Bullish meeting line:

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

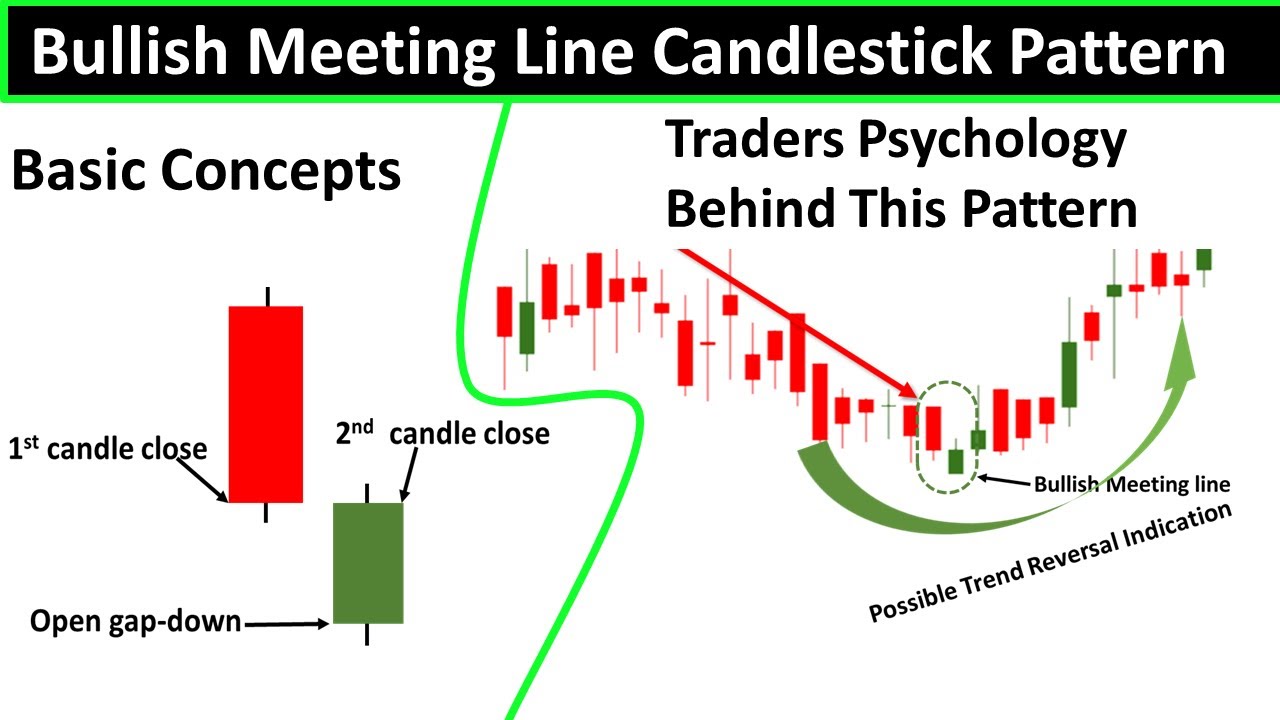

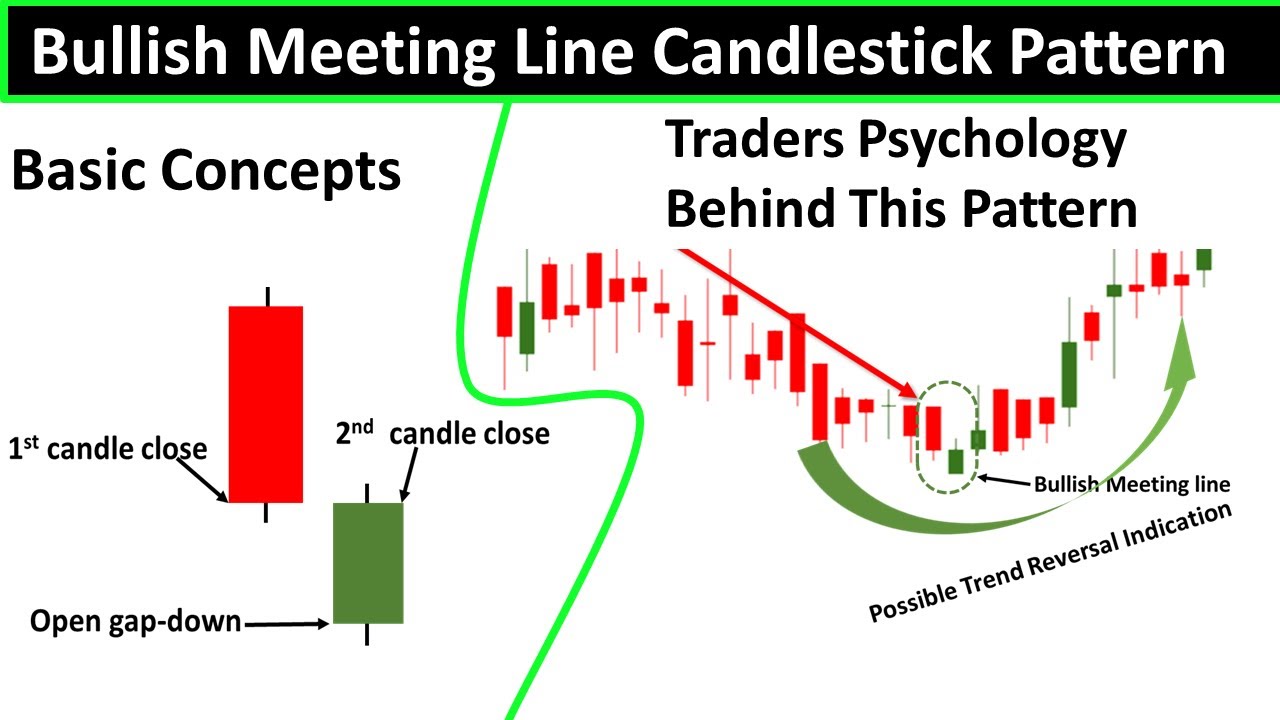

Bullish meeting line:Introduction Ksy ho forex ky members umeed h SB thek hon gy aj hum apko ik aham topic ky bars Mai kuch btaye gy ky bullish meeting line Kiya h yh bhot hi important topic h Jo ap ky liyh bhot zarori h yh bhot hi aham h is ko ager ap learn aur read kryn gy to ap ky knowledge Mai izaafa hoga What is a bull rally? Convergence chart candlestick pattern pattern black cloud cover ki tarah aik bullish trend reversal pattern hai jiss main candle aik apne se pehle din kiunder the candlecounter attack pattern saha jata hai. The bottom of the price, banta hai, air k two days shem par mushtamil hota hai. An exampleki pehli sham aik you are real wali bear sun hoti hai, yes k main price bear trend ki akasi karti hai, jab k dosre din ki sham aik you are real Wali bull choti hai, air k pehli candle, under the main gap open ho kar ussi k close close hoti hai.Bull meeting the pattern of the main sellers of the market ki price k low k itek karne k baad uss ki dilchaspi hatam hone k baad bazar main bazar banta hai. Yes The basic pattern is the same "Line-Hold Pattern", but it is closer to a par wick or a small shadow. same house ki waja se usshtalif hota hai. Pola sham mushtamil hota hai, jiss main pehli sham aik ayy sham hoti hai. An exampleki dosri shem aik bear trend wali shem hoti hai, yes pehli shem k down open open snow ussi k close point close hoti hai. Smart candle model The closing point is the same but the warning type is different.

-

#3 Collapse

Assalamu Alaikum Dosto!Bullish Meeting Line PatternBullish meeting line pattern main aik bullish candle bearish trend ki akhari candle par lower side se attack karke market main bearish trend ka khatma karti hai. Ye pattern two days candles par mushtamil hota hai, jiss main pehli candle aik long real body wali bearish candle hoti hai, jo k qeematon ko downward push karti hai. Pattern ki dosri candle aik bullish candle hoti hai, jo k open pehli candle se below gap main hoti hai, lekin close pehli candle k closing point par hoti hai. Yanni pehli aur dosri candles k closing prices same point par melte ya meeting karte hen. Bullish meeting line pattern ka opposite side ya bottom price par bearish meeting line pattern banta hai, jo k bearish trend reversal pattern hai.Candles FormationBullish meeting line pattern main prices bearish trend k khatme par aik strong bullish attack hoti hai. Jiss se bearish trend bullish main badal jata hai. Ye pattern bearish aur bullish candles par mushtamil hota hai, jiss ki formation darjazel tarah se hoti hai;- First Candle: Bullish meeting line candlestick pattern main pehli candle aik bearish candle hoti hai, ye candle price k downtrend ko show kar rahi hoti hai, jo k black ya red color ki candle hoti hai. Ye candle aik strong real body main banti hai, yanni candle ki real body shadow se ziada hoti hai.

- Second Candle: Bullish meeting line pattern ki dosri candle aik bullish candle hoti hai, jo k open to pehli candle k bottom par gap main hoti hai lekin close pehli candle k close price par hoti hai. Ye candle color main white ya green hoti hai, jo k bearish trend ka khatma karti hai.

Explaination Bullish meeting line pattern two days candles ka aik bullish trend reversal pattern hai, jo k "Separating Line Pattern" se mushabehat rakhta hai. Ye pattern prices k bottom par ban kar same bullish trend reversal pattern ki tarah prices k bearish trend k khatme ka bahis banta hai. Pattern ki pehli candle aik strong bearish candle hoti hai, jiss ko aik bullish candle follow karti hai. Bullish candle bearish candle k bottom par gap main open ho kar ussi k close point par close hoti hai. Second candle ki closing point pehli candle k closing point se upper nahi hona chaheye. Ye pattern piercing line pattern ka bhi hum shakal hai. TradingBullish meeting line pattern buyers ki achanak market main pressure ki waja se banti hai, jiss main market main sellers ki dabao ka khatma karke prices k bottom ko bullish trend main badal deti hai. Bullish meeting line pattern par trading se pehle aik confirmation black candle ka hona zarori hai, jo k dosri candle k baad real body main honi chaheye, jiss par buyers market main buy ki entry kar sakte hen. Aggar pattern k baad black candle banti hai to pattern ki reliability khatam ho jati hai. Stop Loss k leye pattern ka sab se bottom position muntakhib karen, jo k dosri candle ka low banega, se two pips below select karen. -

#4 Collapse

Bullish Meeting Line pattern:

"Bullish Meeting Lines" ek candlestick pattern hai jo stocks, forex aur dusre financial instruments ki technical analysis mein istemal hota hai. Ye ek bullish reversal pattern hai jo downtrend ke dauran dikhta hai aur trend ki potential reversal ki signal deta hai. Pattern do candles se bana hota hai: pehli candle ek black candlestick hoti hai jo lambi line ki tarah dikhti hai, aur dusri candle ek white candlestick hoti hai jo bhi lambi line ki tarah dikhti hai. Dusri candle ki closing price pehli candle ki closing price ke barabar hoti hai. Pattern ko aage ke candles par confirm kiya jana chahiye. Traders is pattern ko aksar long positions ko consider karne ya short positions se exit karne ki signal samajhte hain.

How to Trade with Bullish Meeting Line:

Bullish meeting line pattern ke sath trading karne ke liye aap ye steps follow kar sakte hain:

1. Identify the bullish meeting line pattern:

Is pattern ko pehchanne ke liye aapko do consecutive candlesticks ki zarurat hogi. Pehla candlestick bearish hona chahiye aur dusra candlestick uski body ke andar open karna chahiye aur higher close karna chahiye.

2. Confirm the pattern:

Ek baar pattern ko pehchan liya hai, usse confirm karne ke liye aapko dusri technical indicators aur price action ka istemal karna hoga. Isse aapko pattern ke validity aur market conditions ka pata chalega.

3. Entry point:

Jab aap pattern ko confirm kar lete hain, tab aap entry point decide kar sakte hain. Aap entry point ke liye limit order ya market order ka istemal kar sakte hain.

4. Set stop loss:

Stop loss order lagana bahut zaroori hai, taaki aap apne losses ko control kar sake. Aap stop loss level ko pattern ke low ya support level ke paas rakh sakte hain.

5. Take profit target:

Take profit level ko set karna bhi important hai. Aap previous highs, resistance levels ya Fibonacci retracement levels ka istemal kar sakte hain.

6. Risk management:

Hamesha risk management ka dhyan rakhe. Apne trades ke liye risk-reward ratio ko calculate kare aur apne trading plan ke hisab se position size decide kare. Yeh steps aapko bullish meeting line pattern ke sath trading karne mein madad karenge. Lekin yaad rakhe ki market mein koi guarantee nahi hoti hai aur hamesha apne risk tolerance ke hisab se trade kare. -

#5 Collapse

FOREX ME BULLISH MEETING LINE:-"Bullish Meeting Line" ek candlestick pattern hai jo technical analysis mein istemal hota hai, especially stock market aur financial markets mein price trends ke prediction ke liye. Ye pattern market mein uptrend ya bullish reversal signal provide karta hai.FOREX ME BULLISH MEETING LINE CHARACTERISTICS:- Bullish Meeting Line pattern tab hota hai jab do consecutive candlesticks ek uptrend ke beech mein aate hain. Yahan par is pattern ki characteristics hain: Pehla candlestick: Pehla candlestick ek downtrend ya bearish trend ke dauran hota hai. Is candlestick ki closing price kam hoti hai. Dusra candlestick: Dusra candlestick, pehle candlestick ke neeche open hoti hai aur fir upar ki taraf move karti hai. Is candlestick ki closing price pehle candlestick ki opening price ke near ya usse upar hoti hai. Is pattern ka matlab hota hai ki market mein sellers initially control me the, lekin phir buyers ne control ko wapas hasil kiya aur price ko upar le gaye. Ye bullish reversal signal ho sakta hai aur traders isse market mein buying opportunities ki khoj karte hain. Yad rahe ki kisi bhi technical analysis pattern ko istemal karte waqt, dusre indicators aur factors ka bhi dhyan rakha jana chahiye, aur risk management ko bhi samjhna zaroori hai, taaki trading decisions sahi ho sakein.Yeh patterns sirf ek hissa hote hain aur market analysis ke liye kai aur patterns bhi hote hain. In patterns ko sahi tarah se samjhna aur interpret karna, market conditions, trend direction, aur doosre factors par depend karta hai. Technical analysis ko seekhne ke liye, aap ek acche training program ya books ka sahara le sakte hain aur practice ke liye demo trading accounts ka istemal kar sakte hain. -

#6 Collapse

Bullish meeting Line design: "Bullish meeting Lines" ek candle design hai jo stocks, forex aur dusre monetary instruments ki specialized investigation mein istemal hota hai. Ye ek bullish inversion design hai jo downtrend ke dauran dikhta hai aur pattern ki potential inversion ki signal deta hai. Design do candles se bana hota hai: pehli light ek dark candle hoti hai jo lambi line ki tarah dikhti hai, aur dusri candle ek white candle hoti hai jo bhi lambi line ki tarah dikhti hai. Dusri light ki shutting cost pehli flame ki shutting cost ke barabar hoti hai.Design ko aage ke candles standard affirm kiya jana chahiye. Dealers is design ko aksar long positions ko consider karne ya short positions se exit karne ki signal samajhte hain. Step by step instructions to Exchange with Bullish meeting Line: Bullish meeting line design ke sath exchanging karne ke liye aap ye steps follow kar sakte hain: 1. Distinguish the bullish meeting line design: Is design ko pehchanne ke liye aapko do successive candles ki zarurat hogi. Pehla candle negative hona chahiye aur dusra candle uski body ke andar open karna chahiye aur higher close karna chahiye. 2. Affirm the example: Ek baar design ko pehchan liya hai, usse affirm karne ke liye aapko dusri specialized pointers aur cost activity ka istemal karna hoga. Isse aapko design ke legitimacy aur economic situations ka pata chalega. 3. Passage point: Hit aap design ko affirm kar lete hain, tab aap section point choose kar sakte hain. Aap section point ke liye limit request ya market request ka istemal kar sakte hain. 4. Set stop misfortune: Stop misfortune request lagana bahut zaroori hai, taaki aap apne misfortunes ko control kar purpose. Aap stop misfortune level ko design ke low ya support level ke paas rakh sakte hain. 5 . Take benefit target: Take benefit level ko set karna bhi significant hai. Aap past highs, opposition levels ya Fibonacci retracement levels ka istemal kar sakte hain. 6. Risk the executives: Hamesha risk the executives ka dhyan rakhe. Apne exchanges ke liye risk-reward proportion ko compute kare aur apne exchanging plan ke hisab se position size choose kare. Yeh steps aapko bullish meeting line design ke sath exchanging karne mein madad karenge. Lekin yaad rakhe ki market mein koi ensure nahi hoti hai aur hamesha apne risk resistance ke hisab se exchange kare. -

#7 Collapse

Bullish Meeting Line Candlestick Pattern ka Introduction Bullish Meeting Line candlestick pattern traders ke liye ek ahem tool hai jo bullish reversal ko pehchanne mein madadgar hota hai. Is pattern ki madad se aap market mein hone wale changes ko samajh sakte hain aur sahi trading decisions le sakte hain.Candlestick charts tijarti analysis mein ek ahem hissa hain jo traders ko market ke future price movements ka andaza lagane mein madadgar hotay hain. Bullish Meeting Line candlestick pattern, yaani "Bullish Milti Line" candlestick pattern, ek aham pattern hai jo traders ki tijarti analysis mein istemal hota hai. Is article mein hum Bullish Meeting Line pattern ko tafsili taur par samjhenge aur dekheinge ke yeh pattern traders ko market ke mukhtalif situations mein kaise madadgar hota hai. Bullish Meeting Line Pattern Ki Pechan Bullish Meeting Line pattern ek bullish reversal pattern hai, jo market mein bearish move ke baad aata hai. Is pattern ki pehchan karne ke liye, aapko do consecutive candlesticks ki formation par tawajjo deni hoti hai. Pehli candlestick bearish hoti hai, yaani iski closing price lower hoti hai. Lekin doosri candlestick bullish hoti hai, yaani iski closing price higher hoti hai. Doosri candlestick ka open price typically pehli candlestick ke close price ke qareeb hota hai. Yeh pattern bullish reversal ko indicate karti hai. Bullish Meeting Line Pattern Ka Tafsili Ta'aruf Bullish Meeting Line pattern ka tafsili ta'aruf karne ke liye, samajhna hoga ke yeh pattern kyun bullish reversal signal provide karta hai. Jab market mein Bullish Meeting Line pattern form hoti hai, to yeh darust karta hai ke pehle bearish trend tha lekin ab market mein bullish trend shuru hone ki sambhavna hai. Pehli candlestick bearish trend ki indication hoti hai, lekin doosri candlestick mein buyers ne control hasil kiya aur price ko upar le gaye, jo bullish move ko darust karti hai. Is pattern ka istemal karke traders market ke reversal points ko pehchan kar long positions le sakte hain. Trading Mein Bullish Meeting Line Pattern Ka Istemal Bullish Meeting Line pattern traders ke liye ahem hota hai kyunki iski madad se woh market mein hone wale bullish reversal ko pehchan sakte hain. Jab aap Bullish Meeting Line pattern dekhte hain, to iska matlab hota hai ke aapko long position ya buy karne ka mauka mil sakta hai. Lekin yaad rahe ke ek single pattern par pura bharosa na karen aur dusre technical indicators aur market analysis ka bhi istemal karen trading decision lene se pehle. Lekin tijarti trading hamesha risk ke saath aati hai, isliye risk management ka bhi khayal rakhna zaroori hai. Agar aap is pattern ko sahi tarah se samajh lete hain aur use karte hain, to yeh aapko tijarti mukhlif situations mein faida pohuncha sakta hai. -

#8 Collapse

Introduce of Bullish Meeting Line Pattern Aoa Ummid karta hon Ap Sab khariat Say Hon gy AJ Bullishes Meeting line PATTERN main aik bullish candle bearish trend ki akhari candle par lower side se attack karke market main bearish trend ka khatma karti hai. Ye pattern two days candles par mushtamil hota hai, jiss main pehli candle aik long real body wali bearish candle hoti hai, jo k qeematon ko downward push karti hai. Pattern ki dosri candle aik bullish candle hoti hai, jo k open pehli candle se bellows gap main hoti hai, lekin closed pehli candles k closing point par hoti hai. Yanni pehli aur dosri candles k closing prices same point par melte ya meeting karte hen. BULLISHNESS meeting line pattern ka opposite side ya bottom price par TRADING ho Jay gii The Explanation of Bullesh Meeting Line Pattern Dear Jab bh Bullish Meeting line pattern main prices bearish trend k khatme par aik strong bullish attacks hoti hai. Jiss se BEARISH trend bullish main badal jata hai. Ye pattern bearish aur bullish CANDLES par mushtamil hota hai, Ess First Candle say Bullish meeting line candlestick patterns main pehli candle aik bearish candle hoti hai, ye candle price k downtrend ko show kar rahi hoti hai, jo k black ya red color ki candle hoti hai. Aor trading Stradgy follow karein gy Trading Stradgy Dear Jab bh Bullishes Meeting line pattern two days candles ka aik bullish trend reversal PATTERN hai, jo k "Separating Line Pattern" se mushabehat rakhta hai. Ye pattern prices k bottom par ban kar same bullish trend reversal pattern ki tarah prices k bearish trend k khatme ka bahis banta hai. Pattern ki pehli candle aik strong bearish candle hoti hai, jiss ko aik bullish candle follow karti hai. Bullish candle bearish candle k bottom par gap main open ho kar ussi k close point par close hoti hai. Second candle ki closing point pehli candle k closings point se Bullishness Meeting line pattern buyers ki achanak market main pressure ki waja se banti hai, jiss main market main sellers ki dabao ka khatma karke prices k bottom ko Bullishness trend main badal deti hai. Bullish Meeting line pattern par trading se pehle aik confirmation black candle ka hona zarori hai, jo k dosri candle k baad real body main honi chaheye, jiss par buyers market main buying ki entry kar sakte hen. Aggar pattern k baad black candle banti hai to pattern ki reliability khatam ho jati hai. Stop Loss k leye PATTERN ka sab se bottom position muntakhib karen, jo k dosri candle ka lowered banega, se two pips take profit used karein gy Tu Hi Better Profit Gain ho gy -

#9 Collapse

Asalam o Alikum Dear forex members Introduction: Dear friends Umeed Krta Hun Kah ap Sub Khariyat Sy Hun Gy aj hum apko ik aham topic ky bars Mai kuch btaye gy ky bullish meeting line Kiya h yh bhot hi important topic h Jo ap ky liyh bhot zarori h yh bhot hi aham h is ko ager ap learn aur read kryn gy to ap ky knowledge Mai izaafa Hoga Bull Ray: Dear friends Convergence chart candlestick pattern pattern black cloud cover ki tarah aik bullish trend reversal pattern hai jiss main candle aik apne se pehle din ki under the candle counter attack pattern saha jata hai The bottom of the price banta hai air k two days shem par mushtamil hota hai An example ki pehli sham aik you are real wali bear sun hoti hai yes k main price bear trend ki akasi karti hai jab k dosre din ki sham aik you are real Wali bull choti hai air k pehli candle under the main gap open ho kar ussi k close close hoti HaiDear friends Bull meeting the pattern of the main sellers of the market ki price k low k itek karne k baad uss ki dilchaspi hatam hone k baad bazar main bazar banta hai Yes The basic pattern is the same Line Hold Pattern but it is closer to a par wick or a small shadow same house ki waja se usshtalif hota hai Pola sham mushtamil hota hai jiss main pehli sham aik ayy sham hoti hai An exampleki dosri shem aik bear trend wali shem hoti hai yes pehli shem k down open open snow ussi k close point close hoti hai Smart candle model The closing point is the same but the warning type is different

-

#10 Collapse

Introduction:Dear friends umeed hay k AP sab thk hon gay.aj Jo AP nay post share ki hy wo bhot he eham hay aor bullish meeting lines k bary main mazeed main AP say kuch maloomat share kroon ga .umeed hy apko phar k is say bhot faida ho ga.Definition:Bullish meeting lines do candle stick bullish reversal pattern hain jo neechay ke rujhan mein hoti hain aur rujhan ke ulat jane ka ishara deti hain. Bullish meeting lines ki pehli candle bearish hai, aur is ke baad aik musbat candle aati hai jo pichli candle ke bilkul qareeb band ho jati hai .About the bullish meeting lines in market:candle stick pattern qeemat ke adaad o shumaar ki numaindagi karte hain, jis ka matlab hai ke woh hamein market ke baray mein aur is ki muntaqili ke baray mein thora sa batatay hain. aur candle stuck ke namonon ka tajzia karne se, hamein yeh samajhney ka mauqa milta hai ke market kyun harkat mein aayi .bilashuba, market ki harkat ke peechay sahih wajohaat janna namumkin hai. bahar haal, qeemat ki karwai ko dekhna hamesha aik achi mashq hai. waqt ke sath sath aap baar baar anay walay namonon ko note karna shuru kar den ge jo bohat achi terhan se tijarti hikmat amlyon mein tabdeel ho satke hain. dar haqeeqat, hum khud aksar naye tijarti aayidyaz haasil karne ke liye market action dekhte hain !yeh kehnay ke baad, aayiyae dekhte hain ke taizi se meeting lines hamein market ke baray mein kya bta sakti hain .chunkay market mandi ke rujhan se aati hai, ziyada tar market ke shurka manfi nuqta nazar rakhtay hain. khayaal kya jata hai ke qeematein girty rahen gi, jis se farokht ke dabao mein izafah hota hai jo market ko neechay ki taraf dhkilta hai, jis se taizi ki meeting linon ki pehli mom batii banti hai .market ke manfi jazbaat aglay trading session ke aaghaz tak phail jatay hain, aur market ko aik ahem manfi farq ko injaam dainay par majboor karta hai. farq ko dekhte hue, yeh wazeh hai ke reechh ab bhi control mein hain aur market par ghalba jari rakhen ge .Uses of bullish meeting lines:taham, jaisa ke market taizi aur taizi se neechay chala gaya hai, kuch kharidaron ko lagta hai ke yeh bohat neechay chala gaya hai aur dobarah oopar aajay ga. is ke baad, kharidari ka dabao barh jata hai aur mom batii nah sirf khalaa ko band karti hai balkay pichli baar ke qareeb qareeb tak rehti hai .yeh haqeeqat ke pichlle session ke nuqsanaat ko poora karne ke liye bail kaafi mazboot thay, market mein umeed peda karta hai. jald hi mazeed tajir aur sarmaya car is ki pairwi karen ge aur rujhan ko dobarah tabdeel karen ge !rsi ka istemaal - rsi aik dogli momentum indicator hai jo 0 aur 100 ke darmiyan reading ko out pitt karta hai. riwayati tashreeh yeh hai ke 30 se ​​nichy reading ziyada farokht honay wali market ka ishara deti hai. rsi ke liye hamari mukammal guide isharay ko ziyada geherai mein shaamil karti hai . bindz boulanger ke sath - boulanger bindz, mukhtsiran, do linen hain jo harkat Pazeer ost ke dono taraf se do mayaari anhrafat ko daur karti hain. agar market nichale bowling baind se agay jati hai to usay riwayati tor par over sealed samjha jata hai. yahan aap boulanger baind ke baray mein mazeed parh satke hainExample of bullish meeting lines:pehlay din neechay ki qeemat ke rujhan mein aik lambi siyah mom batii hai. is ke baad aik lambi safaid mom batii hai jis ki qeemat aik hi qeemat par ya is ke qareeb do mom btyon ke darmiyan band hoti hai. is taizi se meeting lines candle ka break out neechay ki taraf hai, neechay ki taraf bunyadi rujhan mein shaamil ho raha hai . -

#11 Collapse

Bullish meeting line pattern main aik bullish candle bearish trend ki akhari candle par lower side se attack karke market main bearish trend ka khatma karti hai. Ye pattern two days candles par mushtamil hota hai, jiss main pehli candle aik long real body wali bearish candle hoti hai, jo k qeematon ko downward push karti hai. Pattern ki dosri candle aik bullish candle hoti hai, jo k open pehli candle se below gap main hoti hai, lekin close pehli candle k closing point par hoti hai. Yanni pehli aur dosri candles k closing prices same point par melte ya meeting karte hen. Bullish meeting line pattern ka opposite side ya bottom price par bearish meeting line pattern banta hai, jo k bearish trend reversal pattern hai.Bullish Meeting Line Pattern Ka Tafsili Ta'aruf Stop loss order lagana bahut zaroori hai, taaki aap apne losses ko control kar sake. Aap stop loss level ko pattern ke low ya support level ke paas rakh sakte hain.design ko pehchanne ke liye aapko do successive candles ki zarurat hogi. Pehla candle negative hona chahiye aur dusra candle uski body ke andar open karna chahiye aur higher close karna chahiye. 2. Affirm the example: Ek baar design ko pehchan liya hai, usse affirm karne ke liye aapko dusri specialized pointers aur cost activity ka istemal karna hoga. Isse aapko design ke legitimacy aur economic situations ka pata chalega. 3. Passage point: Hit aap design ko affirm kar lete hain, tab aap section point choose kar sakte hain. Aap section point ke liye limit request ya market request ka istemal kar sakte hain. 4. Set stop misfortune: Stop misfortune request lagana bahut zaroori hai, taaki aap apne misfortunes ko control kar purpose. Aap stop misfortune level ko design ke low ya support level ke paas rakh sakte hain. 5 . Take benefit target: Take benefit level ko set karna bhi significant hai. Aap past highs, opposition levels ya Fibonacci retracement levels ka istemal kar sakte hain. 6. Risk the executives: Hamesha risk the executives ka dhyan rakhe. Apne exchanges ke liye risk-reward proportion ko compute kare aur apne exchanging plan ke hisab se position size choose kare.

Pehla candlestick: Pehla candlestick ek downtrend ya bearish trend ke dauran hota hai. Is candlestick ki closing price kam hoti hai. Dusra candlestick: Dusra candlestick, pehle candlestick ke neeche open hoti hai aur fir upar ki taraf move karti hai. Is candlestick ki closing price pehle candlestick ki opening price ke near ya usse upar hoti hai. Meeting line pattern two days candles ka aik bullish trend reversal PATTERN hai, jo k "Separating Line Pattern" se mushabehat rakhta hai. Ye pattern prices k bottom par ban kar same bullish trend reversal pattern ki tarah prices k bearish trend k khatme ka bahis banta hai. Pattern ki pehli candle aik strong bearish candle hoti hai, jiss ko aik bullish candle follow karti hai. Bullish candle bearish candle k bottom par gap main open ho kar ussi k close point par close hoti hai. Second candle ki closing point pehli candle k closings point se Bullishness Meeting line pattern buyers ki achanak market main pressure ki waja se banti hai, jiss main market main sellers ki dabao ka khatma karke prices k bottom ko Bullishness trend main badal deti hai. Bullish Meeting line pattern par trading se pehle aik confirmation black candle ka hona zarori hai, jo k dosri candle k baad real body main honi chaheye, jiss par buyers market main buying ki entry kar sakte hen. Aggar pattern k baad black candle banti hai to pattern ki reliability khatam ho jati hai. Stop Loss k leye PATTERN ka sab se bottom position muntakhib karen, jo k dosri candle ka lowered banega, se two pips take profit used karein gy Tu Hi Better Profit Gain ho gy

-

#12 Collapse

Bullish meeting line: "Bullish Meeting Line" ek candlestick pattern hai jo traders aur investors ke liye significant information provide karta hai, specifically market trend reversal ki indication deta hai. Is pattern ki pehchan karna market analysis mein madadgar hota hai.Bullish Meeting Line pattern tab banta hai jab do consecutive candlesticks ek uptrend ke dauran aate hain aur inmein kuch specific conditions meet hoti hain: Pehla Candlestick (Bearish): Pehla candlestick ek downtrend ke baad aata hai aur iski real body (opening aur closing price ke beech ka area) bearish (red ya black) hoti hai. Is candlestick ki closing price lower hoti hai. Dusra Candlestick (Bullish): Dusra candlestick bhi ek downtrend ke baad aata hai, lekin iski real body bullish (green ya white) hoti hai. Is candlestick ki opening price pehle bearish candlestick ki closing price ke bohot kareeb hoti hai aur phir iska closing price pehle candlestick ki real body ke andar hoti hai.Bullish Meeting Line pattern ek reversal pattern hota hai, matlab ke is pattern ke formation ke baad market mein bearish trend ki jagah bullish trend ki sambhavna hoti hai. Yeh pattern traders ko ye signal deta hai ke bearish pressure kam ho rahi hai aur buyers ki strength barh rahi hai.Is pattern ko samajhne ke liye, traders ko market ke overall context aur doosre technical indicators ka bhi istemal karna hota hai. Bullish Meeting Line pattern ke confirmation ke liye, traders often doosre indicators jaise ki volume analysis aur trend lines ka istemal karte hain.Lekin yaad rahe ke kisi bhi candlestick pattern ki tarah, Bullish Meeting Line pattern bhi kabhi-kabhi false signals bhi de sakta hai, isliye risk management aur stop-loss orders ka istemal karna hamesha zaroori hota hai jab aap trading karte hain.

Pehla Candlestick (Bearish): Pehla candlestick ek downtrend ke baad aata hai aur iski real body (opening aur closing price ke beech ka area) bearish (red ya black) hoti hai. Is candlestick ki closing price lower hoti hai. Dusra Candlestick (Bullish): Dusra candlestick bhi ek downtrend ke baad aata hai, lekin iski real body bullish (green ya white) hoti hai. Is candlestick ki opening price pehle bearish candlestick ki closing price ke bohot kareeb hoti hai aur phir iska closing price pehle candlestick ki real body ke andar hoti hai.Bullish Meeting Line pattern ek reversal pattern hota hai, matlab ke is pattern ke formation ke baad market mein bearish trend ki jagah bullish trend ki sambhavna hoti hai. Yeh pattern traders ko ye signal deta hai ke bearish pressure kam ho rahi hai aur buyers ki strength barh rahi hai.Is pattern ko samajhne ke liye, traders ko market ke overall context aur doosre technical indicators ka bhi istemal karna hota hai. Bullish Meeting Line pattern ke confirmation ke liye, traders often doosre indicators jaise ki volume analysis aur trend lines ka istemal karte hain.Lekin yaad rahe ke kisi bhi candlestick pattern ki tarah, Bullish Meeting Line pattern bhi kabhi-kabhi false signals bhi de sakta hai, isliye risk management aur stop-loss orders ka istemal karna hamesha zaroori hota hai jab aap trading karte hain.

-

#13 Collapse

Bullish Meeting Line pattern Aj ham baat kra ga Bullish Meeting Lines.. ek candlestick pattern hai jo stocks, forex aur dusre financial instruments ka taruf asa ha ka technical analysis mein istemal hota hai jee bilkul Ye ek bullish reversal pattern hai jo ka zada tr downtrend ke wqt dakha jata ha aur trend ki potential reversal ki signal deta hai aur aga nzr ana wala Pattern do candles se bana hota hai: pehli candle ek black candlestick hoti hai dosri white jo lambi line ki tarah dikhti hai, aur dusri candle ek choti candlestick hoti hai jo bhi choti line ki tarah dikhti hai. dosri candle ki closing ka paso ki pehli candle ki closing ka paso ke barabar hoti hai ager ap agla Pattern ko aage ke candles par confirm krdiya jana chahiye. Traders is pattern ko aksar labah halat ko consider karne ya short positions se exit karne ki signal samajhte hain jee bilkul asa hi ha Bullish Meeting Line Candlestick Pattern ka Introduction ab ham baat kra ga bulish line ka bara jasa ka Bullish Meeting Line candlestick pattern traders ke liye ek aham auzaar hai jo bullish reversal tk ponchna mein madadgar hota hai. Is pattern ki madad se aap market mein bhot sari hone wale changes ko samajh bhot axah sa smj sakte hain aur sahi trading sikh aur fasla le sakte hain.Candlestick charts tijarti analysis mein ek khas aur zruri hissa hain jo traders ko market ke future price movements ka andaza lagane mein madadgar jee ha bikul asa hi hotay hain. jesa ka Bullish Meeting Line aur candlestick pattern, jesa ka Bullish Milti Line" candlestick pattern, ek aham pattern hai jo traders ki tijarti kaam aur analysis mein istemal hota hai. jasa ka apjanta ha Is article mein hum Bullish Meeting Line pattern ko bhot goor sa taur par samjhenge aur tarteeb aga bi dekheinge ke yeh pattern traders ko aga ki market ke alg alg situations mein kaise madadgar hota hai. ap dakh skka ga aga .. -

#14 Collapse

Introduction of Bullish Meeting Line Pattern Sir, Ess BULLISHES Meeting line PATTERN main aik Bullishness candle bearish trend ki akhari candle par lower side se attack karke market main bearish trend ka khatma karti hai. Ye pattern two days candles par mushtamil hota hai, jiss main pehli candle aik long real body wali bearish candle hoti hai, jo k qeematon ko downward push karti hai. Pattern ki dosri candle aik bullish candle hoti hai, jo k open pehli candle se bellows gap main hoti hai, lekin closed pehli candles k closing point par hoti hai. Yanni pehli aur dosri candles k closing prices same point par melte ya meeting karte hen. BULLISHNESS meeting line pattern ka opposite side ya bottom price par TRADING ho Jay gii aor Bullishness Meeting line pattern main prices bearish trend k khatme par aik strong bullish attacks hoti hai. Jiss se BEARISH trend Bullishness main badal jata hai. Ye pattern bearish aur bullish CANDLES par mushtamil hota hai, Ess First Candle say Bullish meeting line candlestick patterns main pehli candle aik bearish candle hoti hai, ye candle price k downtrend ko show ho Jay Trading Stradgies Sir, Ess Bullishes Meetings line pattern two days candles ka aik bullish trend reversal PATTERN hai, jo k "Separating Line Pattern" se mushabehat rakhta hai. Ye pattern prices k BOTTOM par ban kar same bullish trend reversal pattern ki tarah prices k bearish trend k khatme ka bahis banta hai. Pattern ki pehli candle aik strong bearish candle hoti hai, jiss ko aik bullish candle follow karti hai. Bullish candle bearish candle k bottom par gap main open ho kar ussi k close point par close hoti hai. Second candle ki closing point pehli candle k closings point se Bullishness Meeting line pattern buyers ki achanak market main pressure ki waja se banti hai, jiss main market main sellers ki dabao ka khatma karke prices k bottom ko BULLISHNESS trend main badal deti hai. Bullish Meeting line pattern par trading se pehle aik confirmation black candle ka hona zarori hai, jo k dosri candle k baad real body main honi chaheye, jiss par buyers market main buying ki entry kar sakte hen. Aggar pattern k baad black candle banti hai to pattern ki reliability khatam ho jati hai. Stop Loss k leye PATTERNED ka sab se bottom position muntakhib karen, jo k dosri candles Mein Len gy

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

Bullish meeting line: "Bullish Meeting Line" ek candlestick chart pattern hai jo stock market ya financial markets mein paya jata hai. Ye pattern ek bullish reversal signal provide karta hai, yaani ke ye ishara deta hai ke market mein ek downtrend ke baad ab price mein upar ki orr ki movement hone ki sambhavna hai. Bullish Meeting Line pattern do consecutive (aik ke baad aik) candlesticks se banta hai. Yahan main is pattern ki characteristics in do candlesticks ke hawale se bata raha hoon:- Pehli Candlestick (Bearish): Pehli candlestick ek downtrend ke doran aati hai aur bearish hoti hai, matlab ke iski closing price opening price se kam hoti hai. Is candlestick ko "down candle" bhi kehte hain.

- Dusri Candlestick (Bullish): Dusri candlestick bhi downtrend ke doran aati hai, lekin iski opening price pehli candlestick ki closing price ke qareeb hoti hai. Is candlestick ko "up candle" kehte hain. Dusri candlestick ki closing price pehli candlestick ki closing price se ziada hoti hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:20 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим