Crab and Shark Pattern Working and Benefits in Forex Trading.

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

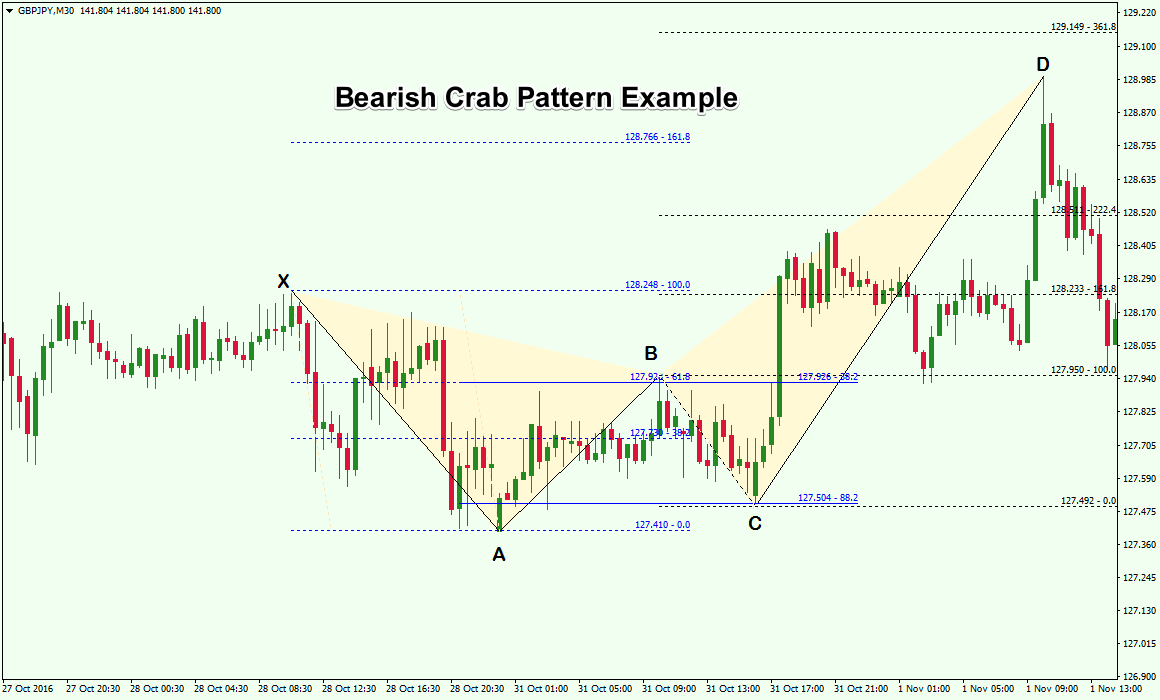

Crab and Shark Pattern Description. Forex trading mein Crab aur Shark pattern aam toor par traders ki taraf se istemal kiye jaane wale technical analysis tools hain. In patterns ka istemal market trends aur price action ke analysis mein kiya jaata hai. Crab aur Shark pattern ko traders isliye istemal karte hain kyunki ye patterns aik potential reversal indication provide karte hain. Crab Pattern. Crab pattern aik reversal pattern hai jo traders ke liye aik powerful tool hai. Is pattern ka istemal bullish aur bearish markets mein kiya jata hai. Crab pattern aik complex pattern hai jis mein 4 swings hote hain aur market mein aik strong reversal indication provide karta hai. Crab pattern indicators. - Point X: Ye point market mein aik high ya low ko represent karta hai. - Point A: Ye point Point X se opposite direction mein move karta hai aur aik retracement level represent karta hai. - Point B: Ye point Point A se move karta hai aur aik retracement level represent karta hai. - Point C: Ye point Point B se move karta hai aur aik retracement level represent karta hai. - Point D: Ye point Point X aur Point C ke beech mein hota hai aur aik strong reversal indication provide karta hai. Shark Pattern. Shark pattern bhi Crab pattern ki tarah aik reversal pattern hai. Is pattern ka istemal bullish aur bearish markets mein kiya jata hai. Shark pattern mein bhi 4 swings hote hain aur market mein aik strong reversal indication provide karta hai. Shark pattern ke indicators. - Point X: Ye point market mein aik high ya low ko represent karta hai. - Point A: Ye point Point X se opposite direction mein move karta hai aur aik retracement level represent karta hai. - Point B: Ye point Point A se move karta hai aur aik retracement level represent karta hai. - Point C: Ye point Point B se move karta hai aur aik retracement level represent karta hai. - Point D: Ye point Point X aur Point C ke beech mein hota hai aur aik strong reversal indication provide karta hai. Main Concepts. Crab aur Shark patterns forex trading mein aik important technical analysis tool hain. Ye patterns market trends aur price action ke analysis mein istemal kiye jaate hain aur traders ko aik potential reversal indication provide karte hain. Crab aur Shark pattern ke indicators Point X, Point A, Point B, Point C aur Point D hote hain jo traders ke liye important hote hain. -

#3 Collapse

Forex Exchanging Graph Examples that Work What is graph design brrhtay hoe'ay aor slae'edng kay rjhanat kay drmean tranzeshn ko aksr astak diagram petrn say zahr kea jata hay۔ pattern lae'nz aor/ea mnhne khtot ke trteb ka astamal krtay hoe'ay، koe'e qemt kay petrn ke shnakht krskta hay، jo qemt ke nql o hrkt ke aek qabl shnakht trteb hay۔ aek tslsl ka nmonh as oqt tear hota feed jb aek mkhtsr oqfay kay awful rjhan apne mojodh smt men jare rhta hay۔ aek alt petrn abhrta roughage jb qemt ka petrn rjhan ke smt men tbdele ke nshandhe krta hay۔ bht say nmonay hen jo tajr astamal krtay hen۔ yhan yh feed kh kchh zeadh marof petrn kesay bnae'ay jatay hen۔ Key Important points tkneke tjzeh a nmonon pr bnaea gea hay، jo graph pr hfazte qemton kay atar chrrhaؤ say bnae'ay janay oalay qabl shnakht dhanchay hen۔ mtoatr qemt poae'nts ko jorrnay oale lae'n، jesay kh aek mqrrh mdt kay doran qemton ke bndsh، blnde، ya km، aek petrn ke nshandhe krte hay۔ tkneke tjzeh kar aor chartst mstqbl men sekeorte ke qemt ke nql o hrkt ke peshn goe'e krnay kay leay nmonay tlash krtay hen۔ yh petrn dohre sr aor kndhon ke tshkel say lay kr pattern lae'nz tk pechedge men hen، jo bneade aor pechedh donon hen۔ Trendlines in Specialized Examination rjhan ke lkeron ko smjhna aor anhen khenchnay kay qabl hona mfed feed keonkh qemton kay nmonay lae'non ya mnhne khtot ke trteb ko astamal krtay hoe'ay pae'ay jatay hen۔ tkneke tjzeh kar qemt kay diagram pr sport aor mzahmt kay alaqon ke nshandhe krnay kay leay pattern lae'nz ka astamal krtay hen۔ nzole choteon (aonchae'eon) ya chrrhtay hoe'ay grton ka aek tslsl aek pattern lae'n bnanay kay leay jrra hoa hay، jo outline (nechay) pr aek sedhe lker hay۔ jhan qemten aonche aor aonche nech ka samna kr rhe hen، aek pattern lae'n jo zaoeh aopr krte hay، ya aopr ke pattern lae'n nzr aate hay۔ chrrhtay hoe'ay nsheb ko jorrnay say ap pattern lae'n bnte hay۔ as kay braks، aek pattern lae'n jo nechay ke trf zaoeh rkhte feed aor asay nechay ke pattern lae'n kay nam say jana jata roughage tb zahr hota feed jb qemton ke aonchae'e km hote roughage aor km hote hay۔ Continuation Examples aek tslsl kay petrn ko mojodh rjhan ke smt men oqfay kay pinnacle pr dekha ja skta hay۔ aonchae'e men، yh as oqt hota feed jb bel rk jatay hen، jb kh mnde men، yh tb hota roughage jb rechh oqfh letay hen۔ yh pesh goe'e krnay ka koe'e treqh nhen roughage kh aaea koe'e rjhan jare rhay ga ya jb qemton ka nmonh tear ho rha feed lhٰza، a pattern lae'nz pr pore tojh dena zrore feed jo qemt ka nmonh bnanay kay leay astamal ke ge'e then aor sath he as bat pr bhe tojh de jae'ay kh qemt tslsl kay zon kay aopr ya nechay totte feed ya nhen۔ tkneke tjzeh kar aksr yh qeas krnay ka mshorh detay hen kh koe'e rjhan as oqt tk qae'm rhay ga jb tk yh sabt nh ho jae'ay kh as ka alt hona sabt nhen ho ga۔ Inversion Examples reorsl petrn qemton ka taen krnay oala petrn feed jo mojodh rjhan men tbdele ke nshandhe krta hay۔ yh nmonay an aoqat ke nshandhe krtay hen jb bel ya rechh apnay aroj pr hotay hen۔ qae'm shdh rjhan rk jae'ay ga، phr mkhalf trf (bel ya rechh) ke trf say tazh mhrk aanay kay awful tbdel ho jae'ay ga۔ msal kay peak pr، toel mdt men rechhon ko rasth denay say phlay، teze ka rjhan rk skta hay، jo bel aor rechh donon kay dbaؤ ko zahr krta hay۔ ntejay kay pinnacle pr، rjhan nechay ke trf mntql hota feed. Flag Flags tslsl kay nmonay hen jo do drift lae'non ko jorr kr bnae'ay jatay hen۔ pennts ke aek amteaze khsoset yh feed kh a ke pattern lae'nen mkhalf smton men sfr krte hen، aek aopr jate roughage aor dosre nechay۔ zel ke msal men aek pennt ko aek msal kay peak pr dkhaea gea hay۔ bht say maamlat men، penent bnnay kay doran hjm km ho jae'ay ga aor phr jb qemt aakhrkar child jae'ay ge to brrh jae'ay ge۔ fleg pol teze say chlnay oalay qlm kay bae'en janb hay، jo aopr ke trf brrhte hoe'e qemt ko zahr krta hay۔ -

#4 Collapse

Range Bound Exchanging Technique k Faidy Dear companions Reach Security Exchanging technique aik aisi exchanging procedure hai jo ki merchant istemal Karte Hain hit market sideways mein development kar rahi hoti hai iski madad se brokers ko thought ho jata hai ki market kagla pattern kaun sa ho ga companions range bound system ka baday ghour say mushahida karna hota hai agar aap is connected kuch significant data to keep away from Karte Hain To aap kabhi bhi is methodology se appropriately fulfilled aur benefit Hasil nahin kar sakte . Prologue to Reach Security Exchanging Technique. Dear companions Jaisa ke oopar Bhi zikr kiya ja chuka hai ki Reach Security Exchanging technique ko kis tarah dealer apni exchanging system banate hain aur is say benefit lene Ki Koshish karte hain ya phir is circumstance mein isko use kesy karte hain companions Reach Security Exchanging Methodology principal mama excessive cost significant resiatance k pinnacle pae act karti hai or low cost primary help ki tarha act karti hai or market en k bech mama he move karti rehti hai aur is tarha kee market ki type ko ham level sideway ya going business sector kehty hain companions range bound fundamental market ki foran development ka pata nahin chalta ki vo kis side per Move kar Jaaye to agar aapka ka take benefit Laga hoga to aap ko fayda to hoga. Exchanging at Reach Security Exchanging Technique. Dear companions range Security exchanging technique per exchanging karne ke liye sabse pahle aapko market ka latest thing pata Hona bahut hello zaruri hai market ki development flat ho chuki to us waqat range wali course principal ham exchange open ker ky proceed kerty hain tou phir agar market hamari open exchange ky against bhi development kerti hai tab bhi turn around bearing primary reach kam hony ki waja sy market kuch time ky liay tou misfortune fundamental run ker sakti hai lekin poke benefit primary development kerna start kerti hea. Extra Note. Dear companions exchanging technique kuch bhi ho sabse pahle aapko Iske uncovered mein learning aur experience Ka Hona bahut hello there significant hota hai kyun kay agar aapko iske exposed mein experience ya information nahin hoga to aap legitimate tarike se exchanging nahin kar sakte isliye exchanging karne se pahle aapko range Security exchanging procedure ko lajmi center karna hota hai exchanging start karne se pahle. -

#5 Collapse

How Pattern is Significant in Forex Exchanging Market Pattern Forex market kabhi bhi aik hey course principal development nehi kerti market kabhi up development ker rehi hoti hai aur kabhi descending tou agar ham market fundamental kisi bhi time per kisi bhi heading primary exchange open ker lety hain tou hamain misfortune ho sakta hai kyun ky market beshak aik hello waqat principal the two headings primary development ker rehi hoti hai lekin market ka by and large pattern aik hey heading principal hota hai jo bullish bhi ho sakta hai aur negative bhi aur agar pattern bullish ya negative na ho tou market tou apni development ker rehi hoti hai jo sideways market move ker rehi hoti hai aur same market ky pattern ko sideways pattern kehty hain so market ka jo bhi pattern ho market hamesha apny pattern ko follow kerty huey development ker rehi hoti hai Kinds of Pattern Forex market ki development three sorts pattern ko follow kerty huey development kerti hai ky agar market ki generally speaking development up heading principal ho jesy ky agar kuch time ky bahd obstruction level break ho raha ho tou maket ka pattern bullish hota hai jis ko upswing bhi kehty hain aur agar market ki cost decline ho rehi ho ya by and large market descending side per development ker rehi ho jesy ky support levels ko break ker rehi ho tou same time per market fundamental descending pattern ya negative pattern chal raha hota hai lekin agar market ki by and large development just aik greetings support aur opposition ky darmian ho rehi ho ky bar support aur obstruction per ponch ker market turn around development shoru ker deti ho aur koi bhi support ya opposition break na ho rehi ho tou aesy time per market primary sideways pattern chal raha hota hai Pattern Find kerna Agar ham market principal exchange open kerty hain aur pattern ko disregard kerty hain tou market ka pattern agar hamari open exchange ky against ho tou hamain misfortune hona shoru ho jata hai agar ham same open exchange ko secure nehi kerty tou hamara misfortune increment hoty account hello wash ho jata hai lehaza pattern ko find kerna bahot zaruri hota hai ky agar ham exchange open kerny sy pehly market ka pattern find ker lety hain aur phir same pattern ko follow kerty huey exchange open kerty hain tou kuch time ky liay tou hamain misfortune bhi ho sakta hai lekin punch market pattern ko follow kerna shoru kerti hai tou hamara same misfortune bhi khatam ho jata hai aur hamain open exchange fundamental benefit hasil hona shoru ho jata hai Suggestions for Effective Forex Exchanging Hit market fundamental bullish pattern ko ham find ker lety hain tou ham same time per market primary purchase principal exchange open kerty hain ky hamain aesy time per sell primary exchange open kerny per misfortune ho sakta hai jabky purchase wali exchange bullish pattern fundamental benefit deti hai aur agar market fundamental negative pattern chal raha ho tou hamain same time per sell fundamental exchange enter kerni chahiay ky market in general downtrend primary development ker rehi hoti hai tou hamain sell principal open ki jany wali exchange principal benefit hasil ho sakta hai lekin pattern ko follow kerny ky liay hamain long time exchange proceed kerna hoti hai aur agar ham brief time frame exchange kerna chahty hain tou phir hamain by and large pattern per exchange kerny ki bajaey market ky latest thing per exchange kerna hoti hai jo bar retracement per bhi exchange open ki ja sakti hai sideways pattern primary hamain support sy purchase aur obstruction sy sell principal exchange open kerna hoti hai lekin breakout agar open exchange ky against ho tou wahan per stop misfortune bhi zarur set hona chahiay -

#6 Collapse

Instructions to gold exchanging Doston jaisa ki ham log jante Hain ki market mein kam karna aasan Nahin hota hai market ko hamen time Dena padta hai aur Market mein sabse quick money gold hai jismein kam karna bahut greetings mushkil hai ismein Kafi jyada risk hota hai jo log ismein agar kam karna chahte hain to unko chahie ki vah iske exposed mein mukmmal information mein kyunki yah ek aisa pair hai Jo hamare account ko unfamiliar wash kar deta hai isliye hamen chahie ki Ham ismein samajh ke kam Karen agar hamare pass reward achcha hai tab hamen gold mein kam karna chahie Varna Ham ismein considering Karke achcha munafa Kama sakte hain exchanging karna aasan hota hai lekin exchanging mein benefit lena Kafi mushkil hota hai Ham is mein jitna achcha kam karenge hamen kamyabi milegi hamen ismein specialized examination aur major investigation ko follow karke kam karna chahie kyunki hamen pata hai ki Ham market mein agar achcha kam karenge to hamen kamyabi milegi kamyabi hamesha hamen new psyche ke Sath milati hai agar Ham ismein extra kam karenge to Ham kamyab Nahin ho sakte. Gold exchanging investigation Doston jaisa ki aap log jante Hain ki gold mein kam karna Kitna mushkil hota hai agar Ham Goldman information lekar kam karenge to hamen is mein kam karne mein aasani Hogi aur ham achcha work kar sakte hain gold mein Ham investigation karenge to hamen gold ki move ka sambandh lagegi Ham ismein marker ko follow karenge Ham mukmmal information lenge gold exchanging ke liye specialized examination best examination hai isko follow karke Ham market se achcha munafa Kama sakte hain jaisa ki aap log jante Hain ki Ham ismein jitna achcha kam karenge jitni jyada mehnat karenge hamen kamyabi milegi hamesha hamen loris ke sath kam karna hota hai extra kam se hamen kuchh bhi Nahin milta hamen bahut jyada misfortune ka samna karna standard sakta hai. How to Exchange On Gold with Little Record Adjust? Gold exchanging ke liye hamesha information lekar kam karna hota hai gold mein jitna achcha kam karenge hamen kamyabi milegi without information ke agar Ham is mein kam karenge to hamen kamyabi Nahin milegi kamyabi hamesha hamen acche work aur acche experience ke Sath milati hai Jo log ismein achcha Kam Nahin karte hain vah ismein kamyab bhi nahin ho sakte hain customary kam karen to aasani se Ham is business mein kamyab ho sakte hain hamen ismein crucial butt-centric se isko bhi follow karte rahana photograph hai aasani se Ham is business se kamyab ho sakte hain jaisa ki hamen pata hai ki demo account ismein hamare information ke liye hota hai demo account mein Ham practis kam karte Hain Ham demo account se bahut hello there acchi exchanging kar sakte hain kyunki aapko pata hai ki ismein agar ham without information ke kam karenge to hamen kamyabi Nahin milegi kamyabi hamesha mein acche work ke Sath milati hai acchi mehnat ke Sath milati hai. Ismein significant hota hai ki Ham ismein arranging Karen aur uske terrible Ham ismein work Karen to hamen kamyabi milegi kamyabi hamesha hamen acche information aur acche experience ke Sath milati hai Jo log ismein achcha Kam Nahin karte hain vah ismein kamyab bhi nahin ho sakte hain kamyabi hamesha hamen experience se milati hai experience hamare pass achcha Hoga to Ham ismein acchi exchanging kar sakte hain hamen ismein Cash the board ko follow karke kam karte rahana chahie Jo log ismein extra kam karte hain ya befasol kam karte hain vah ismein kamyab greetings nahin ho sakte kamyabi hamesha mein acche information aur acche experience ke Sath milati hai hamen is mein specialized examination ko lazmi dekhna hota hai -

#7 Collapse

Subtleties of "Bullish Counterattack Line Candles Pattren" in Forex Exchanging. Bullish Counterattack Lines bullish counterline mein ham inversion up train mein dekhte hain assault hote ki primary sign ki jo line hai vah kyon strain invert hoti hai downtrend se up train ki taraf ismein barish ke signal kaise rehte hain tum post karte do variety ke jo inverse bearing hoti hai usmein third aur jo for embarrassment hoti hai vah affirm next cost ki course ki taraf retirement ki jaati hai What Are Counterattack Lines? bahut achcha question hai ki counter tak aapke hai kya tu hai ham dekhe ki ek joke and sticker inversion design hote hain ham kam account assault ko dekhe to ismein ham dekhte hain ki light mein chawal ke aate hain disadvantage karti hai ke liye to hona chahie market remedy ke upar exchange karte rahe ek acchi exchange open ho sakti hai Understanding Bullish Counterattack Lines jcounter assault ko dekha jaaye to yah connect with hota hai dynamic downtrend ke upar agar post karen ke town countertack kya hota hai to usmein ham market course karte hain market ko samajhte hain to hamen sumit rate karte anta hote hain shopclues ko put in karte hain ham request ko place karke acche the analyte kar sakte hain hamen come sohan design ke sath se visit ko kaise use karte hain gas unit astha exchanging ke sath ham ideal body ko karte comparable qualities ko dekhte hain first standard jo hamari claus hote uski first flame ke sath farm vehicle size karen to hamari jhooth moving hai bearing kyon nahin hoti hai s candle mein ham solid karte hain inverse heading se Bullish Counterattack Lines Broker Brain research counter assault design mein murmur dekhte hain ki promoting kaise design pabbu karti hai jo design aap merchant use karte ho unpatterned ko follow karte ho to humne experience tak design ko follow karna hai hamen significant ke upar study karni hai exchanging karni hai har design aapko exchanging mein benefit bhi dete hain vah nahin design ko follow karke aap check karte rahte ho lekin punch bhi aap market mein counter-assault design ko le aap kis ko samjhaie to jarur uske sath acche se kam karte shade dissect kar purpose to hello exchanging mein are productive exchange bhi kar sakti hai aur contamination to call abhi karte hain -

#8 Collapse

IDENTIFICATION OF CRAB PATTREN: I hope aap sab khariyat sy hoon gy Forex exchanging Marketing main developments three sorts pattern ko follow kerty huey development kerti hai ky agar market ki generally speaking development up heading principal ho jesy ky agar kuch time ky bahd obstruction level break ho raha ho tou maket ka pattern bullish hota hai jis ko upswing bhi kehty hain aur agar market ki cost decline ho rehi ho ya by and large market descending side per development ker rehi ho jesy ky support levels ko break ker rehi ho tou same time per market fundamental descending pattern ya negative pattern chal raha hota hai lekin agar market ki by and large development just aik greetings support aur opposition ky darmian ho rehi ho ky bar support aur obstruction per ponch ker market turn around development shoru ker deti ho aur koi bhi support ya opposition break na ho rehi ho tou aesy time per market primary sideways pattern chal jata Hei.EXPLANATION OF BULLISH SHARK PATTREN: Shark Pattren ko kabel istemaal bnaty hei our ye bhoot asaan Pattren ko kabel pigeon forge and senior members eis pattern ko ham find ker lety hain tou ham same time per market primary purchase principal exchange open kerty hain ky hamain aesy time per sell primary exchange open kerny per misfortune ho sakta hai jabky purchase wali exchange bullish pattern fundamental benefit deti hai aur agar market fundamental negative pattern chal raha ho tou hamain same time per sell fundamental exchange enter kerni chahiay ky market in general downtrend primary development ker rehi hoti hai tou hamain sell principal open ki jany wali exchange principal benefit hasil ho sakta hai lekin pattern ko follow kerny ky liay hamain long time exchange proceed kerna hoti hai aur agar ham brief time frame exchange kerna chahty hain tou phir hamain by and large pattern per exchange kerny ki bajaey market ky latest thing per exchange kerna hoti hai jo bar retracement per bhi exchange open ki ja sakti hai sideways pattern primary hamain support sy purchase aur obstruction sy sell principal exchange open karty hen.

TRADINGS STRATEGY'S:Dear members forex exchanging Market Agar ham market principal exchange open kerty hain aur pattern ko disregard kerty hain tou market ka pattern agar hamari open exchange ky against ho tou hamain misfortune hona shoru ho jata hai agar ham same open exchange ko secure nehi kerty tou hamara misfortune increment hoty account hello wash ho jata hai lehaza pattern ko find kerna bahot zaruri hota hai ky agar ham exchange open kerny sy pehly market ka pattern find ker lety hain aur phir same pattern ko follow kerty huey exchange open kerty hain tou kuch time ky liay tou hamain misfortune bhi ho sakta hai lekin punch market pattern ko follow kerna shoru kerti hai tou hamara same misfortune bhi khatam ho jata hai aur hamain open exchange fundamental benefit hasil hona shoru karty hen our successful hoty hein.

-

#9 Collapse

CRAB AUR SHARK PATTERN:-"Crab" aur "Shark" patterns tijarat mein istemal hone wale chart patterns hain jo khaas taur par trading mein istemal hotay hain. Ye patterns traders aur investors ke liye price charts ki tafseel se tehqiqat aur mustaqbil ke price movements ke baray mein peshgoi karne ke liye istemal hotay hain. Yahan har pattern aur unke faidayon ki aik choti si jayeza hai. Crab Pattern: Crab pattern aik harmonic chart pattern hai jo advanced Fibonacci patterns ki family mein aata hai. Iska istemal price movements mein potenital reversal points paish karnay ke liye kiya jata hai. Ye pattern paanch points X, A, B, C, aur D se mushtamil hota hai, aur ismein Fibonacci ratios ka istemal potential reversal levels ka taayun karne ke liye hota hai. Traders is pattern ko istemal karte hain taakay woh wohan price ka rukh badlanay ke mumkin points ko pehchan saken jahan se woh trading positions ko dakhil ya nikal saken. Faiday: Traders ko potential trend reversal points paish karne mein madadgar hota hai. Traders ko woh khaas price levels miltay hain jahan woh stop-loss ya take-profit orders rakh sakte hain. Isay doosray technical analysis tools ke saath istemal karke traders behtareen trading faislay kar sakte hain. Shark Pattern: Shark pattern technical analysis mein istemal hone wala aik aur advanced harmonic pattern hai. Crab pattern ki tarah, isay potential reversal points ko paish karne ke liye istemal kia jata hai. Shark pattern paanch points X, A, B, C, aur D se mushtamil hota hai, aur ismein potential reversal levels ko taayun karne ke liye Fibonacci ratios ka sahara liya jata hai. Isay doosray patterns jaise Butterfly ya Gartley patterns ki nisbat kam aur khaas tour par paish anay wala pattern samjha jata hai. Faiday: Crab pattern ki tarah, Shark pattern traders ko market mein palatnay ke potential points paish karne mein madadgar hota hai. Traders is pattern ko istemal karke trading positions mein dakhil ya nikalnay ke liye munasib risk-reward ratios dhoond sakte hain. 1. Price Chart Analysis: Sab se pehla qadam hota hai tijarat ke liye aik price chart ka analysis karna. Aap trading platforms jaise ke MetaTrader, TradingView, ya kisi aur platform ka istemal karke price charts dekh sakte hain. 2. Pattern Recognition: Crab aur Shark patterns ko pehchanne ke liye aapko price chart par in patterns ke characteristic points (X, A, B, C, aur D) ko tafseel se dhoondna hoga. Ye points Fibonacci ratios ka istemal karke tay kiye jate hain. 3. Fibonacci Ratios: In patterns mein Fibonacci ratios ka ahem hissa hota hai. Aapko Fibonacci retracement aur Fibonacci extension tools ka istemal karke X se D tak ke levels ko measure karna hoga. Ye levels pattern ke tay shuda points ke comparison mein hotay hain. 4. Confirmatory Indicators: Patterns ko identify karne ke bad, aapko confirmatory indicators ka istemal karke unke validity ko verify karna chahiye. Ismein RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), aur doosray technical indicators shamil ho sakte hain. 5. Entry aur Exit Points: Patterns ko pehchanne ke baad, aap entry aur exit points decide kar sakte hain. Aap decide karenge ke trading position ko kis price level par enter karna hai aur kis price level par exit karna hai. 6. Risk Management: Risk management aik ahem hissa hota hai. Aapko decide karna hoga ke kitna risk lena hai aur stop-loss aur take-profit orders set karna hoga. 7. Monitor aur Adjust: Trading position ko enter karne ke bad, market ko monitor karte rahein aur agar zarurat ho to apni strategy ko adjust karte rahein. Market conditions mein tabdeel hone par flexible rehna ahem hai. 8. Learning aur Practice: Patterns ko samajhna aur sahi tijarat faislay lena aik skill hai jo practice aur experience se behtar hoti hai. Is liye aapko regular practice aur learning par tawajjo deni chahiye.CRAB AUR SHARK PATTERN K KAM K TARIKY:-

Crab Pattern: Crab pattern aik harmonic chart pattern hai jo advanced Fibonacci patterns ki family mein aata hai. Iska istemal price movements mein potenital reversal points paish karnay ke liye kiya jata hai. Ye pattern paanch points X, A, B, C, aur D se mushtamil hota hai, aur ismein Fibonacci ratios ka istemal potential reversal levels ka taayun karne ke liye hota hai. Traders is pattern ko istemal karte hain taakay woh wohan price ka rukh badlanay ke mumkin points ko pehchan saken jahan se woh trading positions ko dakhil ya nikal saken. Faiday: Traders ko potential trend reversal points paish karne mein madadgar hota hai. Traders ko woh khaas price levels miltay hain jahan woh stop-loss ya take-profit orders rakh sakte hain. Isay doosray technical analysis tools ke saath istemal karke traders behtareen trading faislay kar sakte hain. Shark Pattern: Shark pattern technical analysis mein istemal hone wala aik aur advanced harmonic pattern hai. Crab pattern ki tarah, isay potential reversal points ko paish karne ke liye istemal kia jata hai. Shark pattern paanch points X, A, B, C, aur D se mushtamil hota hai, aur ismein potential reversal levels ko taayun karne ke liye Fibonacci ratios ka sahara liya jata hai. Isay doosray patterns jaise Butterfly ya Gartley patterns ki nisbat kam aur khaas tour par paish anay wala pattern samjha jata hai. Faiday: Crab pattern ki tarah, Shark pattern traders ko market mein palatnay ke potential points paish karne mein madadgar hota hai. Traders is pattern ko istemal karke trading positions mein dakhil ya nikalnay ke liye munasib risk-reward ratios dhoond sakte hain. 1. Price Chart Analysis: Sab se pehla qadam hota hai tijarat ke liye aik price chart ka analysis karna. Aap trading platforms jaise ke MetaTrader, TradingView, ya kisi aur platform ka istemal karke price charts dekh sakte hain. 2. Pattern Recognition: Crab aur Shark patterns ko pehchanne ke liye aapko price chart par in patterns ke characteristic points (X, A, B, C, aur D) ko tafseel se dhoondna hoga. Ye points Fibonacci ratios ka istemal karke tay kiye jate hain. 3. Fibonacci Ratios: In patterns mein Fibonacci ratios ka ahem hissa hota hai. Aapko Fibonacci retracement aur Fibonacci extension tools ka istemal karke X se D tak ke levels ko measure karna hoga. Ye levels pattern ke tay shuda points ke comparison mein hotay hain. 4. Confirmatory Indicators: Patterns ko identify karne ke bad, aapko confirmatory indicators ka istemal karke unke validity ko verify karna chahiye. Ismein RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), aur doosray technical indicators shamil ho sakte hain. 5. Entry aur Exit Points: Patterns ko pehchanne ke baad, aap entry aur exit points decide kar sakte hain. Aap decide karenge ke trading position ko kis price level par enter karna hai aur kis price level par exit karna hai. 6. Risk Management: Risk management aik ahem hissa hota hai. Aapko decide karna hoga ke kitna risk lena hai aur stop-loss aur take-profit orders set karna hoga. 7. Monitor aur Adjust: Trading position ko enter karne ke bad, market ko monitor karte rahein aur agar zarurat ho to apni strategy ko adjust karte rahein. Market conditions mein tabdeel hone par flexible rehna ahem hai. 8. Learning aur Practice: Patterns ko samajhna aur sahi tijarat faislay lena aik skill hai jo practice aur experience se behtar hoti hai. Is liye aapko regular practice aur learning par tawajjo deni chahiye.CRAB AUR SHARK PATTERN K KAM K TARIKY:- -

#10 Collapse

Crab and Shark Pattern Details. Forex trading ka world bohat hi complex hai, aur jis tarah se ismein traders apne trades ke liye different patterns ka use karte hai, inmein se kuch patterns Crab aur Shark Patterns hai. In dono patterns ka use traders apne trades ko samajhne aur predict karne ke liye karte hai. Crab Pattern Definition. Crab pattern me traders ko market ki movement ke baare mein pata chalta hai. Is pattern ke use se traders ko pata chalta hai ki market me price ka movement kis direction mein hoga. Crab pattern ko identify karne ke liye traders ko Fibonacci retracements aur extensions ka use karna hota hai. Is pattern ko identify karne ke liye traders ko bhi Fibonacci retracements ka use karna hota hai. Agar market me koi specific range ke andar price move karta hai, to is pattern ka use kiya jata hai. Crab pattern ko identify karne ke liye traders ko Fibonacci retracements ke first and second swings ko connect karna hota hai. Shark Pattern definition. Shark Pattern ko identify karne ke liye traders ko market ki movement ko closely observe karna hota hai. Is pattern ke use se traders ko pata chalta hai ki market ke price ka movement kis direction mein hoga. Shark pattern ko identify karne ke liye traders ko Fibonacci retracements aur extensions ka use karna hota hai. Shark Pattern ko identify karne ke liye traders ko Fibonacci retracements ke first and second swings ko connect karna hota hai. Agar market me price ka movement koi specific range ke andar karta hai, to is pattern ka use kiya jata hai. Difference Between. Crab aur Shark Patterns ke use se traders apne trades ko samajhne aur predict karne me help milta hai. Isiliye traders ko in patterns ka use karna chahiye, aur inke baare mein jyada se jyada knowledge honi chahiye. -

#11 Collapse

Crab Pattern ,Introduction. Crab Pattern, yaani karkat ka patta, ek technical analysis tool hai jo stock market aur financial markets mein istemal hota hai. Iska maqsad market ke behavior ko samajhna aur trading decisions banane mein madadgar hona hota hai. Identification of Crab Pattern. Crab pattern ko pehchanna market mein kisi stock ya asset ki movement ko closely observe karke hota hai. Yeh pattern generally ek bearish (girawat ki taraf) trend ke doran paya jata hai aur 4 mukhtalif points se ban jata hai: Initial Leg. Is pattern ki shuruaat hoti hai ek strong downward move se. Isse AB leg kehte hain. Correction.AB leg ke baad, market mein ek thori si tezi hoti hai, jise BC leg kehte hain. Lekin yeh tezi bhi kisi had tak mukhlis hoti hai. Extension. BC leg ke baad, market mein ek aur downward move hota hai jo CD leg kehlata hai. Is leg mein market gir kar 1.618% ya 2.618% tak pohanchti hai, jo ke AB leg ki length se measure kiya jata hai. Completion.CD leg ke baad, market mein thori si aur tezi hoti hai, jo ke D point par mukammal hoti hai. Trading Strategy. Crab pattern ko pehchane ke baad, traders is pattern ke hisab se trading decisions banate hain. Agar market crab pattern ke sath milti hai, toh traders selling position (bechne ka position) par ja sakte hain, kyun ke yeh pattern bearish reversal ko indicate karta hai. Shark Pattern. **Mukhtasar Tareef (Introduction):** Shark pattern, yaani shark ka patta, bhi ek technical analysis tool hai jo market mein istemal hota hai. Is pattern ka maqsad market ke future price direction ko samajhna aur trading ke liye sahi samay par positions lena hota hai. Identification of Shark Pattern. Shark pattern ko pehchanna market mein kisi stock ya asset ki movement ko closely observe karke hota hai. Yeh pattern bearish trend ke doran paya jata hai aur 5 mukhtalif points se bana hota hai. Is pattern ki shuruaat hoti hai ek strong downward move se. Isse XA leg kehte hain,,XA leg ke baad, market mein ek thori si tezi hoti hai, jise AB leg kehte hain. Lekin yeh tezi bhi kisi had tak mukhlis hoti hai.AB leg ke baad, market mein ek aur downward move hota hai jo BC leg kehlata hai. Is leg mein market gir kar 1.618% ya 2.618% tak pohanchti hai, jo ke XA leg ki length se measure kiya jata hai. BC leg ke baad, market mein ek kuch had tak upward correction hoti hai jo CD leg kehlata hai. Ismein market wapas aakar 0.886% ya 1.13% tak pohanchti hai, jo ke BC leg ki length se measure kiya jata hai. Completion. CD leg ke baad, market mein thori si aur downward move hoti hai, jo ke D point par mukammal hoti hai. Trading Strategy. Shark pattern ko pehchane ke baad, traders is pattern ke hisab se trading decisions banate hain. Agar market shark pattern ke sath milti hai, toh traders selling position (bechne ka position) par ja sakte hain, kyun ke yeh pattern bearish reversal ko indicate karta hai.Mukhtasar taur par, crab aur shark patterns technical analysis ke tools hain jo traders ko market ke behavior ko samajhne aur trading strategies banane mein madadgar hote hain, lekin inka istemal samajhdari aur tajwez se kiya jana chahiye. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#12 Collapse

Bullish Shark Pattern Kia Ha?

Bullish harmonic Shark pattern ek technical analysis tool hai jo traders use karte hain price movements aur trend reversals ko identify karne ke liye. Ye pattern Fibonacci retracement aur extension levels par based hai. Shark pattern mein hum swing high (XA leg) aur swing low (AB leg) points ko identify karte hain. Fir hum Fibonacci retracement levels ka use karke BC leg ke low point ko determine karte hain. BC leg typically 0.618 Fibonacci retracement level ke near hota hai. Uske baad hum CD leg ko identify karte hain. Ye leg usually 1.618 Fibonacci extension level tak extend hota hai. Jab ye levels confirm ho jate hain tab hum bullish Shark pattern ko samajh lete hain. Ye pattern bullish trend reversal indicate karta hai.

Entry Or Exit Point:

Traders is pattern ko entry aur exit points ke liye use karte hain. Entry point typically BC leg ke low point ke near hota hai, aur exit point CD leg ke completion ke baad hota hai.

Volatility:

Ye pattern market volatility aur price action ke saath bhi consider kiya jata hai. Isliye, practice aur experience ke saath hi aap is pattern ko better understand aur use kar sakte ho.

Bullish Shark Pattern Identify Karna:

Bullish harmonic Shark pattern identify karne ke liye aapko kuch steps follow karne honge. Yahan main aapko us process ko step-by-step explain karunga:

1. Sabse pehle aap trend direction determine karenge. Agar market upward trend mein hai, toh Shark pattern bullish reversal indicate kar sakta hai.

2. Ab aap swing low (AB leg) aur swing high (XA leg) points ko identify karenge. Swing low point A aur corresponding high point X ko dhundhein.

3. Fibonacci retracement tool ka use karte hue, XA leg ke low point se AB leg ke high point tak retracement levels plot karenge.

4. BC leg ke low point ko identify karenge. Ye typically 0.618 Fibonacci retracement level ke near hota hai.

5. CD leg ko identify karenge. Ye usually 1.618 Fibonacci extension level tak extend hota hai. Jab aap in steps ko follow karte hain tab aap Shark pattern ko identify kar sakte hain. Ye pattern aapko entry aur exit points ke liye help karta hai.

Bullish Shark Pattern Example:

Maan lo ki aap forex trading kar rahe ho aur aapko bullish harmonic Shark pattern dhondna ha. To ap Sabse pehle aap trend direction determine karte hain. Aap notice karte hain ki USD/JPY pair upward trend mein hai. Ab aap swing low (AB leg) aur swing high (XA leg) points ko dhundhte hain. Aapko ek significant low point A aur corresponding high point X milte hain. Ab aap Fibonacci retracement levels ka use karte hain. Fibonacci retracement tool se aap XA leg ke low point se AB leg ke high point tak retracement levels plot karte hain. Next step mein, aap BC leg ke low point ko dhundhte hain. Let's say, BC leg ka low point B 0.618 Fibonacci retracement level ke near hai. Finally, aap CD leg ko dhundhte hain. Suppose, CD leg 1.618 Fibonacci extension level tak jaata hai. Jab aap in steps ko follow karte hain, tab aap bullish harmonic Shark pattern ko identify kar lete hain. Is pattern se aap entry aur exit points determine kar sakte hain apne trades ke liye. Lekin yaad rakhein ye sirf ek tool hai aur aapko market conditions aur price action ko bhi consider karna hoga. Practice aur experience ke saath aap is pattern ko better identify kar payenge.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:48 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим