Risk and Reward Ratio in Forex Trading.

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Risk and Reward Ratio. Description. Forex trading mein, risk aur reward ratio bahut ahem hota hai. Is article mein hum aapko batayenge ki risk aur reward ratio kya hai aur kaise aap iska istemal kar sakte hain. Risk and Reward. Risk aur reward ratio ka matlab hai ki aap kitna risk le rahe hain aur uske badle mein kitna reward milne wala hai. Agar aap ek trader hain to aapko pata hoga ki forex market mein trading karne ke liye risk lena bahut jaruri hai. Lekin yeh bhi bahut ahem hai ki aap apne risk ko manage kar sakein aur reward ko bhi dekhte rahen. Risk and Reward Ratio Workings. Agar aapne kisi trade ko enter kiya hai to aapko pata hoga ki aapko stop loss aur target level set karna hota hai. Stop loss level ko set karne se aap apne risk ko control kar sakte hain aur target level ko set karne se aap apna reward dekh sakte hain. Agar aapka stop loss level aapke entry price se bahut door hai to aapka risk bahut zyada hoga. Lekin agar aapka target level aapke entry price se bahut paas hai to aapka reward bahut zyada hoga. Risk and Reward Ratio calculation. Risk aur reward ratio ko calculate karne ke liye aapko apne stop loss level aur target level ko dekhna hoga. Agar aapka stop loss level $50 aur target level $100 hai to aapka risk aur reward ratio 1:2 hoga. Agar aapko lagta hai ki aapka risk bahut zyada hai to aap apna stop loss level kam kar sakte hain. Aur agar aapka target level bahut kam hai to aap apna target level bada sakte hain. More Points. Risk aur reward ratio forex trading mein bahut ahem hai. Agar aap apne risk ko manage kar sakte hain aur apna reward dekh sakte hain to aap apne trading ko bahut hi profitable bana sakte hain. Lekin aapko hamesha yeh yaad rakhna hoga ki forex trading mein risk lena bahut jaruri hai aur aapko apne risk ko control karna bhi bahut jaruri hai. -

#3 Collapse

Forex Trading mein "Risk and Reward Ratio" ek ahem concept hai, jo traders ke liye mahatvapurn hota hai. Iska matlab hota hai: 1. **Risk Ratio (Risk):** Yeh woh amount hai jo aap taiyar hain khona, jab aap trade karte hain. Isay aap apni trading capital ke percentage mein ya fixed monetary amount mein express kar sakte hain. Aap risk ko control ke liye stop-loss orders ka istemal karte hain, jo aapki trade ko ek specific price level par band kar dete hain, agar market against aapke trade ke ja raha hai. 2. **Reward Ratio (Reward):** Yeh woh amount hai jo aap trading se expect karte hain kamane ke liye. Aap isay apne target profits ke roop mein ya fixed monetary amount mein set kar sakte hain. **Risk and Reward Ratio ka Importance:** - Yeh ratio traders ko unki trades ke liye ek clear risk aur reward define karne mein madadgar hota hai. - Isse traders apne trades ko plan kar sakte hain aur samajh sakte hain ke unka profit potential kya hai aur kitni risk woh lena chahte hain. - Aap ek favorable Risk and Reward Ratio set kar ke apni trading strategy ko optimize kar sakte hain. Jyada tar traders 1:2 ya 1:3 risk-reward ratio ko follow karte hain, matlab agar aap 1% risk le rahe hain toh aap kam se kam 2% ya 3% reward expect karenge. **Example:** Agar aap $1000 se trading kar rahe hain aur aap apne trade par 1% risk le rahe hain, toh aapki maximum loss $10 hoga. Agar aap apne trade par 1:2 risk-reward ratio apply karte hain, toh aapko kam se kam $20 profit chahiye hoga. Yad rahe ke har trade unique hoti hai aur ismein risk aur reward ko dhyan mein rakhkar samajhna aur plan karna zaroori hai. -

#4 Collapse

INTRODUCTION Dear Fellows, Aaj hum Forex trading mein, risk aur reward ratio k baraay mi discuss karygy q k ye trading mi bahut impirtant hota hain. Ess article mein hum aapk liay mention arygy k risk aur reward ratio kya hai aur kaise aap iska use mi laa sakty hain. Firex market mi jab tak apko ess ka achi trah andaza nahi hoga tab tak aap faida nahi uthaa sakygy. How It Works Fellows, Jaisa k humko pata hai k forex market mi in rehnay k liay hmain har side ka pata hona bahot zaruri hota hain. Suppose, aap ney kisi trade ko enter kiya hai to aapko well known hoga ki aapko stop loss aur target level set karna hota hain awar stop loss level ko adjust karne se aap apne risk ko ik had control kar saktey hain aawr target level ko set karne se aap apna reward dekh b sakte hain awar use mi b lt k aa skaty hain jo k market mi acha sabit hota hain. IMPORTANCE Fellows, Market mi apni value banay k liay apko hmesha sy eski importnace dekhni paetti hain ess k bagher aap kabhi b kamyab tarder nahi ban sakty. Mazees ye j Risk aur reward ratio forex trading mein bahut important hain. Awar agar aap apne risk ko achi traha sy manage kar sakte hain aur apna reward dekh sakte hain to aap apne trading ko bahut hi benefitfull bana sakte hain. Ess k abaraks aapko hamesha yeh zehan mi rakhna hoga ki forex trading mein risk lena bahut needfukl hota hai aur aapko apne risk ko control karna bhi awr ess ko smajhna b bahot important hota hain. Ess k bagher ap market mi apny wadam nahi jamaa sakty. Moreover, ye b k subject ratio traders ko unki trades ke liye ek saaf risk aur reward define karne mein helpfull sabit hota hai awar ss ki waja sy traders apne trades ko plan kar sakte hain aur understand kar sakte hain ke unka profit potential kya hai aur kitni risk wo leay sakty hain awar kitna afford kar skaty hain. Fellows, agar ap ek favorable Risk and Reward Ratio set kar ke apni trading achi tarah plan kar k ess ko optimize kar sakte hain. Mostly traders 1:2 ya 1:3 risk-reward ratio ko maanty hai awr ess py amal karte hain jiski waja sy wo market mi faida utahty hain. Thanks -

#5 Collapse

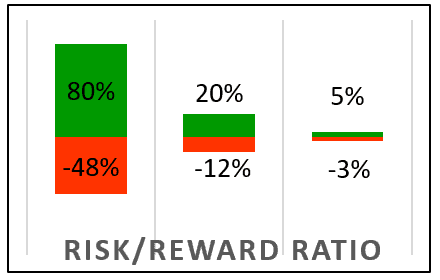

Risk/reward ratio:

Risk/reward ratio marks the prospective reward an investor can earn for every dollar they risk on an investment. Many investors use risk/reward ratios to compare the expected returns of an investment with the amount of risk they must undertake to earn these returns. A lower risk/return ratio is often preferable as it signals less risk for an equivalent potential gain.

Trades Plan Karna:

Traders apni trades plan karne ke liye aksar is approach ka istemaal karte hain. Is ratio ko calculate karne ke liye trader ke risk (agar asset ki price unexpected direction mein move ho jaye) ko reward se divide kiya jata hai. Risk/reward ratio ke kaafi cases mein, market strategists apne investments ke liye ideal ratio ko 1:3 maante hain, yaani ek unit additional risk ke liye teen units expected return. Investors stop-loss orders aur put options jaise derivatives ka istemaal karke risk/reward ko seedhe tareeke se manage kar sakte hain.

Risk-to-reward Ratio, Individual:

Forex trading mein risk-to-reward ratio, individual stocks ki trading mein istemaal hone wala aik measure hai. Alag-alag trading strategies mein optimal risk-to-reward ratio kaafi farq karta hai. Kuch trial-and-error methods aksar istemaal kiye jaate hain takay di gayi trading strategy ke liye sab se behtar ratio tayyaar kiya ja sake, aur kai investors apne investments ke liye pehle se specify kiye gaye risk-to-reward ratio rakhte hain.

Potential Risk Rewad Ratio:

Investors apne potential loss ko estimate karne ke liye kai tareeqon ka istemaal karte hain, jaise ke technical analysis mein historical price data ka analysis karna, price action ki historical standard deviation ka istemaal karna, fundamental analysis mein company ke financial statements ka assessment karna, aur value-at-risk (VaR) jaise models ka istemaal karna. Yeh tareeqe investors ko madad karte hain taa ke woh investment ki value par asar daalne wale factors ko pehchaan sakein aur potential downside ko estimate kar sakein. -

#6 Collapse

Forex (foreign exchange) trading, ya currency trading, aik dunyawi tijarat hai jis mein mukhtalif mulkon ki currencies ka exchange hota hai. Yeh aik shauq ya karobaar ke tor par kiya ja sakta hai, lekin ismein kisi bhi tarah ka karobar karne ke liye bara risk hai. Is article mein, hum forex trading mein risk aur inaam ki sharah ke bare mein guftagu karenge.

Risk aur Reward Ka Ta'alluq

Forex trading mein, her trade ki taraf se aik muqarrar risk aur inaam hota hai. Yeh risk aur inaam ka ta'alluq trading strategy aur trade ka size par hota hai. Agar aap zyada risk lenge to inaam bhi zyada hoga, lekin iska ulta bhi sahi hai.

Risk aur Reward Ratio

Forex trading mein, risk aur reward ratio ka ahem kirdar hota hai. Yeh ratio aap ko batata hai ke aap har trade mein kitna risk lenge aur kitna inaam hasil karenge. Aam tor par, acha risk aur reward ratio 1:2 ya is se zyada hota hai, jahan aap her trade mein ek unit risk lete hain aur do ya zyada units ka inaam hasil karte hain.

Risk Management

Forex trading mein kamiyabi ke liye, risk management ahem hai. Aap ko apne trades ko control karne aur nuksan se bachne ke liye apna risk manage karna hoga. Iske liye aap stop-loss orders ka istemal kar sakte hain, jo aap ko nuksan se bachane mein madad karte hain.

Reward Ka Istehsal

Forex trading mein achi strategy aur risk management ke sath, aap ko inaam hasil karne ka moqa mil sakta hai. Lekin yaad rahe ke har trade mein inaam hasil nahi hota, aur nuksan ka khatra hamesha mojud hota hai. Isliye, hamesha mehnat aur tajurba ke sath trading karein aur apne risk aur reward ratio ka khayal rakhein.

Nihayat

Forex trading mein risk aur reward ka ta'alluq aik barabar aur ahem hota hai. Agar aap apne trades ko control mein rakhte hain aur achi risk management ka istemal karte hain, to aap ko kamiyabi mil sakti hai. Lekin yaad rahe ke forex trading mein koi bhi tajurba sirf aik din ka nahi hota, balkay ismein istiqamat aur mehnat ki zarurat hoti hai.

Isliye, forex trading mein dakhliyat karne se pehle, apne ap ko achi tarah se tayyar karein aur apne risk aur reward ratio ka khayal rakhein. Yeh aap ko trading safar mein madadgar sabit ho sakta hai. -

#7 Collapse

Risk aur Reward Ka Ta'alluq

1. Risk aur Reward Ki Tareef- Risk: Risk wo potential loss ya uncertainty hai jo kisi investment ya trading activity ke saath juda hota hai. Har investment ya trade ke saath ek certain level ka risk hota hai jise investors aur traders ko samajhna zaroori hai.

- Reward: Reward wo potential profit ya return hai jo kisi investment ya trading activity se mil sakta hai. Ye wo financial benefit hai jo investors aur traders apne investment ya trade se expect karte hain.

2. Risk aur Reward Ka Ta'alluq Trading Mein- Risk Management: Risk aur reward trading mein closely linked hote hain aur dono ka ta'alluq risk management ke saath hota hai. Risk management strategies ka istemal karke traders apne trades ke risk ko control karte hain.

- Risk aur Reward Ratio: Risk aur reward ka ta'alluq traders ke liye ek crucial concept hai. Ek achha risk aur reward ratio maintain karke traders apne trades ke liye suitable entry aur exit points tay karte hain.

Risk aur Reward Management Strategies- Stop-loss Orders: Stop-loss orders ek important risk management tool hain jo traders apne trades ke liye set karte hain. Ye orders unhein nuksan se bachate hain agar market against unke expectations move karta hai.

- Profit Targets: Profit targets bhi ek important aspect hain risk aur reward management ka. Traders apne trades ke liye predefined profit targets set karte hain taake wo apne profits ko lock kar sakein jab market unke favor mein move karta hai.

Risk aur Reward Ka Evaluation- Risk Assessment: Traders ko har trade ke liye potential risk ka evaluation karna zaroori hai. Ye unhein ye samajhne mein madad karta hai ke kitna loss wo afford kar sakte hain.

- Reward Potential: Traders ko bhi ye dekhna zaroori hai ke har trade ke liye kya potential reward hai. Ye unhein ye samajhne mein madad karta hai ke kya wo trade ke liye justify kiye gaye risk ke saath trade kar rahe hain ya nahi.

Conclusion

Risk aur reward ka ta'alluq trading aur investments mein ek mukhtasir aur ahem concept hai. Har trade ya investment ke saath ek certain level ka risk hota hai, lekin agar sahi risk management strategies ka istemal kiya jaye aur achha risk aur reward ratio maintain kiya jaye, toh traders apne trading journey ko successful bana sakte hain. Isliye, har trader ko apne trades ke risk aur reward ko carefully evaluate karna chahiye aur apne trading strategies ko risk management ke principles ke saath align karna chahiye.

-

#8 Collapse

**Forex Trading Mein Risk Aur Reward Ratio: Kya Hai Aur Kaise Use Karein?**

Forex trading mein successful hone ke liye risk aur reward ratio ko samajhna aur effectively manage karna zaroori hai. Yeh ratio aapke trading decisions ko guide karta hai aur aapki overall trading strategy ko behtar banata hai. Aaiye, risk aur reward ratio ko detail mein samajhte hain aur dekhtay hain ke yeh Forex trading mein kaise kaam karta hai.

**Risk Aur Reward Ratio Ka Taaruf**

Risk aur reward ratio trading risk aur potential reward ke beech ka relationship measure karta hai. Yeh ratio aapko yeh batata hai ke har trade par aap kitna risk utha rahe hain aur uske muqablay mein aapko kitna reward mil sakta hai. Iska basic formula hai:

\[ \text{Risk aur Reward Ratio} = \frac{\text{Potential Loss}}{\text{Potential Gain}} \]

**Risk Aur Reward Ratio Ki Calculation**

1. **Potential Loss**: Yeh wo amount hai jo aap trade mein lose kar sakte hain agar market aapke against move kare. Yeh stop-loss order se determine hota hai.

2. **Potential Gain**: Yeh wo amount hai jo aapko trade se mil sakta hai agar market aapke favor mein move kare. Yeh take-profit level se determine hota hai.

3. **Ratio Calculation**: For example, agar aapka potential loss $100 hai aur potential gain $300 hai, to risk aur reward ratio hoga:

\[ \text{Ratio} = \frac{100}{300} = 1:3 \]

**Effective Use Of Risk Aur Reward Ratio**

1. **Optimal Ratio Selection**: Forex trading mein, common practice yeh hai ke risk aur reward ratio ko 1:2 ya 1:3 rakha jaye. Iska matlab hai ke aap apne potential reward ko apne risk se double ya triple rakhen.

2. **Trading Plan**: Risk aur reward ratio ko trading plan mein incorporate karna zaroori hai. Har trade ke entry aur exit points ko set karte waqt, ratio ko consider karke stop-loss aur take-profit levels ko adjust karein.

3. **Risk Management**: Risk aur reward ratio ko effective risk management ke part ke tor par use karein. High ratio risk aur reward se aap apni losses ko manage kar sakte hain aur profits ko maximize kar sakte hain.

4. **Consistency**: Consistent trading ke liye, risk aur reward ratio ko har trade ke liye monitor karein. Yeh approach aapko long-term profitability aur sustainability ensure karne mein madad karti hai.

**Challenges Aur Considerations**

1. **Market Volatility**: Forex market ki volatility aapke risk aur reward ratio ko affect kar sakti hai. Isliye, market conditions ko monitor karna zaroori hai.

2. **False Signals**: Risk aur reward ratio ke basis par trading karte waqt false signals bhi mil sakte hain. Isliye, other technical indicators aur analysis ko bhi consider karna chahiye.

**Conclusion**

Forex trading mein risk aur reward ratio ka effective use karne se aap apni trading strategy ko optimize kar sakte hain. Is ratio ko samajhkar aur trading plan mein incorporate karke, aap apne risk ko manage kar sakte hain aur potential rewards ko maximize kar sakte hain. Consistency aur effective risk management se aap trading ke long-term goals achieve kar sakte hain.

-

#9 Collapse

Forex trading, yaani foreign exchange trading, duniya ka sab se bara financial market hai jahan currencies ka exchange hota hai. Yeh market duniya bhar ke traders, investors, banks, aur financial institutions ke liye paisa banane ka aik zariya hai. Lekin, iske sath risk bhi jura hota hai. Risk aur reward ka taluq har trade mein hota hai, aur yeh taluq samajhna zaroori hai agar aap forex market mein successful hona chahte hain. Is article mein hum forex trading ke risk aur reward ratio ke har pehlu ko detail mein discuss karenge.

1. Forex Trading Kya Hai?

Forex trading yaani foreign exchange trading, do mukhtalif currencies ke darmiyan khareed aur farokht ka amal hai. Forex market aik decentralized market hai, jahan currencies ka exchange over-the-counter (OTC) hota hai, yani yeh market physical location pe maujood nahi hoti. Is market mein currencies ka pair form mein trade hoti hain, jaise EUR/USD, GBP/JPY, etc. Traders ek currency khareedte hain aur doosri bechte hain, aur profit tab hota hai jab unhone jis currency ko khareeda hai uski qeemat barhti hai.

Forex market mein trading ka maqsad faida hasil karna hota hai. Yeh market 24 ghante khula rehta hai, lekin trading sessions different hoti hain: Asian, European, aur North American sessions. Yeh flexibility forex trading ko aur bhi attractive banati hai.

2. Risk and Reward Ratio Kya Hai?

Risk and reward ratio forex trading mein ek important concept hai. Yeh ratio yeh batata hai ke aap apni capital ka kitna hissa risk mein daal rahe hain aur uske badle mein kitna profit hasil karne ki umeed hai. Yeh ratio aapko apni trading decisions ko logically aur objectively lene mein madad karta hai.

Misal ke taur par, agar aapka risk and reward ratio 1:3 hai, to iska matlab hai ke agar aap 100 dollars ka risk le rahe hain, to aap 300 dollars kamane ki umeed kar rahe hain. Risk and reward ratio calculate karna ek simple process hai lekin iska correct estimate karna asaan nahi hota.

Forex market mein risk high hota hai, lekin agar aap apni strategy ko theek se follow karte hain aur apne trades ko achi tarah manage karte hain, to aap apna risk limit kar sakte hain aur apni expected rewards ko maximize kar sakte hain.

3. Risk Management Ki Ahmiyat

Forex trading mein risk management ki bohot zyada ahmiyat hai. Forex market mein high leverage ka istimaal hota hai, jo profits ko bohot zyada barha sakta hai, lekin iske sath risk bhi bohot zyada hota hai. Agar aap risk management ko theek se samajh kar apne trades manage nahi karte, to aap apni sari investment kho sakte hain.

Risk management ka maqsad yeh hota hai ke aap apni capital ka aik chhota hissa har trade mein risk karein. Bohot se professional traders yeh suggest karte hain ke aap apni total capital ka sirf 1% ya 2% hi har trade mein risk karein. Is tarah agar aapka trade loss mein bhi jata hai to aap apni capital ko bacha sakte hain aur market mein dobara se participate karne ke qabil hote hain.

4. Risk and Reward Ratio Ki Calculation

Risk and reward ratio ko calculate karna forex trading mein ek important step hai. Yeh calculation aapko trade enter karne se pehle hi maloom honi chahiye. Isko calculate karne ke liye aapko apni entry price, stop-loss level, aur take-profit level ka ilm hona chahiye.

Agar aapki entry price 1.1000 hai, stop-loss 1.0950 par hai, aur take-profit 1.1150 par hai, to aapka risk 50 pips ka hai aur reward 150 pips ka. Is tarah, aapka risk and reward ratio 1:3 ban jata hai. Is ratio ka matlab yeh hota hai ke aap har 1 dollar ka risk le kar 3 dollars kamane ki umeed kar rahe hain.

Yeh ratio har trader ke liye alag ho sakta hai, lekin commonly accepted ratios 1:2 ya 1:3 hoti hain. Is ratio ka faida yeh hota hai ke agar aapke sirf 50% trades successful hote hain, tab bhi aap overall profit mein rahte hain.

5. Forex Trading Mein Risk Factors

Forex trading mein bohot se risk factors hote hain jo aapke trades ko affect kar sakte hain. In factors ko samajhna aur inke liye tayyar rehna zaroori hai taake aap apne risk ko effectively manage kar sakein.- Market Volatility: Forex market ki volatility high hoti hai, yani prices mein tezi se uthal-pu dikhai deti hai. Yeh volatility bohot zyada profit bana sakti hai, lekin agar aapne apne trades ko protect nahi kiya to yeh aapko bohot nuksan bhi de sakti hai.

- Economic Events: Economic events, jaise GDP reports, employment data, aur interest rate announcements, forex market ko bohot zyada impact karte hain. Yeh events prices ko bohot tezi se move kar sakte hain.

- Geopolitical Tensions: Geopolitical tensions, jaise wars, elections, aur international conflicts, forex market mein uncertainty paida karte hain. Is uncertainty ki wajah se prices unexpected moves kar sakti hain.

- Leverage: Forex market mein leverage ka bohot bara role hota hai. Leverage aapko apni initial capital se zyada badi positions lene ki ijazat deta hai. Leverage se aap zyada profit kama sakte hain, lekin yeh aapke losses ko bhi barha sakta hai.

6. High Risk, High Reward Strategy

Forex trading mein kuch traders high risk, high reward strategy ko apnate hain. Yeh strategy un logon ke liye hai jo high risk lene ke liye tayar hain aur bohot zyada profits ki umeed karte hain. Is strategy mein aap high leverage ka istimaal karte hain aur chhoti movements mein bade profits kama sakte hain.

Lekin is strategy mein sab se bara risk yeh hota hai ke aapke losses bhi bohot zyada ho sakte hain. Agar market aapke against move karta hai to aap apni sari capital kho sakte hain. Yeh strategy beginners ke liye nahi hoti, isliye agar aap new trader hain to is strategy se door rehna hi behtar hai.

Is strategy ka faida yeh hai ke aap short-term mein bohot zyada profit kama sakte hain. Agar aap market ka trend theek se predict kar lete hain to aap bohot kam waqt mein apni capital ko do ya teen guna kar sakte hain.

7. Low Risk, Low Reward Strategy

Low risk, low reward strategy un traders ke liye hai jo steady aur stable profits ko tarjeeh dete hain. Is strategy mein aap kam leverage ka istimaal karte hain aur apne trades ko bohot soch samajh kar enter karte hain.

Is strategy ka faida yeh hai ke aapka risk bohot kam hota hai. Agar aapki trade ghalat bhi jati hai to aapke losses limited hote hain. Is strategy mein aapko patience rakhna padta hai kyun ke ismein profits dheere dheere bante hain.

Yeh strategy un traders ke liye behtareen hoti hai jo forex trading ko ek full-time career banana chahte hain. Aapko apne goals ko realistic rakhna chahiye aur hamesha apni strategy ke sath consistent rehna chahiye.

8. Capital Preservation

Forex trading mein capital preservation bohot important hai. Yeh tabhi possible hai jab aap apne risk and reward ratio ko theek se manage karte hain. Agar aap har trade mein apni capital ka bohot zyada hissa risk mein daal dete hain to aapke paas kuch hi ghalat trades ke baad capital khatam ho sakti hai.

Aapko apni capital ko har haal mein protect karna chahiye taake aap lambe arse tak market mein reh sakte hain. Capital preservation ke liye aapko chhoti positions lena aur apne risk ko effectively manage karna hoga.

Stop-loss orders aur proper risk management techniques ka istemal karke aap apni capital ko preserve kar sakte hain. Forex trading mein sirf profit kamana important nahi hota, balki apni capital ko bacha kar rakhna bhi bohot zaroori hota hai.

9. Stop-Loss Orders ka Istemaal

Stop-loss orders forex trading mein aapke losses ko control karne ka ek bohot effective tareeqa hai. Yeh orders aapke trades ko protect karte hain jab market aapke against move karta hai. Stop-loss order set karne ka matlab yeh hota hai ke agar market ek specific level par pohch jata hai to aapki trade automatically close ho jati hai.

Stop-loss orders set karte waqt aapko apne risk tolerance ko madde nazar rakhna chahiye. Aap apna stop-loss order apne entry point ke qareeb ya door set kar sakte hain, lekin yeh depend karta hai aapki trading strategy aur market conditions par.

Stop-loss orders ka faida yeh hai ke yeh aapke losses ko limit kar dete hain. Forex market bohot zyada volatile hoti hai, aur agar aapne stop-loss set nahi kiya to market aapki position ko aapke against bohot zyada move kar sakti hai.

10. Take-Profit Orders ka Istemaal

Take-profit orders stop-loss orders ka opposite kaam karte hain. Jab aapka desired profit level achieve ho jata hai to yeh orders aapki position ko automatically close kar dete hain. Yeh aapko apne profits ko lock karne mein madad karte hain jab market aapke favor mein move kar raha hota hai.

Take-profit orders ka faida yeh hai ke aapko apne profits ko manually monitor nahi karna padta. Yeh orders set karne ke baad aapko bas market ki movement ka wait karna hota hai. Jab market aapki set price par pohchti hai to aapka profit automatically secure ho jata hai.

Take-profit orders set karte waqt aapko apne risk and reward ratio ko madde nazar rakhna chahiye. Yeh orders aapko disciplined trading strategy follow karne mein madad karte hain.

11. Market Analysis Ki Ahmiyat

Market analysis forex trading ka aik zaroori hissa hai. Market analysis ke bina aap apne trades ko effectively execute nahi kar sakte. Market analysis se murad yeh hai ke aap market ke trends, economic data, aur doosri relevant information ko samajh kar apne trades ko plan karte hain.

Market analysis do tarikon se ki ja sakti hai: technical analysis aur fundamental analysis. Dono tarikon ka apna apna faida hai, aur aik successful trader in dono approaches ko combine karke apni trading strategy banata hai.

Market analysis se aapko pata chalta hai ke market kis direction mein move kar sakta hai. Yeh analysis aapko apna risk and reward ratio estimate karne mein madad karta hai aur aapke trading decisions ko theek se execute karne mein madadgar hota hai.

12. Technical Analysis Ka Role

Technical analysis forex trading mein charts aur historical price data ka istimaal karke future price movements ko predict karne ka tareeqa hai. Yeh analysis support aur resistance levels, trend lines, candlestick patterns, aur indicators ka istimaal karke ki jati hai.

Technical analysis ka faida yeh hota hai ke yeh aapko market ki short-term movements ko samajhne mein madad karta hai. Yeh analysis mostly traders ke liye useful hoti hai jo short-term ya intraday trading karte hain.

Indicators jaise Moving Averages, RSI, MACD, aur Bollinger Bands, traders ko market ka sentiment samajhne mein madad karte hain. Technical analysis se aap apne entry aur exit points ko theek se determine kar sakte hain, jo ke aapke risk and reward ratio ko manage karne mein zaroori hota hai.

13. Fundamental Analysis Ka Role

Fundamental analysis forex market mein economic indicators, political events, aur news reports ka analysis hota hai. Yeh analysis market ke long-term trends ko samajhne mein madad karta hai. Fundamental analysis se aapko yeh pata chal sakta hai ke kis currency ka value barhne ya girne ka chance hai.

Economic indicators jaise GDP, unemployment rates, inflation data, aur central bank policies market ke sentiment ko affect karte hain. Fundamental analysis ka faida yeh hai ke yeh aapko market ke broader picture ko samajhne mein madad karta hai.

Fundamental analysis ke sath sath aapko technical analysis ka bhi istimaal karna chahiye taake aap apne trades ko theek se plan kar sakein. Yeh analysis aapke long-term trades ke liye bohot zaroori hoti hai.

14. Diversification Ki Strategy

Diversification forex trading mein apne risk ko manage karne ka ek aur effective tareeqa hai. Iska matlab yeh hai ke aap apni investments ko different currencies ya markets mein spread karte hain taake aapka overall risk kam ho jaye.

Diversification ka faida yeh hai ke agar aapki ek ya do trades loss mein bhi jaati hain to aapki doosri trades aapke overall loss ko cover kar sakti hain. Yeh strategy aapke portfolio ko balanced banati hai aur aapke risk and reward ratio ko manage karne mein madad karti hai.

Lekin, diversification ka matlab yeh nahi hai ke aap apne risk management ke principles ko ignore kar sakte hain. Aapko har trade ke liye apna risk and reward ratio theek se manage karna chahiye, chahe aap diversified portfolio hi kyu na bana rahe hon.

15. Emotional Control Ki Zaroorat

Forex trading mein emotional control bohot zaroori hai. Market ke fluctuations ko dekh kar traders ka emotional ho jana aam baat hai. Jab traders greed ya fear mein aakar decisions lete hain, to aksar unke trades ghalat hote hain aur wo loss mein chale jate hain.

Emotions ko control karna isliye zaroori hai taake aap apni strategy ke mutabiq disciplined trading decisions le sakein. Forex market bohot fast-paced hoti hai, aur agar aap apne emotions ko control nahi karte to aapka risk and reward ratio bigad sakta hai.

Isliye, har trade se pehle apne emotions ko side par rakh kar apne strategy aur analysis ke mutabiq decision lena chahiye. Agar aap apni strategy ke sath consistent rahte hain to aapko long-term mein zaroor faida hoga.

16. Risk and Reward Ratio Ka Consistency Se Istemaal

Risk and reward ratio ka consistent istimaal forex trading mein bohot zaroori hai. Yeh ratio aapke trading plan ka ek integral hissa hona chahiye. Agar aap apne ratio ko consistently follow karte hain to aap apne losses ko control kar sakte hain aur apne profits ko maximize kar sakte hain.

Consistency forex trading mein success ki key hai. Bohot se traders apne initial trades mein loss hota dekh kar apni strategy ko badal dete hain. Yeh approach ghalat hai. Aapko apne risk and reward ratio ko follow karte rehna chahiye aur apne trades ko systematically manage karna chahiye.

Agar aap consistently apni strategy ke sath trade karte hain to aap lambe arse mein successful ho sakte hain. Yeh consistency aapko disciplined trader banati hai aur market mein survive karne mein madad karti hai.

17. Trading Plan Ki Ahmiyat

Forex trading mein ek solid trading plan ki ahmiyat bohot zyada hoti hai. Trading plan aapke goals, risk tolerance, aur trading strategies ka ek roadmap hota hai. Yeh plan aapko disciplined trader banata hai aur aapke trading decisions ko logically manage karne mein madad karta hai.

Trading plan mein aap apni risk management strategies, entry aur exit points, aur market analysis ko define karte hain. Yeh plan aapko har trade ke liye ek clear direction deta hai.

Aik successful trading plan wo hota hai jo realistic goals par mabni hota hai. Aapko apne resources aur market ki realities ko samajh kar apne trading plan ko design karna chahiye. Is plan ke bina aap market mein random decisions le sakte hain jo aapke losses ko barha sakte hain.

18. Demo Trading Ka Faida

Demo trading ek excellent tareeqa hai forex market ko samajhne ka aur apni strategies ko test karne ka bina real paisa khoe. Forex trading mein entry se pehle demo account ka istemal aapko market ke dynamics ko samajhne mein madad karta hai.

Demo trading se aapko risk and reward ratio ko practically samajhne ka mauka milta hai. Yeh aapko apni mistakes ko identify karne ka chance deta hai aur aap apni strategies ko real market conditions mein test kar sakte hain.

Demo trading ke zariye aap apne emotional responses ko bhi test kar sakte hain. Real trading ke pressure ke baghair aap dekh sakte hain ke market fluctuations par aap kaise react karte hain. Yeh experience aapko real trading ke liye achi tarah se prepare karta hai.

19. Conclusion: Risk Aur Reward Ka Balance

Forex trading mein risk aur reward ka balance maintain karna bohot zaroori hai. Yeh balance aapko long-term success hasil karne mein madad karta hai. Risk and reward ratio ka theek se samajhna aur isko consistently follow karna aapki trading journey ko successful bana sakta hai.

Is article mein humne dekha ke forex trading mein risk and reward ratio ka taluq kitna important hai. Aapko apne goals, risk tolerance, aur market ki realities ke mutabiq apna risk and reward ratio set karna chahiye. Trading plan, risk management, aur emotional control ke sath agar aap apne ratio ko consistently follow karte hain to aap forex market mein lambe arse tak successful reh sakte hain.

Forex trading bohot profitable ho sakti hai, lekin yeh sirf un logon ke liye hai jo is market ki complexities ko samajhte hain aur apni strategies ko logically execute karte hain. -

#10 Collapse

Forex trading mein risk aur reward ratio ek ahem tool hai jo traders ko madad deta hai unki trades ko better manage karne mein. Is concept ko samajhna har trader ke liye zaroori hai, kyun ke yeh unki overall strategy ka hissa hota hai aur risk ko control karne mein madad karta hai.

Risk aur reward ratio ka matlab yeh hota hai ke aap kitna risk utha rahe hain kisi ek trade pe aur aap kitna reward expect kar rahe hain ussi trade se. Aasan tareeqe se samjha jaye to agar aapka risk 1 hai aur reward 2, to iska matlab yeh hai ke agar aap jeet gaye to aap do guna paise kamayenge lekin agar aap har gaye to sirf ek unit ka nuksaan hoga. Yani, aapki reward expectation aapke risk se zyada honi chahiye.

Forex trading mein, yeh zaroori hai ke traders aise trades karein jahan unka reward potential risk se zyada ho. Misaal ke taur par, agar aap har trade mein 1% risk le rahe hain, to aapko aisa setup choose karna chahiye jahan kam az kam 2% ya us se zyada ka profit banne ka chance ho. Is tarah ka ratio aapko consistency ke saath profit mein rehne ka zyada chance deta hai.

Aksar naye traders yeh galti karte hain ke woh apna risk aur reward ka ratio manage nahi karte aur impulsive decisions lete hain. Forex market volatile hoti hai, is liye har trade ka outcome unpredictable hota hai. Aise mein agar risk zyada utha liya jaye aur reward kam ho, to yeh strategy long term mein nukhsan deh ho sakti hai.

Aik or cheez jo traders ko samajhni chahiye wo yeh hai ke aapko hamesha risk management par focus karna chahiye, aur is process mein stop loss ka istemal buhat ahem hai. Stop loss aapko ek specific level par trade ko band karne mein madad deta hai jab aapki trade nuksaan mein ja rahi ho. Is se aapko yeh faida hota hai ke aap apna poora capital nahi gawate aur market mein zyada der tak tikne ka chance milta hai.

Ek common technique jo traders use karte hain wo yeh hoti hai ke woh apne trades ka risk reward ratio 1:2 ya 1:3 rakhte hain. Yeh is liye ki agar aapki trades ka 50% bhi successful hota hai, to aap phir bhi munafa mein rehte hain. Misaal ke taur par agar aap 10 trades karte hain aur 5 successful hote hain, to agar aapka risk reward ratio 1:2 hai, to aap ka overall profit hamesha positive hoga. Yeh cheez long term trading mein consistency ka source banti hai.

Magar yeh bhi zaroori hai ke koi bhi strategy blindly follow na ki jaye. Har trader ko apni market analysis aur trading style ke mutabiq apna risk reward ratio set karna chahiye. Har market ki dynamics mukhtalif hoti hain aur har trader ki approach bhi alag hoti hai. Is liye zaroori hai ke aap apni trading ko analyze karte rahein aur apne strategy mein zarurat ke mutabiq adjustments karte rahein.

Aakhir mein, yeh baat samajhna zaroori hai ke risk aur reward ratio koi fixed formula nahi hai, balki yeh ek guideline hai jo aapko disciplined trading ki taraf le kar ja sakti hai. Forex trading mein success ka raaz sirf high rewards ke chakkar mein nahi hai, balki controlled risk ke sath steady growth mein hai. Hamesha yeh yaad rakhein ke trading ek marathon hai, sprint nahi, is liye patience aur risk management ko apni strategy ka hissa banayein.

Is liye, jab bhi aap trade karein, apne aap se yeh sawal zaroor poochhein: "Main kitna risk utha raha hoon aur iske muqable mein kitna reward expect kar raha hoon?" Agar aapka answer disciplined aur thought-out hai, to aapki chances of success forex market mein badh jate hain

-

#11 Collapse

Forex trading mein risk aur reward ka ratio ek ahem concept hai jo har trader ko samajhna chahiye. Yeh ratio aapko batata hai ke aap apne trade par kitna risk le rahe hain aur uske mukable mein kitna reward mil sakta hai. Yeh concept trade karte waqt aapke decisions ko sahi direction dene mein madad karta hai aur aapke overall trading strategy ko behtar bana sakta hai.

Jab aap forex market mein trade karte hain, to aapko har trade par apna risk aur potential reward evaluate karna hota hai. Risk aur reward ka ratio aam taur par ek specific number ke form mein hota hai, jo aapko yeh batata hai ke agar trade successful hoti hai to aapko kitna profit milega aur agar trade unsuccessful hoti hai to aapko kitna nuksan uthana padega.

Maslan, agar aapka risk aur reward ratio 1:2 hai, to iska matlab hai ke aap har 1 unit risk ke mukable mein 2 units ka reward expect kar rahe hain. Is ratio ko samajhna aapko yeh decide karne mein madad karta hai ke aapko ek particular trade mein enter karna chahiye ya nahi. Aapko hamesha yeh ensure karna chahiye ke aapka risk reward ratio favorable ho, taake agar aap ke trades mein se kuch unsuccessful bhi ho, to aap overall profit mein rahe.

Risk aur reward ka ratio aapko trading decisions ko analyze karte waqt bhi guide karta hai. Jab aap kisi trade ka plan bana rahe hote hain, to aapko apni entry aur exit points ko carefully select karna hota hai. Entry point wo price hoti hai jahan aap trade start karte hain aur exit point wo price hoti hai jahan aap trade close karte hain. Yeh points define karte hain ke aapka stop loss aur take profit levels kya honge. Stop loss level aapko batata hai ke aap kitna nuksan bardasht kar sakte hain, jabke take profit level aapko batata hai ke aap kitna profit expect kar rahe hain.

Aapko yeh bhi yaad rakhna chahiye ke risk aur reward ratio ko sirf ek trade ke liye evaluate nahi karna chahiye, balki apni overall trading strategy ke liye bhi consider karna chahiye. Agar aap consistently trades ke liye high risk reward ratio choose karte hain, to aapka overall profit potential bhi badhega.

Forex trading mein risk aur reward ka ratio ko samajhna aur use effectively apply karna aapke trading success ke liye bohot zaroori hai. Yeh aapko disciplined aur systematic approach provide karta hai, jo aapko trading ke risks ko manage karne aur profits ko maximize karne mein madad karta hai. Hamesha apne trades ko analyze karein, risk aur reward ratio ko evaluate karein, aur trading decisions ko sahi data ke basis par lein. Is tarah se aap forex trading mein apni success rate ko improve kar sakte hain aur apne financial goals ko achieve kar sakte hain

- CL

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#12 Collapse

Risk and Reward Ratio in Forex Trading

Forex trading mein success hasil karne ke liye risk management ek zaroori hissa hai. Is mein sab se ahem concept "Risk and Reward Ratio" ka hota hai. Yeh ratio aapko batata hai ke aap kitna risk le rahe hain aur us risk ke badle mein kitna potential reward mil sakta hai. Agar aapka risk management strong ho, to aap market mein lambe arsay tak profitable reh sakte hain.

Chaliye is concept ko detail mein samajhte hain:

1. Risk and Reward Ratio Kya Hai?

Risk and Reward Ratio yeh batata hai ke har trade mein aap kitna risk le rahe hain aur kitna profit expect kar rahe hain. Yeh ratio aksar is tarah express hota hai: 1:2, 1:3, ya 1:1. Iska matlab yeh hai ke agar aapka ratio 1:2 hai, to aap 1 dollar ka risk le kar 2 dollars ka profit expect kar rahe hain.

2. Iska Ahmiyat Kya Hai?

Risk and Reward Ratio aapko har trade mein apni position ko manage karne ka plan deta hai. Agar aap sirf high-probability trades par focus karte hain jahan reward zyada ho aur risk kam, to aap market mein profitable reh sakte hain, chahe aapki trades ka success rate 50% ya us se kam bhi ho.

3. Example:

Agar aap ek trade open karte hain jahan aapka stop-loss 50 pips par hai aur aapka target 100 pips par hai, to aapka risk and reward ratio 1:2 hai. Iska matlab yeh hai ke agar aapki trade successful hoti hai, to aapka profit do guna hoga jitna aapne risk kiya tha.

4. Right Ratio Ka Intikhab:

Har trader ke liye ideal risk and reward ratio alag ho sakta hai, lekin generally, traders ko koshish karni chahiye ke wo 1:2 ya us se zyada ka ratio follow karen. Yeh isliye important hai ke agar aapki trades ka ratio 1:2 hai, to aapko sirf 50% trades jeetne ki zaroorat hai taake aap profitable reh sakein.

5. Risk Management:

Risk and Reward Ratio ka istamaal effective risk management ka ek hissa hai. Aapko apne har trade ke liye ek clear plan banana chahiye jisme stop-loss aur take-profit levels clear hon. Aam tor par traders apne risk ko account ke 1-2% tak limit karte hain, taake wo bade nuksan se bach sakein.

6. Emotional Discipline:

Risk and Reward Ratio ke sath sath, emotional discipline bhi zaroori hai. Kai traders, greed ya fear ki wajah se apne pre-planned risk and reward ratio se hatt jaate hain, jo ke ultimately unke liye nuksan ka sabab ban sakta hai. Apne plan par qayam rehna aapko long-term success de sakta hai.

Nateeja:

Risk and Reward Ratio forex trading mein ek fundamental tool hai jo aapko apne risk ko manage karne aur consistent profit banane mein madad de sakta hai. Har trade se pehle apna ratio decide karein, us par qayam rahein, aur apni trades ko emotions se dor rakh kar execute karein. Yeh strategy aapko forex market mein sustainable success dila sakti hai.

- CL

- Mentions 0

-

سا4 likes

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:31 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим