Bearish Flag pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

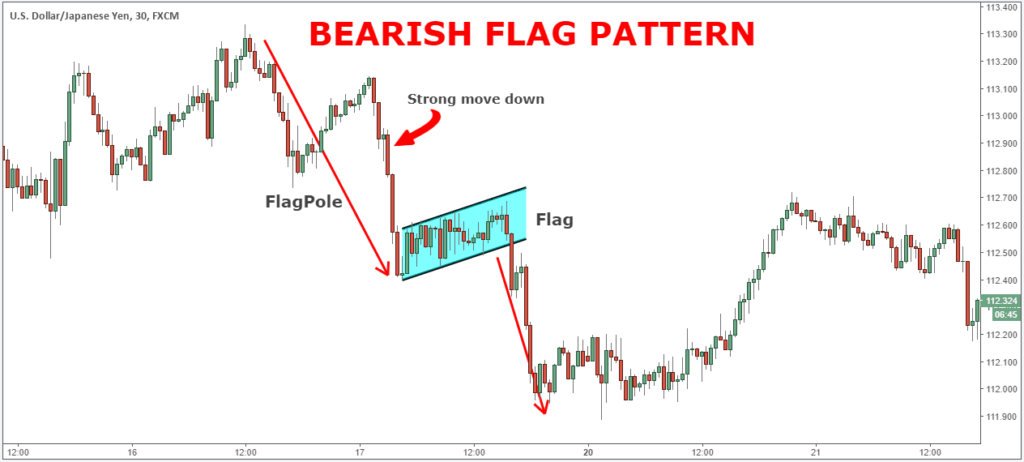

AOA Introduction Friends kya haal hai aapke main u need karta hun aap khairiyat se Honge Aaj is topic ko Ham discuss Karenge vah Hai bearish flag pattern Hameshah trader's es ko analysis ke liye use karte hain aur ham is pattern ko Apne trade Mein use karte hain ya Jab yah pattern trading chart Mein appear Hota Hai To Ham is pattern ke mutabik Kaise trade Karen ki Hamen market Se Achcha benefits Hasil Ho isko understand karne ki koshish Karte Hain Bearish Flag Pattern Bearish flag pattern traders ke liye ek Sell signal provide Karta Hai is pattern ke mutabik price ka Dobara ya down trend Shuru Hone ke chances hote hain traders is pattern Ko Dekhkar short position Le sakte hain yah exiting short position ko hold kar sakte hain (Some important rule of this pattern) Flag Pole Bearish flag pattern ki formation ka pahla step Hota Hai Jab Kisi stock ya assist ki price mein ek strong down trend hota hai is down trend ko flagpole Kahate Hain Flag Formation Flag Pol ke bad price Mein Ek consolidation phase aata hai Jise flag Kahate Hain yah consolidation phase usually price Mein sideways moment ya slight upar Neeche ke movement ko intecate Karta Hai flag formation Ek rectangle Ya parallelogram Ki Tarah dikhi deta hai Break out Bearish flag pattern tab confirmation Hota Hai Jab flag formation ke bad price niche ki taraf break out Karti Hai break out ka matlab hota hai ki price flag ke bottom ko cross Karke Don ki taraf Jaane Lagti Hai Target Traders or invester usually is pattern ko Dekhte Hue Ek target set karte hain target ka calculation flag Pole ki length Se Kiya jata hai flagpole ki length ko flag ke break out point se niche extend Karke target level decide Karte Hain Volume Analysis Is pattern ko understand karne ke liye volume analysis bhi important hai agar flag formation ke dauran volume decrease hoti hai aur break out ke sem volume increase hota hai to yah pattern stronger Hota Hai lekin yah Baat aapke zahan Mein honi chahie ki flag pattern bhi 100% accurate Nahin Hota isliye traders ko is pattern ke sath sath Aur Bhi factors ko analysis karna chahie jasse overall market trend support and resistance level aur news event Etc -

#3 Collapse

Bearish Flag Pattern

Bearish flag pattern ek ahem technical analysis tool hai jo ke market mein hone wale bearish price movements ko identify karne mein madad deta hai. Yeh pattern ek flag jaise dikhta hai jismein price action ek downtrend ke dauran milti hai. Bearish flag pattern ek continuation pattern hai, jo ke ek downtrend ke beech mein dekha jata hai aur isay bearish trend ke further continuation ka indication samjha jata hai. Is pattern ko samajh kar traders aur investors ko market ki movement ko samajhne mein madad milti hai aur unhe sahih trading decisions lene mein madad milti hai.

Bearish flag pattern ka nam isliye hai kyunke yeh ek flag jaise dikhta hai jismein flag pole aur ek flag hota hai. Flag pole ek sudden downward price movement ko darust karta hai jo ke phir ek sideways movement ya consolidation phase mein aata hai aur flag ko banata hai. Flag ke baad phir se ek downward price movement hota hai, jo ke original downtrend ke continuation ka indication hota hai.

Bearish flag pattern ko recognize karne ke liye, traders ko kuch key elements par tawajju deni hoti hain:- Flag Pole: Flag pole ek sudden downward price movement ko represent karta hai jo ke bearish trend ka initial phase hota hai. Is downward movement ke doran volume barh jata hai aur market mein strong selling pressure mehsoos hoti hai.

- Flag: Flag ek sideways price consolidation phase ko represent karta hai jo ke flag pole ke baad hota hai. Is phase mein price ek rectangle ya parallelogram ki shakal mein move karta hai, aur volume typically kam hota hai.

- Breakout: Bearish flag pattern ka confirmation ek breakout ke sath hota hai. Jab price flag ke neeche se breakout karta hai, to yeh bearish trend ke continuation ka indication hota hai aur traders ko short positions lena recommend kiya jata hai.

Bearish flag pattern ko samajhne ke liye, traders ko kuch points ka khayal rakhna zaroori hai:- Trend Confirmation: Bearish flag pattern ka istemal karne se pehle, traders ko market ke overall trend ko confirm karna zaroori hai. Agar market already bearish hai, to bearish flag pattern ka impact zyada hota hai.

- Volume Analysis: Is pattern ko confirm karne ke liye, traders ko trading volumes ka bhi tajziya karna zaroori hai. Agar breakout ke doran volume barh jata hai, to yeh pattern zyada reliable hota hai.

- Risk Management: Har trading strategy mein, risk management bohot ahem hai. Bearish flag pattern ke istemal mein bhi traders ko stop loss orders ka istemal karna chahiye taake nuksan se bacha ja sake aur unki trading capital ko surakshit rakha ja sake.

Bearish flag pattern ka istemal karke, traders ko market mein hone wale potential price movements ka idea milta hai aur unhe sahih trading decisions lene mein madad milti hai. Is pattern ko samajh kar traders bearish trends ke continuation mein shamil ho sakte hain aur is tarah se profits earn kar sakte hain.

Bearish flag pattern ke mukhtalif variations bhi hoti hain jo ke traders ko mukhtalif market conditions ke mutabiq sahih maloomat faraham karte hain. Kuch common variations is pattern mein shamil hain:- Descending Flag: Descending flag pattern mein flag ke lines ko neeche ki taraf slope hoti hai. Yeh pattern ek strong downtrend ke doran dekha jata hai aur bearish trend ke continuation ka indication hota hai.

- Rectangular Flag: Rectangular flag pattern mein flag ka shape rectangle ki tarah hota hai, jismein price consolidation phase clearly dekhai jati hai.

- Pennant: Pennant pattern ek triangle jaise shape hota hai jo ke flag pole ke baad hota hai. Yeh pattern bhi bearish trend ke doran dekha jata hai aur bearish continuation ka indication hota hai.

Is tarah se, bearish flag pattern ek ahem technical tool hai jo ke traders aur investors ko market ki movement ko samajhne mein madad deta hai. Is pattern ko samajh kar traders ko bearish trends ke continuation mein shamil hone ka mauka milta hai aur is tarah se profits earn karne ka acha moqa milta hai. Magar iske saath hi, traders ko risk management ko bhi dyaan mein rakhna chahiye taake unki trading capital surakshit rahe aur unhe nuksan se bachaya ja sake.

-

#4 Collapse

Forex trading has gained significant popularity in Pakistan in recent years, with many individuals venturing into the financial markets to explore opportunities for profit. Among the various trading strategies employed by traders, one of the commonly used patterns is the Bearish Flag pattern. This article will delve into the intricacies of the Bearish Flag pattern, its significance in forex trading, and how traders in Pakistan can utilize it to make informed decisions.

1. Samajhdaar Trader Ki Pehchaan: Bearish Flag Pattern

Bearish Flag pattern ek aham technical analysis tool hai jo forex market mein istemal hota hai. Is pattern ki pehchaan karnay se traders market ki movements ko samajh sakte hain aur aane wale trends ka andaza lagaa sakte hain. Bearish Flag pattern ka matlab hota hai ke market mein girawat ki sambhavna hai.

2. Bearish Flag Pattern: Kya Hai?

Bearish Flag pattern ek price action pattern hai jo market mein bearish trend ko indicate karta hai. Is pattern mein price mein ek sharp downward movement hoti hai, jo phir ek small sideways movement ke baad dobara neeche ki taraf jaati hai. Is sideways movement ko "flag" kehte hain aur yeh bearish movement ke baad aati hai, isliye ise Bearish Flag pattern kehte hain.

3. Bearish Flag Pattern Ki Tafseelat

Bearish Flag pattern ki tafseelat ko samajhna traders ke liye zaroori hai. Is pattern mein price mein sharp decline ke baad ek rectangular shape ka consolidation phase hota hai jo flag kehlata hai. Is consolidation phase ke doran volume usually decrease hota hai. Phir price mein neeche ki taraf chali jaati hai jo flagpole kehte hain, jo pichle decline ki lambaai hoti hai.

4. Bearish Flag Pattern Ki Pehchan: Kaise Karein?

Bearish Flag pattern ki pehchan karna traders ke liye aham hai taake woh sahi waqt par trade kar sakein. Is pattern ki pehchan ke liye traders ko price chart par dhyaan dena hota hai. Agar price mein ek sharp downward movement ke baad ek sideways movement observed hota hai aur phir price neeche ki taraf chalne lagti hai, to yeh Bearish Flag pattern ka ek indication ho sakta hai.

5. Bearish Flag Pattern Mein Entry Aur Exit Points

Bearish Flag pattern mein entry aur exit points ko determine karna zaroori hai taake traders sahi waqt par trade kar sakein aur loss ko minimize kar sakein. Entry point usually flag break ke baad kiya jata hai, jab price ne flag ki lower trendline ko breach karta hai. Exit point ko determine karne ke liye traders stop loss aur take profit levels ka istemal karte hain.

6. Bearish Flag Pattern Ka Istemal Forex Trading Mein

Bearish Flag pattern ka istemal karke traders forex market mein trading karte waqt price movements ko samajh sakte hain aur profitable trades kar sakte hain. Is pattern ko samajhna aur sahi tafseelat ke saath analyze karna traders ke liye zaroori hai taake woh market ke movements ko predict kar sakein aur apne trades ko successful banayein.

7. Bearish Flag Pattern: Forex Trading Mein Pakistan Ka Istemal

Pakistan mein forex trading ka trend barhta ja raha hai aur traders Bearish Flag pattern jaise technical analysis tools ka istemal karke apni trading ko improve kar rahe hain. Is pattern ko samajhna aur sahi tafseelat ke saath analyze karna Pakistan ke traders ke liye bhi aham hai taake woh market ke movements ko samajh sakein aur apne trading strategies ko refine kar sakein.

Nateeja

Bearish Flag pattern ek aham technical analysis tool hai jo forex trading mein traders ko market ke movements ko samajhne mein madad karta hai. Pakistan ke traders ko bhi is pattern ka istemal karke apni trading ko behtar banane ke liye tayyar rehna chahiye. Saath hi, sahi tafseelat ke saath analyze karna aur risk management ko dhyaan mein rakhte hue trading karna zaroori hai taake traders apne trades ko successful banayein.

- CL

- Mentions 0

-

سا1 like

-

#5 Collapse

Bazaar mein tijarat karne walon ke liye har qisam ke chart patterns ka ilm ahem hota hai. Ye patterns unko bataate hain ke bazaar ka rukh kis taraf ja raha hai aur kis tarah ke transactions unke liye munafa bana sakte hain ya nuqsaan se bacha sakte hain. Ek aham chart pattern jo aksar traders ki tawajju paata hai, wo hai "Bearish Flag". Is article mein, hum bearish flag pattern ke bare mein tafseel se baat karenge.

1. Bearish Flag Kya Hai?

Bearish flag ek technical analysis pattern hai jo kisi security ya stock ke price chart par nazar aata hai. Is pattern ko dekh kar traders samajhte hain ke qeemat kaafi jald girne wala hai. Bearish flag pattern ko dekhne ke liye, price action ko dekha jata hai jo ek flag ki shakal banata hai, jisme price ek neeche ki taraf rukh karta hai.

2. Bearish Flag Pattern Ka Tareeqa-e-Kar

Bearish flag pattern ko pehchanne ke liye, pehle trader ko uptrend mein ek strong move ya price rally dekhni hoti hai. Phir, is rally ke baad price mein ek chhota sa downward movement hota hai, jo ek flag ki shakal banata hai. Ye flag typically ek parallel price channel ke andar hota hai.

3. Flag Pole aur Flag

Bearish flag pattern mein do ahem hisse hote hain: flag pole aur flag. Flag pole wo initial upward movement hota hai jo price chart par vertical line ki shakal mein dikhta hai. Flag, jise kabhi-kabhi consolidation zone bhi kaha jata hai, wo ek chhota sa downward movement hota hai jo flag pole ke baad aata hai.

4. Volume Ka Eham Kirdar

Bearish flag pattern ko confirm karne ke liye volume ka bhi eham kirdar hota hai. Agar flag ke dauran volume kam ho ya girte hue ho, to ye bearish signal ko aur bhi mazboot karta hai.

5. Bearish Flag Pattern Ke Istemal Ke Fawaid

Bearish flag pattern ko samajh kar traders nuqsaan se bach sakte hain aur munafa kamane ke liye sahi waqt ka intezar kar sakte hain. Is pattern ko samajhne se traders ko entry aur exit points ka sahi faisla karne mein madad milti hai.

6. Khatraat aur Muawin Points

Bearish flag pattern ka istemal karne se pehle, traders ko kuch khatraat aur muawin points ka khayal rakhna zaroori hai. Ye shamil kar sakte hain:- Confirmation: Pattern ko confirm karne ke liye, traders ko doosri technical indicators ki bhi zaroorat hoti hai.

- Stop-loss: Har trade ke liye stop-loss ka tay kiya jana chahiye taake nuqsaan se bacha ja sake.

- Risk Management: Trading plan banane ke doran risk management ko bhi madah kardiya jana chahiye.

7. Conclusion

Bearish flag pattern ek mufeed tareeqa hai jisse traders market ke direction aur price action ko samajh sakte hain. Is pattern ki sahi samajh aur istemal se traders apne trading strategies ko improve kar sakte hain aur consistent profits kamane mein madad milti hai. Lekin, is pattern ka istemal karne se pehle, zaroori hai ke traders apne knowledge ko barqarar rakhein aur proper risk management ka khayal rakhein. -

#6 Collapse

Bearish Flag Chart Pattern in Forex Trading

Bearish Flag Chart Pattern

Forex market me bearish flag chart pattern price action analysis me istemal hota hy aur bearish trend ke reversal ko indicate karta hy. Bearish flag pattern bullish move ke bad form hota hy aur traders ke liye trading opportunities create karta hy. Chaliye, bearish flag chart pattern ke ehm points ke bare me complete detail se janein. Bearish flag chart pattern, ek continuation pattern ke sath ek bearish trend ke reversal ki indication deta hy. Is pattern me price me ek bullish move ke bad ek flag-like structure form hota hy. Flag structure ek rectangular shape me hota hy, jisme price range narrow hoti hy. Flag pattern ke bad price dobara bearish move karny ki tendency dikhti hy. Traders bearish flag pattern ko trend reversal aur entry/exit points ke liye istemal karty hein.

Characteristics Of The Bearish Flag Pattern:

Bearish flag pattern ka pata lagane ke liye kuch khasiyat hein. Pehly to, flagpole, jo ke price me initial steep decline hota hy, tezi se aur qareebi vertical hona chahiye. Ye strong selling pressure aur significant move lower ko dikhata hy. Fir us ke bad wali consolidation muddat qareebi narrow honi chahiye, jahan chhoti mombattiyan ya price bars ek tight range me trade karti hein. Pattern ka flag portion flagpole ki height ka 50% se zeyada mana nahin karna chahiye. Agar flag 50% se zeyada retraces karti hy, to ye ishara ho sakta hy ke selling pressure kam ho raha hy aur pattern itna reliable nahin hy. Flag se breakout usually tezi se volume ke sath hota hy, jo ke neechy ki traffic ki continuation ko signal karta hy.

Bearish Flag Candlestick Pattern Trading:- Identification: Pehly to traders ko Bearish Flag Candlestick Pattern ko identify karna hota hy. Is ke liye, price charts aur candlestick patterns ko closely monitor karna zaroori hy.

- Confirmation: Pattern ko confirm karny ke liye, traders doosre technical indicators aur volume analysis ka istemal karty hein. High trading volumes ke sath bearish breakout hone par, us breakout ki credibility badh jati hy.

- Short Positions: Jab bearish flag ka breakout confirm ho jata hy, traders short positions lete hein, expecting ke prices me neechy ki taraf further movement hoga.

- CL

- Mentions 0

-

سا0 like

-

#7 Collapse

Bearish Flag Pattern: Ek Technical Analysis Tool

Bearish Flag Pattern forex trading mein ek mufeed chart pattern hai jo price trends ko identify karne aur trading decisions ko support karne mein madad karta hai. Yeh article aapko bearish flag pattern ke bare mein mufeed maloomat faraham karega.

1. Pattern Ki Formation:

- Bearish flag pattern typically ek downtrend ke doran form hota hai.

- Is pattern mein pehle ek strong downward price move hota hai, jise flagpole kehte hain.

- Phir price mein ek consolidation phase hota hai, jise flag kehte hain, jismein price range-bound rehta hai aur ek flag-like structure banta hai.

2. Key Characteristics:

Flagpole:

Flagpole typically vertical downtrend ke form mein hota hai, jismein price mein ek sharp downward move hota hai.

Flag:

Flag pattern mein price range-bound hota hai aur ek rectangular shape banta hai, jismein price horizontal trend mein rehta hai.

3. Trading Strategy:

Breakout Confirmation:

Traders typically wait karte hain jab price flag pattern ke neeche breakout karta hai, jisse pattern ka confirmation hota hai.

Entry Point:

Breakout ke baad, traders enter karte hain short positions mein, expecting ki price further downward move karega.

Stop-loss Placement:

Stop-loss orders typically flag pattern ke upper side ke breakout level ke upar set kiye jaate hain, jisse nuksaan ko minimize kiya ja sake.

4. Pattern Ki Validity:

- Bearish flag pattern ka pattern tab consider kiya jata hai jab iski formation clearly identifiable ho aur breakout confirm ho.

- False breakouts se bachne ke liye, traders ko breakout confirmation ka wait karna chahiye.

Nateeja:

Bearish flag pattern ek important chart pattern hai jo downtrend ke doran market reversals aur trading opportunities ko predict karne mein madad karta hai. Traders ko is pattern ko sahi se identify karna aur breakout confirmation ka wait karna chahiye, taake unhe sahi trading decisions mil sakein.

-

#8 Collapse

BEARISH FLAG PATTERN:- Introduction:

- Bearish Flag Pattern ek technical analysis tool hai jo stock market mein use hoti hai.

- Yeh pattern price action ko analyze karne mein madad karta hai aur downward trend ki prediction karta hai.

- Understanding the Bearish Flag Pattern:

- Bearish Flag Pattern ek continuation pattern hai jo downward trend ke doran dekha jata hai.

- Is pattern mein ek sharp downward move hota hai, phir ek consolidation phase hota hai jise flag kehte hain, aur phir phir se downward move shuru hota hai.

- Key Characteristics of Bearish Flag Pattern:

- Sharp Downward Move: Pehle phase mein, price mein tezi se girawat hoti hai.

- Consolidation Phase: Dusre phase mein, price range-bound rehti hai aur ek flag ki shape banati hai.

- Downward Continuation: Teesre phase mein, price phir se neeche ki taraf jaati hai.

- Identification of Bearish Flag Pattern:

- Pehchanne ke liye, pehle sharp downward move ko identify karna zaroori hai.

- Phir flag ke shape ki formation dekhni hai jo generally ek rectangle ya parallelogram ki tarah hoti hai.

- Consolidation phase ke doran volume kam hota hai.

- Price breakout ke baad volume barh jata hai.

- Trading Strategies with Bearish Flag Pattern:

- Entry Point:

- Entry point ko flag ke neeche breakout ke baad consider kiya jata hai.

- Breakout ke baad agar volume barh raha hai toh yeh confirmation sign hai.

- Stop Loss:

- Stop loss ko flag ke upper boundary ke thode se upar rakhna chahiye.

- Agar price upper boundary ko cross karti hai toh yeh pattern invalid ho jata hai.

- Target:

- Target ko initial downward move ke height se estimate kiya jata hai.

- Isse ek clear risk-reward ratio maintain hota hai.

- Entry Point:

- Example of Bearish Flag Pattern:

- Ek stock ka price $50 se $40 girne ke baad ek flag formation dikhata hai.

- Consolidation phase ke doran volume kam hota hai.

- Phir price $40 ke neeche breakout karke $35 tak gir jata hai.

- Importance of Bearish Flag Pattern:

- Bearish Flag Pattern traders ko future price movements ka idea deta hai.

- Is pattern ki madad se traders apne trading strategies ko improve kar sakte hain.

- Yeh pattern market ke sentiment ko samajhne mein madad karta hai.

- Limitations of Bearish Flag Pattern:

- Kabhi kabhi false signals bhi generate ho sakte hain.

- Is pattern ki confirmation ke liye breakout ka wait karna zaroori hota hai jo kabhi delay ho sakta hai.

- Market volatility aur unexpected news se pattern ki validity affect ho sakti hai.

- Conclusion:

- Bearish Flag Pattern ek powerful tool hai jo traders ko downward trends ke identification mein madad karta hai.

- Is pattern ko samajhne aur sahi tareeke se istemal karne se traders apne trading performance ko improve kar sakte hain.

- Hamesha risk management aur proper analysis ke sath hi is pattern ko istemal karna chahiye.

- Introduction:

-

#9 Collapse

Bearish Flag pattern?

Bearish Flag pattern forex trading mein ek common chart pattern hai jo price trend ke continuation ya reversal ko indicate karta hai. Neeche diye gaye headings ke zariye Bearish Flag pattern ki kuch khaas characteristics samjha jaa sakta hai:

1. **Tasavvur aur Usool:**

- Bearish Flag pattern ek price continuation pattern hai jo bearish trend ke doran develop hota hai.

- Is pattern ka shape ek flag ki tarah hota hai, jismein ek sharp price decline (flagpole) ke baad ek sideway price consolidation (flag) observed hoti hai.

2. **Formation:**

- Bearish Flag pattern ka formation typically do stages mein hota hai: flagpole aur flag.

- Flagpole ek sharp downward price movement hoti hai, jabki flag ek consolidation period hota hai jismein price sideways move karta hai.

3. **Volume:**

- Bearish Flag pattern ke formation ke doran volume ki decrease ki expectation hoti hai.

- Flagpole ke doran high volume observed hoti hai jabki flag ke doran volume decrease hoti hai indicating market consolidation.

4. **Slope:**

- Flagpole ke slope typically downward hoti hai indicating strong bearish momentum.

- Flag ke slope horizontal ya slightly upward hoti hai indicating price consolidation aur market indecision.

5. **Breakout:**

- Bearish Flag pattern ka breakout typically downside hota hai.

- Jab price flag ke neeche break karta hai, yani flag ke lower boundary ko penetrate karta hai, to yeh bearish breakout signal hota hai.

6. **Confirmation aur Risk Management:**

- Bearish Flag pattern ko confirm karne ke liye traders ko additional technical indicators ka istemal karna chahiye jaise ki volume analysis, support aur resistance levels.

- Risk management ke liye traders ko stop-loss orders lagana chahiye taake unexpected market movements se bacha ja sake.

7. **Trading Strategies:**

- Bearish Flag pattern ko trading strategies mein incorporate karke traders short positions enter kar sakte hain.

- Is pattern ke breakout ke baad traders apne entry aur exit points ko define kar sakte hain.

8. **Historical Analysis aur Practice:**

- Bearish Flag pattern ko identify karne ke liye traders ko historical price data par backtesting aur practice ki zaroorat hoti hai.

- Iske through traders apne trading strategies ko refine kar sakte hain aur better decision making kar sakte hain.

Bearish Flag pattern ek powerful tool hai jo traders ko bearish trend ke continuation ko identify karne mein madad karta hai. Lekin iske istemal se pehle thorough analysis aur risk management ka dhyan rakhna zaroori hai.

منسلک شدہ فائلیں -

#10 Collapse

Bearish Flag pattern ek technical analysis pattern hai jo price action analysis mein istemal hota hai. Ye pattern typically downtrend ke doran form hota hai aur ek continuation pattern ke roop mein dekha jata hai.

Bearish Flag pattern kaise dikhta hai:- Pole (Flagpole): Bearish Flag pattern ka formation ek sharp downtrend ke baad hota hai, jise "pole" ya "flagpole" kaha jata hai. Ismein price ek sharp downward movement exhibit karta hai.

- Flag (Rectangle): Pole ke baad, price ek consolidation phase mein enter karta hai jise "flag" ya "rectangle" ke roop mein dekha jata hai. Is phase mein price ek horizontal range mein trade karta hai, typically sideways movement hota hai.

- Continuation Pattern: Bearish Flag pattern ek continuation pattern hai, jo indicate karta hai ke downtrend ke baad ek temporary pause aata hai aur phir downtrend jari rehta hai.

- Breakout: Bearish Flag pattern ke baad, price ka breakout typically flag ke neeche hota hai, jise downtrend ka continuation signal maana jata hai. Breakout ke baad price mein further downward movement dekha jata hai.

- Entry aur Exit Points: Traders bearish flag pattern ko dekhkar trading decisions lete hain. Agar flag ke breakout confirm hota hai, toh traders short positions lete hain aur stop-loss aur target levels ko set karte hain.

-

#11 Collapse

Bearish Flag Chart Pattern in Forex Trading

Bearish Flag Chart Pattern

Forex market me bearish flag chart pattern price action analysis me istemal hota hy aur bearish trend ke reversal ko indicate karta hy. Bearish flag pattern bullish move ke bad form hota hy aur traders ke liye trading opportunities create karta hy. Chaliye, bearish flag chart pattern ke ehm points ke bare me complete detail se janein. Bearish flag chart pattern, ek continuation pattern ke sath ek bearish trend ke reversal ki indication deta hy. Is pattern me price me ek bullish move ke bad ek flag-like structure form hota hy. Flag structure ek rectangular shape me hota hy, jisme price range narrow hoti hy. Flag pattern ke bad price dobara bearish move karny ki tendency dikhti hy. Traders bearish flag pattern ko trend reversal aur entry/exit points ke liye istemal karty hein.

Characteristics Of The Bearish Flag Pattern:

Bearish flag pattern ka pata lagane ke liye kuch khasiyat hein. Pehly to, flagpole, jo ke price me initial steep decline hota hy, tezi se aur qareebi vertical hona chahiye. Ye strong selling pressure aur significant move lower ko dikhata hy. Fir us ke bad wali consolidation muddat qareebi narrow honi chahiye, jahan chhoti mombattiyan ya price bars ek tight range me trade karti hein. Pattern ka flag portion flagpole ki height ka 50% se zeyada mana nahin karna chahiye. Agar flag 50% se zeyada retraces karti hy, to ye ishara ho sakta hy ke selling pressure kam ho raha hy aur pattern itna reliable nahin hy. Flag se breakout usually tezi se volume ke sath hota hy, jo ke neechy ki traffic ki continuation ko signal karta hy.

Bearish Flag Candlestick Pattern Trading:- Identification: Pehly to traders ko Bearish Flag Candlestick Pattern ko identify karna hota hy. Is ke liye, price charts aur candlestick patterns ko closely monitor karna zaroori hy.

- Confirmation: Pattern ko confirm karny ke liye, traders doosre technical indicators aur volume analysis ka istemal karty hein. High trading volumes ke sath bearish breakout hone par, us breakout ki credibility badh jati hy.

- Short Positions: Jab bearish flag ka breakout confirm ho jata hy, traders short positions lete hein, expecting ke prices me neechy ki taraf further movement hoga.Bearish flag pattern ek important chart pattern hai jo downtrend ke doran market reversals aur trading opportunities ko predict karne mein madad karta hai. Traders ko is pattern ko sahi se identify karna aur breakout confirmation ka wait karna chahiye, taake unhe sahi trading decisions mil sakein.

-

#12 Collapse

What is bearish flag chart pattern in forex trading.

Forex market me bearish flag chart pattern price action analysis me istemal hota hy aur bearish trend ke reversal ko indicate karta hy. Bearish flag pattern bullish move ke bad form hota hy aur traders ke liye trading opportunities create karta hy. Chaliye, bearish flag chart pattern ke ehm points ke bare me complete detail se janein. Bearish flag chart pattern, ek continuation pattern ke sath ek bearish trend ke reversal ki indication deta hy. Is pattern me price me ek bullish move ke bad ek flag-like structure form hota hy. Flag structure ek rectangular shape me hota hy, jisme price range narrow hoti hy. Flag pattern ke bad price dobara bearish move karny ki tendency dikhti hy. Traders bearish flag pattern ko trend reversal aur entry/exit points ke liye istemal karty hein.

Analysis of bearish flag chart pattern in forex trading.

Bearish flag pattern ka pata lagane ke liye kuch khasiyat hein. Pehly to, flagpole, jo ke price me initial steep decline hota hy, tezi se aur qareebi vertical hona chahiye. Ye strong selling pressure aur significant move lower ko dikhata hy. Fir us ke bad wali consolidation muddat qareebi narrow honi chahiye, jahan chhoti mombattiyan ya price bars ek tight range me trade karti hein. Pattern ka flag portion flagpole ki height ka 50% se zeyada mana nahin karna chahiye. Agar flag 50% se zeyada retraces karti hy, to ye ishara ho sakta hy ke selling pressure kam ho raha hy aur pattern itna reliable nahin hy. Flag se breakout usually tezi se volume ke sath hota hy, jo ke neechy ki traffic ki continuation ko signal karta hy.

Trading strategy with bearish flag chart pattern in forex trading.- Identification: Pehly to traders ko Bearish Flag Candlestick Pattern ko identify karna hota hy. Is ke liye, price charts aur candlestick patterns ko closely monitor karna zaroori hy.

- Confirmation: Pattern ko confirm karny ke liye, traders doosre technical indicators aur volume analysis ka istemal karty hein. High trading volumes ke sath bearish breakout hone par, us breakout ki credibility badh jati hy.

- Short Positions: Jab bearish flag ka breakout confirm ho jata hy, traders short positions lete hein, expecting ke prices me neechy ki taraf further movement hoga.

-

#13 Collapse

Bearish flag pattern

Bearish Flag Pattern: Kya Hai aur Kaise Kam Karta Hai?

Forex trading aur stocks mein technical analysis ka istemal market trends aur price movements ke andaza lagane ke liye kiya jata hai. Ek aham candlestick pattern jo traders ke liye ahem hota hai, woh hai "Bearish Flag" pattern. Yeh pattern ek continuation pattern hai jo market ke downtrend mein aam tor par dekha jata hai. Chaliye dekhte hain ke Bearish Flag pattern kya hai aur kaise kaam karta hai, sath hi ek misaal ke zariye samajhte hain.

Bearish Flag Pattern Kya Hai?

Bearish Flag pattern ek bearish continuation pattern hai jo downtrend ke dauraan dikhta hai. Is pattern mein, market mein ek strong downtrend ke baad ek small sideways price movement hota hai, jo ek flag ke jaise dikhta hai. Yeh sideways movement ek chhoti si bullish rally ke baad hota hai, jo flag pole kehte hain. Fir, yeh flag pole ke opposite direction mein ek bearish breakout hota hai, jo downtrend ko continue karta hai.

Bearish Flag Pattern Ki Khaasiyat:- Downtrend Ki Confirmation: Bearish Flag pattern downtrend ki muddat ko confirm karta hai. Yeh pattern dikhaata hai ke market ke sellers apni control ko barqarar rakh rahe hain aur price ko neeche le jaane ki koshish kar rahe hain.

- Momentum Ka Pata Lagana: Bearish Flag pattern se traders ko market ke momentum ka pata lagta hai. Agar yeh pattern sahi tareeqe se confirm hota hai to yeh dikhata hai ke downtrend ka momentum jari hai.

- Entry Aur Exit Points Ka Pata Lagana: Traders Bearish Flag pattern ka istemal kar ke entry aur exit points ka pata lagate hain. Agar yeh pattern sahi tareeqe se confirm hota hai to traders iske zariye positions enter kar sakte hain ya phir existing positions ko hold kar sakte hain.

Misal:

Chaliye ek misal ke zariye samajhte hain ke Bearish Flag pattern kaise kaam karta hai:- Flag Pole: Pehle, ek strong downtrend hota hai jo ek long downward move ko indicate karta hai.

- Sideways Movement (Flag): Yeh downtrend ke baad ek chhoti si bullish rally hoti hai, jo ek sideways movement ke roop mein dikhti hai. Yeh sideways movement flag ke roop mein dikhta hai.

- Bearish Breakout: Sideways movement ke baad, price ek bearish breakout karta hai aur phir se downtrend ke mukhalif direction mein move karta hai.

- Confirmation: Is pattern ke banne ke baad, jab bearish breakout confirm hota hai, tab traders ko downtrend ke muddat ko confirm karne ki zarurat hoti hai.

Bearish Flag pattern ek powerful tool hai jo traders ko market trends aur price movements ke bare mein maloomat faraham karta hai. Lekin, jaise har trading strategy ya pattern, iska istemal bhi samajhdari aur tajurba ke sath karna zaroori hai.

-

#14 Collapse

Bearish Flag Chart Pattern in Forex Trading

Bearish Flag Chart Pattern

Forex market me bearish flag chart pattern price action analysis me istemal hota hy aur bearish trend ke reversal ko indicate karta hy. Bearish flag pattern bullish move ke bad form hota hy aur traders ke liye trading opportunities create karta hy. Chaliye, bearish flag chart pattern ke ehm points ke bare me complete detail se janein. Bearish flag chart pattern, ek continuation pattern ke sath ek bearish trend ke reversal ki indication deta hy. Is pattern me price me ek bullish move ke bad ek flag-like structure form hota hy. Flag structure ek rectangular shape me hota hy, jisme price range narrow hoti hy. Flag pattern ke bad price dobara bearish move karny ki tendency dikhti hy. Traders bearish flag pattern ko trend reversal aur entry/exit points ke liye istemal karty hein.

Characteristics Of The Bearish Flag Pattern:

Bearish flag pattern ka pata lagane ke liye kuch khasiyat hein. Pehly to, flagpole, jo ke price me initial steep decline hota hy, tezi se aur qareebi vertical hona chahiye. Ye strong selling pressure aur significant move lower ko dikhata hy. Fir us ke bad wali consolidation muddat qareebi narrow honi chahiye, jahan chhoti mombattiyan ya price bars ek tight range me trade karti hein. Pattern ka flag portion flagpole ki height ka 50% se zeyada mana nahin karna chahiye. Agar flag 50% se zeyada retraces karti hy, to ye ishara ho sakta hy ke selling pressure kam ho raha hy aur pattern itna reliable nahin hy. Flag se breakout usually tezi se volume ke sath hota hy, jo ke neechy ki traffic ki continuation ko signal karta hy.

Bearish Flag Candlestick Pattern Trading:- Identification: Pehly to traders ko Bearish Flag Candlestick Pattern ko identify karna hota hy. Is ke liye, price charts aur candlestick patterns ko closely monitor karna zaroori hy.

- Confirmation: Pattern ko confirm karny ke liye, traders doosre technical indicators aur volume analysis ka istemal karty hein. High trading volumes ke sath bearish breakout hone par, us breakout ki credibility badh jati hy.

- Short Positions: Jab bearish flag ka breakout confirm ho jata hy, traders short positions lete hein, expecting ke prices me neechy ki taraf further movement hoga.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

**Bearish Flag Pattern Ke Sath Trading**

**1. Bearish Flag Pattern Ki Pehchan:**

- Bearish Flag Pattern ek continuation pattern hai jo market ki downtrend ko confirm karta hai.

- Yeh pattern ek strong downtrend ke baad banta hai, jismein ek short-term consolidation phase ke dauran flag bana hota hai.

- Is pattern ko bearish flag kehte hain kyunki yeh typically downward movement ko continue karta hai.

**2. Pattern Ke Components:**

- **Flagpole**: Yeh initial downtrend ka part hota hai jo pattern ka base banaata hai. Flagpole sharp aur strong decline ke saath hota hai.

- **Flag**: Yeh consolidation phase hota hai jo flagpole ke baad banta hai. Flag generally upward ya sideways sloping hota hai aur isme chhoti chhoti price movements hoti hain.

- **Breakout**: Flag ke upper boundary se price jab phir se niche jati hai, to pattern complete hota hai aur bearish signal provide karta hai.

**3. Trading Strategy:**

- **Entry Point**: Flag ke lower boundary se breakout hone ke baad entry ki jati hai. Price ke flag ke niche break hone par sell order place kiya jata hai.

- **Stop Loss**: Stop loss ko flag ke upper boundary ke thoda sa upar rakha jata hai taake false breakouts se bachha ja sake.

- **Take Profit**: Profit target ko flagpole ke length ke equivalent distance se set kiya jata hai. For example, agar flagpole 50 pips lamba hai, to profit target bhi 50 pips hota hai.

**4. Pattern Ke Benefits:**

- **Clarity**: Bearish Flag Pattern clear entry aur exit points provide karta hai jo traders ko precise trading decisions lene me madad karte hain.

- **Continuation Signal**: Yeh pattern trend ke continuation ko confirm karta hai, jo ke market ki direction ko follow karne me madad karta hai.

- **Risk Management**: Flag pattern ke clear boundaries ke wajah se stop loss aur take profit levels set karna asaan hota hai.

**5. Considerations:**

- **Volume Analysis**: Bearish Flag Pattern ka effectiveness volume ke analysis par bhi depend karta hai. Volume flagpole ke during high aur flag phase ke dauran low hona chahiye.

- **Pattern Duration**: Pattern ke duration ka dhyan rakhein. Flag pattern zyada der tak consolidate nahi karni chahiye, varna pattern invalid ho sakta hai.

Bearish Flag Pattern ek effective tool hai jo traders ko market ki continuation trends ko identify karne me madad karta hai. Pattern ko sahi tareeke se identify aur trade karna zaroori hai taake accurate results mil sakein.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:09 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим