What Is Stick Sandwich Candlesticks Pattern ?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

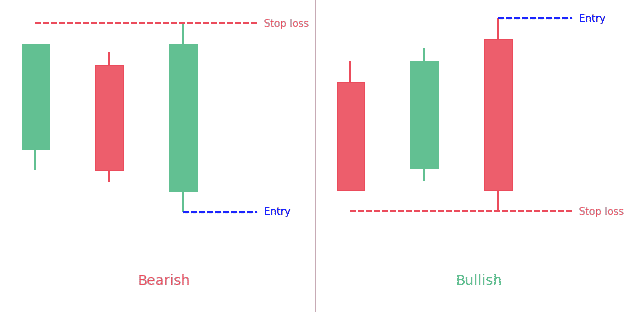

"Stick sandwich" ka matlab hota hai jab kisi shakhs ya cheez ko kisi mushkil ya samasya ke darmiyan phasaya jaye, jahan par woh kisi bhi tarah se nikal nahi sakta aur usay mushkil halat mein chora jata hai. Isay aksar istemal hota hai jab kisi ko do mushkil ya takleef bhari situationon ke darmiyan chora jata hai aur woh kisi bhi taraf nahi ja sakta. Is se wazeh hota hai ke unka koi acha ya munasib option nahi hota, aur woh samasya ka shikaar ho jate hain. Isi tarah, "stick sandwich" ek aisi situation ko darust karti hai jahan par koi asal rasta nahi hota. "Stick Sandwich" candlestick pattern: "Stick Sandwich" candlestick pattern ek technical analysis term hai jo stock market mein istemal hoti hai. Is pattern mein, do candlesticks (mumkin hai ke ek bullish aur ek bearish) aik khaas tareeqay se arrange hoti hain, jo market mein trend reversal ya trend continuation ko darust karne ki koshish karti hain. Formation Of "Stick Sandwich" Candlestick: Stick Sandwich Pattern mein, pehli candlestick ek bearish (girawat ki taraf) candle hoti hai, jiska closing price neeche hota hai. Phir, doosri candlestick aati hai jo bullish (barhne ki taraf) hoti hai, jiska opening price pehli candle ki closing price ke qareeb hota hai. Isi ke baad, teesri candlestick aati hai jo phir se bearish hoti hai aur iski closing price doosri candle ki opening price ke qareeb hoti hai. Stick Sandwich Pattern ko "Stick Sandwich" kehte hain kyunki yeh do bullish candles ke darmiyan ek bearish candle ko sandwich karti hai. Yeh pattern market mein uncertainty ya indecision ko darust kar sakta hai. Agar Stick Sandwich Patternko sahi tareeqay se interpret kiya jaye toh iska matlab ho sakta hai ke trend reversal hone ke chances hain, ya phir market mein consolidation (stability) ho sakti hai. Stick Sandwich Pattern ko samajhna aur istemal karna traders ke liye ahem ho sakta hai, lekin yaad rahe ke kisi bhi technical analysStick Sandwich Patternki successful trading ke liye aur bhi factors ka tayyun karna zaroori hota hai. -

#3 Collapse

Stick Sandwich Candlesticks Pattern Explanation. Stick Sandwich Candlesticks Pattern ek technical analysis tool hai jo stock market mein istemal kiya jata hai. Is pattern ko dekh kar traders stocks ke trend ka andaza lagate hain. Stick Sandwich Candlesticks Pattern Make. Stick Sandwich Candlesticks Pattern mein do bearish candles ke beech mein ek bullish candle hoti hai. Is pattern ko dekh kar traders ko ye samajh mein aata hai ke market mein bearish trend khatam hone wala hai aur bullish trend shuru hone wala hai. Stick Sandwich Candlesticks Pattern Uses. Stick Sandwich Candlesticks Pattern ka istemal trend ka pata lagane ke liye kiya jata hai. Agar is pattern ko dekh kar traders ko lagta hai ke bullish trend shuru hone wala hai to wo stocks khareedte hain aur agar bearish trend shuru hone wala hai to wo stocks bechte hain. Stick Sandwich Candlesticks Pattern Market Anylesis. Stick Sandwich Candlesticks Pattern ki jankari hasil karne ke liye technical analysis tools ka istemal kiya jata hai. Is pattern ko dekh kar traders charts aur graphs ko analyze karte hain. Stick Sandwich Candlesticks Pattern Workings. Stick Sandwich Candlesticks Pattern se traders ko ye maloom ho jata hai ke market mein trend kis direction mein ja raha hai. Is pattern ko dekh kar traders stocks ka future ka andaza laga sakte hain aur apni trading decisions ko iske mutabik adjust kar sakte hain. Candlestick patterns both useful hote hain agar inki help lekar market ko analyse kar liya jaaye aur phir koi bhi trade open ki jaaye to is Tarah se trades successful hoti hain. Stick sandwich candlestick pattern ek useful pattern hai lekin iske liye pahle apna workout kar lena hota hai aur uske bad hi isko apni trading mein apply karna hota hai. -

#4 Collapse

Candlestick Patterns: Forex traders aksar price movements ko analyze karne ke liye candlestick patterns ka istemal karte hain. Ye patterns market ke reversals ya continuations ke liye insights provide karte hain. Ek aisa pattern hai jo "Stick Sandwich" kehlata hai. 2. Stick Sandwich Candlestick Pattern: Stick Sandwich ek aisa teen-candlestick pattern hai jo maujooda trend mein reversal ki alamat ho sakta hai. Is mein do chhoti candlesticks ek badi candlestick ko beech mein "sandwich" karti hain. 3. Stick Sandwich Parts:- a, Candlestick Patterns: Forex traders aksar price movements ko analyze karne ke liye candlestick patterns ka istemal karte hain. Ye patterns market ke reversals ya continuations ke liye insights provide karte hain. Ek aisa pattern hai jo "Stick Sandwich" kehlata hai. 2. Stick Sandwich Candlestick Pattern: Stick Sandwich ek aisa teen-candlestick pattern hai jo maujooda trend mein reversal ki alamat ho sakta hai. Is mein do chhoti candlesticks ek badi candlestick ko beech mein "sandwich" karti hain. 3. Stick Sandwich Parts:- a, Bullish: - Ye candlestick aam taur par bullish hoti hai, matlab ye close open se zyada hoti hai. - Ye maujooda uptrend ko darust karti hai. b.Bearish:: - Dusri candlestick bearish hoti hai, matlab ye open se nicha close hoti hai. - Aksar ye candle pichli close se down gap karta hai. c. Bullish: - Teesri candlestick bhi bullish hoti hai, matlab ye open se zyada close hoti hai. - Ye chahiye ke ye candle pehli candle ki close ke qareeb ya usse oopar close ho. 4. Explaination : Stick Sandwich pattern maujooda bearish trend se bullish trend ki possible reversal ki isharaat deta hai. Dusri candle bearish hone se sentiment mein short-term change ki taraf isharaat hoti hain. Pehli aur teesri candle bullish hone se ye ishara hota hai ke bullish trend dobara shuru ho sakta hai. 5. Trading Strategy: Jab traders Stick Sandwich pattern dekhte hain, to woh ek long (khareedna) position enter karne ka sochte hain. Woh stop-loss order set kar sakte hain jo dusri (bearish) candle ki low se nicha ho. Take-profit level risk tolerance aur market conditions ke mutabiq set kiya ja sakta hai. 6. Verification: Trading decision se pehle Stick Sandwich pattern ko tasdeeq karne ke liye doosre technical analysis tools aur indicators ka istemal karna zaroori hai. Trendline support ya resistance levels jaise additional reversal signs ko dekhein. 7. Risk Management: Jaise ke har trading strategy mein, risk management ahem hai. Hamesha itna risk na uthaye jo aap afford kar sakte hain. Apne trading plan ko follow karein aur sahi position sizing ka istemal karein. 8. Conclusion:- Stick Sandwich Candlestick Pattern Forex mein traders ke liye ahem ho sakta hai jo market mein potential reversals pehchanne ki koshish kar rahe hain. Lekin hamesha yaad rahe ke isey doosri analysis techniques aur risk management strategies ke sath istemal karna chahiye taake aap inform trading decisions le saken. : - Ye candlestick aam taur par bullish hoti hai, matlab ye close open se zyada hoti hai. - Ye maujooda uptrend ko darust karti hai. b.Bearish:: - Dusri candlestick bearish hoti hai, matlab ye open se nicha close hoti hai. - Aksar ye candle pichli close se down gap karta hai. c. Bullish: - Teesri candlestick bhi bullish hoti hai, matlab ye open se zyada close hoti hai. - Ye chahiye ke ye candle pehli candle ki close ke qareeb ya usse oopar close ho. 4. Explaination : Stick Sandwich pattern maujooda bearish trend se bullish trend ki possible reversal ki isharaat deta hai. Dusri candle bearish hone se sentiment mein short-term change ki taraf isharaat hoti hain. Pehli aur teesri candle bullish hone se ye ishara hota hai ke bullish trend dobara shuru ho sakta hai. 5. Trading Strategy: Jab traders Stick Sandwich pattern dekhte hain, to woh ek long (khareedna) position enter karne ka sochte hain. Woh stop-loss order set kar sakte hain jo dusri (bearish) candle ki low se nicha ho. Take-profit level risk tolerance aur market conditions ke mutabiq set kiya ja sakta hai. 6. Verification: Trading decision se pehle Stick Sandwich pattern ko tasdeeq karne ke liye doosre technical analysis tools aur indicators ka istemal karna zaroori hai. Trendline support ya resistance levels jaise additional reversal signs ko dekhein. 7. Risk Management: Jaise ke har trading strategy mein, risk management ahem hai. Hamesha itna risk na uthaye jo aap afford kar sakte hain. Apne trading plan ko follow karein aur sahi position sizing ka istemal karein. 8. Conclusion:- Stick Sandwich Candlestick Pattern Forex mein traders ke liye ahem ho sakta hai jo market mein potential reversals pehchanne ki koshish kar rahe hain. Lekin hamesha yaad rahe ke isey doosri analysis techniques aur risk management strategies ke sath istemal karna chahiye taake aap inform trading decisions le saken. -

#5 Collapse

Candlestick Patterns: Forex traders aksar price movements ko analyze karne ke liye candlestick patterns ka istemal karte hain. Ye patterns market ke reversals ya continuations ke liye insights provide karte hain. Ek aisa pattern hai jo "Stick Sandwich" kehlata hai. 2. Stick Sandwich Candlestick Pattern: Stick Sandwich ek aisa teen-candlestick pattern hai jo maujooda trend mein reversal ki alamat ho sakta hai. Is mein do chhoti candlesticks ek badi candlestick ko beech mein "sandwich" karti hain. 3. Stick Sandwich Parts:- a, Bullish: - Ye candlestick aam taur par bullish hoti hai, matlab ye close open se zyada hoti hai. - Ye maujooda uptrend ko darust karti hai. b.Bearish:: - Dusri candlestick bearish hoti hai, matlab ye open se nicha close hoti hai. - Aksar ye candle pichli close se down gap karta hai. c. Bullish: - Teesri candlestick bhi bullish hoti hai, matlab ye open se zyada close hoti hai. - Ye chahiye ke ye candle pehli candle ki close ke qareeb ya usse oopar close ho. 4. Explaination : Stick Sandwich pattern maujooda bearish trend se bullish trend ki possible reversal ki isharaat deta hai. Dusri candle bearish hone se sentiment mein short-term change ki taraf isharaat hoti hain. Pehli aur teesri candle bullish hone se ye ishara hota hai ke bullish trend dobara shuru ho sakta hai. 5. Trading Strategy: Jab traders Stick Sandwich pattern dekhte hain, to woh ek long (khareedna) position enter karne ka sochte hain. Woh stop-loss order set kar sakte hain jo dusri (bearish) candle ki low se nicha ho. Take-profit level risk tolerance aur market conditions ke mutabiq set kiya ja sakta hai. 6. Verification: Trading decision se pehle Stick Sandwich pattern ko tasdeeq karne ke liye doosre technical analysis tools aur indicators ka istemal karna zaroori hai. Trendline support ya resistance levels jaise additional reversal signs ko dekhein. 7. Risk Management: Jaise ke har trading strategy mein, risk management ahem hai. Hamesha itna risk na uthaye jo aap afford kar sakte hain. Apne trading plan ko follow karein aur sahi position sizing ka istemal karein. 8. Conclusion:- Stick Sandwich Candlestick Pattern Forex mein traders ke liye ahem ho sakta hai jo market mein potential reversals pehchanne ki koshish kar rahe hain. Lekin hamesha yaad rahe ke isey doosri analysis techniques aur risk management strategies ke sath istemal karna chahiye taake aap inform trading decisions le saken. -

#6 Collapse

Stick Sandwich ya Stick Sandwich Candlesticks Pattern ek technical analysis ka concept hai jo share market aur trading mein istemal hota hai. Yeh ek specific candlestick pattern hai jo traders ko price action ka ek particular scenario dikhata hai. Is pattern ko samajhna aur uska istemal karke traders market mein entry aur exit points ka faisla karte hain.

Stick Sandwich pattern ko samajhne ke liye sabse pehle, hume candlesticks aur unki formations ka concept samajhna zaroori hai. Candlesticks market ka har ek movement ko represent karte hain. Har ek candlestick ek specific time period ko darust karta hai, jese ke ek din, ek ghanta ya ek hafte.

Stick Sandwich pattern ek reversal pattern hai, yaani ke iska zahir hota hai ke market ki trend change hone wala hai. Yeh pattern do bearish aur ek bullish (barhavat ki taraf) candlesticks se bana hota hai.

Is pattern mein pehle ek bearish candlestick hota hai jo selling pressure ko indicate karta hai. Uske baad, doosri candlestick hoti hai, jo ki bullish hoti hai, yaani ke buyers ki taraf se aati hai. Aur phir teesri candlestick aati hai, jo dobara bearish hoti hai. Lekin iske nichle hisse mein pehli candlestick se lambi hoti hai, aur isliye isse 'sandwich' kehte hain.

Stick Sandwich pattern ka components- Pehla Candlestick: Ye ek bearish candle hoti hai, jo market mein selling pressure ko dikhata hai. Is candle ki lambai aur chaudiayi ko dekha jata hai.

- Doosra Candlestick: Doosri candlestick bullish hoti hai, yaani ke buyers ki taraf se aati hai. Yeh candle pehli candlestick ke nichle hisse se neeche hoti hai, aur ideally iski lambai pehli candlestick se lambi hoti hai.

- Teesri Candlestick: Teesri candlestick phir se bearish hoti hai, lekin iski lambai pehli candlestick se lambi hoti hai. Is tarah se, yeh candlestick pehli aur doosri candlesticks ko "sandwich" karti hai.

Stick Sandwich pattern ek reversal signal hai. Jab yeh pattern form hota hai, toh traders dekhte hain ke market ka trend change hone wala hai. Agar yeh pattern downtrend ke baad form hota hai, toh ye bullish reversal signal hai, aur traders long positions le sakte hain. Agar yeh pattern uptrend ke baad form hota hai, toh ye bearish reversal signal hai, aur traders short positions le sakte hain.

Is pattern ka istemal karte waqt, traders ko hamesha confirmatory signals aur dusre technical indicators ka bhi istemal karna chahiye. Kisi bhi ek pattern par pura bharosa karke trading karna risky ho sakta hai. Stick Sandwich pattern ke sath volume, moving averages, aur support/resistance levels jese aur indicators ka istemal karke traders ko apne trading decisions ko validate karna chahiye.

Is pattern ki samajh aur istemal mein practice aur experience ki zaroorat hoti hai. Naye traders ko pehle demo accounts ya small positions ke saath practice karna chahiye, aur jab unhe is pattern ko samajhne aur identify karne mein confidence ho, tabhi real trading shuru karni chahiye.

Stick Sandwich pattern ek powerful reversal signal hai jo traders ko market ke trend changes ke bare mein alert karta hai. Lekin iska istemal karne se pehle thorough analysis aur confirmatory signals ka istemal zaroori hai.

-

#7 Collapse

INTRODUCTION

market mein Stich Sandwich ek reversal candlestick pattern hai jo during downtrend dikhai deta hai aur bullish reversal ka signal generate kerta hai. Yeh candlestick pattern aik strong technical trading pattern hay. Jo traders ess pattern per complete knowledw gain gain ker lety hein market kay entry points find kerna easy ho jata hay.

IDENTIFICATION

Kisi bi pattern ki identification basic requirement hoti hay. Ess pattern mein three candlesticks hoti hein, jin mein sey two candles kay center mein aik opposite trend ki candle sandwich ki tarah price chart par form hein. Both side wali candles ki range center wali candle say large hoti hay. Stick sandwich pattern both bullish aur bearish indications provide karta hay.

CHARACTERISTICS

Fellows Es pattern mein first candle green colour and long hoti hy jo indicate karti hy kay market es time bullish control mein hy. Es ky baad second candle red colour mein form hy jo market mein down gap sy open hoti hy aor eski closing price previous candle ki closing price kay same hoti hy. Jab third candle hoti hy woh again green hoti hy aor second candle ko engulfing kar leti hy. Trader ko third candlestick ky break hony ka wait karna chehye. Bullish stick sandwich candlestick pattern mein pehle candle red form hoti hy and second candle green form hoti hy, jo gap down sy open hoti hy. Third candle again red and long form hoti hy jo second candle ko cover kar leti hy. Jiss kay baad woh market ko previous candle k low par ley ati hy. Trader ko es pattern mein break hony ka wait karna chahiye aor ess ky baad he apna aorder place karna chahiye.

CONCLUSION

Forex business mein Stick sandwich candlestick pattern always short term candlestick pattern hote hein. Es candlestick ka closing price mostly 2nd candlestick ke closing price kay up side hota hai. It means yeh three candlesticks combination mein form hoti hain, jo stick sandwich pattern banate hain. Es pattern ko samajhna aur istemal karna traders ke liye important ho sakta hai, but ess ki confirmation kay liye aur technical analysis tools ka istemal better option ho sakti hay. Jiss sey prediction mein mazeed accuracy aa sakti hay.

-

#8 Collapse

The Stick Sandwich candlestick pattern is a three-candle pattern that typically occurs in financial markets such as stocks, forex, or commodities. It's considered a reversal pattern and consists of three candles, where the second candlestick is positioned between two identical or near-identical candles in the opposite direction. Below is a detailed explanation of the Stick Sandwich pattern:

1. First Candlestick (Bullish)

The pattern starts with a bullish candlestick, indicating an upward price movement. This candlestick usually reflects the existing bullish sentiment in the market.

2. Second Candlestick (Bearish)

The second candlestick is bearish and stands out as a "sandwich" between two bullish candles. However, its size is often smaller compared to the other two candles. This candlestick may suggest a temporary reversal or consolidation in the prevailing uptrend.

3. Third Candlestick (Bullish)

The third candlestick is another bullish candle that follows the bearish one. It closes higher than the open of the bearish candlestick, ideally, closing near or above the close of the first bullish candlestick. This candle indicates the continuation of the bullish sentiment after a brief interruption by the bearish candle.

4. Volume Analysis

Volume analysis is essential when identifying the Stick Sandwich pattern. Generally, the volume should be relatively higher during the bullish candles compared to the bearish ones, confirming the strength of the bullish sentiment.

5. Confirmation

Traders often look for additional confirmation signals to validate the Stick Sandwich pattern. This can include factors like support and resistance levels, trend lines, or other technical indicators aligning with the pattern.

6. Price Action Context

Context plays a crucial role in understanding the Stick Sandwich pattern. If the pattern appears at significant support levels or after a strong bullish trend, its significance may increase.

7. Risk Management

Risk management is vital in trading any pattern. Traders should use stop-loss orders to manage risk effectively and protect against unexpected market movements.

The Stick Sandwich pattern suggests a temporary interruption or consolidation in an uptrend, followed by a continuation of the bullish sentiment. However, like any technical pattern, it's essential to consider the overall market context and use proper risk management techniques when trading based on this pattern. -

#9 Collapse

Introduction: Candlesticks patterns market analysis mein ahem hoti hain. Stick sandwich candlesticks pattern ek aham candlesticks pattern hai jo traders ke liye ahem hai. Yeh pattern market trends ko samajhne aur trading decisions ko improve karne mein madadgar sabit ho sakta hai. Is article mein hum stick sandwich candlesticks pattern ke bare mein mukhtasar tafseelat par ghaur karenge.- Stick Sandwich Candlesticks Pattern Ki Pehchan: Stick sandwich candlesticks pattern mein teen consecutive candlesticks shamil hote hain. Pehli candlestick bullish trend ko darust karti hai aur uski body normal se bara hota hai. Dusri candlestick bearish trend ka hissa hoti hai aur iski body pehli candlestick ke just neeche hoti hai. Teesri candlestick phir se bullish trend ka hissa hoti hai aur uski body bhi normal se bara hota hai.

- Upper Candlestick: Upper candlestick bullish trend ka hissa hota hai aur iski body normal se bara hota hai. Yeh candlestick pehli candlestick ke just upar hota hai aur upward price movement ko darust karta hai.

- Middle Candlestick: Middle candlestick ek bearish candlestick hota hai jo upper candlestick ke just neeche hota hai. Yeh candlestick bullish trend ke beech mein ata hai aur bearish reversal ko indicate karta hai.

- Lower Candlestick: Lower candlestick bhi bullish trend ka hissa hota hai aur iski body normal se bara hota hai. Yeh candlestick middle candlestick ke just neeche hota hai aur upward trend ko confirm karta hai.

- Pattern Ki Tasdeeq: Stick sandwich pattern ki tasdeeq karne ke liye, middle candlestick ki high aur low upper aur lower candlesticks ke high aur low se darmiyani honi chahiye. Yani ke middle candlestick ki range upper aur lower candlesticks ki range ke darmiyan honi chahiye.

- Market Mein Application: Stick sandwich pattern market mein reversal ko indicate karta hai. Yeh bullish trend ke baad bearish trend ka signal hai. Jab market mein bullish trend hota hai aur stick sandwich pattern appear hota hai, to yeh ek indication hai ke market mein bearish reversal hone wala hai.

- Stick Sandwich Candlesticks Pattern Ka Istemal: Traders stick sandwich pattern ka istemal karke trade ko enter aur exit karte hain. Agar market mein bullish trend hai aur stick sandwich pattern appear hota hai, to traders short positions ko enter kar sakte hain.

- Stop Loss Aur Target: Traders ko stop loss aur target ko set karne mein madad milti hai stick sandwich pattern se. Jab traders stick sandwich pattern ka istemal karte hain, to woh apni positions ke liye stop loss aur target levels ko define kar sakte hain.

- Stick Sandwich Pattern Ka Tareeqa: Stick sandwich pattern ka tareeqa samajhne ke liye practice aur experience zaroori hai. Traders ko candlesticks ki prices ko analyze karna aur pattern ko identify karna seekhna chahiye.

- Khatra Aur Imtiaz: Har trading pattern ki tarah, stick sandwich pattern bhi khatra aur imtiaz dono ke saath aata hai. Agar traders pattern ko sahi tarah se samajh lete hain aur sahi time par trade karte hain, to yeh unhe profits mein madadgar ho sakta hai.

- Technical Analysis Mein Ahmiyat: Technical analysis mein candlesticks patterns ka istemal market trends aur price movements ko samajhne mein madadgar hai. Candlesticks patterns traders ko market sentiment aur price action ke bare mein valuable insights provide karte hain.

- Stick Sandwich Candlesticks Pattern Aur Trading Strategy: Stick sandwich pattern ko apni trading strategy ka hissa banane se pehle thorough analysis karna zaroori hai. Traders ko pattern ko samajhne aur uski reliability ko assess karne ke liye backtesting aur demo trading ka istemal karna chahiye.

- Conclusion: Stick sandwich candlesticks pattern ek powerful tool hai jo traders ko market trends ko samajhne mein madad deta hai aur unhe better trading decisions lene mein madad karta hai. Is pattern ko samajhne aur sahi tareeqe se apply karne se traders apne trading skills ko improve kar sakte hain aur consistent profits earn kar sakte hain.

-

#10 Collapse

Forex Exchange Mein Stick Sandwich Candlesticks Pattern+-+-+-+

"Stick Sandwich" candlestick pattern, jo ki Japanese candlestick chart analysis mein ek common pattern hai, typically reversal signals ko identify karne mein istemal hota hai. Is pattern mein, do small candles (jo ki opposite directions mein hote hain) ke beech mein ek long candle hota hai. Is long candle ke dono taraf ke small candles ki range mein hota hai.

Forex Exchange Mein Stick Sandwich Candlesticks Pattern Ke Characteristics+-+-+-+

Stick Sandwich candlestick pattern ke kuch key characteristics hote hain:- Three Candles: Stick Sandwich pattern mein teen candles hote hain: ek long candle sandwiched between do chhoti candles.

- Long Candle in Opposite Direction: Sandwich ke beech mein wala candle, jo ki long hota hai, typically opposite direction mein hota hai compared to the trend. Agar trend bullish hai, to ye long candle bearish hoga, aur agar trend bearish hai, to ye long candle bullish hoga.

- Small Candles: Dono taraf ke chhoti candles usually small hoti hain aur inki range long candle ke andar hoti hai.

- Consolidation Signal: Stick Sandwich pattern market mein consolidation ya indecision ko indicate karta hai. Yeh ek transition period ko represent karta hai jab market direction change hone ki possibility hoti hai.

- Volume Confirmation: Ideal scenario mein, Stick Sandwich pattern ke saath volume increase dekhne par pattern ki reliability aur strong hoti hai. Agar volume increase nahi hota, to pattern ki effectiveness kam ho sakti hai.

- Confirmation Signals: Traders usually aur technical indicators ya patterns ke saath Stick Sandwich ko confirm karte hain. For example, trend lines, support aur resistance levels, aur oscillators jaise ki RSI ya Stochastic Oscillator ka use kiya ja sakta hai.

-

#11 Collapse

Stick Sandwich Candlestick Pattern: Wazahat Aur Trading Insights

Forex trading mein candlestick patterns price action aur market trends ko samajhne ke liye essential tools hain. In patterns mein se ek interesting pattern hai "Stick Sandwich." Yeh pattern market ke potential reversal points ko identify karne mein madadgar hota hai. Aaiye, detail se samjhte hain ke Stick Sandwich candlestick pattern kya hai aur iski trading mein kya importance hai.

Stick Sandwich Candlestick Pattern Kya Hai?

Stick Sandwich candlestick pattern ek bearish reversal pattern hai jo generally uptrend ke baad develop hota hai. Yeh pattern teen candlesticks se milkar banta hai aur price ke downward movement ka signal deta hai. Is pattern ki formation aur interpretation traders ko market ke potential turning points ko identify karne mein madad karte hain.

Pattern Ki Characteristics:- Formation:

- Stick sandwich pattern teen candlesticks se milkar banta hai. Pehli candlestick ek long bullish (green) candle hoti hai jo uptrend ko indicate karti hai. Dusri candlestick ek short bearish (red) candle hoti hai jo pehli candle ke body ko cover karti hai. Teesri candlestick bhi ek long bearish (red) candle hoti hai jo dusri candle ke body ko cover karti hai.

- Price Action:

- Yeh pattern tab complete hota hai jab teesri candlestick dusri candle ke body ko poori tarah se cover karti hai. Yeh pattern price ke downward reversal ka indication hota hai aur market mein selling pressure ko indicate karta hai.

- Confirmation:

- Pattern ki confirmation ke liye, traders third candle ke closing price ko dekhte hain. Agar closing price pehli candlestick ke high ke niche aur dusri candlestick ke low ke neeche ho, to pattern ki validity aur bearish reversal signal strong hoti hai.

Trading Insights:- Entry Points:

- Stick Sandwich pattern ke complete hone ke baad, traders generally sell positions enter karte hain. Entry point third candle ke low ke niche set kiya jata hai, jab price downward movement show karti hai.

- Stop-Loss:

- Stop-loss ko pehli candlestick ke high ke thoda upar set kiya jata hai. Yeh risk management ka ek part hai jo unexpected price movements se protection provide karta hai.

- Take-Profit:

- Profit targets ko market ke previous support levels ya price action ke patterns ke basis par set kiya jata hai. Traders price action aur market conditions ke hisaab se take-profit levels ko adjust karte hain.

Example:

Agar GBP/USD pair par ek strong uptrend ke baad Stick Sandwich pattern develop hota hai, aur third candle pehli candlestick ke high ke neeche close hoti hai, to yeh bearish reversal ka signal hota hai. Traders is signal ke basis par short positions enter kar sakte hain aur stop-loss ko recent high ke upar set kar sakte hain.

Conclusion:

Stick Sandwich candlestick pattern forex trading mein ek valuable tool hai jo market ke potential bearish reversals ko identify karne mein madad karta hai. Is pattern ki accurate identification aur confirmation se traders ko effective trading decisions lene aur profitable opportunities capture karne mein madad milti hai. Proper risk management aur profit-taking strategies ke sath, stick sandwich pattern aapke trading strategy ko enhance kar sakta hai aur market movements ko better capture karne mein madad kar sakta hai.

- CL

- Mentions 0

-

سا0 like

- Formation:

-

#12 Collapse

**Stick Sandwich Candlestick Pattern: Kya Hai Aur Kaise Kaam Karta Hai?**

Stick Sandwich candlestick pattern ek popular technical analysis tool hai jo Forex aur stock trading mein use hota hai. Yeh pattern trading charts par market ki trend reversal ya continuation ko identify karne mein madad karta hai. Is post mein, hum Stick Sandwich pattern ko detail mein samjhenge aur iski trading strategy ko explore karenge.

Stick Sandwich pattern ek three-bar pattern hota hai jo do opposite-colored candlesticks ke beech ek small candlestick ke formation se banta hai. Yeh pattern, generally trend reversal ki indication deta hai, aur iska structure kuch is tarah hota hai:

1. **Pehla Candlestick:** Yeh ek strong bearish (red) candlestick hoti hai jo market ke downward momentum ko dikhati hai.

2. **Doosra Candlestick:** Yeh ek choti si bullish (green) candlestick hoti hai jo market ke short-term upward movement ko represent karti hai. Yeh candlestick pehle ki bearish candlestick ke andar hoti hai, yaani ke iski high aur low pehli candlestick ke range mein hoti hai.

3. **Teesra Candlestick:** Yeh phir se ek strong bearish candlestick hoti hai jo second candlestick ke upar open hoti hai aur pehle candlestick ke close ke niche close hoti hai. Yeh candlestick market ke downward pressure ko reinforce karti hai.

Stick Sandwich pattern ka main focus yeh hai ke yeh market ki strength aur weakness ko visually represent karta hai. Jab yeh pattern bearish trend ke dauran banta hai, to yeh ek potential reversal signal hota hai, jahan traders ko caution adopt karni chahiye aur market ke short-term bullish trend ke liye prepare rehna chahiye. Agar yeh pattern bullish trend ke dauran banta hai, to yeh continuation signal ho sakta hai, jahan market ka trend aage bhi continue rehne ki umeed hoti hai.

Is pattern ko identify karne aur use trade decisions mein incorporate karne ke liye, traders ko market ki overall trend aur volume analysis par bhi focus karna chahiye. High volume ke saath pattern ka formation zyada reliable hota hai, kyunke yeh market ke strong sentiment ko reflect karta hai.

In summary, Stick Sandwich candlestick pattern ek powerful tool hai jo traders ko market trends aur reversal signals ko samajhne mein madad karta hai. Pattern ko effectively identify karne aur trading decisions mein integrate karne ke liye thorough analysis aur practice zaroori hai.

-

#13 Collapse

What Is Stick Sandwich Candlesticks Pattern ?

**Stick Sandwich Candlestick Pattern** ek technical analysis pattern hai jo market reversal ko indicate karta hai. Yeh pattern trading charts par price action ka ek specific arrangement hota hai jo potential trend reversals ko signal karta hai. Roman Urdu mein is pattern ko samajhna kuch is tarah se h

**1. Pattern Ka Taaruf:**

Stick Sandwich pattern ek three-candlestick pattern hai jo reversal ka signal deta hai. Yeh pattern do opposite trends ke beech ke transition ko dikhata hai. Is pattern ko samajhne ke liye, aapko teen candlesticks ka sequence dekhna hota hai: ek bearish candlestick, ek small bullish ya bearish candlestick, aur ek bullish candlestick. Yeh pattern usually downtrend ke baad uptrend ki taraf reversal ko indicate karta hai.

**2. Pattern Ki Structure:**

Stick Sandwich pattern ka structure kuch is tarah hota hai:

- **Pehli Candlestick:** Yeh pehli candlestick bearish hoti hai aur iski body bade size ki hoti hai. Yeh candlestick market ke current downtrend ko dikhati hai. Iska close price open price se kafi neeche hota hai.

- **Doosri Candlestick:** Doosri candlestick ka size chhota hota hai aur yeh bullish ya bearish ho sakti hai. Is candlestick ki body pehli candlestick ke body ke andar hoti hai. Yeh candlestick market ki consolidation ya uncertainty ko dikhati hai. Yeh chhoti candlestick generally previous candlestick ke close ke aspaas hoti hai.

- **Teesri Candlestick:** Teesri candlestick bullish hoti hai aur iski body bhi kaafi bade size ki hoti hai. Yeh candlestick pehli bearish candlestick ke saath match hoti hai aur market ke uptrend ko indicate karti hai. Is candlestick ka close price doosri candlestick ke open price se upar hota hai aur pehli candlestick ke close price ke kareeb hota hai.

**3. Pattern Ka Matlab:**

Stick Sandwich pattern ke formation ka matlab hai ke market mein ek significant reversal hone wala hai. Pehli bearish candlestick market ki existing downtrend ko dikhati hai, doosri chhoti candlestick consolidation ya weak trend ko indicate karti hai, aur teesri bullish candlestick market ke reversal aur upar ki taraf movement ko signal karti hai. Is pattern ke complete hone ke baad, market ke upar jane ke chances zyada hote hain.

**4. Entry Aur Exit Points:**

- **Entry Point:** Jab Stick Sandwich pattern complete ho jaye aur teesri bullish candlestick close ho jaye, to aap buy position open kar sakte hain. Is point par aapko market ka reversal signal milta hai.

- **Stop-Loss:** Apne stop-loss ko pehli candlestick ke low ke neeche set karna chahiye. Yeh is baat ko ensure karega ke agar market aapke against jaye, to aapka loss limited rahe.

- **Take-Profit:** Take-profit target aap previous resistance level ya ek fixed pip target set kar sakte hain. Yeh aapko trade ke potential profit ko maximize karne mein madad karega.

**5. Confirmation Indicators:**

Stick Sandwich pattern ko confirm karne ke liye aap additional technical indicators ka use kar sakte hain, jaise ke RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence). Agar yeh indicators bhi bullish signals provide karte hain, to pattern ki confirmation aur bhi strong hoti hai.

**6. Pattern Ki Validity:**

Stick Sandwich pattern tabhi effective hota hai jab yeh clear aur well-defined manner mein ban jaye. Pattern ki authenticity tabhi strong hoti hai jab pehli aur teesri candlestick ki body sizes significant aur clear hoti hain, aur doosri candlestick ka size chhota aur body pehli candlestick ke andar hoti hai.

**7. Risk Management:**

Hamesha trading ke dauran risk management ka khayal rakhein. Stick Sandwich pattern ke sath trading karte waqt risk ko limit karne ke liye stop-loss ka use karein aur apni capital ka 1-2% se zyada risk na karein. Yeh aapko unexpected market moves se protect karega.

### Conclusion

Stick Sandwich candlestick pattern ek powerful tool hai jo market reversal aur potential trend changes ko identify karne mein madad karta hai. Is pattern ko sahi tareeqe se samajhne aur use karne ke liye aapko technical analysis ki knowledge honi chahiye. Pattern ke formation ke baad trading decisions lene se pehle, additional confirmation aur risk management ko bhi dhyan mein rakhein. Is pattern ko effectively use karke aap apne trading strategy ko enhance kar sakte hain aur market ke reversal points ka faida utha sakte hain. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#14 Collapse

Stick Sandwich candlestick pattern ek technical analysis ka tool hai jo trading charts mein price movements ko analyze karne ke liye use hota hai. Yeh pattern market ke potential reversal points ko identify karne mein madadgar hota hai aur isse traders ko future price movements ke baare mein insights milte hain. Is pattern ko samajhne ke liye, humein pehle candlestick patterns ke basics ko samajhna zaroori hai.

Stick Sandwich pattern teen candlesticks ke combination se mil kar banta hai. Is pattern mein pehla candlestick ek bullish candlestick hota hai jo ke market ke upward movement ko indicate karta hai. Dusra candlestick ek doji ya small body candlestick hota hai, jo ke pehle candlestick ke body ke beech mein hota hai aur market ki uncertainty ko dikhata hai. Teesra candlestick phir se ek bullish candlestick hota hai jo ke market ke upward movement ko continue karta hai.

Pattern ke analysis ke liye, sabse pehle, pehle candlestick ki body aur high-low range ko observe karna padta hai. Iske baad, dusra candlestick, jo ke ek doji ya small body hota hai, iski positioning important hoti hai. Yeh candlestick pehle candlestick ki body ke beech mein hona chahiye aur iska color bhi bearish ya neutral ho sakta hai. Teesra candlestick, jo ke bhi bullish hota hai, pehle candlestick ki body ko cover karta hai aur yeh confirm karta hai ke market ki upward movement continue ho sakti hai.

Is pattern ke use se traders ko market ke sentiment ko samajhne mein madad milti hai. Jab yeh pattern market mein form hota hai, to yeh indicate karta hai ke market mein bullish trend ki continuation ho sakti hai. Traders is pattern ko use karke entry aur exit points decide kar sakte hain. Stick Sandwich pattern ke formation ke baad, agar market bullish movement continue karti hai to yeh pattern ek strong signal ho sakta hai ke market mein uptrend ban raha hai.

Lekin, Stick Sandwich pattern ko sirf ek standalone indicator ke taur par rely nahi karna chahiye. Yeh pattern tab zyada reliable hota hai jab isse additional technical indicators aur market conditions ke sath confirm kiya jaye. Jaise ke volume, support aur resistance levels, aur overall market trend ko dekhna zaroori hota hai. Yeh pattern ko use karke trading decisions lene se pehle thorough analysis aur risk management ka bhi dhyan rakha jana chahiye.

Stick Sandwich pattern trading strategies ke liye ek useful tool hai, lekin isse use karte waqt market ki dynamics aur other indicators ko bhi consider karna zaroori hai. Is pattern ke formation ke baad market ka behavior aur price action ko closely monitor karna chahiye, taake accurate trading decisions liye ja sakein aur potential risks ko minimize kiya ja sake.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:25 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим