Technical or Fundamental analysis kya hain

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

-

سا0 like

-

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

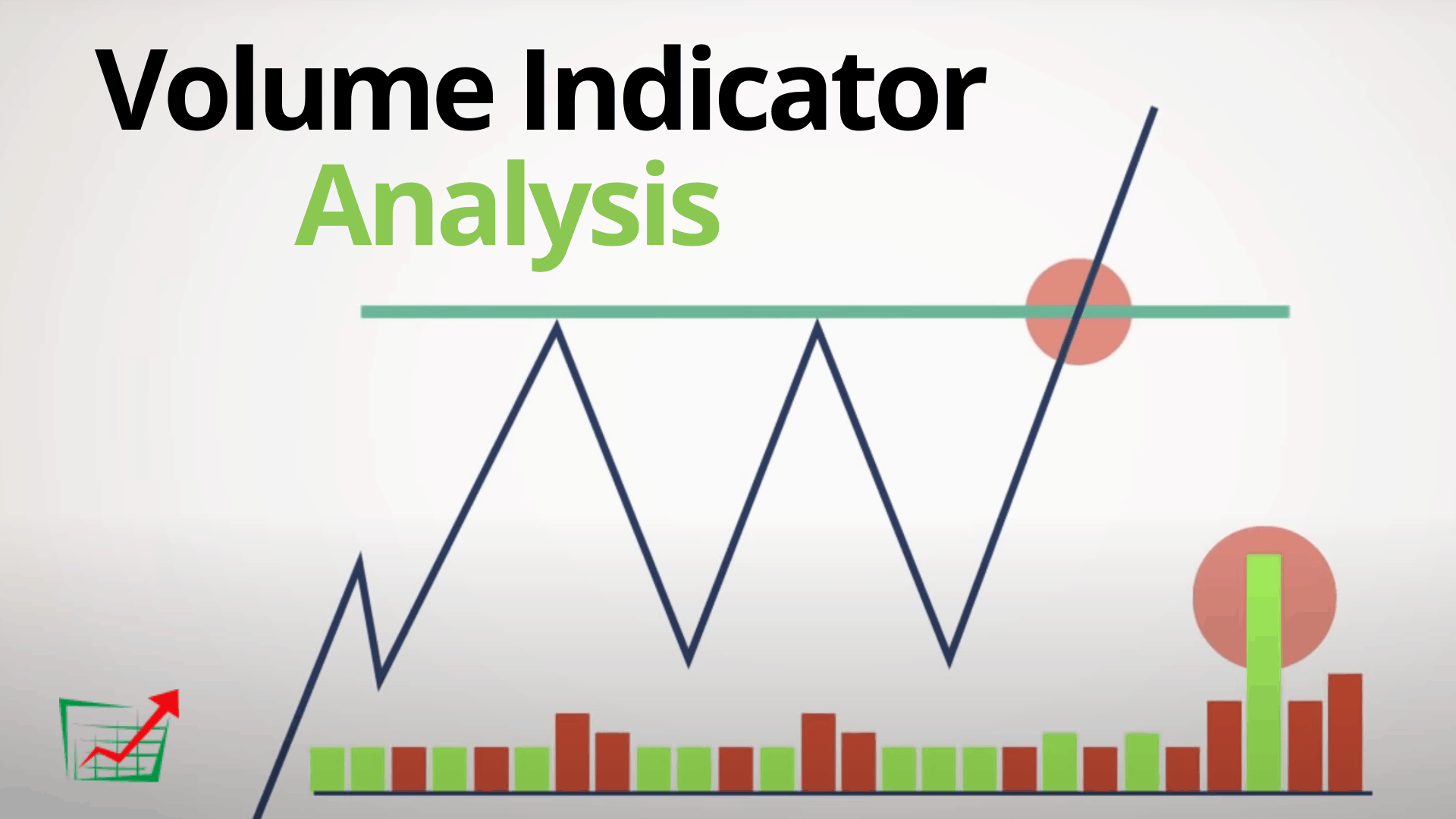

Technical Analysis aur Fundamental Analysis, dono financial markets mein trading aur investment ke do alag tariko hain jinse traders aur investors market ke performance aur securities ke future movements ko samajhne ki koshish karte hain. Niche main dono ke basic concepts ko explain kar raha hoon: 1. Technical Analysis: Technical analysis ek tarika hai jisme traders aur investors market data aur price charts ko study karte hain taki woh securities ke future price movements ko predict kar sakein. Isme kuch mukhya points hote hain: Price Charts: Technical analysts price charts aur historical price data ka istemal karte hain. Yeh charts candlesticks, bar charts, aur line charts ke roop mein ho sakte hain. Technical Indicators: Various technical indicators jaise ki moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), aur Bollinger Bands ka istemal price ke patterns aur trends ko identify karne ke liye kiya jata hai. Patterns: Technical analysts price patterns jaise ki Head and Shoulders, Double Top, aur Double Bottom ke pehchan karke future price movements ko anticipate karte hain. Volume Analysis:

Various technical indicators jaise ki moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), aur Bollinger Bands ka istemal price ke patterns aur trends ko identify karne ke liye kiya jata hai. Patterns: Technical analysts price patterns jaise ki Head and Shoulders, Double Top, aur Double Bottom ke pehchan karke future price movements ko anticipate karte hain. Volume Analysis:  Volume data bhi important hota hai taki pata chale ki market mein kitni trading activity ho rahi hai. Support aur Resistance:

Volume data bhi important hota hai taki pata chale ki market mein kitni trading activity ho rahi hai. Support aur Resistance:  Support aur resistance levels ko identify karne ka bhi mahatvapurna hissa hota hai. Yeh levels woh points hote hain jahaan price mein reversals hone ke chances hote hain. 2. Fundamental Analysis:

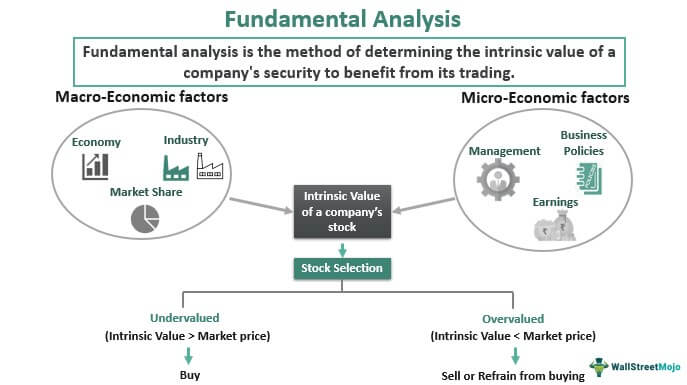

Support aur resistance levels ko identify karne ka bhi mahatvapurna hissa hota hai. Yeh levels woh points hote hain jahaan price mein reversals hone ke chances hote hain. 2. Fundamental Analysis:  Fundamental analysis mein traders aur investors ek company ya security ke financial statements aur economic factors ko evaluate karte hain taki woh uski intrinsic value ko determine kar sakein. Isme kuch mukhya points hote hain: Financial Statements: Fundamental analysts company ke financial statements jaise ki balance sheet, income statement, aur cash flow statement ko analyze karte hain. Inse company ke financial health aur performance ka pata chalta hai. Economic Factors: Economic indicators jaise ki GDP growth rate, interest rates, inflation rate, aur employment data ka bhi mahatvapurna roop se istemal hota hai. Yeh factors overall market aur industry conditions ko influence karte hain. Industry Analysis: Fundamental analysts industry trends aur competition ko bhi study karte hain taki pata chale ki ek company ya sector ke liye kis tarah ke growth prospects hain. Valuation: Intrinsic valuation models jaise ki discounted cash flow (DCF) ka istemal kiya jata hai taki pata chale ki security undervalued hai ya overvalued hai.In dono analysis methods ke apne advantages aur limitations hote hain. Technical analysis traders ko short-term price movements ke liye madadgar hota hai, jabki fundamental analysis long-term investment decisions ke liye jyada use hota hai. Kuch traders dono methods ko milake bhi use karte hain taki unka decision making process aur robust ho sake.

Fundamental analysis mein traders aur investors ek company ya security ke financial statements aur economic factors ko evaluate karte hain taki woh uski intrinsic value ko determine kar sakein. Isme kuch mukhya points hote hain: Financial Statements: Fundamental analysts company ke financial statements jaise ki balance sheet, income statement, aur cash flow statement ko analyze karte hain. Inse company ke financial health aur performance ka pata chalta hai. Economic Factors: Economic indicators jaise ki GDP growth rate, interest rates, inflation rate, aur employment data ka bhi mahatvapurna roop se istemal hota hai. Yeh factors overall market aur industry conditions ko influence karte hain. Industry Analysis: Fundamental analysts industry trends aur competition ko bhi study karte hain taki pata chale ki ek company ya sector ke liye kis tarah ke growth prospects hain. Valuation: Intrinsic valuation models jaise ki discounted cash flow (DCF) ka istemal kiya jata hai taki pata chale ki security undervalued hai ya overvalued hai.In dono analysis methods ke apne advantages aur limitations hote hain. Technical analysis traders ko short-term price movements ke liye madadgar hota hai, jabki fundamental analysis long-term investment decisions ke liye jyada use hota hai. Kuch traders dono methods ko milake bhi use karte hain taki unka decision making process aur robust ho sake.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:57 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим