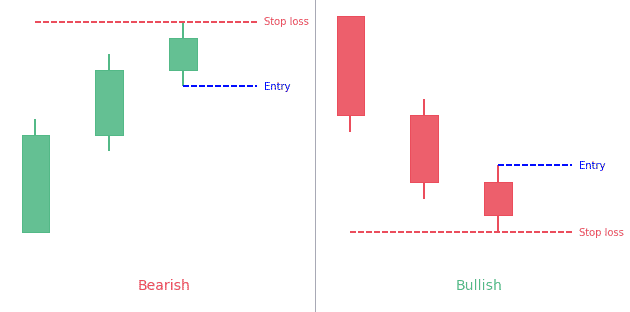

Bullish stalled candlestick pattern trading ki duniya mein ek important reversal signal hai. Yeh pattern tab banta hai jab market ek upward trend mein hota hai, lekin kuch samay ke liye bullish momentum ko kho deta hai. Is post mein hum is pattern ki pehchan, formation, aur trading strategy par nazar dalenge.

#### Pattern Ki Pehchan

Bullish stalled pattern mein teen candles hoti hain:

1. **Pehli Candle**: Yeh ek strong bullish candle hoti hai jo pehle ke bearish trend ke baad aati hai. Is candle ki length achi hoti hai aur yeh market ke bullish momentum ko dikhati hai.

2. **Doosri Candle**: Yeh ek smaller bullish candle hoti hai jo pehli candle se choti hoti hai. Iska closing price pehli candle ke closing price ke kareeb hota hai. Is candle se yeh pata chalta hai ke bullish momentum ab thoda kamzor ho raha hai.

3. **Teesri Candle**: Yeh ek bearish candle hoti hai jo doosri candle ke closing price ke neeche close hoti hai. Yeh candle bearish pressure ko darshati hai aur is pattern ki asli khushkhabri hoti hai.

#### Pattern Ki Formation

Is pattern ka formation tab hota hai jab traders ko pehli candle ke baad price mein further rise ki umeed hoti hai. Lekin doosri candle ke choti hone se yeh signal milta hai ke market mein buying pressure kam ho raha hai. Jab teesri candle bearish close hoti hai, to yeh ek clear signal hota hai ke market bullish sentiment ko kho raha hai, aur potential reversal ki taraf ja raha hai.

#### Trading Strategy

1. **Confirmation**: Is pattern ko confirm karne ke liye teesri candle ke close hone ka intezar karein. Agar yeh bearish candle previous closing price se neeche close hoti hai, to yeh ek strong signal hai ke market ne bullish momentum kho diya hai.

2. **Entry Point**: Aap teesri candle ke close hone ke baad sell position open kar sakte hain. Is point par aapko yeh samajh aata hai ke market reversal ki taraf ja raha hai.

3. **Stop-Loss**: Risk management ke liye aap stop-loss ko doosri candle ke highest point ke upar rakh sakte hain. Yeh aapko potential losses se bachata hai agar market aapke against chale.

4. **Target Price**: Target price ka tayun previous support levels ya Fibonacci retracement levels ke hisab se karna chahiye. Yeh aapko profit taking ke liye achhe points dhoondhne mein madad karega.

### Nakhira

Bullish stalled candlestick pattern ek valuable tool hai jo traders ko market reversals ka signal dete hai. Is pattern ki pehchan aur trading strategy ko samajh kar, traders effective decisions le sakte hain. Hamesha yaad rahe, kisi bhi trading decision se pehle market ki current conditions aur risk management ko samajhna zaroori hai. Agar aap is pattern ko sahi tareeqe se istemal karte hain, to aap apne trading portfolio ko behter bana sakte hain.

- CL

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Renko Chart Pattern Ki Ahmiyat**

Renko chart ek unique technical analysis tool hai jo price movements ko visualise karne ke liye bricks ka istemal karta hai. Yeh traditional candlestick aur bar charts se kaafi mukhtalif hai, kyunki yeh sirf price changes par focus karta hai, na ke time intervals par. Renko chart ki ahmiyat ko samajhne ke liye neeche kuch aham points diye gaye hain:

1. **Basic Structure:**

- Renko chart bricks ya blocks ke form mein hota hai. Har brick ek fixed price movement ko dikhata hai, jo traders ko price action ko asani se samajhne mein madad karta hai.

- Jab price ek specific range se zyada move karti hai, tab ek naya brick banta hai. Is tarah, agar price upward move kare to white (ya green) brick banegi, aur agar downward move kare to black (ya red) brick banegi.

2. **Price Action Focus:**

- Renko charts price action par zyada focus karte hain, isliye yeh noise ko kam karte hain jo market ke fluctuations ki wajah se hoti hai.

- Yeh traders ko clearer trends aur reversals dikhate hain, jo decision-making mein madadgar hote hain.

3. **Trend Identification:**

- Renko charts trends ko identify karne ke liye bohot effective hote hain. Agar price upward trend mein hai to successive white bricks banengi, aur agar downward trend mein hai to successive black bricks banengi.

- Traders is pattern ka istemal karke long ya short positions le sakte hain.

4. **Support and Resistance Levels:**

- Renko charts support aur resistance levels ko identify karne mein madadgar hote hain. Yeh levels tab bante hain jab price kisi specific level par rukti hai ya reversal show karti hai.

- Is tarah traders ko entry aur exit points identify karne mein madad milti hai.

5. **Simplicity and Clarity:**

- Renko charts kaafi simple aur clear hote hain. Yeh technical analysis ke liye complex indicators ko use karne ki zarurat ko kam karte hain.

- Iski simplicity beginners ke liye bhi trading seekhne mein asan hoti hai.

6. **Limitations:**

- Renko charts ki limitations bhi hain; yeh time ko represent nahi karte, isliye kabhi kabhi price movements ki timing ka pata nahi chal pata.

- Yeh sudden price spikes ya gaps ko capture nahi karte, jo analysis mein ek challenge ho sakta hai.

7. **Combining with Other Tools:**

- Renko charts ko doosre technical analysis tools jaise Moving Averages, RSI ya MACD ke sath combine karna behtar hota hai.

- Yeh combination traders ko zyada reliable signals aur comprehensive analysis provide karta hai.

8. **Market Conditions:**

- Renko charts tab behtar kaam karte hain jab market mein clear trends ho. Agar market volatile hai ya range-bound hai, to yeh charts kabhi kabhi misleading ho sakte hain.

9. **Conclusion:**

- Renko chart pattern ek effective tool hai jo traders ko price movements ko visualise karne aur trading decisions lene mein madad karta hai. Is chart ka sahi istemal karke traders profitable opportunities hasil kar sakte hain. Agar Renko charts ko doosre indicators ke sath mila kar istemal kiya jaye, to yeh trading strategy zyada effective ban sakti hai. Traders ko is pattern ko samajhkar informed decisions lene chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:50 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим