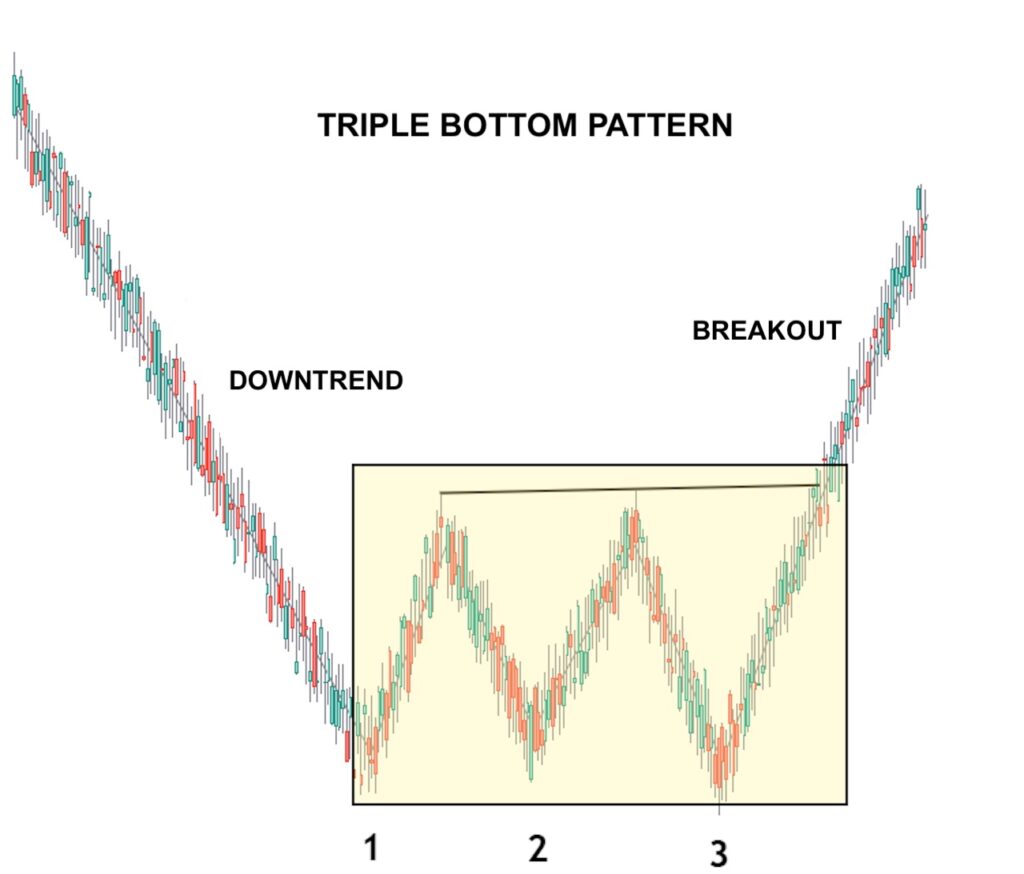

Triple bottom candle pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Assalam alaikum dear members !- umeed ha ap sb khairiat se hn gy or apki trading achi ja ri ho ge.

- dear members aj ki post main hum triple bottom chart pattern ko study karen gy or dekhen gy k is ko kesy trade kia jata ha.

- Dear members triple bottom chart pattern aik bullish reversal pattern ha. Ye pattern bearish trend k end main bnta ha or es k bad market buy main jati ha.

- es pattern main market 3 bar aik support zone py touch karti ha jski wja se triple bottom bnti ha.

- dear members bearish trend k end main jb market kafi nechy gir chuki hoti ha to us k bad market aik support area de reject ho k wapis aik resistace ki trf ati ha or wahan se wps reject ho k apni previous support ki trf jati ha.

- es trha aik muqam py market 2 lows bnati ha or wahan se wapis previous resistance ki trf jati ha or reject ho k previous support ki trf ati ha or estrha 3 bar aik support ko touch krti ha or tripple bottom pattern bnta ha.

- dear member bottom k bnany k bad market opr js resistance se reject hoti ha 2 bar usko neckline kaha jata ha.

- dear member triple bottom chart pattern main trade karny k lye hamen pattern ki completion ka wait karna chahye.

- jb pattern complete ho jy to es k breakout ka wait karna chahye or neckline k breakout k bad hm es pattern main sell ki trade le skty hain.

- laikin breakout k bad confirmation lazmi ha.

- breakout ki confirmation ye ha k market neckline k bhr usi time frame main candle close kary js main ye pattern bny.

- or eski 2nd confirmation ye ha k breakout k bad market neckline ko dobra test kary.

- es pattern main trade leny k lye hmara stop loss us neckline py ho ga jahan se breakout ho.

- or profit target neckline se support tk k area ki height k equal ho ga.

-

#3 Collapse

TRIPLE BOTTOM CANDLE PATTERN DEFINITION Triple bottom reversal Ek Bullish ka reversal pattern hai yah pattern aamtaur per 3 se 6 month ki term mein bante Hain Jo bar chart line paya jata hai resistance ke upar Ek gap ke bad equal three low hai bar ya line chart per triple bottom reversal break down se bilkul different hai yionee PF Jo negative support break ko Kisi bhi revers pattern ke sath reverse karne ke liye ek current trend honi chahie lows bilkul barabar Nahin honi chahie jisse overall volume ki levels kam hoti Jaati Hai resistance support Badalta Hai RESISTANCE BREAK OUT To Tuti Hui resistance support Ban Jaati Hai resistance break out se lows Tak ka fasla mapa jata hai aur price ke target ke liye resistance gap Mein Shamil Kiya jata hai Pattern jitni der takat taiyar Hota Hai break out utna hi important Hota jata hai triple bottom reversal Jo 6 ya usse zyada month ki term main hi large bottoms ki represent karti hai jismein price ke target Mein effect hone ka Imkaan hai pattern me se sirf tri angle descending main Bearish over tones Hain Agar volume aur Momentum mein bullish Mein izaafa Hota Hai to break out ke imkANAT barh Jaate Hain

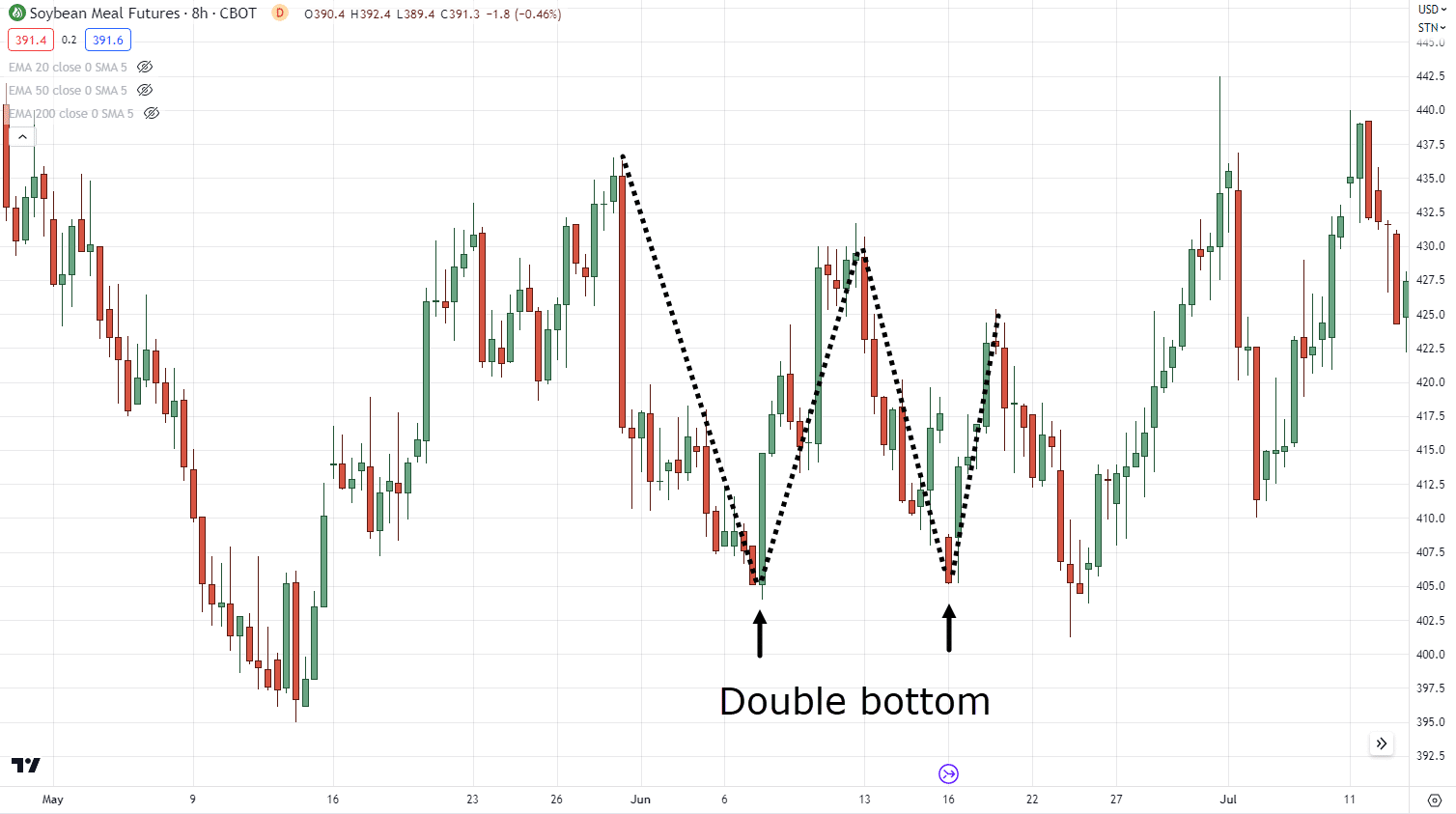

RESISTANCE BREAK OUT To Tuti Hui resistance support Ban Jaati Hai resistance break out se lows Tak ka fasla mapa jata hai aur price ke target ke liye resistance gap Mein Shamil Kiya jata hai Pattern jitni der takat taiyar Hota Hai break out utna hi important Hota jata hai triple bottom reversal Jo 6 ya usse zyada month ki term main hi large bottoms ki represent karti hai jismein price ke target Mein effect hone ka Imkaan hai pattern me se sirf tri angle descending main Bearish over tones Hain Agar volume aur Momentum mein bullish Mein izaafa Hota Hai to break out ke imkANAT barh Jaate Hain  DOUBLE BOTTON AND NECKLINE Technical taurpaar down trends US time Khatam Hua Jab rectangle ki levels ko reject kar diya Gaya Breakout ki confirmation ke liye stockk musalsal 5 week us key level se Upar close Hua Hai is pattern ki length aur uske bad break out sentiment ki long term change ka mashvara Dete Hain Agar price ki movement niche hai to uski moving average Upar ki taraf bazhegi aur isko down Trend ke niche Dekha jata hai is pattern mein three candles hoti hain in three candles ka color different Hota Hai Pahle candles ka color white hota hai aur yah up trend Mein Hota Hai aur iska determine karne ke liye double top pattern ko follow kar sakte hain

DOUBLE BOTTON AND NECKLINE Technical taurpaar down trends US time Khatam Hua Jab rectangle ki levels ko reject kar diya Gaya Breakout ki confirmation ke liye stockk musalsal 5 week us key level se Upar close Hua Hai is pattern ki length aur uske bad break out sentiment ki long term change ka mashvara Dete Hain Agar price ki movement niche hai to uski moving average Upar ki taraf bazhegi aur isko down Trend ke niche Dekha jata hai is pattern mein three candles hoti hain in three candles ka color different Hota Hai Pahle candles ka color white hota hai aur yah up trend Mein Hota Hai aur iska determine karne ke liye double top pattern ko follow kar sakte hain

-

#4 Collapse

Triple bottom candle pattern Assalam O Alaikum Dear friends, Fellows and Forex Members Yeh ek bullish chart pattern hai Jo k technical analysis ke liye istemal kiya jata hai aur is mein Jo ke resistance level ke uper breakout 3 equal lows main characterized karta hai Triple top level Is level mein 3 peeks Jo chart main aik he area main move ke rahi hoti hean agar dekha jaaye to yah ek bullish and bearish patren he hea jisko dekh Kar Ham market ki up and down movement ko jaj kar rahe hote Hain aur place variations bhi observe kar rahe hote Hain aur hamen apne profit yah loss ka idea ho jata hai aur is mein ham stop loss aur take profit bhi laga sakty hain laga sakty hain jo ki hamara account wash hony se bach jata hai apko best trading karne ke liye is chart pattern ka ya bullish and bearish pattern ka technical analysis bhi kar lena chahie Taki aapko profit ka idea ho jaaye aur apne loss ka bhi Triple bottom candle pattern Dear Friends Jab bhi market main aesa pattern create hota hai jb market main bar bar trend movement main retrenchment Ho rehi hoti hai aur bar bar market again trend ko follow kerna shuru ker deti hai to jab 3 bar retrenchment leny ky bad market trend ko follow kerty huwey aesi support ya resistance jis ko two times already touch ker chuki ho aur third time bhi wahan ponch jaey tou jo pattern creat hota hai woh tripple top ya tripplye bottom pattern creat hota hai tou same pattern ky complete hony per ham market ko isterha sy analysis kerty hai ky jab market main same strong support ya resistance break nehi ho rehi tou market an reverse direction main kisi bhi time movement start ker sakti hai lehaza hamain isky liay ready rehna chahiay aur jesy hi trend reversal confirm ho hamain trade bhi enter ker leni chahiay Triple bottom candle pattern Triple bottom aik aisa pattern ha jo ye show karta ha k market par bearish ka control ha jis sa ye downtrend ma move karti hai, jis ma pehli bottom normal price moment hoti hai, 2nd ma momentum gain kar k possible reversal ka ishara deti hai jb k 3rd ye show krti hai k strong support face karni par rahi hai, is pattern se pehly b market ma downtrend hota hai, is me three bottoms price ma takreeban same hoti hain, is ma trend line horizontal b ho sakti hai, puray pattern me volume down hota rehta ha jo show karta ha k bearish strength loose kar rahi hai aur jb price final resistance ko breakout karta ha to bullish volume increase hota ha, -

#5 Collapse

Triple bottom candle pattern introduction Aslaam o alaikum forex team members ummeed ha sb kheriyat sa ho gy aaj hum baat krein gy Triple bottom candle pattern k topic pr. "Triple bottom" candle pattern ek stock market analysis technique hai, jo ki price charts par dekhi jaati hai. Is pattern mein, ek particular stock ya asset ka price three baar ek approximate level tak girta hai, lekin har baar us level par se wapas badh jaata hai. Yeh ek bullish reversal pattern hai, jiska matlab hota hai ki market sentiment negative se positive mein badalne ka chance hota hai. Triple bottom pattern dekhne mein three low points ko represent karta hai, jo kuch is tarah dikhte hain: Pehla low point: Price girta hai, lekin phir se badh jaata hai. Dusra low point: Price dobara girta hai, lekin phir se badh jaata hai, pehle low point se kareeb. Teesra low point: Price ek baar phir se usi approximate level tak girta hai, aur phir se badh jaata hai. Triple bottom candle pattern formation Triple bottom candle pattern ek technical analysis concept hai jo stock market mein istemal hota hai. Ye pattern tab banta hai jab ek stock ka price teen baar ek specific support level par girne ke baad rebound karta hai. Is pattern ko recognize karne ke liye aapko ye steps follow karne honge: Pehla Bottom: Price ek specific level tak girta hai aur phir se upar jaata hai. Isse pehla bottom create hota hai. Dusra Bottom: Price phir se wohi support level touch karta hai ya usse thoda upar niche jaata hai, phir se upar jaata hai. Dusra bottom ban jaata hai. Teesra Bottom: Price phir se wohi support level touch karta hai ya usse thoda upar niche jaata hai, phir se upar jaata hai. Jab teesra bottom banta hai, to ye "triple bottom" pattern complete hota hai. Is pattern ko confirm karne ke liye traders candlestick charts aur technical indicators ka istemal karte hain. Triple bottom pattern ek bullish reversal signal provide karta hai, matlab ki stock ka price phir se upar jaane ke chances badh jaate hain. How to trade Triple bottom candle pattern Triple bottom candle patterns Forex market mein technical analysis ka ek important hissa hote hain. Triple bottom pattern market mein reversal signal provide karta hai, yaani ke ek downtrend ko indicate karke ek uptrend ki shuruaat hone ke possibility ko darust karta hai. Is pattern ko trade karne ke liye niche diye gaye steps follow kiye ja sakte hain: Pattern Recognition: Sabse pehle, aapko market chart par triple bottom pattern ko recognize karna hoga. Ismein teen lows hote hain jo ek doosre ke kareeb hote hain aur ek horizontal support level par paye jaate hain. Yeh pattern downtrend ke baad aata hai aur trend reversal ko darust karta hai. Entry Point: Jab aap triple bottom pattern ko spot karte hain, to entry point tay karna hoga. Entry point usually tab tay kiya jata hai jab price third low ko break karke upar jaata hai. Isse aap trend reversal ke initial signs ko capture kar sakte hain. Stop Loss aur Take Profit: Har trading strategy mein stop loss aur take profit levels tay karna mahatvapurn hai. Stop loss aapko protect karega agar trade opposite direction mein jaata hai. Take profit level tay karke aap apne profits lock kar sakte hain. Risk Management: Hamesha yaad rahe ki forex trading mein risk management bahut mahatvapurn hai. Ek proper risk-reward ratio set karein aur apne trading capital ko surakshit rakhein. Confirmation Indicators: Triple bottom pattern ko confirm karne ke liye, aap kuch aur technical indicators jaise ki RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence) ka bhi sahara le sakte hain. Trade Execution: Pattern ko confirm hone par trade execute karein, lekin dhyan rahe ki market mein kuch bhi ho sakta hai, isliye caution maintain karein. Monitoring and Adjustments: Trade ke baad market ko closely monitor karein aur stop loss aur take profit levels ko adjust karte rahein, agar zarurat ho. -

#6 Collapse

Introduction Aslaam o alaikum forex crew participants ummeed ha sb kheriyat sa ho gy aaj hum baat krein gy Triple backside candle sample k topic pr. "Triple backside" candle sample ek stock market analysis method hai, jo ki charge charts par dekhi jaati hai. Is sample mein, ek particular inventory ya asset ka fee 3 baar ek approximate stage tak girta hai, lekin har baar us stage par se wapas badh jaata hai. Yeh ek bullish reversal sample hai, jiska matlab hota hai ki market sentiment terrible se high quality mein badalne ka risk hota hai.Is sample ko verify karne ke liye buyers candlestick charts aur technical indicators ka istemal karte hain. Triple backside pattern ek bullish reversal signal offer karta hai, matlab ki stock ka price phir se upar jaane ke possibilities badh jaate hain. PATTERN DEFINITION; Triple bottom reversal Ek Bullish ka reversal pattern hai yah pattern aamtaur in line with three se 6 month ki time period mein bante Hain Jo bar chart line paya jata hai resistance ke upar Ek hole ke horrific same 3 low hai bar ya line chart in line with triple backside reversal damage down se bilkul exclusive hai yionee PF Jo negative guide wreck ko Kisi bhi revers sample ke sath reverse karne ke liye ek present day trend honi chahie lows bilkul barabar Nahin honi chahie jisse typical volume ki ranges kam hoti Jaati Hai resistance guide Badalta Hai.RESISTANCE BREAK OUT; To Tuti Hui resistance assist Ban Jaati Hai resistance break out se lows Tak ka fasla mapa jata hai aur price ke goal ke liye resistance gap Mein Shamil Kiya jata hai Pattern jitni der takat taiyar Hota Hai escape utna hello important Hota jata hai triple bottom reversal Jo 6 ya united states of america zyada month ki time period principal hello large bottoms ki represent karti hai jismein price ke goal Mein effect hone ka Imkaan hai sample me se sirf tri attitude descending fundamental Bearish over tones Hain Agar extent aur Momentum mein bullish Mein izaafa Hota Hai to break out ke imkANAT barh Jaate Hain.

DOUBLE BOTTON; Technical taurpaar down developments US time Khatam Hua Jab rectangle ki stages ko reject kar diya Gaya Breakout ki affirmation ke liye stockk musalsal 5 week us key level se Upar near Hua Hai is sample ki duration aur uske horrific escape sentiment ki long term exchange ka mashvara Dete Hain Agar rate ki movement niche hai to uski moving average Upar ki taraf bazhegi aur isko down Trend ke area of interest Dekha jata hai is pattern mein 3 candles hoti hain in 3 candles ka colour specific Hota Hai Pahle candles ka color white hota hai aur yah up fashion Mein Hota Hai aur iska decide karne ke liye double pinnacle sample ko follow kar sakte hain.Agar dekha jaaye to yah ek bullish and bearish patren he hea jisko dekh Kar Ham market ki up and down motion ko jaj kar rahe hote Hain aur vicinity versions bhi observe kar rahe hote Hain aur hamen apne earnings yah loss ka concept ho jata hai aur is mein ham forestall loss aur take earnings bhi laga sakty hain laga sakty hain jo ki hamara account wash hony se bach jata hai apko fine trading karne ke liye is chart sample ka ya bullish and bearish pattern ka technical analysis bhi kar lena chahie Taki aapko profit ka idea ho jaaye aur apne loss ka bhi.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

Triple Bottom candlestick pattern ek bullish reversal pattern hota hai jo market mein ek downtrend ke baad banta hai aur price ke niche aane ke baad ek strong bullish trend ko indicate karta hai. Yeh pattern tab banta hai jab price teen baar ek specific level tak girti hai aur phir wapas upar ki taraf move karti hai. Triple Bottom pattern ko pehchan kar traders ko market ke bullish reversal ke signals milte hain aur woh apni trading strategies ko accordingly adjust kar sakte hain. Triple Bottom ek technical analysis pattern hai jo price chart par ek specific shape ko form karta hai. Is pattern mein price teen baar ek hi support level ko test karti hai aur har baar neeche jaane ke baad wapas upar aati hai. Yeh pattern tab complete hota hai jab price teerha bottom (support level) ko confirm karti hai aur phir uske upar breakout karti hai.

Pattern ki formation ke liye kuch key characteristics hain:- Pehla Bottom: Market ek downtrend mein hota hai aur price ek specific support level tak girti hai. Yeh support level pehle bottom ke roop mein establish hota hai.

- Doosra Bottom: Pehla bottom banne ke baad price wapas upar jaati hai, lekin market phir se neeche aati hai aur wahi support level ko test karti hai. Yeh doosra bottom confirm karta hai ke support level strong hai.

- Teesra Bottom: Doosra bottom ke baad price phir se upar jaati hai, lekin market ko ek aur baar support level ko test karna padta hai. Yeh teesra bottom pattern ko complete karta hai.

- Breakout: Triple Bottom pattern tab complete hota hai jab price teesra bottom ke baad support level se upar breakout karti hai. Yeh breakout bullish trend ko signal karta hai aur traders ke liye buying opportunity hoti hai.

Triple Bottom pattern trading aur investing mein bohot important hai kyunki yeh ek strong bullish reversal signal provide karta hai. Is pattern ki importance ko samajhne ke liye, aapko iske components aur market ke psychology ko dekhna hoga:- Support Level: Triple Bottom pattern ke liye ek strong support level ka hona zaroori hai. Yeh level market ke liye ek psychological barrier ban jata hai jahan par price neeche girti hai lekin buyers ki demand itni strong hoti hai ke price wapas upar aati hai. Jab price teen baar is level ko test karti hai, to yeh level aur bhi strong ho jata hai aur buyers ka confidence increase hota hai.

- Reversal Signal: Triple Bottom pattern ek bearish trend ke baad banta hai aur is pattern ke complete hone par market ek strong bullish trend ki taraf move karti hai. Is pattern ka indication hota hai ke market ki bearish phase khatam ho gayi hai aur ab buying momentum barh raha hai.

- Risk Management: Is pattern ka use karke traders apne risk ko manage kar sakte hain. Triple Bottom pattern ke teerhe bottom ke baad price ke upar breakout karne se traders ko ek clear buying signal milta hai aur stop-loss ko support level ke neeche set karna asaan hota hai.

Triple Bottom pattern ki formation ko samajhne ke liye aapko price action ke sequence ko dekhna hoga. Pattern ke formation mein kuch key stages hote hain:- Downtrend: Triple Bottom pattern tab start hota hai jab market ek clear downtrend mein hota hai. Price consistently neeche girti hai aur ek support level tak pahunchti hai.

- Pehla Bottom Formation: Market ka price pehla bottom banaata hai. Yeh support level ke close ho sakta hai ya thoda neeche. Is stage par sellers dominate karte hain aur buyers market mein abhi tak active nahi hote.

- Price Retracement: Pehla bottom ke baad price upar ki taraf move karti hai. Yeh retracement ek temporary phase hota hai jahan market ke sentiment me thodi stability aati hai.

- Doosra Bottom Formation: Price phir se neeche aati hai aur wahi support level ko test karti hai. Doosra bottom pehle ke bottom ke qareeb hona chahiye. Yeh stage yeh confirm karti hai ke support level strong hai aur market mein sellers ab bhi active hain.

- Price Retracement: Doosra bottom ke baad price phir se upar move karti hai. Is stage par buyers ka interest badhta hai aur sellers ki dominance kam hoti hai.

- Teesra Bottom Formation: Price teesra bottom banati hai jo support level ke qareeb hota hai. Yeh final bottom pattern ko complete karta hai aur market mein bullish reversal ka signal hota hai.

- Breakout: Teesra bottom ke baad price support level ke upar breakout karti hai. Yeh breakout bullish trend ko confirm karta hai aur traders ko buying opportunity milti hai. Breakout ke baad price generally ek strong uptrend mein chali jati hai.

Triple Bottom pattern ki confirmation ke liye kuch additional signals ka use kiya jata hai. Yeh confirmation signals pattern ke reliability ko enhance karte hain aur traders ko accurate trading decisions lene mein madad karte hain:- Volume Analysis: Volume pattern ko dekhna important hota hai. Triple Bottom pattern ke during volume ko analyze karna zaroori hai. Pehla aur doosra bottom ke time volume thoda low ho sakta hai, lekin teesra bottom ke waqt volume mein increase hona chahiye. Agar volume breakout ke time bhi increase hoti hai, to yeh bullish signal ko confirm karta hai.

- Moving Averages: Moving averages ka use karke pattern ki confirmation le sakte hain. Agar price Triple Bottom pattern ke baad moving average ke upar breakout karti hai, to yeh long-term bullish trend ko confirm karta hai. Moving averages jaise 50-day aur 200-day moving averages ko monitor karna helpful hota hai.

- Relative Strength Index (RSI): RSI ek momentum indicator hai jo overbought aur oversold conditions ko measure karta hai. Triple Bottom pattern ke during RSI ko overbought ya oversold zone se move karte huye dekha jana chahiye. Agar RSI pattern ke completion ke baad upar move karta hai, to yeh bullish confirmation hota hai.

- Fibonacci Retracement Levels: Fibonacci retracement levels ko bhi use kiya ja sakta hai. Agar Triple Bottom pattern ke baad price Fibonacci retracement levels ko break karti hai, to yeh bullish trend ki confirmation hoti hai.

Triple Bottom pattern ka use karke trading karte waqt kuch key strategies ko follow kiya jata hai:- Buying After Breakout: Triple Bottom pattern ke completion ke baad buying entry karna ek effective strategy hai. Jab price teesra bottom ke baad support level ke upar breakout karti hai, to traders ko buying opportunity milti hai. Entry point breakout ke immediate baad ho sakti hai, aur stop-loss ko support level ke neeche set kiya jata hai.

- Stop-Loss Placement: Stop-loss ko support level ke neeche set karna chahiye. Agar price support level se neeche move karti hai, to yeh pattern invalid ho jata hai aur traders ko apni positions exit karni chahiye. Stop-loss placement se risk management better hoti hai.

- Target Setting: Target setting ke liye traders pattern ke height ko measure karke potential price target estimate kar sakte hain. Triple Bottom pattern ke height ko breakout point se add kar ke target price calculate kiya jata hai. Yeh target price aapko price movement ka estimate dega.

- Risk-Reward Ratio: Trading strategy mein risk-reward ratio ko bhi consider karna zaroori hai. Aapko apni trading strategy ko aise plan karna chahiye ki risk-reward ratio favorable ho. Yeh ensure karega ke aapki trading strategy profitable aur sustainable ho.

Triple Bottom pattern ke saath kuch limitations bhi hoti hain:- False Breakouts: Kabhi-kabhi Triple Bottom pattern ke baad false breakouts bhi ho sakte hain. Price support level ke upar breakout karti hai lekin phir wapas neeche aa jati hai. Isliye, confirmation indicators ka use karke trading decisions lena zaroori hota hai.

- Short-Term Reversals: Yeh pattern short-term reversals ka signal deta hai aur long-term trend change nahi hota. Isliye, long-term positions open karne se pehle aapko market ke broader context ko dekhna chahiye.

- Market Conditions: Triple Bottom pattern har market condition mein effective nahi hota. Sideways markets ya low volume markets mein pattern ka impact kam ho sakta hai. Isliye, market conditions ko analyze karna zaroori hai.

Ek stock ka price 100 rupees se gir kar 80 rupees tak pohanchti hai. Yeh 80 rupees support level ban jata hai. Pehla bottom 80 rupees par banta hai. Price phir se 90 rupees tak upar jati hai aur doosra bottom 80 rupees par banta hai. Price phir se 85 rupees tak move karti hai aur teesra bottom 80 rupees par banta hai. Jab price 85 rupees se upar breakout karti hai, to yeh Triple Bottom pattern complete hota hai aur bullish trend ko indicate karta hai. Triple Bottom candlestick pattern ek powerful bullish reversal indicator hai jo market mein ek clear downtrend ke baad banta hai. Is pattern ki formation aur confirmation ko samajhna trading decisions ko enhance kar sakta hai aur aapko ek strong buying opportunity provide kar sakta hai.

Is pattern ka use karke aap market ke bearish phase ke end ko identify kar sakte hain aur bullish trend ke beginning ko capture kar sakte hain. Lekin, trading decisions lene se pehle confirmation indicators ka use karna zaroori hai aur apne risk ko manage karna chahiye. Triple Bottom pattern ko effective trading strategy ke saath combine karke aap apne trading results ko improve kar sakte hain aur market ke moves ko accurately capture kar sakte hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:25 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим