Shooting star candlestick pattern

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

AOA Introduction Friends kya hal hain aapke main ummid karta hun aap khairiyat se Honge Aaj Jis topic ko Ham discuss Karne Wale Hain vah Hai shooting star candlestick pattern Ham trading chart per is pattern ko kaise identify kar sakte hain candle ki formations kya hai or es pattern per hum kasey trading kar sky hain Isko Ham discuss Karenge Taki is Candle se ham kasey market Se Achcha profit Hasil kar sake Details of Shooting star candle Shooting star candlestick strong indication deti hai ki stock ya assist ya currency iski maujuda bullish trend Ab Yahan per End hone wala hai jisse price ki Agali candle bearish ki Banna Shuru Hoti Hai shooting star candlestick price ke top per Ek Small real body ke sath upper side per long Shadow banati Hai yah candle bullish trend ko Mazid up word jaane se rok kar market ke invers signal provide Karti Hai yah candle long time frame mein zada Mmoasar jab ke kese stock ya assets ke price indicator per overbought zone main chali hate hy candle ka upper shadow real body ke mukabale Mein 2 Guna Hona ya es bueno zada Hona chahey candle ke lower side per Koi Shadow nahin hona chahie lekin Agar Banta bhi hai to yah real body se size mein zada Nahin hoga yah pattern aapko price ya market ke top per Nazar Aata Hai Candle Formation Shooting star candlestick ke liye price ke top trend ya bullish trend Mein Hona important hai jabki yah candlestick last candle honi chahie Jis ki ke small real body ke sath upper side per Ek Lamba Shadow bhe Hota Hai Ham isko niche discuss Karte Hain Shooting star candlestick Shooting star candlestick Ek small real body wali long upper Shadow ki candle Hoti Hai yah candle price ke top per banti hai jisse market Mumkina Tor per trend change karti hai normal price chart per yah candle Ek natural candle bhi tasvar Hogi Shadow price ke top per banne Ge Trading Shooting star candle normal price chart per Koi Khas reaction nahi dete lekin Jab Bhi yah price ke top per ya bullish trend Mein banti hai to yah Mumkina for per bearish trend reversal ka kam Karti Hai yah candle traders ke liye ek bearish signal hota Hai Jis per Sell ki entry ki Ja sakti hai jabki dusre technical indicator isko use karna per indicator ka Value overbought zone main Hona chahey yah candle Ek single candle pattern Hai Is vajah Se yah trend confirmation ke liye bearish real body ki candle ke bad hi market Mein entry Karen bearish candle ka lazme shooting star candle ke baad lower per close home chahey Stop loss candle ke sabse top position ya Shadow ke high price Se 2 pips above set Karen -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Understanding of night star candle plan What is evening Star light hoax ka starh astak ke qemt ka graph petrn hota roughage jsay tkneke tjzeh kar as bat ka pth lganay kay leay astamal krtay hen kh rjhan kb tbdel honay oala feed yh aek beersh kendl stk petrn roughage jo ten mother bteon pr mshtml feed aek brre sfed mother bte aek chhote se mother bte aor aek srkh mother bte farce kay staray kay petrn qemt kay aopre rjhan kay sath mnslk hotay hen as bat ke nshandhe krtay hen kh aopr ka rjhan apnay akhttam kay qreb feed hoax kay staray ka mkhalf sbh kay staray ka petrn feed jsay teze kay asharay kay pinnacle pr dekha jata roughage. Working of night Star hr mother bte aek mother bte aor do oÙks pr mshtml hote roughage mother bte ke lmbaee as tjarte dn kay doran sb say zeadh aor sb say km qemt kay drmean renj ka aek fnkshn feed aek lmbe mother bte qemt men brre tbdele ke nshandhe krte feed jbkh aek chhote mother bte qemt men aek chhote tbdele ke nshandhe krte roughage dosray lfzon men lmbay mother bte kay jsm rjhan ke smt kay lhaz say shded khred o frokht kay dba ke nshandhe krtay hen jb kh chhote mother bte as bat ke nshandhe krte hen kh qemt ke km hrkt roughage. Comprehension of night Star light aeonng astar petrn ko asash ke qemt kay kendl stk graph men dekha ja skta feed js men ten mother btean shaml hen phle aek lmbe bade kendl roughage jo khle qemt kay aopr qrebe qemt kay sath qemt men brray azafay ke nmaendge krte roughage yh teze oale mother bte asash ke qemt men azafay ke rftar ko zahr krte roughage dosre mother bte starh feed js ka aek chhota sa jsm feed ea to blsh ya beersh ya bgher bade gher janbdar starh ke khsoset yh btate roughage kh asash ke qemt mtoazn khred o frokht kay aardr kay sath khle qemt kay balkl qreb sth pr bnd hote feed starh gzshth teze ke rftar men sst roe ka asharh krta roughage. aek msale aeonng star petrn men phle mother bte say staray tk aek oqfh hona chaheay as ka mtlb yh feed kh khle qemt gzshth qrebe qemt say teze say brrhe aor as doran bht km ya yhan tk kh koee len nook nhen hoa. -

#4 Collapse

Following Stop in Forex Exchanging Following stop misfortune request ki aik qisam hai jo aik tajir ko apne munafe ki hifazat karne ki ijazat deti hai jabkay stap las ke request ko khud bakhud change kar ke mumkina nuqsanaat ko mehdood karta hai kyunkay market un ke haq mein jati hai hit koi tajir following stop request deta hai to woh taweel position ke liye mojooda market ki qeemat se neechay ya mukhtasir position ke liye mojooda market ki qeemat se ziyada feesad ya dollar ki raqam muqarrar karta hai. jaisa ke market ki qeemat tajir ke haq mein muntaqil hoti hai, following stop makhsoos feesad ya dollar ki raqam ke hisaab se market ki qeemat ki pairwi karta hai . Clarification of Following Stop Misfortune. misaal ke peak standard, agar koi tajir mein stock kharidata hai aur 10 % ka following stop set karta hai, to ibtidayi stop las request $ 45 standard diya jaye ga. agar stock $ 60 tak barh jata hai, to following stop $ 54 mein change hojaye ga, jo ke mojooda market ki qeemat se 10 % kam hai. agar stock ki qeemat $ 54 ya is se neechay gir jati hai, to following stop request ko mutharrak kya jaye ga, aur tajir ke mumkina nuqsanaat ko mehdood karne ke liye position farokht ki jaye gi . Benifits of Following Stop Misfortune. Following stop misfortune aksar tajir apne munafe ki hifazat ke liye istemaal karte hain jabkay mumkina ulta fawaid ki ijazat dete hain. taham, yeh note karna zaroori hai ke agar market tridr ke khilaaf chalti hai aur phir un ke haq mein wapas aati hai to following stops ke nateejay mein waqt se pehlay rok diya ja sakta hai. Benefit of Following Stop Misfortune. Following stop misfortune aik representative ke sath aik request hota hai jo security farokht karne ke liye diya jata hai agar yeh aik khaas qeemat point se neechay ajata hai, jis ka taayun market ki qeemat se kam feesad ya aik muqarara raqam ke pinnacle standard kya jata hai. Following stop misfortune sarmaya karon aur taajiron ke liye aik faida mand apparatus hai, kyunkay yeh inhen mumkina nuqsanaat ko mehdood karne ke sath mumkina fawaid ki bhi ijazat deta hai . Following stop misfortune ka aik faida yeh hai ke yeh sarmaya karon ko apne mumkina nuqsanaat ko mehdood karne ki ijazat deta hai. is ki wajah yeh hai ke security ki qeemat bherne ke sath hello Following stap misfortune khud bakhud change ho jata hai, jis se sarmaya vehicle munafe ko band kar sakta hai aur apne manfi khatray ko mehdood kar sakta hai. yeh khaas pinnacle standard ghair mustahkam marketon mein mufeed hai jahan qeematon mein taizi se utaar charhao aa sakta hai, kyunkay yeh achanak mandi ki soorat mein barray nuqsaan ko rokkk sakta hai . Following stop misfortune ka aik aur faida yeh hai ke yeh sarmaya karon ko security ke mumkina fawaid mein hissa lainay ki ijazat deta hai. is ki wajah yeh hai ke stap misfortune request sirf is soorat mein mutharrak hota hai poke security ki qeemat aik khaas satah se neechay aajay, jis se sarmaya karon ko qeemat bherne ki soorat mein koi bhi faida haasil karne ki ijazat millti hai . -

#5 Collapse

The ichimoku pointer, the cloud The ichimoku pointer, the cloud. Ichimoku lower or furthest breaking point sy mel kar banta hai or en line k bech k space ko greem assortment ya red tone sy hide kiya jata hai. Ham ye janany ki khosis karty hain k eska matlab kiya hai. Cloud ki pehle or tez move karny wali limit change or example ki typical hoti hai. Then again jo second more sluggish boundry hoti hai wo 52 period high or low ka community hoti hai. Cloud ka huge component ye hai k ye 26 period ki projection ko future mom show karta hai. Ichimoku association with Fibonacci Dear Firends, Ichimoku aur Fibonaci pointer ki design same hoti Hy jin ko ham market demand ko place karny mom or stop mishap or take benefit ko set karny mother help karta hai. Fibonacci lines specialist ko market ki possible assistance or resistance ko find karny mother help karty hain. Seller ko jb market ki support or impediment ka pata chal jae to usk lae benefit hasil karna straightforward ho jata hai. Sponsorship or impediment level ko ya to feature break kar sakti hai ya support or resistance ko hit kar k market wapas move kar jati hai. So seller ko apny orders ko place karna basic ho jata hai. Jo shipper forex trading mother design ko find kar leta hai wo asal mom benefit ko hasil karny mom kamyab ho jata hai. Market mom agr design k sath trade open ki jae to exhibit seller ki friend blacklist jati hai or agr market k against trade ki jae to ye he market shipper ki dushman blacklist jati hai or intermediary k record wash hony ki rah hamwar ho jaty hain. So dealer ko apny account ki saftey ko yaqeeni banany k lae design mother he trade open karny chahe. Comprehension of Ichimoku Cloud Marker Ichimoku cloud pointer aik asa Pointer hy jo aik hi time mother market kay design ki energy ki or sponsorship or resistance level ki information deta hai. Jo information ichimoku hamy deta hai us ko agent bhot valueable samajty hain. However, kuch agent ko ichimoku pointer k sign ko pick karny mother bhot issue hoti hai. Ichimoku pointer k 2 key parts hoty hain. Initial segment hota hai change and check. Ye moving ordinary ki tarha chart standard nazar aty hain anyway ye wo moving typical ni hai jis ko ham trading mom use karty hain. 2. Ichimoku cloud bhot critical part hai or pointer chiefly es standard hw stand karta hai. Change and baselines Jesa k pehle analyze kar chuky hain ye frame standard moving typical ki tarha nazar ati hai anyway ye wo moving ordinary ni hoti jis ko ham trading mom use karty hain. Change or standard 9 or 26 period ema k high or discouraged spot mom focus point show karti hai. Es ka matlab hai k ye pechy dakhta hai 9 or 26 period ema ko or us period k most vital or smallest expense ko ley kar es line ko range k focus mom plot karti hai. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is Transient exchanging? Dear forex Companions forex exchanging market mein hit aap momentary exchanging ke mutabik apni working karte hain to ismein aap ko kam time ke liye apni exchange open karte hain aur transient ki exchanging mein position ko notice karne mein ghanton ka ya ek racket ke liye brokers exchange hold rakhte hain aur lekin aamtaur per 7 commotion se jyada Nahin ki jaati isliye iske result mein kam time mein jitna jyada benefit hasil ho jata hai merchants aur exchanging technique ko apne liye advantage hasil kar sakte hain lekin risk ki vajah se yah exchanging Ek jyada khatarnak hoti hai isko exchanging Karne rib dealers hazard and prize proportion ko oversee karte shade aur rules and guidelines ko observe karte tint kam karte hain aur market se kam time mein achcha benefit Lene ki Koshish karte Hain is surat mein achcha information aur experience greetings aapko market ko acchi tarike se examination karne mein madad karta hai aur Is Tarah aap achcha fayda Le sakte hain. Benefits of Transient exchanging: Dear companions transient preparation ka sabse jyada advantage hota hai ki ismein benefit bahut kam time mein hasil ho jata hai aur jaise hey market open hoti hai aap apna request place Karke market se kam time mein achcha benefit hasil kar sakte hain.Short term exchanging mein aap apne capital ko bhot kaam time mein increment kar sakte hain aur hasil sharpen rib benefit per pull out lagakar dobara Apne Bach jaane rib capital ke sath fek exchanging kar sakte hain. Transient ki preparing mein merchant market ki muktsar mudit mein ups and down se fayda lete hain jiski vajah se kam time mein jyada fayda hasil kar lete hain yah Ek bahut best open door hoti hai ki market kitality ke mutabik activity lekar usse fayda uthaya ja sakta hai. Inconveniences of Momentary exchanging: Dear companions transient ki exchanging mein sabse bada disservices hota hai merchant ko bahut jyada misfortune ka samna karna cushion sakta hai kyunki market ki achanak change sharpen ki vajah se usko market ko examination karne mein galti ho sakti hai jiski vajah se usko misfortune ka samna ho sakta hai.Short and exchanging mein sabse mushkil ko bahut jyada time market ko Dena hota hai aur Is Tarah aap apni specialized break down hello there broker market mein cost ki next second ki creation Karke apna request place karte hain lekin nakami ki surat mein misfortune hota hai aur Unka account bhi wash ho sakta hai -

#7 Collapse

What Is Wedge Graph Example? Forex wedge diagram design fundamentally poke market mein marginally downtrend ya upturn boycott raha hota hai or market apni development complete krty huye somewhat retracement complete krti rehti hai, tu isko wedge kaha jata hai.jub rectification ho rahi hoti hai tab market principal wdges show ho rahy hoty hain jis ko dekh kar murmur apni exchange kar skty hain or benefit lay skty hain forex primary jo wedges hoty hain wo hmain tarde find out karny principal help dety hain. Poke market upturn aur downtrend mein ho to is Surat Mein Ham benefit Hasil kar sakte hain aur hit sideways market move kar rahi ho to utilize Waqt exchange Lagana thoda Mushkil Hota Hai market Mein benefit Hasil karna Ek bahut hey jyada Aasan kam hai Kyunki market bahut jyada designs banati hai aur design ko follow karti hai Is Tarah Agar Ham designs ko Sikh Lete Hain To Ham is Mein Ek proficient broker Boycott sakte hain. Forex exchanging principal Wedges ki 2 fundamental sorts hoti hain. Rising wedge ko application iska name sy he jan sakhty hain ky yeh wedge apko market principal upwards development ko show krti hai. Hit market fundamental bullish pattern hota hai or us circumstance ko yeh wedge appropriately show krti hai Aur iski development ko acchi tarah bata deti hai. wedge design tab banta hai hit bhi market kisi point per higher high or higher low bnati hy dosto hit yeh design upswing me banta hai to isko inversion design samjha jaata hai bcz yeh appni strength free karta rehta hai lekin agar yeh design downtrend mai banta hai to showcase negative ka signal de rahi hoti hai bcz market ny amendment k liye bhi wapis jana hota hain. Falling Or Plunging Wedge: Falling wedge market mai down pattern mai jata hai aur market Punch upar ki taraf development karne ke awful inversion development karne lagti hai to usko yeh wedge demonstrate kehty hai aur humko appropriately show karti hai ki market ki next development stomach muscle is point ke terrible inversion sharpen lagi hai is veg ko aap is ke naam se bhi pahchan sakte hain ki iski development kis taraf sharpen lagi hai Yeh FIR yah kis tarah Ki development ko show karti hai. Falling wedge banane se pahle market revision karti hai yani ke market upar Se specialty girti hai aur FIR thora sa uper high banati hai aur uske sath opposition ka pahla point banati hai uske awful thora Specialty Low Banati hai aur iske sath market Yahan per pahla support bhi banaa deti Hai aur reject hokar FIR Upar ki taraf move karti hai aur FIR safe se reject hokar support per Aati yani ke market Aik design banaa Leti Hai aur FIR last fundamental market safe ko break karke aur uske terrible safe line ko Retest Karke Upar ki taraf nikal Jaati Hai ise Ham falling wedge Kahate hain aur poke market obstruction ko retest kar rahi ho to uske awful Ham purchase key exchange le sakte hain. -

#8 Collapse

Shooting Star candlestick pattern ek single candlestick pattern hai, jo price action analysis mein use kiya jata hai. Ye pattern price reversal aur trend exhaustion ki indication deta hai. Shooting Star pattern ki wazahat aur characteristics niche diye gaye hain:Shooting Star pattern bearish reversal aur trend exhaustion ki indication deta hai. Lekin isko samajhna aur interpret karna traders ke liye zaruri hai. Isliye, professional advice aur market research ke saath is pattern ka istemal karna behtar hoga. Shooting star candlestick pattern 1. Structure: Shooting Star pattern ek bearish reversal pattern hai, jismein ek small body aur ek long upper shadow (wick) hota hai. Lower shadow (wick) ya bilkul na ho ya bahut chota ho. Shooting Star pattern bullish trend ke baad dikhta hai. 2. Indication: Shooting Star pattern bullish trend ke exhaustion aur possible trend reversal ki indication deta hai. Ye pattern buyers aur sellers ke struggle ko represent karta hai, jahan buyers price ko push karne ki koshish karte hain, lekin sellers dominate ho jaate hain aur price ko neeche push karte hain. 3. Confirmation: Shooting Star pattern ka confirmation, next candlestick ke price action ke saath hota hai. Agar price next candlestick mein lower open aur lower close ke saath neeche jata hai, toh Shooting Star pattern ka confirmation hota hai. 4. Trading Strategy: Shooting Star pattern ka istemal trading strategy mein kiya ja sakta hai. Agar Shooting Star pattern bullish trend ke baad dikhta hai, toh traders short position lete hain aur stop loss order Shooting Star pattern ke high level se thoda upar set karte hain. Target price ko previous support level ke paas ya lower levels par set kiya jata hai. 5. Context: Shooting Star pattern ka sahi interpretation, overall market context aur trend analysis ke saath karna zaruri hai. Is pattern ko dusre technical indicators aur price patterns ke saath confirm karna zaruri hai, taaki sahi trading decisions liye ja sake. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

SHOOTING STAR CANDLESTICK PATTERN DEFINITION Shooting Star Ek Bearish candle stick hai Jiska upri Shadow Ek long Shadow hai lower ya koi niche ka Shadow Nahin Hai Aur din ke Low Se Ke Kareeb Ek Small real body hai Yeh Hai yah Ek up Trend ke bad appear Hota Hai shooting star Ek type ki candlestick hai Jo is time Banti Hai Jab security khulati hai significantly Aage barhati hai lekin phir open ke near din ko again closes kar deti hai candlestick ko shooting star considered ke liye is ki formation price ki peshgi ke Duran Zyada honi chahie Iske alawa Din Ki Sabse highest price aur opening price ke between distance shooting star ke body se doguna zyada Hona chahie real body ke niche little to on body Nahin Hona chahie WHAT A SHOOTING STAR WILL SHADOW US Shooting Star Ek Bearish reversal pattern hai Jo price ki direction Mein potential change ka signal deta hai up trend Ape end ke nearing hai Kyunke Momentum weakening parh rahi hai aur sellers more confident feeling kar rahe hain ke voh price ki action main reversal per force kar sakte hain i is vajah se shooting star candlestick pattern ek powerful formation hai is ki shape pattern ko bahut zyada attention Deti Hai Kyunki candle Hamesha Baki price ke action se Chipak Jaati Hai yah Khas Taur per Aisa Hota Hai Jab shooting star ki wick main new short term high hote hai

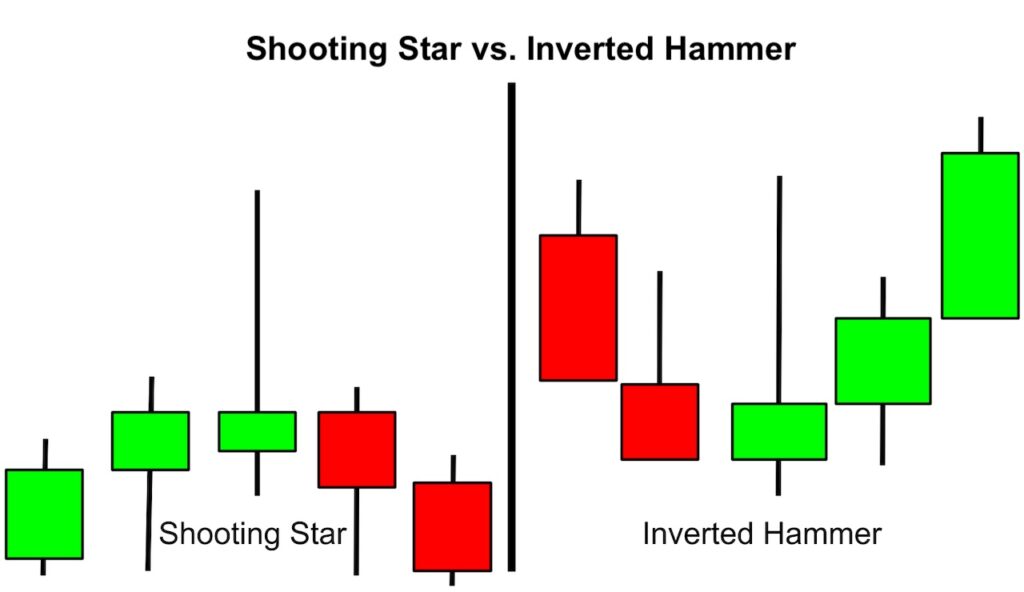

WHAT A SHOOTING STAR WILL SHADOW US Shooting Star Ek Bearish reversal pattern hai Jo price ki direction Mein potential change ka signal deta hai up trend Ape end ke nearing hai Kyunke Momentum weakening parh rahi hai aur sellers more confident feeling kar rahe hain ke voh price ki action main reversal per force kar sakte hain i is vajah se shooting star candlestick pattern ek powerful formation hai is ki shape pattern ko bahut zyada attention Deti Hai Kyunki candle Hamesha Baki price ke action se Chipak Jaati Hai yah Khas Taur per Aisa Hota Hai Jab shooting star ki wick main new short term high hote hai  DIFFERENCE BETWEEN SHOOTING STAR AND INVERTATED HAMMER Inverted hammer aur shooting star lagbhag Ek Jaise look hain lekin inmein difference hai shooting star is time Hota Hai Jab price barh Jaati Hai aur phir prices fall Hain Jab Ke Ek inverted hammer candlestick fall hai aur uske bad prices rises cute potential negative pahlu Ke reversal ka signal Dete Hain aur yah sabse zyada effective Hota Hai Jab yah two To teen consecutive Rising candles higher high ke bad banta hai trading session Ke dauran Ek shooting star khulata hai aur strongly bar hta Hai vohin buying pressure dikhata hai jo last trading session main Dekha jata hai

DIFFERENCE BETWEEN SHOOTING STAR AND INVERTATED HAMMER Inverted hammer aur shooting star lagbhag Ek Jaise look hain lekin inmein difference hai shooting star is time Hota Hai Jab price barh Jaati Hai aur phir prices fall Hain Jab Ke Ek inverted hammer candlestick fall hai aur uske bad prices rises cute potential negative pahlu Ke reversal ka signal Dete Hain aur yah sabse zyada effective Hota Hai Jab yah two To teen consecutive Rising candles higher high ke bad banta hai trading session Ke dauran Ek shooting star khulata hai aur strongly bar hta Hai vohin buying pressure dikhata hai jo last trading session main Dekha jata hai

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:49 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим