How To Trade With Support and Resistance In Forex

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

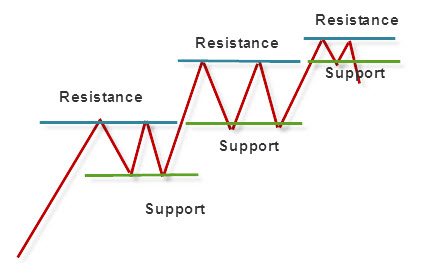

Introduction to Support and Resistance Support aur resistance levels Forex trading ke duniya mein ahem taur par mawaad hain. Ye levels currency pair ke chart par aise ahem keemat ki taraf ishara karte hain jahan market participants ke amal price reversals ya tezi se tabdeel hone ka zariya bante hain. Support levels asal mein floorno ki tarah kaam karte hain, jahan par khareedari ki rujhan aksar is baat ko rokne mein madadgar hoti hai ke prices mazeed girne se bach jayein, jabke resistance levels asal mein chhaton ki tarah kaam karte hain, jahan par bechne ki rujhan aksar mazeed upri harkat ko dabane mein madadgar hoti hai. In levels ko samajhna aur effectively istemal karna tijarati strategies ka behtareen banna hai. Support and Resistance Levels Support aur resistance levels mukhtalif factors ki bina par bante hain, jaise ke psychological influences, supply aur demand dynamics, historical price action, market sentiment, aur trendlines. Traders aksar psychological levels, jaise ke round numbers, par zyada tawajjo dete hain, kyun ke yeh aksar ahem market tawajjo ko attract karte hain aur support ya resistance zones ban jate hain. Is ke ilawa, pichli unchi aur nichli keematain, sath hi sath chart par key turning points, horizontal support aur resistance levels ke tor par kaam kar sakti hain. Trendlines, dono taraaf ki (ascending aur descending), dynamic support aur resistance zones faraham karte hain, jabke moving averages aur pivot points in ahem levels ko pehchanne ke liye ahem technical tools faraham karte hain. [IMG]https://www.************.com/attachment/image/1719867?d=1437780887[/IMG] Identifying Support and Resistance Levels Support aur resistance levels pehchanne ka ek maharat hai jo har Forex trader ko develop karna zaroori hai. Horizontal support aur resistance levels ko pehchanne mein aam taur par asanai hoti hai, jo aksar aise khaas keematon ko shamil karte hain jahan peechle mein ulat-phir ya ittefaq hua hai. Ye levels aksar round numbers ya yaadgar historical price levels se jurne sakte hain. Lekin, trendlines ko pehchanna significant lows ko uptrend mein ya highs ko downtrend mein jorne ki darkhwast karta hai, jo diagonal lines bana deti hain jo dynamic support aur resistance faraham karte hain. Moving averages, chahe woh simple ya exponential hon, price data ko smooth karte hain aur traders ko trends aur potential support ya resistance areas pehchanne mein madadgar hote hain. Pivot points, pichle din ke price action ke aadhar par calculate kiye jate hain, din traders ke liye central pivot points aur support aur resistance levels faraham karte hain.

Support and Resistance Levels Support aur resistance levels mukhtalif factors ki bina par bante hain, jaise ke psychological influences, supply aur demand dynamics, historical price action, market sentiment, aur trendlines. Traders aksar psychological levels, jaise ke round numbers, par zyada tawajjo dete hain, kyun ke yeh aksar ahem market tawajjo ko attract karte hain aur support ya resistance zones ban jate hain. Is ke ilawa, pichli unchi aur nichli keematain, sath hi sath chart par key turning points, horizontal support aur resistance levels ke tor par kaam kar sakti hain. Trendlines, dono taraaf ki (ascending aur descending), dynamic support aur resistance zones faraham karte hain, jabke moving averages aur pivot points in ahem levels ko pehchanne ke liye ahem technical tools faraham karte hain. [IMG]https://www.************.com/attachment/image/1719867?d=1437780887[/IMG] Identifying Support and Resistance Levels Support aur resistance levels pehchanne ka ek maharat hai jo har Forex trader ko develop karna zaroori hai. Horizontal support aur resistance levels ko pehchanne mein aam taur par asanai hoti hai, jo aksar aise khaas keematon ko shamil karte hain jahan peechle mein ulat-phir ya ittefaq hua hai. Ye levels aksar round numbers ya yaadgar historical price levels se jurne sakte hain. Lekin, trendlines ko pehchanna significant lows ko uptrend mein ya highs ko downtrend mein jorne ki darkhwast karta hai, jo diagonal lines bana deti hain jo dynamic support aur resistance faraham karte hain. Moving averages, chahe woh simple ya exponential hon, price data ko smooth karte hain aur traders ko trends aur potential support ya resistance areas pehchanne mein madadgar hote hain. Pivot points, pichle din ke price action ke aadhar par calculate kiye jate hain, din traders ke liye central pivot points aur support aur resistance levels faraham karte hain.  Trading Strategies with Support and Resistance Support aur resistance levels ko shamil karne wali trading strategies aksar kargar hoti hain. Ek aam tareeqa breakout trading hota hai. Jab prices resistance level ko paar karte hain, to yeh bullish trend continuation ka ishara ho sakta hai, jis se traders ko stop-loss orders ke saath long positions enter karne ke liye motivate hota hai, jabke prices support level ko paar karte hain, to yeh bearish trend continuation ko darust kar sakta hai, jis se traders ko stop-loss orders ke saath short positions enter karne ke liye motivate hota hai. Lekin traders ko fakeouts se bachne ke liye savdhan rehna chahiye, jahan prices briefly inn levels ko paar karte hain phir ulta ho jate hain. Is risk ko kam karne ke liye, traders additional technical indicators ka istemal kar sakte hain ya trade enter karne se pehle confirmation ka intezar kar sakte hain. Ek aur tareeqa range trading hai, jo range-bound market ke andar support levels ke qareeb khareedari aur resistance levels ke qareeb bechne ko shamil karta hai. Range-bound shirait prices ko establish kiye gaye support aur resistance levels ke darmiyan oscillate hone ke zariye ki jati hain, jo traders ko us range ke andar price swings se faida uthane ke liye mauka deti hain. Traders ko is strategy ko istemal karte waqt sabr aur discipline ka istemal karna chahiye, kyun ke unka maqsad us establish range ke andar choti price movements ko capture karna hota hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Trading Strategies with Support and Resistance Support aur resistance levels ko shamil karne wali trading strategies aksar kargar hoti hain. Ek aam tareeqa breakout trading hota hai. Jab prices resistance level ko paar karte hain, to yeh bullish trend continuation ka ishara ho sakta hai, jis se traders ko stop-loss orders ke saath long positions enter karne ke liye motivate hota hai, jabke prices support level ko paar karte hain, to yeh bearish trend continuation ko darust kar sakta hai, jis se traders ko stop-loss orders ke saath short positions enter karne ke liye motivate hota hai. Lekin traders ko fakeouts se bachne ke liye savdhan rehna chahiye, jahan prices briefly inn levels ko paar karte hain phir ulta ho jate hain. Is risk ko kam karne ke liye, traders additional technical indicators ka istemal kar sakte hain ya trade enter karne se pehle confirmation ka intezar kar sakte hain. Ek aur tareeqa range trading hai, jo range-bound market ke andar support levels ke qareeb khareedari aur resistance levels ke qareeb bechne ko shamil karta hai. Range-bound shirait prices ko establish kiye gaye support aur resistance levels ke darmiyan oscillate hone ke zariye ki jati hain, jo traders ko us range ke andar price swings se faida uthane ke liye mauka deti hain. Traders ko is strategy ko istemal karte waqt sabr aur discipline ka istemal karna chahiye, kyun ke unka maqsad us establish range ke andar choti price movements ko capture karna hota hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:50 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим