Engulfing Candlestick Pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

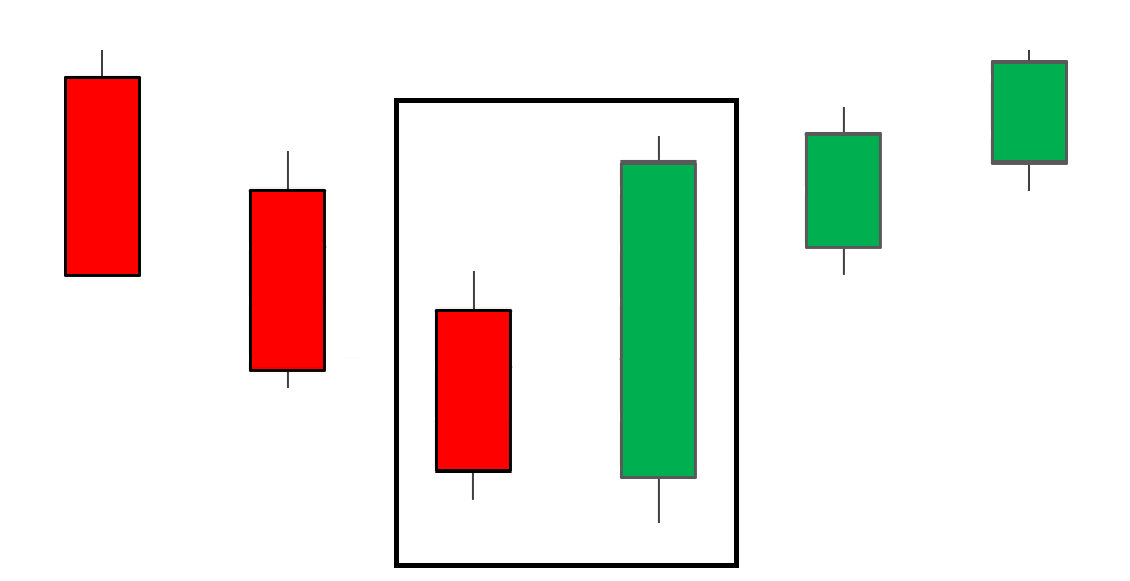

Introduction of Engulfing Candlestick Pattern Engulfing Candlestick Pattern, jo kay candlestick chart analysis ka aham hissa hai, ye market mein aane wale trend ka pata lagane mein madadgar hota hai. Is pattern mein do mukhtalif candlesticks hoti hain jo aik dosray ko 'engulf' karti hain, yani pehli candlestick doosri ko puri tarah se cover karti hai. Is pattern mein do mukhtalif types hoti hain: Bullish Engulfing Pattern]: Jab pehli candlestick bearish (girawat ki taraf) hoti hai aur doosri candlestick bullish (barhavat ki taraf) hoti hai aur doosri candlestick pehli ko poori tarah se cover karti hai, to ye bullish engulfing pattern kehlata hai. Iska matlab hota hai ke market mein possible trend reversal ho sakta hai. Bearish Engulfing Pattern Is mein pehli candlestick bullish hoti hai aur doosri candlestick bearish hoti hai, aur doosri candlestick pehli ko puri tarah se cover karti hai. Ye bearish engulfing pattern hota hai aur iska matlab hota hai ke market mein possible downward trend ho sakta hai. Engulfing candlestick pattern trading strategy Engulfing candlestick pattern traders ke liye ek aham tool hai kyunki isse future price movements ka andaza lagaya ja sakta hai, aur trading decisions liye ja sakte hain. Is pattern ko samajhna aur istemal karna, traders ke liye mahatvapurn gyan hai. Engulfing Candlestick Pattern, yaani "Dakhil Karna Candlestick Pattern," ek trading strategy hai jisay candlestick charts par istemal kiya jata hai. Is strategy mein, do aik saath aane wali candlesticks ko dekha jata hai, jo market ki trend reversal ko darust karti hain. Bullish Engulfing Pattern (Urooj Wala Dakhil Karna Pattern): Yeh pattern bearish (girawat ki) trend ko indicate karta hai aur market mein urooj (bullish) hone ki sambhavna ko darust karta hai. Is pattern mein pehli candlestick choti hoti hai aur bearish (downward) trend ko represent karti hai. Dusri candlestick lambi hoti hai aur pehli candlestick ko puri tarah se "engulf" karti hai. Agar yeh pattern sahi tareekay se confirm hota hai, toh traders long position (khareedna) le sakte hain. Bearish Engulfing Pattern (Girawat Wala Dakhil Karna Pattern): Yeh pattern bullish (urooj ki) trend ko indicate karta hai aur market mein girawat (bearish) hone ki sambhavna ko darust karta hai. Is pattern mein pehli candlestick lambi hoti hai aur bullish trend ko represent karti hai. Dusri candlestick choti hoti hai aur pehli candlestick ko puri tarah se engulf karti hai. Agar yeh pattern sahi tareekay se confirm hota hai, toh traders short position (bechna) le sakte hain. Is trading strategy ko istemal karne se pehle, aapko candlestick charts ki samajh aur market analysis ki practice ki zarurat hoti hai. Always remember that no trading strategy is foolproof, and risk management is crucial in trading. Isliye, hamesha apne trading plan ko surakshit rakhne ke liye risk management strategies ka bhi istemal karein. -

#3 Collapse

Engulfing Candlestick Pattern

engulfing candlestick pattern aik Maroof aur mo-asar ulat patteren hai jo financial instrument ki qeemat ki naqal o harkat ke rujhan mein mumkina tabdeelion ki nishandahi karne ke liye takneeki tajzia mein istemaal hota hai. is mein do mom batian hain, jin mein se doosri pehli ko poori terhan lapait layte hai, jo market ke mood mein aik ahem tabdeeli ka ishara deti hai. taizi aur mandi dono qasmon mein, yeh namona nazar aata hai :

Bullish Engulfing Pattern:

pehli candle stuck par bearish candle neechay ke rujhan ya mustaqbil ki qeemat mein kami ki nishandahi karti hai . doosri candle stuck mein khuli hui pichli bearish candle ke oopar band honay wali aik barri blush candle usay poori terhan lapait layte hai . is patteren ko baaz auqaat kharidari ke mauqa ke tor par dekha jata hai kyunkay yeh mandi se taizi ke rujhan mein tabdeeli ki nishandahi karta hai .

Bearish Engulfing Pattern:

pehli candle stick par aik taizi ki mom batii oopar ke rujhan ya mumkina qeemat mein izafay ki nishandahi karti hai . aik barri bearish candle –apne samnay blush candle ko mukammal tor par ghair layte hai aur doosri candle stick mein khulay neechay band ho jati hai . bearish engulfing patteren taizi se mandi ke rujhan mein tabdeeli ki tajweez karta hai aur usay asasay ko baichnay ya kam karne ke baray mein sochnay ke liye aik tup ke tor par liya jata hai.

Key Points to Remember:

reversal signal ki shiddat ka aik aur ishara pehli ke muqablay mein doosri shama ki shiddat hai. aik barri lifaafa mom batii ke zareya aik mazboot ulat jane ki nishandahi ki jati hai . aik paidaar rujhan ke baad, engulfing patteren ziyada qabil aetmaad hotay hain kyunkay woh rujhan ke thakawat ki nishandahi karte hain . tijarti faislay karne se pehlay, tajir aksar izafi takneeki isharay ya chart patteren istemaal karte hain taakay engulfing patteren ki durustagi ki tasdeeq ki jasakay . tijarti faislay karne se pehlay, tajir aksar izafi takneeki isharay ya chart patteren istemaal karte hain taakay engulfing patteren ki durustagi ki tasdeeq ki jasakay .

patteren ki tasdeeq karne ke liye, aap ko doosri mom batii ke band honay ka intzaar karna hoga. agar mom batii ke band honay se patteren ki toseeq nahi hoti hai, to intra day utaar charhao patteren ke khatam honay ka sabab ban sakta hai .

engulfing candlestick pattern takneeki tajzia mein aik Maroof aur mufeed tool hai, jo taajiron ko maliyati mandiyon mein mumkina rujhan ki tabdeelion ka pata laganay mein madad karta hai. behtar faislay karne ke liye, usay dosray tajzia ke tareeqon aur rissk managment ke tareeqa car ke sath istemaal kya jana chahiye, jaisa ke kisi bhi tijarti signal ke sath . -

#4 Collapse

Engulfing Candlestick Pattern: Assalam o alaikum!Dear my friends Engulfing candlestick pattern ek reversal pattern hota hai. Ye pattern kisi bhi market trend ky give up hony par banta hai. Is sample ki perceive karna bohot asan hota hai. Day by day ki jo candle bohot kum frame ki ho or us ki wicks bari hon. Or agly din ki jo full candle banti hai.is ko hum engulfing candlestick kehty hein.Engulfing candlestick styles ek aisa pattern hota hai jo market mein important hamare liye bohot hello informative hota hai engulfing candlestick sample mein fundamental jab kisi assist your resistance degree se a a candle dusre candle ko ja mukmmal tor par according to engulf kar leti hai to hum usko engulfing candlestick sample kahate hain. Engulfing candlestick pattern 1 reversal pattern hota hai jab market place mein ek trend complete ho jata hai to next trend ki ki begin mein yah pattern humein nazar aata hai aur yah hamare liye kisi bhi trend ki affirmation hoti hai.` Bearish engulfing pattern: Dear my sisters and brothers Bearish engulfing pattern technical chart pattern hai jo trader ko ye signal deta hai k marker mein lower price any wali hai. Es pattern mein pehle ek thy or market tori uptrend mein hogi. But phir sellers nay takeover kar liya or market ko down drag kar liya. Second candle ka first candle ko engulf karna zaruri hai or es patten ki itni zyada significance ni hein jab market choppy condition mein ho.lakin kuch trader ye bhi kehty hain k engulfing pattern banta hi tab hai jab market choppy behave kar rahi ho. Es pattern mein hum stop loss both candle ky high point par laga sakty hain ta k hum maximum loss say bach sakein. Bullish engulfing pattern: Dear forex traders Bullish engulfing pattern two candlestick ek reversal pattern ko kaha jata hai.is pattern mein second candlestick pehly candlestick ki body ko completely engulf karti hai. is pattern mein pehly candle bearish hoti hai or second candle bullish hoti hai aur ye pehly candle ki body sy bari hoti hai. is pattern ki help sy humein market ka pata chalta hai ky market mein pehly seller ziada thy aur market down fall kar gai but phir next session mein buyer ziada ho gi aur wo market ko previous candle ky opening point sy bhi up move karwany mein kamyab ho gaye. Bullish engulfing pattern mein hum stop loss ko both candle ky low pattern par set kar sakty hain. Bullish engulfing pattern bearish engulfing pattern k bilkul opposite banta hai aur agar trader ko aisy patterns ki knowledge ho to wo in say best result hasil karny mein kamyab ho sakty hain. So humein patterns ko zarur importance deni chahiye. -

#5 Collapse

Engulfing Candlestick Pattern

engulfing candlestick pattern aik Maroof aur mo-asar ulat patteren hai jo financial instrument ki qeemat ki naqal o harkat ke rujhan mein mumkina tabdeelion ki nishandahi karne ke liye takneeki tajzia mein istemaal hota hai. is mein do mom batian hain, jin mein se doosri pehli ko poori terhan lapait layte hai, jo market ke mood mein aik ahem tabdeeli ka ishara deti hai. taizi aur mandi dono qasmon mein, yeh namona nazar aata hai :

Bullish Engulfing Pattern:

pehli candle stuck par bearish candle neechay ke rujhan ya mustaqbil ki qeemat mein kami ki nishandahi karti hai . doosri candle stuck mein khuli hui pichli bearish candle ke oopar band honay wali aik barri blush candle usay poori terhan lapait layte hai . is patteren ko baaz auqaat kharidari ke mauqa ke tor par dekha jata hai kyunkay yeh mandi se taizi ke rujhan mein tabdeeli ki nishandahi karta hai .

Bearish Engulfing Pattern:

pehli candle stick par aik taizi ki mom batii oopar ke rujhan ya mumkina qeemat mein izafay ki nishandahi karti hai . aik barri bearish candle –apne samnay blush candle ko mukammal tor par ghair layte hai aur doosri candle stick mein khulay neechay band ho jati hai . bearish engulfing patteren taizi se mandi ke rujhan mein tabdeeli ki tajweez karta hai aur usay asasay ko baichnay ya kam karne ke baray mein sochnay ke liye aik tup ke tor par liya jata hai.

Key Points to Remember:

reversal signal ki shiddat ka aik aur ishara pehli ke muqablay mein doosri shama ki shiddat hai. aik barri lifaafa mom batii ke zareya aik mazboot ulat jane ki nishandahi ki jati hai . aik paidaar rujhan ke baad, engulfing patteren ziyada qabil aetmaad hotay hain kyunkay woh rujhan ke thakawat ki nishandahi karte hain . tijarti faislay karne se pehlay, tajir aksar izafi takneeki isharay ya chart patteren istemaal karte hain taakay engulfing patteren ki durustagi ki tasdeeq ki jasakay . tijarti faislay karne se pehlay, tajir aksar izafi takneeki isharay ya chart patteren istemaal karte hain taakay engulfing patteren ki durustagi ki tasdeeq ki jasakay .

patteren ki tasdeeq karne ke liye, aap ko doosri mom batii ke band honay ka intzaar karna hoga. agar mom batii ke band honay se patteren ki toseeq nahi hoti hai, to intra day utaar charhao patteren ke khatam honay ka sabab ban sakta hai .

engulfing candlestick pattern takneeki tajzia mein aik Maroof aur mufeed tool hai, jo taajiron ko maliyati mandiyon mein mumkina rujhan ki tabdeelion ka pata laganay mein madad karta hai. behtar faislay karne ke liye, usay dosray tajzia ke tareeqon aur rissk managment ke tareeqa car ke sath istemaal kya jana chahiye, jaisa ke kisi bhi tijarti signal ke sath . -

#6 Collapse

Engulfing Candlestick Pattern

Engulfing Candlestick Pattern forex trading mein ek ahem candlestick pattern hai jo market ke reversals ko anticipate karne mein istemal hota hai. Ye pattern typically trend reversal ya trend continuation ko indicate karta hai aur traders ko potential entry aur exit points provide karta hai.

Engulfing Candlestick Pattern mein do candlesticks hote hain: pehla candlestick chota hota hai aur doosra candlestick pehle wale candlestick ko engulf karta hai. Agar bullish engulfing pattern hai, to pehla candlestick bearish hota hai aur doosra candlestick usko completely cover karta hai. Agar bearish engulfing pattern hai, to pehla candlestick bullish hota hai aur doosra candlestick usko completely cover karta hai.

Bullish engulfing pattern dekhne par traders ko bullish reversal ki ummed hoti hai. Is pattern mein doosra candlestick pehle candlestick ko completely cover karta hai aur ye indicate karta hai ke bullish momentum strong ho sakta hai aur market mein uptrend shuru ho sakta hai.

Bearish engulfing pattern dekhne par traders ko bearish reversal ki ummed hoti hai. Is pattern mein doosra candlestick pehle candlestick ko completely cover karta hai aur ye indicate karta hai ke bearish pressure strong ho sakta hai aur market mein downtrend shuru ho sakta hai.

Engulfing Candlestick Pattern ka istemal karke, traders ko market ke reversals ko anticipate karne mein madad milti hai aur unhe potential entry aur exit points provide hoti hai. Is pattern ka istemal karne ke liye, traders ko doosri candlestick ki body size, shadows, aur volume ko closely observe karna hota hai.

Lekin, jaise har technical analysis tool ke saath hota hai, Engulfing Candlestick Pattern ko confirmatory signals aur market context ke saath dekhna zaroori hai. Agar ye pattern high volume ke saath aur strong price action ke sath dekha jata hai, to iski reliability aur validity zyada hoti hai.

Overall, Engulfing Candlestick Pattern forex trading mein ek powerful tool hai jo traders ko market ke reversals ko anticipate karne mein madad deta hai. Lekin, traders ko is pattern ka sahi tareeke se interpret karne ke liye practice aur experience ki zaroorat hoti hai. -

#7 Collapse

Introduction (Mutarif):

Forex trading, ek dynamic aur complex market hai jahan traders currencies ko buy aur sell karte hain, ummed ke sath ke prices increase ya decrease honge. Lekin, yeh market unpredictable bhi ho sakta hai, isliye traders ko sahi samay par market ke movements ko samajhna zaroori hai. Isi mein technical analysis ka ek important aspect hai candlestick patterns ka istemal, jisme Engulfing Candlestick Pattern ek significant role ada karta hai.

Engulfing Candlestick Pattern Kya Hai? (Engulfing Candlestick Pattern Kya Hai?):

Engulfing Candlestick Pattern ek powerful tool hai jo market ke direction ko predict karne mein istemal hota hai. Ye pattern do consecutive candlesticks se banta hai, jisme pehla candlestick chhota hota hai aur doosra candlestick pehle ko completely engulf karta hai. Agar doosra candlestick pehle ko upar engulf karta hai, to ye Bullish Engulfing Pattern hai aur agar niche engulf karta hai, to ye Bearish Engulfing Pattern hai.- Types of Engulfing Candlestick Patterns (Engulfing Candlestick Patterns Ke Types):

Engulfing Candlestick Patterns ke do mukhtalif types hote hain: Bullish Engulfing aur Bearish Engulfing. Bullish Engulfing ek uptrend ka signal deta hai jabke Bearish Engulfing ek downtrend ka signal hai. Ye patterns traders ko market ke reversals ki jankari dete hain.

Bullish Engulfing Pattern tab hota hai jab ek chhota red candle ek bara green candle ko engulf karta hai. Ye ek bullish reversal signal hai aur traders ko uptrend ka aghaz hone ka indication deta hai. Is pattern ko dekh kar traders long positions enter kar sakte hain ya phir short positions ko cover kar sakte hain.

Bearish Engulfing Pattern (Bearish Engulfing Pattern):

Bearish Engulfing Pattern tab hota hai jab ek chhota green candle ek bara red candle ko engulf karta hai. Ye ek bearish reversal signal hai aur traders ko downtrend ka aghaz hone ka indication deta hai. Is pattern ko dekh kar traders short positions enter kar sakte hain ya phir long positions ko close kar sakte hain.- Kyun Use Karen Engulfing Candlestick Pattern? (Engulfing Candlestick Pattern Kyun Istemal Karen?):

Engulfing Candlestick Pattern ka istemal karne se pehle, traders ko iski importance samajhni chahiye. Ye pattern market ke sentiment aur trend ka pata lagane mein madad karta hai aur traders ko sahi waqt par entries aur exits ka faisla lene mein madad deta hai.

Engulfing Candlestick Patterns ko trading strategies mein shamil karne se pehle, traders ko market ko samajhna zaroori hai. Ye patterns sirf ek part hain aur sirf inhe dekh kar trading na karna chahiye. Lekin, in patterns ko samajh kar traders apne existing strategies ko improve kar sakte hain.- Identifying Engulfing Candlestick Patterns (Engulfing Candlestick Patterns Ka Pehchan):

Engulfing Candlestick Patterns ko pehchan'ne ka tareeqa asan hai. Traders ko sirf do consecutive candlesticks ki zarurat hoti hai jo ek doosray ko poora engulf karte hain. Is pattern ko identify karne ke liye traders ko candlestick charts par nazar rakhni hoti hai aur price action ko observe karna hota hai.

Engulfing Candlestick Patterns ko istemal karte waqt risk management ka khayal rakhna zaruri hai. Traders ko apne positions ko manage karte waqt is pattern ke signals ko samajhna chahiye aur apni stop-loss orders ko set karna chahiye. Ye patterns market ke reversals ka indication dete hain, lekin kabhi-kabhi ye signals galat bhi ho sakte hain.- Engulfing Candlestick Pattern ka Istemal Kis Timeframe Par Kiya Jaye? (Engulfing Candlestick Pattern Ka Istemal Kis Timeframe Par Kiya Jaye?):

Engulfing Candlestick Patterns ko kisi bhi timeframe par istemal kiya ja sakta hai, lekin adhi ghante ya ek ghante ke chart par ye patterns zyada mufeed hote hain. Traders apne trading style aur preference ke mutabiq timeframe ka chunav kar sakte hain. Lambe samay tak ke charts par bhi ye patterns dekhe ja sakte hain lekin short-term trading ke liye adhi ghante ya ek ghante ke chart zyada suitable hote hain.

Engulfing Candlestick Patterns ki misalain market mein aasani se milti hain. Historical charts par analysis karke traders ko in patterns ka asani se pata lag jata hai. Examples dekh kar traders apni understanding ko mazeed behtar kar sakte hain. Lekin, hamesha yaad rakhein ke past performance future results ko guarantee nahi karte.- Conclusion (Ikhtitam):

Engulfing Candlestick Pattern forex trading mein ek ahem tool hai jo traders ko market ke trends ko samajhne mein madad deta hai. Is pattern ko samajh kar traders apni trading strategies ko behtar bana sakte hain aur apne trading performance ko improve kar sakte hain. Lekin, sirf is pattern par depend mat karein aur hamesha apni analysis aur research par bhi focus karein.

- References (Hawalat):

Traders ko Engulfing Candlestick Patterns ko samajhne aur istemal karne ke liye mukhtalif kitabein aur online resources mojood hain. Some useful references include Steve Nison's "Japanese Candlestick Charting Techniques" and Gregory L. Morris's "Candlestick Charting Explained."

- Types of Engulfing Candlestick Patterns (Engulfing Candlestick Patterns Ke Types):

-

#8 Collapse

Engulfing Candlestick Pattern

Engulfing Candlestick Pattern do candelon ka ek pattern hai jo stock market mein ek trend reversal ka signal deta hai. is pattern mein pahli candle ek bearish candle hoti hai, jiske bad ek badi bullish candle aati hai jo puri tarah se pahli candle ko apne andar sama leti hai. isase pata chalta hai ki bull market wapas a raha hai aur share ki kimaten badhane wali hain.

Engulfing Candlestick Pattern ki khasiyaten- pahli candle ek bearish candle hoti hai, jiska matlab hai ki share ki kimaten gir rahi hain.

- dusri candle ek bullish candle hoti hai, jiska matlab hai ki share ki kimaten badh rahi hain.

- bullish candle puri tarah se pahli candle ko apne andar sama leti hai.

- is pattern ka matlab hai ki bull market wapas a raha hai aur share ki kimaten badhane wali hain.

Engulfing Candlestick Pattern ka istemal kaise karen

Engulfing Candlestick Pattern ka istemal stock market mein trading ke liye kiya ja sakta hai. is pattern ko dekhne ke bad aap share ko kharid sakte hain aur ummid kar sakte hain ki share ki kimaten badhengi. halanki, yah yad rakhna jaruri hai ki koi bhi trading pattern 100% sahi nahin hota hai aur hamesha risk hota hai.

Engulfing Candlestick Pattern ki kuchh udaharan

niche kuchh udaharan diye gaye hain ki Engulfing Candlestick Pattern ka istemal kaise kiya ja sakta hai:

Engulfing Candlestick Pattern ke bare mein aur jankari

Engulfing Candlestick Pattern ke bare mein aur jankari ke liye aap nimnalikhit sansadhanon se paraamarsh kar sakte hain. -

#9 Collapse

Engulfing Candlestick Pattern

Engulfing Candlestick Pattern:

1. Tanzeem:- Engulfing candlestick pattern ek powerful reversal pattern hai jo traders ko market mein potential trend change ki indication deta hai.

- Ye pattern bullish aur bearish markets dono mein dekha jata hai.

2. Bullish Engulfing Pattern:- Bullish engulfing pattern bearish trend ke baad dekha jata hai aur bullish reversal ka indication deta hai.

- Is pattern mein pehla candlestick bearish hota hai jabki doosra candlestick lambi body ke saath bullish hota hai aur pehle candlestick ko poora engulf karta hai.

3. Bearish Engulfing Pattern:- Bearish engulfing pattern bullish trend ke baad dekha jata hai aur bearish reversal ka indication deta hai.

- Is pattern mein pehla candlestick bullish hota hai jabki doosra candlestick lambi body ke saath bearish hota hai aur pehle candlestick ko poora engulf karta hai.

4. Tafseel:- Engulfing pattern ko confirm karne ke liye, doosre candlestick ki body pehle candlestick ki body ko completely cover karna chahiye.

- Is pattern ko samajhne ke liye traders ko previous trend aur volume ke saath price action ka analysis karna chahiye.

5. Forex Trading Mein Istemal:- Engulfing pattern ko dekh kar traders potential trend reversal ka anticipation karte hain.

- Agar engulfing pattern ko ek strong support ya resistance level ke saath dekha jaye, to iska significance aur reliability badh jata hai.

6. Naseehat:- Engulfing pattern ko confirm karne ke liye traders ko doosre technical indicators aur price action ke saath combine karke analysis karna chahiye.

- False signals se bachne ke liye, confirmation ke liye doosre indicators ka istemal zaroori hai.

- Har trading decision se pehle thorough analysis aur risk management ka istemal karein.

-

#10 Collapse

Engulfing Candlestick Pattern

1. Intro: Candlestick patterns play a crucial role in technical analysis, offering insights into market sentiment and potential price movements. One such pattern is the engulfing candlestick pattern, which signals a potential reversal in market direction. In this guide, we'll delve into the engulfing candlestick pattern, its significance, and how traders can utilize it effectively.

2. Candlestick Patterns Ki Ahmiyat: Candlestick patterns shareef ko market ki tajziyaat mein aham kirdaar ada karte hain. Ye patterns market ka mizaaj aur keemati lehron ka andaza lagane mein madadgar sabit hote hain. In patterns mein se ek ahem pattern hai "engulfing candlestick pattern," jo keemat ki pehli bulandi ya girawat ki nishandahi karta hai.

3. Engulfing Candlestick Pattern Ka Tareeqa-e-Kaam: Engulfing candlestick pattern ki pehchan karna asaan hai. Is mein do mukhtalif candles shamil hote hain: pehla candle chhota hota hai aur doosra candle usay puri tarah se gher leta hai. Agar pehla candle bullish (Upar ki taraf) hai aur doosra candle bearish (Neeche ki taraf) hai, to ye "Bearish Engulfing" kehlata hai aur yeh aksar market ke neeche girne ki nishandahi karta hai. Ummul hazraat, agar pehla candle bearish hai aur doosra candle bullish hai, to ye "Bullish Engulfing" kehlata hai aur yeh market ki upar ki taraf rukh ki nishandahi karta hai.

4. Bearish Engulfing: Bearish engulfing pattern market ki girawat ka signal deta hai. Is mein pehla candle chhota hota hai jo bullish hota hai, aur doosra candle usay poori tarah se gher leta hai aur bearish hota hai. Ye pattern zyada tar upar jaane ke baad aur behtar trading opportunities ke liye istemal hota hai.

5. Bullish Engulfing: Bullish engulfing pattern market ki umeedon ka izhaar karta hai. Is mein pehla candle bearish hota hai, lekin doosra candle usay poori tarah se gher leta hai aur bullish hota hai. Ye pattern zyada tar neeche girne ke baad aur behtar trading opportunities ke liye istemal hota hai.

6. Engulfing Candlestick Pattern Ke Fayde: Engulfing candlestick pattern ko samajhna aur istemal karna traders ke liye ahem hai kyunki isse market ke mizaj ka andaza lagaya ja sakta hai. Ye pattern aksar trend reversals ki pehchaan karta hai aur traders ko behtar entry aur exit points provide karta hai.

7. Engulfing Candlestick Pattern Ka Istemal: Engulfing candlestick pattern ko trading strategies mein shamil karne ke liye, traders ko doosre technical indicators ke saath mila kar istemal karna chahiye. Iske saath sahi risk management aur stop-loss orders ka istemal bhi zaroori hai.

8. Conclusion: Engulfing candlestick pattern ek powerful technical analysis tool hai jo traders ko market ke mizaj aur potential reversals ka andaza lagane mein madad karta hai. Is pattern ko samajhna aur istemal karna traders ke liye zaroori hai taake woh behtar trading decisions le sakein aur market movements ka faida utha sakein.

9. Final Words: Umeed hai ke yeh guide aapko engulfing candlestick pattern ke baare mein behtar samajh aur istemal karne mein madad karegi. Yeh pattern sirf ek tool hai aur saath hi market analysis aur risk management ke saath mila kar istemal karna chahiye. Trading mein kamiyabi hasil karne ke liye hamesha education aur practice ka aham hissa hai. Happy trading!

- CL

- Mentions 0

-

سا0 like

-

#11 Collapse

**Engulfing Candlestick Pattern: Forex Trading Mein Reversal Signals Aur Strategies**

Candlestick patterns trading analysis ka ek ahem hissa hain, jo traders ko market trends aur price movements samajhne mein madad karte hain. In patterns mein se ek important aur popular pattern hai “Engulfing Candlestick Pattern.” Yeh pattern trend reversal aur market sentiment ko indicate karta hai. Is post mein, hum Engulfing Candlestick Pattern ko detail mein samjhenge, iski types, aur Forex trading mein iski importance aur use ko explore karenge.

**Engulfing Candlestick Pattern Kya Hai?**

Engulfing Candlestick Pattern ek reversal pattern hai jo typically market ke trend change ke signals ko provide karta hai. Yeh pattern do candlesticks par based hota hai: ek chhoti aur ek badi candlestick. Yeh pattern bullish aur bearish dono types mein form hota hai aur price movements ke reversal signals ko indicate karta hai.

**Types of Engulfing Patterns:**

1. **Bullish Engulfing Pattern**:

- **Formation**: Yeh pattern tab banta hai jab ek chhoti bearish candlestick ko ek badi bullish candlestick engulf karti hai. Pehli candlestick market ke bearish trend ko represent karti hai, jabke doosri candlestick us trend ko reverse karte hue bullish signal deti hai.

- **Significance**: Bullish Engulfing Pattern market ke bearish trend ke end aur bullish trend ke start ka indication deta hai. Yeh pattern market me buying pressure ke increase aur sellers ke dominance ke decrease ko signal karta hai.

2. **Bearish Engulfing Pattern**:

- **Formation**: Yeh pattern tab banta hai jab ek chhoti bullish candlestick ko ek badi bearish candlestick engulf karti hai. Pehli candlestick market ke bullish trend ko represent karti hai, jabke doosri candlestick us trend ko reverse karte hue bearish signal deti hai.

- **Significance**: Bearish Engulfing Pattern market ke bullish trend ke end aur bearish trend ke start ka indication deta hai. Yeh pattern market me selling pressure ke increase aur buyers ke dominance ke decrease ko signal karta hai.

**Engulfing Pattern Ki Pehchan**:

1. **Bullish Engulfing Pattern**:

- **Pehli Candlestick**: Chhoti bearish candle jo market ke downtrend ko represent karti hai.

- **Doosri Candlestick**: Badi bullish candle jo pehli candle ko completely engulf karti hai aur market ke reversal ka signal deti hai.

2. **Bearish Engulfing Pattern**:

- **Pehli Candlestick**: Chhoti bullish candle jo market ke uptrend ko represent karti hai.

- **Doosri Candlestick**: Badi bearish candle jo pehli candle ko completely engulf karti hai aur market ke reversal ka signal deti hai.

**Trading Strategy Using Engulfing Pattern**:

1. **Entry Point**:

- **Bullish Engulfing**: Entry point ko bullish candlestick ke high ke upar set karein. Isse confirmation milta hai ke market ka direction upward shift ho raha hai.

- **Bearish Engulfing**: Entry point ko bearish candlestick ke low ke neeche set karein. Isse confirmation milta hai ke market ka direction downward shift ho raha hai.

2. **Stop-Loss**:

- **Bullish Engulfing**: Stop-loss ko pehli bearish candlestick ke low ke neeche set karein.

- **Bearish Engulfing**: Stop-loss ko pehli bullish candlestick ke high ke upar set karein.

3. **Profit Target**:

- Profit target ko technical analysis aur support/resistance levels ke basis par set karein. Market ke reversal aur trend continuation signals ko consider karte hue target price ko determine karein.

**Confirmation Aur Risk Management**:

Engulfing Pattern ke signals ko confirm karne ke liye additional technical indicators, jaise Moving Averages aur Relative Strength Index (RSI), ka use karein. Risk management techniques, jaise stop-loss orders aur proper position sizing, ko implement karna zaroori hai taake potential losses ko limit kiya ja sake.

**Conclusion**

Engulfing Candlestick Pattern Forex trading mein trend reversal aur market sentiment ko samajhne ke liye ek valuable tool hai. Is pattern ki types, jaise Bullish aur Bearish Engulfing, traders ko market ke potential reversal points ko identify karne mein madad karte hain. Accurate identification aur effective trading strategies ke sath, aap Engulfing Pattern ko successful trading mein integrate kar sakte hain aur profitable trades achieve kar sakte hain. Technical analysis aur risk management techniques ko combine karke, aap apni trading performance ko enhance kar sakte hain aur market trends ko better predict kar sakte hain.

-

#12 Collapse

Engulfing candlestick pattern trading mein ek bohot important aur commonly used technical analysis tool hai, jo traders ko market mein trend reversals ko pehchan-ne mein madad karta hai. Ye pattern do candlesticks par mabni hota hai, jisme doosri candlestick pehli candlestick ko engulf yaani dhank leti hai, iska matlab ye hota hai ke doosri candlestick pehli ke poore range ko cover kar leti hai, chahe ye bullish engulfing ho ya bearish engulfing. Trading mein candlestick patterns ka use price action ko samajhne ke liye hota hai. Yeh patterns market ke price behavior ko reflect karte hain aur traders ko batate hain ke market mein aane wale dinon mein price kis direction mein ja sakta hai. Candlestick charts mein har ek candle ek specific time period ki opening price, closing price, highest price, aur lowest price ko show karti hai.

Candlestick ka structure kuch is tarah hota hai:- Body: Yeh candle ka main part hota hai jo opening aur closing price ke darmiyan distance ko dikhata hai. Agar closing price opening price se zyada ho, to body usually white ya green hoti hai, aur agar closing price kam ho to body black ya red hoti hai.

- Wick/Shadow: Yeh body ke upar aur neeche ka part hota hai jo market ki high aur low prices ko dikhata hai. Yeh wicks price ke extreme levels ko dikhate hain jo us time frame ke dauran touch kiye gaye the.

Engulfing pattern do consecutive candles se mil kar banta hai. Pehli candle choti hoti hai aur doosri candle usse kaafi badi hoti hai jo pehli candle ki poori body ko cover karti hai. Isme do types hote hain:- Bullish Engulfing Pattern: Jab market ka downtrend chal raha hota hai aur ek choti bearish candle banne ke baad ek bari bullish candle ban jati hai jo pehli bearish candle ko poori tarah engulf kar leti hai. Yeh pattern ye indicate karta hai ke downtrend khatam ho raha hai aur uptrend shuru ho sakta hai.

- Bearish Engulfing Pattern: Iska bilkul ulta hota hai. Jab ek uptrend ke dauran ek choti bullish candle ke baad ek bari bearish candle ban jati hai jo pehli candle ko engulf kar leti hai. Yeh pattern ye signal deta hai ke uptrend khatam ho sakta hai aur market downtrend ki taraf ja sakti hai.

Bullish engulfing pattern ek aisa candlestick pattern hai jo trend reversal ka indicator hota hai, especially jab market downtrend mein ho. Is pattern ka ana signify karta hai ke bearish momentum weak ho raha hai aur bulls (buyers) market mein control le rahe hain. Yaani, yeh pattern is baat ki nishandahi karta hai ke ab market ka trend reversal hone wala hai aur price upward direction mein move karega.

Bullish Engulfing Pattern ke Components- Pehli Candle: Yeh choti bearish candle hoti hai jisme market ne downward momentum ko dikhaya hota hai. Is candle ka color red ya black hota hai, jo ye show karta hai ke opening price closing price se zyada thi, aur price neeche giri.

- Doosri Candle: Yeh badi bullish candle hoti hai jo pehli bearish candle ko engulf kar leti hai. Is candle ka color green ya white hota hai, jo ye indicate karta hai ke closing price opening price se zyada thi. Yeh signal karta hai ke buyers ab dominate kar rahe hain aur price ko upar le jane ka irada rakhte hain.

Is pattern ka significance ye hai ke jab market ek extended downtrend mein hoti hai aur suddenly yeh pattern form hota hai, to yeh ek potential reversal ka sign hota hai. Bears ne pehle price ko neeche dabocha hota hai, lekin buyers ne strong interest show karte hue price ko wapas upar push kiya hota hai. Jab ek bari bullish candle ek choti bearish candle ko engulf kar leti hai, to iska matlab yeh hai ke market sentiment ab bullish hai.

Bullish Engulfing ka Practical Example

Agar hum sochain ke market ek sustained downtrend mein hai, aur har candle ne pehli se neeche close kiya, yeh indicate karta hai ke sellers dominate kar rahe hain. Phir, ek bearish candle banne ke baad achanak ek badi bullish candle ban jati hai jo pehli ko engulf kar leti hai. Yeh pattern traders ko signal karta hai ke ab buying ka waqt hai kyunki market ka trend reverse hone wala hai.

Bearish Engulfing Pattern

Bearish engulfing pattern bullish engulfing pattern ka ulta hota hai. Yeh pattern tab banata hai jab ek uptrend ke baad market mein selling pressure shuru hota hai. Yeh reversal ka indicator hota hai jo ye signal deta hai ke ab price neeche giregi.

Bearish Engulfing Pattern ke Components- Pehli Candle: Yeh choti bullish candle hoti hai jo ek uptrend ka indication deti hai. Market is dauran bullish tha aur buyers ne price ko upar push kiya tha. Is candle ka color green ya white hota hai.

- Doosri Candle: Yeh badi bearish candle hoti hai jo pehli bullish candle ko engulf kar leti hai. Is candle ka color red ya black hota hai, jo ye indicate karta hai ke market ab selling pressure mein hai aur price neeche gir rahi hai.

Is pattern ka significance ye hai ke jab market ka uptrend chal raha hota hai aur ye pattern form hota hai, to yeh sellers ke dominant hone ka sign hota hai. Bulls (buyers) ne pehle price ko push kiya hota hai lekin sellers ke aggressive hone se price wapas neeche girti hai. Jab ek badi bearish candle ek choti bullish candle ko engulf karti hai, to iska matlab hota hai ke market sentiment ab bearish hai.

Bearish Engulfing ka Practical Example

Agar hum dekhein ke market ek strong uptrend mein hai aur har candle ne pehli se upar close kiya, yeh bullish sentiment ko reflect karta hai. Lekin phir ek choti bullish candle ke baad ek badi bearish candle ban jati hai jo pehli ko engulf kar leti hai. Is pattern ko dekh kar traders samajh lete hain ke ab selling pressure shuru ho gaya hai aur yeh waqt sell karne ka ho sakta hai.

Kaise Engulfing Pattern ko Effectively Trade Kiya Jaye

Ab jab hume pata chal gaya ke engulfing pattern kya hota hai, to ab hum samajhte hain ke is pattern ko trading mein kaise effectively use kiya jaye.- Trend Confirmation: Sabse pehle, engulfing pattern ka use tab hi karna chahiye jab aapko current trend ka pata ho. Agar market downtrend mein ho aur bullish engulfing pattern nazar aye, to iska matlab ye ho sakta hai ke uptrend shuru hone wala hai. Usi tarah agar market uptrend mein ho aur bearish engulfing pattern nazar aye, to iska matlab ho sakta hai ke ab market neeche girne wali hai.

- Volume Analysis: Engulfing patterns ko trade karte waqt volume analysis karna bhi zaroori hai. Agar engulfing candle ke sath high volume ho, to yeh signal zyada reliable hota hai. Volume indicate karta hai ke market mein kitni liquidity aur interest hai. High volume ke sath engulfing pattern zyada effective hota hai.

- Support aur Resistance Levels: Engulfing pattern ko identify karte waqt support aur resistance levels ka analysis zaroor karna chahiye. Agar bullish engulfing pattern support level par form ho raha ho, to yeh ek strong signal hota hai ke market wahan se reversal karegi. Agar bearish engulfing pattern resistance level par form ho, to yeh signal karta hai ke market wahan se neeche girne wali hai.

- Stop-Loss aur Take-Profit Strategies: Trading mein risk management zaroori hoti hai, aur engulfing pattern ke sath trade karte waqt stop-loss aur take-profit set karna bohot zaroori hai. Stop-loss ko pehli candle ke low par rakhna chahiye agar bullish engulfing pattern ho, aur high par agar bearish engulfing pattern ho.

Engulfing Pattern ki Limitations

Halaanke engulfing pattern ek strong reversal indicator hai, lekin iske kuch limitations bhi hain:- False Signals: Kabhi kabhi engulfing pattern ke baad expected reversal nahi hota aur market sideways ya phir trend continue karti hai. Isliye hamesha dusre confirmation signals ka wait karna zaroori hota hai jaise ke volume, support-resistance, ya moving averages.

- Market Volatility: Highly volatile markets mein engulfing patterns ka reliability kam ho sakti hai kyunki price fluctuations unpredictable hoti hain. Isliye hamesha engulfing patterns ko dusre technical indicators ke sath combine karna chahiye.

- Time Frame Sensitivity: Har time frame par engulfing patterns ka significance different hota hai. Higher time frames (daily, weekly) par banne wale engulfing patterns zyada reliable hote hain, jabke lower time frames (5-minute, 15-minute) par banne wale patterns ka reliability kam ho sakta hai.

Trading mein engulfing patterns ka istemal ek trader ko better decisions lene mein madad de sakta hai, lekin yeh important hai ke aap in patterns ko dusre technical tools ke sath combine kar ke use karein taake false signals se bacha ja sake. Volume, support-resistance, aur trend analysis ke sath engulfing patterns ko samajhna aur trade karna zyada profitable ho sakta hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#13 Collapse

Engulfing Candlestick Pattern Kya Hai?

Engulfing Candlestick Pattern aik bohot mashhoor aur aham pattern hai jo traders ko market ke reversal ya continuation ke signals deta hai. Yeh pattern do candlesticks par mabni hota hai, jahan doosri candlestick pehli ko mukammal tor par "engulf" kar leti hai. Is ka matlab hai ke doosri candlestick pehli ke size ko poori tarah cover kar leti hai, aur yeh trend ke ulatnay ya mazid barqarar rahnay ka ishara karti hai.

Bullish Engulfing Pattern:

Bullish Engulfing Pattern tab banta hai jab market aik downtrend main hoti hai aur ek chhoti bearish (red) candle ke baad ek bari bullish (green) candle aati hai jo pehli bearish candle ko puri tarah se cover karti hai. Iska matlab hai ke buyers ne sellers ko overpower kar diya hai aur market ab upar ki taraf jaane wali hai. Yeh ek strong buy signal hota hai.

Key points:

- Pehli candle bearish hoti hai (red ya black).

- Doosri candle bullish hoti hai (green ya white) jo pehli ko puri tarah engulf karti hai.

- Yeh usually downtrend ke end par dikhayi deti hai, aur price reversal ka ishara deti hai.

Bearish Engulfing Pattern:

Bearish Engulfing Pattern tab banta hai jab market aik uptrend main hoti hai aur ek chhoti bullish (green) candle ke baad ek bari bearish (red) candle aati hai jo pehli bullish candle ko puri tarah engulf kar leti hai. Iska matlab hai ke sellers ne buyers ko overpower kar diya hai aur market ab neeche ki taraf jaane wali hai. Yeh ek strong sell signal hota hai.

Key points:

- Pehli candle bullish hoti hai (green ya white).

- Doosri candle bearish hoti hai (red ya black) jo pehli ko puri tarah engulf kar leti hai.

- Yeh usually uptrend ke end par dikhayi deti hai, aur price ke neeche jaane ka ishara deti hai.

Engulfing Pattern Ka Istemaal:

- Trend Reversal:

Bullish ya bearish engulfing patterns ko use karke aap market ke reversal ko pehchaan sakte hain. Yeh pattern batata hai ke market ki direction change ho sakti hai.

- Confirmation:

Hamesha kisi doosray technical indicators, jaise ke RSI ya moving averages ke sath confirmation lena zaroori hota hai taake false signals se bacha ja sake.

Conclusion:

Engulfing Candlestick Pattern aik powerful tool hai jo price action ke analysis main madadgar sabit hota hai. Yeh pattern trading strategy ko enhance karta hai aur aapko market ke mood ko samajhnay main madad deta hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#14 Collapse

Engulfing Candlestick Pattern

Engulfing candlestick pattern trading mein aik powerful indicator hai jo market ke reversal ya continuation ko indicate karta hai. Ye pattern do candlesticks par مشتمل hota hai: pehli candlestick choti hoti hai aur doosri candlestick pehli ko puri tarah se engulf karti hai. Is pattern ki do main types hain: bullish engulfing aur bearish engulfing.

Bullish Engulfing Pattern:

Ye pattern tab banta hai jab pehli candlestick bearish (red) hoti hai aur doosri candlestick bullish (green) hoti hai. Jab doosri candlestick pehli ko pura engulf kar leti hai, to ye market ke bullish hone ki nishani hoti hai. Iska matlab hai ke buyers ki strength barh rahi hai aur market price upar ki taraf move kar sakti hai. Ye pattern aksar support levels ke aas-paas nazar aata hai.

Bearish Engulfing Pattern:

Is pattern ke liye pehli candlestick bullish (green) hoti hai aur doosri candlestick bearish (red) hoti hai. Jab doosri candlestick pehli ko engulf karti hai, to ye market ke bearish hone ki nishani hoti hai. Iska matlab hai ke sellers ki strength barh rahi hai aur price niche ki taraf move karne ka potential rakhti hai. Ye pattern resistance levels ke aas-paas zyada dekha jata hai.

Is Pattern Ka Istemal:

Engulfing pattern ka istemal karte waqt kuch cheezein yaad rakhna zaroori hai. Sabse pehle, ye ensure karein ke pattern saaf aur clear ho. Iske baad, aapko confirmation signals ki zaroorat hoti hai, jese ke volume increase ya additional indicators jaise RSI ya MACD. Ye aapko ye batayega ke trend ki reversal ya continuation ke liye aapka decision kitna strong hai.

Trading mein risk management bhi bohot important hai. Agar aap engulfing pattern ko trade kar rahe hain, to stop-loss orders zaroor lagayen. Ye aapko potential losses se bacha sakta hai agar market aapke expectation ke khilaf chalti hai.

Conclusion:

Engulfing candlestick pattern ek effective tool hai jo traders ko market ke potential reversals ya continuations ko identify karne mein madad karta hai. Iska sahi istemal aur additional confirmation indicators ke sath, aap trading decisions ko behter bana sakte hain. Is pattern ko samajhna aur practice karna aapki trading skills ko nayi bulandiyon tak le ja sakta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:12 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим