What Is Risk aur praise:

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

What Is Risk aur praise:Risk aur reward ratio aksar ek numeric cost mein explicit kiya jata hai. For instance, agar aapka hazard-praise ratio 1:2 hai, toh iska matlab hai ke aap har exchange mein 1 unit danger le rahe hain aur agar change a success ho jaye toh aapko 2 unit praise mil sakta hai. Is con foreign exchange market mein hazard o praise es gap kay tor par daikh ja sakta good day jahan par ap rading mein enter hotay hein or jahan par prevent loss set kartay hein trading karnay walon kay ley stop loss aik aisa device hota hey jo kese bhe alternate ko khod say he rook dayta good day jacept ki madad se investors aur buyers apne trading techniques ko optir foreign exchange participants Risk aur praise ratio ek buying and selling aur making an investment concept hai jisse Iska matlab hota hai ke aap trading ya investing mein kitni chance lenge, uske assessment mein kitna ability profit ya praise mil sakta hai.Is idea ka primary idea yeh hai ke jab aap kisi investment ya exchange mein paisa lagate hain, toh aapko usmein kitni threat leni padti hai woh measure karna zaroori hota hai. Aap yeh determine karte hain ke agar aapka alternate ya funding loss mein rex market ka har trader serf es bat ko janta hi there apnay buying and selling target ke hasell karnay ke koshesh kartay hovay forex market mein threat ko kes tarekay say solid keya ja sakta hiya or risk ko kes tarah manae keya jay sab say zyada safarshaat mein say aik howdy forex marketplace ka aik dealer es bat okay yaqene banay ga fe exchange account 2% say zyada hota hi there jaye toh aap kitna nuksan utha sakte hain. Iske sath mize karte hain. Woh yeh dekhte hain ke unka danger-praise ratio kitna hai aur kya woh trade is ratio ke mutabiq hai ya nahi. Agar ratio favorable hai, toh woh change kar sakte hain, lekin agar ratio negative hai, toh woh change se bachte hain. Is tarah se, hazard aur praise ratio trading aur making an investment mein ek ahem hissa hai jo aapko apne monetary selections ko samjhne aur manipulate karne mein madadgar hota hai.

-

#3 Collapse

Risk aur Prize jo financial markets mein trading aur investment mein kafi ahmiyat rakhte hain. In dono ko samajh kar, traders aur investors apni trading aur investment strategies ko samajh kar aur bana kar apne financial goals ko achieve karte hai.

Risk

Risk ek situation hai jahan kisi bhi action ya decision ka outcome uncertain hota hai aur negative consequences ka khatra hota hai. Financial markets mein, risk usually associated hota hai with the possibility of financial loss ya adverse market movements ke saath. Market mein trading karte waqt, har trade ya investment ek certain level of risk ke saath aata hai.

Kuch factors hain jo risk ko influence karte hain:- Market Risk: Yeh market ke general fluctuations se related hota hai. Market mein price changes, volatility, aur economic conditions ke fluctuations is tarah ke risk ko influence karte hain.

- Company Risk: Company specific factors bhi ek important source of risk hote hain. Jese ke company ke performance, management changes, regulatory issues, etc.

- Leverage Risk: Leverage use karna trading mein ek common practice hai, lekin iska use karne se bhi risk badh jata hai. Leverage use karke traders apne investment ko badha sakte hain, lekin agar market movement traders ki expectations ke against hoti hai, toh loss bhi badh jata hai.

- Liquidity Risk: Market mein liquidity kam hone se bhi risk badh jata hai. Agar kisi asset ya security ko kharidne ya bechne ki process mein liquidity ka issue ho, toh investors ko desired price par transaction nahi kar paate aur isse loss ho sakta hai.

Har ek trader ya investor apni risk tolerance level ke mutabiq trading aur investment decisions leta hai. Kuch log high risk tolerance rakhte hain aur aggressive strategies use karte hain, jabki doosre conservative approach prefer karte hain.

Prize

Prize ya "Reward" trading aur investment mein woh outcome hai jo traders ya investors expect karte hain. Yeh profit ya positive outcome ka potential hota hai. Har trade ya investment ki expectation hoti hai ke woh ek prize ya reward ke form mein result ho. Prize usually associated hota hai with financial gain aur investment objectives ke accomplishment se.

Kuch factors hain jo prize ko influence karte hain:- Market Performance: Market ke performance, economic conditions, aur specific asset ya security ke performance prize ko directly influence karte hain.

- Investment Strategy: Traders aur investors ki apni strategies aur goals hoti hain jinse unka prize depend karta hai. Kuch log short-term gains ke liye trading karte hain, jabki doosre long-term investments ko prefer karte hain.

- Risk Management: Prize ko influence karne mein risk management ka bhi ek bada role hota hai. Agar traders aur investors apne risk ko effectively manage karte hain, toh unka prize potential increase hota hai.

- External Factors: External factors jese ke geopolitical events, regulatory changes, aur market sentiment bhi prize ko influence kar sakte hain.

Risk aur Prize ke Taluqat

Risk aur Prize dono hi closely related hote hain aur financial markets mein inse judi hui hui hoti hai. Typically, zyada prize wale trades ya investments usually zyada risk ke saath aate hain, jabki kam prize wale usually kam risk ke saath aate hain.

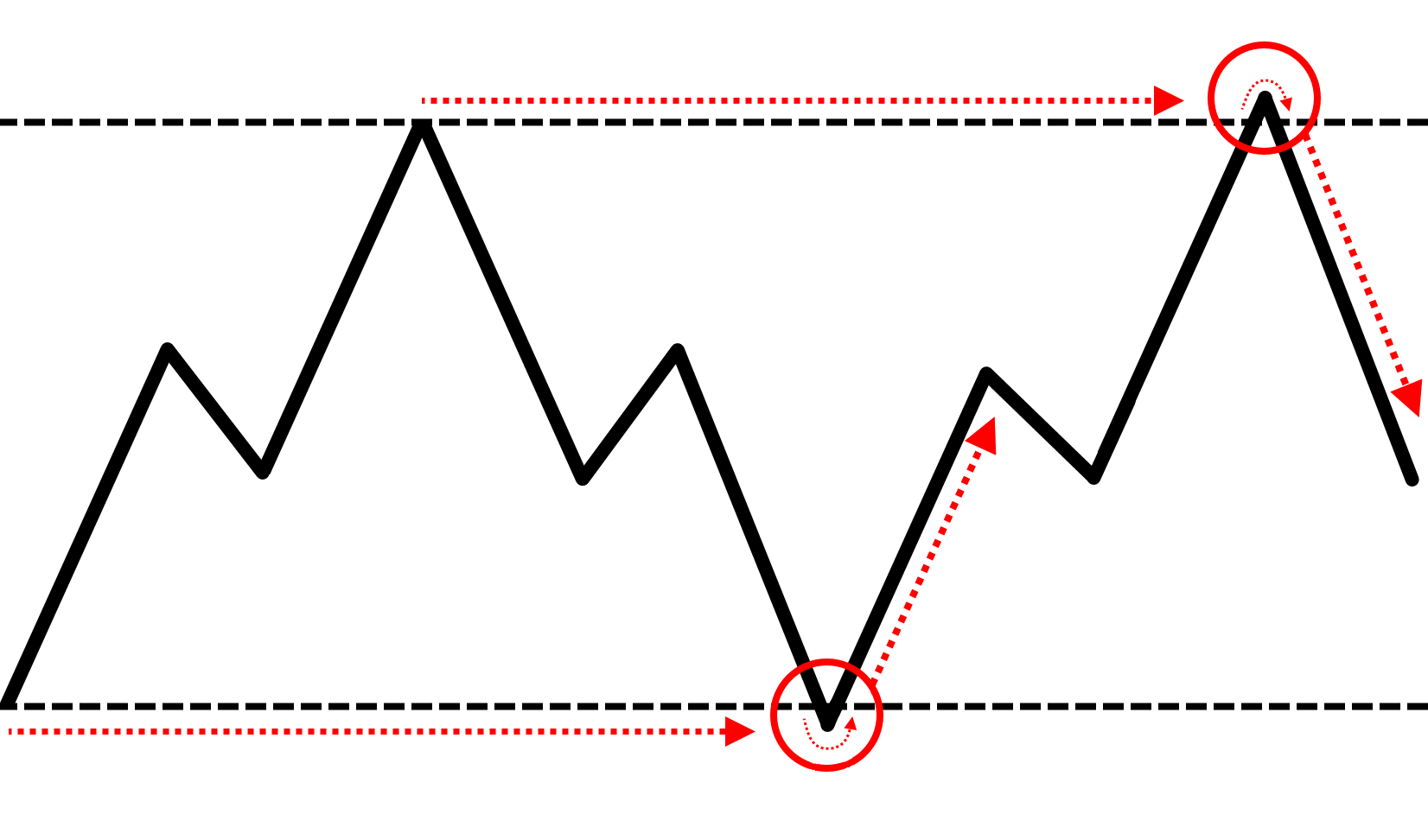

Iske alawa, traders aur investors risk aur prize ko evaluate karte waqt apne risk-reward ratio ko bhi dekhte hain. Yeh ratio unko batata hai ke ek trade ya investment ke liye kitna risk lena sahi hoga, jisse ke unka prize potential maximize ho sake.

Risk aur prize ke darmiyan ka balance rakhna trading aur investment mein bahut zaroori hai. Agar koi trader ya investor zyada risk le leta hai bina prize potential ko samajhe, toh unka loss ka risk badh jata hai. Isi tarah, agar koi zyada cautious approach rakhta hai aur zyada risk avoid karta hai, toh unka prize potential bhi kam ho jata hai.

Isliye, successful trading aur investment ke liye, traders aur investors ko apne risk aur prize ke darmiyan ka balance maintain karna zaroori hota hai. Iske liye proper risk management techniques aur thorough analysis ki zaroorat hoti hai. Har trade ya investment decision ko carefully evaluate karke, traders aur investors apne financial goals ko achieve kar sakte hain. -

#4 Collapse

**Risk Aur Praise: Forex Trading Mein Inka Kya Kirdar Hai?**

Forex trading ek dynamic aur unpredictable field hai jahan traders ko market movements aur financial risks ko manage karna parta hai. Is process mein “Risk” aur “Praise” dono hi crucial factors hote hain jo trading decisions aur overall trading success ko impact karte hain. Aaj hum in dono terms ko detail mein samjhenge aur dekhenge ke yeh Forex trading mein kis tarah se influence karte hain.

### Risk Kya Hai?

Risk Forex trading mein wo uncertainty hai jo potential losses ya gains ko represent karta hai. Trading ke har decision ke sath ek certain level ka risk associated hota hai, aur yeh risk market conditions, economic events, aur personal trading strategies ke according vary karta hai. Risk ko samajhna aur manage karna trading ka ek important aspect hai.

**Types of Risks:**

1. **Market Risk:** Yeh risk market ke price movements se related hota hai. Agar market aapke trade ke against move karti hai, to aapko losses ka saamna karna pad sakta hai.

2. **Leverage Risk:** Leverage use karne se aapki trading capacity barh jati hai, lekin yeh risk bhi increase hota hai. High leverage se aapke losses bhi magnify ho sakte hain.

3. **Liquidity Risk:** Jab market mein sufficient liquidity nahi hoti, to aapko desired price par trades execute karne mein mushkil hoti hai. Yeh risk slippage aur high transaction costs ko increase kar sakta hai.

**Risk Management Techniques:**

1. **Stop-Loss Orders:** Stop-loss orders ko set karke aap predefined loss limit ko manage kar sakte hain. Yeh aapko unexpected market movements se protect karta hai.

2. **Diversification:** Different currency pairs aur assets mein invest karke risk ko diversify kiya ja sakta hai. Yeh ek single asset ke losses ko balance karne mein madad karta hai.

3. **Position Sizing:** Position size ko risk tolerance ke according adjust karna chahiye. Yeh aapke capital ko protect karne aur losses ko limit karne mein help karta hai.

### Praise Kya Hai?

Praise (yaane ki profits) Forex trading mein wo gains hain jo aap trading ke zariye achieve karte hain. Praise ka determination market conditions, trading strategy, aur decision-making process ke upar hota hai. Effective trading strategies aur market analysis se aap profits ko maximize kar sakte hain.

**Strategies for Maximizing Praise:**

1. **Technical Analysis:** Market trends aur price movements ko samajhne ke liye technical indicators aur chart patterns ka use karna zaroori hai. Yeh aapko entry aur exit points identify karne mein madad karta hai.

2. **Fundamental Analysis:** Economic indicators aur news events ko analyze karke trading decisions ko better forecast kiya ja sakta hai. Yeh long-term trends aur market sentiment ko understand karne mein help karta hai.

3. **Backtesting:** Trading strategies ko historical data ke sath test karke aap unki effectiveness ko evaluate kar sakte hain. Yeh aapko future trading decisions ko improve karne mein madad karta hai.

### Conclusion

Forex trading mein "Risk" aur "Praise" dono hi essential elements hain jo trading outcomes ko influence karte hain. Risk management techniques ko implement karke aap potential losses ko minimize kar sakte hain, jabke effective strategies aur analysis se profits ko maximize kar sakte hain. Trading decisions ko informed aur strategic banane ke liye risk aur praise ke concepts ko samajhna zaroori hai. Risk aur praise ko balance karke, aap apni trading performance ko improve kar sakte hain aur market opportunities ka fayda utha sakte hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5 Collapse

### What is Risk aur Praise: Ek Jaiza

**Risk** aur **Praise** do aise concepts hain jo har business aur investment strategy mein ahmiyat rakhte hain. Yeh do concepts ka samajhna aapko decision-making mein madad de sakta hai, chahe aap trading kar rahe hon, kisi business venture mein invest kar rahe hon, ya apne personal finances manage kar rahe hon. Is post mein hum in dono concepts ko detail se samjhenge.

#### Risk Kya Hai?

Risk ka matlab hai kisi bhi activity ya investment mein hone wali uncertainties ya potential losses. Jab aap kisi decision ka faisla karte hain, to aap aksar uncertain outcomes ka samna karte hain. Forex trading, stock market, aur real estate investments jaise fields mein risk ka hona aam hai.

Risk ko alag alag shakal mein dekha ja sakta hai:

1. **Market Risk**: Yeh risk market ki movements se juda hota hai. Aam tor par, economic changes, geopolitical events, ya natural disasters is par asar daal sakte hain.

2. **Credit Risk**: Yeh risk kisi counterparty ke default hone ka hota hai. Misal ke taur par, agar aapne kisi company mein invest kiya aur wo company fail ho gayi, to aapko apni investment ka nuqsan ho sakta hai.

3. **Liquidity Risk**: Iska matlab hai ke aap apni investments ko asaani se cash mein convert nahi kar sakte. Is wajah se aapko losses ho sakte hain jab aapko apni investments bechne ki zaroorat ho.

#### Praise Kya Hai?

Praise ka matlab hai kisi ki achievements ya accomplishments ki tareef karna. Yeh ek positive reinforcement hai jo logon ko motivate karne aur unki performance ko behtar karne mein madad karta hai. Praise ka kuch important pehlu hain:

1. **Motivation**: Jab aap kisi ki efforts ki tareef karte hain, to yeh unhe aur behtar karne ke liye inspire karta hai. Yeh unki self-esteem ko barhata hai aur unhe kaam karne ki motivation deta hai.

2. **Team Dynamics**: Ek positive work environment banane ke liye praise bohot zaroori hai. Jab team members ko unke contributions ki tareef hoti hai, to yeh teamwork aur collaboration ko barhata hai.

3. **Feedback Mechanism**: Praise ek effective feedback tool hai. Jab logon ko yeh bataya jata hai ke unka kaam accha hai, to yeh unhe samajhne mein madad karta hai ke kya cheezen unke liye sahi ja rahi hain.

#### Risk aur Praise ka Taluq

Risk aur praise ka ek dusre se gehra taluq hai. Jab aap kisi risk ko uthane ka faisla karte hain, to aapko uske potential rewards ke bare mein sochna chahiye. Praise bhi is process mein ahem kirdar ada karta hai. Jab log risk uthane par motivate hote hain, to unhe praise dena unki efforts ko sarahne aur unhe behtar karne ke liye zaroori hota hai.

#### Conclusion

Risk aur praise dono concepts har field mein ahmiyat rakhte hain. Risk ka samajhna aapko informed decisions lene mein madad karta hai, jabke praise aapko motivation aur teamwork mein behtari laata hai. In dono concepts ka balance banana zaroori hai taake aap apne personal aur professional life mein behtari la sakein.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:46 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим