Bullish meeting line:

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

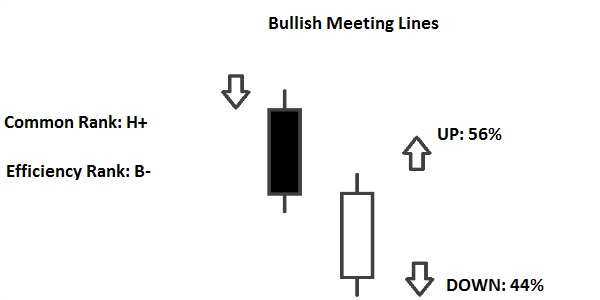

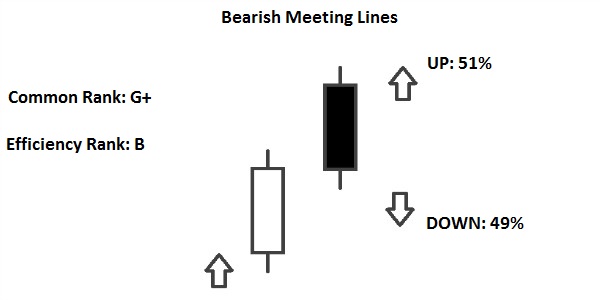

Bullish Meeting Line, ek bullish reversal candlestick pattern hai, jo price chart par dikhai deta hai. Is pattern mein ek downtrend ke baad ek bearish candle ke baad ek bullish candle formation hoti hai. Bullish Meeting Line pattern bullish trend ki shuruat ya price reversal ka indication deta hai. Bullish Meeting Line pattern ki wazahat: 1. Pehla Candle: Bullish Meeting Line pattern ki pehli candle ek bearish candle hoti hai, jiske open price high se higher hoti hai aur close price low ke paas ya uske neeche hoti hai. 2. Dusra Candle: Bullish Meeting Line pattern ki dusri candle ek bullish candle hoti hai, jiske open price pehle bearish candle ke close price ke paas ya uske neeche hoti hai aur close price high ke paas ya uske paas hoti hai. Is bullish candle ki body pehli bearish candle ki body ko partially cover karti hai. Bullish Meeting Line pattern bullish reversal ka signal deta hai, kyunki ye indicate karta hai ki downtrend khatam ho sakta hai aur bullish pressure aa rahi hai. Is pattern ko confirm karne ke liye, traders dusre technical indicators aur price action analysis ka istemal karte hain. Traders Bullish Meeting Line pattern ko identify karke trading strategies develop karte hain. Yeh pattern buying opportunity provide karta hai, jahaan par traders long positions lete hain, stop-loss orders lagate hain aur price increase ki expectation rakhte hain. Bullish Meeting Line pattern ko analyze karne ke liye, traders ko candlestick charting techniques aur technical analysis ke concepts ko samajhna zaruri hota hai. Isse traders price movements ko better understand kar sakte hain aur trading decisions ko improve kar sakte hain. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

"Bullish Meeting Line" ek trading term hai jo market analysis mein ahem hai. Is pattern mein do consecutive candles aati hain: Bullish Candle: Pehli candle ek uptrend ya bullish trend ko darust karti hai, iska matlab hai ke market mein tawanai hai aur traders optimistic hain. Doji Candle: Dusri candle doji pattern hoti hai, jo ke pehli candle ke close ke qareeb open hoti hai. Yeh doji candle, market ke bearish pressure ko darust karti hai, lekin puri tarah se bearish nahi hoti. Bullish Meeting Line traders ko ishara deta hai ke bearish trend mein aik possible reversal ho sakta hai aur uptrend ka aghaz hone ki sambhavna hoti hai. Is pattern ki samajh traders ke liye zaroori hai takay woh sahi waqt par trading decisions le saken aur market ke movements ko behtar tareeqe se samajh saken. Bullish Meeting Line in Trading "Bullish Meeting Line" trading mein aik ahem pattern hai jo market analysis mein istemal hota hai. Is pattern ki madad se traders market mein hone wale possible trend reversals ko samajh sakte hain. Is pattern mein do consecutive candles hote hain. Pehli candle ek bullish trend ko darust karti hai, yani market mein tawanai hai aur traders optimistic hain. Lekin doosri candle doji pattern hoti hai, jo ke pehli candle ke close ke qareeb open hoti hai. Yeh doji candle market mein bearish pressure ko darust karti hai, lekin puri tarah se bearish nahi hoti. "Bullish Meeting Line" traders ko ishara deta hai ke bearish trend mein aik possible reversal ho sakta hai aur uptrend ka aghaz hone ki sambhavna hoti hai. Is pattern ko samajh kar, traders apne trading decisions ko behtar tareeqe se plan kar sakte hain. Lekin yaad rahe, har trading decision ko samajhna aur soch samajh kar lena bohot zaroori hai. Iske saath hi risk management ka bhi khayal rakhna bohot ahem hai taake trading mein kamiyabi hasil ki ja sake. "Bullish Meeting Line" jaise patterns ko samajh kar, traders apni trading skills ko sudhar sakte hain aur market ke movements ko behtar tareeqe se predict kar sakte hain. -

#4 Collapse

Bullish Meeting Line Candlestick Pattern:

Bullish Meeting Line Mombatti Pattern -

Mombatti Patterns:

Candlestick patterns forex aur stock markets mein traders ke liye ahem tools hote hain jo market sentiment aur price movements ko samajhne mein madad karte hain. Bullish Meeting Line ek aham candlestick pattern hai jo uptrend ki continuation ko darust karta hai.

Bullish Meeting Line Ki Pehchan:

Bullish Meeting Line pattern ko do consecutive candles se pehchana ja sakta hai. Pehla candle ek downtrend ke doran banaye gaye hai aur neeche ki taraf ja raha hai. Doosra candle bhi neeche ki taraf shuru hota hai lekin phir se uptrend ke andar aake pehle candle ke oopar close hota hai.

Bullish Meeting Line Ki Tafsir:

Bullish Meeting Line pattern ek bullish reversal signal hai jo uptrend ki continuation ko darust karta hai. Jab doosra candle pehle candle ke oopar close hota hai, to yeh batata hai ke downtrend ke baad buying pressure shuru ho gaya hai aur uptrend dobara shuru hone ki sambhavna hai.

Bullish Meeting Line Ka Istemal:- Confirmation ke Liye Intezar: Bullish Meeting Line pattern ko confirm karne ke liye traders doosre technical indicators aur price action ko dekhte hain. Agar pattern ke baad ek aur bullish candle aata hai, to yeh pattern ki tasdeeq hoti hai.

- Entry aur Exit Points: Traders Bullish Meeting Line pattern ko dekh kar apne positions ko adjust karte hain. Agar pattern confirm ho jata hai, to traders long positions le sakte hain ya phir existing short positions ko close kar sakte hain.

- Stop Loss aur Take Profit Levels: Traders apni positions ke liye sahi stop-loss aur take-profit levels tay karte hain taki nuksan kam ho aur faida zyada ho sake.

Nateeja:

Bullish Meeting Line candlestick pattern ek bullish reversal signal hai jo uptrend ki continuation ko indicate karta hai. Lekin, jaise ke har trading tool, is pattern ko istemal karte waqt doosre factors aur risk management ko bhi mad e nazar rakha jana chahiye. Sahi tajziya aur discipline ke saath, traders is pattern ka sahi istemal karke apne trading performance ko behtar bana sakte hain.

- CL

- Mentions 0

-

سا0 like

-

#5 Collapse

Bullish Meeting Line Candlestick Pattern Kya Hai?

Bullish Meeting Line Candlestick Pattern ek ahem technical analysis pattern hai jo forex trading mein istemal hota hai. Ye pattern typically bearish trend ke baad aata hai aur bullish reversal ka indication deta hai. Bullish Meeting Line pattern do consecutive candlesticks se bana hota hai, jisme pehla candlestick bearish hota hai aur doosra candlestick bullish hota hai.

Bullish Meeting Line Candlestick Pattern Ki Tafseel

Bullish Meeting Line Candlestick Pattern ko identify karne ke liye kuch key characteristics hain:- Pehla Candlestick (Bearish): Bullish Meeting Line pattern ka pehla candlestick ek bearish candle hota hai jo downtrend ke indication ke roop mein aata hai.

- Doosra Candlestick (Bullish): Doosra candlestick bullish hota hai aur pehle candlestick ke nichle hisse mein open hota hai aur uske close ke qareeb close hota hai. Iski body ka size pehle candlestick se bara hona zaroori hai.

- Volume Ka Tafseel: Bullish Meeting Line pattern ke sath sath, volume ka bhi dhyan dena zaroori hai. Agar doosre candlestick ke saath volume bhi increase hota hai, toh ye pattern ki strength ko aur bhi zyada confirm karta hai.

Bullish Meeting Line Candlestick Pattern Ka Istemal

Bullish Meeting Line Candlestick Pattern ko trading mein istemal karne ke liye, traders ko kuch points ka dhyan rakhna zaroori hai:- Confirmation Wait Karein: Bullish Meeting Line pattern ke appearance ke baad, traders ko confirmatory signals ka wait karna chahiye. Agar next candlestick ka price action bhi bullish hai aur volume bhi confirm karta hai, toh traders entry ya exit points decide kar sakte hain.

- Stop Loss Aur Take Profit Levels Set Karein: Position enter karte waqt, traders ko tight stop loss aur take profit levels set karna chahiye takay nuksan se bacha ja sake aur profits ko lock kiya ja sake.

- Market Context Ko Samajhein: Bullish Meeting Line pattern ko samajhne ke liye, traders ko overall market context ko bhi samajhna zaroori hai. Agar ye pattern strong support level ya kisi aur important level ke paas aata hai, toh iska significance aur strength badh jata hai.

Nateeja

Bullish Meeting Line Candlestick Pattern ek mufeed technical analysis tool hai jo traders ko bearish trend ke exhaustion aur bullish reversal ke baare mein bataata hai. Isko samajh kar, traders apne trading decisions ko improve kar sakte hain aur market trends ko better analyze kar sakte hain. Lekin, traders ko confirmatory signals aur overall market context ko bhi dhyan mein rakhna chahiye trading decisions lene mein.

Bullish Meeting Line Candlestick Pattern: -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Bullish Meeting Line Candlestick Pattern: Ek Forex Trading Mein Ahem Candlestick Pattern

Forex trading mein, candlestick patterns traders ke liye ek ahem tool hain jo market ke movements ko samajhne aur analyze karne mein madadgar hota hai. Bullish Meeting Line Candlestick Pattern bhi un patterns mein se ek hai jo uptrend ko indicate karta hai aur traders ko bullish signals faraham karta hai. Is article mein, hum Bullish Meeting Line Candlestick Pattern ke baare mein guftagu karenge aur samjheinge ke yeh kis tarah se forex trading mein istemal hota hai.

Bullish Meeting Line Candlestick Pattern Kya Hai?

Bullish Meeting Line Candlestick Pattern ek bullish reversal pattern hai jo market ke downtrend ke end ko darust karta hai. Is pattern mein do consecutive candlesticks shamil hote hain: pehli candlestick ek bearish (red) candle hoti hai aur doosri candlestick ek bullish (green) candle hoti hai. Doosri candlestick ki opening price pehli candlestick ki closing price ke qareeb hoti hai aur price ka movement upar hota hai.

Bullish Meeting Line Candlestick Pattern Ki Pehchan:

Bullish Meeting Line Candlestick Pattern ki pehchan karne ke liye, kuch zaroori points ko dhyan mein rakhna zaroori hai:- Pehli Candlestick:

Bullish Meeting Line Candlestick Pattern ki shuruaat pehli candlestick ke saath hoti hai jo ek downtrend ke dauran form hoti hai. Yeh candlestick ek bearish (red) candle hoti hai aur market mein selling pressure ko darust karti hai. - Doosri Candlestick:

Doosri candlestick bullish (green) hoti hai aur pehli candlestick ki closing price ke qareeb open hoti hai. Is candlestick ki body pehli candlestick ke body mein ghuste hue hoti hai aur price ka movement upar hota hai.

Bullish Meeting Line Candlestick Pattern Ka Istemal:

Bullish Meeting Line Candlestick Pattern ka istemal karke, traders uptrend ke shuruaat ko identify kar sakte hain aur apne trades ko uske mutabiq adjust kar sakte hain. Jab yeh pattern confirm ho jata hai, traders buy positions enter kar sakte hain ya existing sell positions ko close kar sakte hain.

Lekin, ek bullish meeting line pattern ke signals ko confirm karne ke liye, traders ko dusri technical analysis tools aur indicators ka bhi istemal karna chahiye. Yeh pattern kabhi kabhi false signals bhi generate kar sakta hai, isliye traders ko hamesha cautious rehna chahiye.

Bullish Meeting Line Candlestick Pattern forex trading mein ek ahem tool hai jo traders ko trend reversals ko identify karne mein madad karta hai. Lekin, traders ko hamesha dhyan mein rakhna chahiye ke koi bhi pattern ya indicator 100% kamyaab nahi hota aur uske signals ko confirm karne ke liye dusri analysis aur risk management principles ka istemal karna zaroori hota hai. Samajhdari aur tajziya ke saath, Bullish Meeting Line Candlestick Pattern ka istemal karke traders apne trading strategies ko behtar bana sakte hain aur munafa kamane ka faida utha sakte hain.

- CL

- Mentions 0

-

سا0 like

- Pehli Candlestick:

-

#7 Collapse

Bullish Meeting Line Candlestick Pattern:

Bullish Meeting Line Candlestick Pattern ek technical analysis tool hai jo traders aur investors use karte hain price movements ka analysis karne ke liye, especially stock market ya anya financial markets mein. Is pattern ko samajhne ke liye,

kuch important points hain:- Formation: Bullish Meeting Line Pattern mein, pehla candle bearish hota hai, yani ki iska closing price lower hota hai uske opening price se. Dusra candle bullish hota hai, yani ki iska closing price higher hota hai uske opening price se. Dono candles ke ranges ek dusre ke qareeb hoti hain.

- Context: Is pattern ko identify karte waqt, traders ko overall market context ko bhi dekhna zaroori hota hai. Agar yeh pattern ek strong downtrend ke baad aata hai, toh iska significance zyada hota hai compared to agar yeh pattern kisi sideways market mein ya weak trend ke baad aata hai.

- Volume: Volume bhi ek important factor hota hai Bullish Meeting Line Candlestick Pattern ko samajhne ke liye. Agar doosre candle ke saath volume bhi increase hota hai, toh yeh pattern ka confirmation aur strong hota hai.

- Confirmation: Is pattern ko confirm karne ke liye, traders doosre indicators aur tools ka bhi istemaal karte hain, jaise ki moving averages, RSI (Relative Strength Index), ya MACD (Moving Average Convergence Divergence).

- Risk Management: Jaise ki har trading strategy mein, risk management Bullish Meeting Line Pattern ke liye bhi zaroori hai. Stop loss levels aur entry/exit points ko define karna important hota hai.

Overall, Bullish Meeting Line Candlestick Pattern ko samajh kar aur sahi tarah se interpret karke traders aur investors market movements ka better analysis kar sakte hain, lekin woh hamesha dusre technical indicators aur market context ko bhi consider karna nahi bhoolte.

- CL

- Mentions 0

-

سا0 like

-

#8 Collapse

Bullish Meeting Line Candlestick Pattern: Aik Mazboot Signal

Forex trading mein technical analysis ka istemal traders ke liye aham hota hai aur candlestick patterns is analysis ka eham hissa hain. Ek aham bullish reversal pattern jo traders ke darmiyan mashhoor hai wo hai "Bullish Meeting Line Candlestick Pattern". Is article mein hum Bullish Meeting Line candlestick pattern ke khaasiyat aur iske istemal ke bare mein guftagu karenge.

1. Bullish Meeting Line Candlestick Pattern Kya Hai? Bullish Meeting Line candlestick pattern ek reversal pattern hai jo downtrend ke baad nazar aata hai aur bullish reversal ki possibility ko darust karta hai. Is pattern mein do achayi ki candles nazar aati hain jinmein se pehli candle bearish (girawat ki taraf) hoti hai aur doosri candle bullish (barhne ki taraf) hoti hai. Doosri candle pehli candle ke neeche open hoti hai aur pehli candle ke closing price ke qareeb close hoti hai.

2. Khaasiyat: Bullish Meeting Line candlestick pattern ke kuch khaasiyat darj zail hai:- Bullish Reversal Signal: Bullish Meeting Line pattern downtrend ke baad nazar aata hai aur bullish reversal ki possibility ko darust karta hai. Is pattern ki presence ko dekh kar traders ko uptrend ke shuru hone ki umeed hoti hai.

- Do Achayi Ki Candles: Is pattern mein do achayi ki candles nazar aati hain, jinmein se pehli candle downtrend ko darust karti hai aur doosri candle bullish momentum ki shuruat ko darust karti hai.

- Confirmation ke Liye Volume ka Tawajjo: Bullish Meeting Line pattern ko confirm karne ke liye traders ko volume ko bhi dekhna chahiye. Agar doosri candle pehli candle ke close ke oopar volume ke sath close hoti hai, to ye pattern ki strength ko darust karta hai.

3. Istemal aur Trading Instructions: Bullish Meeting Line candlestick pattern ko samajhne ke liye aur sahi tareeqay se istemal karne ke liye traders ko kuch hidayat par amal karna chahiye:- Identify the Pattern: Pehle to traders ko price chart ko closely observe kar ke Bullish Meeting Line pattern ko pehchan na chahiye. Is pattern mein pehli candle bearish hoti hai aur doosri candle bullish hoti hai jo pehli candle ke neeche open hoti hai.

- Confirm the Signal: Bullish Meeting Line pattern ko samajhne ke baad, traders ko iske confirmation ke liye doosri factors ko bhi dekhte rehna chahiye. Agar doosri candle pehli candle ke close ke oopar close hoti hai aur volume ke sath close hoti hai, to ye pattern ki validity ko confirm karta hai.

- Entry aur Exit Points: Bullish Meeting Line pattern ke signals ke istemal kar ke traders ko entry aur exit points ka faisla karna chahiye. Agar ye pattern uptrend ke baad nazar aata hai to traders buy ki positions le sakte hain.

- Stop-Loss aur Take-Profit Levels: Trading positions lete waqt, traders ko stop-loss aur take-profit levels ko bhi set karna chahiye. Stop-loss order unhein nuksan se bachata hai agar trade ghalt sabit ho gayi, jabke take-profit order unhein munafa ko maximize karne mein madad karta hai.

4. Conclusion: Bullish Meeting Line candlestick pattern ek aham technical signal hai jo bullish reversal ki possibility ko darust karta hai. Halanki ye pattern keval ek indication hai aur iski confirmation ke liye doosri factors ka bhi moolyankan zaroori hai. Traders ko is pattern ko samajh kar sahi tareeqay se istemal karna chahiye aur apne risk management strategy ko bhi mad e nazar rakhte hue trading decisions lena chahiye.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Bullish Meeting Line: Kya Hai Aur Yeh Trading Mein Kaise Madadgar Ho Sakti Hai?**

Trading aur technical analysis ke duniya mein, "Bullish Meeting Line" ek ahem candlestick pattern hai jo market trends aur price movements ko samajhne mein madad karta hai. Yeh pattern khas taur par bullish trends ko identify karne ke liye use hota hai aur investors ko potential buying opportunities ko recognize karne mein help karta hai. Is post mein, hum bullish meeting line pattern ko detail mein samjhenge aur dekhenge yeh trading strategy mein kaise madadgar ho sakta hai.

**Bullish Meeting Line Kya Hai?**

Bullish Meeting Line ek candlestick pattern hai jo market trend ke reversal ya continuation ko indicate karta hai. Yeh pattern do candlesticks se milkar bana hota hai:

1. **Pehli Candlestick:** Yeh ek red (bearish) candlestick hoti hai jo market mein ek downtrend ko reflect karti hai. Is candlestick ki closing price previous day ke open price se lower hoti hai.

2. **Doosri Candlestick:** Yeh ek green (bullish) candlestick hoti hai jo pehli candlestick ke close ke aas-paas ya usse thoda upar open hoti hai. Is candlestick ki closing price pehli candlestick ke open price ke aas-paas ya usse upar hoti hai.

**Pattern Ka Interpretation:**

Bullish Meeting Line pattern typically ek bullish reversal signal hai. Jab yeh pattern form hota hai, to yeh indicate karta hai ke market mein bearish trend khatam ho sakta hai aur bullish trend shuru ho sakta hai. Yeh pattern market ke sentiment shift ko reflect karta hai, jahan buyers ka interest increase hota hai aur sellers ka pressure kam hota hai.

**Trading Mein Iska Use Kaise Karein?**

1. **Confirmation:** Bullish Meeting Line pattern ka use karte waqt, confirmation signals bhi dekhna zaroori hota hai. Yani, agar pattern ban jata hai, to ensure karein ke price subsequent days mein upar ki taraf move kar rahi hai. Additional technical indicators jaise Moving Averages ya RSI bhi confirmation ke liye use kiye ja sakte hain.

2. **Entry Points:** Jab aapko Bullish Meeting Line pattern dikhe, to potential entry point ke liye wait karein jab price pattern ke high ke upar trade kare. Yeh signal provide karta hai ke bullish momentum continue ho sakta hai.

3. **Stop-Loss Aur Take-Profit:** Trading risk ko manage karne ke liye stop-loss orders ko set karein, jo pattern ke low ke thoda niche placed honi chahiye. Take-profit orders ko previous resistance levels ke around set karna behtar hota hai.

**Conclusion:**

Bullish Meeting Line ek valuable candlestick pattern hai jo bullish trends ko identify karne mein madad karta hai. Is pattern ko samajhkar aur market conditions ke sath align karke, aap effective trading decisions le sakte hain. Yeh pattern aapko potential buying opportunities aur market reversals ko accurately spot karne mein madadgar sabit ho sakta hai.

-

#10 Collapse

Bullish Meeting Line candlestick pattern ek bullish reversal pattern hai jo typically downtrend ke baad chart par nazar aata hai. Iska matlab yeh hai ke market mein price girne ka silsila khatam ho sakta hai aur bullish (upar ki taraf) movement shuru ho sakti hai.

Bullish Meeting Line Pattern tab banta hai jab:- Pehla candle bearish ho (price neeche gaya ho).

- Dusra candle bullish ho (price upar gaya ho), aur is candle ka closing price pehle candle ke closing price ke barabar ho ya uske kareeb ho.

Is pattern ka interpretation yeh hota hai ke bearish trend mein selling pressure kam ho raha hai aur buyers market mein wapas aa rahe hain, jisse market ka trend reverse ho sakta hai.

Trading mein madad kaise karta hai:- Trend Reversal Signal: Bullish Meeting Line pattern ek indication hota hai ke downtrend khatam ho raha hai aur uptrend shuru ho sakta hai.

- Entry Point: Jab yeh pattern confirm hota hai, traders isse apna entry point bana kar long position le sakte hain.

- Stop Loss: Is pattern ke low ke neeche stop-loss lagakar apne risk ko control kar sakte hain.

Is pattern ke sath risk management aur doosre indicators ka istemal karna zaroori hota hai, kyunki koi bhi pattern 100% accurate nahi hota.

Bullish Meeting Line pattern ke mazeed tafseelat aur samajhne ke liye kuch aham points ko dekhte hain:

1. Pattern Ki Banawat (Structure)- Pehla Candle (Bearish Candle): Yeh candle ek downtrend ke dauran banta hai, jisme opening price high hota hai aur closing price low hota hai. Iska matlab yeh hota hai ke sellers dominate kar rahe hain.

- Dusra Candle (Bullish Candle): Iske baad dusra candle bullish hota hai, jisme price neeche se khulta hai, magar buying pressure ke vajah se price upar band hota hai. Is candle ka closing price almost pehle candle ke closing price ke barabar hota hai.

2. Market Psychology- Sellers Exhaustion: Pehle bearish candle ke baad, market mein selling pressure apne peak par hota hai, lekin dusre candle mein buyers aggressive ho jate hain aur price ko pehle candle ke close tak wapas le aate hain. Yeh indication hota hai ke market mein selling ka pressure kam ho gaya hai aur buyers market control kar rahe hain.

- Indecision to Reversal: Yeh pattern batata hai ke market mein pehle indecision tha, lekin ab reversal ki taraf signal aa raha hai.

3. Confirmation- Third Candle: Bullish Meeting Line ke baad agar teesra candle bhi bullish hota hai to yeh confirmation hoti hai ke reversal shuru ho chuka hai.

- Volume Analysis: Volume ko bhi dekhna zaroori hota hai. Agar bullish candle mein volume zyada ho, to yeh pattern zyada strong mana jata hai.

4. Risk Management- Stop Loss: Yeh pattern trading mein entry point ke tor par to acha signal de sakta hai, magar risk management ke liye stop loss lagana zaroori hota hai. Stop loss ko typically pehle bearish candle ke neeche lagaya jata hai.

- Position Sizing: Sahi position size ka istemal karna chahiye taki risk ko control kiya ja sake. Har trade mein apne capital ka sirf chhota hissa risk karna chahiye.

5. Pattern Strengthening Factors- Agar Bullish Meeting Line ek major support level ke qareeb banta hai, to iska signal zyada reliable hota hai.

- Dusre technical indicators jaise ke RSI (Relative Strength Index), Moving Averages, aur MACD ke sath is pattern ka istimaal karna isko aur zyada strong signal banata hai.

6. Limitations- False Signals: Jaise doosre technical patterns mein hota hai, Bullish Meeting Line bhi kabhi kabhi false signal de sakta hai, jab market ke overall trend ya macroeconomic conditions iske khilaaf hon.

- Time Frame: Yeh pattern har time frame mein kaam nahi karta. Higher time frames (1-hour, 4-hour, daily) par iski reliability zyada hoti hai, jabke lower time frames mein chhoti movements ke vajah se yeh false signals de sakta hai.

Agar aap is pattern ka istemal karte hain to dusre confirmation signals ka zaroor khayal rakhein aur apni trading strategy ko test karne ke liye backtesting ya demo trading ka istemal kar sakte hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

Bullish Meeting Line Kya Hai?

Bullish meeting line aik bullish candlestick pattern hota hai jo do dinon par mushtamil hota hai. Is pattern ka zikar zyada tar technical analysis mein hota hai aur ye is baat ki nishani hoti hai ke market mein bullish reversal hone wala hai. Iska matlab yeh hota hai ke pehle din mein bearish momentum hota hai, lekin doosre din mein market bullish territory mein chala jata hai.

Pehle Din ka Analysis

Pehle din mein, market mein bearish trend dekha jata hai, jisme price girta hai aur ek bearish candle banti hai. Yeh candle iss baat ka indication hota hai ke sellers zyada powerful hain aur demand se zyada supply hai. Yeh selling pressure investors ko yeh sochne par majboor karta hai ke market ka downtrend jaari rahega.

Doosre Din ka Reversal

Doosre din mein, market mein ek reversal hota hai aur bullish candle banti hai. Yeh bullish candle pehle din ke closing price ke barabar ya thodi si us se upar close hoti hai, lekin yeh previous day ke low se upar khulti hai. Is se yeh pata chalta hai ke buyers ne market ko control mein le liya hai aur market ab reversal ke liye tayar hai.

Key Characteristics- Pehle Din ka Bearish Candle: Is pattern mein pehla din bearish hota hai, jisme ek lambi bearish candle banti hai.

- Doosre Din ka Bullish Candle: Doosre din mein ek bullish candle banti hai jo pehle din ki closing price ke aas paas close hoti hai.

- Psychology of Market: Is pattern mein market ke psychology ko samajhna zaroori hota hai. Jab bearish trend ke baad ek bullish candle ban rahi hoti hai, toh iska matlab yeh hota hai ke market mein buyers wapas aa gaye hain aur demand mein izafa ho gaya hai.

Bullish meeting line ka trading mein bohot ahm kirdar hai, khas tor par jab investors trend reversal ki talash mein hote hain. Is pattern ka faida uthate hue, traders is waqt market mein buy karte hain jab price bullish territory mein jane ke indications deti hai. Yaani, jab doosre din ki bullish candle close hoti hai toh yeh waqt hota hai buy ka signal lena ka.

Stop Loss aur Take Profit Levels

Bullish meeting line ke saath trading mein stop loss aur take profit levels set karna bohot ahm hota hai. Stop loss ko pehle din ke low ke neeche set karna chahiye, takay agar market wapas bearish ho jaye, toh apka loss limited rahe. Take profit ko aap recent highs par set kar sakte hain ya phir kisi support/resistance zone ke aas paas.

Is Pattern Ki Kamiyaan

Har technical indicator ki tarah, bullish meeting line bhi 100% accurate nahi hota. Kabhi kabhi yeh pattern fail ho sakta hai, aur market wapas bearish zone mein chali jati hai. Is liye zaroori hai ke is pattern ko doosre indicators ke saath mila kar use kiya jaye jaise ke Relative Strength Index (RSI) ya Moving Averages. Agar yeh doosre indicators bhi bullish indications de rahe hoon, toh bullish meeting line ka signal aur zyada strong ban jata hai.

Conclusion

Bullish meeting line aik ahm candlestick pattern hai jo market ke reversal ke waqt dikhayi deta hai. Is pattern ka sahi tareeqa se use karke, traders bohot faida utha sakte hain, lekin zaroori hai ke isko doosre indicators ke saath confirm kiya jaye. Har trade ke liye risk management ka khayal rakhna aur sahi stop loss levels set karna trader ko losses se bacha sakta hai.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:18 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим