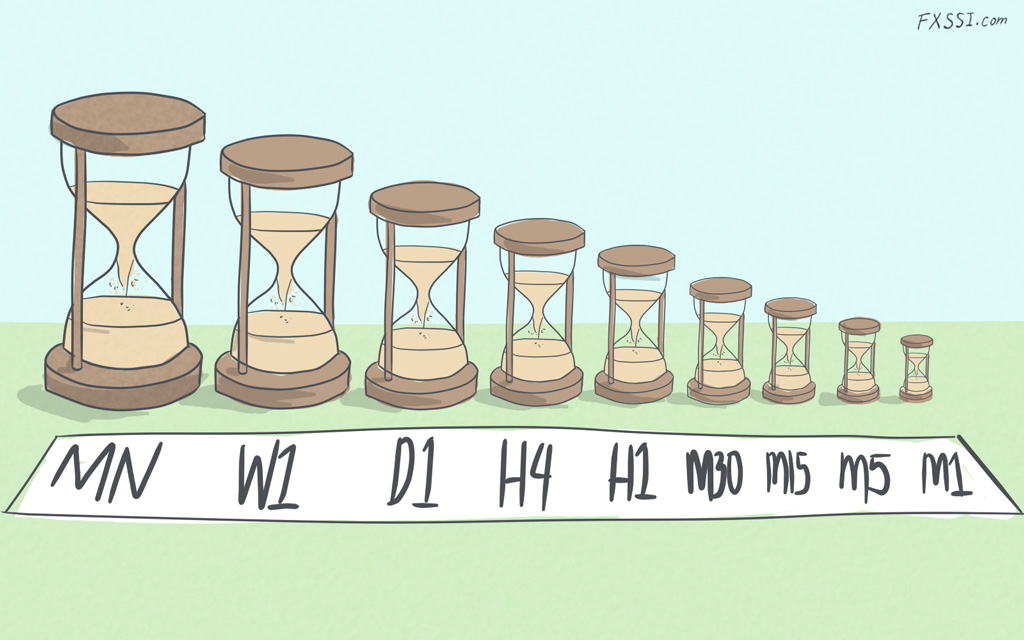

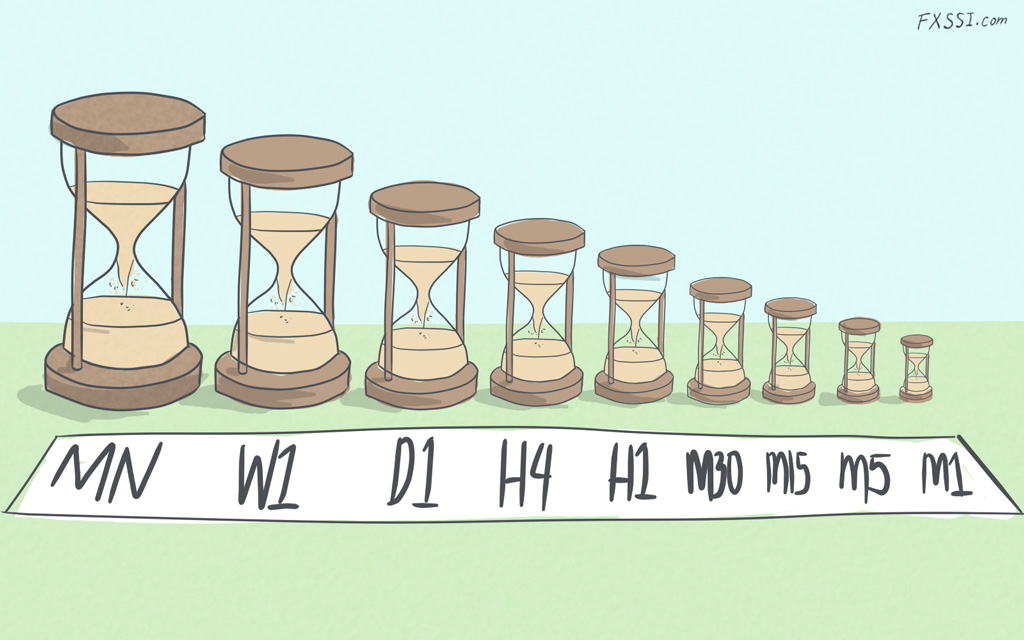

Multi Time Frame (MTF) analysis forex trading mein ek bohot important technique hai. Yeh traders ko market ki better understanding aur trading decisions ko improve karne mein madad deti hai. Is method mein alag-alag time frames ko study kiya jata hai, taake ek broader perspective mil sake aur accurate entries aur exits plan kiye ja sakey. Multi Time Frame Analysis ka mtlab hai ke ek forex trader multiple time frames ko use karte hue market trends, patterns aur signals ko analyze kare. Is technique mein, usually teen main time frames dekhe jate hain:

Higher time frames jaise ke daily (D1), weekly (W1), aur monthly (MN) charts, long-term trends aur overall market direction ko samajhne mein madadgar hoti hain. HTF analysis se aapko market ka broader context milta hai, jo trading decisions ko influence kar sakta hai. For example, agar aap daily chart pe ek strong uptrend dekh rahe hain, to aap lower time frames pe bhi buy opportunities ko search karenge.

Intermediate Time Frame (ITF)

Intermediate time frames jaise ke 4-hour (H4) aur 1-hour (H1) charts medium-term trends aur market cycles ko analyze karne ke liye use hote hain. Yeh time frames HTF aur LTF ke darmiyan bridge ka kaam karte hain. Intermediate time frames pe analysis se aapko specific trends aur patterns ko identify karne mein madad milti hai jo short-term trading decisions ko support karte hain.

Lower Time Frame (LTF)

Lower time frames jaise ke 15-minute (M15), 5-minute (M5), aur 1-minute (M1) charts short-term price movements aur precise entry/exit points ko identify karne ke liye use hote hain. LTF analysis se aapko real-time market movements ka idea milta hai aur aap apni trades ko accurately execute kar sakte hain.

Multi Time Frame Analysis Ka Faida

Multi Time Frame Analysis (MTFA) ko effective tarike se implement karne ke liye kuch practical steps ko follow karna zaroori hai. Aapko systematic approach adopt karna hoga, jo aapki trading strategy ko enhance kar sake.

Step 1: Choose Your Primary Time Frame

Sabse pehle, apna primary time frame select karein jo aapki trading style se match karta ho. Agar aap swing trader hain, to aap daily (D1) ya 4-hour (H4) chart ko apna primary time frame bana sakte hain. Scalpers aur day traders ke liye, 15-minute (M15) ya 5-minute (M5) chart zyada suitable hote hain.

Step 2: Identify the Higher Time Frame

Primary time frame select karne ke baad, ek higher time frame identify karein jo overall market trend aur direction ko determine karne mein madad karega. For example, agar aapka primary time frame 4-hour (H4) chart hai, to aap daily (D1) chart ko higher time frame ke liye use kar sakte hain.

Step 3: Analyze the Higher Time Frame Trend

Higher time frame pe trend ko analyze karein aur identify karein ke market uptrend, downtrend ya range-bound condition mein hai. Yeh analysis aapko market ke broader context ko samajhne mein madad karega aur aapki trading strategy ko direction dega.

Step 4: Choose the Lower Time Frame

Lower time frame select karein jo aapko precise entry aur exit points ko identify karne mein madad kare. Agar aapka primary time frame 4-hour (H4) chart hai, to aap 1-hour (H1) ya 15-minute (M15) chart ko lower time frame ke liye use kar sakte hain.

Step 5: Confirm the Trend with Lower Time Frame

Lower time frame pe trend aur patterns ko confirm karein. Yeh aapko entry aur exit points ko accurately identify karne mein madad karega. For example, agar higher time frame pe uptrend hai, to aap lower time frame pe buy signals ko search karenge.

Step 6: Use Technical Indicators

Technical indicators jaise ke moving averages, RSI, MACD, aur support/resistance levels ko use karein taake trend aur entry/exit points ko further validate kiya ja sake. Indicators aapki analysis ko support karne mein bohot madadgar hote hain.

Step 7: Set Your Entry and Exit Points

Lower time frame pe analysis complete karne ke baad, apne entry aur exit points ko set karein. Entry point wo level hoga jahan aap trade ko initiate karenge, jabke exit point wo level hoga jahan aap trade ko close karenge. Stop loss aur take profit levels ko bhi define karna zaroori hai taake risk management effective ho.

- Higher Time Frame (HTF): Yeh long-term trend aur overall market direction ko identify karne ke liye use hoti hai.

- Intermediate Time Frame (ITF): Yeh medium-term trends aur cycles ko analyze karne ke liye hoti hai.

- Lower Time Frame (LTF): Yeh short-term price movements aur entry/exit points ko pinpoint karne ke liye hoti hai.

Higher time frames jaise ke daily (D1), weekly (W1), aur monthly (MN) charts, long-term trends aur overall market direction ko samajhne mein madadgar hoti hain. HTF analysis se aapko market ka broader context milta hai, jo trading decisions ko influence kar sakta hai. For example, agar aap daily chart pe ek strong uptrend dekh rahe hain, to aap lower time frames pe bhi buy opportunities ko search karenge.

Intermediate Time Frame (ITF)

Intermediate time frames jaise ke 4-hour (H4) aur 1-hour (H1) charts medium-term trends aur market cycles ko analyze karne ke liye use hote hain. Yeh time frames HTF aur LTF ke darmiyan bridge ka kaam karte hain. Intermediate time frames pe analysis se aapko specific trends aur patterns ko identify karne mein madad milti hai jo short-term trading decisions ko support karte hain.

Lower Time Frame (LTF)

Lower time frames jaise ke 15-minute (M15), 5-minute (M5), aur 1-minute (M1) charts short-term price movements aur precise entry/exit points ko identify karne ke liye use hote hain. LTF analysis se aapko real-time market movements ka idea milta hai aur aap apni trades ko accurately execute kar sakte hain.

Multi Time Frame Analysis Ka Faida

- Broader Perspective: Multi time frame analysis se aapko market ka ek comprehensive view milta hai. Aap short-term fluctuations ko ignore karke long-term trends pe focus kar sakte hain.

- Improved Accuracy: Different time frames ko analyze karke aap trading signals ki accuracy ko validate kar sakte hain. Agar multiple time frames pe similar signals mil rahe hain, to trading decision zyada reliable hota hai.

- Better Risk Management: MTF analysis se aapko potential risk factors aur market conditions ka better understanding milti hai, jo aapko apni risk management strategies ko improve karne mein madad karti hai.

- Enhanced Timing: Multiple time frames ko analyze karke aap better timing ke sath trades enter aur exit kar sakte hain. Yeh strategy aapko market ke volatile movements se bachane mein madad karti hai.

Multi Time Frame Analysis (MTFA) ko effective tarike se implement karne ke liye kuch practical steps ko follow karna zaroori hai. Aapko systematic approach adopt karna hoga, jo aapki trading strategy ko enhance kar sake.

Step 1: Choose Your Primary Time Frame

Sabse pehle, apna primary time frame select karein jo aapki trading style se match karta ho. Agar aap swing trader hain, to aap daily (D1) ya 4-hour (H4) chart ko apna primary time frame bana sakte hain. Scalpers aur day traders ke liye, 15-minute (M15) ya 5-minute (M5) chart zyada suitable hote hain.

Step 2: Identify the Higher Time Frame

Primary time frame select karne ke baad, ek higher time frame identify karein jo overall market trend aur direction ko determine karne mein madad karega. For example, agar aapka primary time frame 4-hour (H4) chart hai, to aap daily (D1) chart ko higher time frame ke liye use kar sakte hain.

Step 3: Analyze the Higher Time Frame Trend

Higher time frame pe trend ko analyze karein aur identify karein ke market uptrend, downtrend ya range-bound condition mein hai. Yeh analysis aapko market ke broader context ko samajhne mein madad karega aur aapki trading strategy ko direction dega.

Step 4: Choose the Lower Time Frame

Lower time frame select karein jo aapko precise entry aur exit points ko identify karne mein madad kare. Agar aapka primary time frame 4-hour (H4) chart hai, to aap 1-hour (H1) ya 15-minute (M15) chart ko lower time frame ke liye use kar sakte hain.

Step 5: Confirm the Trend with Lower Time Frame

Lower time frame pe trend aur patterns ko confirm karein. Yeh aapko entry aur exit points ko accurately identify karne mein madad karega. For example, agar higher time frame pe uptrend hai, to aap lower time frame pe buy signals ko search karenge.

Step 6: Use Technical Indicators

Technical indicators jaise ke moving averages, RSI, MACD, aur support/resistance levels ko use karein taake trend aur entry/exit points ko further validate kiya ja sake. Indicators aapki analysis ko support karne mein bohot madadgar hote hain.

Step 7: Set Your Entry and Exit Points

Lower time frame pe analysis complete karne ke baad, apne entry aur exit points ko set karein. Entry point wo level hoga jahan aap trade ko initiate karenge, jabke exit point wo level hoga jahan aap trade ko close karenge. Stop loss aur take profit levels ko bhi define karna zaroori hai taake risk management effective ho.

تبصرہ

Расширенный режим Обычный режим