ATR Indicator In Forex

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

ATR Indicator In Forexٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

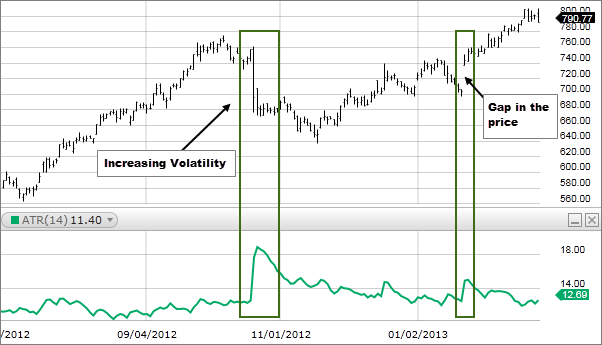

Introduction to ATR Indicator Average True Range (ATR) forex mein ek popular technical indicator hai jo forex trading aur doosre maaliyat ke market mein istemaal hota hai. Isay 1970s mein J. Welles Wilder Jr. ne tayyar kia tha aur iska asal maqsad aset ki keemat ke movement ki volatility ko napna hai. Is indicator ne traders aur analysts mein phel gaya hai kyunki iska maqsad market ke haalaat ko samajhna aur soch samajh kar trading ke faislay lena mein madadgar hota hai. Is ATR indicator ko puri tarah samajhne ke liye, iska calculation samajhna zaroori hai. ATR ek directional indicator nahi hai jaisay ke Moving Average ya Relative Strength Index (RSI). Balkay, iska maqsad keemat ki volatility ka level quantified karna hai. Is calculation mein kuch steps shamil hain. Calculating ATR: True Range and Average True Range Sab se pehle hum True Range (TR) ko calculate karte hain. True Range teen mukhtalif values mein se jo sab se bari hoti hai.

Calculating ATR: True Range and Average True Range Sab se pehle hum True Range (TR) ko calculate karte hain. True Range teen mukhtalif values mein se jo sab se bari hoti hai.- Current high aur current low ke darmiyan ka farq.

- Pichli band hone wale closing price aur current high ke darmiyan ka farq ka absolute value.

- Pichli band hone wale closing price aur current low ke darmiyan ka farq ka absolute value.

ATR in Different Time FramesATR values ko samjhna traders ke liye ahem hai. Jab ATR kam hota hai, to ye ishara hota hai ke market mein volatility kam hai. Isse market mein consolidation ya uncertainty ka dorra hota hai. Traders aksar samajhte hain ke kam ATR values ko apni stop-loss orders ko khasoosan tight karne ka ishara samjhte hain kyunki keemat ke zabardast jhatke mehdood hote hain. Umre daraz ke traders, jo positions ko lambi arsey tak hold karte hain, unhain aksar daily ya weekly charts jaise lambi time frames aur thora ziyada lamba ATR period istemal karke market ke overall sentiment ko jaanchne mein madad milti hai. Doosri taraf, jo traders intraday trading karte hain, woh aksar choti time frames jaise ke 5-minute ya 15-minute charts aur kam ATR period istemal karte hain taake woh choti muddat ki volatility ko tezi se samajh saken aur apni day trades ke liye munasib stop-loss aur take-profit levels set kar saken.

ATR in Different Time FramesATR values ko samjhna traders ke liye ahem hai. Jab ATR kam hota hai, to ye ishara hota hai ke market mein volatility kam hai. Isse market mein consolidation ya uncertainty ka dorra hota hai. Traders aksar samajhte hain ke kam ATR values ko apni stop-loss orders ko khasoosan tight karne ka ishara samjhte hain kyunki keemat ke zabardast jhatke mehdood hote hain. Umre daraz ke traders, jo positions ko lambi arsey tak hold karte hain, unhain aksar daily ya weekly charts jaise lambi time frames aur thora ziyada lamba ATR period istemal karke market ke overall sentiment ko jaanchne mein madad milti hai. Doosri taraf, jo traders intraday trading karte hain, woh aksar choti time frames jaise ke 5-minute ya 15-minute charts aur kam ATR period istemal karte hain taake woh choti muddat ki volatility ko tezi se samajh saken aur apni day trades ke liye munasib stop-loss aur take-profit levels set kar saken.  ATR Strategies in Forex Trading ATR ko trading strategies mein shamil karne ke liye traders apni trading decisions ko informed banane ke liye isay istemal karte hain. Woh isay use kar ke apni position sizes ko current ATR value ke mutabiq adjust kar sakte hain. Jab ATR ziyada hota hai, isse zyada volatility ka ishara milta hai, to traders apni position sizes ko kam kar sakte hain taa ke risk ko control kiya ja sake. Ulti sorat mein, jab ATR kam hota hai, to woh apni position sizes ko barha sakte hain taa ke potential breakouts ka faida uthaya ja sake. ATR ko dynamic trailing stops set karne ke liye bhi use kia ja sakta hai. Traders apni stop-loss orders ko ATR ke multiple par based kar ke adjust karte hain, jisse unko trading position ko retain karne mein madad milti hai jab tak ke market unke favor mein move kar raha hai, lekin agar keemat unke khilaf move hoti hai to unko specific ATR multiple ke hisab se exit karne mein madad milti hai. Kuch traders specifically high ATR values ko talash karte hain take woh volatility breakout trading mein shamil ho saken. Unka maqsad hota hai ke increased volatility ke doran aksar zabardast keemat ke jhatke aate hain, unka faida uthana. Jabke ATR forex traders ke liye aik ahem tool hai, to iske limitations ko tasleem karna aur trading decisions mein isay madadgar banate waqt in limitations ko madde nazar rakhte hain, ye bhi zaroori hai. ATR ek late indicator hai kyunki isay historical price data par based kia jata hai. Ye real-time signals provide nahi kar sakta aur achanak market events ko anumaan nahi laga sakta. Iske alawa, ATR keemat ke movement ki direction ke baare mein maloomat nahi deta. Ye sirf volatility ko napta hai. Traders ko isay doosre technical indicators ya chart patterns ke sath istemal kar ke informed decisions lene chahiye. ATR Limitations and Considerations ATR price outliers ya gaps ke liye bhi sensitive ho sakta hai. Traders ko ajeeb market conditions mein ATR values ko interpret karne par ehtiyaat baratna chahiye. ATR period ka chunao iske asar ko bhi mutasir kar sakta hai. Chhote periods zyada sensitive readings result dete hain, jabke lambi periods smother, kam volatile ATR values provide karte hain. Traders ko apni strategy ke liye behtareen kisam ka period talash karne ke liye alag alag periods ka istemal karne mein experiment karna chahiye. Aakhri tor par, ATR values market conditions ke mutabiq bhi tabdeel ho sakti hain. Trending markets mein ATR barh sakta hai jabke consolidation ke doran ye kam ho sakta hai. Traders ko apni strategies ko isabat dena chahiye.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

ATR Strategies in Forex Trading ATR ko trading strategies mein shamil karne ke liye traders apni trading decisions ko informed banane ke liye isay istemal karte hain. Woh isay use kar ke apni position sizes ko current ATR value ke mutabiq adjust kar sakte hain. Jab ATR ziyada hota hai, isse zyada volatility ka ishara milta hai, to traders apni position sizes ko kam kar sakte hain taa ke risk ko control kiya ja sake. Ulti sorat mein, jab ATR kam hota hai, to woh apni position sizes ko barha sakte hain taa ke potential breakouts ka faida uthaya ja sake. ATR ko dynamic trailing stops set karne ke liye bhi use kia ja sakta hai. Traders apni stop-loss orders ko ATR ke multiple par based kar ke adjust karte hain, jisse unko trading position ko retain karne mein madad milti hai jab tak ke market unke favor mein move kar raha hai, lekin agar keemat unke khilaf move hoti hai to unko specific ATR multiple ke hisab se exit karne mein madad milti hai. Kuch traders specifically high ATR values ko talash karte hain take woh volatility breakout trading mein shamil ho saken. Unka maqsad hota hai ke increased volatility ke doran aksar zabardast keemat ke jhatke aate hain, unka faida uthana. Jabke ATR forex traders ke liye aik ahem tool hai, to iske limitations ko tasleem karna aur trading decisions mein isay madadgar banate waqt in limitations ko madde nazar rakhte hain, ye bhi zaroori hai. ATR ek late indicator hai kyunki isay historical price data par based kia jata hai. Ye real-time signals provide nahi kar sakta aur achanak market events ko anumaan nahi laga sakta. Iske alawa, ATR keemat ke movement ki direction ke baare mein maloomat nahi deta. Ye sirf volatility ko napta hai. Traders ko isay doosre technical indicators ya chart patterns ke sath istemal kar ke informed decisions lene chahiye. ATR Limitations and Considerations ATR price outliers ya gaps ke liye bhi sensitive ho sakta hai. Traders ko ajeeb market conditions mein ATR values ko interpret karne par ehtiyaat baratna chahiye. ATR period ka chunao iske asar ko bhi mutasir kar sakta hai. Chhote periods zyada sensitive readings result dete hain, jabke lambi periods smother, kam volatile ATR values provide karte hain. Traders ko apni strategy ke liye behtareen kisam ka period talash karne ke liye alag alag periods ka istemal karne mein experiment karna chahiye. Aakhri tor par, ATR values market conditions ke mutabiq bhi tabdeel ho sakti hain. Trending markets mein ATR barh sakta hai jabke consolidation ke doran ye kam ho sakta hai. Traders ko apni strategies ko isabat dena chahiye.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduction to ATR Indicator

Average True Range (ATR) forex main ek popular technical indicator hey jo forex trading or doosre maaliyat ke market main istemaal hota hey. Isay 1970s main J. Welles Wilder Jr. ne tayyar kia tha or iska asal maqsad aset ki keemat ke movement ki volatility ko napna hey. Is indicator ne traders or analysts main phel gaya hey kyunki iska maqsad market ke haalaat ko samajhna or soch samajh kar trading ke faislay lena main madadgar hota hey. Is ATR indicator ko puri tarah samajhne ke liye, iska calculation samajhna zaroori hey. ATR ek directional indicator nahi hey jaisay ke Moving Average ya Relative Strength Index (RSI). Balkay, iska maqsad keemat ki volatility ka level quantified karna hey. Is ca

Calculating ATR: True Range and Average True Range

Sab se pehle hum True Range (TR) ko calculate karte hein.

True Range teen mukhtalif values main se jo sab se bari hoti hey.- Current high or current low ke darmiyan ka farq.

- Pichli band hone waly closing price or current high ke darmiyan ka farq ka absolute value.

- Pichli band hone waly closing price or current low ke darmiyan ka farq ka absolute value.

ATR in Different Time Frame

ATR values ko samjhna traders ke liye ahem hey. Jab ATR kam hota hey, to ye ishara hota hey ke market main volatility kam hey. Isse market main consolidation ya uncertainty ka dorra hota hey. Traders aksar samajhte hein ke kam ATR values ko apni stop-loss orders ko khasoosan tight karne ka ishara samjhte hein kyunki keemat ke zabardast jhatke mehdood hote hein. Umre daraz ke traders, jo positions ko lambi arsey tak hold karte hein, unhein aksar daily ya weekly charts jaise lambi time frames or thora ziyada lamba ATR period istemal karke market ke overall sentiment ko jaanchne main madad milti hey. Doosri taraf, jo traders intraday trading karte hein, woh aksar choti time frames jaise ke 5-minute ya 15-minute charts or kam ATR period istemal karte hein taake woh choti muddat ki volatility ko tezi se samajh saken or apni day trades ke liye munasib stop-loss or take-profit levels se

ATR Strategies in Forex Trading

ATR ko trading strategies main shamil karne ke liye traders apni trading decisions ko informed banane ke liye isay istemal karte hein. Woh isay use kar ke apni position sizes ko current ATR value ke mutabiq adjust kar sakte hein. Jab ATR ziyada hota hey, isse zyada volatility ka ishara milta hey, to traders apni position sizes ko kam kar sakte hein taa ke risk ko control kiya ja sake. Ulti sorat main, jab ATR kam hota hey, to woh apni position sizes ko barha sakte hein taa ke potential breakouts ka faida uthaya ja sake. ATR ko dynamic trailing stops set karne ke liye bhi use kia ja sakta hey. Traders apni stop-loss orders ko ATR ke multiple par based kar ke adjust karte hein, jisse unko trading position ko retain karne main madad milti hey jab tak ke market unke favor main move kar raha hey, lekin agar keemat unke khilaf move hoti hey to unko specific ATR multiple ke hisab se exit karne main madad milti hey. Kuch traders specifically high ATR values ko talash karte hein take woh volatility breakout trading main shamil ho saken. Unka maqsad hota hey ke increased volatility ke doran aksar zabardast keemat ke jhatke aate hein, unka faida uthana. Jabke ATR forex traders ke liye ak ahem tool hey, to iske limitations ko tasleem karna or trading decisions main isay madadgar banate waqt in limitations ko madde nazar rakhte hein, ye bhi zaroori hey. ATR ek late indicator hey kyunki isay historical price data par based kia jata hey. Ye real-time signals provide nahi kar sakta or achanak market events ko anumaan nahi laga sakta. Iske alawa, ATR keemat ke movement ki direction ke baare main maloomat nahi deta. Ye sirf volatility ko napta hey. Traders ko isay doosre technical indicators ya chart patterns ke sath istemal kar ke informed decisions lene chahiye. ATR

Limitations and Considerations

ATR price outliers ya gaps ke liye bhi sensitive ho sakta hey. Traders ko ajeeb market conditions main ATR values ko interpret karne par ehtiyaat baratna chahiye. ATR period ka chunao iske asar ko bhi mutasir kar sakta hey. Chhote periods zyada sensitive readings result dete hein, jabke lambi periods smother, kam volatile ATR values provide karte hein. Traders ko apni strategy ke liye behtareen kisam ka period talash karne ke liye alag alag periods ka istemal karne main experiment karna chahiye. Aakhri tor par, ATR values market conditions ke mutabiq bhi tabdeel ho sakti hein. Trending markets main ATR barh sakta hey jabke consolidation ke doran ye kam ho sakta hey. Traders ko apni strategies ko isabat dena chahiye.

t kar saken.ain.

منسلک شدہ فائلیں -

#4 Collapse

### ATR Indicator In Forex: Kya Hai Aur Kaise Use Karein?

Forex trading mein technical analysis tools ka use trading decisions ko guide karne aur market conditions ko samajhne ke liye kiya jata hai. In tools mein se ek important indicator hai "Average True Range" (ATR). ATR indicator market ki volatility ko measure karta hai aur trading strategies mein significant role play karta hai. Aayiye, samajhte hain ke ATR indicator kya hai, ye kaise kaam karta hai, aur isko forex trading mein kaise effectively use kiya jata hai.

#### ATR Indicator Kya Hai?

ATR indicator, jo Average True Range ka short form hai, market ke volatility ko measure karne ke liye use hota hai. Is indicator ko J. Welles Wilder ne develop kiya tha aur ye price movements ki intensity ko quantifying karta hai. ATR indicator price fluctuations ke average range ko calculate karta hai aur market ke overall risk aur volatility ko samajhne mein madad karta hai.

#### ATR Indicator Kaise Kaam Karta Hai?

1. **True Range Calculation:**

ATR indicator ki calculation mein pehle "True Range" (TR) ko determine kiya jata hai. TR ko calculate karne ke liye teen values ka use hota hai:

- **Current High - Current Low**

- **Current High - Previous Close**

- **Previous Close - Current Low**

Sabse bada value in teenon ka True Range ko represent karta hai.

2. **Average True Range:**

True Range values ko ek specific time period ke liye average kiya jata hai. Typically, ATR 14-period ke liye calculate kiya jata hai, lekin traders apne requirements ke hisaab se time period adjust kar sakte hain.

#### ATR Indicator Ki Usefulness

1. **Volatility Measurement:**

ATR market ki volatility ko measure karta hai, jo traders ko market ke risk level ko assess karne mein madad karta hai. High ATR value indicate karti hai ke market volatile hai, jabke low ATR value indicate karti hai ke market stable hai.

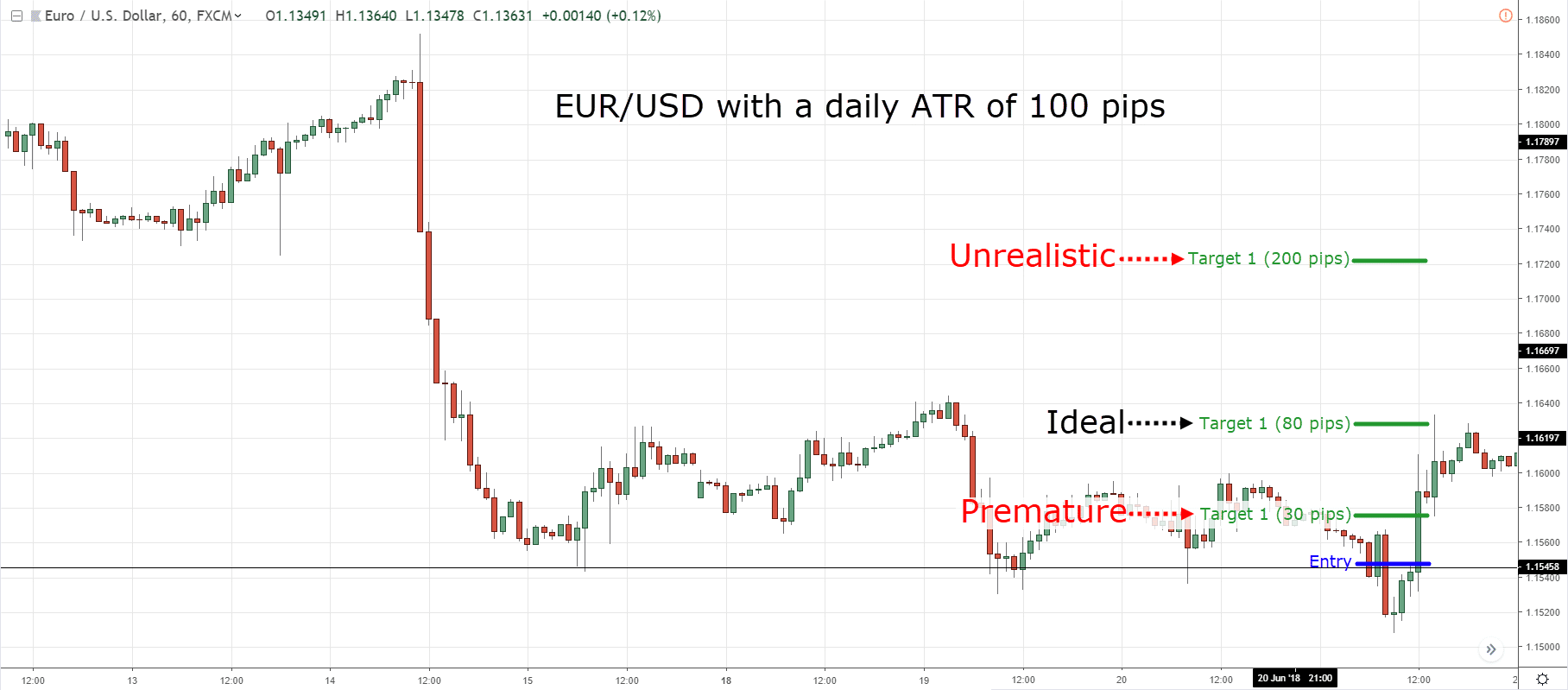

2. **Trade Planning:**

ATR indicator ko trade planning ke liye use kiya jata hai, khas kar stop-loss aur take-profit levels ko set karne mein. Volatile markets mein stop-loss ko wide set karna zaruri hota hai, jabke low volatility markets mein narrow stop-loss sufficient ho sakta hai.

3. **Trend Confirmation:**

ATR ko trend confirmation ke liye bhi use kiya jata hai. Agar ATR value high hai aur price trend ke direction mein move kar rahi hai, to ye trend ki strength aur sustainability ko confirm karta hai.

4. **Entry and Exit Points:**

ATR indicator traders ko entry aur exit points ko identify karne mein madad karta hai. Volatility increase hone par traders new positions open kar sakte hain, aur volatility decrease hone par existing positions close kar sakte hain.

#### ATR Indicator Ki Strategy

1. **Stop-Loss Placement:**

ATR value ko use karke stop-loss levels ko set karen. Agar ATR value high hai, to stop-loss ko wider set karen taake market fluctuations ko accommodate kiya ja sake. Low ATR value ke sath, stop-loss ko narrower set karen.

2. **Take-Profit Levels:**

ATR ko take-profit levels ke calculation mein bhi use kar sakte hain. High ATR value ke sath, profit targets ko bhi broader set karen, jabke low ATR value ke sath, targets ko narrow rakhen.

3. **Position Sizing:**

ATR indicator ko position sizing decisions mein bhi use kiya jata hai. Volatile markets mein, position size ko chhota rakhen taake risk manage kiya ja sake. Stable markets mein, position size ko bada kar sakte hain.

4. **Volatility Breakouts:**

ATR value ko market breakouts ke identify karne ke liye use kiya jata hai. Agar ATR value suddenly increase hoti hai, to market breakout ke potential ko indicate karta hai aur traders ko new trading opportunities milti hain.

#### Advantages of ATR Indicator

1. **Volatility Insight:**

ATR market ke volatility ko effectively measure karta hai aur trading decisions ko informed bana sakta hai.

2. **Risk Management:**

ATR indicator risk management strategies ko enhance karta hai aur stop-loss aur take-profit levels ko accurately set karne mein madad karta hai.

3. **Adaptability:**

ATR ko different timeframes aur market conditions ke sath adapt kiya ja sakta hai, jo iski versatility ko highlight karta hai.

#### Limitations of ATR Indicator

1. **Lagging Indicator:**

ATR ek lagging indicator hai jo past price data ke basis par calculate hota hai. Isliye, market trends ke changes ko immediately capture nahi kar sakta.

2. **No Directional Insight:**

ATR volatility measure karta hai lekin market ke directional movement ke baare mein information provide nahi karta.

#### Conclusion

ATR indicator forex trading mein ek valuable tool hai jo market ki volatility ko measure karta hai aur trading strategies ko enhance karta hai. Is indicator ki effective use se aap stop-loss aur take-profit levels ko accurately set kar sakte hain, trade planning ko improve kar sakte hain, aur market ke volatility ko better understand kar sakte hain. Halanki, ATR ki limitations ko bhi dhyan mein rakhein aur additional technical analysis tools ke sath combine karke use karein taake successful trading outcomes achieve kiye ja sakein.

-

#5 Collapse

ASSALAMU ALAIKUM

Forex me ATR Indicator Ka TAARUF

ATR (Average True Range) indicator ek volatility measure hai jo price movement ki variability ko assess karta hai. ATR indicator ka istemal traders aur investors market ki volatility ko samajhne ke liye karte hain. Yeh indicator typically 14 periods ka average calculate karta hai aur iske zariye yeh dekha ja sakta hai ke price kitni frequently aur kitni aggressively move kar rahi hai.

ATR ka calculation teen cheezon ko consider karta hai:- Current High - Current Low: Aaj ke high aur low ke beech ka farq.

- Previous Close - Current High: Pehle din ke close aur aaj ke high ke beech ka farq.

- Previous Close - Current Low: Pehle din ke close aur aaj ke low ke beech ka farq.

In teen values ka maximum value liya jata hai aur iska average calculate kiya jata hai, jo ke ATR ko give karta hai.

ATR high hone ka matlab hai ke market mein zyada volatility hai, jab ke ATR low hone ka matlab hai ke market relatively stable hai. Traders ATR ko stop-loss levels, position sizing, aur trading strategies ko tailor karne ke liye use karte hain.

Forex me ATR Indicator Ki mukammal wazahat

ATR (Average True Range) indicator ka mukammal wazahat yeh hai:

1. Purpose:

ATR market ki volatility ko measure karta hai, yaani price movements ki intensity ko. Yeh market ke range aur fluctuation ki width ko reflect karta hai.

2. Calculation:

ATR ko calculate karne ke liye, pehle "True Range" (TR) determine kiya jata hai. True Range ki calculation ke liye teen values consider ki jati hain:- Current High - Current Low: Aaj ke high aur low ke beech ka farq.

- Previous Close - Current High: Pehle din ke close aur aaj ke high ke beech ka farq.

- Previous Close - Current Low: Pehle din ke close aur aaj ke low ke beech ka farq.

In teen values me se jo sabse zyada hoti hai, usay True Range (TR) kehte hain.

ATR Calculation: ATR calculate karne ke liye, pehle TR ki values ko ek specific period (e.g., 14 periods) ke liye average kiya jata hai. Yeh average ATR ko give karta hai.

3. Interpretation:- High ATR Value: Market mein zyada volatility hai, yani price movements zyada hain. Yeh trend ki strength ko bhi indicate kar sakta hai.

- Low ATR Value: Market mein kam volatility hai, yani price movements relatively stable hain. Yeh chhoti trading ranges ko indicate karta hai.

- Stop-Loss Placement: High ATR ke dauran, stop-loss levels ko door rakha ja sakta hai taake chhoti fluctuations se trade exit na ho. Low ATR ke dauran, stop-loss ko nazdeek rakha ja sakta hai.

- Position Sizing: ATR ki madad se position size ko adjust kiya ja sakta hai. Zyada volatility ke dauran position size ko kam kiya ja sakta hai aur kam volatility ke dauran barhaya ja sakta hai.

- Trend Confirmation: ATR ko trend confirmation ke liye bhi use kiya jata hai. Jab ATR badhta hai, to yeh indicate karta hai ke market mein momentum strong hai.

ATR ko trading strategies mein incorporate karna trading decisions ko enhance kar sakta hai, khaaskar jab market ki volatility ko consider kiya jaye.

Shukria

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

### ATR Indicator in Forex

Average True Range (ATR) indicator forex trading mein volatility ka andaza lagane ke liye istemal hota hai. Yeh indicator traders ko market ke movement ki taqat ka pata deta hai, jo ke trading decisions banate waqt kafi madadgar sabit hota hai.

#### ATR Indicator Ki Pehchaan

ATR indicator ko J. Welles Wilder ne develop kiya tha aur yeh market ki price fluctuations ko measure karta hai. Yeh indicator kisi bhi time frame mein istemal kiya ja sakta hai, lekin zyada tar short-term traders isse use karte hain. ATR ki value hamesha positive hoti hai aur iski koi direction nahi hoti; yeh sirf market ki volatility ko darshata hai.

#### ATR Ka Kaam

ATR ki calculation mein do cheezen shamil hoti hain: True Range aur Average. True Range ko calculate karne ke liye teen cheezen dekhi jati hain:

1. Aaj ki high aur aaj ki low ke darmiyan ka farq.

2. Pichli closing price aur aaj ki high ke darmiyan ka farq.

3. Pichli closing price aur aaj ki low ke darmiyan ka farq.

In teeno values ka maximum lena True Range ko tay karta hai. Phir is True Range ka average nikaal kar ATR ko calculate kiya jata hai. Aam tor par 14-period ATR ka istemal hota hai.

#### ATR Ka Istemal

ATR indicator ko istemal karte waqt kuch khaas baatein madde nazar rakhni chahiye:

1. **Volatility ki Pehchaan**: Jab ATR ki value barh rahi hoti hai, toh yeh market ki volatility ke barhne ki nishani hoti hai. Iska matlab hai ke price movements tez honge. Agar ATR ki value ghat rahi hai, toh market mein stability hai.

2. **Stop Loss Aur Take Profit**: ATR ko stop loss aur take profit levels tay karne ke liye bhi istemal kiya ja sakta hai. Agar ATR ki value zyada hai, toh stop loss ko thoda door rakhna behtar hota hai taake market ki fluctuations se nuksan na ho.

3. **Breakout Trading**: Jab market ki volatility barh jati hai, toh yeh breakout trading ke liye achha signal hota hai. Traders yeh dekhte hain ke kya price levels breakout ke liye tayar hain.

#### Conclusion

ATR indicator forex trading mein ek powerful tool hai jo traders ko market ki volatility samajhne mein madad karta hai. Is indicator ko istemal karke traders apne stop loss aur take profit levels ko behtar bana sakte hain, aur market ke behavior ko achhe se samajh sakte hain. ATR ko apni trading strategy mein shamil karne se traders ko profitable opportunities mil sakti hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:10 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим