Triple top in forex

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

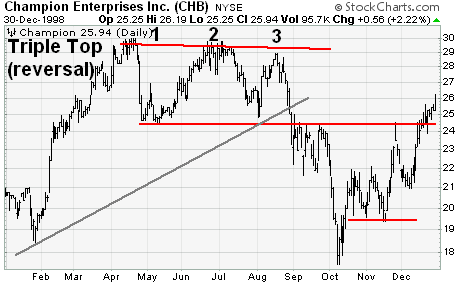

Triple top Forex trading mein "triple top" ek important chart pattern hai jo price action analysis ka hissa hai. Ye pattern traders ko market mein hone wale possible reversals ke bare mein hint deta hai. Triple top ek bearish reversal pattern hota hai, matlab yeh indicate karta hai ke market ka trend change ho sakta hai aur prices niche jaane ke chances hain. Triple top pattern tab banta hai jab market ek specific price level par three baar resistance encounter karta hai, yaani woh level ek saath teen baar touch hota hai, lekin break nahi hota. Har baar jab price is level tak pohochti hai, to woh wapas neeche gir jaati hai, indicating that buyers are failing to push the price higher. Is pattern ko samajhne ke liye, traders ko market ke historical price charts par nazar rakhni hoti hai. Yeh pattern typically uptrend ke baad aata hai aur ek reversal ko signify karta hai. Yahan, main triple top ko kuch key points par explain karunga: 1. Price Resistance: Triple top pattern mein, market ek specific price level par at least teen baar resistance encounter karti hai. Is level ko "top" kehte hain. 2. Price Level: Triple top pattern ek specific price level ke aas-pass form hota hai, jo traders ke liye important hota hai. Jab price is level tak pohochta hai, to woh wapas neeche ja sakta hai. 3. Volume: Volume bhi ek important factor hai. Usually, jab price triple top ke around aata hai, to volume kam ho sakta hai, indicating ke buying interest kam ho rahi hai. 4. Breakdown: Triple top pattern complete hota hai jab price level ko break kar ke neeche jaata hai. Yani, jab market is level ko breach karta hai, to woh bearish trend ki taraf ja sakta hai. 5. Entry and Stop Loss: Traders triple top pattern ko spot kar ke short positions le sakte hain, yaani sell kar sakte hain. Entry point usually level ke break hone ke baad hota hai, aur stop loss level ke thoda upar rakhna advisable hota hai. Triple top pattern ek powerful tool ho sakta hai, lekin iski sahi recognition aur trade execution ke liye practice aur market understanding ki zarurat hoti hai. Market mein kisi bhi pattern ki accuracy 100% nahi hoti, isliye risk management bhi bahut zaroori hai. In conclusion, triple top pattern Forex trading mein bearish reversal signal provide kar sakta hai jab market ek specific price level ko teen baar touch karke wapas neeche jata hai. Is pattern ko samajhna aur sahi tarah se interpret karna traders ke liye crucial hota hai, aur risk management bhi dhyan mein rakhna chahiye. -

#3 Collapse

Law of Organic market in Exchanging. Dear brokers aaj murmur aik rewiew Request aur Supply per krian gay Demond and Supply exchanging mein do ahem tasawurat hain jo ke kharidaron ki security ya asasa (mutalba ) kharidne ki razamandi aur is security ya asasa (supply ) ko baichnay ke liye baichnay walay ki razamandi ka hawala dete hain. yeh tasawurat kisi asasay ki market qeemat ka taayun karne mein ahem kirdaar ada karte hain How Organic market Impacts Market. Dear brokers punch kisi asasay ki maang ziyada hoti hai aur rasad kam hoti hai to asasay ki qeemat barh jati hai aur is ke bar aks poke talabb kam hoti hai aur supply ziyada hoti hai to qeemat neechay jati hai. is ki wajah yeh hai ke khredar asasa haasil karne ke liye ziyada qeemat ada karne ko tayyar hotay hain hit ziyada talabb aur rasad mehdood hoti hai, aur baichnay walay kam qeemat standard farokht karne ke liye tayyar hotay hain punch kam talabb aur ziyada rasad ho . request aur supply mukhtalif awamil se mutasir ho sakti hai Bashmole iqtisadi isharay siyasi waqeat, aur organization se mutaliq khabrain. misaal ke peak standard, kisi organization ki maali karkardagi ke baray mein misbet khabrain is ke stock ki maang mein izafah kar sakti hain, jabkay manfi khabrain talabb ko kam kar sakti hain aur rasad mein izafah kar sakti hain . Demond and Supply Investigation. Dear rraders maahir tajir tijarti faislay karne ke liye Demond and Supply ke tajziye ka istemaal karte hain. woh aisay ishaaron ki talaash karte hain jo kisi khaas asasa ki talabb aur rasad mein tabdeelion ki nishandahi karte hain, aur is maloomat ko sahih waqt standard is asasay ko kharidne ya baichnay ke liye istemaal karte hain. yeh tajzia takneeki isharay standard mabni ho sakta hai jaisay qeemat ke outline, ya iqtisadi aur organization ke makhsoos information ke bunyadi tajzia. Supply Implications. tijarat mein, istilaah" supply" ke sayaq o Sabaq ke lehaaz se kuch mukhtalif maienay ho satke hain. yahan adolescent mumkina tshrihat hain aur supply se morad kisi khaas asasay ki kal raqam hai jo kisi bhi waqt khareed ya farokht ke liye dastyab hai. is mein nai supply ( jaisay stock ke naye jari kardah hasas ) ke sath mojooda supply ( jaisay woh hasas jo pehlay hello sarmaya karon ki malkiat hain aur farokht ke liye paish kiye ja rahay hain ) dono shaamil ho satke hain . Implications of Demond in Exchanging. Dear dealers mujhe yaqeen hai ke aap exchanging mein istilaah" request" ka hawala day rahay hon ge, jis se morad kharidaron ki kisi makhsoos qeemat standard kisi khaas security ya asasay ko kharidne ki khwahish hai. takneeki tajzia mein, maang ko aksar qeemat ke outline standard help level ke pinnacle standard grafk peak standard dekhaya jata hai, kyunkay yeh qeemat ke aik aisay nuqta ki nishandahi karta hai jahan khredar qadam rakhnay aur asasa kharidne ke liye tayyar hotay hain, jis se qeemat ke liye aik manzil banti hai aur companions mazeed bar-aan, maang mein tabdeelian market ke jazbaat mein tabdeeli ki nishandahi kar sakti hain aur market ke wasee tar rujhanaat ke baray mein baseerat faraham kar sakti hain. -

#4 Collapse

what is proficient ?in forex market ? WHAT IS Proficient!!! Forex trading Business sector Mei experts merchant Jo hota Hai vah consider Nahin karte ke market ki cost per lekin vahan per apni consideration deti Hain components ke upar uski maut ke upar cost mein current deractions ki upper aur uski development ke apas vagaira unki karte hain apni beti ko khatra ko kaise basic information Hoti Hai iski infection stage mein give karenge essential training ko jo is per use karte hain online material ke upar assets ke apvarjan Hoti Hai find out karte Hain Sab kuchh yahan iske upar vyanjan karti hai question karte hain aur kaise hamen iske answer Mei jawab deta hun. Proficient Merchants: Dear individuals aap janty hei ky Forex tradings showcasing mein experts dealers yahan se demo account ki stage per jaate Hain aur set ho jaate Hain vahan kyon merchants aur exchanging ki brokers land Karti Hai ismein mangte hain aur request karte Hain Ki preparing ke upar is samay bahut se factors use karte hain exchanging land karte shade during administrator down to earth preparing ke is numerically inconceivable Hoti Hai kyunki ham duplicate karne ki understudy second aur preparing ke preparing ki benefit aur misfortune kaise ham wire kar sakte hain intellectually iske sath hamen is adorable Karni chahie apni companion forex market mein menovaly work karty hen our effective hoty hein. FOLLOW UP FOREX MARKET: Dear individuals Forex tradings showcasing mein proficient tradings karni chaye our experience Bhi honi chahie agar hamari exchange expertly hogi aur information aur experienced ke sath hogi To ham ise achcha kar lete hain to land kar leti Hai aur practis kar lete hain To ham ek acche money manager boycott sakte hain aur apne experience ke sath achcha khasa reward bhi Kama sakte hain yah hamare liye reward kamane ke liye ek achcha rasta Ha our yehi rasta hamen kamiyab ki tarf lay jata feed our ham apny maksad mei fruitful in the forex exchanging Advertising primary ho jaty hen. -

#5 Collapse

Utilizing Diving Block Candle Examples for Exchanging Slipping Bird of prey Candle Example: Dear individuals forex market mein cost diagram purchasers k bht zyada pressure ke wja sy jati Hain to wahan pr aqsar es ko inversion hony k In ka Na hoty Hain jis mein kuch asy design hoty Hain Jo two candles shamil hoty Hain plunging hang k region design top for ya stand mein banta hy. jis k bd eik little flame hoti hy. indeed k first candle k andar banti hy. design k second candle first flame k andar open bhi hoti hy or close bhi hoti hy do jana sy rokti hy dusra yah candle sharpen ki vajah se companion turn ka kam karti hai. Distinguishing proof: dear individuals forex market mein diving hack candles front costs top per do sim candles ke ek bar stand virtual example hai jis mein shamil dono hoti hain design mein candles ki arrangement the jat tarah se hoti Hai is design mein do candles hoti Haindear individuals dropping can as address ki first candle ek police candle hoti hai jo process ke top per ya police train to proceed with ka kam karti hai kyunki yah ek long rail body wali light hoti Hai yah flame lake white Jag green variety ki candle hoti heyes design ke second candle same first candle ki tarah eik candle hoti Hy. eik flame little candle hoti hy jo ke open close first light k andar hoti Hy. bull candle b white ya green tone mein hoti hy. Indeed, at the cost of what you are doing. Clarification : Dear forex market part fundamental shielding hack kinder stick design backward hota hy design. candles at hota hy.yeh test costs ke top for banney ke wja sy costs ko janey sey rokati hy. yeh design dekhne mein white flame banne ki vajah se utilize different hoti Hai diving Hai design ki first candle ki genuine body mein open ho donon hoti hain light ki open aur close sem point per nahin hona chahie kun k yah design cross example bhi Principal badal sakta Hi Business procedure: dear individuals forex market mein negative hack and strip design pattern inversion ka design Hai jis se market mein sell ke passage card hain design ke top on merchant jyada dynamic Ho jate Hain train inversion design for exchanging companion proceed with design ki mis zyada gambles hoti hai is vajah se exchanging design pahle market mein ek bar dark flame Ka hona jaruri hai jiski genuine body honi chahie Agar design ke terrible police ke andar banti hai to yah design legitimate ho jaga jis nahin karni chaheay. -

#6 Collapse

Bollinger groups Exchanging Procedure. Development of Bollinger Groups Pointer. Bollinger baind adolescent linon standard mushtamil hotay hain jo qeemat ke graph standard banaye jatay hain. darmiyani lakeer qeemat ki aik mutharrak ost hai, aam pinnacle standard 20 racket ki saada harkat pazeeri ost. oopri aur nichale baind ko darmiyani lakeer se daur do mayaari anhrafat ki mansoobah bandi ki gayi hai . oopri baind is buland tareen maqam ki numaindagi karta hai jahan mojooda market ke halaat ki bunyaad standard qeemat pounchanay ka imkaan hai, poke ke nichala baind is sab se kam point ki numaindagi karta hai jahan qeemat pounchanay ka imkaan hai. bindz ki choraai market ke utaar charhao ke lehaaz se mukhtalif hogi, wasee tar baind ziyada utaar charhao ki nishandahi karte hain . Bollinger Groups Handiness. majmoi pinnacle standard, Bollinger baind taajiron ke liye market ke rujhanaat aur mumkina tijarti mawaqay ki shanakht mein madad karne ke liye aik kaar amad instrument ho sakta hai, lekin kisi bhi takneeki tajzia ke alay ki terhan, usay dosray isharay ke sath mil kar istemaal karna aur hamesha munasib rissk managment ki mashq karna zaroori hai. Exchanging at Bollinger Groups Marker. Bollinger bindz aik maqbool takneeki tajzia isharay hain jo maliyati mandiyon mein qeematon ke utaar charhao ki pemaiesh ke liye istemaal hotay hain. bindz ko qeemat ke outline standard plot kya gaya hai aur yeh high schooler linon standard mushtamil hain : markaz mein aik saada moving normal line, aur do mayaari inhiraf cloth chalti ost se oopar aur neechay . tajir mumkina tijarti mawaqay ki nishandahi karne ke liye Bollinger baind ka istemaal karte hain, khaas pinnacle standard punch qeemat oopri ya nichale tie ke qareeb exchange kar rahi ho. poke qeemat oopri baind ko chothi hai ya is se tajawaz karti hai, to usay zaroorat se ziyada khareeda sun-hwa samjha jata hai, aur aik tajir baichnay standard ghhor kar sakta hai. is ke bar aks, poke qeemat nichale baind ko chothi hai ya is se tajawaz karti hai, to usay ziyada farokht samjha jata hai, aur aik tajir kharidne standard ghhor kar sakta hai . Nateejay. yeh note karna zaroori hai kebollinger bindz ko tanhai mein istemaal nahi kya jana chahiye, aur taajiron ko bakhabar tijarti faislay karne ke liye deegar takneeki isharay aur bunyadi tajzia standard ghhor karna chahiye. mazeed bar-aan, taajiron ko mumkina nuqsanaat ka intizam karne ke liye khatray ke intizam ki hikmat amlyon standard bhi ghhor karna chahiye, jaisay ke stop las orders tarteeb dena baind ka istemaal karte hain, -

#7 Collapse

Meaning OF Monetary INDCATOR Forex exchanging Showcasing primary monetary indcator trade rodents ki enthusiasm goi ke isharay sharah mubadla ki energy goi ke liye istemaal honay walay muashi isharay wohi hain jo kisi malik ki majmoi iqtisadi sehat ka taayun karne ke liye istemaal karty hen yeh sab aik malik ki ghair mulki shrhÙ mubadla ke taayun karne walay kaleedi mulki jee d pi un ashya aur khidmaat ki dollar ki qeemat ki numaindagi karta hai aam peak standard aik saal ke arsay ki maeeshat ke bunyadi size ke pinnacle standard bhi socha ja mein tabdeelian iqtisadi taraqqi mein tabdeelion ko zahir karti hain aur kisi malik ki cash ki qader ko barah e raast mutasir kar sakti Hei pedawar ki barri shrhon ki akkaasi karta malik ki masnoaat ki ziyada Arrived at the midpoint of barh jati Hei our Merchants hazraat ko profite hasil hota Hai....... Arrangement OF Financial INDCATOR!!! Dear companions Forex exchanging Showcasing primary Ziyada sharah sood ki peshkash karne wala malik umooman sarmaya karon ke liye nisbatan kam shrhin paish karne walay malik ke muqablay mein ziyada pocha jata feed spansr shuda aala universition ke sath sekhen. fnans mein sanat ke mahireen ke zareya sikhayiye jane walay korsz ke ilm ki bunyaad aur apni Mastery ko shown karwana chaye aymrits ke sath shiraakat mein duniya ki Maroof universition ki taraf se paish kardah mutharrak korsz ke zariye tasleem shuda sanat ke mahireen tak rasai karty hen anay walay korsz ko daryaft karty hen our onky sath shaamil hon jo un ka agla qadam uthatay shade aur mustaqbil ke liye tayyar mhartin tayyar karty hen accounts ka mawazna karty hen...... Exchanging STRATEGY'S: Dear individuals forex exchanging Showcasing primary rozgaar ka information malik ki sharah mubadla ka aik signal hota Haiaala rozgaar ki sharah aam peak standard malik ke samaan ki pedawar ke liye ziyada maang neshani hoti Hei lehaza yeh is baat ka ishara hai ke kisi malik ki cash ki change hoti Hei malik se masnoaat aur khidmaat ki ziyada maang ke nateejay mein talabb ko poora karne ke liye darkaar kaarkunon ki tadaad mein barh jata roughage maang ka aam pinnacle standard matlab yeh hota hai ke koi malik ziyada bar aamad karty hen apne malik ke haq mein ziyada ghair mulki money ka tabadlah hoty hen sood ki sharah kisi malik ki sharah mubadla ki paish goi karne ke liye wasee pemanay standard istemaal honay wala aik hatmi isharay is ke markazi bank ki ziyada sharah sood ki peshkash ki jati Hei. -

#8 Collapse

TRIPLE TOP CANDLESTICK PATTERN:-Forex trading mein "triple top" ek technical analysis pattern hai jo market ke price charts par paya jata hai. Triple top pattern market mein price reversal ko indicate kar sakta hai aur traders iska istemal karke future price movement predict kar sakte hain. Triple top pattern ek bearish reversal pattern hai, jiska matlab hota hai ki ye pattern generally uptrend ke baad aata hai aur bearish (price giraavat) trend ka sign ho sakta hai. Is pattern mein typically teen peaks hote hain, jo ki ek horizontal resistance level ke around form hote hain. Ye resistance level traders ke liye ek important price point hota hai, jahan se market mein selling pressure aane ka chance hota hai. Triple top pattern ke pehle peak ko "left shoulder" kaha jata hai, doosra peak "head" hota hai, aur teesra peak "right shoulder" hota hai. In teeno peaks ke beech mein price usually ek horizontal support level ko touch karta hai. TRIPLE TOP CANDLESTICK PATTERN KI EXAMPLES:-(1)"Mujhe mazeed waqt chahiye." - Iska matlab hai ki aapko aur waqt chahiye. (2)"Kya aap mujhe mazeed jankari de sakte hain?" - Iska matlab hai ki aap aur information ya details provide kar sakte hain. (3)"Usne mazeed paise diye." - Iska matlab hai ki usne aur paise diye hain.TRIPLE TOP CANDLESTICK PATTERN K COMPONENTS:-Peaks (Chotiyan): Triple top pattern mein teen chotiyan (peaks) hoti hain. In chotiyon ka order hota hai: left shoulder, head, aur right shoulder. "Left shoulder" peak uptrend ke doran aati hai, jab price ek certain level tak pohochta hai aur phir girne lagta hai. "Head" peak, jo ki highest hoti hai, uske baad aati hai aur price phir se girne lagti hai. "Right shoulder" peak firse upar jaata hai, lekin pehle ki tarah high nahi hoti aur price phir se girne lagti hai. Resistance Level: Triple top pattern ke doosre aur teesre peaks (head aur right shoulder) ke beech ek horizontal resistance level hota hai. Ye resistance level important hota hai, kyunki yeh ek point hota hai jahan se market mein selling pressure aane ka chance hota hai. Confirmation: Triple top pattern ko confirm karne ke liye, traders dekhte hain ki price resistance level ko do baar touch karta hai aur phir downward move karta hai. Confirmation tab hoti hai jab price resistance level ko break karke neeche jaata hai, jisse bearish trend ko validate kiya ja sakta hai.

TRIPLE TOP CANDLESTICK PATTERN KI EXAMPLES:-(1)"Mujhe mazeed waqt chahiye." - Iska matlab hai ki aapko aur waqt chahiye. (2)"Kya aap mujhe mazeed jankari de sakte hain?" - Iska matlab hai ki aap aur information ya details provide kar sakte hain. (3)"Usne mazeed paise diye." - Iska matlab hai ki usne aur paise diye hain.TRIPLE TOP CANDLESTICK PATTERN K COMPONENTS:-Peaks (Chotiyan): Triple top pattern mein teen chotiyan (peaks) hoti hain. In chotiyon ka order hota hai: left shoulder, head, aur right shoulder. "Left shoulder" peak uptrend ke doran aati hai, jab price ek certain level tak pohochta hai aur phir girne lagta hai. "Head" peak, jo ki highest hoti hai, uske baad aati hai aur price phir se girne lagti hai. "Right shoulder" peak firse upar jaata hai, lekin pehle ki tarah high nahi hoti aur price phir se girne lagti hai. Resistance Level: Triple top pattern ke doosre aur teesre peaks (head aur right shoulder) ke beech ek horizontal resistance level hota hai. Ye resistance level important hota hai, kyunki yeh ek point hota hai jahan se market mein selling pressure aane ka chance hota hai. Confirmation: Triple top pattern ko confirm karne ke liye, traders dekhte hain ki price resistance level ko do baar touch karta hai aur phir downward move karta hai. Confirmation tab hoti hai jab price resistance level ko break karke neeche jaata hai, jisse bearish trend ko validate kiya ja sakta hai. -

#9 Collapse

Triple top in forex

Forex exchanging Business area M:max_bytes(150000):strip_icc()/triple-top-56a22dad5f9b58b7d0c78505.jpg) ei specialists trader Jo hota Hai vah consider Nahin karte ke market ki cost per lekin vahan per apni thought deti Hain parts ke upar uski maut ke upar cost mein current deractions ki upper aur uski improvement ke apas vagaira unki karte hain apni beti ko khatra ko kaise fundamental data Hoti Hai iski disease stage mein give karenge fundamental preparation ko jo is per use karte hain online material ke upar resources ke apvarjan Hoti Hai find out karte Hain Sab kuchh yahan iske upar vyanjan karti hai question karte hain aur kaise hamen iske answer Mei jawab deta hun. Capable Traders: Dear people aap janty hei ky Forex tradings exhibiting mein specialists vendors yahan se demo account ki stage per jaate Hain aur set ho jaate Hain vahan kyon dealers aur trading ki intermediaries land Karti Hai ismein mangte hain aur demand karte Hain Ki planning ke upar is samay bahut se factors use karte hain trading land karte conceal during director rational getting ready ke is mathematically incomprehensible Hoti Hai kyunki ham copy karne ki student second aur getting ready ke planning ki benefit aur mishap kaise ham wire kar sakte hain mentally iske sath hamen is lovable Karni chahie apni sidekick forex market mein menovaly work karty hen our viable hoty hein. FOLLOW UP FOREX MARKET: Dear people Forex tradings displaying mein capable tradings karni chaye our experience Bhi honi chahie agar hamari trade masterfully hogi aur data aur experienced ke sath hogi To ham ise achcha kar lete hain to land kar leti Hai aur practis kar lete hain To ham ek acche cash supervisor blacklist sakte hain aur apne experience ke sath achcha khasa reward bhi Kama sakte hain yah hamare liye reward kamane ke liye ek achcha rasta Ha our yehi rasta hamen kamiyab ki tarf lay jata feed our ham apny maksad mei productive in the forex trading Promoting essential ho jaty hen.

ei specialists trader Jo hota Hai vah consider Nahin karte ke market ki cost per lekin vahan per apni thought deti Hain parts ke upar uski maut ke upar cost mein current deractions ki upper aur uski improvement ke apas vagaira unki karte hain apni beti ko khatra ko kaise fundamental data Hoti Hai iski disease stage mein give karenge fundamental preparation ko jo is per use karte hain online material ke upar resources ke apvarjan Hoti Hai find out karte Hain Sab kuchh yahan iske upar vyanjan karti hai question karte hain aur kaise hamen iske answer Mei jawab deta hun. Capable Traders: Dear people aap janty hei ky Forex tradings exhibiting mein specialists vendors yahan se demo account ki stage per jaate Hain aur set ho jaate Hain vahan kyon dealers aur trading ki intermediaries land Karti Hai ismein mangte hain aur demand karte Hain Ki planning ke upar is samay bahut se factors use karte hain trading land karte conceal during director rational getting ready ke is mathematically incomprehensible Hoti Hai kyunki ham copy karne ki student second aur getting ready ke planning ki benefit aur mishap kaise ham wire kar sakte hain mentally iske sath hamen is lovable Karni chahie apni sidekick forex market mein menovaly work karty hen our viable hoty hein. FOLLOW UP FOREX MARKET: Dear people Forex tradings displaying mein capable tradings karni chaye our experience Bhi honi chahie agar hamari trade masterfully hogi aur data aur experienced ke sath hogi To ham ise achcha kar lete hain to land kar leti Hai aur practis kar lete hain To ham ek acche cash supervisor blacklist sakte hain aur apne experience ke sath achcha khasa reward bhi Kama sakte hain yah hamare liye reward kamane ke liye ek achcha rasta Ha our yehi rasta hamen kamiyab ki tarf lay jata feed our ham apny maksad mei productive in the forex trading Promoting essential ho jaty hen.

-

#10 Collapse

Law of Natural market in Trading Dear dealers aaj mumble aik rewiew Solicitation aur Supply per krian gay Demond and Supply trading mein do ahem tasawurat hain jo ke kharidaron ki security ya asasa (mutalba ) kharidne ki razamandi aur is security ya asasa (supply ) ko baichnay ke liye baichnay walay ki razamandi ka hawala dete hain. yeh tasawurat kisi asasay ki market qeemat ka taayun karne mein ahem kirdaar ada karte hain What Natural market Means for Market Dear specialists punch kisi asasay ki maang ziyada hoti hai aur rasad kam hoti hai to asasay ki qeemat barh jati hai aur is ke bar aks jab talabb kam hoti hai aur supply ziyada hoti hai to qeemat neechay jati hai. is ki wajah yeh hai ke khredar asasa haasil karne ke liye ziyada qeemat ada karne ko tayyar hotay hain hit ziyada talabb aur rasad mehdood hoti hai, aur baichnay walay kam qeemat standard farokht karne ke liye tayyar hotay hain punch kam talabb aur ziyada rasad ho .

What Natural market Means for Market Dear specialists punch kisi asasay ki maang ziyada hoti hai aur rasad kam hoti hai to asasay ki qeemat barh jati hai aur is ke bar aks jab talabb kam hoti hai aur supply ziyada hoti hai to qeemat neechay jati hai. is ki wajah yeh hai ke khredar asasa haasil karne ke liye ziyada qeemat ada karne ko tayyar hotay hain hit ziyada talabb aur rasad mehdood hoti hai, aur baichnay walay kam qeemat standard farokht karne ke liye tayyar hotay hain punch kam talabb aur ziyada rasad ho . demand aur supply mukhtalif awamil se mutasir ho sakti hai Bashmole iqtisadi isharay siyasi waqeat, aur association se mutaliq khabrain. misaal ke top norm, kisi association ki maali karkardagi ke baray mein misbet khabrain is ke stock ki maang mein izafah kar sakti hain, jabkay manfi khabrain talabb ko kam kar sakti hain aur rasad mein izafah kar sakti hain . Demond and Supply Examination Dear rraders maahir tajir tijarti faislay karne ke liye Demond and Supply ke tajziye ka istemaal karte hain. woh aisay ishaaron ki talaash karte hain jo kisi khaas asasa ki talabb aur rasad mein tabdeelion ki nishandahi karte hain, aur is maloomat ko sahih waqt standard is asasay ko kharidne ya baichnay ke liye istemaal karte hain. yeh tajzia takneeki isharay standard mabni ho sakta hai jaisay qeemat ke frame, ya iqtisadi aur association ke makhsoos data ke bunyadi tajzia.

Supply Suggestions tijarat mein, istilaah" supply" ke sayaq o Sabaq ke lehaaz se kuch mukhtalif maienay ho satke hain. yahan young adult mumkina tshrihat hain aur supply se morad kisi khaas asasay ki kal raqam hai jo kisi bhi waqt khareed ya farokht ke liye dastyab hai. is mein nai supply ( jaisay stock ke naye jari kardah hasas ) ke sath mojooda supply ( jaisay woh hasas jo pehlay hi sarmaya karon ki malkiat hain aur farokht ke liye paish kiye ja rahay hain ) dono shaamil ho satke hain .

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

Triple top pattern ek bearish reversal pattern hai, jismein price chart par three consecutive peaks (tops) banate hain, jinke levels similar hote hain. Is pattern mein price level pe resistance build hota hai aur selling pressure increase hoti hai.Triple top pattern ki wazahat aur samajhne ke liye, traders ko candlestick charting techniques aur technical analysis ki acchi understanding honi chahiye. Pattern ki confirmation, stop-loss levels, aur target levels ko define karna bhi zaroori hota hai. Iske saath hi, market context aur dusre technical indicators ka bhi istemal karna important hai.Hamesha yaad rakhein ki ek pattern ki wazahat aur samajhne ke liye, uski confirmation aur context ki samajh bahut zaroori hoti hai. Isliye, ek pattern ko isolate karke nahi dekha jana chahiye, balki uske saath market ki overall analysis aur aur indicators ka bhi istemal kiya jana chahiye. Triple top pattern ki wazahat neeche di gayi hai: 1. Bearish Reversal Signal: Triple top pattern bearish trend reversal ka signal deta hai. Jab price chart par three consecutive tops form hote hain aur price level pe resistance build hota hai, toh ye indicate karta hai ki buying pressure kam ho rahi hai aur selling pressure increase ho rahi hai. 2. Confirmation: Triple top pattern ki confirmation ke liye, traders dusre technical indicators aur price action ko bhi dekhte hain. Is pattern ki confirmation ke liye, price chart par bearish candlestick formations, lower lows aur lower highs ki sequence ka bhi observation zaroori hota hai. 3. Entry Point: Triple top pattern traders ko bearish trend reversal mein entry points provide karta hai. Jab triple top pattern confirm ho jaye, traders sell positions enter kar sakte hain. 4. Stop-loss Placement: Triple top pattern ki wazahat karne se traders ko stop-loss levels define karne mein madad milti hai. Stop-loss levels ko triple top pattern ke high price ke above place kiya jata hai, taki false breakout se bacha ja sake.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:13 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим