Adaptive price zone indicator ki limitations

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

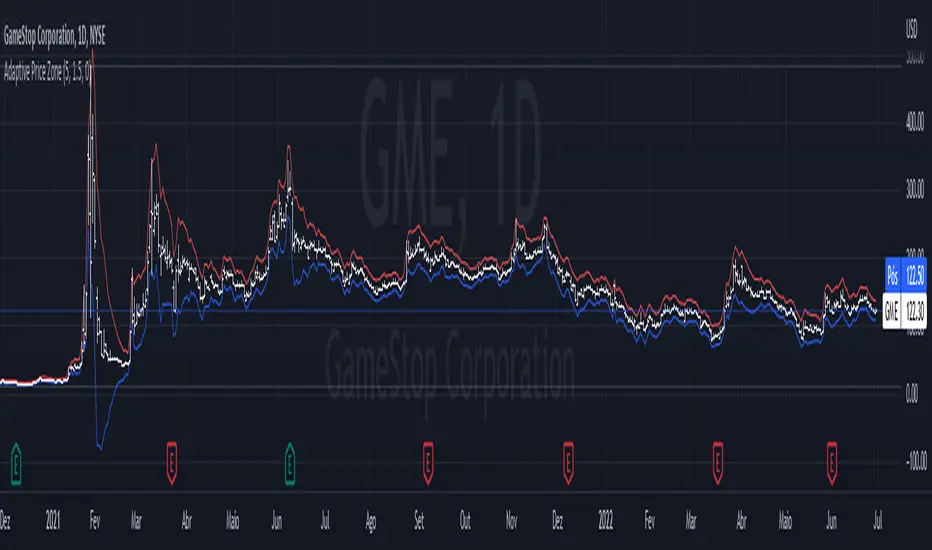

LIMITATIONS OF ADAPTIVE PRICE ZONE INDICATORIntroduction: Adaptive Price Zone (APZ) Indicator aik technical analysis ka tool hai jo traders aur investors istemal kartay hain taakay woh market trends aur price levels ka andaza laga sakay. Lekin, is indicator ke istemal mein kuch hadood aur limitations hoti hain. Is post mein hum APZ indicator ki hadood ko tafseel se samjhayenge. Details:Lagging Nature (Maamool Se Peechay Rehna): APZ Indicator ka aik bara masla yeh hai keh yeh market ke current trends ko peechay se reflect karta hai. Iska matlab hai keh is indicator ke signals aksar late aatay hain, jis se traders ko opportunities ko peechay chal kar dhoondna parta hai.Market Volatility Par Asar: APZ Indicator ki performance market ki volatility par bhi asar andaz hoti hai. Agar market zyada volatile hai toh APZ ke signals kam asar andaz hote hain aur traders ko zyada cautious rehna parta hai.Optimization Ki Zarurat: APZ Indicator ko istemal karne ke liye parameters ko optimize karna zaroori hota hai. Har market aur time frame ke liye alag parameters ki zarurat hoti hai. Isko optimize na karna traders ke liye mushkil ho sakta hai. False Signals (Ghalat Signals): APZ Indicator kabhi-kabhi false signals bhi generate kar sakta hai. Yani ke is indicator ke signals sahi na ho aur traders ko nuksan ho sakta hai.Sirf Price Data Par Mabni: APZ Indicator sirf price data par mabni hoti hai aur dusre factors jaise ke trading volume, market sentiment, aur fundamental analysis ko ignore karti hai. Iski wajah se yeh market conditions ko poori tarah se samajhnay mein asani nahi pesh karti. Zyada Analysis Ki Zarurat: APZ Indicator ka istemal karne ke liye traders ko aur bhi technical analysis tools aur indicators ki zarurat hoti hai. Isi tarah ke aur tools ko samajhna aur istemal karna traders ke liye mushkil ho sakta hai.Market Changes Par Naamumkin Hai: Market dynamics hamesha changing hoti hain, aur APZ Indicator aik mukhtasar waqt ke liye acha kaam kar sakta hai, lekin market ke lambe arsay ke liye samjhnay mein madadgar nahi hoti.Risk Management Ki Kami: APZ Indicator trading decisions ke liye madadgar ho sakti hai, lekin yeh risk management ko ignore kar deti hai. Traders ko hamesha apnay risk aur reward ratios ka khayal rakhna zaroori hota hai. Subjective Interpretation (Mansoobati Tashreeh): APZ Indicator ki tashreeh (interpretation) traders par depend karti hai, aur har trader apnay tajziyat ke hisab se isko samajh sakta hai. Isi wajah se yeh kabhi-kabhi different traders ke liye different results de sakti hai.Historical Data Par Depend Karna: APZ Indicator ka istemal historical price data par depend karta hai. Yeh woh data hai jo peechay gaye waqt ki ghaltiyon ko darust karti hai. Lekin, market future mein kis tarah se behave karegi, yeh historical data par poori tarah se bharosa karne par depend nahi karta. Conclusion:Is tafseel se wazeh hai keh Adaptive Price Zone (APZ) Indicator ke istemal mein kuch limitations hain jo traders ko samajhna aur inka jawab dena zaroori hai. APZ Indicator ko doosray technical analysis tools ke saath istemal karke traders apni trading strategies ko mazeed mazbooti den saktay hain. Magar yeh yaad rakhna zaroori hai keh market mein kisi bhi waqt par risk hota hai aur traders ko apni mehnat aur tajziyat ke hisab se trading decisions leni chahiye. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#3 Collapse

Adaptive Price Zone (APZ) indicator ek ahem technical tool hai jo traders ko price fluctuations aur market trends ko samajhne mein madad deta hai. Is indicator ka main purpose price ke volatility ke mutabiq adapt karna hota hai. APZ indicator ko kisi bhi financial instrument mein use kiya ja sakta hai, jese ke stocks, forex, commodities, aur indices. Is tool ka khas focus market ke price zones ko highlight karna hota hai, jahan reversal ya continuation moves hone ki potential hoti hai. Halaanki Adaptive Price Zone indicator ko traders asani se use kar sakte hain, lekin iske kuch limitations hain jo trading decisions lete waqt samajhna zaroori hota hai. Iss article mein hum detail se samjhenge ke Adaptive Price Zone indicator kya hai, iska kaam kya hota hai, aur iske limitations ko trading mein kaise samjha ja sakta hai.

Adaptive Price Zone (APZ) ek trend-following aur volatility-based indicator hai jo 1996 mein Lee Leibfarth ne introduce kiya tha. Is indicator ka purpose yeh hai ke market ke volatile conditions ke mutabiq adjust ho jaye. Yeh indicator price ke movement ke according upper aur lower bands draw karta hai, jo is baat ki indication dete hain ke price kis range mein move kar raha hai.

APZ ke through traders ko price ke extreme levels ka pata chal jata hai. Jab price upper band ko touch karti hai to yeh overbought condition ka indication hoti hai, aur jab price lower band ko touch karti hai to yeh oversold condition ko highlight karti hai.

Lekin jese har technical indicator ke kuch apne faide aur nuksaan hote hain, APZ bhi kuch limitations ke sath aata hai jo har trader ko samajhne chahiye.

Adaptive Price Zone Indicator Ki Limitations

Lagging Nature

Technical indicators ko do categories mein divide kiya jata hai: leading aur lagging. APZ indicator ek lagging indicator hai, jo iska matlab hai ke yeh market ke past price data par base karta hai. Yeh future ke market moves ko pehle se predict nahi karta, balki past data ke basis par analysis deta hai. Iska matlab yeh hai ke APZ indicator se aapko price movements ka idea thoda late milta hai. Jab tak APZ aapko overbought ya oversold condition ka signal deta hai, tab tak market ka trend change hone lagta hai.

Lagging indicators ka main drawback yeh hota hai ke jab market me rapid changes hote hain, to yeh un changes ko timely detect nahi karte. Yeh traders ke liye ek mushkil situation create kar sakta hai, khaaskar jab markets highly volatile hon ya sudden price movements dekhne ko mil rahe hon.

False Signals in Range-Bound Markets

Range-bound markets mein APZ ka use karna kabhi kabhi misleading ho sakta hai. Jab market sideways move kar raha hota hai ya ek tight range mein trade kar raha hota hai, to APZ frequently overbought aur oversold signals generate karta hai. Iss type ke signals false hote hain, kyunki market koi clear trend follow nahi kar raha hota.

For example, agar market kisi specific range mein move kar raha ho aur APZ indicator repeatedly overbought ya oversold condition show kar raha ho, to iska matlab nahi ke trend change hone wala hai. Iss case mein APZ aapko false signals dega, jo aapke trading decisions ko negatively affect kar sakte hain.

Whipsaw Movements

Whipsaw ek aesi situation hoti hai jab market price rapidly move karta hai lekin koi clear direction nahi hoti. Whipsaw movements usually high volatility ya economic events ke dauran hoti hain. APZ indicator whipsaw movements ke dauran effective signals nahi de paata, kyunki yeh past data ke basis par bands draw karta hai.

Iss condition mein, APZ aapko misleading signals dega, jese ke price upper band ko touch karegi lekin wahan se aur bhi zyada upar chali jayegi, ya lower band ko touch karne ke baad aur neeche chali jayegi. Is tarah ke whipsaw movements ke dauran APZ ka use karna risky ho sakta hai.

Repainting Issue

Repainting ek aesi problem hoti hai jo kai technical indicators mein paayi jati hai, aur APZ bhi iss se poori tarah bach nahi sakta. Repainting ka matlab hota hai ke indicator apne historical data ko update karta rehta hai jese jese new price data aata hai. Iss wajah se pehle diye gaye signals badal jate hain.

Traders ko yeh lagta hai ke indicator ne sahi signal diya tha, lekin jab wo apni trade history ko dekhte hain, to unko pata chalta hai ke signal change ho gaya tha. Yeh misleading ho sakta hai aur trading analysis mein confusion create kar sakta hai.

Not Suitable for All Market Conditions

APZ indicator ko har market condition mein use nahi kiya ja sakta. Yeh specifically trending markets mein achha kaam karta hai, jahan price ek direction mein steadily move kar raha hota hai. Lekin jab market sideways ya consolidation phase mein hoti hai, to APZ zyada effective nahi hota.

Iss tarah ke markets mein, APZ repeatedly upper aur lower bands ke signals de sakta hai, jo aapko confusion mein daal sakta hai. Iss wajah se, APZ ko use karte waqt market conditions ka dhyaan rakhna bohat zaroori hota hai.

Overbought and Oversold Levels Always Accurate Nahi Hote

APZ indicator ke overbought aur oversold levels hamesha accurate nahi hote. Jab market strongly trending hota hai, to price repeatedly upper band ko touch kar sakti hai lekin abhi bhi overbought nahi hoti, ya price lower band ko touch kar sakti hai lekin oversold nahi hoti.

Yeh trader ke liye mushkil situation hoti hai kyunki agar trader upper band ko overbought samajh kar sell kar de, aur market continue bullish rahe, to trader ka loss ho sakta hai. Isi tarah, lower band ko oversold samajh kar buy karne par market aur neeche ja sakti hai.

Settings Ki Complexity

APZ ke accurate signals lene ke liye iski settings ka sahi hona zaroori hota hai. Iska matlab hai ke APZ ko har market ke liye customize karna parta hai. Default settings har market aur financial instrument ke liye kaam nahi karte, aur agar aap isko sahi tarah se adjust nahi karte, to aapko false signals milne ke chances barh jate hain.

Settings adjust karna hamesha asaan nahi hota, khaaskar agar aap naya trader hain. Aapko market ke volatility, instrument ke nature, aur time frame ko samajhna hota hai taake aap APZ ko sahi tarah se customize kar sakein. Yeh complexity kai traders ke liye mushkil ho sakti hai, jo sirf simple indicators use karna pasand karte hain.

Lagging in High Volatility Conditions

High volatility market conditions mein, APZ ke signals lag karte hain. High volatility mein price ke movements bohot tez aur unpredictable hote hain, aur APZ ka calculation method is tarah ke sudden price changes ke sath asani se adjust nahi kar pata. Jab market extreme volatility face kar raha ho, to APZ ka upper ya lower band ka signal late milta hai.

Iss wajah se, high volatility conditions mein APZ indicator par fully rely karna risky ho sakta hai, aur traders ko doosre volatility-based tools jese ke Bollinger Bands ya Average True Range (ATR) indicators ke sath combine karna padta hai taake unko better signals mil sakein.

Backtesting Ke Liye Reliable Nahi

APZ ko backtesting ke liye reliable samjha nahi jata. Repainting ke issue ki wajah se, backtesting results kaafi misleading ho sakte hain. Jab aap past price data par APZ ka backtest karte hain, to aapko lagta hai ke indicator ne sahi signals diye, lekin real-time trading mein aapko wohi signals wapas milte hain. Is wajah se APZ ko future price movements ke liye accurately predict karne mein problems aa sakti hain.

Backtesting mein accurate aur reliable results lena bohot zaroori hota hai taake aap apni strategy ko effectively optimize kar sakein. Lekin APZ ka repainting issue is process ko mushkil banata hai, jo traders ke liye ek badi challenge hoti hai.

Adaptive Price Zone Indicator Ko Better Use Karne Ki Strategies

APZ ke limitations ko samajhne ke baad, yeh zaroori hai ke traders apni trading strategies mein in cheezon ka dhyaan rakhain:- Combine with Other Indicators: APZ ko doosre technical indicators ke sath combine karna chahiye jese ke RSI (Relative Strength Index), Moving Averages, aur MACD (Moving Average Convergence Divergence). Yeh indicators APZ ke false signals ko filter karne mein madad karte hain aur aapko zyada reliable trading opportunities dete hain.

- Focus on Trending Markets: APZ trending markets mein zyada effective hota hai, isliye jab bhi market ek strong uptrend ya downtrend mein ho, tabhi APZ indicator ka use karna fayda mand hota hai. Range-bound markets mein isko avoid karna chahiye.

- Adjust Settings According to Market Volatility: APZ ke parameters ko market ke volatility ke hisaab se adjust karna bohot zaroori hai. Isko manually adjust karke aap zyada accurate signals le sakte hain, jese ke different financial instruments aur market conditions ke liye customize settings.

- Use Risk Management: APZ ke false signals ke chances ko dekhte hue, hamesha strong risk management strategies ko follow karna zaroori hai. Stop-loss aur take-profit levels ko clear define karna chahiye taake agar market unexpected move kare to aapka nuksaan minimum ho.

Adaptive Price Zone indicator ek powerful tool hai jo price volatility ke mutabiq adjust karta hai aur traders ko overbought aur oversold conditions ke signals deta hai. Lekin iske kuch limitations hain jese ke lagging nature, whipsaw movements, false signals, aur repainting issue. In cheezon ko samajhna bohot zaroori hai, taake aap APZ ko effectively use kar sakein.

Har market aur financial instrument ke liye APZ ko customize karna padta hai, aur isko doosre technical indicators ke sath combine karna chahiye taake aapko zyada reliable aur accurate signals mil sakein. Hamesha risk management strategies ko apne trading plan ka hissa banayein taake aapke trades safe aur profitable rahen.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:26 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим