Overbought and Oversold Trading Strategy in Forex Guidelines and Benefits.

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

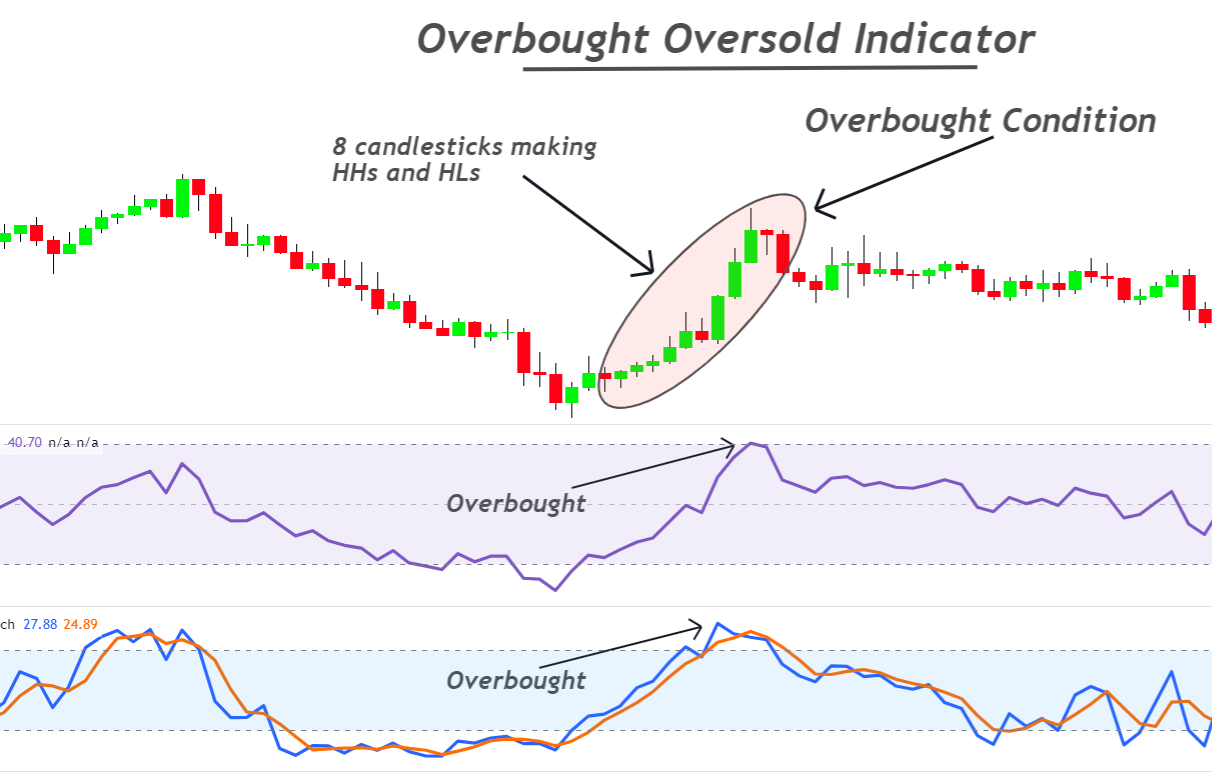

Overbought and Oversold Trading. Agar aap forex trading mein kaam karte hain, to aapko overbought aur oversold trading strategy ke bare mein pata hona chahiye. Ye strategy aapko ye batati hai ke kis samay kisi currency pair mein buy ya sell karna chahiye. Is article mein hum overbought aur oversold trading strategy ke bare mein Roman Urdu mein batayenge. Sabse pehle, hum overbought aur oversold ke bare mein baat karenge. Overbought ka matlab hota hai ke kisi currency pair ki price bahut high ho gayi hai aur ab us mein koi further buying ka scope nahi hai. Oversold ka matlab hota hai ke kisi currency pair ki price bahut low ho gayi hai aur ab us mein koi further selling ka scope nahi hai. Overbought and Oversold Trading Strategy. Overbought aur oversold trading strategy ka use karke traders kisi currency pair ki price movement ko predict kar sakte hain. Agar kisi currency pair ki price overbought zone mein hai to traders sell kar sakte hain aur agar oversold zone mein hai to traders buy kar sakte hain. Overbought aur Oversold Indicator. Overbought aur oversold indicator ka use karke traders kisi currency pair ki overbought aur oversold zone ko identify kar sakte hain. Sabse popular overbought aur oversold indicator RSI (Relative Strength Index) hai. RSI ka use karke traders kisi currency pair ki overbought aur oversold zone ko identify kar sakte hain. Overbought aur Oversold Trading Strategy Uses. Overbought aur oversold trading strategy ka use karne ke liye aapko kuch steps follow karne honge: Step 1: Overbought aur oversold indicator ka use karke kisi currency pair ki overbought aur oversold zone ko identify karein. Step 2: Agar kisi currency pair ki price overbought zone mein hai to aap sell kar sakte hain. Agar oversold zone mein hai to aap buy kar sakte hain. Step 3: Stop loss aur take profit ka use karke apni trade ko manage karein. Overbought aur oversold trading strategy forex trading mein bahut important hai. Ye strategy aapko kisi currency pair ki price movement ko predict karne mein help karti hai. Overbought aur oversold indicator ka use karke traders kisi currency pair ki overbought aur oversold zone ko identify kar sakte hain. Agar aap overbought aur oversold trading strategy ka use karte hain to aap apni trading performance improve kar sakte hain. -

#3 Collapse

Guidelines (Hidayat): Oscillators Ka Istemal: Forex mein overbought (zada khareedi gayi) aur oversold (zada bechi gayi) halat pehchanne ke liye RSI, Stochastic Oscillator, ya CCI jaise indicators ka istemal hota hai. Ye indicators 0 se 100 ke beech numerical values provide karte hain. Overbought Pehchanne: Jab koi indicator ek specific threshold (masalan, 70 ya 80) ko paar kar leta hai, toh yeh ishara karta hai ke price shayad ulta rukh le sakti hai. Oversold Pehchanne: Jab koi indicator ek specific threshold (masalan, 30 ya 20) ke neeche gir jata hai, toh yeh ishara karta hai ke price shayad ulta rukh le sakti hai. Aur Indicators Ke Sath Tasdeeq Karen: Signals ko tasdeeq karne ke liye aur technical analysis tools ya chart patterns ka bhi istemal karen. Risk Ko Control Karein: Hamesha stop-loss orders ka istemal karke nuksan ko rokne ke liye apni trading ko manage karen. Benefits (Fayde): Virodhak Approach (Contrarian Approach): Samjhein ke jab kuch cheez overbought hoti hai, toh yeh bechna acha hota hai, aur jab oversold hoti hai, toh yeh khareedna acha hota hai, jisse reversals ke doran munafa ho sakta hai. Risk Kam Karna: Reversal points pehchanna, majboot trends mein risk ko kam karta hai. Tasdeeq (Confirmation): Yeh dusre analysis tools ke sath istemal karke tasdeeq karne ke liye signals ke roop mein kaam karte hain. Scalping Ke Liye Mufeed:Short-term trading jaise scalping ya day trading ke liye mufeed hota hai. Tadadat Ke Anusar Istemal: Alag-alag timeframes par istemal kiya ja sakta hai, jo alag trading styles ke liye upayogi hota hai. Objective Signals:

Objective numerical values provide karte hain, jo faisla karne mein madadgar hote hain.Dhyan rahe ki yeh indicators puri tarah se reliable nahi hote aur strong trends ke doran market overbought ya oversold reh sakti hai. Isliye inse aur technical analysis tools ke sath aur risk management ke sath istemal karna mahatvapurn hai.

Objective numerical values provide karte hain, jo faisla karne mein madadgar hote hain.Dhyan rahe ki yeh indicators puri tarah se reliable nahi hote aur strong trends ke doran market overbought ya oversold reh sakti hai. Isliye inse aur technical analysis tools ke sath aur risk management ke sath istemal karna mahatvapurn hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

OVERBOUGHT AUR OVERSOLD STRATEGY:-"Overbought" aur "oversold" trading concepts market analysis mein use hone wale terms hain jo traders ko market ke condition aur potential price reversals ke baray mein samjhne mein madadgar hotay hain. Ye concepts primarily technical analysis ki roshni mein dekhe jate hain, aur traders inka istemal trading decisions banane mein karte hain. Chaliye in dono concepts ko detail se samjhein: Overbought (Zyada Khareeda Gaya): Overbought ek situation hai jahan market mein ek specific asset ya security ki keemat itni tezi se badh jati hai ki woh ab normal ya justified nahi lagti. Iska matlab hai ki us asset ko zyada khareeda gaya hai, aur ab market mein uski keemat ko niche le jane ka potential hota hai. Overbought hone par traders mehsoos karte hain ki asset ka price ab niche jane ka samay aya hai aur woh is par short-selling ya sell orders place karke profit kamane ki koshish karte hain. Oversold (Zyada Becha Gaya): Oversold ek situation hai jahan market mein ek specific asset ya security ki keemat itni tezi se giri hoti hai ki woh ab normal ya justified nahi lagti. Iska matlab hai ki us asset ko zyada becha gaya hai, aur ab market mein uski keemat ko badhane ka potential hota hai. Oversold hone par traders mehsoos karte hain ki asset ka price ab badhne ka samay aya hai, aur woh is par buy orders place karke profit kamane ki koshish karte hain. OVERBOUGHT AUR OVERSOLD STRATEGY K COMPONENTS:-Relative Strength Index (RSI): RSI ek popular momentum indicator hai jo asset ke recent price changes ko evaluate karta hai. RSI ki calculation asset ke upar hone wale aur niche hone wale days ke price changes ko dekhti hai. RSI ki value 70 ke upar hone par asset ko overbought maana jata hai, jabki 30 ke niche hone par asset oversold ho sakta hai. Stochastic Oscillator: Stochastic Oscillator bhi ek momentum indicator hai, jo asset ke current price ko uske price range ke relative position par evaluate karta hai. Stochastic Oscillator ki reading 80 ke upar hone par asset ko overbought aur 20 ke niche hone par asset ko oversold mana jata hai. Moving Averages (MA): Moving averages asset ke historical price data ko smooth karne mein madadgar hote hain aur trend ko identify karne mein istemal hote hain. Overbought aur oversold conditions ko detect karne ke liye, traders often short-term aur long-term moving averages ke cross-overs ko dekhte hain. For example, jab short-term MA long-term MA ko upar se cross karti hai, to ye ek overbought signal ho sakta hai, aur jab short-term MA long-term MA ko niche se cross karti hai, to ye ek oversold signal ho sakta hai. Bollinger Bands: Bollinger Bands ek volatility indicator hain jo asset ke price volatility ko measure karte hain. Bollinger Bands mein upper band aur lower band hoti hain. Overbought condition mein price upper band ke pass hoti hai, jabki oversold condition mein price lower band ke pass hoti hai. Volume Analysis: Volume bhi ek important component hai overbought aur oversold conditions ko evaluate karne mein. Agar kisi asset ke sath zyada volume ke sath price increase ya decrease hoti hai, to ye ek sign ho sakta hai ki overbought ya oversold condition hai.

OVERBOUGHT AUR OVERSOLD STRATEGY K COMPONENTS:-Relative Strength Index (RSI): RSI ek popular momentum indicator hai jo asset ke recent price changes ko evaluate karta hai. RSI ki calculation asset ke upar hone wale aur niche hone wale days ke price changes ko dekhti hai. RSI ki value 70 ke upar hone par asset ko overbought maana jata hai, jabki 30 ke niche hone par asset oversold ho sakta hai. Stochastic Oscillator: Stochastic Oscillator bhi ek momentum indicator hai, jo asset ke current price ko uske price range ke relative position par evaluate karta hai. Stochastic Oscillator ki reading 80 ke upar hone par asset ko overbought aur 20 ke niche hone par asset ko oversold mana jata hai. Moving Averages (MA): Moving averages asset ke historical price data ko smooth karne mein madadgar hote hain aur trend ko identify karne mein istemal hote hain. Overbought aur oversold conditions ko detect karne ke liye, traders often short-term aur long-term moving averages ke cross-overs ko dekhte hain. For example, jab short-term MA long-term MA ko upar se cross karti hai, to ye ek overbought signal ho sakta hai, aur jab short-term MA long-term MA ko niche se cross karti hai, to ye ek oversold signal ho sakta hai. Bollinger Bands: Bollinger Bands ek volatility indicator hain jo asset ke price volatility ko measure karte hain. Bollinger Bands mein upper band aur lower band hoti hain. Overbought condition mein price upper band ke pass hoti hai, jabki oversold condition mein price lower band ke pass hoti hai. Volume Analysis: Volume bhi ek important component hai overbought aur oversold conditions ko evaluate karne mein. Agar kisi asset ke sath zyada volume ke sath price increase ya decrease hoti hai, to ye ek sign ho sakta hai ki overbought ya oversold condition hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:16 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим