Pennant chart patterns:

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

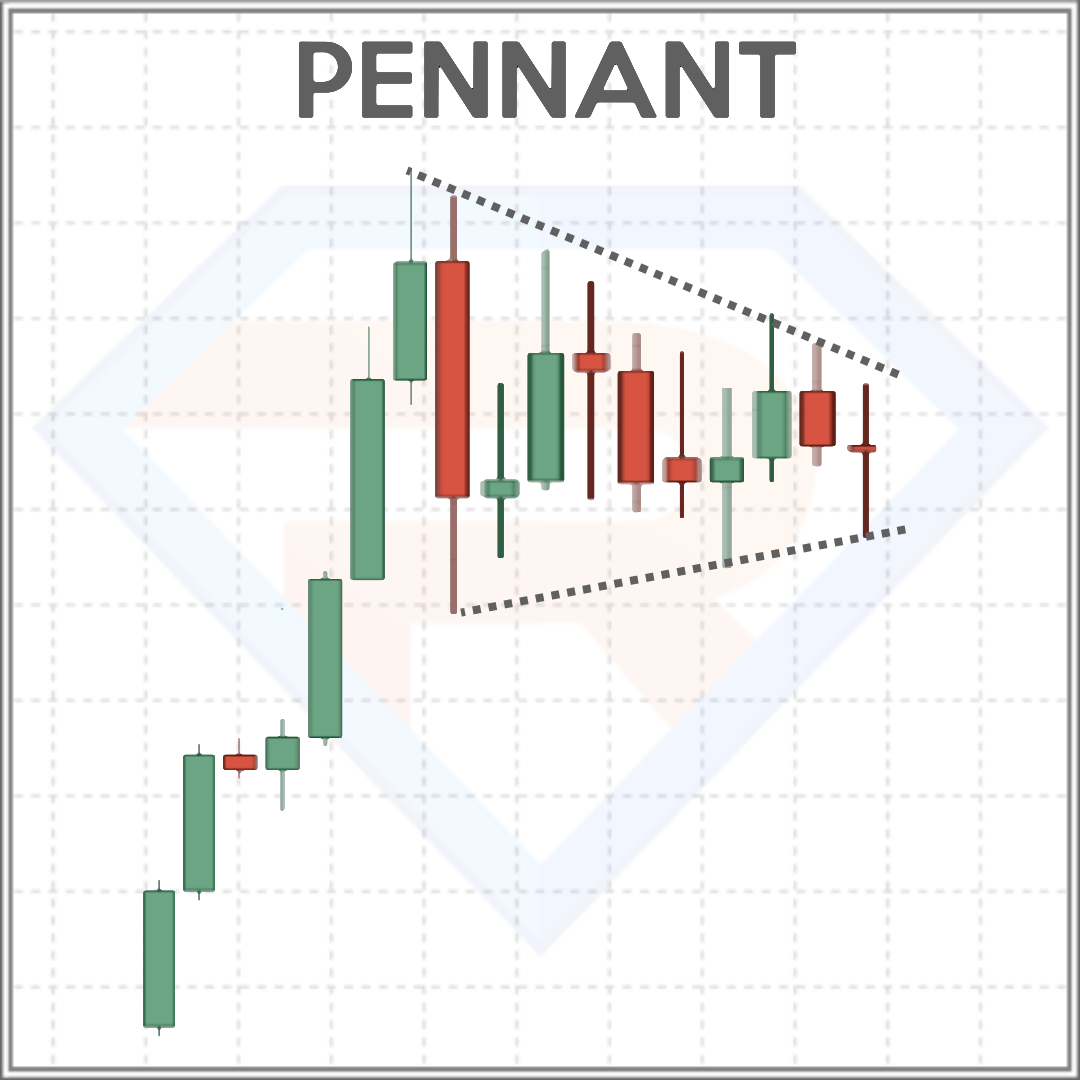

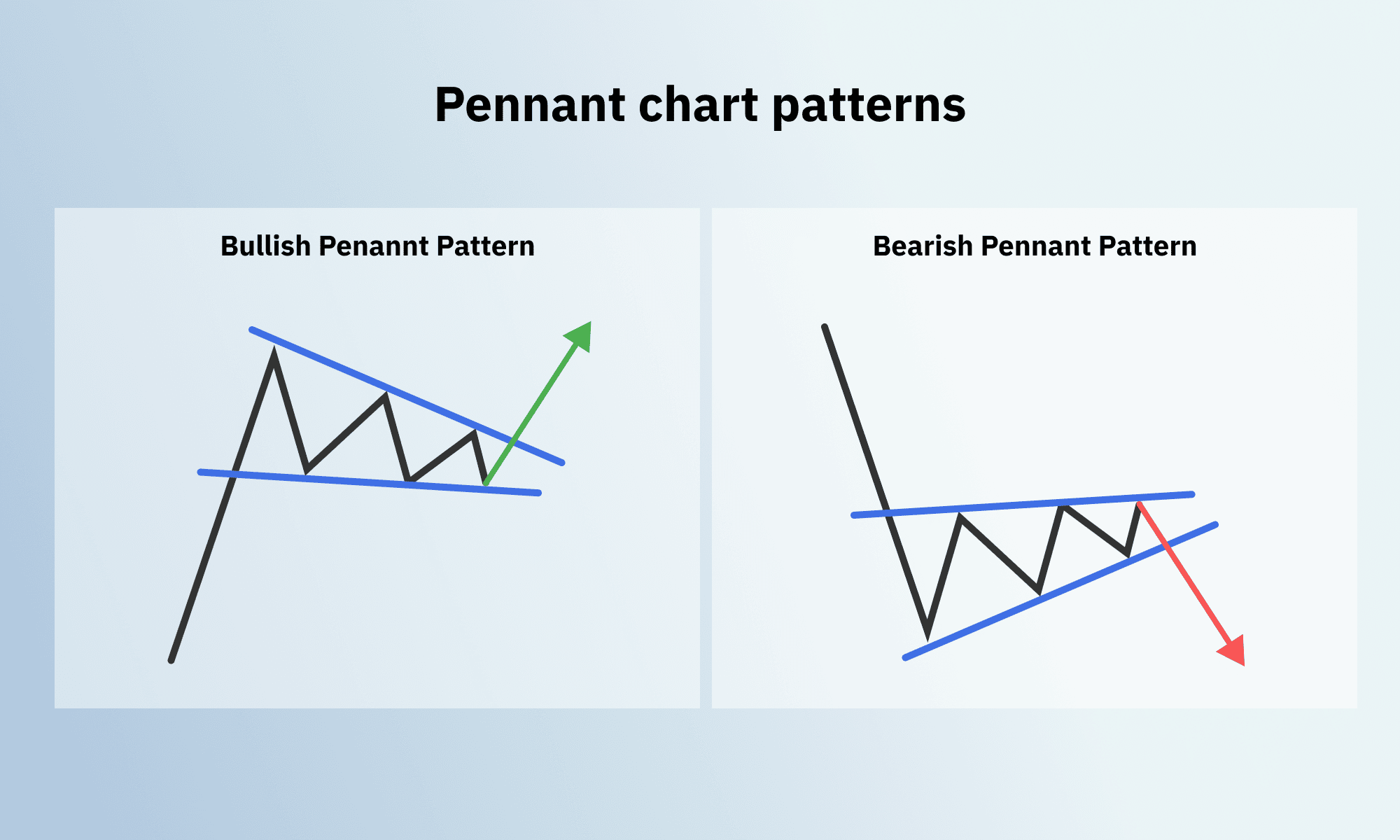

Assalam alaikum dosto! umeed ha ap sb khairiat se hn gy or apka trading week acha jaa raha ho ga. aj ki post main hum continuation patterns main se pennant chart patterns ko study karen gy or dekhen gy ye kia hota ha or esko kesy trade kia hata ha. WHAT IS PENNANT PATTERN? dear members pennat pattern aik continuation pattern ha mtlb k ye jis trend main bnta ha us trend k continue hony ki nishani hota ha.agr bullish main bny to es k breakout k bad market bullish hoti ha. or agr bearish main bny to es k breakout k bad market bearish hoti ha. Es pattern ki 2 types hoti hain Bullish pennant pattern. Bearish Pennant Pattern. in dono patterns ko hum bari bari discuss karen gy Bullish Pennant Pattern: dear members ye pattern bullish trend main bnta ha jb market kafi opr ja chuki ho to market thori retracement leti ha or estrha ka pattern bnta ha. es main market higher lows or lower highs bnati ha. Highs ko highs se milaen to aik trend line bnti ha kr lows ko lows se mila k dosri trend line bnti ha estrha market 2 trend lines k darmyan move karti ha. How to trade it? Dear members bullish pennant ko trade karny k lye hamen chahye k pattern k complete hony or es k breakout ka wait karen jb breakout ho jy to uski confirmation ka wait karen jb confirmation ho jy to hum es main buy ki entry le skty hain or hmara stoploss bullish penneta ki hoper trend line ya us se nechy ho ga jb k profit tarhet pennant ki height k equal ho ga. Bearish Pennant Pattern: ye pattern bearish trend main bnta ha jb market kafi nechy gir chuki ho to market retracement lety hovy consolidate hoti ha or es trha ka pattern bnta ha. es main market lower highs or higher lows bnati ha. lows ko lows se mila kr or highs ko highs se mla k trend lines bnti ha or market i trend lines k drmyan move karti ha . How to trade it? Dear members es pattern main trade karny k lye hmn breakout ka wait karna chahye or eski confirmation k bad sell ki trade leni chahye or es main hmara stop loss pennant ki lower trend line ya us se opr ho ga jb k profit targe pannent ki height k equal ho ga. -

#3 Collapse

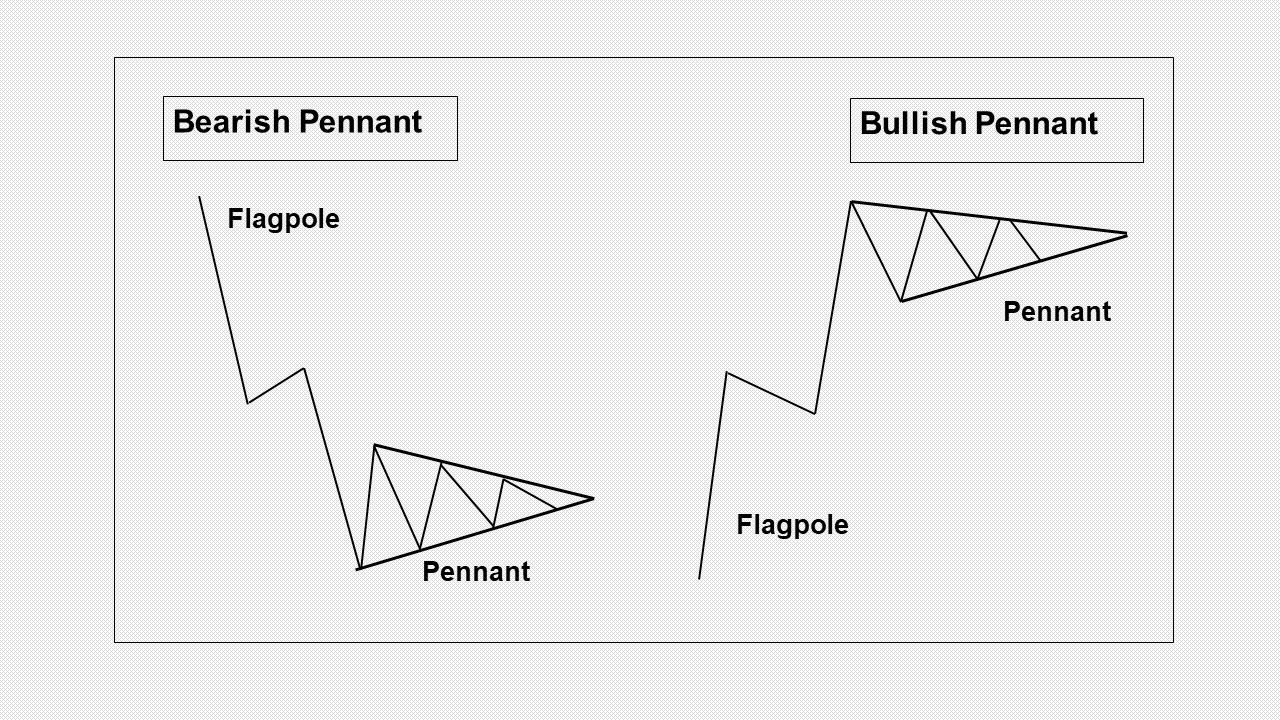

Forex Trading Mein Pennant Pattern Ka Ta'aruf Forex trading, jahan currencies ko kharidna aur bechna hota hai, mein technical analysis ek ahem hissa hota hai. Technical analysis, past price movements aur market data ko istemal karke future price trends ko samajhne ka tareeqa hai. Ek aham technical analysis pattern jo traders ke liye ahem hota hai, woh hai "Pennant Pattern." Pennant Pattern Kya Hota Hai? Pennant pattern ek continuation pattern hai jo price chart par dekha ja sakta hai. Yeh pattern ek trading instrument ki price movement ko represent karta hai jab market temporary consolidation ya pause mein hota hai. Is pattern ko dekh kar traders ko market ke agle move ka andaza lagana asaan ho jata hai. Pennant Pattern Ki Pechan Pennant pattern ki pehchan kuch khaas features se hoti hai: 1. **Flagpole : Pehle, ek strong uptrend ya downtrend hoti hai jise "flagpole" kehte hain. Isme price mein tezi se izafa hota hai. 2. **Consolidation Phase : Phir, price mein ek consolidation phase ati hai jise "pennant" kehte hain. Is phase mein price ek specific range mein trade karti hai aur yeh range usually triangular shape mein hoti hai. 3. **Volume: Volume bhi ek ahem factor hai. Pennant pattern ke doran volume usually kam hoti hai, jo indicate karta hai ke market mein uncertainty hai aur traders apne agle move ka intezar kar rahe hain. Istemal Pennant pattern ko tijarat mein istemal karne ke liye traders ko kuch steps follow karne hote hain: 1. **Entry Point: Jab pennant pattern ban raha hota hai, traders entry point tay karte hain. Agar pennant uptrend ke baad a raha hai, toh traders long position lete hain, aur agar downtrend ke baad a raha hai, toh traders short position lete hain. 2. **Stop Loss Aur Take Profit Levels: Har trade mein stop loss aur take profit levels set kiye jate hain taki nuksan se bacha ja sake aur profit maximize kiya ja sake. 3. **Risk Management: Hamesha yaad rahe ke risk management ek ahem hissa hai. Trading mein apne risk ko manage karna bohat zaroori hai. Conclusions: Pennant pattern, Forex trading mein ek ahem technical analysis tool hai jo traders ko market trends samajhne mein madadgar hota hai. Is pattern ko samjhna aur sahi tarike se istemal karna traders ke liye zaroori hai agar woh consistent aur successful trading karna chahte hain. Magar yaad rahe, market mein risk hamesha hota hai, aur kisi bhi pattern ko istemal karne se pehle thorough research aur risk management ka amal karna bohat zaroori hai. -

#4 Collapse

Pennant Chart Pattern: Dear Forex Members Pennant Chart Pattern market ma continuation pattern ko show karta hai or ye information deta hain ke market kuch dair es pattern ma move karny ke badh mazeed up move kar sakti hai or trader ko es pattern ma ki formation ke badh break out ka wait karna chahiye or phir es information ki base par trade karni chahiye. Traders ke liye ye important hai ke wo pennant ke volume ko predict kary. Jab volume low ho ga to consolidation period create ho jay ga or jab volume increase kar jay to market ke break out hony ke chances barh jaty hain. Kuch trader pennant chart pattern ko technical analysis ke sath conjuction ma use karty hain or es base par market ki movement ko confirm karty hain. How to Understand Pennant Chart Pattern: Dear Forex Members trading market me Pennant Chart Pattern aik flag design ke patterns banne ke badh hi hoti hai, jisme market pehly up down aur up down movement karne ke badh aik up side pe breakout karta hai, jis se market me bohot upward side pe teezi ati hai aur market ki trend up side pe continue ho jati hai. Agar hum is ki misal gold ki aj kal ki trading se lein to market me gold pehlay 1800$ aur 1808$ ke darmeyan trading kar rahi thi lekin aj achanak ye market me upward chalna shoro ho gaye aur market ki 1818$ ki position pe bhi price chali gaye. Pennant chart Pattern me traders kisi bare breakout ke intezar me hote hein isi waja se market me is ka sahi patterns ka samajhna zarori hai. Market me Pennant chart Pattern pe stop loss last down side position pe lagayen aur market me take profit ko last up side ke double position pe set karein. Information of Pennant Chart Pattern: Dear Students Pennant chart pattern ek aisa pattern hota hai jismein market apni movement ko complete kar rahi hoti hai aur jab market is candlestick pattern ko breakout karti hai to aisi situation main apko bohot perfect entry mil sakti hai aur ap apne different important analysis ko complete kar sakte hain ya market pattern apko different time frames bhi available ho sakta hai no doubt jab ap gold or silver key movement ko observe karte hain to usmein apko is market pattern mein bohot zyada advantages of sakte hain kyunke jab aap is candlestick pattern ko study karte hain to ap iski movement ko hundred percent gold or silver per apply kar sakte hain jismein apko throughout the day one time must yah pattern mil sakta hai. -

#5 Collapse

​Pennant chart pattern introduction Aslaam o alaikum Forex team members aaj hum baat krein gy pennant chart pattern k baary mein. Pennant chart pattern ek technical analysis tool hai jo stock market mein istemal hota hai. Ye pattern ek temporary consolidation phase ko darust karta hai, jahan price ek choti si flag ya pennant ki tarah behave karta hai. Yahan kuch khas tafseelat hain: Starting Move (Ibtida Harkat): Pennant pattern usually ek strong uptrend ya downtrend ke baad shuru hota hai. Agar price uptrend mein hai to starting move upward hota hai aur agar downtrend mein hai to downward hota hai. Flagpole (Jhanda Ka Danda): Starting move ko flagpole kehte hain, jo ke price ki aggressive move hoti hai. Isme traders ki active buying ya selling hoti hai. Consolidation (Mussalsal Hona): Flagpole ke baad, price ek consolidation phase mein enter karta hai. Is phase mein price range-bound hoti hai aur ek pennant shape banti hai. Yeh phase usually short-term hota hai. Breakout (Todna): Jab pennant shape pura hojata hai, to ek breakout hota hai. Agar price uptrend mein tha, to breakout upward hota hai aur agar downtrend mein tha, to downward hota hai. Volume (Volume): Pennant pattern ki confirmation ke liye volume ka bhi dehan dena zaroori hai. Breakout ke samay volume typically increase hota hai. Price Target (Nishana): Pennant pattern se price target nikala ja sakta hai. Iske liye flagpole ki length ko breakout point se measure kiya jata hai. Isse approximate target mil jata hai. Pennant chart pattern formation Pennant chart pattern ek technical analysis mein istemal hota hai aur yeh market mein hone wale potential price moves ko identify karne ke liye use hota hai. Pennant pattern ek continuation pattern hota hai, jo ki ek uptrend ya downtrend ke beech mein aata hai. Yeh kuch steps hain jinse aap pennant pattern ko pehchan sakte hain: Dekhein: Sabse pehle, aapko current price chart par dhyan dena hoga. Pennant pattern typically ek flag ki tarah dikhta hai, jahan ek lambi uptrend ya downtrend ke baad ek choti si consolidation phase hoti hai. Flagpole: Flagpole ek vertical line hoti hai jo trend se judi hoti hai. Uptrend ke case mein yeh upward direction mein hoti hai, jabki downtrend ke case mein downward direction mein hoti hai. Yeh flagpole trend ke strong movement ko represent karta hai. Pennant Formation: Flagpole ke baad, ek small triangle-shaped pattern banta hai, jise pennant kehte hain. Yeh typically ek converging trendline pattern hota hai, jahan price ki volatility kam ho jati hai. Breakout: Pennant formation ke baad, ek breakout hota hai, jo ki usually flagpole ke direction mein hota hai. Agar flagpole uptrend mein hai, to breakout bhi upward hota hai, aur agar flagpole downtrend mein hai, to breakout downward hota hai. Volume Analysis: Breakout ke samay volume ki bhi analysis karni chahiye. High volume breakout usually stronger hota hai. Target Price: Pennant pattern se aap ek approximate target price nikal sakte hain. Iske liye flagpole ki height ko breakout point se measure karna hota hai, aur usse future price target nikala ja sakta hai. How to trade Pennant chart pattern Forex market mein Pennant chart pattern ko trade karne ke liye, aap ye steps follow kar sakte hain: Pennant Pattern Ki Understanding: Pehle toh aapko Pennant chart pattern ko samajhna hoga. Ye ek continuation pattern hota hai, jo market mein short-term consolidation ko represent karta hai, phir market trend ke direction mein move karta hai. Price Confirmation: Pennant pattern ko trade karne se pehle, aapko iske saath price action ko confirm karna hoga. Dekhein ki price Pennant pattern ke andar kis direction mein move kar rahi hai. Entry Point: Jab aapko lagta hai ki Pennant pattern confirm ho gaya hai aur market ek direction mein move kar raha hai, toh entry point ko determine karein. Aap entry point ke liye breakout ka wait kar sakte hain, jab price Pennant ke upper ya lower trendline ko cross karta hai. Stop Loss and Take Profit: Hamesha ek stop loss aur take profit level set karein, taaki aapka risk management ho. Stop loss aapko loss se bachata hai, aur take profit aapko profit booking mein madadgar hota hai. Risk Management: Apne trading account ke liye ek risk management plan banayein aur usse follow karein. Jyada risk na lein aur apne trading capital ko surakshit rakhein. Practice: Pennant pattern ko trading practice ke through samjhein. Demo account par trading karein ya historical price data ko use karke backtesting karein. News and Economic Events: Forex market mein trading karte waqt, market news aur economic events ko dhyan mein rakhein, kyunki ye trading decisions par prabhavit ho sakte hain. Continued Learning: Forex trading ek dynamic market hai, isliye aapko hamesha naye gyaan aur strategies sikhne ke liye taiyar rehna chahiye. -

#6 Collapse

Asslam O Alikum umeed ha ap sb khairiat se hn gy or apka exchanging week acha jaa raha ho ga.aj ki post fundamental murmur continuation designs principal se flag diagram designs ko concentrate on karen gy or dekhen gy ye kia hota ha or esko kesy exchange kia hata ha. WHAT IS Flag Example? dear individuals pennat design aik continuation design ha mtlb k ye jis pattern fundamental bnta ha us pattern k proceed hony ki nishani hota ha.agr bullish principal bny to es k breakout k awful market bullish hoti ha.or then again agr negative fundamental bny to es k breakout k terrible market negative hoti ha. Es design ki 2 sorts hoti hain Bullish flag design.Negative Flag Example. in dono designs ko murmur bari talk about karen gy Bullish Flag Example: dear individuals ye design bullish pattern primary bnta ha jb market kafi opr ja chuki ho to advertise thori retracement leti ha or estrha ka design bnta ha.es primary market more promising low points or worse high points bnati ha.Highs ko highs se milaen to aik pattern line bnti ha kr lows ko lows se mila k dosri pattern line bnti ha estrha market 2 pattern lines k darmyan move karti ha. How to exchange it? Dear individuals bullish flag ko exchange karny k lye hamen chahye k example k complete hony or es k breakout ka stand by karen jb breakout ho jy to uski affirmation ka stand by karen jb affirmation ho jy to murmur es primary purchase ki passage le skty hain or hmara stoploss bullish penneta ki hoper pattern line ya us se nechy ho ga jb k benefit tarhet flag ki level k equivalent ho ga Negative Flag Example: ye design negative pattern principal bnta ha jb market kafi nechy gir chuki ho to showcase retracement lety hovy unite hoti ha or es trha ka design bnta ha.es principal market worse high points or more promising low points bnati ha.lows ko lows se mila kr or highs ko highs se mla k pattern lines bnti ha or market I pattern lines k drmyan move karti ha . How to exchange it? Dear individuals es design primary exchange karny k lye hmn breakout ka stand by karna chahye or eski affirmation k awful sell ki exchange leni chahye or es fundamental hmara stop misfortune flag ki lower pattern line ya us se opr ho ga jb k benefit targe pannent ki level k equivalent ho ga. -

#7 Collapse

PENNANT CHART CANDLESTICK PATTERN:-main Forex aur trading se judi kuchh mool prakriyao ko samajhta hoon, jismein Pennant chart pattern aur candlestick patterns bhi shamil hain. Pennant ek continuation pattern hota hai, jo ki price trend ke dauran aata hai aur usually short-term consolidation periods ke baad dekha jaata hai. Yeh pattern bullish ya bearish trend ke dauran develop ho sakta hai. Pennant chart pattern ek flag jaise dikhta hai, isliye ise flag pattern ke roop mein bhi jana jata hai. Pennant pattern ki kuchh mukhya pehchan ke gun hote hain::max_bytes(150000):strip_icc()/IO-Chart-02152019-5c66c9584cedfd00014aa38e.png) PENNANT CHART CANDLESTICK PATTERN KI PEHCHAN:-Flagpole (Dhwajank): Pehle, ek strong price move hota hai, jise flagpole ke roop mein dekha ja sakta hai. Agar price upar badh raha hai, to flagpole bullish hota hai, aur agar price niche ja raha hai, to flagpole bearish hota hai. Consolidation (Samanvay): Flagpole ke baad ek consolidation phase aata hai, jismein price range-bound hoti hai aur ek pennant-like structure banti hai. Breakout (Tutna): Price consolidation ke baad usually ek breakout hota hai, jismein price ek specific direction mein move karti hai. Agar flagpole bullish tha, to breakout upar hota hai, aur agar bearish tha, to breakout niche hota hai. Volume (Miqdaar): Pennant pattern ke dauran volume bhi mahatvapurn hota hai. Normally, jab price consolidation ke dauran volume kam hota hai, to yeh ek indication ho sakta hai ki market me uncertainty hai. Breakout ke samay, volume me tezi se badlav hota hai, jo trend direction ko confirm karta hai. Price Target (Lakshya Kimat): Pennant pattern ka ek tarika hota hai price target calculate karne ka. Iske liye, flagpole ki height ko calculate karen aur usse breakout point se add karen (agar bullish pattern hai) ya subtract karen (agar bearish pattern hai). Isse aapko approximate price target mil sakta hai. Stop Loss (Nuksan Rokna): Trading me, hamesha stop-loss order set karna mahatvapurn hota hai, taaki aap apne nuksan ko control kar saken. Agar aap pennant pattern ke sath trading kar rahe hain, to stop-loss order ko ek strategy ka hissa banaye taaki aap nuksan se bach saken. Confirmation (Pakki Tasdeek): Pennant pattern ko trading decision ke liye istemal karne se pehle, aapko dusre technical indicators aur analysis tools ka bhi istemal karke pattern ki tasdeek karni chahiye. Yeh aapko false signals se bacha sakta hai. Yad rahe, trading risk aur market volatility ke sath juda hua hota hai, aur har pattern 100% sahi nahi hota. Isliye, trading ke liye hamesha cautious approach rakhein aur risk management ko samjhein. Agar aapne trading shuru ki hai ya fir seekh rahe hain, to practice trading demo account par karke apne skills ko sudhar sakte hain.

PENNANT CHART CANDLESTICK PATTERN KI PEHCHAN:-Flagpole (Dhwajank): Pehle, ek strong price move hota hai, jise flagpole ke roop mein dekha ja sakta hai. Agar price upar badh raha hai, to flagpole bullish hota hai, aur agar price niche ja raha hai, to flagpole bearish hota hai. Consolidation (Samanvay): Flagpole ke baad ek consolidation phase aata hai, jismein price range-bound hoti hai aur ek pennant-like structure banti hai. Breakout (Tutna): Price consolidation ke baad usually ek breakout hota hai, jismein price ek specific direction mein move karti hai. Agar flagpole bullish tha, to breakout upar hota hai, aur agar bearish tha, to breakout niche hota hai. Volume (Miqdaar): Pennant pattern ke dauran volume bhi mahatvapurn hota hai. Normally, jab price consolidation ke dauran volume kam hota hai, to yeh ek indication ho sakta hai ki market me uncertainty hai. Breakout ke samay, volume me tezi se badlav hota hai, jo trend direction ko confirm karta hai. Price Target (Lakshya Kimat): Pennant pattern ka ek tarika hota hai price target calculate karne ka. Iske liye, flagpole ki height ko calculate karen aur usse breakout point se add karen (agar bullish pattern hai) ya subtract karen (agar bearish pattern hai). Isse aapko approximate price target mil sakta hai. Stop Loss (Nuksan Rokna): Trading me, hamesha stop-loss order set karna mahatvapurn hota hai, taaki aap apne nuksan ko control kar saken. Agar aap pennant pattern ke sath trading kar rahe hain, to stop-loss order ko ek strategy ka hissa banaye taaki aap nuksan se bach saken. Confirmation (Pakki Tasdeek): Pennant pattern ko trading decision ke liye istemal karne se pehle, aapko dusre technical indicators aur analysis tools ka bhi istemal karke pattern ki tasdeek karni chahiye. Yeh aapko false signals se bacha sakta hai. Yad rahe, trading risk aur market volatility ke sath juda hua hota hai, aur har pattern 100% sahi nahi hota. Isliye, trading ke liye hamesha cautious approach rakhein aur risk management ko samjhein. Agar aapne trading shuru ki hai ya fir seekh rahe hain, to practice trading demo account par karke apne skills ko sudhar sakte hain. -

#8 Collapse

umeed ha ap sb khairiat se hn gy or apka trading week acha jaa raha ho ga.aj ki post key mumble continuation plans head se banner chart plans ko focus on karen gy or dekhen gy ye kia hota ha or esko kesy trade kia hata ha. WHAT IS pennant Model? dear people pennat plan aik continuation plan ha mtlb k ye jis design key bnta ha us design k continue hony ki nishani hota ha.agr bullish head bny to es k breakout k horrendous market bullish hoti ha.or of course agr pessimistic principal bny to es k breakout k awful market pessimistic hoti ha. Es plan ki 2 sorts hoti hain. Bullish pennant Model: dear people ye plan bullish example essential bnta ha jb market kafi opr ja chuki ho to publicize thori retracement leti ha or estrha ka plan bnta ha.es essential market really encouraging depressed spots or more regrettable high focuses bnati ha.Highs ko highs se milaen to aik design line bnti ha kr lows ko lows se mila k dosri design line bnti ha estrha market 2 example lines k darmyan move karti ha.

Bullish pennant Model: dear people ye plan bullish example essential bnta ha jb market kafi opr ja chuki ho to publicize thori retracement leti ha or estrha ka plan bnta ha.es essential market really encouraging depressed spots or more regrettable high focuses bnati ha.Highs ko highs se milaen to aik design line bnti ha kr lows ko lows se mila k dosri design line bnti ha estrha market 2 example lines k darmyan move karti ha.  How to trade it? Dear people bullish banner ko trade karny k lye hamen chahye k model k complete hony or es k breakout ka stand by karen jb breakout ho jy to uski insistence ka stand by karen jb assertion ho jy to mumble es essential buy ki entry le skty hain or hmara stoploss bullish penneta ki hoper design line ya us se nechy ho ga jb k advantage tarhet banner ki level k identical ho ga.

How to trade it? Dear people bullish banner ko trade karny k lye hamen chahye k model k complete hony or es k breakout ka stand by karen jb breakout ho jy to uski insistence ka stand by karen jb assertion ho jy to mumble es essential buy ki entry le skty hain or hmara stoploss bullish penneta ki hoper design line ya us se nechy ho ga jb k advantage tarhet banner ki level k identical ho ga.  Negative Banner Model: ye configuration negative example head bnta ha jb market kafi nechy gir chuki ho to feature retracement lety hovy join hoti ha or es trha ka plan bnta ha.es chief market more regrettable high focuses or really encouraging depressed spots bnati ha.lows ko lows se mila kr or highs ko highs se mla k example lines bnti ha or market I design lines k drmyan move karti ha .

Negative Banner Model: ye configuration negative example head bnta ha jb market kafi nechy gir chuki ho to feature retracement lety hovy join hoti ha or es trha ka plan bnta ha.es chief market more regrettable high focuses or really encouraging depressed spots bnati ha.lows ko lows se mila kr or highs ko highs se mla k example lines bnti ha or market I design lines k drmyan move karti ha .

-

#9 Collapse

Pennant Chart Pattern: Pennant pattern design ko exchange karne se pehle, aapko iske saath cost activity ko affirm karna hoga. Dekhein ki value Flag design ke andar kis heading mein move kar rahi hai.aapko lagta hai ki Flag design affirm ho gaya hai aur market ek course mein move kar raha hai, toh section point ko decide karein. Aap passage point ke liye breakout ka stand by kar sakte hain, poke value Flag ke upper ya lower trendline ko cross karta hai.Hamesha ek stop misfortune aur take benefit level set karein, taaki aapka risk the executives ho. Stop misfortune aapko misfortune se bachata hai, aur take benefit aapko benefit booking mein madadgar hota hai Apne exchanging account ke liye ek risk the board plan banayein aur usse follow karein. Jyada risk na lein aur apne exchanging capital ko surakshit rakhein. Flag design ko exchanging practice ke through samjhein. Demo account standard exchanging karein ya authentic cost information ko use karke back testing karein. Forex market mein exchanging karte waqt, market news aur monetary occasions ko dhyan mein rakhein, kyunki ye exchanging choices standard prabhavit ho sakte hain. Pennant chart pattern or Flag diagram design ek specialized mein istemal hota hai aur yeh market mein sharpen ridge potential cost moves ko distinguish karne ke liye use hota hai. Flag design ek continuation design hota hai, jo ki ek upturn ya downtrend ke beech mein aata hai.Sabse pehle, aapko current cost outline standard dhyan dena hoga. Flag design commonly ek banner ki tarah dikhta hai, jahan ek lambi upturn ya downtrend ke baad ek choti si combination stage hoti hai.Flagpole ek vertical line hoti hai jo pattern se judi hoti hai. Upturn ke case mein yeh up course mein hoti hai, jabki downtrend ke case mein descending heading mein hoti hai. Yeh flagpole pattern areas of strength for ke ko address karta hai, ek little triangle-molded design banta hai, jise flag kehte hain. Yeh normally ek combining trendline design hota hai, jahan cost ki unpredictability kam ho jati hai Flag development ke baad, ek breakout hota hai, jo ki typically flagpole ke bearing mein hota hai. Agar flagpole upturn mein hai, to breakout bhi up hota hai, aur agar flagpole downtrend mein hai, to breakout descending hota hai.Breakout ke samay volume ki bhi investigation karni chahiye. High volume breakout generally more grounded hota hai. Pennant Candle Pattern Ki identification: Flag or Pennat outline design ek specialized investigation apparatus hai jo financial exchange mein istemal hota hai. Ye design ek impermanent union stage ko darust karta hai,Pennant design typically areas of strength for ek ya downtrend ke baad shuru hota hai. Agar cost upswing mein hai to beginning move up hota hai aur agar downtrend mein hai to descending hota hai.move ko flagpole kehte hain, jo ke cost ki forceful move hoti hai. Isme merchants ki dynamic purchasing ya selling hoti hai.Is stage mein cost range-bound hoti hai aur ek flag shape banti hai. Yeh stage typically present moment hota hai. Punch flag shape pura hojata hai, to ek breakout hota hai. Agar cost upswing mein tha, to breakout up hota hai aur agar downtrend mein tha, to descending hota hai.Pennant design ki affirmation ke liye volume ka bhi dehan dena zaroori hai. Breakout ke samay volume commonly increment hota hai.

Pennant chart pattern or Flag diagram design ek specialized mein istemal hota hai aur yeh market mein sharpen ridge potential cost moves ko distinguish karne ke liye use hota hai. Flag design ek continuation design hota hai, jo ki ek upturn ya downtrend ke beech mein aata hai.Sabse pehle, aapko current cost outline standard dhyan dena hoga. Flag design commonly ek banner ki tarah dikhta hai, jahan ek lambi upturn ya downtrend ke baad ek choti si combination stage hoti hai.Flagpole ek vertical line hoti hai jo pattern se judi hoti hai. Upturn ke case mein yeh up course mein hoti hai, jabki downtrend ke case mein descending heading mein hoti hai. Yeh flagpole pattern areas of strength for ke ko address karta hai, ek little triangle-molded design banta hai, jise flag kehte hain. Yeh normally ek combining trendline design hota hai, jahan cost ki unpredictability kam ho jati hai Flag development ke baad, ek breakout hota hai, jo ki typically flagpole ke bearing mein hota hai. Agar flagpole upturn mein hai, to breakout bhi up hota hai, aur agar flagpole downtrend mein hai, to breakout descending hota hai.Breakout ke samay volume ki bhi investigation karni chahiye. High volume breakout generally more grounded hota hai. Pennant Candle Pattern Ki identification: Flag or Pennat outline design ek specialized investigation apparatus hai jo financial exchange mein istemal hota hai. Ye design ek impermanent union stage ko darust karta hai,Pennant design typically areas of strength for ek ya downtrend ke baad shuru hota hai. Agar cost upswing mein hai to beginning move up hota hai aur agar downtrend mein hai to descending hota hai.move ko flagpole kehte hain, jo ke cost ki forceful move hoti hai. Isme merchants ki dynamic purchasing ya selling hoti hai.Is stage mein cost range-bound hoti hai aur ek flag shape banti hai. Yeh stage typically present moment hota hai. Punch flag shape pura hojata hai, to ek breakout hota hai. Agar cost upswing mein tha, to breakout up hota hai aur agar downtrend mein tha, to descending hota hai.Pennant design ki affirmation ke liye volume ka bhi dehan dena zaroori hai. Breakout ke samay volume commonly increment hota hai.  Graph design ek aisa design hota hai jismein market apni development ko complete kar rahi hoti hai aur poke market is candle design ko breakout karti hai to aisi circumstance fundamental apko bohot wonderful passage mil sakti hai aur ap apne different significant investigation ko complete kar sakte hain ya market design apko different time periods bhi accessible ho sakta hai no question hit ap gold or silver key development ko notice karte hain to usmein apko is market design mein bohot zyada benefits of sakte hain kyunke punch aap is candle design ko study karte hain to ap iski development ko hundred percent gold or silver per apply kar sakte hain jismein apko over the course of the very beginning time must yah design mil sakta hai. exchanging market me Flag Graph Example aik banner plan ke designs banne ke badh greetings hoti hai, jisme market pehly up down aur up down development karne ke badh aik up side pe breakout karta hai, jis se market me bohot up side pe teezi ati hai aur market ki pattern up side pe proceed with ho jati hai. Pennant Chart Pattern Trading: Chart market main continuation design ko show karta hai or ye data deta hain ke market kuch dair es design mama move karny ke badh mazeed up move kar sakti hai or dealer ko es design mama ki arrangement ke badh break out ka stand by karna chahiye or phir es data ki base standard exchange karni chahiye. Dealers ke liye ye significant hai ke wo flag ke volume ko anticipate kary. Poke volume low ho ga to combination period make ho jay ga or hit volume increment kar jay to showcase ke break out hony ke chances barh jaty hain. Kuch merchant flag diagram design ko specialized investigation ke sath conjuction mama use karty hain or es base standard market ki development ko affirm karty hain.Pennant design, Forex exchanging mein ek ahem specialized examination instrument hai jo dealers ko market patterns samajhne mein madadgar hota hai. Is design ko samjhna aur sahi tarike se istemal karna dealers ke liye zaroori hai agar woh predictable aur effective exchanging karna chahte hain. Magar yaad rahe, market mein risk hamesha hota hai, aur kisi bhi design ko istemal karne se pehle careful examination aur risk the executives ka amal karna bohat zaroori hai.

Graph design ek aisa design hota hai jismein market apni development ko complete kar rahi hoti hai aur poke market is candle design ko breakout karti hai to aisi circumstance fundamental apko bohot wonderful passage mil sakti hai aur ap apne different significant investigation ko complete kar sakte hain ya market design apko different time periods bhi accessible ho sakta hai no question hit ap gold or silver key development ko notice karte hain to usmein apko is market design mein bohot zyada benefits of sakte hain kyunke punch aap is candle design ko study karte hain to ap iski development ko hundred percent gold or silver per apply kar sakte hain jismein apko over the course of the very beginning time must yah design mil sakta hai. exchanging market me Flag Graph Example aik banner plan ke designs banne ke badh greetings hoti hai, jisme market pehly up down aur up down development karne ke badh aik up side pe breakout karta hai, jis se market me bohot up side pe teezi ati hai aur market ki pattern up side pe proceed with ho jati hai. Pennant Chart Pattern Trading: Chart market main continuation design ko show karta hai or ye data deta hain ke market kuch dair es design mama move karny ke badh mazeed up move kar sakti hai or dealer ko es design mama ki arrangement ke badh break out ka stand by karna chahiye or phir es data ki base standard exchange karni chahiye. Dealers ke liye ye significant hai ke wo flag ke volume ko anticipate kary. Poke volume low ho ga to combination period make ho jay ga or hit volume increment kar jay to showcase ke break out hony ke chances barh jaty hain. Kuch merchant flag diagram design ko specialized investigation ke sath conjuction mama use karty hain or es base standard market ki development ko affirm karty hain.Pennant design, Forex exchanging mein ek ahem specialized examination instrument hai jo dealers ko market patterns samajhne mein madadgar hota hai. Is design ko samjhna aur sahi tarike se istemal karna dealers ke liye zaroori hai agar woh predictable aur effective exchanging karna chahte hain. Magar yaad rahe, market mein risk hamesha hota hai, aur kisi bhi design ko istemal karne se pehle careful examination aur risk the executives ka amal karna bohat zaroori hai.  ye design negative pattern principal bnta ha jb market kafi nechy gir chuki ho to showcase retracement lety hovy unite hoti ha or es trha ka design bnta ha.es fundamental market worse high points or more promising low points bnati ha.lows ko lows se mila kr or highs ko highs se mla k pattern lines bnti ha or market I pattern lines k drmyan move karti ha . design fundamental exchange karny k lye hmn breakout ka stand by karna chahye or eski affirmation k terrible sell ki exchange leni chahye or es primary hmara stop misfortune flag ki lower pattern line ya us se opr ho ga jb k benefit targe pannent ki level k equivalent ho ga.Pennant design ek continuation design hai jo cost graph standard dekha ja sakta hai. Yeh design ek exchanging instrument ki cost development ko address karta hai punch market transitory union ya stop mein hota hai. Is design ko dekh kar brokers ko market ke agle move ka andaza lagana asaan ho jata hai.

ye design negative pattern principal bnta ha jb market kafi nechy gir chuki ho to showcase retracement lety hovy unite hoti ha or es trha ka design bnta ha.es fundamental market worse high points or more promising low points bnati ha.lows ko lows se mila kr or highs ko highs se mla k pattern lines bnti ha or market I pattern lines k drmyan move karti ha . design fundamental exchange karny k lye hmn breakout ka stand by karna chahye or eski affirmation k terrible sell ki exchange leni chahye or es primary hmara stop misfortune flag ki lower pattern line ya us se opr ho ga jb k benefit targe pannent ki level k equivalent ho ga.Pennant design ek continuation design hai jo cost graph standard dekha ja sakta hai. Yeh design ek exchanging instrument ki cost development ko address karta hai punch market transitory union ya stop mein hota hai. Is design ko dekh kar brokers ko market ke agle move ka andaza lagana asaan ho jata hai.

-

#10 Collapse

. Introduction Pennant Chart Pattern, ya forex trading mein aik ahem technical analysis tool hai jo market trends ko samajhne mein madadgar hota hai. 2. Pennant Ki Pechan Pennant ek visual chart pattern hota hai jo market ke upward ya downward movement ko indicate karta hai. Iski pehchan aik flag ya pennant jaisi shape se hoti hai. 3. Bullish Pennant Bullish pennant, jab market uptrend mein hoti hai, woh ban sakti hai. Is mein price mein choti si downtrend hoti hai, phir aik pennant shape banti hai, aur phir price wapis uptrend mein chala jata hai. 4. Bearish Pennant Bearish pennant, jab market downtrend mein hoti hai, woh ban sakti hai. Is mein price mein choti si uptrend hoti hai, phir aik pennant shape banti hai, aur phir price wapis downtrend mein chala jata hai. 5. Trading Strategy Pennant pattern ko samajh kar traders trading decisions lete hain. Bullish pennant dekh kar traders long positions le sakte hain, jabke bearish pennant dekh kar short positions le sakte hain. 6. Entry aur Exit Points Traders ko pennant pattern se entry aur exit points tay karne mein madad milti hai. Entry point typically pennant ke breakout ke baad hota hai, jab price trend ke according move karta hai. 7. Stop-Loss aur Target Trading mein safety ke liye stop-loss aur target levels tay kiye jate hain. Pennant pattern ke basis par traders apne stop-loss aur target levels decide karte hain. 8. Risk Management Har trading strategy mein risk management ahem hota hai. Pennant pattern ka istemal karke traders apne risk ko control kar sakte hain. 9. Conclusion Pennant chart pattern, forex trading mein aik powerful tool hai jo traders ko market trends ko samajhne aur trading decisions lene mein madadgar hota hai. Isko samajhne aur istemal karne ke liye practice aur experience ki zarurat hoti hai. -

#11 Collapse

Assalamu-Alaikum! Dear members Me umeed kerti hoke aap sb khair se hoge or ap sb ka forex trading py kam bahut acha chal rha hoga. Aj jis topic py hum baat kre gy wo Neeche mention hy. Topic : Pennant chart patterns Pennant chart patterns, ya jhandi paternain, technical analysis mein istemal hone wale aham chart patterns hain jo kisi bhi financial market mein trading karne walon ke liye ahem hoti hain. Ye patterns market mein price movement ko analyze karne aur future price direction ka andaza lagane mein madadgar hoti hain. Pennant patterns trading strategies mein istemal ki jati hain aur ye traders ko price ki aur market trend ki samajhne mein madadgar hoti hain. Pennant pattern ka naam iske shape ke resemblance se aya hai, jo ek jhanda ya jhandi jaisa hota hai. Ye pattern do tarah ke hote hain: bullish pennant aur bearish pennant. Explanation Bullish Pennant Bullish pennant pattern tab banta hai jab ek strong uptrend ke baad price mein ek consolidation phase ati hai. Is phase mein price ek chhoti si triangular shape mein move karti hai. Is pattern ko dekh kar traders ko ye samajhna chahiye ke market mein bullish momentum abhi bhi active hai aur future mein price kaafi zor se upar ja sakta hai. Bullish pennant ko samjha jata hai ke buyers ne control maintain kiya hua hai aur ab unka next target upar ki taraf hai. Bullish pennant ko identify karne ke liye, traders ko price chart par ek chhoti si flag ya pennant ki shape dhundni hoti hai jo ek uptrend ke baad ati hai. Is pattern ko confirm karne ke liye, traders price breakout ka wait karte hain, jab price pennant ke upper side se bahar nikalta hai. Is breakout par traders long positions lete hain. Bearish Pennant Bearish pennant pattern tab banta hai jab ek strong downtrend ke baad price mein consolidation phase ati hai aur price ek triangular shape mein move karti hai, lekin is baar neeche ki taraf. Ye pattern traders ko ye indication deta hai ke market mein bearish momentum abhi bhi active hai aur future mein price kaafi neeche ja sakta hai. Bearish pennant ko samjha jata hai ke sellers ne control maintain kiya hua hai aur ab unka next target neeche ki taraf hai. Bearish pennant ko identify karne ke liye, traders ko price chart par ek chhoti si flag ya pennant ki shape dhundni hoti hai jo ek downtrend ke baad ati hai. Is pattern ko confirm karne ke liye, traders price breakout ka wait karte hain, jab price pennant ke lower side se bahar nikalta hai. Is breakout par traders short positions lete hain. Yad rahe ke pennant patterns sirf ek tool hain aur inko dusri technical indicators aur analysis ke saath istemal karna behtar hota hai. Market mein kisi bhi pattern ka 100% guarantee nahi hota, isliye risk management ka bhi dhyan rakhna zaroori hai. Traders ko market mein entry aur exit points ko carefully plan karna chahiye aur stop-loss orders ka istemal karke apne positions ko protect karna chahiye. -

#12 Collapse

PENNANT CHART PATTERN DEFINITION Technical analysis Mein pennantt chart Ek type ka containation ka pattern hai jisse FLAGpole ke naam se Jana jata hai Jab security Mein Ek large movement Hoti Hai To in ke consolidation ki.. Ke dauran trend ki line change hoti hai jismein ek se two Tak rahti Hain Iske bad break out ke dauran volume Mein Bara izaafa Hona chahie initial move ko large volume ke sath complete Kiya jata hai aur traders symmetrical Triangle ki upri trend line se break out per Nazar rakhte Hain flagpole ka Pichhle trends ki higher represent karta hai bahut se traders pennant chart pattern se break out ke new long ya short position mein enter hote nazar ate hai UNDERSTANDING OF PENNANT ek bullish ka pennant ban raha hai Aur vah pennant ki upri trend line ke bilkul upar Ek limit buye order De sakta hai Jab security khatam ho Jaati Hai To traders is pattern ki confirmation karne ke liye average volume Se zyada Talash kar sakta hai jab tak vah price ke target Tak Nahin pahunch Jata us Waqt Tak vah Apne position ko barkrar Rakh sakte hain stop loss level Aksar pennant pattern ke sabse nichle point per set Kiya jata hai Kyunki ine level se pattern Ek long term reversal ke start ko maloomat kar sakti hain zyadatar traders pattern ko technical analysis ki confirmation ke bad istemal Karte Hain

UNDERSTANDING OF PENNANT ek bullish ka pennant ban raha hai Aur vah pennant ki upri trend line ke bilkul upar Ek limit buye order De sakta hai Jab security khatam ho Jaati Hai To traders is pattern ki confirmation karne ke liye average volume Se zyada Talash kar sakta hai jab tak vah price ke target Tak Nahin pahunch Jata us Waqt Tak vah Apne position ko barkrar Rakh sakte hain stop loss level Aksar pennant pattern ke sabse nichle point per set Kiya jata hai Kyunki ine level se pattern Ek long term reversal ke start ko maloomat kar sakti hain zyadatar traders pattern ko technical analysis ki confirmation ke bad istemal Karte Hain  EXAMPLE WITH THE PENNANT Example ke Taur per consolidation ke phase ke dauran relatives strength index ki levels ko dekh sakte hain over sold level Tak pahunch sakte hain pennant Jahan brack out Ek new support level banaa sakta hai stock Jab Tut Jata Hai To ek pennant paiyda karta hai consolidation. Ka experience karta hai traders level se break out ko buying ka opportunity dekh sakte hain aur profit kama sakte hai aur is ki identify moving average ke Taur per ki Jaati Hai

EXAMPLE WITH THE PENNANT Example ke Taur per consolidation ke phase ke dauran relatives strength index ki levels ko dekh sakte hain over sold level Tak pahunch sakte hain pennant Jahan brack out Ek new support level banaa sakta hai stock Jab Tut Jata Hai To ek pennant paiyda karta hai consolidation. Ka experience karta hai traders level se break out ko buying ka opportunity dekh sakte hain aur profit kama sakte hai aur is ki identify moving average ke Taur per ki Jaati Hai

-

#13 Collapse

WHAT IS PENNANT PATTERN? dear members pennat pattern aik continuation pattern ha mtlb k ye jis trend main bnta ha us trend k continue hony ki nishani hota ha.agr bullish main bny to es k breakout k bad market bullish hoti ha. or agr bearish main bny to es k breakout k bad market bearish hoti ha. Es pattern ki 2 types hoti hain Bullish pennant pattern. Bearish Pennant Pattern. in dono patterns ko hum bari bari discuss karen gy Bullish Pennant Pattern: dear members ye pattern bullish trend main bnta ha jb market kafi opr ja chuki ho to market thori retracement leti ha or estrha ka pattern bnta ha. es main market higher lows or lower highs bnati ha. Highs ko highs se milaen to aik trend line bnti ha kr lows ko lows se mila k dosri trend line bnti ha estrha market 2 trend lines k darmyan move karti ha.How to trade it? Dear members bullish pennant ko trade karny k lye hamen chahye k pattern k complete hony or es k breakout ka wait karen jb breakout ho jy to uski confirmation ka wait karen jb confirmation ho jy to hum es main buy ki entry le skty hain or hmara stoploss bullish penneta ki hoper trend line ya us se nechy ho ga jb k profit tarhet pennant ki height k equal ho ga. How to trade Pennant chart pattern Forex market mein Pennant chart pattern ko trade karne ke liye, aap ye steps follow kar sakte hain: Pennant Pattern Ki Understanding: Pehle toh aapko Pennant chart pattern ko samajhna hoga. Ye ek continuation pattern hota hai, jo market mein short-term consolidation ko represent karta hai, phir market trend ke direction mein move karta hai. Price Confirmation: Pennant pattern ko trade karne se pehle, aapko iske saath price action ko confirm karna hoga. Dekhein ki price Pennant pattern ke andar kis direction mein move kar rahi hai. Entry Point: Jab aapko lagta hai ki Pennant pattern confirm ho gaya hai aur market ek direction mein move kar raha hai, toh entry point ko determine karein. Aap entry point ke liye breakout ka wait kar sakte hain, jab price Pennant ke upper ya lower trendline ko cross karta hai. Stop Loss and Take Profit: Hamesha ek stop loss aur take profit level set karein, taaki aapka risk management ho. Stop loss aapko loss se bachata hai, aur take profit aapko profit booking mein madadgar hota hai. Risk Management: Apne trading account ke liye ek risk management plan banayein aur usse follow karein. Jyada risk na lein aur apne trading capital ko surakshit rakhein. Practice: Pennant pattern ko trading practice ke through samjhein. Demo account par trading karein ya historical price data ko use karke backtesting karein. Pennant Pattern Kya Hota Hai? Pennant pattern ek continuation pattern hai jo price chart par dekha ja sakta hai. Yeh pattern ek trading instrument ki price movement ko represent karta hai jab market temporary consolidation ya pause mein hota hai. Is pattern ko dekh kar traders ko market ke agle move ka andaza lagana asaan ho jata hai.

-

#14 Collapse

Forex Main Pennant Chart Patterns

Pennant chart patterns forex trading mein ahem hain. Yeh patterns price action ki ek tarah hain jo traders ko price movement ko predict karne mein madad karte hain. Pennant patterns ek mukhtasar arsay mein hotay hain aur market mein short-term trends ko indicate karte hain.

Pennant Ki Tareef

Pennant ek continuation pattern hai jo market mein uptrend ya downtrend ke doran ban sakta hai. Yeh pattern ek flag ki tarah hota hai jo pole ke around form hota hai. Iski bunyadi tareef yeh hai ke yeh ek choti si range mein hota hai jo ek market trend ke doran form hoti hai.

Pennant Patterns Ke Components

Pennant pattern mein do mukhtalif components hote hain.

Pole

Yeh pole ek vertical move hota hai jo trend ki direction ko indicate karta hai aur pennant pattern ka foundation hota hai.

Pennant

Yeh ek choti si rectangular shape ki hoti hai jo pole ke baad form hoti hai. Isme price ek tight range mein consolidate hoti hai.

Pennant Patterns Ke Mukhtalif Types

Pennant patterns ki mukhtalif types hote hain jinmein shaamil hain.

Bullish Pennant

Yeh pattern uptrend ke doran ban sakta hai aur yeh ek temporary pause ko darust karta hai jisme price consolidate hoti hai. Iske baad market usually uptrend mein continue karta hai.

Bearish Pennant

Yeh pattern downtrend ke doran dekha ja sakta hai aur yeh bhi ek temporary consolidation period ko darust karta hai. Iske baad market usually downtrend mein continue karta hai.

Pennant Patterns Ke Formation Ki Sharait

Pennant patterns ki formation ke liye kuch zaroori sharait hote hain.

Volume

Pennant pattern ke formation ke doran volume usually decrease hota hai. Yeh indicate karta hai ke market mein activity kam ho rahi hai aur traders range-bound price movement ko dekh rahe hain.

Time Frame Pennant patterns short-term hotay hain aur usually kuch hafton ya dinon mein form hote hain.

Price Consolidation

Pennant pattern ke doran price ek tight range mein consolidate hoti hai, jo ke ek flag ki tarah hoti hai.

Pennant Patterns Ke Trading Strategies

Pennant patterns ke trading strategies include kuch mukhtalif approaches.

Entry Point

Traders usually entry point ko pole ke breakout ke baad set karte hain. Agar uptrend mein hain, toh entry point ko pole ke high ke breakout ke baad set karte hain aur agar downtrend mein hain, toh pole ke low ke breakout ke baad.

Stop Loss

Stop loss ko typically pennant ke opposite side ke breakout ke thodi der baad lagaya jata hai taake false breakouts ko avoid kiya ja sake.

Target Price

Target price ko usually pole ke height se calculate kiya jata hai aur traders is price ko apna profit-taking level set karte hain.

Pennant Patterns Ke Benefits aur Challenges

Pennant patterns ke istemal ke kuch faide aur challenges hote hain:

Benefits

Pennant patterns short-term traders ke liye mufeed hotay hain jo quick profits kamana chahte hain. Yeh bhi trend continuation ko identify karne mein madadgar hote hain.

Challenges

False breakouts ko identify karna mushkil ho sakta hai aur market mein volatility ke doran pennant patterns ki accuracy kam ho sakti hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

PENNANT CHART CANDLESTICK PATTERN:-

Pennant Chart Candlestick Pattern: Forex Mein Ek Mukhya Technical Analysis Tool

Forex trading mein safal hone ke liye, traders ko market ka gahra gyaan aur technical analysis ke mool tatvaon ko samajhna zaroori hai. Candlestick patterns aur chart patterns is technical analysis ke pramukh hisse hain jo traders ko market ke price action aur trend ka pata lagane mein madad karte hain. Ek aham chart pattern jo traders ka dhyan apni taraf akarshit karta hai, woh hai "Pennant Chart Candlestick Pattern."

1. Introduction to Candlestick Patterns: Candlestick patterns ek prakar ke chart patterns hain jo market ke price action ko represent karte hain. Har ek candlestick chart par, har candle ek specific time period ki trading activity ko darshata hai. Har candlestick ke do hisse hote hain: body aur shadows (ya wicks). Body candle ki opening aur closing price ke beech ki range ko darshata hai, jabki shadows ya wicks high aur low prices ko darshate hain.

2. Pennant Chart Pattern ki Pehchan: Pennant chart pattern ek continuation pattern hai jo market mein ek temporary pause ya consolidation ko darshata hai, phir se trend direction mein jaari hone ke baad. Yeh pattern ek flag ya pennant jaise dikhta hai, jisme price ek triangle ke andar hoti hai. Yeh usually ek uptrend ya downtrend ke beech mein dikhta hai aur traders ko trend continuation ka indication deta hai.

3. Pennant Chart Pattern ke Pramukh Gun: Pennant chart pattern ko samajhne ke liye kuch mukhya gun hote hain:- Trend: Pennant pattern ko pehchane ke liye, pehle current trend ka pata lagana zaroori hai. Pennant usually existing trend ke beech mein dikhta hai.

- Volume: Price ke sath volume ka analysis karna bhi zaroori hai. Typically, pennant formation ke doran volume decrease hota hai, indicating consolidation phase.

- Symmetrical Triangle: Pennant usually symmetrical triangle ke andar hota hai jisme price ek tight range mein trade hoti hai.

4. Pennant Chart Pattern ka Prayog: Pennant chart pattern ko samajh kar, traders ko trading decisions lene mein madad milti hai. Jab pennant pattern detect hota hai, traders ko following steps follow karne chahiye:- Entry Point: Agar price pennant ke breakout ke direction mein move karta hai, traders ko entry point par trade karna chahiye.

- Stop Loss: Stop loss order ko set karna zaroori hai taki unforeseen market movements se protect kiya ja sake.

- Target: Traders ko target level ko set karna chahiye, jisme wo profits lock kar sakein.

5. Pennant Pattern ka Misaal: Maan lo ki ek forex pair mein uptrend dikhai de rahi hai aur phir ek pennant pattern detect hota hai. Agar price pennant ke upper trendline ko break karta hai, toh traders ko long position lena chahiye target ke towards. Stop loss order ko lower trendline ke niche set kiya ja sakta hai.

6. Trading Risks aur Precautions: Har trading strategy ke saath risk juda hota hai, isliye traders ko hamesha risk management ko dhyan mein rakhna chahiye. Stop loss order ka istemal karna, position sizing ka dhyan rakhna aur emotions par control rakhna kuch important precautions hain jo traders ko follow karna chahiye.

7. Conclusion: Pennant chart pattern ek powerful technical analysis tool hai jo traders ko market trends ko samajhne aur trading opportunities ko explore karne mein madad karta hai. Is pattern ko samajhne ke liye, traders ko market ke trend ko identify karna, volume ka analysis karna aur symmetrical triangle ko samajhna zaroori hai. Saath hi, trading decisions lene se pehle risk management ka bhi dhyan rakhna chahiye. Overall, pennant pattern ek valuable addition hai har ek trader ke toolkit mein jo unhein market mein safal hone mein madad karta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:58 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим