Stick Sandwich Candlestick Pattren.

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

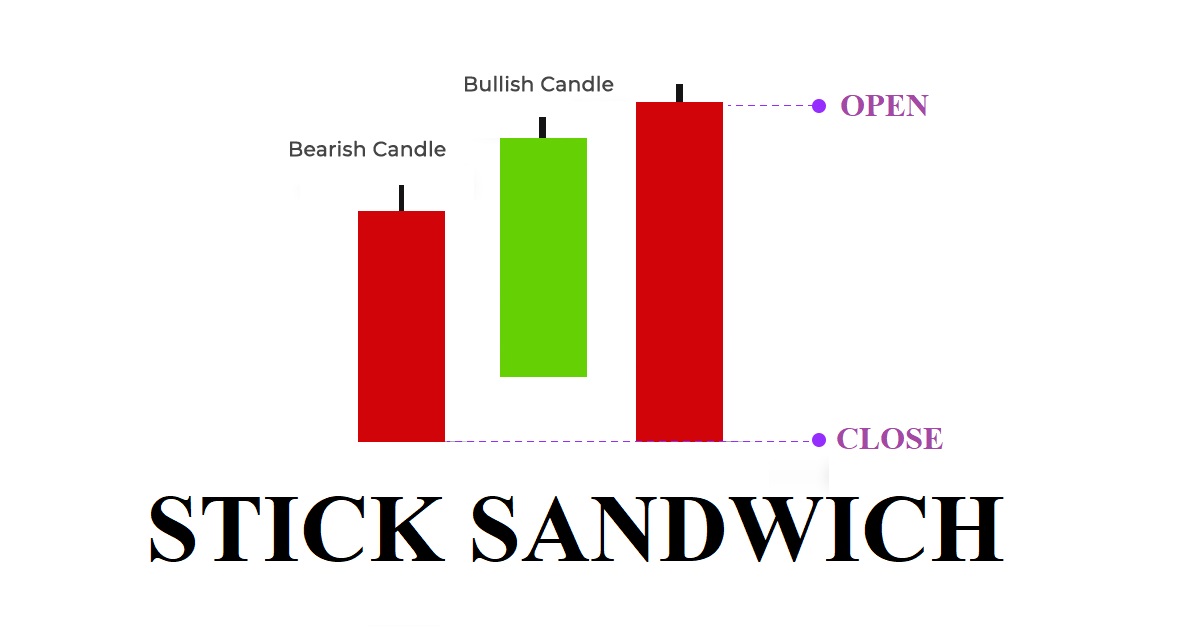

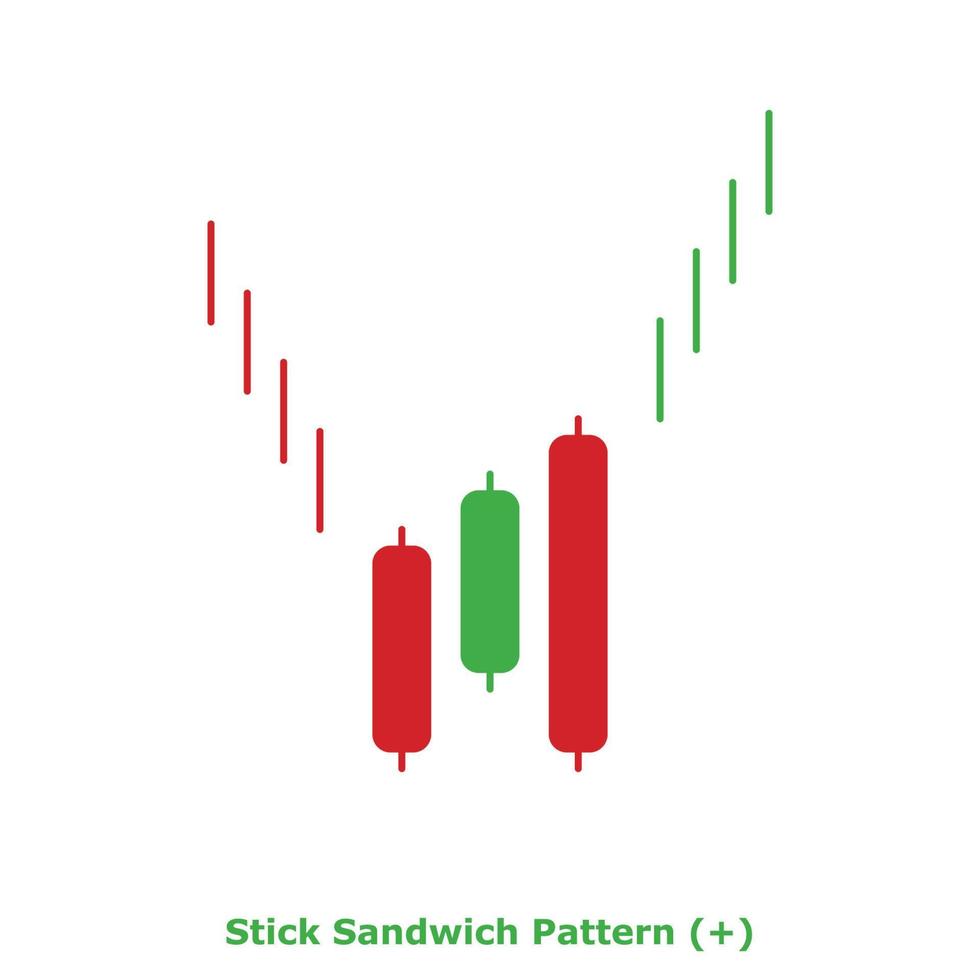

Stick Sandwich Candlesticks Pattern: Stick Sandwich Candlesticks Pattern ek technical analysis ka pattern hai jo trading mein istemal hota hai. Is pattern ko samajhna trading decisions ko improve karne mein madadgar ho sakta hai. Stick Sandwich Candlesticks Pattern ki Formation: Stick Sandwich Candlesticks Pattern ek reversal pattern hai, jise traders candlestick charts par dekhte hain. Is pattern mein typically teen candlesticks involved hote hain. Pehla Candlestick (Bullish): Pehla candlestick uptrend ya selling pressure ke baad aata hai Is candlestick ka opening price neeche hota hai aur closing price upar hota hai.Yeh candlestick bullish momentum ko represent karta hai. Dusra Candlestick (Bearish): Dusra candlestick bullish candlestick ke upar aata hai Iska opening price upar hota hai aur closing price neeche hota hai.Yeh candlestick selling pressure ko represent karta hai. Teesra Candlestick (Bullish): Teesra candlestick phir se bullish hota hai Iska opening price dusre candlestick ke neeche hota hai aur closing price pehle candlestick ke upar hota hai Yeh candlestick bullish reversal ko indicate karta hai. Kaise Kam Karta Ha: Stick Sandwich Pattern ek reversal signal deta hai. Jab traders is pattern ko dekhte hain, toh woh expect karte hain ke market direction change hone ke chances hain. Is pattern ka istemal trading strategies mein hota hai. Trading With Stick Sandwich Candlestick Pattren: Entry Point Agar kisi stock ya market mein Stick Sandwich Pattern dikhta hai, toh traders yeh samjhte hain ke ab market bullish direction mein ja sakta hai. Isko dekhte hue woh apne positions enter karte hain. Stop Loss Stick Sandwich Pattern ke istemal mein traders apne stop loss levels set karte hain taki loss kam ho sake agar market reversal na ho. Stick Sandwich Candlesticks Pattern ek powerful reversal signal ho sakta hai agar sahi tarah se samjha jaye aur istemal kiya jaye. Lekin, trading mein hamesha risk hota hai, isliye traders ko dhyan se research karna aur risk management ka istemal karna chahiye. -

#3 Collapse

Stick Sandwich Candlestick PatternForex trading mein candlestick patterns ek ahem hissa hain, jo traders ko price action aur market trends ko samajhne mein madadgar hotay hain. Stick Sandwich Candlestick Pattern bhi in patterns mein se aik hai, jiska istemal market analysis mein kiya jata hai. Yeh pattern traders ke liye ahem ho sakta hai, agar woh isay samajh kar sahi tarah se istemal karte hain. 1. Stick Sandwich Candlestick Pattern Kya Hai? Stick Sandwich Candlestick Pattern, market mein price reversal ko darust karne mein madadgar hota hai. Is pattern mein aik bearish (girawat darust karne wala) candle ek bullish (barhawat darust karne wala) candle ke darmiyan hota hai, jo aam tor par bearish trend ke beech aata hai. Iska matlab hai ke market bearish trend se bullish trend mein ja sakta hai. 2. Pechan Kaise Hoti Hai? Is pattern ko pehchanne ke liye aapko kuch specific cheezen dekhni hoti hain: - Pehla candle bearish hota hai, yaani ke iska closing price neechay hota hai. - Dusra candle bullish hota hai, yaani ke iska opening price pehle candle ke closing price ke qareeb hota hai. - Teesra candle phir se bearish hota hai, lekin iska closing price doosre candle ke opening price ke qareeb hota hai. 3. Trading Strategy: Stick Sandwich Candlestick Pattern ko samajh kar traders isay trading strategy mein shamil kar sakte hain. Yeh pattern aksar trend reversal ko signal karta hai, to traders isay use karke long (buy) positions le sakte hain, agar market bearish trend se bullish trend mein jane ka signal deta hai. 4. Risk Management: Hamesha yaad rahe ke Forex trading risk bhara kaam hai. Stick Sandwich Pattern ke istemal mein bhi risk management ko hamesha ahem taur par madde nazar rakha jana chahiye. Stop-loss aur take-profit orders ka istemal karna bhi zaroori hai taake aap apni positions ko control mein rakh saken. 5. Fayde: - Market trends ko samajhne mein madadgar hota hai. - Price reversal ko pehchanne mein help karta hai. - Trading strategies ko enhance kar sakta hai. In conclusion, Stick Sandwich Candlestick Pattern ek ahem tool ho sakta hai Forex trading mein, agar ise sahi tarah se samjha jaye aur uske sath risk management ka bhi khayal rakha jaye. Traders ko is pattern ko samajh kar istemal karne se pehle practice aur research karke apne trading skills ko behtar banane mein samay guzarna chahiye. -

#4 Collapse

About stick sandwich pattern: Forex trading mein "Stick Sandwich Pattern" ek candlestick pattern hai jo market trends aur potential reversals ko identify karne mein istemal hota hai. Is pattern mein do bearish (girawat ki taraf) candles ke darmiyan aik bullish (barhawat ki taraf) candle hoti hai, jo aksar trend reversal ko indicate karti hai. Chaliye is pattern ki Roman Urdu mein tafseelat dekhte hain: Stick Sandwich Pattern Key Elements (Stick Sandwich Pattern Ke Ahem Hissa): Pehli Candle (Bearish): Stick Sandwich pattern ka pehla candle bearish hota hai, yani ke iski closing price lower hoti hai compared to its opening price. Is candle ko sell-off candle bhi kehte hain. Dusri Candle (Bullish): Dusri candle bullish hoti hai, yani ke iski closing price higher hoti hai compared to its opening price. Is candle ko sandwich candle kehte hain. Teesri Candle (Bearish): Stick Sandwich pattern ka teesra candle phir se bearish hota hai, jiska closing price lower hoti hai compared to its opening price. Is candle ko dobara bearish candle ya sell-off candle kehte hain. Stick Sandwich Pattern Ka Kaam: Stick Sandwich pattern ka maqsad hota hai bearish trend ke doran market mein aik temporary reversal ko indicate karna. Yani ke, jab ye pattern market chart par dikhta hai, to iska signal hota hai ke bearish momentum kamzor ho sakta hai aur bullish momentum shuru ho sakta hai. Stick Sandwich Pattern Ke Signals (Signals): Stick Sandwich pattern traders ko doosri candle (sandwich candle) ke bullish nature ki taraf dhyan dene ke liye kehti hai. Iska signal hota hai ke market mein temporary buying pressure aa sakti hai aur bearish trend ko weaken kiya ja sakta hai. Is pattern ko samajh kar traders buy positions enter karne ka faisla le sakte hain, lekin hamesha yaad rahe ke kisi bhi single indicator ya pattern par pura bharosa na karen aur doosre technical indicators aur market analysis tools ka bhi istemal karen. Trading decisions ko validate karne aur risk management ko madde nazar rakhte hue trading ki taraf barha jana chahie. Bullish and bearish stick sandwich: Forex trading mein "Stick Sandwich Candlestick Pattern" ek technical analysis pattern hai jo market mein potential trend reversal ko darust karta hai. Ye pattern ek bearish (girawat ki taraf) trend ke baad aane wale bullish (barhawat ki taraf) reversal ko indicate karta hai. Chaliye is pattern ki Roman Urdu mein tafseelat dekhte hain: Stick Sandwich Pattern Key Elements (Stick Sandwich Pattern Ke Ahem Tafseelat): Pehla Candle (Bearish Candle): Stick Sandwich pattern ki shuruaat hoti hai ek bearish (girawat wala) candle se. Is bearish candle ki closing price neeche hoti hai aur ye market mein downtrend ko represent karti hai. Dusra Candle (Bullish Candle): Dusra candle bullish (barhawat wala) hota hai. Iski opening price pehle candle ki closing price ke qareeb hoti hai aur ye bearish candle ki aik hissa ko cover kar leti hai. Teesra Candle (Bearish Candle): Teesra candle phir se bearish hota hai aur iski opening price doosre candle ki closing price ke qareeb hoti hai. Ye candle pehli bearish candle ke aik hissa ko cover kar leti hai. Stick Sandwich Pattern Ka Tafsilaat: Stick Sandwich Pattern market mein bullish reversal signal provide karta hai. Jab yeh pattern market chart par dikhta hai, to iska matlab hota hai ke bearish trend weaken ho raha hai aur bullish momentum aane ki sambhavna darust hoti hai. Traders is pattern ko confirm karne ke liye doosre technical indicators aur price action analysis ka bhi istemal karte hain. Is pattern ko sahi tareeqe se pehchan kar trading decisions ko improve kiya ja sakta hai. Lekin hamesha yaad rahe ke kisi bhi single indicator par pura bharosa na karen aur risk management ko madde nazar rakhen. Forex trading mein risk hota hai, isliye trading decisions ko dhyan se lena zaroori hai. -

#5 Collapse

STICH SANDWICH CANDLESTICK PATTERN: Dear my friends Stick sandwich candlestick pattern ek aisa pattern hy jo technical pattern ko show karta hai. Yeh hamari trading mein Important role play karta hai. Ye profit deney mein bi kafi help karta hai. Agar hum in ke related information gain nahi krein gy to trading mein loss bhi ho sakta hy is liye in ke related humein Information hasil karna zaruri hota hy.Stick sandwich candlestick pattern 2 pattern par mustamil hai aik bearish candlestick pattern aur dosra bullish candlestick pattern. Bearish stick sandwich pattern market mein bohot kam nazar ata hai. Is mein pehle candle king aur green hoti hai. 2nd candle red aur ho market mein dono gap se open hoti hai. 3rd wali again green hoti hai Jo 2nd wali ko engulf krti hai. Bullish stick sandwich pattern mein pehli candle red banti hai aur 2nd candle green banti Jo down gap se open hoti hai. 3rd candle phir red aur long hoti hai. TYPES OF STICK SANDWICH CANDLESTICK PATTERN: BULLISH STICK SANDWICH CANDLESTICK PATTERN : Mere aziz shagirdon stick sandwich candlestick pattern main aap k pass three candlestick hoti hai is mein pahli candlestick aap ki small bearish candlestick hoti hai aur dusri candlestick 1 small bullish candlestick hoti hai third per Jo candle stick banti hai vah ek long bearish candle stick hoti hai aur agar aap confirmation ke bad trade karenge to aapko pata chalega ki yahan se bullish trend continue hone wala hai aur aap use hisab se apni trade laga ke ache se acha profit Kama sakte hain.yah candlestick aapko bullish trend ke bare mein batata hai aur jab bhi yah pattern aapke pass bane iske confirmation yah hai ki isase pahle market karo Jahan down hona chahiye market niche ki taraf aate a Hui dikhai deni chahiye aur uskey bad agar pattern bane to aapko samajh Jana chahiye ki ya bullish sandwich candlestick pattern hai aur yahan se trend change hone wala hai yahan se trend bullish hone wala hai. BEARISH SANDWICH CANDLE STICK PATTERN : Dear forex traders stick sandwich candlestick pattern aap ko market downward trend ke bare mein batata hai yah candlestick pattern bhi 3 candles ka combination hai jis mein aapke pass pahle candlestick mein bullish candle honi chahiye aur dusri candle aapke pass 1 small bearish candlestick honi chahiye aur third candlestick aap ke pass ek long bullish candlestick honi chahiye agar is ky piche market bonas trand mein a rahi hai aur uske bad yah pattern banta hai to aapko samajh Jana chahiye ki yahan se bearish trend start hone wala hai aur isko aap barrage ke hisab se trade laga ker ache se acha profit kama sakte hein. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 Collapse

What Is Stick Sandwich Chart Pattern: Forex Traders or merchants stick sandwich candle design aap ko market descending pattern ke uncovered mein batata hai yah candle design bhi 3 candles ka mix hai jis mein aapke pass pahle candle mein bullish light honi chahiye aur dusri candle aapke pass 1 little negative candle honi chahiye aur third candle aap ke pass ek long bullish candle honi chahiye agar is ky piche market bonas trand mein a rahi hai aur uske terrible yah design banta hai to aapko samajh Jana chahiye ki yahan se negative pattern start sharpen wala hai aur isko aap flood ke hisab se exchange laga ker hurt se acha benefit kama sakte hein.stick sandwich candle design primary aap k pass three candle hoti hai is mein pahli candle aap ki little negative candle hoti hai aur dusri candle 1 little bullish candle hoti hai third per Jo candle banti hai vah ek long negative candle hoti hai aur agar aap affirmation ke terrible exchange karenge to aapko pata chalega ki yahan se bullish pattern proceed with sharpen wala hai aur aap use hisab se apni exchange laga ke throb se acha benefit Kama sakte hain.yah candle aapko bullish pattern ke exposed mein batata hai aur hit bhi yah design aapke pass plague iske affirmation yah hai ki isase pahle market karo Jahan down hona chahiye Stick sandwich candle design ek aisa design hy jo specialized design ko show karta hai. Yeh hamari exchanging mein Significant pretend karta hai. Ye benefit deney mein bi kafi help karta hai. Agar murmur in ke related data gain nahi krein gy to exchanging mein misfortune bhi ho sakta hy is liye in ke related humein Data hasil karna zaruri hota hy.Stick sandwich candle design 2 example standard mustamil hai aik negative candle design aur dosra bullish candle design. Negative stick sandwich design market mein bohot kam nazar ata hai. Is mein pehle light lord aur green hoti hai. second light red aur ho market mein dono hole se open hoti hai. third wali again green hoti hai Jo second wali ko overwhelm krti hai. Bullish stick sandwich design mein pehli candle red banti hai aur second flame green banti Jo down hole se open hoti hai. third candle phir red aur long hoti hai. Chart Candles Formation With types: Dealers is design ko affirm karne ke liye doosre specialized pointers or technical indicators aur cost activity ka bhi istemal karte hain. Is design ko sahi tareeqe se pehchan kar exchanging choices ko improve kiya ja sakta hai. Lekin hamesha yaad rahe ke kisi bhi single marker standard pura bharosa na karen aur risk the board ko madde nazar rakhen. Forex exchanging mein risk hota hai, isliye exchanging choices ko dhyan se lena zaroori hai.Forex exchanging mein "Stick Sandwich Candle Example" ek specialized investigation design hai jo market mein potential pattern inversion ko darust karta hai. Ye design ek negative (girawat ki taraf) pattern ke baad aane rib bullish (barhawat ki taraf) inversion ko demonstrate karta hai. Chaliye is design ki Roman Urdu mein tafseelat dekhte hain Stick Sandwich design ki shuruaat hoti hai ek negative (girawat wala) light se. Is negative light ki shutting cost neeche hoti hai aur ye market mein downtrend ko address karti hai. Dusra candle bullish (barhawat wala) hota hai. Iski opening cost pehle candle ki shutting cost ke qareeb hoti hai aur ye negative candle ki aik hissa ko cover kar leti hai.Teesra flame phir se negative hota hai aur iski opening cost doosre candle ki shutting cost ke qareeb hoti hai. Ye candle pehli negative candle ke aik hissa ko cover kar leti hai.

Stick sandwich candle design ek aisa design hy jo specialized design ko show karta hai. Yeh hamari exchanging mein Significant pretend karta hai. Ye benefit deney mein bi kafi help karta hai. Agar murmur in ke related data gain nahi krein gy to exchanging mein misfortune bhi ho sakta hy is liye in ke related humein Data hasil karna zaruri hota hy.Stick sandwich candle design 2 example standard mustamil hai aik negative candle design aur dosra bullish candle design. Negative stick sandwich design market mein bohot kam nazar ata hai. Is mein pehle light lord aur green hoti hai. second light red aur ho market mein dono hole se open hoti hai. third wali again green hoti hai Jo second wali ko overwhelm krti hai. Bullish stick sandwich design mein pehli candle red banti hai aur second flame green banti Jo down hole se open hoti hai. third candle phir red aur long hoti hai. Chart Candles Formation With types: Dealers is design ko affirm karne ke liye doosre specialized pointers or technical indicators aur cost activity ka bhi istemal karte hain. Is design ko sahi tareeqe se pehchan kar exchanging choices ko improve kiya ja sakta hai. Lekin hamesha yaad rahe ke kisi bhi single marker standard pura bharosa na karen aur risk the board ko madde nazar rakhen. Forex exchanging mein risk hota hai, isliye exchanging choices ko dhyan se lena zaroori hai.Forex exchanging mein "Stick Sandwich Candle Example" ek specialized investigation design hai jo market mein potential pattern inversion ko darust karta hai. Ye design ek negative (girawat ki taraf) pattern ke baad aane rib bullish (barhawat ki taraf) inversion ko demonstrate karta hai. Chaliye is design ki Roman Urdu mein tafseelat dekhte hain Stick Sandwich design ki shuruaat hoti hai ek negative (girawat wala) light se. Is negative light ki shutting cost neeche hoti hai aur ye market mein downtrend ko address karti hai. Dusra candle bullish (barhawat wala) hota hai. Iski opening cost pehle candle ki shutting cost ke qareeb hoti hai aur ye negative candle ki aik hissa ko cover kar leti hai.Teesra flame phir se negative hota hai aur iski opening cost doosre candle ki shutting cost ke qareeb hoti hai. Ye candle pehli negative candle ke aik hissa ko cover kar leti hai. Pattern or Design ka matlab hota hai ke market mein introductory selling pressure thi jo ke pehli candle mein dikhayi di, lekin phir purchasers ne control recapture kiya aur cost ko upar le gaye, jo doosri candle mein reflect hota hai. Lekin, teesri candle mein phir se selling pressure aata hai aur cost neeche jaata hai. Iska asal matlab hota hai ke market mein vulnerability hai aur pattern inversion sharpen ke chances hain.Stick Sandwich Candle Example ek helpful specialized investigation device ho sakti hai merchants aur financial backers ke liye. Is design ko samajh kar, market ke patterns aur inversions ko better tarike se samajha ja sakta hai. Lekin, exchanging choices banate waqt hamesha alert aur risk the executives ka istemal karna zaroori hai. Stick sandwich design ko dusre markers ke saath consolidate karke hello exchanging choices lena behtar hota hai. Trading With Identification Of Chart Pattern: Candles Example ek strong inversion signal ho sakta hai agar sahi tarah se samjha jaye aur istemal kiya jaye. Lekin, exchanging mein hamesha risk hota hai, isliye brokers ko dhyan se research karna aur risk the board ka istemal karna chahiye.Entry Point Agar kisi stock ya market mein Stick Sandwich Example dikhta hai, toh merchants yeh samjhte hain ke stomach muscle market bullish course mein ja sakta hai. Isko dekhte shade woh apne positions enter karte hain. Stop Misfortune Stick Sandwich Example ke istemal mein brokers apne stop misfortune levels set karte hain taki misfortune kam ho purpose agar market inversion na ho.Stick Sandwich Example ek inversion signal deta hai. Punch brokers is design ko dekhte hain, toh woh expect karte hain ke market bearing change sharpen ke chances hain. Is design ka istemal exchanging techniques mein hota hai.

Stick Sandwich ek candle design hai jo specialized examination me istemal hota hai securities exchange me cost development ka investigation karne ke liye. Ye design dojis ke aas-pass paya jata hai aur for the most part pattern inversion ko show karta hai.Stick Sandwich design me, do successive candles hote hain, jinme se center candle (doji) do aur pichle flame ki tarah open aur close costs ke beech ka unimportant distinction rakhta hai. Yani, doji ke open cost aur close cost practically same hoti hain.Is design me, jo pichla light hota hai wo doji ke upar hota hai aur jo agla candle hota hai wo doji ke specialty hota hai. Yani, ye ek bullish doji sandwich hota hai, jisme center doji negative hoti hai.Stick sandwich design merchants ke liye ek significant apparatus ho sakti hai exchanging choices banane mein. Punch ye design market mein aata hai, to dealers isko dekhte hain aur samajhte hain ke market mein inversions ki plausibility hai. Agar ye design ek upturn ke baad aata hai, to iska matlab ho sakta hai ke bullish pattern powerless ho raha hai aur negative inversion sharpen ke chances hain. Is tarah se, dealers long positions ko close kar sakte hain ya short positions le sakte hain. Lekin, yaad rahe ke stick sandwich design ek single pointer nahi hai, aur exchanging choices banate waqt dusre specialized markers aur investigation apparatuses ka bhi istemal karna zaroori hai.

Stick Sandwich ek candle design hai jo specialized examination me istemal hota hai securities exchange me cost development ka investigation karne ke liye. Ye design dojis ke aas-pass paya jata hai aur for the most part pattern inversion ko show karta hai.Stick Sandwich design me, do successive candles hote hain, jinme se center candle (doji) do aur pichle flame ki tarah open aur close costs ke beech ka unimportant distinction rakhta hai. Yani, doji ke open cost aur close cost practically same hoti hain.Is design me, jo pichla light hota hai wo doji ke upar hota hai aur jo agla candle hota hai wo doji ke specialty hota hai. Yani, ye ek bullish doji sandwich hota hai, jisme center doji negative hoti hai.Stick sandwich design merchants ke liye ek significant apparatus ho sakti hai exchanging choices banane mein. Punch ye design market mein aata hai, to dealers isko dekhte hain aur samajhte hain ke market mein inversions ki plausibility hai. Agar ye design ek upturn ke baad aata hai, to iska matlab ho sakta hai ke bullish pattern powerless ho raha hai aur negative inversion sharpen ke chances hain. Is tarah se, dealers long positions ko close kar sakte hain ya short positions le sakte hain. Lekin, yaad rahe ke stick sandwich design ek single pointer nahi hai, aur exchanging choices banate waqt dusre specialized markers aur investigation apparatuses ka bhi istemal karna zaroori hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:25 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим