Swing High aur Swing Low Pattern

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

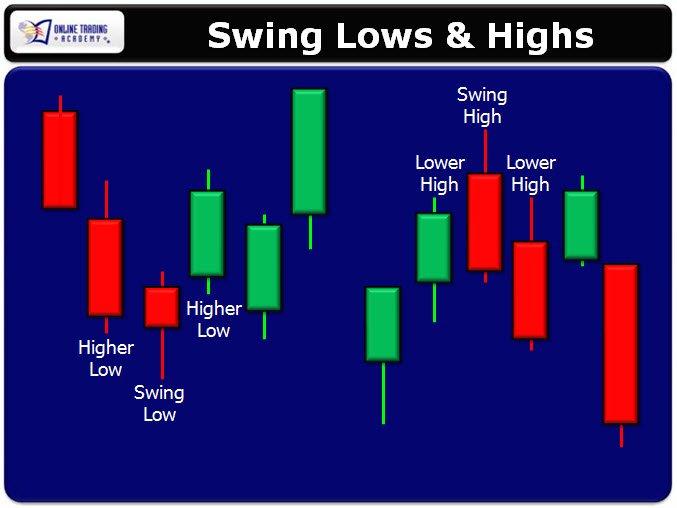

Swing High aur Swing Low Pattern Swing High aur Swing Low Pattern, technical analysis mein istemaal hone wale do aham chart patterns hain. In dono patterns ka istemaal price action ka analysis karne ke liye kiya jata hai. Aaiye in dono patterns ko samajhte hain. Swing High Swing High ka matlab hota hai ki jab kisi security ka price ek peak level tak pahunchta hai, aur phir is peak level se neeche aane lagta hai, to us peak level ko Swing High kehte hain. Yeh ek bearish signal hota hai, yani ki price down jayega. Is pattern ko identify karne ke liye, aapko price chart par pehle se banaye gaye high levels ko dekhna hoga. Jab bhi koi security ek naya high banata hai aur phir price down aane lagta hai, to us naye high ko Swing High kehte hain. Is pattern se aapko pata chalta hai ki price down jayega, aur aapko sell karne ki position leni chahiye. Swing Low Swing Low ka matlab hota hai ki jab kisi security ka price ek bottom level tak pahunchta hai, aur phir is bottom level se upar jata hai, to us bottom level ko Swing Low kehte hain. Yeh ek bullish signal hota hai, yani ki price up jayega. Is pattern ko identify karne ke liye, aapko price chart par pehle se banaye gaye low levels ko dekhna hoga. Jab bhi koi security ek naya low banata hai aur phir price up jata hai, to us naye low ko Swing Low kehte hain. Is pattern se aapko pata chalta hai ki price up jayega, aur aapko buy karne ki position leni chahiye. Conclusion Swing High aur Swing Low patterns ke istemaal se aap price action ka analysis kar sakte hain. In patterns ko identify karne ke liye aapko price chart par high aur low levels ko dekhna hota hai. Isse aapko pata chalta hai ki price up jayega ya down jayega, aur aap apni trading strategy ko uske hisaab se design kar sakte hain. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Swing high aur swing low pattern introduction Swing high aur swing low patterns stock market aur technical analysis mein istemal hotay hain. Yeh patterns price charts par nazar rakhte hain aur traders ko market trends ko samajhne mein madadgar hote hain. Swing High (Uccha) Pattern: Yeh pattern tab hota hai jab ek security ya stock ka price ek specific samay par ek certain level tak pohochta hai aur phir wapas kam ho jata hai. Yani, jab price temporary taur par upar jata hai aur phir neeche aata hai. Swing high points traders ko market mein selling opportunities ka pata chalne mein madadgar hote hain. Swing Low (Neecha) Pattern: Swing low pattern tab hota hai jab ek security ya stock ka price ek specific samay par ek certain level tak gir jata hai aur phir wapas upar uthata hai. Yani, jab price temporary taur par neeche jata hai aur phir upar aata hai. Swing low points traders ko market mein buying opportunities ka pata chalne mein madadgar hote hain. Swing high aur swing low pattern formation Swing high aur swing low patterns technical analysis mein istemal hotay hain aur market ke price movements ko samajhne mein madadgar hotay hain. Yeh patterns traders aur investors ke liye important hote hain kyunki inka istemal price trends ka pata lagane aur trading decisions banane ke liye hota hai. Swing High (Uccha Maang): Jab market mein price ek specific point tak badhti hai aur phir girne lagti hai, tab woh point "Swing High" kehlata hai. Yeh point market ke current trend ka reversal point ho sakta hai. Swing Low (Neechi Maang): Jab market mein price ek specific point tak girne ke baad phir badhti hai, tab woh point "Swing Low" kehlata hai. Yeh bhi ek reversal point ho sakta hai. In patterns ko samajhne ke liye aap price charts ka istemal karte hain, jaise ki candlestick charts ya line charts. Swing high aur swing low points ko identify karne ke baad, traders in points ko support aur resistance levels ke roop mein dekhte hain aur trading strategies banate hain. How to trade Swing high aur swing low pattern Forex market mein Swing high aur Swing low patterns ka istemal trading strategies banane mein kiya jata hai. Yahan kuch steps hain jo aapko in patterns ka istemal karke trading karne mein madadgar ho sakte hain: Swing High aur Swing Low Identifikation: Pehle to aapko market mein Swing Highs aur Swing Lows ko pehchanne ki adat dalni hogi. Swing High market mein aisi point hoti hai jahan price ek upward trend ke baad trend reversal ka indication deti hai, jabki Swing Low ek downward trend ke baad trend reversal ko darust karti hai. Trend Analysis: Ab aapko market ka overall trend samajhna hoga. Agar market mein uptrend hai, to aap Swing Low par buy kar sakte hain, aur agar market mein downtrend hai, to Swing High par sell kar sakte hain. Entry Point Aur Stop Loss: Ek bar aap trend ko identify kar lete hain, to aap entry point aur stop loss set kar sakte hain. Entry point woh point hota hai jahan aap trade karte hain, aur stop loss woh point hota hai jahan aap apni nuksan ko rokne ke liye order lagate hain. Risk aur Reward Ka Vikalp: Har trade ke liye risk aur reward ka vikalp sochna mahatvapurn hai. Aapko yeh decide karna hoga ki aap kitna risk lenge aur kitna profit chahenge. Isse aap apne trade ko manage kar sakte hain. Technical Indicators Ka Istemal: Swing trading mein aap technical indicators jaise ki moving averages, RSI, aur MACD ka istemal karke bhi trade ko confirm kar sakte hain. Practice: Swing trading mein mahir hone ke liye practice ki zaroorat hoti hai. Demo account par trading karna aapko bina risk ke practice karne mein madadgar ho sakta hai. News Aur Events Ka Dhyan: Market mein news aur events ka bhi dhyan rakhna zaroori hai, kyunki yeh trading decisions par asar daal sakte hain. -

#4 Collapse

Introduction Swing High aur Swing Low Pattern, forex trading mein trend reversals ka ek important tool hai. Is article mein hum Swing High aur Swing Low Pattern ke baare mein Roman Urdu mein jaanenge. What is a swing high? Swing High ka matlab hota hai ki price chart pe kisi bhi asset ke price mein ek high point hai, jisme se price down hote hue apna trend reverse karta hai. Yeh high point, ek uptrend ke end ya phir ek downtrend ke reversal point ke taur pe bhi kaam karta hai. What is Swing Low? Swing Low ka matlab hota hai ki price chart pe kisi bhi asset ke price mein ek low point hai, jisme se price up hote hue apna trend reverse karta hai. Yeh low point, ek downtrend ke end ya phir ek uptrend ke reversal point ke taur pe bhi kaam karta hai. Swing High aur Swing Low Pattern Uses Swing High aur Swing Low Pattern ka use karke aap price chart pe trend reversal points ko identify kar sakte hai. Aap market trend ke saath chal sakte hai ya phir market reversals mein apna trade plan bana sakte hai. Agar aap Swing High aur Swing Low Pattern ka use karke trend reversals ko identify karna chahte hai, to aapko price chart pe Swing High aur Swing Low ko mark karna hoga. Ek downtrend ke end pe, Swing Low ki jagah ek Swing High create hota hai aur ek uptrend ke end pe, Swing High ki jagah ek Swing Low create hota hai.Swing High aur Swing Low Pattern ki madad se aap price chart pe trend reversals ko identify kar sakte hai aur apne trading strategy ko bhi improve kar sakte hai. Lekin, yeh pattern sirf ek tool hai aur aapko ek aur technical analysis aur risk management ke saath use karna chahiye. Conclusion Swing High aur Swing Low Pattern forex trading mein trend reversal points ko identify karne ka ek important tool hai. Is pattern ka use karke aap market trends ke saath chal sakte hai aur apne trading strategy ko improve kar sakte hai. Lekin, yeh pattern sirf ek tool hai aur aapko ek aur technical analysis aur risk management ke saath use karna chahiye. -

#5 Collapse

INTRUDUCTION OF SWING HIGH PATTREN: Piyary dosto omeed hy ap sab khariyat sy hoon gy Forex tradings Marketing main Swing High ka matlab hota hai ki jab kisi security ka price ek peak level tak pahunchta hai, aur phir is peak level se neeche aane lagta hai, to us peak level ko Swing High kehte hain. Yeh ek bearish signal hota hai, yani ki price down jayega. Is pattern ko identify karne ke liye, aapko price chart par pehle se banaye gaye high levels ko dekhna hoga. Jab bhi koi security ek naya high banata hai aur phir price down aane lagta hai, to us naye high ko Swing High kehte hain. Is pattern se aapko pata chalta hai ki price down jayega, aur aapko sell karne ki position leni hoti hey our rujhaan ko follow karty hen our CANDL bnaty hei. DETAILS OF SWING LOW PATTREN: Dear friends Forex trading Marketing Mei Swings Lower ka matlb Hei ky jab market Mei rujhaan apny pair ky hisab sey TRENDLINE ko show karty hen our eis ky topic ka matlab hota hai ki jab kisi security ka price ek bottom level tak pahunchta hai, aur phir is bottom level se upar jata hai, to us bottom level ko Swing Low kehte hain. Yeh ek bullish signal hota hai, yani ki price up jayega.Is pattern ko identify karne ke liye, aapko price chart par pehle se banaye gaye low levels ko dekhna hoga. Jab bhi koi security ek naya low banata hai aur phir price up jata hai, to us naye low ko Swing Low kehte hain. Is pattern se aapko pata chalta hai ki price up jayega, aur aapko buy karne ki position leni chahiye.Dear members Swinging high our lowe ka matlb hota Hai jab market Mei rujhaan ka ezafa hota Hai to pair apny CANDL High ki tarh bnaty hei our rujhaan Mei kami sey candle hoty hen High aur Swing Low patterns ke istemaal se aap price action ka analysis kar sakte hain. In patterns ko identify karne ke liye aapko price chart par high aur low levels ko dekhna hota hai. Isse aapko pata chalta hai ki price up jayega ya down jayega, aur aap apni trading strategy ko uske hisaab se design kar sakte hain.Swing High aur Swing Low Pattern, technical analysis mein istemaal hone wale do aham chart patterns hain. In dono patterns ka istemaal price action ka analysis karne ke liye kiya jata hai. Aaiye in dono patterns ko samajhte jaty hen our pair ky candle ko follow karty hen.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

SWING HIGH AUR SWING LOW:-Swing High aur Swing Low patterns technical analysis mein istemal hoti hain, aur ye traders ko market ke price trends aur reversals ko samajhne mein madadgar hoti hain. In patterns ki wazahat neeche di gayi hai: Swing High (Uchchamudra): Swing High ek aise price point ko represent karta hai jahan par ek uptrend (market ke price mein izafa) ke baad price reverses aur kam ho jati hai. Is pattern ko usually ek peak ya high point ke roop mein dekha jata hai jahan par traders ne profit book kiya hota hai. Swing High ek resistance level ko darust karta hai, kyonki is point par price ke further izafe ko roka ja sakta hai. Swing Low (Nimnamudra): Swing Low ek aise price point ko represent karta hai jahan par ek downtrend (market ke price mein giraavat) ke baad price reverses aur badhne lagti hai. Is pattern ko ek low point ya valley ke roop mein dekha jata hai jahan par traders ne kharidari ki shuruaat ki hoti hai. Swing Low ek support level ko darust karta hai, kyonki is point par price ke further girne ko roka ja sakta hai. SWING HIGH AUR SWING LOW K COMPONENTS:-Time Frame: Swing High aur Swing Low patterns ko samajhne aur confirm karne ke liye, aapko market ke different time frames par price charts dekhne ki zaroorat hoti hai. Short-term aur long-term time frames par dekhte hue aapko patterns ko identify karna hoga. Confirmatory Indicators: In patterns ko confirm karne aur trading decisions ko validate karne ke liye, aapko dusre technical indicators ka bhi sahara lena chahiye. Aap RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), aur Stochastic Oscillator jaise indicators ka istemal kar sakte hain. Risk Management: Trading decisions lene se pehle hamesha risk management ko yaad rakhein. Stop-loss aur take-profit orders set karein taaki aapko loss se bacha ja sake, aur profits ko secure kiya ja sake. Trend Analysis: Swing High aur Swing Low patterns ko samajhne ke liye, aapko market ke overall trend ko bhi dekhna hoga. Agar market uptrend mein hai, toh Swing Low patterns ko aur downtrend mein hai toh Swing High patterns ko dhyan se dekhein. Practice and Learning: Yeh patterns samajhne aur unka istemal karne mein practice aur learning ka mahatvapurna role hota hai. Demo trading accounts ka istemal karke aap apne skills ko improve kar sakte hain bina real money risk kiye. Historical Data Analysis: Historical price data par ki gayi analysis bhi aapke liye helpful ho sakti hai, kyunki isse aap past patterns ko dekh kar market ke future movements ke baare mein better understanding develop kar sakte hain.

SWING HIGH AUR SWING LOW K COMPONENTS:-Time Frame: Swing High aur Swing Low patterns ko samajhne aur confirm karne ke liye, aapko market ke different time frames par price charts dekhne ki zaroorat hoti hai. Short-term aur long-term time frames par dekhte hue aapko patterns ko identify karna hoga. Confirmatory Indicators: In patterns ko confirm karne aur trading decisions ko validate karne ke liye, aapko dusre technical indicators ka bhi sahara lena chahiye. Aap RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), aur Stochastic Oscillator jaise indicators ka istemal kar sakte hain. Risk Management: Trading decisions lene se pehle hamesha risk management ko yaad rakhein. Stop-loss aur take-profit orders set karein taaki aapko loss se bacha ja sake, aur profits ko secure kiya ja sake. Trend Analysis: Swing High aur Swing Low patterns ko samajhne ke liye, aapko market ke overall trend ko bhi dekhna hoga. Agar market uptrend mein hai, toh Swing Low patterns ko aur downtrend mein hai toh Swing High patterns ko dhyan se dekhein. Practice and Learning: Yeh patterns samajhne aur unka istemal karne mein practice aur learning ka mahatvapurna role hota hai. Demo trading accounts ka istemal karke aap apne skills ko improve kar sakte hain bina real money risk kiye. Historical Data Analysis: Historical price data par ki gayi analysis bhi aapke liye helpful ho sakti hai, kyunki isse aap past patterns ko dekh kar market ke future movements ke baare mein better understanding develop kar sakte hain. -

#7 Collapse

Swing High, trading charts par wo point hota hai jahan par asset ya security ka price ek muddat tak badhta hai aur phir girne lagta hai. Yani ke, jab market mein prices ek uptrend mein hote hain aur phir ek specific point par girte hain, to woh point Swing High kehlaya jata hai. Ye point traders ke liye mahatvapurna hota hai, kyun ke is point par market sentiment aur trend reversal ki pehchan hoti hai. Kaise Swing High Ko Pehchana Jata Hai: Swing High ko pehchana jata hai trading charts par. Iske liye aapko ek candlestick chart ya bar chart ka istemal karna hota hai. Jab market mein price ek uptrend mein hoti hai, to har naye high point par ek Swing High banta hai. Ye point woh highest point hota hai jahan se price girne lagta hai. Swing High ke pehchanne ke liye aapko candlestick patterns aur technical indicators ka istemal kar sakte hain. Jab price ek uptrend mein hoti hai aur phir ek bearish candlestick pattern ya technical indicator ke signals dikhata hai, to woh point Swing High ke tor par consider kiya jata hai. Swing High ka Istemal: Swing High ka istemal traders market mein trend reversal aur entry/exit points ke liye karte hain. Agar market mein uptrend ho raha hai aur ek Swing High point pe price gir rahi hai, to traders isko ek potential trend reversal ka sign samajhte hain. Is point par wo long positions ko close kar sakte hain ya short positions enter kar sakte hain. Swing High ke istemal mein risk management bhi aham hota hai. Traders apne stop-loss orders ko Swing High ke upar set kar sakte hain takay nuksan se bacha ja sake. Swing Low" trading strategy trading mein ek aham aur mufeed tareeqa hai jo ke technical analysis ke zariye istemal hota hai. Ye strategy traders ke liye maqsadmand ho sakti hai jo market mein price reversals ya trend changes ko pesh karne ki koshish kar rahe hain. Is strategy mein "Swing Low" ek specific technical indicator ya pattern ko refer karta hai jo market ke trend reversals ko pehchanne mein madadgar hota hai. "Swing Low" ka matlab hota hai ke market mein ek particular samay par price ek lower point tak gir jata hai aur phir wahan se upar ki taraf move karta hai. Is point ko "Swing Low" kehte hain. Ye indicator market mein bearish trend ke baad bullish trend ko indicate karta hai. "Swing Low" ko pehchane ke liye traders aksar candlestick charts ka istemal karte hain. Ismein traders candlesticks ke patterns aur price levels ko dekhte hain. Agar ek candlestick pattern mein market price ek specific low point tak gir kar wahan se upar ki taraf move karti hai, to isey ek potential "Swing Low" ke taur par consider kiya jata hai. Candlestick Chart: "Swing Low" ko pehchane ke liye aap candlestick charts ka istemal kar sakte hain. Har candlestick ek specific time period ko darust karti hai, jaise ke ek din, ek ghanta, ya ek hafta. Swing Low Point: Jab market price ek specific time period ke andar ek lower point tak gir kar wahan se upar ki taraf move karti hai, to ye point "Swing Low" kehlata hai. Reversal Indicator: "Swing Low" ek reversal indicator hota hai, matlab ke ye bearish trend se bullish trend mein change hone ki indication deta hai. Trading Strategy: Traders "Swing Low" ko apni trading strategy mein shamil karke market ke trend reversals ko pesh kartay hain. Agar market ek "Swing Low" banata hai, to traders long positions lena ya bearish positions ko close karna sochte hain, kyun ke ye ek bullish reversal ka sign ho sakta hai. -

#8 Collapse

EXPLAINATION OF SWING HIGH AND SWING LOWHigh swing Forex trading mein tab aap ko nazar aati hai jab Koi pair ab upward move karta hai to is mein phr continuously wo upar ki taraf move karta rahata hai jis se us ki prices maximum sy maximum hoti rahti Hain is liye aap ko is mein work karne ke liye ye yad rakhna chahie ke Forex trading main aap ko hai swing high aur swing low Forex trading co properly aap is phenomena ko observe karte hue bahut easily trading mein amazing work kar sakte hain jis ke liye aap ko market ko observe karna bahut zaroori hota hai,otherwise market observe Kiya baghir trading mein Kabhi bhi acchi tarah trading nahi h gi,where as ,Low swing Forex trading mein mostly aap ko tab nazar aati hai jab trading mein aap kisi bhi pair ki movement down ward dekhte hain aur phir continuously vote down move karta hai jis se aap trading mein loss ka phenomena dekh sakte hain, trading mein Kam Karne wale members yah baat lazmi jante honge ke yellow showing trading mein bahut acchi profit dene ke liye important hota hai aap market ko property observe kar rahe hain to aap ko trading main is movement se bahut achi entry lekar trading main aap acha profit gain kar sakte hain jis ke liye aap important hai ki trading mein aap hamesha yah baat mind mein rakhenge Forex trading ap ko aisi patterns ko mind mein rakhte hue trade open karne se aap trading mein profit Le sakte hain.TRADING STATERGYSwing high aur swing low patterns technical analysis mein use hotay hain aur market ke price movements kounderstand mein helpful hotay hain. Yeh patterns traders aur investors ke liye important hote hain bcz in ka use price trends ka pata lagane aur trading decisions banane ke liye hota hai.Swing High Jab market mein price aik specific point tak increase hoti ha aur phir deacrease hone lagti hai, tab woh point "Swing High" kehlata hai. Yeh point market ke current trend ka reversal point ho sakta hai.Swing Low Jab market price mein aik specific point tak girne ke baad phir barhti hai, tab woh point "Swing Low" kehlata hai. Yeh bhi aik reversal point ho sakta hai.In patterns ko understnad kar ne ke liye aap price charts ka use karte hain, jaise ki candlestick charts ya line charts. Swing high aur swing low points ko identify karne ke baad, traders in points ko support aur resistance levels ke shape mein dekhte hain aur trading strategies banate hain aur trading karte hain.MORE INFORMATIONSwing High and Swing Low Pattern forex trading mein trend reversal points ko identify karne ka aik important tool hai, Is pattern ka istemal kar ke aap market trends ke saath chal sakte hai aur apne trading strategy ko improve kar sakte hai aur aik successful trader ban sakte hain. but, yeh pattern sirf aik tool hai aur ap ko aik aur technical analysis aur risk management ke saath use karna chahiye take ap ki trading statergy improve ho sake. -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

swing high and low pattern Asalam-o-alikum to all members aaj ma forex trading ky es pattern ky bary mein apko btao ga jis se hum market ko samjh sakty hain . trading mein tab aap ko nazar aati hai jab Koi pair ab upward move karta hai to is mein phr continuously wo upar ki taraf move karta rahata hai jis se us ki prices maximum sy maximum hoti rahti Hain is liye aap ko is mein work karne ke liye ye yad rakhna chahie ke Forex trading main aap ko hai swing high aur swing low Forex trading co properly aap is phenomena ko observe karte hue bahut easily trading mein amazing work kar sakte hain jis ke liye aap ko market ko observe karna bahut zaroori hota hai,otherwise market observe Kiya baghir trading mein Kabhi bhi acchi tarah trading nahi h gi,where as ,Low swing Forex trading mein mostly aap ko tab nazar aati hai jab trading mein aap kisi bhi pair ki movement down ward dekhte hain aur phir continuously vote down move karta hai jis se aap trading mein loss ka phenomena dekh sakte hain. Explaination Pattern forex trading mein trend reversal points ko identify karne ka aik important tool hai, Is pattern ka istemal kar ke aap market trends ke saath chal sakte hai aur apne trading strategy ko improve kar sakte hai aur aik successful trader ban sakte hain. but, yeh pattern sirf aik tool hain . strategy trading mein ek aham aur mufeed tareeqa hai jo ke technical analysis ke zariye istemal hota hai. Ye strategy traders ke liye maqsadmand ho sakti hai jo market mein price reversals ya trend changes ko pesh karne ki koshish kar rahe hain. Is strategy mein "Swing Low" ek specific technical indicator ya pattern ko refer karta hai jo market ke trend reversals ko pehchanne mein madadgar hota hai. Swinging high our lowe ka matlb hota Hai jab market Mei rujhaan ka ezafa hota Hai to pair apny CANDL High ki tarh bnaty hei our rujhaan Mei kami sey candle hoty hen High aur Swing Low patterns ke istemaal se aap price action ka analysis kar sakte hain. In patterns ko identify karne ke liye aapko price chart par high aur low levels ko dekhna hota hai. Isse aapko pata chalta hai ki price up jayega ya down jayega, aur aap apni trading strategy ko uske hisaab se design kar sakte hain.Swing High aur Swing Low Pattern, technical analysis mein istemaal hone wale do aham chart patterns hain. In dono patterns ka istemaal price action ka analysis karne ke liye kiya jata hai. conclusion Marketing main Swing High ka matlab hota hai ki jab kisi security ka price ek peak level tak pahunchta hai, aur phir is peak level se neeche aane lagta hai, to us peak level ko Swing High kehte hain. Yeh ek bearish signal hota hai, yani ki price down jayega. Is pattern ko identify karne ke liye, aapko price chart par pehle se banaye gaye high levels ko dekhna hoga. Jab bhi koi security ek naya high banata hai aur phir price down aane lagta hai, to us naye high ko Swing High kehte hain. Is pattern se aapko pata chalta hai ki price down jayega . price chart par high aur low levels ko dekhna hota hai. Isse aapko pata chalta hai ki price up jayega ya down jayega, aur aap apni trading strategy ko uske hisaab se design kar sakte hain. Thanks -

#10 Collapse

Forex trading mein "Swing High" aur "Swing Low" price ke specific points hote hain jo trend analysis mein istemal hote hain. Inka istemal traders aur investors trend ke reversal aur continuation ko samajhne ke liye karte hain. Chaliye in dono concepts ko Roman Urdu mein tafseelat se samjhein: Main concept: Swing High (Swing Uncha): Swing High ek price point hai jahan price kisi uptrend ke dauran ek temporary peak ya high point tak pohunchti hai aur phir neeche girne lagti hai. Swing High ek potential trend reversal point ko darust karta hai aur yeh bearish (girawat ki taraf) signal hota hai. Is point par traders selling positions enter kar sakte hain ya stop-loss orders lagate hain. Swing Low (Swing Neecha): Swing Low ek price point hai jahan price kisi downtrend ke dauran ek temporary low point tak gir jati hai aur phir upar badhne lagti hai. Swing Low ek potential trend reversal point ko darust karta hai aur yeh bullish (barhawat ki taraf) signal hota hai. Is point par traders buying positions enter kar sakte hain ya stop-loss orders lagate hain. Swing High aur Swing Low ka Istemal: Swing High aur Swing Low points ka istemal trend analysis mein hota hai. Agar market mein uptrend hai to traders Swing High points ko dekhte hain, aur agar market mein downtrend hai to Swing Low points par tawajjo dete hain. Yeh points traders ko trend ke strength aur potential reversals ko samajhne mein madadgar hote hain. Swing High aur Swing Low ko doosre technical indicators aur price patterns ke saath combine karke trading decisions liye jate hain. Trend analysis ke dauran Swing High aur Swing Low points ko samajhna traders ke liye ahem hota hai kyunki yeh unko market ke dynamics aur price movements ko samajhne mein madadgar hote hain. Swing high and swing low benefits: Forex trading mein "Swing High" aur "Swing Low" price action analysis ka hissa hota hai. Yeh levels market ke price movements ke important points ko represent karte hain. Chaliye in dono concepts ko Roman Urdu mein tafseel se samjhein: Swing High (Swing Bulandi): Swing High ek price level hota hai jahan se price ne upar jana tha aur phir gir kar neeche aaya hai. Yani, jab market price ek specific point tak pohanchti hai aur phir woh neeche girti hai, to woh point Swing High kehlata hai. Swing High level ko traders resistance point ke taur par dekhte hain aur is level ko break karne par price ko upar jane ka potential signal samajhte hain. Swing Low (Swing Kamzori): Swing Low ek price level hota hai jahan se price ne neeche jana tha aur phir upar chala gaya hai. Yani, jab market price ek specific point tak girti hai aur phir woh upar badhti hai, to woh point Swing Low kehlata hai. Swing Low level ko traders support point ke taur par dekhte hain aur is level ko break karne par price ko neeche jane ka potential signal samajhte hain. Swing High aur Swing Low levels market analysis mein istemal hote hain taki traders price trends aur reversals ko samajh saken. Jab Swing High level break hota hai, to ye bullish (barhawat ki taraf) movement ko indicate kar sakta hai. Jab Swing Low level break hota hai, to ye bearish (girawat ki taraf) movement ko indicate kar sakta hai. Traders Swing High aur Swing Low levels ke saath doosre technical indicators aur patterns ka bhi istemal karte hain taki sahi trading decisions liya ja sake aur risk management ki taraf tawajjo di ja sake.

- Mentions 0

-

سا0 like

-

#11 Collapse

Swing High and Swing Low patterns price action analysis mein use kiye jaane wale patterns hain. Ye patterns price chart pe price swings ko identify karne aur trend direction ko samajhne ke liye istemal kiye jaate hain. Swing High and Swing Low patterns ki wazahat aur characteristics niche diye gaye hain:Swing High and Swing Low patterns price swings aur trend reversals ko identify karne mein madad karte hain. Lekin inko samajhna aur interpret karna traders ke liye zaruri hai. Isliye, professional advice aur market research ke saath in patterns ka istemal karna behtar hoga. Swing High aur Swing Low Pattern 1. Structure: Swing High pattern mein, price chart pe ek high point form hota hai, jahan price previous high points se higher hai. Swing Low pattern mein, price chart pe ek low point form hota hai, jahan price previous low points se lower hai. Ye patterns price swings ko indicate karte hain. 2. Indication: Swing High and Swing Low patterns trend direction aur potential reversals ko indicate karte hain. Swing High pattern bullish trend ke exhaustion aur possible trend reversal ki indication ho sakta hai. Swing Low pattern bearish trend ke exhaustion aur possible trend reversal ki indication ho sakta hai. 3. Confirmation: Swing High and Swing Low patterns ka confirmation, next price action ke saath hota hai. Agar price Swing High level ko neeche break karke close karta hai, toh Swing High pattern ka confirmation hota hai. Agar price Swing Low level ko upar break karke close karta hai, toh Swing Low pattern ka confirmation hota hai. 4. Trading Strategy: Swing High and Swing Low patterns ka istemal trading strategy mein kiya ja sakta hai. Agar Swing High pattern ka confirmation ho jaata hai, toh traders short position lete hain aur stop loss order Swing High level se thoda upar set karte hain. Agar Swing Low pattern ka confirmation ho jaata hai, toh traders long position lete hain aur stop loss order Swing Low level se thoda neeche set karte hain. 5. Context: Swing High and Swing Low patterns ka sahi interpretation, overall market context aur trend analysis ke saath karna zaruri hai. In patterns ko dusre technical indicators aur price patterns ke saath confirm karna zaruri hai, taaki sahi trading decisions liye ja sake. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduction: Forex mein Swing High aur Swing Low pattern aam taur par market ka trend analyze karne ke liye istemaal kiya jaata hai. Yeh pattern traders ko market ke future movement ki prediction karne mein madad deta hai. Swing High Pattern: Swing High ya uchha tareen point wo point hota hai jahan market mein ek temporary peak ya high point reach hota hai. Yeh traders ke liye ek mahatvapurn signal hota hai kyunki is point par market trend change hone ka chance hota hai. Swing High ko identify karne ke liye traders previous highs ko dekhte hain.Swing high pattern mein, market ki uptrend mein jab price apni peak tak pohanchta hai aur wahan se downward trend shuru karta hai tou yeh Swing High pattern kehlata hai. Jab market mein swing high pattern nazar aata hai tou yeh aam taur par sell signal ke tor par samjha jaata hai. Swing Low Pattern: Swing Low ya neecha tareen point wo point hota hai jahan market mein ek temporary low ya low point reach hota hai. Yeh bhi traders ke liye ek mahatvapurn signal hota hai kyunki is point par market trend change hone ka chance hota hai. Swing Low ko identify karne ke liye traders previous lows ko dekhte hain.Swing low pattern mein, market ki downtrend mein jab price apni lowest point tak pohanchta hai aur wahan se upward trend shuru karta hai tou yeh Swing Low pattern kehlata hai. Jab market mein swing low pattern nazar aata hai tou yeh aam taur par buy signal ke tor par samjha jaata hai. Swing High aur Swing Low Pattern Uses: Traders Swing High aur Swing Low patterns ka istemal market ke trend ka pata lagane mein karte hain. Jab market ek Swing High ke baad ek Swing Low banata hai, to isse trend reversal ka signal mil sakta hai. Isi tarah, jab market ek Swing Low ke baad ek Swing High banata hai, to trend reversal ka indication ho sakta hai. Trading Strategy: Traders Swing High aur Swing Low patterns ko apni trading strategy mein shamil karte hain. Agar market ek Swing High banata hai aur phir ek Swing Low, to yeh bearish (girawat) trend ki taraf ishara kar sakta hai. Iske viprit, agar market ek Swing Low banata hai aur phir ek Swing High, to yeh bullish (udharan) trend ki taraf ishara kar sakta hai. Risk Management: Swing High aur Swing Low patterns ka istemal karne se pehle traders risk management ko bhi dhyan mein rakhte hain. Stop-loss orders ka istemal karke loss ko kam karne ka prayas karte hain, taki nuksan se bacha ja sake. Conclusion Swing High aur Swing Low pattern forex mein traders ke liye useful tool hai. Iske istemaal se traders market ki trend analyze kar sakte hain aur future movement ki prediction kar sakte hain. Jab market mein Swing High ya Swing Low pattern nazar aaye tou traders ko sell ya buy signal ke tor par action lena chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:16 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим