Bearish engulfing candlestick sample.

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

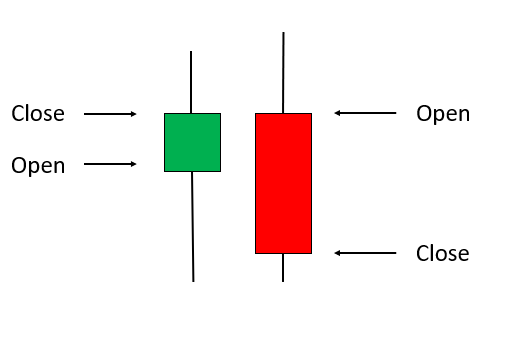

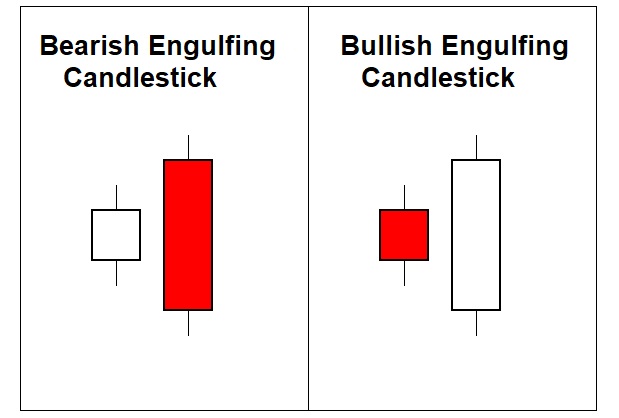

Bearish engulfing candlestick sample... Assalamu Alaikum expensive for member ummid Karti hun ki aap sab khairiyat se honge aur farak buying and selling enterprise a chi running quality ke sath market se achcha earnings Le Rahi honge dear jaisa ki Ham sabko pata hai ki is business Mein a success hone ke liye hamen iske tamam men factor sample ko samajhna jaruri hota hai jab tak hamen ine chijon ke naked mein entire understanding Nahin hota aur yah shape hamesha facility offer karta hai ki yahan se Ham achcha understanding hasil kar sakte hain. Bearish engulfing candlestick pattern: Bearish Engulfing Candlestick Pattern ek tijarati signal hai jo tijarat karne walon ko buying and selling ko analyze karne mein madadgar hota hai. Ye pattern candlestick charts par dekha ja sakta hai jo traders ke liye ahem hote hain.Bearish Engulfing Candlestick Pattern ek candlestick sample hai jo investors ko buying and selling ke signals aur traits ko pehchanne mein madadgar hota hai.Is pattern ko pehchanne ke liye, buyers ko candlestick charts ka istemal karna hota hai, jahan ye sample do alag-alag candles se banta hai: Trading Signal: Bearish Engulfing Candlestick Pattern ek candlestick sample hai jo traders ko buying and selling ke signals aur developments ko pehchanne mein madadgar hota hai. First Candle (Bullish): first candle ek bullish candle hoti hai jo bullish trend ke sath khatam hoti hai, matlab ke uski closing charge uski beginning rate se upar hoti hai. Second Candle (Bearish): Second candle pehle candle ko puri tarah se gher kar neeche girati hai, iska matlab hai ke deliberate fashion mein negative shift shuru ho gaya hai. Agar Bearish Engulfing Candlestick Pattern ke baad ek aur poor candle aaye, to isse ye bhi tasdeeq hoti hai ke inventory ki keemat mein aur kami ki ummed hai.Importance: Bearish Engulfing Candlestick Pattern ek tijarati sample hai jo traders ko unki trading ko behtar tarike se analyze karne mein madadgar hota hai. Is sample ki madad se investors ko ye pata lag sakta hai ke inventory ki keemat mein kami anay wali hai. Ye pattern traders ke liye ahem hota hai kyunki isse buying and selling selections lene mein madad milti hai aur unhein behtar buying and selling opportunities milti hain.

Trading Strategy: Bearish engulfing candlestick sample buying and selling method ek technical evaluation ka hissa hai jahan buyers candlestick charts ka istemal kar ke marketplace ki price motion ko examine karte hain. Is sample mein do candles shamil hote hain: pehla candle bullish hota hai aur dusra candle u.S.A. Neeche girta hai aur pehle candle ko puri tarah se engulf kar leta hai. Yeh sign bearish reversal ko darust karta hai aur behtar strategy hai agar ise confirmatory indicators ke sath istemal kiya jaye. Trader is signal ko samajh kar sell positions le sakte hain ya present lengthy positions ko close kar sakte hain, lekin risk management bhi ahem hai is method mein.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Importance: Bearish Engulfing Candlestick Pattern ek tijarati sample hai jo traders ko unki trading ko behtar tarike se analyze karne mein madadgar hota hai. Is sample ki madad se investors ko ye pata lag sakta hai ke inventory ki keemat mein kami anay wali hai. Ye pattern traders ke liye ahem hota hai kyunki isse buying and selling selections lene mein madad milti hai aur unhein behtar buying and selling opportunities milti hain.Trading Strategy: Bearish engulfing candlestick sample buying and selling method ek technical evaluation ka hissa hai jahan buyers candlestick charts ka istemal kar ke marketplace ki price motion ko examine karte hain. Is sample mein do candles shamil hote hain: pehla candle bullish hota hai aur dusra candle u.S.A. Neeche girta hai aur pehle candle ko puri tarah se engulf kar leta hai. Yeh sign bearish reversal ko darust karta hai aur behtar strategy hai agar ise confirmatory indicators ke sath istemal

-

#4 Collapse

Bearish engulfing candlestick sample. Bearish engulfing candlestick pattern ek technical analysis tool hai jo stock market ya financial markets me use hota hai. Ye pattern typically ek downtrend ya bearish trend ke dauraan paya jata hai aur ek potential trend reversal ka indication deta hai. Bearish engulfing candlestick pattern kuch is tarah se hota hai:- Pehla candlestick ek uptrend (bullish trend) ke dauraan form hota hai aur positive price movement represent karta hai.

- Dusra candlestick, pehle candlestick ko completely engulf karta hai, yaani ki uska opening price pehle candlestick ke closing price ke neeche hota hai aur closing price pehle candlestick ke opening price ke neeche hota hai.

- Opening price: $50

- Closing price: $60

- Opening price: $55 (Isse lower opening price hai pehle candlestick ke closing price se)

- Closing price: $45 (Isse lower closing price hai pehle candlestick ke opening price se)

-

#5 Collapse

"Bearish engulfing candlestick pattern Roman Urdu mein: Bearish engulfing candlestick pattern ek technical analysis ka pattern hai jo trading mein istemal hota hai. Is pattern mein do candlesticks hoti hain: 1. Pehli candlestick ek uptrend ko show karti hai, jismein bullish (khareedne wale) sentiment hota hai. 2. Dusri candlestick, jo pehli candlestick ko poori tarah se engulf kar leti hai, bearish (bechne wale) sentiment ko darust karti hai. Yeh pattern usually price reversal ko suggest karta hai aur traders ko market mein selling ki taraf dhyan dena chahiye." -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Bearish Engulfing Chart Pattern: Bearish engulfing or Negative inundating candle test trading strategy ek specialized assessment ka hissa hai jahan purchasers candle graphs ka istemal kar ke commercial center ki cost movement ko look at karte hain. Is test mein do candles shamil hote hain: pehla candle bullish hota hai aur dusra light u.S.A. Neeche girta hai aur pehle flame ko puri tarah se overwhelm kar leta hai. Yeh sign negative inversion ko darust karta hai aur behtar methodology hai Negative Overwhelming Candle Example ek tijarati test hai jo brokers ko unki exchanging ko behtar tarike se dissect karne mein madadgar hota hai. Is test ki madad se financial backers ko ye pata slack sakta hai ke stock ki keemat mein kami anay wali hai.Ye design brokers ke liye ahem hota hai kyunki isse trading choices lene mein madad milti hai aur unhein behtar trading open doors milti hain. Design or Plan two days candles standard mushtamil hai, jiss ki pehli fire significant solid areas for aik candle hoti hai, jo k costs k bullish ya up design ki alamat hoti hai. Plan ki dosri light aik negative fire hoti hai, aur ye candle pehli candle ki nisbat veritable body head bohut bari bhi hoti hai aur ye candles pehli candles ko apne andar mukamal lapait central le leti hai, jiss se costs ka mazeed up-climb ruk jata hai. Plan ki dosri fire ka open pehli light k close se top standard opening essential hota hai, Aor Negative inundating flame configuration costs k top head banne ki waja se aik negative sign genrate karta hai, jiss standard market major sell ki entry ki ja sakti hai. Plans standard trade enter karne se plan ki dosri light aik insistence flame ki zarorat parti hai, jo k real body central aik negative candle honi chaheye, aur dosri candle k base standard close bhi honi chaheye. Formation Of Bearish Chart Pattern Candles: Bearish engulfing or Negative immersing candle design aik negative inversion design hai jo bullish pattern ke oopar hota hai Yeh truly do candle standard mushtamil hai pehli aik choti bullish flame hai aur doosri barri negative light hai jo choti bullish candle ko wonderful pinnacle standard Inundate Kar deti hai Yeh design ziyada ahem samjha jata hai agar negative candle ka genuine body lamba ho aur upper shadow kam ya nah ho merchants aksar negative inundating design ko dosray negative signs ke sath mil kar talaash karte hain aur hit negative overwhelming example ki nishandahi ki jati hai to mukhtasir position mein daakhil hotay hain Taham is baat ko zehen mein rakhna zaroori hai ke yeh design mustaqbil ki qeematon ki naqal o harkat ka koi zamanat yafta isharay nahi hai Punch negative overwhelming patteren ki nishandahi ki jati hai to dealers aksar mukhtasir positions mein daakhil hotay nazar atay hain Stap nuqsaan aam peak standard bullish candle ki oonchai se oopar rakha jata hai aur hadaf munafe aksar support level ya pehlay ki kam standard set kya jata hai Yeh note karna zaroori hai ke negative inundating design tamam kand patteren ki terhan mustaqbil ki qeematon ki naqal o harkat ka koi zamanat yafta ishara nahi hai

Design or Plan two days candles standard mushtamil hai, jiss ki pehli fire significant solid areas for aik candle hoti hai, jo k costs k bullish ya up design ki alamat hoti hai. Plan ki dosri light aik negative fire hoti hai, aur ye candle pehli candle ki nisbat veritable body head bohut bari bhi hoti hai aur ye candles pehli candles ko apne andar mukamal lapait central le leti hai, jiss se costs ka mazeed up-climb ruk jata hai. Plan ki dosri fire ka open pehli light k close se top standard opening essential hota hai, Aor Negative inundating flame configuration costs k top head banne ki waja se aik negative sign genrate karta hai, jiss standard market major sell ki entry ki ja sakti hai. Plans standard trade enter karne se plan ki dosri light aik insistence flame ki zarorat parti hai, jo k real body central aik negative candle honi chaheye, aur dosri candle k base standard close bhi honi chaheye. Formation Of Bearish Chart Pattern Candles: Bearish engulfing or Negative immersing candle design aik negative inversion design hai jo bullish pattern ke oopar hota hai Yeh truly do candle standard mushtamil hai pehli aik choti bullish flame hai aur doosri barri negative light hai jo choti bullish candle ko wonderful pinnacle standard Inundate Kar deti hai Yeh design ziyada ahem samjha jata hai agar negative candle ka genuine body lamba ho aur upper shadow kam ya nah ho merchants aksar negative inundating design ko dosray negative signs ke sath mil kar talaash karte hain aur hit negative overwhelming example ki nishandahi ki jati hai to mukhtasir position mein daakhil hotay hain Taham is baat ko zehen mein rakhna zaroori hai ke yeh design mustaqbil ki qeematon ki naqal o harkat ka koi zamanat yafta isharay nahi hai Punch negative overwhelming patteren ki nishandahi ki jati hai to dealers aksar mukhtasir positions mein daakhil hotay nazar atay hain Stap nuqsaan aam peak standard bullish candle ki oonchai se oopar rakha jata hai aur hadaf munafe aksar support level ya pehlay ki kam standard set kya jata hai Yeh note karna zaroori hai ke negative inundating design tamam kand patteren ki terhan mustaqbil ki qeematon ki naqal o harkat ka koi zamanat yafta ishara nahi hai  Pattern or design Major areas of strength for aik inversion ka signal deti hai. Design two days candles standard mushtamil hai, jiss ki pehli candle areas of strength for aik candle hoti hai, jo k costs k bullish ya up pattern ki alamat hoti hai. Design ki dosri flame aik negative light hoti hai, aur ye candle pehli candle ki nisbat genuine body primary bohut bari bhi hoti hai aur ye candles pehli candles ko apne andar mukamal lapait principal le leti hai, jiss se costs ka mazeed up-ascent ruk jata hai. Design ki dosri flame ka open pehli light k close se top standard hole primary hota hai, Aor Negative overwhelming candle design costs k top fundamental banne ki waja se aik negative sign genrate karta hai, jiss standard market principal sell ki passage ki ja sakti hai. Designs standard exchange enter karne se design ki dosri candle aik affirmation candle ki zarorat parti hai, jo k genuine body fundamental aik negative candle honi chaheye Bearish Engulfing Chart Candles Trading: Bearish engulfing candlestick or Negative immersing candle design exchanging technique ek specialized ka hissa hai jahan dealers candle outlines ka istemal kar ke market ki cost activity ko investigate karte hain. Is design mein do candles shamil hote hain: pehla light bullish hota hai aur dusra candle usse neeche girta hai aur pehle flame ko puri tarah se overwhelm kar leta hai. Yeh signal negative inversion ko darust karta hai aur behtar system hai agar ise corroborative markers ke sath istemal kiya jaye. Merchant is signal ko samajh kar sell positions le sakte hain ya existing long positions ko close kar sakte hain Candle Example ek tijarati design hai jo dealers ko unki exchanging ko behtar tarike se dissect karne mein madadgar hota hai. Is design ki madad se brokers ko ye pata slack sakta hai ke stock ki keemat mein kami anay wali hai Ye design merchants ke liye ahem hota hai kyunki isse exchanging choices lene mein madad milti hai aur unhein behtar exchanging open doors milti hain.

Pattern or design Major areas of strength for aik inversion ka signal deti hai. Design two days candles standard mushtamil hai, jiss ki pehli candle areas of strength for aik candle hoti hai, jo k costs k bullish ya up pattern ki alamat hoti hai. Design ki dosri flame aik negative light hoti hai, aur ye candle pehli candle ki nisbat genuine body primary bohut bari bhi hoti hai aur ye candles pehli candles ko apne andar mukamal lapait principal le leti hai, jiss se costs ka mazeed up-ascent ruk jata hai. Design ki dosri flame ka open pehli light k close se top standard hole primary hota hai, Aor Negative overwhelming candle design costs k top fundamental banne ki waja se aik negative sign genrate karta hai, jiss standard market principal sell ki passage ki ja sakti hai. Designs standard exchange enter karne se design ki dosri candle aik affirmation candle ki zarorat parti hai, jo k genuine body fundamental aik negative candle honi chaheye Bearish Engulfing Chart Candles Trading: Bearish engulfing candlestick or Negative immersing candle design exchanging technique ek specialized ka hissa hai jahan dealers candle outlines ka istemal kar ke market ki cost activity ko investigate karte hain. Is design mein do candles shamil hote hain: pehla light bullish hota hai aur dusra candle usse neeche girta hai aur pehle flame ko puri tarah se overwhelm kar leta hai. Yeh signal negative inversion ko darust karta hai aur behtar system hai agar ise corroborative markers ke sath istemal kiya jaye. Merchant is signal ko samajh kar sell positions le sakte hain ya existing long positions ko close kar sakte hain Candle Example ek tijarati design hai jo dealers ko unki exchanging ko behtar tarike se dissect karne mein madadgar hota hai. Is design ki madad se brokers ko ye pata slack sakta hai ke stock ki keemat mein kami anay wali hai Ye design merchants ke liye ahem hota hai kyunki isse exchanging choices lene mein madad milti hai aur unhein behtar exchanging open doors milti hain.  Flame ek bullish candle hoti hai jo bullish pattern ke sath khatam hoti hai, matlab ke uski shutting cost uski opening cost se upar hoti hai.Second candle pehle candle ko puri tarah se gher kar neeche girati hai, iska matlab hai ke arranged pattern mein negative shift shuru ho gaya hai.Agar Negative Overwhelming Candle Example ke baad ek aur negative light aaye, to isse ye bhi tasdeeq hoti hai ke stock ki keemat mein aur kami ki ummed hai.Bearish Inundating Candle Example ek candle design hai jo merchants ko exchanging ke signals aur patterns ko pehchanne mein madadgar hota hai.Is design ko pehchanne ke liye, brokers ko candle graphs ka istemal karna hota hai, jahan ye design do alag candles se banta ha

Flame ek bullish candle hoti hai jo bullish pattern ke sath khatam hoti hai, matlab ke uski shutting cost uski opening cost se upar hoti hai.Second candle pehle candle ko puri tarah se gher kar neeche girati hai, iska matlab hai ke arranged pattern mein negative shift shuru ho gaya hai.Agar Negative Overwhelming Candle Example ke baad ek aur negative light aaye, to isse ye bhi tasdeeq hoti hai ke stock ki keemat mein aur kami ki ummed hai.Bearish Inundating Candle Example ek candle design hai jo merchants ko exchanging ke signals aur patterns ko pehchanne mein madadgar hota hai.Is design ko pehchanne ke liye, brokers ko candle graphs ka istemal karna hota hai, jahan ye design do alag candles se banta ha

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:32 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим