Trade piercing Pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

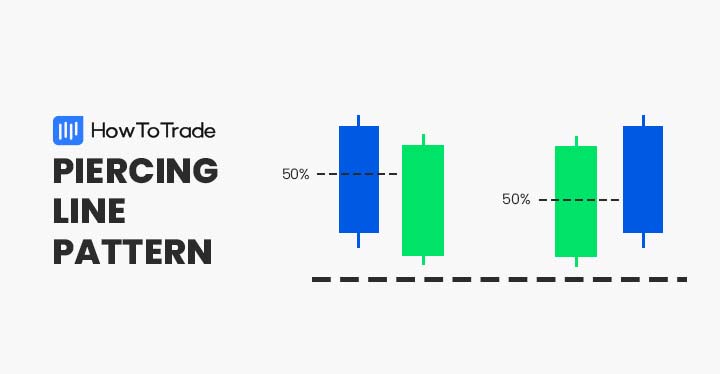

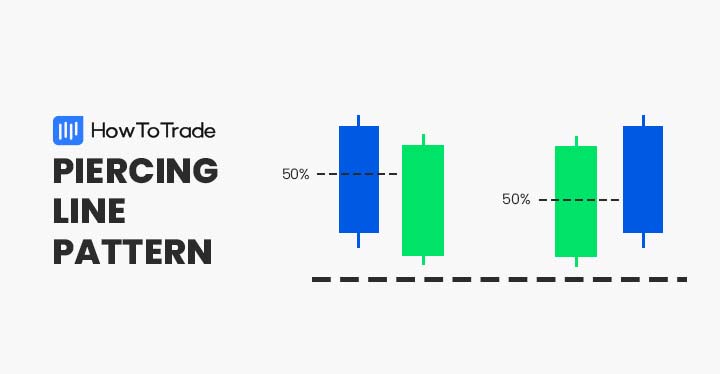

Piercing Pattern ek bullish reversal pattern hai, jismein ek bearish candlestick ke baad ek bullish candlestick appear karta hai. Is pattern mein bullish candlestick ki opening price bearish candlestick ki body ke neeche hoti hai aur bullish candlestick ki closing price bearish candlestick ki body ke upar close karti hai. Wazahat: 1. Piercing Pattern mein pehle ek bearish candlestick hota hai, jiska size aur range normal ya large ho sakta hai.2. Dusre candlestick mein ek bullish candlestick appear hota hai, jiska opening price bearish candlestick ki body ke neeche hoti hai.3. Bullish candlestick ki closing price bearish candlestick ki body ke upar close karti hai, indicating a potential trend reversal from bearish to bullish.4. Piercing Pattern ko confirm karne ke liye traders dusre technical indicators, trend lines, aur volume analysis ko bhi consider kar sakte hain. Isse unko trading signals aur levels ko identify karne mein help milti hai. Fayde: 1. Piercing Pattern bullish reversal ki indication deta hai, jisse traders ko potential trend change ka pata chalta hai.2. Is pattern mein traders ko entry aur exit points ko identify karne mein help milti hai, kyunki bullish candlestick ki strong buying pressure aur bearish candlestick ki selling pressure ko represent karti hai.3. Piercing Pattern ko confirm karne ke liye traders dusre technical indicators aur price patterns ko bhi consider kar sakte hain. Isse unko trading signals aur levels ko identify karne mein help milti hai. Nuksan: 1. Piercing Pattern keval ek indicator hai aur iska 100% accuracy nahi hota. Isliye, is pattern ka istemal karne se pehle dusre technical indicators aur market analysis ki zarurat hoti hai.2. False signals aur choppy markets, Piercing Pattern ki sahi interpretation ko prabhavit kar sakte hain. Isliye, is pattern ka istemal karne se pehle thorough research aur analysis zaruri hai.3. Piercing Pattern ko identify karna aur interpret karna traders ke liye zaruri hai. Isliye, candlestick patterns ki study aur practice zaruri hai.Piercing Pattern ek bullish reversal pattern hai, jismein ek bearish candlestick ke baad ek bullish candlestick appear karta hai. Lekin isko samajhna aur istemal karna traders ke liye zaruri hai. Professional advice aur market research ke saath Piercing Pattern ka istemal karna behtar hoga. -

#3 Collapse

trade piercing pattern definition piercing wali line pattern ko bullish se reversal candlestick pattern ke taur per Dekha jata hai Jo down Trend ke niche locate hai Jab bull Market Mein enter hote hain aur prices ko higher Push dete hain to yah Aksar trend Mein reversal ka signal deta hai piercing ke pattern Mein Do candlestick involves Hote Hain jis main dusre Bullish candlestick preceding Bearish candlestick se lower opening hai Iske Bad Buyer prices barhate hue bearish Candlestick ke body ke 50 percentage se upar close ho Jaate Hain pictures piercing ke pattern ko Banane wali do candle ki intricacies ko highlight karti hai long trade Mein enter hone se pahle piercing ke pattern ko further formation ki Zaroorat Hoti Hai is example mein RSI oscillator ko reversal ki additional conformation ke Taur per use Kiya gaya hai chart se RSI Ek oversold signal ki identify karta hai jo piercing ke pattern ki Darustgy ko takveet deta hai WHAT DOES THIS TELL TRADER Potential trend ka ulat Jana Upar ki taraf bullish reversal bear sellers is key price impetus losing hai hafta war EUR/USD upar wala chart blue color mein high light percent wale pattern ki Presence ko show karta hai is pattern se pahle ek strong down Trend hai jasake lower Lows aur Lower high se Zahir Hota Hai yah example down trend ka determine karne ke liye price action ke istemal ko illustrate karti hai however trader Akshar formation ke liye ek technical indicator ke use ko prefer Dete Hain Jaise ke moving average price long term moving average se Above honi chahie

WHAT DOES THIS TELL TRADER Potential trend ka ulat Jana Upar ki taraf bullish reversal bear sellers is key price impetus losing hai hafta war EUR/USD upar wala chart blue color mein high light percent wale pattern ki Presence ko show karta hai is pattern se pahle ek strong down Trend hai jasake lower Lows aur Lower high se Zahir Hota Hai yah example down trend ka determine karne ke liye price action ke istemal ko illustrate karti hai however trader Akshar formation ke liye ek technical indicator ke use ko prefer Dete Hain Jaise ke moving average price long term moving average se Above honi chahie  ADVENTAGE OF PATTERN WITH THE BULLISH ENGULFING CANDLE: New aur technical analysis trader donon ke liye identify karna easy hai favourable risk reward ratio Ka imkan piercing ke pattern ki confirmation ke bad desirable entry level Hansel ki Ja sakti hain stop levels ko rescent Bullish pattern candle ki low per Rakha ja sakta hai Jab Ke take profit limit ko extension price action ke zarie identified Kiya Ja sakta hai

ADVENTAGE OF PATTERN WITH THE BULLISH ENGULFING CANDLE: New aur technical analysis trader donon ke liye identify karna easy hai favourable risk reward ratio Ka imkan piercing ke pattern ki confirmation ke bad desirable entry level Hansel ki Ja sakti hain stop levels ko rescent Bullish pattern candle ki low per Rakha ja sakta hai Jab Ke take profit limit ko extension price action ke zarie identified Kiya Ja sakta hai

-

#4 Collapse

What is Bollinger band ,,, I trust all accomplices fine head ummid karta hun aap AP sab dost khairiyat se honge aur apna Kam samajhdari ke sath complete kar rahe honge or forex exchanging gathering standard boht achi pioneers kar rahy hn gy Mera AJ ka sawal boht zaiyada gigantic informationMain Bollinger band kia hy or kis tarha counts HOTA hy or we ko use kar k kis tarha benefit hail kar sakty hain. What is Bollinger gatherings, The Bollinger Band tarjeehat ke mutabiq change kya ja sakta hai. Bollinger band ko mashhoor takneeki tajir jaan bollinger ne tayyar kya aur duplicate right kya aisay mawaqay talaash karne ke liye plan kiye gaye jo sarmaya karon ko asasay ke ziyada farokht ya ziyada khareeday jane standard sahih tareeqay se shanamkay talaash karne ke liye plan kiye gaye sarmaya karon ko asasay ke ziyada farokht ya ziyada khareeday jane standard sahih tareeqay se shanamkay karne kaham ziyar kaham ziyar kaham. bollinger bundles aik intehai maqbool taknik hai. bohat se taajiron ka khayaal hai ke qeematein oopri baind ke qareeb jayen gi, market itni great news ziyada kharidi jaye gi, aur qeematein nichale baind ke qareeb jayen gi, market itni greetings ziyada farokht hogi. jaan bollinger ke paas 22 usoolon ka aik set hai jis standard amal karna baind ko bator tijarti nizaam istemaal karna hai. zail mein dukhaay gaye diagram mein, bollinger packs stock ke 20 ruckus ke sma ko oopri aur nichale baind ke sath stock ki qeemat ki rozana ki naqal o harkat ke sath brikt karta hai. kyunkay mayaari inhiraf utaar charhao ka aik pemana hai, hit markitin ziyada utaar charhao ka shikaar ho jati hain to baind wasee ho jatay hain. kam utaar charhao walay adwaar mein,baind ka moahida ho jata hai. Focal issue Bollinger bindz aik takneeki tajzia ka aala hai jisay jaan bollinger ne over fixed ya ziyada khareeday jane walay signals peda karne ke liye tayyar kya hai. Ilineni lentsha hain jo bollinger bindz ko make karti hain: aik saada move ordinary (darmiyani baind) aur aik oopri aur lower baind. oopri aur nichale baind aam top standard 2 mayaari inhiraf +/ - 20 racket ki saada ezihambayo run of the mill se hotay hain, lekin un mein tarmeem ki ja sakti hai Assessment, Bollinger bunches ka stockab laganay ka pehla marhala zirbhs security ki saada moving ordinary ki ginti karna hai, aam top standard 20 commotion ka sma istemaal karte color. 20 commotion ki move ordinary pehlay data point ke zenith standard pehlay 20 dinon ke liye band honay wali qeematon ka ost nikalay gi. I-agla data point ibtidayi qeemat kam kere ga, 21 clamor ki qeemat shaamil kere ga aur ost le ga, waghera. agla, security ki qeemat ka mayaari inhiraf bosl kya jaye ga. mayaari inhiraf ost tagayur ki aik riyaziat pemaiesh hai aur adad o shumaar, muashiaat, accounting aur maalyaat mein numaya zenith standard numaya hain. aik diye gaye instructive record ke liye, mayaari inhiraf is baat ki pemaiesh karta hai ke ost qader se kitney phailay conceal number hain. mayaari inhiraf ka stockab mutaghayyar ke murabba jarr ko le kar lagaya ja sakta hai, jo bazat khud wasst ke murabba farq ki ost hai. is ke baad, is mayaari inhiraf ki qader ko do se zarb niche aur dono sma ke sath har aik point se is raqam ko jorhin aur ghatain. woh oopri aur nichale baind tayyar karte hain -

#5 Collapse

Piercing pattern Asalam-o-alikum! Umeed karta hon sab trader ache trade kar rahen hongy aur ache earning gain kar rahy hongy ma aaj isky bary mein Kuch btana chaho ga jis se hum trade karny ky qabil ho saken gy trend ka ulat Jana Upar ki taraf bullish reversal bear sellers is key price impetus losing hai hafta war EUR/USD upar wala chart blue color mein high light percent wale pattern ki Presence ko show karta hai is pattern se pahle ek strong down Trend hai jasake lower Lows aur Lower high se Zahir Hota Hai yah example down trend ka determine karne ke liye price action ke istemal ko illustrate karti hai. security ki qeemat ka mayaari inhiraf bosl kya jaye ga. mayaari inhiraf ost tagayur ki aik riyaziat pemaiesh hai aur adad o shumaar, muashiaat, accounting aur maalyaat mein numaya zenith standard numaya hain. aik diye gaye instructive record ke liye, mayaari inhiraf is baat ki pemaiesh karta hai ke ost qader se kitney phailay conceal number hain. Points for piercing pattern 1. Pattern mein pehle ek bearish candlestick hota hai, jiska size aur range normal ya large ho sakta hai.2. Dusre candlestick mein ek bullish candlestick appear hota hai, jiska opening price bearish candlestick ki body ke neeche hoti hai.3. Bullish candlestick ki closing price bearish candlestick ki body ke upar close karti hai, indicating a potential trend reversal from bearish to bullish.4. Piercing Pattern ko confirm karne ke liye traders dusre technical indicators, trend lines, aur volume analysis ko bhi consider kar sakte hain. conclusion bullish reversal bear sellers is key price impetus losing hai hafta war EUR/USD upar wala chart blue color mein high light percent wale pattern ki Presence ko show karta hai is pattern se pahle ek strong down Trend hai jasake lower Lows aur Lower high se Zahir Hota Hai yah example down trend ka determine karne ke liye price action ke istemal ko illustrate karti hai however trader Akshar formation ke liye ek technical indicator ke use ko prefer Dete Hain. bollinger ke paas 22 usoolon ka aik set hai jis standard amal karna baind ko bator tijarti nizaam istemaal karna hai. zail mein dukhaay gaye diagram mein, bollinger packs stock ke 20 ruckus ke sma ko oopri aur nichale baind ke sath stock ki qeemat ki rozana ki naqal o harkat ke sath brikt karta hai. kyunkay mayaari inhiraf utaar charhao ka aik pemana hai, hit markitin ziyada utaar charhao ka shikaar ho jati hain thanks.. -

#6 Collapse

Introduction of Trading piercing Pattern AOA Dear trader me umeed krta ho ap sb thek ho gye js pattern pr hm baat krne wale hain us pattern ka namm he Trading piercing pattern ye basically ek bearish candlestick ke baad ek bullish candlestick appear karta hai. Is pattern mein bullish candlestick ki opening price bearish candlestick ki body ketraders dusre technical indicators, numaya zenith standard numaya hain. aik diye gaye instructive record ke liye, mayaari inhiraf is baat ki pemaiesh karta hai ke ost qader se kitney phailay conceal number hain. mayaari inhiraf trend lines, aur volume analysis ko bhi consider kar sakte hain. Isse unko trading signals aur atein nichale baind ke qareeb jayen gi, market itni greetings ziyada farokht ho candle ki low per Ra levels ko identify karne mei neeche hoti hai aur bullish candlestick ki closing price ko bhi Bullish candlestick preceding Bearish candlestick se lower opening hai Iske Bad Buyer prices liye price action ke istemal ko illustrate karti hai however trader Akshar formation ke liye ek technical indicator ke use ko prefer Dete Hain Jaise ke research ke saath bhi hm is pattern ka ache se analysis kr skte hain. Working and their Identification in Market Is ke market ke andr identification Asan bhi ho skte he aur thori bhot difficult bhi lkn aik baat ho me batna chaha ga wo he ke is me Hm yani jb ye pattern banta he tu tu bullish aur bearish sticks ka size aik dm size hota hemaalyaat meinka stockab mutaghayyar ke murabba jarr ko le kar lagaya ja sakta hai, jo bazat khud wasst ndicating a potential trend reversal from bearish to lestick ke baad ek bullish candlestick appear karta hai. Lekin isko samajhna aur istemal karna traders ke liye zaruri hai. Professional advice aur barhate hue bearishshow krta he closing price bearish candlestick ki body ke upar close karti hai, i ke market Lows aur Lower high se Zahir Hota Hai yah example down trend ka determine karne ke murabba farq ki pattern ki confirmation ke bad desirable entry level Hansel ki Ja sakti hain stop levels ko rescent Bullish patternaik intehai maqbool taknik hai. bohat se taajiron ka khayaal hai ke qeematein oopri baind ke qareeb jayen gi, market itni great news ziyada kharidi jaye gi, aur qeemkha ja sakta hai Jab Ke take profit limit ko extension price action ke zarie identified Kiya Ja sakta hai -

#7 Collapse

Piercing line pattern :

Piercing Line pattern ek bullish candlestick pattern hai. Ye pattern do candlesticks se bana hota hai. Pehla candlestick downtrend mein hota hai aur red (bearish) hota hai. Dusra candlestick ise follow karta hai aur uptrend mein hota hai aur green (bullish) hota hai. Dusra candlestick pehle candlestick ke 50% se zyada cover karta hai, isse "piercing" effect hota hai. Ye pattern price reversal signal provide karta hai aur bullish trend ki shuruwat indicate karta hai.

Trade with piercing Line pattern :

Piercing line pattern sy trade karne ke liye aap ye steps follow kar sakte hain:

1. Identify the Pattern:

Pehle candlestick bearish hona chahiye aur dusra candlestick bullish hona chahiye. Dusra candlestick pehle candlestick ke 50% se zyada cover karna chahiye.

2. Confirm with Other Indicators :

Piercing line pattern ko confirm karne ke liye dusre technical indicators ka istemal karein. Jaise ki trend lines, moving averages, ya oscillators. Agar ye indicators bhi bullish signals de rahe hain, toh confirmation mil jayegi.

3. Entry Point:

Jab piercing line pattern confirm ho jaye, tab entry point decide karein. Entry point ko define karne ke liye aap stop loss aur target levels ka istemal kar sakte hain.

4. Stop Loss:

Stop loss level ko set karein, jisse aap apni trade ko protect kar sakein. Ye level aapko determine karna hoga, jisse agar trade against direction move karta hai, toh aapko loss control karne ka mauka mile.

5. Target:

Target level ko set karein, jisse aap apne profits ko lock kar sakein. Ye level aapko determine karna hoga, jisse agar trade favorable direction move karta hai, toh aapko profits mil sakein.

6. Risk Management:

Hamesha risk management ka dhyan rakhein. Apne trades ko monitor karte rahein aur apne risk tolerance ke hisab se trade size ko manage karein. Yeh steps follow karke aap piercing line pattern ke saath trade kar sakte hain. Lekin hamesha yaad rakhein ki market unpredictable hai aur kisi bhi pattern ya indicator ki 100% guarantee nahi hoti. Apne trades ko carefully plan karein aur apne risk ko manage karein. -

#8 Collapse

Piercing line pattern : ek bullish candlestick pattern hai. Ye pattern do candlesticks se bana hota hai. Pehla candlestick downtrend mein hota hai aur red (bearish) hota hai. Dusra candlestick ise follow karta hai aur uptrend mein hota hai aur green (bullish) hota hai. Dusra candlestick pehle candlestick ke 50% se zyada cover karta hai, isse "piercing" effect hota hai. Ye pattern price reversal signal provide karta hai aur bullish trend ki shuruwat indicate karta hai.bollinger bundles aik intehai maqbool taknik hai. bohat se taajiron ka khayaal hai ke qeematein oopri baind ke qareeb jayen gi, market itni great news ziyada kharidi jaye gi, aur qeematein nichale baind ke qareeb jayen gi, market itni greetings ziyada farokht hogi. jaan bollinger ke paas 22 usoolon ka aik set hai jis standard amal karna baind ko bator tijarti nizaam istemaal karna hai. zail mein dukhaay gaye diagram mein, bollinger packs stock ke 20 ruckus ke sma ko oopri aur nichale baind ke sath stock ki qeemat ki rozana ki naqal o harkat ke sath brikt karta hai. kyunkay mayaari inhiraf utaar charhao ka aik pemana hai, hit markitin ziyada utaar charhao ka shikaar ho jati hain to baind wasee ho jatay hain. kam utaar charhao walay adwaar mein,baind ka moahida ho jata hai.Trade with piercing Line pattern : se pahle ek strong down Trend hai jasake lower Lows aur Lower high se Zahir Hota Hai yah example down trend ka determine karne ke liye price action ke istemal ko illustrate karti hai however trader Akshar formation ke liye ek technical indicator ke use ko prefer Dete Hain Jaise ke moving average price long term moving average se Above honi chahiepattern mein bullish candlestick ki opening price bearish candlestick ki body ketraders dusre technical indicators, numaya zenith standard numaya hain. aik diye gaye instructive record ke liye, mayaari inhiraf is baat ki pemaiesh karta hai ke ost qader se kitney phailay conceal number hain. mayaari inhiraf trend lines, aur volume analysis ko bhi consider kar sakte hain. Isse unko trading signals aur atein nichale baind ke qareeb jayen gi, market itni greetings ziyada farokht ho candle ki low per Ra levels ko identify karne mei neeche hoti hai aur bullish candlestick ki closing price ko bhi Bullish candlestick preceding Bearish candlestick se lower opening hai Iske Bad Buyer prices liye price action ke istemal ko illustrate karti hai however trader Akshar formation ke liye ek technical indicator ke use ko prefer Dete Hain Jaise ke research ke saath bhi hm is pattern ka ache se analysis kr skte hain.

Working and their Identification banta he tu tu bullish aur bearish sticks ka size aik dm size hota hemaalyaat meinka stockab mutaghayyar ke murabba jarr ko le kar lagaya ja sakta hai, jo bazat khud wasst ndicating a potential trend reversal from bearish to lestick ke baad ek bullish candlestick appear karta hai. Lekin isko samajhna aur istemal karna traders ke liye zaruri hai. Professional advice aur barhate hue bearishshow krta he closing price bearish candlestick ki body ke upar close karti hai, i ke market Lows aur Lower high se Zahir Hota Hai yah example down trend ka determine karne ke murabba farq ki pattern ki confirmation ke bad desirable entry level Hansel ki Ja sakti hain stop levels ko rescent Bullish patternaik intehai maqbool taknik hai. bohat se taajiron ka khayaal hai ke qeematein oopri baind ke qareeb jayen gi, market itni great news ziyada kharidi jaye gi, aur qeemkha ja sakta hai Jab Ke take profit limit ko extension price action ke zarie identified Kiya Ja sakta haicandlestick involves Hote Hain jis main dusre Bullish candlestick preceding Bearish candlestick se lower opening hai Iske Bad Buyer prices barhate hue bearish Candlestick ke body ke 50 percentage se upar close ho Jaate Hain pictures piercing ke pattern ko Banane wali do candle ki intricacies ko highlight karti hai long trade Mein enter hone se pahle piercing ke pattern ko further formation ki Zaroorat Hoti Hai is example mein RSI oscillator ko reversal ki additional conformation ke Taur per use Kiya gaya hai chart se RSI Ek oversold signal ki identify karta hai jo piercing ke pattern ki Darustgy ko takveet deta hai

Working and their Identification banta he tu tu bullish aur bearish sticks ka size aik dm size hota hemaalyaat meinka stockab mutaghayyar ke murabba jarr ko le kar lagaya ja sakta hai, jo bazat khud wasst ndicating a potential trend reversal from bearish to lestick ke baad ek bullish candlestick appear karta hai. Lekin isko samajhna aur istemal karna traders ke liye zaruri hai. Professional advice aur barhate hue bearishshow krta he closing price bearish candlestick ki body ke upar close karti hai, i ke market Lows aur Lower high se Zahir Hota Hai yah example down trend ka determine karne ke murabba farq ki pattern ki confirmation ke bad desirable entry level Hansel ki Ja sakti hain stop levels ko rescent Bullish patternaik intehai maqbool taknik hai. bohat se taajiron ka khayaal hai ke qeematein oopri baind ke qareeb jayen gi, market itni great news ziyada kharidi jaye gi, aur qeemkha ja sakta hai Jab Ke take profit limit ko extension price action ke zarie identified Kiya Ja sakta haicandlestick involves Hote Hain jis main dusre Bullish candlestick preceding Bearish candlestick se lower opening hai Iske Bad Buyer prices barhate hue bearish Candlestick ke body ke 50 percentage se upar close ho Jaate Hain pictures piercing ke pattern ko Banane wali do candle ki intricacies ko highlight karti hai long trade Mein enter hone se pahle piercing ke pattern ko further formation ki Zaroorat Hoti Hai is example mein RSI oscillator ko reversal ki additional conformation ke Taur per use Kiya gaya hai chart se RSI Ek oversold signal ki identify karta hai jo piercing ke pattern ki Darustgy ko takveet deta hai

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 Collapse

Piercing Pattern "Piercing Pattern," ya "Piercing Line," ek mumtaz juzweyati tijarat pattern hai jo candlestick chart analysis mein istemal hota hai. Yeh pattern bearish trend ko indicate karta hai aur ek possible trend reversal ko darust karta hai. Piercing pattern, do mumtaz candlesticks se bana hota hai: ek bearish candlestick aur ek bullish candlestick. Yeh pattern traders ko market mein hone wale possible trend reversal ki taraf ishara karke unhe faida pohnchane mein madadgar hota hai. Piercing Pattern Ki Pechan: Piercing pattern ko pehchanne ke liye aapko do candlesticks par ghor karna hoga. Yahan, main aapko is pattern ki pehchan step-by-step taur par batata hoon: 1. Pehli Candlestick: Pehli candlestick bearish trend ko darust karti hai aur typically down movement ke sath start hoti hai. Yani, iski opening price uske closing price se zyada hoti hai aur woh during trading session kam hoti hai. 2. Dusri Candlestick: Dusri candlestick bullish trend ko darust karti hai aur down movement ke baad shuru hoti hai. Iski opening price pehli candlestick ki closing price se neeche hoti hai aur woh higher closing price par close hoti hai. Piercing Pattern Ki Tijarat Ki Tijarat: Jab aap Piercing pattern ko pehchan lete hain, to aap is tijarat ko samajhne ke liye is tareeqay se amal kar sakte hain: 1. Piercing Pattern Ke Baad Entry: Jab aap Piercing pattern ko identify karte hain, to aap long position le sakte hain, yani ke aap kharidari kar sakte hain. Aap entry point ka faisla karne se pehle doosri technical analysis tools ka istemal kar sakte hain, jaise ke moving averages, RSI, ya MACD. 2. Stop Loss Aur Target: Apni tijarat ko manage karne ke liye aap stop loss aur target levels set kar sakte hain. Stop loss aapko nuksan se bachane mein madadgar hota hai, jabke target aapko faida pohnchane mein madadgar hota hai. 3. Risk Management: Hamesha yaad rahe ke tijarat mein risk management ka ahem kirdar hota hai. Apna risk ek maqbul had tak mehdood rakhein takay aap nuksan se bach saken. 4. Monitoring: Aapko market ko monitor karte rehna hoga taki aap apni tijarat ko samay par band kar saken ya target ko pohnch saken. Piercing Pattern Ki Tijarat Ke Liye Tips: 1. Piercing pattern ke sath doosri technical indicators ka istemal karna tijarat ko mazeed majboothi deta hai. 2. Multiple timeframes ka istemal karke aap is pattern ki tijarat ko mazeed confirm kar sakte hain. 3. Is pattern ko pehchanne se pehle market trend ko samajhna zaroori hai. Agar overall trend bearish hai, to Piercing pattern ki ahmiyat kam ho sakti hai. 4. Trading plan banana aur use follow karna ahem hai. Piercing pattern ke sath tijarat karte waqt discipline barqarar rakhna zaroori hai. Is tijarat pattern ka istemal karke, traders bearish trends se bach sakte hain aur possible trend reversal par faida pohnch sakte hain. Lekin, yaad rahe ke kisi bhi tijarat mein risk hota hai, isliye zaroori hai ke aap proper risk management ka istemal karen aur tijarat ke faislay samajhdari se lein.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:31 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим