Pin Bar Candlestick Pattern In Forex

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

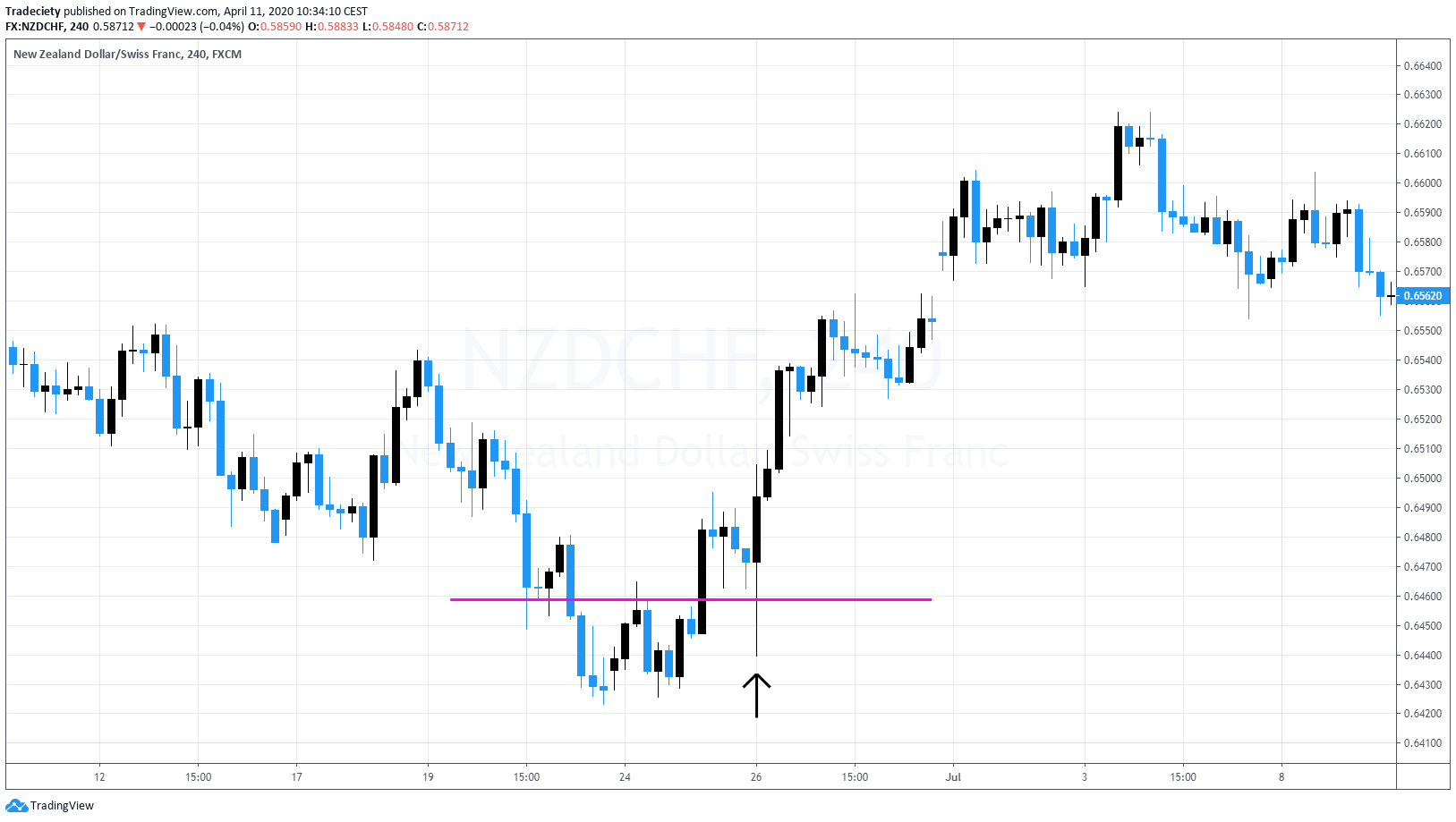

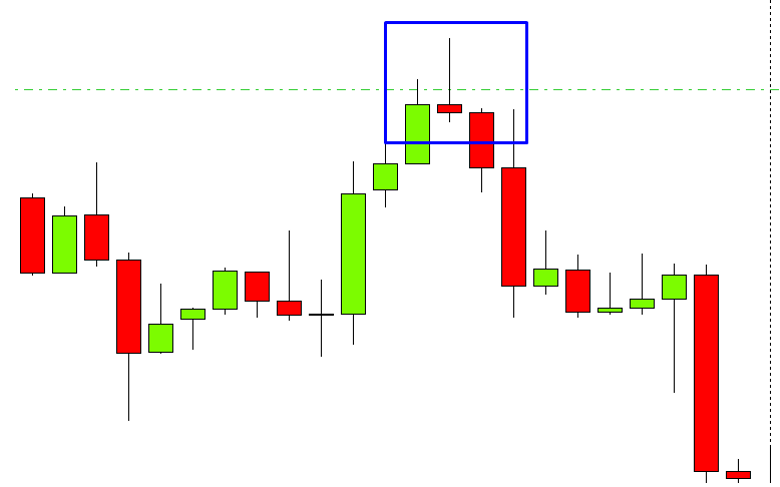

Introduction to Pin Bar Candlestick Pattern Pin bar candlestick pattern, jo aksar pinocchio bar ke tor par jana jata hai, forex market mein technical analysis ka aham aur pehchaana gaya hissa hai. Is pattern mein market ke jazbat aur qeemat ke ulte-pulte hone ki chances ko samajhna aur samjha jata hai, sath hi sath chances tak keemat ke palatne ya jaari rehne ki soochana bhi milti hai. Iske ahem pehluo, tafsir, aur trading strategies ko samajhna, forex traders ke liye faisla karne ke liye ahem hai. Anatomy of a Pin Bar Aik pin bar teen main hisson se banta hai: open, close, aur wick ya shadow. Open woh keemat hai jis par candle shuru hoti hai, close woh keemat hai jis par yeh samapt hoti hai, aur wick woh patli rekha hai jo candle ke jism ke upar ya niche failti hai. Pin bar ka pehchanne wala khasiyat yeh hoti hai ke uski lambi wick hoti hai, jo trading session ke doran keemat mein tezi se palatne ko darust karti hai, jabke wick ke mukable mein candle ke jism ka aakar chota hota hai. Aik bullish pin bar tab banta hai jab lambi wick candle ke jism ke niche hoti hai. Isse yeh darust hota hai ke trading session ke doran bechne wale ne keemat ko kam kiya, lekin neeche ki taraf jane ki tezi ko barqarar nahi rakha. Aam taur par, close open se ziada hoti hai, iska matlab hai ke trading session ke ant tak kharidari wale control mein aa gaye. Ulta, bearish pin bar mein lambi wick candle ke jism ke upar hoti hai. Isse yeh hota hai ke kharidari wale temporarily keemat ko upar le gaye, lekin upar ki taraf jane ki tezi ko barqarar nahi rakha, aur aam taur par close open se kam hoti hai, iska matlab hai ke trading session ke ant tak bechne wale control mein aa gaye.

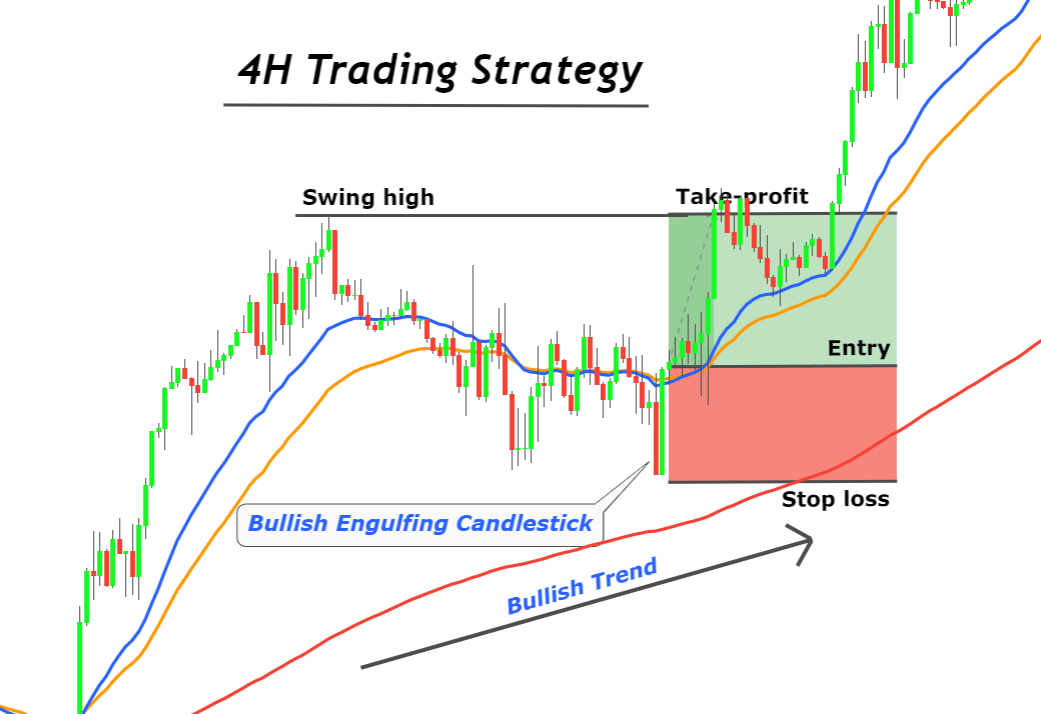

Anatomy of a Pin Bar Aik pin bar teen main hisson se banta hai: open, close, aur wick ya shadow. Open woh keemat hai jis par candle shuru hoti hai, close woh keemat hai jis par yeh samapt hoti hai, aur wick woh patli rekha hai jo candle ke jism ke upar ya niche failti hai. Pin bar ka pehchanne wala khasiyat yeh hoti hai ke uski lambi wick hoti hai, jo trading session ke doran keemat mein tezi se palatne ko darust karti hai, jabke wick ke mukable mein candle ke jism ka aakar chota hota hai. Aik bullish pin bar tab banta hai jab lambi wick candle ke jism ke niche hoti hai. Isse yeh darust hota hai ke trading session ke doran bechne wale ne keemat ko kam kiya, lekin neeche ki taraf jane ki tezi ko barqarar nahi rakha. Aam taur par, close open se ziada hoti hai, iska matlab hai ke trading session ke ant tak kharidari wale control mein aa gaye. Ulta, bearish pin bar mein lambi wick candle ke jism ke upar hoti hai. Isse yeh hota hai ke kharidari wale temporarily keemat ko upar le gaye, lekin upar ki taraf jane ki tezi ko barqarar nahi rakha, aur aam taur par close open se kam hoti hai, iska matlab hai ke trading session ke ant tak bechne wale control mein aa gaye.  Trading Strategies with Pin Bars Pin bars ki tafsir inke maujooda keemat chart aur market ke wasee context par mabni hoti hai. Downtrend ke neeche bullish pin bars ya uptrend ke oopar bearish pin bars aksar mazboot palatne ki soochana dete hain, aur isse yeh ishara hota hai ke opposite rukh mein keemat ka palatne ka aik mumkin trend change hone ki chances hai. Lekin kabhi-kabhi pin bars jari rehne ki soochana bhi de sakte hain, jaise maan lijiye ke aik uptrend ke majmooe ke doran aik bullish pin bar aata hai, jo yeh ishara karta hai ke trend dobara shuru hone se pehle aik waqtan-fa-waqtan rukawat anay wali hai. Taasub ki tafsir barqarar karne ke liye, traders aksar inhe doosri technical tools jaise moving averages, trendlines, ya support aur resistance levels ke saath milakar istemal karte hain, taake inke trading signals ko mazbooti milti hai. Muqarrar risk management, jaise ke stop-loss orders set karna aur munasib position sizing, maal ki hifazat karne ke liye ahem hai, taake agar trade jo samjha gaya tha waisa nahi hota to capital ki hifazat ho sake. Limitations and Considerations Halanki pin bars qeemati tools hain, lekin yeh puri tarah se beghairat nahi hain, aur traders ko inke limitation ka ilm hona chahiye. Jhootay signals bhi aate hain, is liye pin bars ko doosri technical analysis methods ke saath istemal karne ka ahem hai. Is ke sath hi, market ke wasee context ko bhi samajhna ahem hai, jaise ke maali events, news releases, aur jang-e-ma'rik ke masail, kyun ke yeh bahar ke factors pin bar patterns ki kargarai par asar dal sakte hain. Is se aage, traders ko yaad rakhna chahiye ke pin bars ki ahmiyat time frame par bhi mukhtalif ho sakti hai. Pin bar candlestick pattern forex trader ke toolkit mein aik taqatwar aur mufeed tool hai. Iski salahiyat keemat ke trend mein palatne ya jari rehne ki soochana dene mein isay technical analysis ke liye behtareen banati hai. Lekin traders ko dardnaak tareeqe se istemal karna chahiye, munasib risk management techniques istemal karna chahiye, aur pin bars ko aik mukhtalif trading strategy ke hisse ke taur par shaamil karna chahiye. Pin bars ko doosri tafseelat ke saath istemal karke, aur wasee market mohaul ko madde nazar rakhte hue, inke istemal ko mazeed efektiv bana sakte hain. Jaise ke har trading tool, pin bars tab tak kargar hain jab inhe aik mukhtalif trading approach ka hissa banaya jata hai.

Trading Strategies with Pin Bars Pin bars ki tafsir inke maujooda keemat chart aur market ke wasee context par mabni hoti hai. Downtrend ke neeche bullish pin bars ya uptrend ke oopar bearish pin bars aksar mazboot palatne ki soochana dete hain, aur isse yeh ishara hota hai ke opposite rukh mein keemat ka palatne ka aik mumkin trend change hone ki chances hai. Lekin kabhi-kabhi pin bars jari rehne ki soochana bhi de sakte hain, jaise maan lijiye ke aik uptrend ke majmooe ke doran aik bullish pin bar aata hai, jo yeh ishara karta hai ke trend dobara shuru hone se pehle aik waqtan-fa-waqtan rukawat anay wali hai. Taasub ki tafsir barqarar karne ke liye, traders aksar inhe doosri technical tools jaise moving averages, trendlines, ya support aur resistance levels ke saath milakar istemal karte hain, taake inke trading signals ko mazbooti milti hai. Muqarrar risk management, jaise ke stop-loss orders set karna aur munasib position sizing, maal ki hifazat karne ke liye ahem hai, taake agar trade jo samjha gaya tha waisa nahi hota to capital ki hifazat ho sake. Limitations and Considerations Halanki pin bars qeemati tools hain, lekin yeh puri tarah se beghairat nahi hain, aur traders ko inke limitation ka ilm hona chahiye. Jhootay signals bhi aate hain, is liye pin bars ko doosri technical analysis methods ke saath istemal karne ka ahem hai. Is ke sath hi, market ke wasee context ko bhi samajhna ahem hai, jaise ke maali events, news releases, aur jang-e-ma'rik ke masail, kyun ke yeh bahar ke factors pin bar patterns ki kargarai par asar dal sakte hain. Is se aage, traders ko yaad rakhna chahiye ke pin bars ki ahmiyat time frame par bhi mukhtalif ho sakti hai. Pin bar candlestick pattern forex trader ke toolkit mein aik taqatwar aur mufeed tool hai. Iski salahiyat keemat ke trend mein palatne ya jari rehne ki soochana dene mein isay technical analysis ke liye behtareen banati hai. Lekin traders ko dardnaak tareeqe se istemal karna chahiye, munasib risk management techniques istemal karna chahiye, aur pin bars ko aik mukhtalif trading strategy ke hisse ke taur par shaamil karna chahiye. Pin bars ko doosri tafseelat ke saath istemal karke, aur wasee market mohaul ko madde nazar rakhte hue, inke istemal ko mazeed efektiv bana sakte hain. Jaise ke har trading tool, pin bars tab tak kargar hain jab inhe aik mukhtalif trading approach ka hissa banaya jata hai.  Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#3 Collapse

Pin Bar, yaani "Pinocchio Bar," ek prasiddh candlestick pattern hai jo forex trading aur technical analysis mein istemal hota hai. Ye ek single candlestick pattern hai jo sambhav trend reversal aur market sentiment mein hone wale badlavon ke bare mein mahatvapurn jaankari pradan kar sakta hai. Yahan ek saral vyakhya di gayi hai Pin Bar candlestick pattern ki: Dikhaav: Pin Bar ek single candlestick se bana hota hai. Ismein ek chhota sa asal jism hota hai, jo bullish (hara ya safed) ya bearish (laal ya kaala) ho sakta hai. Pin Bar ki khaas pehchan ek lambi chhadi ya shadow hoti hai, jo jism se kaafi bahar nikalti hai. Aksar, iski ulte chhadi (tail ke opposite side ki shadow) ki kuch ya bilkul hi chhadi hoti hai. Tabeer: Pin Bar apne naam Pinocchio (ek kathit kalpanik vyakti jiske jhoot bolne par naak lambi hoti thi) se milta hai; usi tarah, Pin Bar ki lambi chhadi ek jhooti chaal ko darust karta hai. Ek bullish Pin Bar mein, lambi chhadi jism ke neeche hoti hai aur yeh dikhata hai ki trading session ke doran prices kaafi nicha gayi thi lekin khariddaar ne prices ko upar dhakela aur closing price opening price ke paas ya usse upar ki taraf ki hai. Ek bearish Pin Bar mein, lambi chhadi jism ke upar hoti hai aur yeh dikhata hai ki prices ne upar gayi thi lekin bechne wale ne prices ko neeche dhakela aur closing price opening price ke paas ya usse neeche ki taraf hai. Lambi chhadi ek disha mein price levels ko naakarmanit karne ki nishchit sanket hai. Market Sentiment: Ek bullish Pin Bar ek downtrend se uptrend ki sambhav reversal ko dikhata hai. Ek bearish Pin Bar ek uptrend se downtrend ki sambhav reversal ko dikhata hai. Isse market sentiment mein parivartan ki suchna milti hai aur yeh ek prabhavit reversal sanket ho sakta hai. Tasdeeq (Confirmation): Pin Bar ki suchna ko tasdeeq karne ke liye, traders aksar agli candlestick ya agle samay ki price action ka intezaar karte hain, jisse Pin Bar ke dwara di gayi reversal ko pramaanit kiya ja sake. Aur pramaan hasil karne ke liye, technical indicators ya support/resistance levels ko bhi madhya mein rakhte hain. Trading Strategy:

Ek bullish Pin Bar ek downtrend se uptrend ki sambhav reversal ko dikhata hai. Ek bearish Pin Bar ek uptrend se downtrend ki sambhav reversal ko dikhata hai. Isse market sentiment mein parivartan ki suchna milti hai aur yeh ek prabhavit reversal sanket ho sakta hai. Tasdeeq (Confirmation): Pin Bar ki suchna ko tasdeeq karne ke liye, traders aksar agli candlestick ya agle samay ki price action ka intezaar karte hain, jisse Pin Bar ke dwara di gayi reversal ko pramaanit kiya ja sake. Aur pramaan hasil karne ke liye, technical indicators ya support/resistance levels ko bhi madhya mein rakhte hain. Trading Strategy: Jab traders ek Pin Bar dekhte hain, to woh aksar usi disha mein positions lena ka vichar karte hain jise Pin Bar sanket karta hai. Pin Bar ke aadhar par sahi risk management techniques ka istemal karein, jaise stop-loss orders set karke, taki potential nuksan ko prabandhit kiya ja sake. Seemaayein (Limitations): Pin Bar sambhav reversal sanket ho sakte hain, lekin yeh purnasash ho nahi hote aur galat sanket bhi aa sakte hain. Hamesha inka istemal doosre technical analysis tools ke saath aur bade market context ko dhyan mein rakhte hue karein. Arthik samachar ghatnayein aur bahari factors market sentiment ko prabhavit kar sakte hain, isliye trading karte waqt relevant khabron ke bare mein suchit rahein. Sarvasar, Pin Bar candlestick pattern forex trading mein sambhav trend reversal aur market sentiment ke bare mein jaankari pradan karne ke liye ek mahatvapurn tool hai. Traders iska istemal samjhe bujhe trading nirnay lene ke liye karte hain, lekin yeh ek vistrit analysis strategy ka hissa hona chahiye jo forex market ko prabhavit karne wale doosre indicators aur factors ko shamil karta hai.

Jab traders ek Pin Bar dekhte hain, to woh aksar usi disha mein positions lena ka vichar karte hain jise Pin Bar sanket karta hai. Pin Bar ke aadhar par sahi risk management techniques ka istemal karein, jaise stop-loss orders set karke, taki potential nuksan ko prabandhit kiya ja sake. Seemaayein (Limitations): Pin Bar sambhav reversal sanket ho sakte hain, lekin yeh purnasash ho nahi hote aur galat sanket bhi aa sakte hain. Hamesha inka istemal doosre technical analysis tools ke saath aur bade market context ko dhyan mein rakhte hue karein. Arthik samachar ghatnayein aur bahari factors market sentiment ko prabhavit kar sakte hain, isliye trading karte waqt relevant khabron ke bare mein suchit rahein. Sarvasar, Pin Bar candlestick pattern forex trading mein sambhav trend reversal aur market sentiment ke bare mein jaankari pradan karne ke liye ek mahatvapurn tool hai. Traders iska istemal samjhe bujhe trading nirnay lene ke liye karte hain, lekin yeh ek vistrit analysis strategy ka hissa hona chahiye jo forex market ko prabhavit karne wale doosre indicators aur factors ko shamil karta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 02:19 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим