What is the Dark Cloud Cover?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

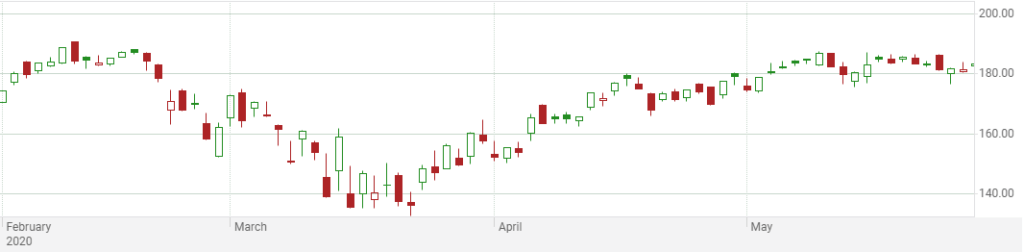

Understanding Technical Analysis aek nmonh ya shkl jo tkneke tjzeh men dekha ja skta hay oh seah badl ka ahath hay۔ sekeorte tredrz jo tarekhe tredng deta men petrn tlash krtay hen aor as deta ko astamal krtay hoe'ay astak ka andazh lganay ke koshsh krtay hen oh tkneke tjzeh kay nzm o zbt ke mshq krtay hen۔ mstqbl ke qemton men honay oale tbdeleon ke peshen goe'e krnay kay leay، tkneke tjzeh krnay oalay tajr aam tor pr charts ko dekhtay hen jo qemt ke nql o hrkt ya asason kay tjarte hjm kay aadad o shmar ko zahr krtay hen۔ tkneke tjzeh men baz asason ka toel mdte bneade tjzeh shaml nhen hota hay۔ blkh، yh aek mkhtsr mdte tjarte nzm o zbt say zeadh hay۔ tkneke tjzeh as kay bjae'ay qlel mdte tjarte sgnlz pr tojh mrkoz kray ga jo kse asasay kay charts aor nmonon ka as ke tarekh ya degr sekeortez say moaznh krkay as ke srmaeh kare ke kshsh ka andazh lgasktay hen۔ Understanding Dark Cloud Cover fqrh "ghray badl ka ahath" say mrad aek kendl stk petrn hay jo kh rechh ka asharh hay، as ka mtlb yh hay kh jare aopr ka rjhan jld he nechay ke trf bdl skta hay۔ qemt kay chart jo kh kendl stk charts kay nam say jana jata hay tkneke tjzeh men aam hen۔ oh oqt kay sath sath kse mkhsos sekeortez kay afttahe، bnd honay، zeadh aor km qemton ko zahr krtay hen۔ mae'ekrosaft kamn astak (NASDAQ:MSFT) kendl stk chart zel men dkhaea gea hay jo 2020 men qemt dkhata hay۔ srkh/seah mom btean mzbot frokht ke qoton ke nshandhe krte hen، jb kh sbz/sfed mom btean zeadh mzbot khred dbaؤ ke nshandhe krte hen۔ Practical Example pressures. yhan bdnam zmanh atar chrrhaؤ oalay astak tesla (NASDAQ: TSLA) kay leay kendl stk chart ke aek msal hay۔ yhan، aek seah badl ka ahath do treqon say dekha ja skta hay: tesla kendl stk chart jb rechh kendl stk bel kendl stk ke pchhle bndsh kay aopr khlte hay aor phlay ke bel kendl stk kay ost poae'nt kay nechay bnd hote hay، to yh bae'en janb phle shma dan bnate hay۔ tahm، as petrn kay bad koe'e tsdeqe kendl stk (azafe bel kendl stk) zahr nhen hote hay۔ dosre msal men، bel kendl stk ke pchhle bndsh kay aopr aek rechh kendl stk khlte hay۔

yhan bdnam zmanh atar chrrhaؤ oalay astak tesla (NASDAQ: TSLA) kay leay kendl stk chart ke aek msal hay۔ yhan، aek seah badl ka ahath do treqon say dekha ja skta hay: tesla kendl stk chart jb rechh kendl stk bel kendl stk ke pchhle bndsh kay aopr khlte hay aor phlay ke bel kendl stk kay ost poae'nt kay nechay bnd hote hay، to yh bae'en janb phle shma dan bnate hay۔ tahm، as petrn kay bad koe'e tsdeqe kendl stk (azafe bel kendl stk) zahr nhen hote hay۔ dosre msal men، bel kendl stk ke pchhle bndsh kay aopr aek rechh kendl stk khlte hay۔

- Mentions 0

-

سا0 like

-

#3 Collapse

Dark Cloud Cover ek trading term hai jo ke technical analysis mein istemal hoti hai. Ye pattern usually uptrend ya bullish trend ke doran dekha jata hai aur yeh trader ko potential trend reversal ki suchna deta hai. Is pattern mein pehle ek strong bullish candle hoti hai, jo ke uptrend ko represent karti hai, phir ek bearish candle aati hai jo pehli candle ke upper open hoti hai lekin phir se nichay chali jati hai, yani ke bearish pressure show karti hai. Dark Cloud Cover ko trader is liye dekhte hain kyunki ye market mein bearish momentum ka sign ho sakta hai aur is se future price decline ki possibility hoti hai. Isay samajhna trading mein ahem hota hai takay trader apne positions ko samjhe aur theek tareeqe se manage kar saken. What is the Dark Cloud Cover in Trading Dark Cloud Cover ek trading mein ahem (significant) pattern hai jo technical analysis mein istemal hota hai. Isko samajhna traders ke liye bohot zaroori hai kyun ke is pattern se potential trend reversals ke baray mein maloomat milti hai. Is pattern ki asaan taur par samajhne ke liye, yeh dekha jata hai ke market mein uptrend ho raha hota hai: Bullish Candle: Sab se pehle, ek taqatwar bullish candle hoti hai, jo ke price mein tezi ka ishara karti hai. Is candle mein traders ki optimism hoti hai. Bearish Candle: Bullish candle ke baad, ek bearish candle aati hai. Is candle ki khaas baat yeh hoti hai ke yeh pehle bullish candle ke close ke upper open hoti hai, lekin phir tezi se neeche chali jati hai, ideal taur par pehle bullish candle ke darmiyan close hoti hai. Is bearish candle ki neeche ki taraf movement, sentiment mein tabdeeli ka ishara hoti hai. Is se yeh samjha jata hai ke bearish pressure barh rahi hai, jo ke uptrend ki mukhalifat mein ishara ho sakta hai. Traders Dark Cloud Cover ko aksar ek warning sign ke taur par dekhte hain ke market mein mukhtalif mudde ho sakte hain. Traders ke liye Dark Cloud Cover jaise patterns ko pehchan kar samajhna bohot zaroori hai. Aise patterns ko pehchan kar traders apni positions ko behtar tareeqe se manage kar sakte hain aur market ke movements par fayda utha sakte hain. Yaad rahe, kamiyabi trading mein technical analysis, market awareness, aur risk management ki ek sahi combination par mabni hoti hai. -

#4 Collapse

What is the Dark Cloud Cover? Dark Cloud Cover (DCS) ek bearish candlestick pattern hai jo amuman technical analysis mein istemal hota hai taakee kisi maali aset, jaise ke stocks, currency pairs, ya commodities, ke keemat mein mukhtalif pattiyon ko pesh-goi karne mein madadgar ho. Yeh pattern aksar do candlesticks se bana hota hai:- Pehla candlestick ek lambi bullish (upward) candle hoti hai jo ek uptrend ya bullish market sentiment ko darust karti hai.

- Dusra candlestick ek bearish (downward) candle hoti hai jo pehli candlestick ke closing price se upar khulta hai aur pehli candlestick ke body ke darmiyan se nichle hisse mein band hoti hai.

-

#5 Collapse

Assalamu-Alaikum! Dear members Me umeed kerti hoke aap sb khair se hoge or ap sb ka forex trading py kam bahut acha chal rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. Dark Cloud Cover DCS yaani Andheray Badal Ka Chadar ek candlestick chart pattern hai jo stock market aur technical analysis mein istemal hota hai. Ye pattern traders aur investors ko price reversals ki pehchan karne mein madadgar hota hai, khaas karke bearish girawat reversals ko samajhne mein. Dark Cloud Cover pattern do candlesticks se bana hota hai aur ye ek downtrend ke baad aane wala bearish reversal signal deta hai. Is pattern ko samajhne ke liye, yeh components important hain: Pehla Candlestick Day 1 Pehla candlestick uptrend mein hota hai. Is candlestick ka color usually green bullish hota hai. Pehla candlestick ek solid body ke saath hota hai aur ideally strong buying activity ko represent karta hai. Dusra Candlestick Day 2 Dusra candlestick pehle candlestick ki upper body shadow se shuru hota hai. Iska color typically red bearish hota hai. Dusra candlestick ka size aur range pehle candlestick se bara hota hai. Dusra candlestick ki closing price pehle candlestick ki closing price ke neeche hoti hai. Dark Cloud Cover pattern ka matlab hota hai ke uptrend ke baad bearish pressure aa rahi hai aur prices mein girawat hone ke chances hain. Ye pattern ek potential trend reversal ko indicate karta hai aur traders ko selling opportunities ke baare mein sochne mein madadgar hota hai. Dark Cloud Cover ko confirm karne ke liye, traders usually wait karte hain ke teesra candlestick Day 3 bhi bearish direction mein move kare, yani ke price aur girne lage. Agar aisa hota hai, to Dark Cloud Cover pattern stronger ho jata hai. Is pattern ko use karte waqt, traders stop-loss orders ka istemal karte hain taake nuksan se bacha ja sake. Dark Cloud Cover pattern ko dusre technical indicators aur market analysis ke saath combine karke istemal karna behtar hota hai, taki trade decisions sahi tarah se liya ja sake. Dark Cloud Cover ek powerful reversal signal ho sakta hai, lekin market mein kisi bhi pattern ya indicator ke 100% accuracy par bharosa nahi karna chahiye. Isliye, risk management aur proper analysis ka istemal karna hamesha zaroori hota hai jab trading ki baat aati hai. -

#6 Collapse

Dark cloud cover pattern : Dark Cloud Cover pattern, ya DCC, ek bearish candlestick pattern hai jo trading mein use hota hai. Ye pattern typically ek uptrend ke baad dikhta hai aur bearish reversal ki indication deta hai. Ismein ek bullish candlestick followed by a larger bearish candlestick hota hai, jo pehle wale candlestick ko cover karta hai. Ye pattern bearish momentum ki indication hai aur traders iska use trend reversal ke liye karte hain. How to Identify dark cloud cover pattern : Dark Cloud Cover pattern ko identify karne ke liye, aap candlestick charts ka istemal kar sakte hain. Is pattern ko dhundne ke liye aapko do consecutive candlesticks ki zaroorat hogi. Pehla candlestick bullish (upward) trend mein ho aur dusra candlestick pehle wale candlestick ko cover karne wala bearish (downward) candlestick ho. Agar aapko ye pattern mil jata hai, toh aap samajh sakte hain ki Dark Cloud Cover pattern present hai. Trade with dark cloud pattern : Dark Cloud Cover pattern ke sath trading karne ke characteristics yeh hote hain: - Ye pattern bearish reversal ki indication deta hai. - Ismein pehle ek bullish candlestick hota hai, followed by a larger bearish candlestick. - Bearish candlestick pehle wale candlestick ko cover karta hai. - Is pattern mein bearish momentum ki possibility hoti hai. - Traders is pattern ko dekh kar sell positions enter kar sakte hain ya existing long positions ko exit kar sakte hain. - Stop loss aur target price levels ko set karna important hota hai. - Risk management aur proper research karna trading mein zaroori hota hai. -

#7 Collapse

Dark Cloud Cover ek candlestick pattern hai jo financial markets mein trading ke liye use hota hai. Ye pattern bearish reversal ko indicate karta hai, yaani agar market uptrend mein ho aur Dark Cloud Cover ka pattern ban jaye, to iska matlab yeh hota hai ke market ne apna direction badal kar neeche ki taraf jaana shuru kar diya hai.

Components of Dark Cloud Cover

Dark Cloud Cover pattern do candlesticks se milkar banta hai:- Pehli Candlestick: Yeh ek lambi bullish (white/green) candlestick hoti hai jo ke current uptrend ko represent karti hai. Is candlestick ka close previous candlestick ke high ke upar hota hai.

- Doosri Candlestick: Yeh ek bearish (black/red) candlestick hoti hai jo ke pehli candlestick ke close ke baad gap up se open hoti hai lekin uska close pehli candlestick ke body ke mid point se neeche hota hai.

Formation of Dark Cloud Cover

Dark Cloud Cover pattern ka formation kuch is tarah hota hai:- Market uptrend mein hota hai, aur ek lambi bullish candlestick ban jati hai. Yeh bullish candlestick buyers ki strength ko show karti hai.

- Agle trading session mein, market gap up ke sath open hoti hai, jo ke buyers ki taraf se aur zyada strength ko indicate karti hai.

- Lekin trading session ke dauran, selling pressure increase hota hai, aur bearish candlestick pehli bullish candlestick ke body ke mid point ke neeche close hoti hai. Yeh selling pressure aur reversal ki shuruaat ko indicate karta hai.

Dark Cloud Cover pattern significant kyu hota hai? Is pattern ki significance kuch points mein samjhayi ja sakti hai:- Reversal Signal: Dark Cloud Cover pattern ek bearish reversal signal hai, yaani agar yeh pattern ban raha ho to isse yeh indication milta hai ke market uptrend se downtrend mein shift hone wala hai.

- Market Sentiment: Is pattern se market sentiment ka pata chalta hai. Pehli bullish candlestick buyers ki strength ko show karti hai lekin agle hi din bearish candlestick ka ban jana sellers ki wapsi aur buyers ke weak hone ko indicate karta hai.

- Psychological Impact: Yeh pattern traders ke psychological perspective ko bhi show karta hai. Jab market gap up ke sath open hoti hai lekin uske baad selling pressure dominate karta hai, to yeh traders ke psychology mein fear aur uncertainty ko increase karta hai.

Dark Cloud Cover pattern ko trading mein kaise use kar sakte hain, iske liye kuch strategies hain jo traders follow kar sakte hain:

1. Confirmation

Dark Cloud Cover pattern ke baad confirmation ka wait karna zaroori hai. Confirmation ka matlab yeh hota hai ke agle trading session mein ek aur bearish candlestick ban jaye jo ke downtrend ki shuruaat ko confirm kare.

2. Volume Analysis

Volume bhi ek important factor hai Dark Cloud Cover pattern ko analyze karte waqt. Agar bearish candlestick ke formation ke dauran volume increase hota hai to yeh strong selling pressure ko indicate karta hai jo ke downtrend ke continuation ko support karta hai.

3. Support and Resistance Levels

Support aur resistance levels ka analysis bhi zaroori hai. Agar Dark Cloud Cover pattern kisi major resistance level par ban raha hai to yeh aur zyada significant ho jata hai.

4. Risk Management

Risk management har trading strategy ka essential part hai. Is pattern ko trade karte waqt stop-loss levels ka set karna zaroori hai. Typically, stop-loss ko pehli bullish candlestick ke high ke thoda upar set karna chahiye.

5. Combining with Other Indicators

Dark Cloud Cover pattern ko doosre technical indicators ke sath combine karna bhi useful ho sakta hai. For example, moving averages, RSI (Relative Strength Index), aur MACD (Moving Average Convergence Divergence) ko use karke is pattern ki reliability ko aur increase kiya ja sakta hai.

Example of Dark Cloud Cover

Ek practical example ke through Dark Cloud Cover pattern ko samajhna aur bhi aasaan ho jata hai. Assume karein ke XYZ stock ek uptrend mein chal raha hai aur uski pehli bullish candlestick 50 se open hoke 55 par close hoti hai. Agle din stock 56 par open hota hai lekin session ke end tak selling pressure ke wajah se stock 52 par close hota hai. Yeh ek classic Dark Cloud Cover pattern ka example hai.

Analysis of the Example

Is example mein:- Pehli bullish candlestick buyers ki strength ko indicate kar rahi hai.

- Doosri bearish candlestick ke open hone par market gap up hui, jo ke aur zyada buyers ki interest ko show kar raha hai.

- Lekin bearish candlestick ke formation ke baad selling pressure ne dominate kar liya aur stock pehli candlestick ke mid point se neeche close hua.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#8 Collapse

**Dark Cloud Cover Kya Hai?**

Dark Cloud Cover ek candlestick pattern hai jo technical analysis mein use hota hai stock market aur forex trading mein price reversals ko predict karne ke liye. Ye pattern bearish reversal pattern hai, jo typically uptrend ke baad appear hota hai aur indicate karta hai ke market ka momentum downward direction mein change hone wala hai.

Dark Cloud Cover pattern ko identify karne ke liye kuch specific criteria hote hain. Is pattern mein do consecutive candles hote hain: pehla candle bullish (upward movement) hota hai aur doosra candle us se neeche open hota hai aur previous candle ke upper half mein close hota hai. Is se indicate hota hai ke bullish trend ke baad market mein selling pressure aa rahi hai aur potential reversal hone ka chance hai.

Traders Dark Cloud Cover pattern ko identify karne ke baad potential selling opportunities ke liye look karte hain. Is pattern ko confirm karne ke liye traders typically next few candles ka price action bhi observe karte hain. Agar next candles mein price downward move karta hai aur previous high ko break karta hai, toh isko confirm kiya jata hai ke market ka momentum bearish direction mein shift ho raha hai.

Dark Cloud Cover pattern ko trading mein use karte waqt, traders ko risk management strategies ka bhi dhyaan rakhna hota hai. Is pattern ki validity ko confirm karne ke liye volume analysis bhi kiya jata hai, kyunki high volume ke sath ye pattern more reliable hota hai.

Is pattern ka naam uske appearance se aata hai, jisme ek dark (downward) cloud jaise formation create hoti hai uptrend ke baad. Ye pattern traders ko alert karta hai ke potential reversal hone ki possibility hai aur wo apne trading strategies ko us ke hisaab se adjust kar sakte hain.

Dark Cloud Cover pattern ka istemal karne se pehle, zaroori hai ke traders candlestick patterns aur market dynamics ko samajhne ke liye acche se study aur practice karein. Is tarah ke patterns ko effectively identify aur interpret karne se traders apne trading decisions ko improve kar sakte hain aur market trends ko successfully predict karne mein madad mil sakti hai.

**Post Ka Anjaam**

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 Collapse

**Dark Cloud Cover Kya Hai? Forex Trading Mein Iska Kya Maqam Hai?**

Forex trading mein, Dark Cloud Cover ek important bearish candlestick pattern hai jo market ke potential reversal points ko identify karne mein madad karta hai. Yeh pattern technical analysis ka ek ahem hissa hai aur traders ko price action ke basis par decision-making mein guide karta hai. Aaiye dekhen ke Dark Cloud Cover kya hota hai aur forex trading mein iska kya significance hai.

**Dark Cloud Cover Pattern Ki Pehchan**

Dark Cloud Cover ek two-candle bearish reversal pattern hota hai jo uptrend ke baad banta hai. Is pattern ki pehchan ke liye, aapko iske key characteristics dekhne chahiye:

1. **Bullish Candle**: Pattern ki pehli candle ek strong bullish candle hoti hai, jo uptrend ko continue karti hai. Is candle ka body usually large hota hai aur market ke strong buying pressure ko represent karta hai.

2. **Bearish Candle**: Dusri candle, jo Dark Cloud Cover pattern ko complete karti hai, ek bearish candle hoti hai. Yeh candle previous bullish candle ke body ko open ke point se hi cover karti hai aur closing price previous candle ke body ke halfway point ke neeche hoti hai. Yeh bearish candle market ke trend reversal ka indication hoti hai.

**Dark Cloud Cover Ka Significance**

1. **Trend Reversal Signal**: Dark Cloud Cover pattern typically bullish trend ke end aur bearish trend ke start ko indicate karta hai. Jab yeh pattern develop hota hai aur market previous bullish candle ke body ko cover karti hai, to yeh bearish reversal signal hota hai. Yeh traders ko market ke downward movement ke liye prepare karta hai.

2. **Market Sentiment**: Is pattern ke formation ke dauran, market sentiment gradually shift hota hai. Pehli candle ke strong buying pressure ke baad, doosri candle ke bearish closure market ke sentiment change ko reflect karti hai, jo ek potential trend reversal ko dikhati hai.

3. **Trading Strategy**: Dark Cloud Cover pattern ko trading strategy mein integrate karte waqt, traders ko entry aur exit points ko carefully plan karna chahiye. Pattern ke formation ke baad, sell trades execute kiye ja sakte hain, aur stop loss levels ko previous bullish candle ke high ke upar set kiya ja sakta hai. Is pattern ka use karte waqt, market ke overall trend aur support/resistance levels ko bhi consider karna zaroori hai.

**Analysis Aur Confirmation**

1. **Volume Confirmation**: Dark Cloud Cover pattern ke signals ko confirm karne ke liye, trading volume ko dekhna zaroori hai. Pattern ke bearish candle ke dauran high trading volume signal ke strength ko confirm karne mein madad karta hai.

2. **Additional Indicators**: Technical indicators jaise moving averages, RSI (Relative Strength Index), aur MACD (Moving Average Convergence Divergence) ka use pattern ke signals ko confirm karne mein kiya ja sakta hai. Yeh indicators pattern ke accuracy ko enhance karte hain aur additional insights provide karte hain.

3. **Risk Management**: Risk management practices ko follow karna zaroori hai. Stop loss aur take profit levels ko carefully set karna chahiye taake market ke unexpected movements se bachav ho sake.

**Conclusion**

Dark Cloud Cover forex trading mein ek valuable bearish reversal pattern hai jo market ke potential trend changes ko identify karne mein madad karta hai. Is pattern ka sahi use karne se traders apni trading strategies ko optimize kar sakte hain aur market ke movements ko effectively capitalize kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:40 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим