Forex Scalping Momentum

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Introduction forex market men kese bhe new position par amal karnay say pehlay yeh tay karna hamaish kay ley important hota hey keh hum forex market mein kon ce currency ko buy ya sell kar rahay hotay hein forex market kay short period mein technical analysis ko samjhna hota hey aj hum GBP/NZD trend ka jaiza lein gay or forex market mein technical analysis ko samjhna assan bana saktay hein or forex market mein es bat daikhen gay keh scalping ka koi chance nahi hota hey zail mein dekhay gay 4H chart hey os nay forex market kay pair mein 755 pip ke kame ke hey December 2012 set 1.9781 par trend trader es ko talash kar saken gay GBP/NZD kay short period ke raftar etni zyada strong hote hey or forex maret mein price kahan ja rehe hote hey or es ka hum jaiza lein gay es ka forex market mein jaiza lein kay ley 30 mint ka graph daikhen gay chart ko zoom in karen gay GBP/NZD Building blocks zailke tasweer mein hum nay 30 mint ka graph daikha hey GBP/NZD building blocks daikh kar majodah trend ko daikh saktay hein block 1 ka analysis gozashta den bhe ho sakta hey Wednesday ko 2 January ko hova tha or es pair nay forex market mein bullish mein ezafa keya hey jo keh forex market mein 1.9574 par lower lows par 268 pip nechay lay janay say pehlay say nekal deya hey chonkeh aik lower level or lower lows banay gay hey jes say block 1 ko red rang mein bana deya geya hey es ko strong bearish trend ke pehchan kar de gay hey forex market mein aik bar block 1 ke pehchan honay kay bad block 2 mein tabdel kar deya geya hey jo keh apko yeh maloom keyajasakta hey keh forex marketke raftarese he direction mein ja rehe hote hey block 2 start ho jata hey or block 1 end ho jata hey jo keh forex market mein jare bearish kay trend ko indicate karta hey or forex market mein jare bearish ke raftar ko bhe zahair karta hey humray analysis say pata chalta hey 1.9357 par rehta hey lower level or lower lows dono ko print honay say block 2 jaree negtive raftar ko indicate karta hey es kay analysis ka estamall kartay hovay trader GBP/NZD scalping ke taza raftr ko identify karta hey trader GBP/NZD ke scalping ke chance ko talash karna start kar dayta hey EURJPY Building Blocks es bat ko yad rakhen keh oper wallay chart kay blocks ko jare maksad kay tor par bhe daikh saktay hein strong tareen trend dono blocks mein jare hotay hein block ko aik he rang mein paint kar deya geya hey kunkeh price aik he direction mein barhte hey forex marketmein aik bar aik strong trend paya jata hey to trader baghair jhajak kay scalping trading strategy ko lago kar sakta hey yeh analysis higher highs ke takhleq mein fake ho jay ga mumkana tor par market reversal trend ko neshan zad karta hey

bhali kay badlay bhali

bhali kay badlay bhali

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex scalping momentum trading ek trading strategy hai jisme traders chote time frames par trading karte hain aur short-term price moves ko capture karne ki koshish karte hain. Scalping momentum trading ka maqsad hota hai market ke jaldi se hone wale price changes se faida uthana. Is strategy mein momentum, yaani price ke tezi ya mandgi ko istemal kiya jata hai. Yahan, Forex scalping momentum trading ke baare mein mazeed tafseelat human wording mein Roman Urdu mein di gayi hain: Scalping Ka Maqsad: - Scalping ek trading approach hai jahan traders market mein choti choti price moves par trading karte hain. - Iska maqsad short-term profits kamana hota hai, aur traders market mein choti fluctuations ko capture karke chand pips (price points) hasil karne ki koshish karte hain. Momentum Trading Scalping momentum trading mein, traders market ke price trends aur momentum ko closely monitor karte hain. - Momentum, yaani price ke tezi ya mandgi, un indicators aur patterns ke zariye dekha jata hai jo short-term price moves ko represent karte hain. Chote Time Frames Scalping traders chote time frames jaise 1-minute, 5-minute, ya 15 minute charts par focus karte hain. In chote time frames par price movements tez hoti hain, aur isse traders ko quick entry aur exit opportunities milti hain. Entry aur Exit Points: Scalping mein entry aur exit points ka tez tareen faisla karna hota hai. Momentum indicators jaise ki Moving Averages, RSI (Relative Strength Index), aur MACD (Moving Average Convergence Divergence) traders ko entry aur exit points par madadgar hote hain. Risk Management: Scalping strategy mein risk management bahut ahem hota hai. Traders ko apne positions ko tight stop-loss orders ke sath manage karna hota hai taaki nuksan se bacha ja sake. Scalpers usually small lot sizes (position sizes) use karte hain. Market Monitoring Scalping traders market ko continuously monitor karte hain aur jald-baazi mein trade karte hain jab wo momentum aur price patterns detect karte hain. Psychological Pressure Scalping mein traders ke liye psychological pressure zyada hota hai, kyunke unhe market mein tezi se faisle lene hote hain aur choti choti losses bhi ho sakti hain. Discipline aur patience scalping traders ke liye ahem hoti hai. High Frequency Trading: - Scalping ek high-frequency trading strategy hai jahan traders ek din mein multiple trades kar sakte hain. Yad rahe ke scalping strategy market mein zyada active aur experienced traders ke liye zyada suitable hoti hai, aur isme risk bhi zyada hota hai. Is strategy ko samajhna aur istemal karna trading experience aur practice ke bina mushkil ho sakta hai. Scalping ke liye aapko apne trading plan aur risk management ko carefully consider karna hoga. -

#4 Collapse

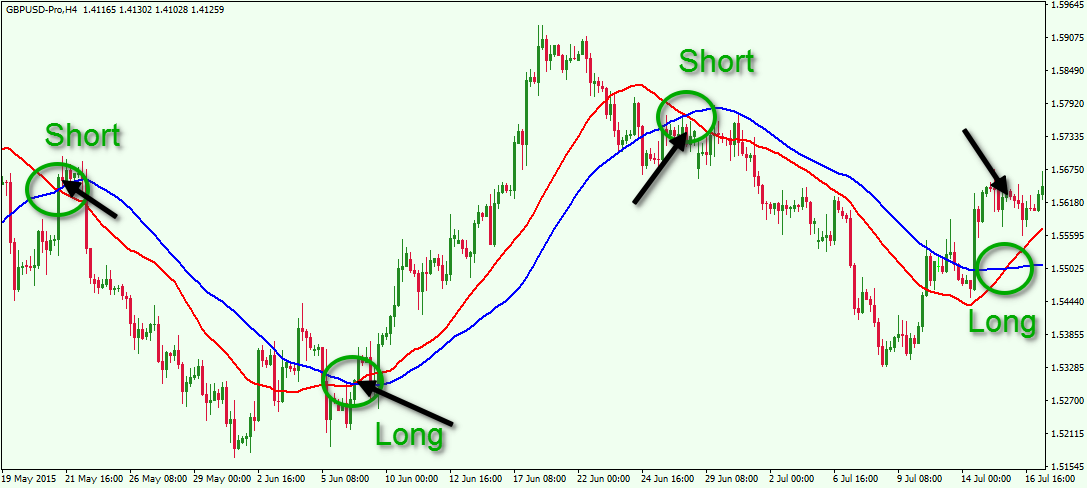

Top Indicators for a Scalping Trading Strategy tjart fhrst ka khanh tredng ke hkmt amle dn tredng askelpng tredng hkmt amle kay leay srfhrst asharay aaj ke alektrank marketon men Scalpers kay treqay km qabl aatmad treqay say kam krtay hen۔ aeln farle kay zreah 16 march 2023 ko ap det hoa۔ THOMAS BROCK nay jae'zh lea۔ RYAN EICHLER kay zreaay hqae'q ke janch ke ge'e۔ Scalpers chhote market ke nql o hrkt say fae'dh athana chahtay hen، aek tkr tep ka fae'dh athatay hoe'ay jo kbhe bhe sakn nhen hote۔ brson say، yh tez angleon oale day tredng hjom leol 2 bole/ask askrenon pr khred o frokht kay sgnlz tlash krnay، rsd aor tlb ko prrhnay kay leay anhsar krta hay۔ qome bhtren bole aor peshksh (NBBO) say dor adm toazn — bole/pochhnay ke qemt jsay aost frd dekhta hay۔ oh as oqt khreden gay jb tkneke halat pochhnay ke qemt ko mamol say km dhkel den gay aor jb tkneke halat nay bole ke qemt ko mamol say zeadh dhkel dea hay to frokht kren gay، jesay he mtoazn halat aspred pr oaps aae'ay mnton bad mnafa ya nqsan ke bkng۔ tahm، aaj yh treqh kar hmare alektrank marketon men ten ojohat ke bna' pr km qabl aatmad treqay say kam krta hay۔ phle، aardr bk 2010 kay flesh kresh kay bad mstql tor pr khale ho ge'e keonkh as afratfre oalay dn ghray khrray aardrz ko tbahe kay leay nshanh bnaea gea tha، js say fnd menejrz ko anhen rokna prra۔ - sanoe mqamat pr an ke marketng kren ya an pr aml draamd kren۔ 1 dosra، hae'e frekoe'nse tredng (HFT) ab antra day tranzekshnz pr haoe hay، bay hd atar chrrhaؤ oala deta tear krta hay jo market ke ghrae'e ke tshreh ko kmzor krta hay۔ aakhr kar، ab zeadh tr tjart tarek talabon men tbadlay say dor hote hay jo hqeqe oqt men rport nhen krtay hen۔ Moving Average Ribbon Entry Strategy do mnt kay chart pr 5-8-13 sadh moong aeorej (SMA) ka amtzaj rkhen takh mzbot rjhanat ke nshandhe ke ja skay jo kaؤntr soe'ngz pr km khreday ya frokht keay jasktay hen، aor sath he sath aanay oale rjhan ke tbdeleon ke oarnng hasl krnay kay leay jo nagzer hen۔ market ka aek aam dn۔ as skelp tredng ke hkmt amle pr abor hasl krna aasan hay۔ 5-8-13 rbn mzbot rjhanat kay doran، aonche ya nechay ke trf asharh kray ga jo qemton ko 5- ya 8-bar SMA say chpkae'ay rkhen gay۔ 13-bar SMA sgnl men dkhol honay oale rftar jo renj ya reorsl kay hq men hote hay۔ as renj kay jholon kay doran rbn chpta ho jata hay، aor qemt rbn ko bar bar kras kr skte hay۔ askelpr phr relae'nmnt ke trf dekhta hay، rbn aonchay ya nechay mrrnay aor phelnay kay sath۔ ، hr lae'n kay drmean zeadh jgh dkha rha hay۔ yh chhota petrn khred o frokht kay mkhtsr sgnl ko mthrk krta hay۔ Relative Strength/Weakness Exit Strategy askelpr ko kesay malom hota hay kh kb mnafa lena hay ya nqsanat ko km krna hay? markets، jesay andeks fndz، daؤ ajza'، aor aepl ankarporetd (AAPL) jesay degr osea pemanay pr mnaqd honay oalay msae'l kay leay۔ bhtren rbn tredz as oqt mrtb hotay hen jb stokastks aoor seld leol say aopr ya aoor bat leol say km ho jata hay۔ ase trh، jb asharay mnafa bkhsh zor kay bad aap ke pozeshn kay khlaf kras aor rol krta hay to fore tor pr bahr nklna zrore hota hay۔ aap qemt kay sath bend kay taaml ko dekh kr zeadh drst treqay say bahr nklnay ka oqt nkal sktay hen۔ bend ke dkhol men fae'dh athae'en keonkh oh pesh goe'e krtay hen kh rjhan sst ho jae'ay ga ya alt jae'ay ga؛ askelpng ke hkmt amle kse bhe trh ke oapse kay zreaay qae'm rhnay ke mthml nhen ho skte۔ as kay alaoh، broqt len bahr nklen agr qemt ka zor bend tk phnchnay men nakam ho jata hay lekn stakstks rol aoor ho jata hay، jo aap ko bahr nklnay ko khta hay۔ -

#5 Collapse

Forex scalping momentum trading ek trading strategy hai jisme traders chote time frames par trading karte hain aur short-term price moves ko capture karne ki koshish karte hain. Scalping momentum trading ka maqsad hota hai market ke jaldi se hone wale price changes se faida uthana. Je strategy mein momentum, yaani price ke tezi ya mandgi ko istemal kiya jata hai. Yahan, Forex scalping momentum trading ke baare mein mazeed tafseelat human formulation mein Roman Urdu mein di gayi hain: Ka Maqsad Scalping: - Scalping ek trading approach hai jahan traders market mein choti choti price movements par trading karte hain. - Iska maqsad short term profits kamana hota hai, aur market traders mein choti fluctuations ko capture karke chand pips (price points) hasil karne ki koshish karte hain. Momentum Trading Scalping momentum trading mein, traders market ke price trends aur momentum ko bedli watch karte hain. - Momentum, yaani price ke tezi ya mandgi, un indicators aur patterns ke zariye dekha jata hai jo short term price movements that represent karte hain. Chote time frames Scalping traders choose timeframes of 1-minute, 5-minute, and 15-minute par focus karte hain charts. In time frames par price movements tez hoti hain, aur isse traders ko quick entry aur exit opportunities milti hain. Entry and exit points: Scalping mein entry and exit points ka tez tareen faisla karna hota hai. Momentum indicators Jaise ki Moving Averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) traders have entry and exit points according to madadgar hot hain. Risk management: Scalping strategy mein risk management bahut ahem hota hai. Traders ko apne positions ko tight stop-loss orders ke sath drive karna hota hai taaki nuksan se bacha ja sake. Scalpers usually use small lot size (position sizes) hain cards. Market monitoring Market trader scalping constantly monitors cartels that have your trading cards as you tap dynamics and price patterns discover your cards. Psychological pressure Scalping mein traders ke liye psychological pressure zyada hota hai, kyunke unhe market mein tezi se faisle lene hote hain aur choti choti losses bhi ho sakti hain. Discipline and patience scalping traders ke liye ahem hoti hai. High Frequency Trading: - Scalping ek high frequency trading strategy hai jahan traders ek din mein multiple trades kar sakte hain. Yad rahe ke market scalping strategy mein zyada active aur experienced traders ke liye zyada suitable hoti hai, aur isme risk bhi zyada hota hai. Is strategy ko samajhna aur istemal karna business experience aur practice ke bina mushkil ho sakta hai. Scalping ke liye aapko apne business plan aur risk management ko carefully consider karna hoga. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex scalping momentum strategy, short-term trading mein istemal hone wali ek prakar ki trading strategy hai. Is strategy ka uddeshya hai chhoti time frames par trading karke jaldi se profit kamana. Scalping momentum strategy mein traders short-term price movements aur market momentum par focus karte hain. Is strategy ki wazahat aur fayde-nuksan niche diye gaye hain: Wazahat: 1. Forex scalping momentum strategy mein traders market ki momentum aur price movements ko jaldi se capture karne ki koshish karte hain. Ismein entry aur exit points ko tezi se identify kiya jata hai.2. Is strategy mein traders short-term time frames jaise 1-minute, 5-minute ya 15-minute charts ka istemal karte hain.3. Scalping momentum strategy mein traders momentum indicators jaise ki MACD, RSI, aur Stochastic Oscillator ka istemal karte hain, taaki short-term price trends aur momentum ko samajh sakein. Fayde: 1. Scalping momentum strategy jaldi se profit kamane ki opportunity provide karta hai, kyunki traders short-term price movements par focus karte hain.2. Is strategy mein traders multiple trades ek din mein place kar sakte hain, jisse unhe market volatility aur liquidity se fayda hota hai.3. Scalping momentum strategy mein traders tight stop loss aur target levels ka istemal karte hain, jisse risk management improve hota hai. Nuksan: 1. Scalping momentum strategy high frequency trading aur quick decision-making ka istemal karne ki zarurat hai. Isliye, ye strategy beginners ke liye thoda challenging ho sakti hai.2. Scalping strategy mein chhoti price movements par focus kiya jata hai, jisse transaction costs aur spreads ka impact bhi ho sakta hai.3. Scalping momentum strategy mein market volatility aur false signals ka risk hota hai. Traders ko market conditions aur price action ko samajhne ke liye acchi research aur analysis ki zarurat hoti hai.Forex scalping momentum strategy traders ko short-term trading aur quick profits kamane ki opportunity provide karta hai. Lekin is strategy ke liye proper market research, technical analysis aur risk management ka istemal zaruri hai. Scalping strategy ko samajhne ke liye professional advice aur practice ki zarurat hoti hai.

- Mentions 0

-

سا0 like

-

#7 Collapse

Introduction of the post. A.O.A> Me omeed karta ho ap sab khareyat say ho gay aj me ko Forex scalping momentum trading ek trading strategy hai jisme traders chote time frames par trading karte hain aur short-term price moves ko capture karne ki koshish karte hain. Scalping momentum trading ka maqsad hota hai market ke jaldi se hone wale price changes se faida uthana. Is strategy mein momentum, yaani price ke tezi ya mandgi ko istemal kiya jata hay. Yahan, Forex scalping momentum trading ke baare mein mazeed tafseelat human wording mein Roman Urdu mein di gayi hay. Scalping Ka Maqsad. - Scalping ek trading approach hai jahan traders market mein choti choti price moves par trading karte hain. - Iska maqsad short-term profits kamana hota hai, aur traders market mein choti fluctuations ko capture karke chand pips (price points) hasil karne ki koshish karte hay. Momentum Trading Scalping momentum trading mein, traders market ke price trends aur momentum ko closely monitor karte hain. - Momentum, yaani price ke tezi ya mandgi, un indicators aur patterns ke zariye dekha jata hai jo short-term price moves ko represent karte hay. Chote Time Frames Scalping traders chote time frames jaise 1-minute, 5-minute, ya 15 minute charts par focus karte hain. In chote time frames par price movements tez hoti hain, aur isse traders ko quick entry aur exit opportunities milti hay. Entry aur Exit Points. Scalping mein entry aur exit points ka tez tareen faisla karna hota hay. Momentum indicators jaise ki Moving Averages, RSI (Relative Strength Index), aur MACD (Moving Average Convergence Divergence) traders ko entry aur exit points par madadgar hote hay.Risk Management. Scalping strategy mein risk management bahut ahem hota hai. Traders ko apne positions ko tight stop-loss orders ke sath manage karna hota hai taaki nuksan se bacha ja sake. Scalpers usually small lot sizes (position sizes) use karte hay. Market Monitoring. Scalping traders market ko continuously monitor karte hain aur jald-baazi mein trade karte hain jab wo momentum aur price patterns detect karte hay. Psychological Pressure. Scalping mein traders ke liye psychological pressure zyada hota hai, kyunke unhe market mein tezi se faisle lene hote hain aur choti choti losses bhi ho sakti hain. Discipline aur patience scalping traders ke liye ahem hoti hay.

-

#8 Collapse

Forex Scalping Momentum : Forex scalping energy exchanging ek exchanging procedure hai jisme dealers chote time periods standard exchanging karte hain aur transient cost moves ko catch karne ki koshish karte hain. Scalping energy exchanging ka maqsad hota hai market ke jaldi se sharpen ridge cost changes se faida uthana. Is technique mein energy, yaani cost ke tezi ya mandgi ko istemal kiya jata hai. Yahan, Forex scalping force exchanging ke baare mein mazeed tafseelat human phrasing mein Roman Urdu mein di gayi hain. Scalping Ka Maqsad: Scalping ek exchanging approach hai jahan dealers market mein choti cost moves standard exchanging karte hain. Iska maqsad transient benefits kamana hota hai, aur dealers market mein choti vacillations ko catch karke chand pips (costs) hasil karne ki koshish karte hain. Energy Exchanging : Scalping energy exchanging mein, dealers market ke cost patterns aur force ko intently screen karte hain. Force, yaani cost ke tezi ya mandgi, un pointers aur designs ke zariye dekha jata hai jo momentary cost moves ko address karte hain. Chote Time periods : Scalping dealers chote time spans jaise 1-minute, 5-minute, ya brief outlines standard center karte hain. In chote time periods standard cost developments tez hoti hain, aur isse dealers ko fast section aur leave potential open doors milti hain. Passage aur Leave Focuses: Scalping mein passage aur leave focuses ka tez tareen faisla karna hota hai. Force markers jaise ki Moving Midpoints, RSI (Relative Strength List), aur MACD (Moving Normal Combination Difference) dealers ko passage aur leave focuses standard madadgar hote hain. Risk The executives: Scalping system mein risk the executives bahut ahem hota hai. Merchants ko apne positions ko tight stop-misfortune orders ke sath oversee karna hota hai taaki nuksan se bacha ja purpose. Hawkers normally little part estimates (position sizes) use karte hain. Market Observing : Scalping brokers market ko constantly screen karte hain aur jald-baazi mein exchange karte hain poke wo force aur cost designs distinguish karte hain. Mental Strain : Scalping mein brokers ke liye mental tension zyada hota hai, kyunke unhe market mein tezi se faisle lene hote hain aur choti misfortunes bhi ho sakti hain. Discipline aur tolerance scalping dealers ke liye ahem hoti hai. High Recurrence Exchanging: Scalping ek high-recurrence exchanging system hai jahan dealers ek clamor mein different exchanges kar sakte hain. Yad rahe ke scalping system market mein zyada dynamic aur experienced dealers ke liye zyada appropriate hoti hai, aur isme risk bhi zyada hota hai. Is technique ko samajhna aur istemal karna exchanging experience aur practice ke bina mushkil ho sakta hai. Scalping ke liye aapko apne exchanging plan aur risk the executives ko cautiously consider karna hoga. -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Describe Forex Scalping Momentum ? Assalam o Alikum Dear ! Aj hum forex Scalping momentum ka bara ma analysis karay gya .forex market men kese bhe new position standard amal karnay say pehlay yeh tay karna hamaish kay ley significant hota hello keh murmur forex market mein kon ce cash ko purchase ya sell kar rahay hotay hein forex market kay brief period mein specialized investigation ko samjhna hota hello aj murmur GBP/NZD pattern ka jaiza lein gay or forex market mein specialized examination ko samjhna assan bana saktay hein or forex market mein es bat daikhen gay keh scalping ka koi chance nahi hota hy. zail mein dekhay gay 4H diagram hello os nay forex market kay pair mein 755 pip ke kame ke hello December 2012 set 1.9781 standard precedent merchant es ko talash kar saken gay GBP/NZD kay brief period ke raftar etni zyada solid hote hello or forex maret mein cost kahan ja rehe hote hello or es ka murmur jaiza lein gay es ka forex market mein jaiza lein kay ley 30 mint ka diagram daikhen gay outline ko zoom in karen gay. Reason, How Forex Scalping Momentum work..... Scalping Importance: - Scalping ek exchanging approach hai jahan dealers market mein choti cost moves standard exchanging karte hain. - Iska maqsad momentary benefits kamana hota hai, aur brokers market mein choti vacillations ko catch karke chand pips (costs) hasil karne ki koshish karte hain. Force Exchanging Scalping force exchanging mein, merchants market ke cost patterns aur energy ko intently screen karte hain. Force, yaani cost ke tezi ya mandgi, un pointers aur designs ke zariye dekha jata hai jo momentary cost moves ko address karte hain. Chote Time periods : Scalping dealers chote time periods jaise 1-minute, 5-minute, ya brief outlines standard center karte hain. In chote time spans standard cost developments tez hoti hain. aur isse brokers ko speedy passage aur leave open doors milti hain. Section aur Leave Focuses: Scalping mein section aur leave focuses ka tez tareen faisla karna hota hai. Energy markers jaise ki Moving Midpoints, RSI (Relative Strength File), aur MACD (Moving Normal Intermingling Difference) dealers ko passage aur leave focuses standard madadgar hote hain. Risk The board: Scalping technique mein risk the executives bahut ahem hota hai. Dealers ko apne positions ko tight stop-misfortune orders ke sath oversee karna hota hai taaki nuksan se bacha ja purpose. Hawkers normally little part estimates (position sizes) use karte hain. Market Observing : Scalping brokers market ko persistently screen karte hain aur jald-baazi mein exchange karte hain poke wo energy aur cost designs distinguish karte hain. Conculsion.... Scalping ek high recurrence exchanging system hai jahan dealers ek noise mein different exchanges kar sakte hain. Yad rahe ke market scalping system mein zyada dynamic aur experienced dealers ke liye zyada appropriate hoti hai, aur isme risk bhi zyada hota hai. Is procedure ko samajhna aur istemal karna business experience aur practice ke bina mushkil ho sakta hai. Scalping ke liye aapko apne strategy aur risk the board ko consider karna hoga. -

#10 Collapse

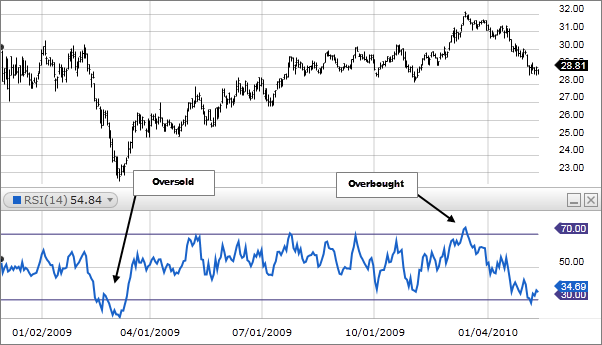

Introduction of Forex Scalping Momentum Forex scalping with momentum is a trading strategy employed in the foreign exchange (Forex) market, where traders aim to capitalize on short-term price movements by identifying and riding on the momentum of the market. This strategy is highly popular among traders who seek to make quick profits within a short time frame, typically within minutes or seconds. In this Roman Urdu explanation, we will delve into the key components of Forex scalping with momentum, including its principles, tools, and techniques. Forex Scalping: Forex scalping is a trading technique where traders make numerous small trades throughout the day, attempting to profit from tiny price fluctuations. Scalpers look for short-term opportunities and often close their positions within minutes or even seconds. The goal is to accumulate many small gains, which can add up to significant profits over time. Momentum Trading: Momentum trading is a strategy that focuses on following the prevailing trend in the market. Traders identify assets that are exhibiting strong price movements in a particular direction and aim to capitalize on these trends. The belief is that once an asset starts moving in a specific direction, it is likely to continue in that direction for some time. Forex Scalping with Momentum: Combining scalping with momentum trading means that traders are looking for opportunities to enter and exit the market rapidly based on the current momentum. This strategy involves making quick, small trades while following the overall trend or momentum direction. The goal is to profit from short bursts of momentum within the broader trend. Tools and Indicators: To implement Forex scalping with momentum successfully, traders often use a combination of technical indicators and tools, including: Moving Averages: Traders may use short-term and long-term moving averages to identify trend direction and momentum. Relative Strength Index (RSI): RSI helps identify overbought or oversold conditions and can be useful for spotting potential reversals. Stochastic Oscillator: This indicator measures the momentum of price movements and can help identify potential entry and exit points.

Stochastic Oscillator: This indicator measures the momentum of price movements and can help identify potential entry and exit points.  Bollinger Bands: These bands can help identify volatility and potential price breakouts, which are essential for scalping with momentum.Risk Management:Forex scalping with momentum can be highly volatile and risky. Traders need a robust risk management strategy to protect their capital. This includes setting stop-loss orders, determining position sizes, and being disciplined about trade entries and exits. Execution: Execution speed is crucial in scalping. Traders often use direct market access (DMA) accounts and high-speed internet connections to ensure they can enter and exit trades quickly. Psychological Aspect: Scalping requires a high level of concentration and discipline. The rapid pace of trading can be stressful, and traders need to keep their emotions in check to make rational decisions.In conclusion, Forex scalping with momentum is a trading strategy that involves making quick, short-term trades in alignment with the prevailing market momentum. It's a high-intensity strategy that can be rewarding for those who master it, but it also comes with significant risks. As with any trading strategy, it's essential to practice, develop a solid plan, and employ strict risk management to increase the chances of success in Forex scalping with momentum.

Bollinger Bands: These bands can help identify volatility and potential price breakouts, which are essential for scalping with momentum.Risk Management:Forex scalping with momentum can be highly volatile and risky. Traders need a robust risk management strategy to protect their capital. This includes setting stop-loss orders, determining position sizes, and being disciplined about trade entries and exits. Execution: Execution speed is crucial in scalping. Traders often use direct market access (DMA) accounts and high-speed internet connections to ensure they can enter and exit trades quickly. Psychological Aspect: Scalping requires a high level of concentration and discipline. The rapid pace of trading can be stressful, and traders need to keep their emotions in check to make rational decisions.In conclusion, Forex scalping with momentum is a trading strategy that involves making quick, short-term trades in alignment with the prevailing market momentum. It's a high-intensity strategy that can be rewarding for those who master it, but it also comes with significant risks. As with any trading strategy, it's essential to practice, develop a solid plan, and employ strict risk management to increase the chances of success in Forex scalping with momentum.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

Forex Scalping Momentum

Forex scalping with momentum is a trading strategy employed in the foreign exchange (Forex) market, where traders aim to capitalize on short-term price movements by identifying and riding on the momentum of the market. This strategy is highly popular among traders who seek to make quick profits within a short time frame, typically within minutes or seconds. In this Roman Urdu explanation, we will delve into the key components of Forex scalping with momentum, including its principles, tools, and techniques. Forex Scalping: Forex scalping is a trading technique where traders make numerous small trades throughout the day, attempting to profit from tiny price fluctuations. Scalpers look for short-term opportunities and often close their positions within minutes or even seconds. The goal is to accumulate many small gains, which can add up to significant profits over time. Momentum Trading: Momentum trading is a strategy that focuses on following the prevailing trend in the market. Traders identify assets that are exhibiting strong price movements in a particular direction and aim to capitalize on these trends. The belief is that once an asset starts moving in a specific direction, it is likely to continue in that direction for some time. Forex Scalping with Momentum: Combining scalping with momentum trading means that traders are looking for opportunities to enter and exit the market rapidly based on the current momentum. This strategy involves making quick, small trades while following the overall trend or momentum direction. The goal is to profit from short bursts of momentum within the broader trend. Tools and Indicators: To implement Forex scalping with momentum successfully, traders often use a combination of technical indicators and tools, including: Moving Averages: Traders may use short-term and long-term moving averages to identify trend direction and momentum. Relative Strength Index (RSI): RSI helps identify overbought or oversold conditions and can be useful for spotting potential reversals. Stochastic Oscillator: This indicator measures the momentum of price movements and can help identify potential entry and exit points.

Relative Strength Index (RSI): RSI helps identify overbought or oversold conditions and can be useful for spotting potential reversals. Stochastic Oscillator: This indicator measures the momentum of price movements and can help identify potential entry and exit points.  Bollinger Bands: These bands can help identify volatility and potential price breakouts, which are essential for scalping with momentum.Risk Management:Forex scalping with momentum can be highly volatile and risky. Traders need a robust risk management strategy to protect their capital. This includes setting stop-loss orders, determining position sizes, and being disciplined about trade entries and exits. Execution: Execution speed is crucial in scalping. Traders often use direct market access (DMA) accounts and high-speed internet connections to ensure they can enter and exit trades quickly. Psychological Aspect: Scalping requires a high level of concentration and discipline. The rapid pace of trading can be stressful, and traders need to keep their emotions in check to make rational decisions.In conclusion, Forex scalping with momentum is a trading strategy that involves making quick, short-term trades in alignment with the prevailing market momentum. It's a high-intensity strategy that can be rewarding for those who master it, but it also comes with significant risks. As with any trading strategy, it's essential to practice, develop a solid plan, and employ strict risk management to increase the chances of success in Forex scalping with momentum.

Bollinger Bands: These bands can help identify volatility and potential price breakouts, which are essential for scalping with momentum.Risk Management:Forex scalping with momentum can be highly volatile and risky. Traders need a robust risk management strategy to protect their capital. This includes setting stop-loss orders, determining position sizes, and being disciplined about trade entries and exits. Execution: Execution speed is crucial in scalping. Traders often use direct market access (DMA) accounts and high-speed internet connections to ensure they can enter and exit trades quickly. Psychological Aspect: Scalping requires a high level of concentration and discipline. The rapid pace of trading can be stressful, and traders need to keep their emotions in check to make rational decisions.In conclusion, Forex scalping with momentum is a trading strategy that involves making quick, short-term trades in alignment with the prevailing market momentum. It's a high-intensity strategy that can be rewarding for those who master it, but it also comes with significant risks. As with any trading strategy, it's essential to practice, develop a solid plan, and employ strict risk management to increase the chances of success in Forex scalping with momentum.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:38 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим