Indicator For Scalping

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

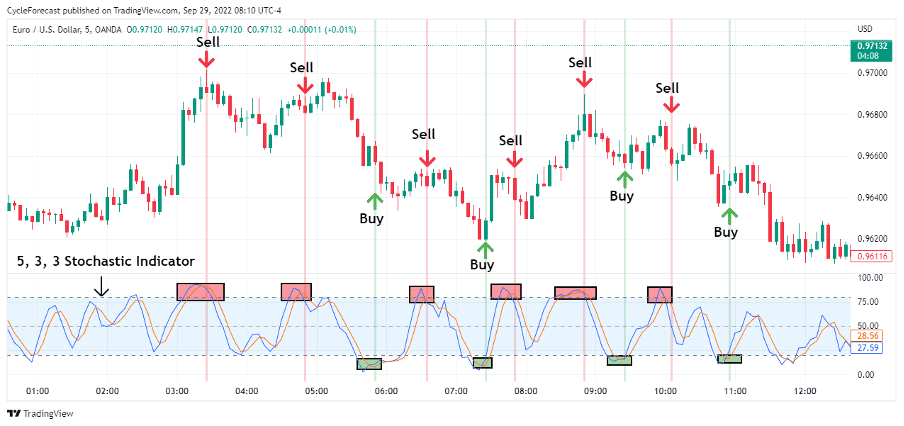

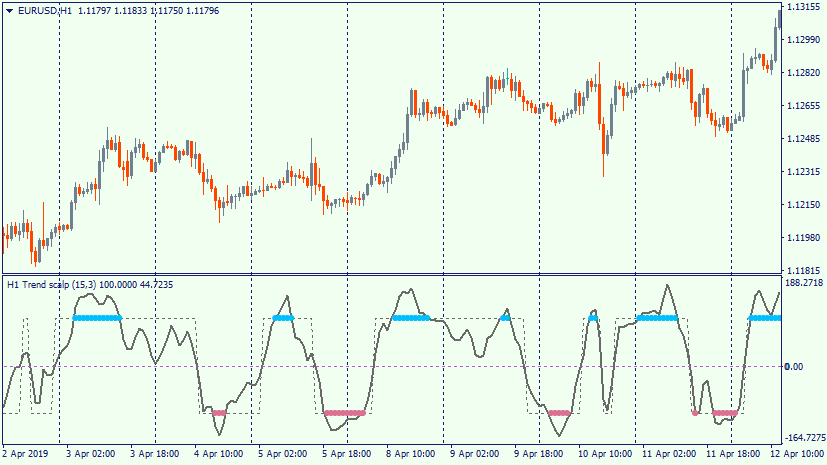

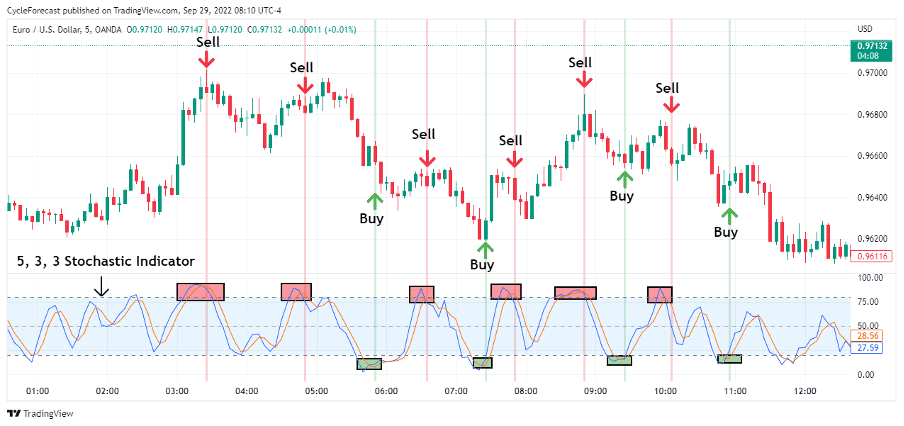

Scalping forex market mein ek trading strategy hai jo chhoti price movements ka faida uthane mein madadgar hoti hai. Is strategy ko kamyaab tareeqay se istemal karne ke liye traders aksar mukhtalif technical indicators ka sahara lete hain. Moving Averages Moving averages scalper ke toolkit mein ek bunyadi tool hai. Ye indicators ek mukhtasir arsay mein price data ko smooth karte hain aur traders ko trends aur potential entry aur exit points ka pata lagane mein madadgar hotay hain. Scalping mein aksar do pramukh qisam ke moving averages istemal kiye jate hain: Simple Moving Averages (SMA) aur Exponential Moving Averages (EMA). SMAs period ke andar tamam prices ko barabar wazan dete hain, jabke EMAs recent prices ko zyada wazan dete hain, jis se inhein chhoti muddat ke movements ke liye zyada jawabgar banaya jata hai. Scalping mein aam taur par 5-period aur 20-period EMAs istemal hoti hain. Jab 5-period EMA 20-period EMA ke ooper se guzar jati hai, to ye bullish signal banati hai aur ek moghe long entry ki taraf ishara karta hai. Ulti sthiti mein, jab 5-period EMA 20-period EMA ke neeche se guzar jati hai, to ye bearish signal banati hai, jis se ek moghe short entry ki taraf ishara hota hai. Ye crossover strategy scalpers ko chhoti muddat ke trends ko asani se capture karne mein madadgar hoti hai. Stochastic Oscillator Stochastic Oscillator scalping ke liye wide istemal hone wala ek momentum indicator hai. Is se market mein overbought (zyada khareedi gayi) aur oversold (zyada bechi gayi) conditions ka andaza lagaya jata hai, jo traders ko moghe reversals ki pehchan mein madadgar hota hai. Stochastic Oscillator do lines se bana hota hai: %K (fast line) aur %D (slow line). 80 ke ooper ke readings overbought conditions ko darust karti hain, jis se potential price pullback ka andaza lagaya jata hai, jabke 20 ke neeche ke readings oversold conditions ko darust karti hain, jis se potential price bounce ki taraf ishara hota hai. Scalpers aksar %K aur %D ke crossover par tawajjo dete hain. Jab %K %D ke upper se guzar jati hai, to ye bullish signal banati hai, jis se moghe long trade ka ishara hota hai. Ulti sthiti mein, jab %K %D ke neeche se guzar jati hai, to ye bearish signal banati hai, jis se moghe short trade ka ishara hota hai. Stochastic lines aur price movements ke darmiyan hone wali ikhtilafat bhi trend reversals ko pehchanne mein ahem hoti hain. Relative Strength Index (RSI) Relative Strength Index (RSI) scalping strategies mein ahem kiya jata hai. Ye momentum oscillator price movements ki taqat aur tezi ko napta hai aur potential reversal points ko pehchane mein madadgar hota hai. RSI ke readings 70 ke ooper overbought conditions ko darust karte hain, jis se potential price pullback ki taraf ishara hota hai. Ulti sthiti mein, 30 ke neeche ke readings oversold conditions ko darust karti hain, jis se potential price bounce ki taraf ishara hota hai. Scalpers aksar RSI ki divergences ka istemal karte hain, jo ek taqatwar tool hai. Divergence tab paida hoti hai jab RSI price ke ulte rukh mein chal rahi hoti hai. For example, agar prices lower low banati hain jab RSI higher low banati hai, to ye ek bullish reversal ki taraf ishara kar sakti hai, jo scalpers ke liye ek ahem entry point dene wala hota hai.

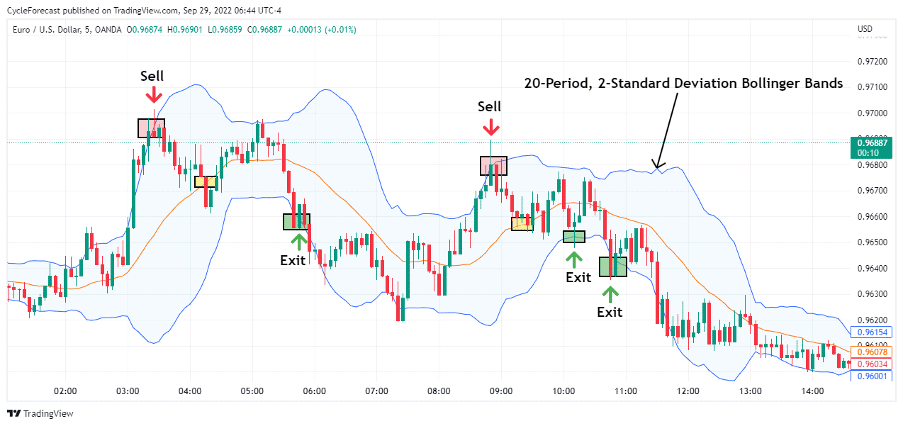

Relative Strength Index (RSI) Relative Strength Index (RSI) scalping strategies mein ahem kiya jata hai. Ye momentum oscillator price movements ki taqat aur tezi ko napta hai aur potential reversal points ko pehchane mein madadgar hota hai. RSI ke readings 70 ke ooper overbought conditions ko darust karte hain, jis se potential price pullback ki taraf ishara hota hai. Ulti sthiti mein, 30 ke neeche ke readings oversold conditions ko darust karti hain, jis se potential price bounce ki taraf ishara hota hai. Scalpers aksar RSI ki divergences ka istemal karte hain, jo ek taqatwar tool hai. Divergence tab paida hoti hai jab RSI price ke ulte rukh mein chal rahi hoti hai. For example, agar prices lower low banati hain jab RSI higher low banati hai, to ye ek bullish reversal ki taraf ishara kar sakti hai, jo scalpers ke liye ek ahem entry point dene wala hota hai.  Bollinger Bands Bollinger Bands scalpers ke liye ahem indicators hain jo price volatility aur potential reversal points ki wazahat karte hain. Ye indicator teen bands se bana hota hai: a middle band (aam taur par 20-period SMA) aur do outer bands jo middle band se standard deviations ko darust karti hain. Jab price upper Bollinger Band ke qareeb pohanchti hai ya usse chuti hai, to ye overbought conditions ko darust karti hai aur potential price reversal ko downside ki taraf ishara karti hai. Ulti sthiti mein, jab price lower Bollinger Band ke qareeb pohanchti hai ya usse chuti hai, to ye oversold conditions ko darust karti hai aur potential price reversal ko upside ki taraf ishara karti hai. Bands ki chaudaai market volatility ko darust karti hai, jahan chhoti chaudaai kam volatility ko aur badi chaudaai zyada volatility ko darust karti hai.

Bollinger Bands Bollinger Bands scalpers ke liye ahem indicators hain jo price volatility aur potential reversal points ki wazahat karte hain. Ye indicator teen bands se bana hota hai: a middle band (aam taur par 20-period SMA) aur do outer bands jo middle band se standard deviations ko darust karti hain. Jab price upper Bollinger Band ke qareeb pohanchti hai ya usse chuti hai, to ye overbought conditions ko darust karti hai aur potential price reversal ko downside ki taraf ishara karti hai. Ulti sthiti mein, jab price lower Bollinger Band ke qareeb pohanchti hai ya usse chuti hai, to ye oversold conditions ko darust karti hai aur potential price reversal ko upside ki taraf ishara karti hai. Bands ki chaudaai market volatility ko darust karti hai, jahan chhoti chaudaai kam volatility ko aur badi chaudaai zyada volatility ko darust karti hai.  Parabolic SAR (Stop and Reverse) Parabolic SAR trend-following aur trailing stop-loss ke liye banaya gaya ek khaas indicator hai, jo scalping mein khaas toor par ahem hota hai. Ye price chart ke ooper ya neeche dots ki shakal mein aata hai, jo potential trend changes ko darust karta hai. Jab Parabolic SAR dots price ke neeche hain, to ye uptrend ko darust karta hai, jo long positions ki taraf ishara karta hai. Ulti sthiti mein, jab dots price ke ooper hain, to ye downtrend ko darust karta hai, jo short positions ki taraf ishara karta hai. Scalpers in dots ko trailing stop-loss orders set karne ke liye istemal karte hain, jo unhe munafa hasil karne aur risk ko effectively manage karne mein madadgar hoti hain, scalping ki tezi se hone wali trading mein. Ye indicators agar mazbooti se istemal kiye jayen, to forex market mein scalping ke liye tezi se aur sochi samjhi trading faislay karne mein traders ki salahiyat ko behtar bana saktay hain. Yaad rahe ke scalping precise taur par kiya jata hai, is ke liye discipline aur aik achi tarah se define ki gayi trading strategy ki zaroorat hoti hai. Is ke sath hi, traders ko tezi se trading ke zariye barhtay huay transactions costs aur asal paisay ko risk karne se pehle demo account mein practice karna chahiye. Is ke ilawa, changing market conditions aur experience ke mutabiq apne approach ko adaapt aur behtar banane ke liye regular taur par kam karna ahem hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Parabolic SAR (Stop and Reverse) Parabolic SAR trend-following aur trailing stop-loss ke liye banaya gaya ek khaas indicator hai, jo scalping mein khaas toor par ahem hota hai. Ye price chart ke ooper ya neeche dots ki shakal mein aata hai, jo potential trend changes ko darust karta hai. Jab Parabolic SAR dots price ke neeche hain, to ye uptrend ko darust karta hai, jo long positions ki taraf ishara karta hai. Ulti sthiti mein, jab dots price ke ooper hain, to ye downtrend ko darust karta hai, jo short positions ki taraf ishara karta hai. Scalpers in dots ko trailing stop-loss orders set karne ke liye istemal karte hain, jo unhe munafa hasil karne aur risk ko effectively manage karne mein madadgar hoti hain, scalping ki tezi se hone wali trading mein. Ye indicators agar mazbooti se istemal kiye jayen, to forex market mein scalping ke liye tezi se aur sochi samjhi trading faislay karne mein traders ki salahiyat ko behtar bana saktay hain. Yaad rahe ke scalping precise taur par kiya jata hai, is ke liye discipline aur aik achi tarah se define ki gayi trading strategy ki zaroorat hoti hai. Is ke sath hi, traders ko tezi se trading ke zariye barhtay huay transactions costs aur asal paisay ko risk karne se pehle demo account mein practice karna chahiye. Is ke ilawa, changing market conditions aur experience ke mutabiq apne approach ko adaapt aur behtar banane ke liye regular taur par kam karna ahem hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#3 Collapse

Scalping ke liye Indicators: Scalping ek trading strategy hai jahan traders tej price movements se chhote munafe kamane ki koshish karte hain. Scalping ko safaltapoorvak karne ke liye traders aksar kai indicators aur tools ka istemal karte hain. Yahan kuch aam taur par scalping ke liye istemal hone wale indicators hain: Moving Averages:

Scalping ek trading strategy hai jahan traders tej price movements se chhote munafe kamane ki koshish karte hain. Scalping ko safaltapoorvak karne ke liye traders aksar kai indicators aur tools ka istemal karte hain. Yahan kuch aam taur par scalping ke liye istemal hone wale indicators hain: Moving Averages: :max_bytes(150000):strip_icc()/dotdash_Final_How_to_Use_a_Moving_Average_to_Buy_Stocks_Jun_2020-01-3b3c3e00d01442789e78a34b31e81d36.jpg) : Chhote time periods ke moving averages, jaise 5-period ya 10-period Simple Moving Average (SMA) ya Exponential Moving Average (EMA), scalping mein short-term trends aur entry/exit points ke liye istemal kiye jate hain. Stochastic Oscillator: Stochastic Oscillator ek momentum indicator hai jo overbought aur oversold conditions ko pehchanne mein madadgar hota hai. Scalpers iska istemal potential reversal points ke liye karte hain. Relative Strength Index (RSI): RSI ek aur momentum oscillator hai jise overbought aur oversold conditions ko pehchanne ke liye istemal kiya jata hai. Scalpers RSI divergences aur extreme readings ko trade signals ke roop mein dekhte hain. Bollinger Bands: Bollinger Bands ek middle band (SMA) aur do outer bands se bane hote hain jo market ki volatility ko represent karte hain. Scalpers inhe istemal karte hain jab price outer bands ko chu jati hai ya unse guzar jati hai, potential price reversal points ko pehchane ke liye. Fibonacci Retracement Levels: Fibonacci retracement levels Fibonacci sequence ke adhar par potential support aur resistance levels ko pehchane mein madadgar hote hain. Scalpers in levels ko entry aur exit points ke liye istemal karte hain. MACD (Moving Average Convergence Divergence): MACD ek trend-following momentum indicator hai. Scalpers MACD crossovers aur divergence patterns ko trade setups ke liye pehchanne mein istemal karte hain. Average True Range (ATR): ATR market ki volatility ko measure karta hai aur iska istemal stop-loss aur take-profit levels set karne ke liye kiya jata hai, bazaar ke current conditions ke hisab se. Ichimoku Cloud: Ichimoku Cloud ek comprehensive indicator hai jo trend direction, support aur resistance levels, aur potential entry aur exit points ke bare mein information provide karta hai. Scalpers ise versatile hone ke liye istemal karte hain. Parabolic SAR (Stop and Reverse): Parabolic SAR ek trend-following indicator hai jo price candles ke upar ya niche dots place karta hai, potential reversals ko indicate karne ke liye. Scalpers ise stops trail karne aur trend changes ko pehchane ke liye istemal karte hain.

: Chhote time periods ke moving averages, jaise 5-period ya 10-period Simple Moving Average (SMA) ya Exponential Moving Average (EMA), scalping mein short-term trends aur entry/exit points ke liye istemal kiye jate hain. Stochastic Oscillator: Stochastic Oscillator ek momentum indicator hai jo overbought aur oversold conditions ko pehchanne mein madadgar hota hai. Scalpers iska istemal potential reversal points ke liye karte hain. Relative Strength Index (RSI): RSI ek aur momentum oscillator hai jise overbought aur oversold conditions ko pehchanne ke liye istemal kiya jata hai. Scalpers RSI divergences aur extreme readings ko trade signals ke roop mein dekhte hain. Bollinger Bands: Bollinger Bands ek middle band (SMA) aur do outer bands se bane hote hain jo market ki volatility ko represent karte hain. Scalpers inhe istemal karte hain jab price outer bands ko chu jati hai ya unse guzar jati hai, potential price reversal points ko pehchane ke liye. Fibonacci Retracement Levels: Fibonacci retracement levels Fibonacci sequence ke adhar par potential support aur resistance levels ko pehchane mein madadgar hote hain. Scalpers in levels ko entry aur exit points ke liye istemal karte hain. MACD (Moving Average Convergence Divergence): MACD ek trend-following momentum indicator hai. Scalpers MACD crossovers aur divergence patterns ko trade setups ke liye pehchanne mein istemal karte hain. Average True Range (ATR): ATR market ki volatility ko measure karta hai aur iska istemal stop-loss aur take-profit levels set karne ke liye kiya jata hai, bazaar ke current conditions ke hisab se. Ichimoku Cloud: Ichimoku Cloud ek comprehensive indicator hai jo trend direction, support aur resistance levels, aur potential entry aur exit points ke bare mein information provide karta hai. Scalpers ise versatile hone ke liye istemal karte hain. Parabolic SAR (Stop and Reverse): Parabolic SAR ek trend-following indicator hai jo price candles ke upar ya niche dots place karta hai, potential reversals ko indicate karne ke liye. Scalpers ise stops trail karne aur trend changes ko pehchane ke liye istemal karte hain.:max_bytes(150000):strip_icc()/dotdash_Final_Support_and_Resistance_Basics_Aug_2020-01-1c737e0debbe49a88d79388977f33b0c.jpg) Volume indicators jaise On-Balance Volume (OBV) ya Volume Price Trend (VPT) market mein bhaagidaari ko darust karte hain aur scalping ke signals ko confirm karne mein madadgar hote hain. Support aur Resistance Levels:

Volume indicators jaise On-Balance Volume (OBV) ya Volume Price Trend (VPT) market mein bhaagidaari ko darust karte hain aur scalping ke signals ko confirm karne mein madadgar hote hain. Support aur Resistance Levels: :max_bytes(150000):strip_icc()/dotdash_Final_Support_and_Resistance_Basics_Aug_2020-01-1c737e0debbe49a88d79388977f33b0c.jpg) Price chart par mukhya support aur resistance levels ko pehchanna scalpers ke liye mahatvapurn hai, kyunki price aksar in levels par react karti hai, trading opportunities pradan karte hain. Scalpers aam taur par in indicators ka mishran istemal karte hain taki signals ko confirm kiya ja sake aur teji se trading decisions liya ja sake. Yaad rahe ki scalping discipline, teji se execution, aur risk management ki maang karta hai, kyun ki yeh frequent trading aur sudden market reversals se bachne ke liye tight stop-loss orders ka istemal karta hai.

Price chart par mukhya support aur resistance levels ko pehchanna scalpers ke liye mahatvapurn hai, kyunki price aksar in levels par react karti hai, trading opportunities pradan karte hain. Scalpers aam taur par in indicators ka mishran istemal karte hain taki signals ko confirm kiya ja sake aur teji se trading decisions liya ja sake. Yaad rahe ki scalping discipline, teji se execution, aur risk management ki maang karta hai, kyun ki yeh frequent trading aur sudden market reversals se bachne ke liye tight stop-loss orders ka istemal karta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:30 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим