Adaptive moving average indicator ki wazahat

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

ADAPTIVE MOVING AVERAGE INDICATOR Introduction: Adaptive Moving Average (AMA) aik technical analysis indicator hai jo trading mein istemal hota hai. Yeh indicator market volatility ko account karke moving average ko adjust karta hai, takay traders ko behtar trading signals mil saken. Iska maqsad trend ko samajhna aur trading decisions ke liye madadgar hone ka hai. Details: AMA ka Formula: AMA ka formula thoda complex hai, lekin main usay aapko asan alfaz mein samjhata hoon. Yeh indicator 2 parts par mabni hota hai: Current Efficiency Ratio (CER): CER calculate karne ke liye, aapko 10-day ka Exponential Moving Average (EMA) aur 10-day ka Smoothed Moving Average (SMA) nikalna hota hai. Phir aap CER ko is formula se nikalte hain: CER = EMA / SMA Current Adaptive Factor (CAF): CAF calculate karne ke liye, aapko peechle CER, abhi ka CER, aur ek "fast" aur "slow" factor (jese 2/30) ka istemal karte hue is formula ko use karte hain: CAF = (CER - CER_slow) / (CER_fast - CER_slow) Ab, hum Adaptive Moving Average (AMA) ko calculate karte hain: AMA = SMA * (1 + CAF) - 1 Is formula ke zariye, AMA calculate hota hai jo traders ko market ke current conditions ke hisab se ek dynamic moving average deta hai. Uses of AMA Indicator: AMA ka istemal traders market analysis aur trading decisions lene mein karte hain. Iske kuch key istemal darust hain: Trend Identification: AMA traders ko market ke trend ko identify karne mein madadgar hota hai. Agar AMA line price ke upar hai, to yeh bullish trend ko darust karta hai, aur agar price ke niche hai, to yeh bearish trend ko darust karta hai. Volatility Adjustment: AMA market ki volatility ko account karke apne calculations ko adjust karta hai. Isse traders ko false signals se bachaya jata hai, kyun ke AMA apne calculations mein market volatility ko shamil karta hai. Entry and Exit Signals: AMA traders ko entry aur exit points tay karne mein madadgar hota hai. Jab AMA line price ke upar hoti hai, to yeh entry point darust karti hai, jabke price ke niche hoti hai, to exit point darust karti hai. Stop Loss Placement: Traders AMA ka istemal stop loss orders teh karne mein bhi karte hain. Yeh unko madad deta hai takay wo apni positions ko nuksan se bacha saken. Conclusion: AMA aik powerful indicator hai, lekin yaad rahe ke har indicator ki tarah, iska bhi istemal carefully aur doosre factors ke sath karna chahiye. Market conditions aur trading strategy ke hisab se iska sahi tarah se istemal karna traders ke liye faida mand ho sakta hai. Iska formula complex hai, lekin trading platforms par aksar isay automatically calculate kar diya jata hai, jisse traders ko asani se istemal karne mein madad milti hai. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Adaptive Moving Average Indicator:

Tasawwur: Adaptive Moving Average (AMA) ek technical analysis indicator hai jo market trends aur price action ka anjaam laganay mein madad deta hai. Yeh ek dynamic indicator hai jo market volatility aur changing trends ko madde nazar rakhta hai. Is indicator ka maqsad traditional moving averages se behtar performance aur flexibility faraham karna hai.

Tehqiqat aur Tadbeer: Adaptive Moving Average (AMA) ko vyapak tehqiqat aur daryafti ka nateeja maana jata hai. Iska maqsad hai ke market ke tezi ya dheemi gati ko samajhna aur uss par moatabar taur par amal karna. Yeh maqsad hasil karne ke liye, yeh indicator moving average ko adjust karta hai taa ke wo recent market conditions ko zyada ahmiyat di jaye.

AMA Ka Tareeqa Kar: AMA ko calculate karne ke liye, pehle ek standard moving average (jese ke 10-period ya 20-period) calculate kiya jata hai. Phir, is moving average ko recent price action ke mutabiq adjust kiya jata hai. Agar market ki volatility zyada hai, toh AMA ki length bhi zyada hogi, aur agar market ki volatility kam hai, toh AMA ki length bhi kam hogi. Yeh tarz e kar ke zariye, yeh indicator market conditions ke mutabiq flexible ho jata hai.

Fawaid: AMA ka istemal karne ke kuch faiday shamil hain:- Flexibility: Is indicator ki flexibility se traders ko market ki tabdeeliyon ka behtar andazah hota hai.

- Real-Time Analysis: AMA recent market conditions ko zyada ahmiyat deta hai, jo ke real-time analysis mein madadgar hota hai.

- Reduced Lag: Traditional moving averages mein lag hota hai jabki AMA lag ko kam karta hai, jisse ke traders ko tezi se trends ka pata chalta hai.

- Adaptability: Market ki tabdeeliyon aur volatility ke mutabiq, AMA apni length ko adjust karta hai, jo ke adaptability ko darust rakhta hai.

Nuqsanat: Jese ke har indicator ke nuqsanat hote hain, AMA ke bhi kuch nuqsanat hain:- Complexity: AMA ka istemal karne ke liye achi understanding aur practice ki zarurat hoti hai.

- False Signals: Jese ke har indicator, AMA bhi kabhi kabhi ghalat signals de sakta hai, khas tor par choppy markets mein.

- Optimization: AMA ko optimize karna challenging ho sakta hai, kyun ke har market ke liye ek sahi length nahi hoti.

Sakht Zarurat aur Istemal: AMA ek versatile indicator hai jo trading strategies mein shamil kiya ja sakta hai. Iska istemal trend identification, entry aur exit points ka faisla karna aur risk management mein kiya ja sakta hai. Iske zarie, traders market ki dynamics ko behtar samajh sakte hain aur trading decisions ko optimize kar sakte hain.

Ikhtitami Guftagu: Adaptive Moving Average (AMA) ek maharat se bhara indicator hai jo traders ko market ki changing conditions aur volatility ka behtar andazah dene mein madad karta hai. Iska istemal sahi tarah se kiya jaye toh yeh ek powerful tool ban sakta hai trading strategies mein. Lekin, har indicator ki tarah, iska istemal bhi achi understanding aur practice ke baghair mushkil ho sakta hai. Isliye, agar kisi shakhs ne iska istemal karna hai, toh pehle isko samajhna aur demo trading mein istemal karna zaruri hai.

-

#4 Collapse

Adaptive Moving Average (AMA) indicator ki ahmiyat yeh hai ke yeh market volatility ko madde nazar rakhte hue moving average ko adjust karta hai. Iski khasiyat yeh hai ke yeh market ke changing conditions ko samajhne mein madad karta hai aur traders ko sahi samay par entry aur exit points pehchanne mein help karta hai.Yeh indicator traders ko niche diye gaye faide faraham karta hai:

Volatility ke Mutabiq Averages:

AMA indicator market ki halat ke mutabiq apni length ko adjust karta hai, jis se market ki volatility ke doran lag bhag auratam results milte hain.

Sahi Entry aur Exit Points:

Adaptive Moving Average traders ko sahi entry aur exit points pehchanne mein madad karta hai. Jab market volatile hoti hai, to yeh indicator short-term aur long-term trends ko dhang se dikhata hai.

Overbought aur Oversold Zones ki Pehchan:

AMA indicator overbought aur oversold zones ko identify karne mein madad karta hai, jo traders ko potential reversal points par alert karta hai.

Trend Changes ki Pehchan:

Is indicator ki madad se traders market ke trend changes ko jaldi samajh sakte hain, jo unhein profitable trading opportunities faraham karta hai.

Adaptability:

Is indicator ki flexibility hai ke market conditions ke hisaab se apni settings ko adjust kiya ja sakta hai, jo traders ko versatile aur customizable tool faraham karta hai.Overall, Adaptive Moving Average (AMA) indicator traders ke liye ek aham tool hai jo unhein market ki halat ko samajhne aur trading decisions lene mein madad karta hai.Adaptive Moving Average (AMA) ko adapt karnay wala harkat-hawalat averaging indicator hai jo market volatility ke hisaab se apni length ko tabdeel karta hai. Yeh aik technical analysis tool hai jo trading charts par istemal hota hai. Yeh trader ko market ki dynamics ka behtar andaza denay mein madad karta hai.Adaptive Moving Average" ko roman Urdu mein likha ja sakta hai:Haiziyati Harkat-Hawalat Averaging Ke Zareye Munazam Kardah"

-

#5 Collapse

Adaptive Moving Average Indicator: Ek Aham Technical Analysis Tool

Technical analysis, jise stock market mein istemal kiya jata hai, ek aham hissa hai investors aur traders ke liye. Ek popular technical indicator jo market trends aur price movements ka analysis karta hai, woh hai Adaptive Moving Average (AMA).

AMA, ek tarah ka moving average hai jo market volatility ke hisaab se apna length adjust karta hai. Iski flexibility se, yeh indicator market ke mukhtalif phases mein bhi kaam aata hai aur traders ko accurate signals provide karta hai.

AMA ke basic formula mein, weightage price volatility ko adjust karne ke liye istemal hota hai. Yeh indicator market ki current volatility ko measure karta hai aur moving average ke calculation ko uske hisaab se update karta hai.

Ek mukhtasir taur par, AMA ki calculation ke dauran zyada volatility wale dino mein moving average ka length bada hota hai, jabke kam volatility wale dino mein length chhoti hoti hai. Is tarah, yeh indicator market ki current conditions ko reflect karta hai.

Traders AMA ko trading strategies mein istemal kar sakte hain, jaise ke trend identification aur entry/exit points ka tajziya karna. Is indicator ko lagane se pehle, traders ko iski parameters ko customize karna hota hai, jese ke volatility ke liye look-back period.

AMA ke istemal se, traders ko market ki samajh mein madad milti hai aur unhein better trading decisions lene mein madad milti hai. Lekin, jaise har technical indicator ki tarah, yeh bhi kisi single indicator ke sath istemal kiya jana chahiye aur dusre confirmatory signals ke sath milakar analysis kiya jana chahiye.

AMA, ek powerful aur adaptive technical analysis tool hai jo market trends aur price movements ko analyze karne mein madad karta hai. Iska istemal karke, traders apne trading strategies ko improve kar sakte hain aur market ka better understanding hasil kar sakte hain.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Adaptive Moving Average (AMA) Indicator: Market Analysis ka Naya Raaz

Investment karne ke liye market ki analysis ka ek aham hissa hota hai. Ismein technical indicators ka istemal investors ke liye asani aur behtar faislon ka zariya ban sakta hai. Ek aham technical indicator jo aaj kal bohot zyada popular ho raha hai wo hai "Adaptive Moving Average" (AMA).

AMA ek tarah ka moving average hai jo market ki volatility ke hisaab se apni flexibility ko adjust karta hai. Iska matlab hai ke yeh indicator market ke mizaaj ko samajh kar apne calculations ko customize karta hai, jisse accurate signals milte hain.

Is indicator ki sabse badi khasiyat yeh hai ke wo market ke halaat ko samajhta hai aur uss par tawajju deta hai. Yeh indicator short-term aur long-term trends ko identify karne mein madadgar sabit hota hai.

AMA ka istemal kaise kiya jata hai? Pehle toh, ek starting period ya timeframe choose kiya jata hai. Phir iske baad, indicator apne calculations ko market ki halat ke mutabiq adjust karta hai. Agar market volatile hai, toh AMA jaldi se apne calculations ko update karta hai. Aur agar market stable hai, toh yeh apni calculations ko slow kar deta hai.

Is indicator ka istemal karne se pehle, zaroori hai ke investors iska sahi taur par samajh lein. Iske liye practice aur market ke mizaaj ko samajhna zaroori hai. Halanki, jab sahi tarah se istemal kiya jata hai, toh yeh ek powerful tool ban sakta hai investors ke liye.

AMA ek naya raasta dikha sakta hai market analysis mein. Iska istemal karke investors apne faislon ko behtar banane mein kamiyab ho sakte hain. Magar, har naye indicator ki tarah, iska istemal karne se pehle thorough research aur understanding ki zaroorat hoti hai.

Is tarah se, Adaptive Moving Average (AMA) indicator market ke complexities ko samajhne aur behtar faislon ke liye ek naya zariya ho sakta hai. Lekin, hamesha yaad rahe ke har indicator ki tarah, iska bhi sahi taur par istemal aur samajh zaroori hai. -

#7 Collapse

Adaptive Moving Average Indicator: Tafseel, Fawaid, Aur Nuqsanat

Intro: Adaptive Moving Average (AMA) ek mukhtalif qisam ka technical indicator hai jo maaliyat mein istemal hota hai. Ye indicator maaloom hota hai takay samay ke sath sath market volatility ko bhi ghor kiya ja sake. Is article mein, hum Adaptive Moving Average Indicator ki tafseel, fawaid aur nuqsanat par ghaur karenge.

Adaptive Moving Average (AMA) Ki Wazahat: AMA ek moving average hai jo market ki current volatility ke mutabiq adjust hota hai. Traditional moving averages aksar static hotay hain, yaani ke woh market ki volatility ke sath sath tabdeel nahi hote. Lekin AMA ki khaasiyat ye hai ke woh market ki halat ko daikh kar apni length ko khud ba khud adjust karta hai. Ye is liye ahem hai ke markets mein volatility tabdeel hoti rehti hai aur static moving averages ko ye samajhna mushkil ho jata hai.

AMA ke tajziyat ke liye, ek parameter hota hai jo aksar volatility index ya volatility measure ke tor par istemal hota hai. Ye parameter market ki halaat ko samajhne mein madad karta hai. Agar market ki volatility barh rahi hai, toh AMA apni length ko barha dega taake recent price movements ko sahi se capture kar sake. Aur agar market ki volatility kam ho rahi hai, toh AMA apni length ko chota kar dega.

AMA ka formula traditional moving average ke formula se mukhtalif hota hai, kyunki is mein ek dynamic factor bhi shamil hota hai jo volatility ko adjust karta hai. Is tarah, AMA market ki halat ke hisaab se apni flexibility ko barqarar rakhta hai.

Fawaid:- Adaptability: AMA ka sab se bara faida hai ke ye market ki halaat ke mutabiq apni length ko adjust karta hai. Is se ye indicator market ke latest trends ko capture karne mein behtareen hota hai.

- Volatility Ka Ilm: AMA volatility ko samajhne mein madad karta hai, jo ke market analysis mein ahem hota hai. Is ke zariye traders market ki tezi ya mandgi ko samajh sakte hain aur apne trading strategies ko us ke mutabiq adjust kar sakte hain.

- Signal Reliability: Adaptive Moving Average ka istemal kar ke traders ko signals milte hain jo traditional moving averages ke mukable zyada reliable hote hain, kyun ke ye current market conditions ko account karte hain.

- Versatility: AMA ke istemal se traders ko ek versatile tool milta hai jo alag alag markets aur timeframes ke liye kaam karta hai. Is ka istemal stocks, forex, aur commodities markets mein bhi kiya ja sakta hai.

Nuqsanat:- Lagging Nature: Jaise ke har moving average ka nuqsan hota hai, Adaptive Moving Average bhi thoda sa late reaction deta hai kyunki ye past price data par based hota hai. Is liye kuch traders ko ye lagging nature nuqsaan de sakta hai.

- Complexity: AMA ka formula traditional moving averages se zyada complex hota hai, jo ke kuch traders ke liye samajhne mein mushkil ho sakta hai. Is ki samajh ke liye traders ko market ki volatility ko samajhne ki zaroorat hoti hai, jo ke beginners ke liye challenging ho sakti hai.

- False Signals: Jaise ke har technical indicator ki tarah, AMA bhi kabhi kabhi false signals generate kar sakta hai, khaaskar jab market mein sudden volatility hoti hai ya phir choppy trading conditions hoti hain.

- Parameter Selection: AMA ke parameter ko set karna bhi kuch mushkil ho sakta hai, kyun ke ye market ki volatility par depend karta hai aur ye volatility change hoti rehti hai. Is liye sahi parameter select karna mushkil ho sakta hai.

Adaptive Moving Average Ka Istemal: Adaptive Moving Average ka istemal mukhtalif maaliyat ke shobon mein hota hai, khaaskar trading aur technical analysis mein. Ye indicator trend direction ko samajhne mein madad karta hai aur traders ko entry aur exit points ke liye signals provide karta hai.

Jaise ke pehle zikar kiya gaya, AMA ek versatile tool hai jo alag alag markets aur timeframes ke liye kaam karta hai. Stock market, forex market, aur commodities market mein is ka istemal hota hai. Is ke saath saath, is ka istemal long term investment strategies aur short term trading strategies mein bhi hota hai.

Conclusion:

Adaptive Moving Average (AMA) ek aham technical indicator hai jo market ki current volatility ke mutabiq apni length ko adjust karta hai. Is ka istemal trend direction ko samajhne aur trading signals generate karne ke liye hota hai. Lekin, is ke nuqsanat bhi hain jaise ke lagging nature aur false signals ka khatra. AMA ka istemal karne se pehle traders ko is ke faide aur nuqsanat ko samajhna zaroori hai, aur sahi parameter select karna bhi ahem hai. Overall, AMA ek powerful tool hai jo market analysis mein istemal kiya ja sakta hai agar sahi tareeqay se istemal kiya jaye.

-

#8 Collapse

Adaptive moving average indicator ki wazahat

Adaptive Moving Average (AMA) Indicator Ki Wazahat

Introduction: Adaptive Moving Average (AMA) ek technical indicator hai jo market ke trends ko analyze karne mein madadgar hota hai. Yeh indicator moving average ki tarah kaam karta hai, lekin iska ek khas feature hai ki yeh market ke volatility ko bhi consider karta hai, jisse yeh market ke current conditions ko better reflect karta hai.

AMA Kaise Kaam Karta Hai: AMA ka basic concept yeh hai ke iska length ya weight market ke volatility par depend karta hai. Agar market zyada volatile hai, toh AMA ka length bhi zyada ho jata hai takay wo current market conditions ko accurately reflect kar sake. Is tarah, yeh indicator market ke changes ko jaldi capture karta hai.

AMA Calculation: AMA ka calculation traditional moving averages ki tarah nahi hota. Iska calculation dynamic hota hai aur current market conditions ko consider karta hai. Yeh kuch steps mein calculate kiya jata hai:- Initial Calculation: Sabse pehle, AMA ko simple moving average (SMA) ke roop mein calculate kiya jata hai. Isse initial AMA milta hai.

���initial=Sum of N-period prices�AMAinitial=NSum of N-period prices - Volatility Index Calculation: Phir, volatility index calculate kiya jata hai. Iske liye, aap 10-period ka Standard Deviation (SD) calculate kar sakte hain.

Volatility Index=Sum of Square of Deviations from SMA�Volatility Index=NSum of Square of Deviations from SMA - Smoothing Constant Calculation: Smoothing constant (SC) calculate karne ke liye, aap 2-period ka EMA formula istemal kar sakte hain.

��=2�+1SC=N+12 - Final AMA Calculation: Ab, final AMA calculate karne ke liye, pehle ka AMA aur current price ke beech ka difference lete hain, aur phir isko SC ke saath multiply karke add karte hain.

���final=���previous+��×(Price−���previous)AMAfina l=AMAprevious+SC×(Price−AMAprevious)

AMA Ka Istemal: AMA ka istemal market ke trends ko identify karne aur trading signals generate karne ke liye kiya jata hai. Jab market volatile hota hai, toh AMA ka length zyada ho jata hai, jisse current trends ko accurately capture kiya ja sakta hai. Isse traders ko market ke movements ka better understanding hota hai aur wo trading decisions lene mein asani hoti hai.

AMA Aur Dusre Indicators Ke Saath Istemal: AMA akele istemal kiya ja sakta hai ya phir dusre indicators ke saath bhi istemal kiya ja sakta hai, jaise RSI, MACD, aur Bollinger Bands. In indicators ka saath dete hue, traders ko aur bhi strong trading signals mil sakte hain.

Conclusion: Adaptive Moving Average (AMA) ek powerful technical indicator hai jo market ke trends ko analyze karne mein madadgar hota hai. Iska unique feature hai ki yeh market ke volatility ko consider karta hai, jisse current market conditions ko better reflect karta hai. AMA ka istemal karke traders market ke movements ko better understand kar sakte hain aur trading decisions lene mein asani hoti hai.

- Initial Calculation: Sabse pehle, AMA ko simple moving average (SMA) ke roop mein calculate kiya jata hai. Isse initial AMA milta hai.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Adaptive Moving Average (AMA) ek technical analysis indicator hai jo market ke trend ko samajhne aur trading decisions banane ke liye istemal kiya jata hai. Yeh ek tarah ka moving average hai jo dusre moving averages se alag hota hai, kyun ke yeh apni sensitivity ko market ke volatility ke mutabiq adjust karta hai. Iski wazahat niche di gayi hai:

- Volatility ke Mutabiq Sensitivity: Adaptive Moving Average, market ki volatility ko madde nazar rakhte hue apni sensitivity ko adjust karta hai. Jaise ke market ki volatility barhti hai, indicator ki sensitivity bhi barh jati hai taake current market conditions ko behtar se samjha ja sake.

- Smoothed Average: AMA ek smoothed average hai jo current price ke sath purane prices ko bhi shamil karta hai. Is tarah se, yeh current trend ko darust se darust represent karta hai aur noise ko kam karta hai.

- Trend Identification: Adaptive Moving Average, trend ka pata lagane mein madad karta hai. Agar indicator ki line price ke upar hai, toh yeh uptrend ko darust kar sakta hai. Agar line price ke neeche hai, toh yeh downtrend ko indicate kar sakta hai.

- Entry aur Exit Points: Is indicator ko istemal karke traders entry aur exit points determine kar sakte hain. Jab AMA ki line price ke upar hai aur price ne ek uptrend shuru kiya hai, toh traders long positions enter kar sakte hain. Jab AMA ki line price ke neeche hai aur price ne downtrend shuru kiya hai, toh traders short positions enter kar sakte hain.

- Trend Changes ki Pehchan: Adaptive Moving Average, trend ke changes ko pehchane mein madad karta hai. Jab indicator ki line trend ke sath chal rahi hoti hai aur phir ek sudden change hota hai, toh yeh trend ke changes ko pehchanne mein madad karta hai.

AMA, market analysis mein ek important tool hai jo traders ko market ke trends ko samajhne aur trading strategies banane mein madad karta hai. Iska istemal karne se pehle, traders ko indicator ki wazahat ko samajhna zaroori hai aur iske saath practice karna chahiye.

-

#10 Collapse

Adaptive Moving Average Indicator

Forex trading mein amooman log mukhtalif technical indicators ka istemal karte hain taake unko trading ke faislay mein madad mil sake.

Introductions to Technical Indicators

Forex trading mein technical indicators aik ahem hissa hain jo traders ko market trends aur price movements ke baray mein maloomat faraham karte hain.

Adaptive Moving Average

Adaptive Moving Average (AMA) ek advanced technical indicator hai jo traders ko market volatility ke hisab se moving averages ko adjust karne ki ijazat deta hai.

Adaptive Moving Average Ka Tareeqa Kaam

AMA indicator market volatility ko analyze karta hai aur moving average ko us ke mutabiq adjust karta hai, jo ke traditional moving averages se mukhtalif hota hai.

Adaptive Moving Average Ka Istemal

AMA indicator ko trend identification aur entry/exit points ke liye istemal kiya jata hai. Ye traders ko market ke mukhtalif phases mein sahi trading signals faraham karta hai.

Adaptive Moving Average Ki Muddat

AMA indicator ki muddat market ki volatility ke hisab se badalti hai, jo ke traditional moving averages ki muddat se mukhtalif hoti hai.

Adaptive Moving Average Aur Dusre Technical Indicators

AMA indicator ko aksar dusre technical indicators ke sath istemal kiya jata hai taake traders ko confirmatory signals mil sakein.

Adaptive Moving Average Ke Faidey

AMA indicator market ki taqatwar aur kamzor phases ko pehchanne mein madadgar hota hai aur traders ko accurate trading signals faraham karta hai.

Adaptive Moving Average Ki Mehdoodiyat

AMA indicator bhi kuch limitations ka shikaar hai jaise ke lag aur false signals, jo ke traders ke liye mushkilat ka bais ban sakte hain.

Adaptive Moving Average Ka Istemal Ke Misaal

AMA indicator ke istemal ka ek misaal ye hai ke jab market volatile hoti hai, to AMA apne muddat ko chota karta hai aur jab market stable hoti hai, to muddat ko barha deta hai.

Adaptive Moving Average Ka Muqabla Dusre Indicators Ke Sath

AMA indicator ko traditional moving averages aur dusre technical indicators se muqabla kar ke dekha ja sakta hai taake us ke faidey aur nuqsanat ka behtar andaza ho sake. -

#11 Collapse

Adaptive Moving Average Indicator

Adaptive Moving Average Indicator (AMA) kya hai?

Adaptive Moving Average (AMA) ek aisa technical indicator hai jo price movements aur volatility ke mutabiq adjust hota hai. Iska design yeh hai ke market ki changing conditions ko reflect kar sake aur trading decisions ko madad de sake. AMA ko John Ehlers ne develop kiya tha, aur yeh ek flexible moving average hai jo market ki behavior ke mutabiq apni sensitivity ko adjust karta hai.

AMA ki Basic Concepts

Moving Average (MA) kya hota hai?

Moving Average ek statistical calculation hai jo ek specific period ke dauran price data ki average value ko represent karta hai. Simple Moving Average (SMA) aur Exponential Moving Average (EMA) dono hi moving averages hain lekin unki calculation methods alag hoti hain.

AMA ka Farq kya hai?

AMA, traditional moving averages se mukhtalif hota hai kyunke yeh market ki volatility aur trend strength ko consider karta hai. Jab market volatile hota hai, AMA apni smoothing factor ko adjust karta hai, aur jab market stable hota hai, yeh zyada smooth results provide karta hai.

AMA ki Calculation

AMA ki calculation thodi complex hai aur yeh do primary components ko involve karti hai:

Efficiency Ratio (ER): Efficiency Ratio ek measure hai jo trend ki strength aur direction ko reflect karta hai. Yeh ratio, actual price movement aur ideal straight-line movement ke beech difference ko measure karta hai. Formula kuch is tarah hota hai:

𝐸

𝑅

=

Absolute Price Change

Sum of Absolute Price Changes

ER=

Sum of Absolute Price Changes

Absolute Price Change

Smoothing Constant (SC): Smoothing Constant ko Efficiency Ratio ke zariye calculate kiya jata hai aur yeh AMA ki responsiveness ko control karta hai. Formula kuch is tarah hota hai:

𝑆

𝐶

=

(

𝐸

𝑅

×

(

2

/

(

𝑁

+

1

)

)

)

+

(

(

1

−

𝐸

𝑅

)

×

(

2

/

(

𝑁

+

1

)

)

)

SC=(ER×(2/(N+1)))+((1−ER)×(2/(N+1)))

Yahan, N moving average period hai.

AMA ka Use kaise karte hain?

Trend Identification: AMA market trends ko identify karne mein madad karta hai. Jab AMA price ke upar hota hai, tab market bullish trend mein hota hai aur jab neeche hota hai to bearish trend hota hai.

Entry and Exit Points: AMA trading signals provide karta hai. Jab price AMA ko cross karti hai to yeh buy ya sell signal generate kar sakta hai.

Volatility Adjustment: AMA market volatility ke mutabiq adjust hota hai, isliye yeh market ki changing conditions ko behtar reflect karta hai.

AMA ka Advantages

Adaptive Nature: AMA market ki changing conditions ko consider karta hai aur accordingly adjust hota hai, jo isay market conditions ke mutabiq zyada accurate banata hai.

Trend Detection: AMA trends ko accurately detect kar sakta hai aur trading decisions ko improve kar sakta hai.

Volatility Adjustment: AMA market ki volatility ko consider karta hai aur isay adjust karta hai, jo trading strategy ko zyada effective banata hai.

AMA ke Disadvantages

Complexity: AMA ki calculation traditional moving averages ke muqablay complex hoti hai, aur isay use karna shayad beginners ke liye mushkil ho sakta hai.

Lagging Indicator: Jaise har moving average, AMA bhi lagging indicator hai jo trends ko market movement ke baad reflect karta hai. Iska matlab hai ke trading signals thodi deri se milte hain.

False Signals: Kabhi kabhi, AMA false signals bhi generate kar sakta hai, especially jab market sideways movement mein hota hai.

AMA ki Implementation

AMA ko apne trading system mein include karne ke liye, aapko pehle iski parameters set karni hongi. Aap trading platforms, jaise MetaTrader ya TradingView, pe AMA indicator ko add kar sakte hain. Parameters set karte waqt, aapko period aur sensitivity ko adjust karna hoga jo aapke trading style aur market conditions ke mutabiq honi chahiye.

AMA ki Practical Examples

Bullish Market Example: Jab market bullish trend mein hota hai aur AMA price ke neeche hota hai, to yeh ek buy signal generate karta hai. Aap AMA ke upar price ke cross hone par buy position open kar sakte hain.

Bearish Market Example: Jab market bearish trend mein hota hai aur AMA price ke upar hota hai, to yeh ek sell signal generate karta hai. Aap AMA ke neeche price ke cross hone par sell position open kar sakte hain.

Conclusion

AMA ek advanced moving average indicator hai jo market ki changing conditions ko consider karta hai aur accordingly adjust hota hai. Iska adaptive nature aur volatility adjustment features trading decisions ko improve karne mein madad karte hain. Lekin, iska complexity aur lagging nature trading signals ko impact kar sakte hain. Effective use ke liye, traders ko AMA ko achi tarah samajhna aur practice karna zaroori hai.

Umeed hai yeh wazahat aapko AMA ke concepts aur use ko samajhne mein madad degi. Agar aapko aur details chahiye ya kisi aur topic par help chahiye, to bataiye.

- CL

- Mentions 0

-

سا0 like

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Adaptive Moving Average Indicator Ki Wazahat

Forex aur stock trading mein, technical indicators ka role market trends ko analyze karna aur trading decisions ko guide karna hota hai. In indicators mein se ek important tool hai "Adaptive Moving Average" (AMA). Yeh indicator moving average techniques ko evolve karte hue market conditions ke mutabiq adjust hota hai. Aaj hum Adaptive Moving Average indicator ki wazahat aur iska trading mein istemal samjhenge.

Adaptive Moving Average (AMA) Kya Hai?

Definition: Adaptive Moving Average (AMA) ek advanced moving average indicator hai jo market conditions ke mutabiq apne calculation method ko adjust karta hai. Yeh indicator price fluctuations aur market volatility ko dhyan mein rakhte hue apna smoothing factor adapt karta hai, jisse ki trend detection aur signal generation zyada accurate ho sakti hai.

Formation: AMA ko create karte waqt, traditional moving averages ki tarah ek fixed period ko consider nahi kiya jata. Iski calculation mein volatility aur price changes ko incorporate kiya jata hai, jisse indicator market ki rapid changes ko quickly reflect kar sake.

AMA Kaise Kaam Karta Hai?

Volatility Adjustment: AMA market ki volatility ke mutabiq adjust hota hai. Jab market zyada volatile hota hai, AMA apne smoothing factor ko kam kar deta hai, jisse price movements ke sath zyada closely follow karta hai. Jab market stable hota hai, AMA smoothing factor ko barhata hai, jisse trend ko clearly identify kiya ja sakta hai.

Calculation Method: AMA ki calculation mein ek smoothing constant use kiya jata hai jo market ki volatility aur price changes ke mutabiq change hota hai. Yeh constant indicator ko market conditions ke mutabiq dynamically adjust karta hai.

AMA Ki Ahmiyat Aur Trading Mein Istemaal

Trend Identification: AMA trends ko identify karne mein madad karta hai. Jab AMA price ke upar hota hai, to yeh bullish trend ka signal hota hai, aur jab AMA price ke niche hota hai, to bearish trend ka signal hota hai. Yeh indicator trend reversals aur market direction ko accurately capture kar sakta hai.

Signal Generation: Trading signals generate karte waqt, AMA ki crossovers ko monitor karna zaroori hota hai. Jab short-term AMA long-term AMA ko cross karti hai, to yeh buy or sell signal ban sakta hai.

Risk Management: AMA risk management mein bhi madadgar hota hai. Indicator ki dynamic adjustment ki wajah se, traders ko market volatility aur price movements ke sath timely decisions lene mein madad milti hai.

Conclusion

Adaptive Moving Average (AMA) ek powerful tool hai jo market conditions ke mutabiq apne smoothing factor ko adjust karta hai, jisse trend detection aur signal generation zyada accurate hoti hai. Forex aur stock trading mein, AMA ki understanding aur implementation se traders ko better trading decisions lene mein madad milti hai. Yeh indicator market volatility aur price fluctuations ko effectively manage karta hai, jisse risk management aur trend analysis improve hoti hai.

- CL

- Mentions 0

-

سا0 like

-

#13 Collapse

**Adaptive Moving Average Indicator Ki Wazahat**

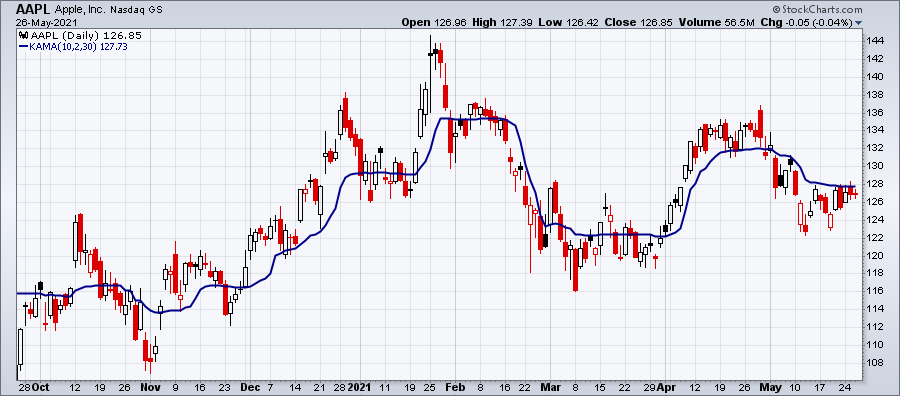

Adaptive Moving Average (AMA) indicator ek shandar tool hai jo traders ko market ke price trends samajhne mein madad deta hai. Yeh indicator standard moving average indicators ka ek advanced version hai, aur isay sab se pehli dafa Perry Kaufman ne introduce kiya tha. Iska maqsad market ke changing conditions ke sath adjust karna aur zyada accurate signals provide karna hai.

### Adaptive Moving Average Ka Taruf

Adaptive Moving Average ko hum "Kaufman's Adaptive Moving Average" (KAMA) bhi kehte hain. Yeh indicator market ki volatility ko samajhne aur price trends ka analysis karne ke liye design kiya gaya hai. Standard moving averages static hote hain, lekin AMA market ki halat ke mutabiq apni calculation ko adjust karta hai.

### Adaptive Moving Average Ka Function

AMA indicator ka function is tarah se hota hai ke yeh market ki volatility ko measure karta hai aur us ke mutabiq apni sensitivity ko adjust karta hai. Jab market mein kam volatility hoti hai, toh AMA smooth aur slow move karta hai, aur jab market mein zyada volatility hoti hai, toh yeh fast react karta hai.

Yeh indicator apni calculation ke liye Efficiency Ratio (ER) ka use karta hai. Efficiency Ratio, price change ki direction aur speed ko measure karta hai. Jab price movement clear aur directional hoti hai, toh ER ka value zyada hota hai, aur AMA fast move karta hai. Jab price movement random hoti hai, toh ER ka value kam hota hai, aur AMA slow move karta hai.

### Adaptive Moving Average Indicator Ka Istemaal

1. **Trend Identification:** AMA indicator ko use karke traders market ke trends ko identify kar sakte hain. Jab AMA ka slope upar ki taraf hota hai, toh yeh bullish trend indicate karta hai, aur jab neeche ki taraf hota hai, toh yeh bearish trend ko indicate karta hai.

2. **Entry Aur Exit Points:** Traders AMA indicator ko entry aur exit points identify karne ke liye bhi use karte hain. Jab price AMA ko cross karke upar jaaye, toh yeh buy signal ho sakta hai, aur jab neeche aaye, toh yeh sell signal ho sakta hai.

3. **Volatility Measure:** AMA indicator volatility ko measure karne mein bhi madadgar hai. Jab market zyada volatile ho, toh AMA zyada rapidly change hota hai, jo traders ko warning deta hai ke market unstable hai.

### Adaptive Moving Average Ki Khasiyat

- **Flexibility:** AMA indicator flexible hai aur market ki changing conditions ke sath adjust hota hai.

- **Accuracy:** Yeh zyada accurate signals provide karta hai compared to standard moving averages.

- **Usability:** Isay different trading strategies mein asani se integrate kiya ja sakta hai.

### Conclusion

Adaptive Moving Average indicator ek powerful tool hai jo traders ko market ke trends aur volatility ko samajhne mein madad deta hai. Yeh indicator dynamic nature rakhta hai, aur market conditions ke mutabiq apni calculation ko adjust karta hai, jo ise zyada efficient aur reliable banata hai. Har trader ko isay apni trading strategy mein shamil karna chahiye taake wo zyada behtar trading decisions le sakein. -

#14 Collapse

Moving Average(MA) indicator

What is Moving Average(MA) indicator:

Moving Average Indicator ka kaam market ke past data ko analyze karke current price ke sath compare karna hy. Isme ik fixed time period hoti hy, jise hum 'moving' kehte hein. Har naye din ya time period ke saath, oldest data remove hota hy or naya data add hota hy, is tarah se ik smooth line banti hy.Yadi hum isko simple language main samjhein toh, MA ik average price hy jo market ke specified time period ke hisab se nikala jata hy. Isse market ke short-term ya long-term trends ka pata lagaya ja sakta hy. Moving Average Indicator ik statistical tool hy jo tijarti charts par maali mawad ki harkat ko dikhane main madad karta hy. Is ka maqsad past ki prices ki average ko calculate kar ke current price ke sath mawafiqat karna hy. Is tajaweez main, har ik din, haftay, ya mahine ki closing prices ko shamil kar ke unka average nikala jata hy. Moving Average Indicator ko istemal karne ka tareeqa asaan hota hy. Jab bhi current price moving average line ko cross karta hy, ye ik signal paida karta hy. Agar current price moving average line se ooper ja rahi hy, to ye ik "buy" signal hy, or agar neeche ja rahi hy, to ye ik "sell" signal hy.Is indicator ka istemal market ke trends ko samajhne main madadgar hota hy, likin yaad rahe ke har ik tajaweez ki tarah, ye bhi kisi bhi tijarti faislay ke liye 100% guarantee nahi deta. Is liye, traders or investors ko chahiye ke dosri tajaweezat or analysis bhi mukhtalif sources se lein.

Exponential Moving Average (EMA): Isme recent prices ko zyada weightage diya jata hy, isse current market conditions ka zyada dhyan rahta hy.

Benefits of Moving Average Indicator:- Trend Identification: Moving Average Indicator ke istemal se investors ko market ke trends ka pata lagta hy, jisse woh future ke price movements ka faisla kar sakte hein.

- Support and Resistance Levels: MA, support or resistance levels ko identify karne main bhi madad karta hy, jo ki investors ke liye important hota hy.

- Entry and Exit Points: Is indicator se investors ko sahi samay par entry or exit points ka faisla karne main asani hoti hy.

- Volatility Ka Pata: Market ki volatility ko samajhne main bhi MA ka istemal hota hy.

Conclusion: Moving Average Indicator ik aham tool hy jo investors ko market ke fluctuations ko samajhne main madad karta hy. Iska istemal sahi tarah se kiya jaye toh ye ik valuable resource ban sakta hy, likin hamesha yaad rahe ke kisi bhi tool ki tarah, ye bhi keval ik guide hy or puri tarah se depend mat karna chahiye. Investors ko hamesha apne research or analysis par bhi bharosa karna chahiye.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

### Adaptive Moving Average Indicator Ki Wazahat

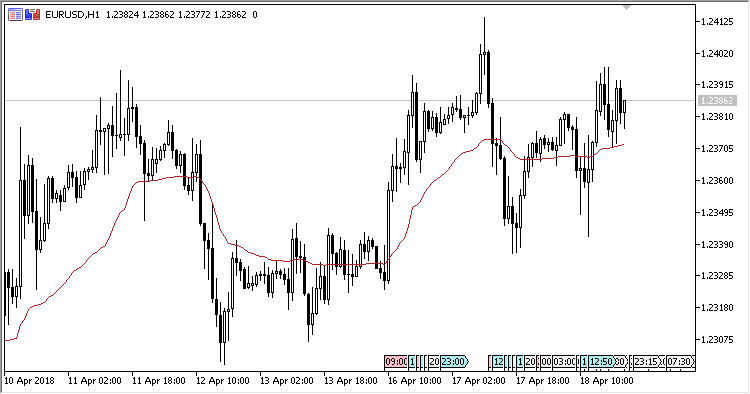

Trading aur investing ki duniya mein indicators ka istemal karke market trends aur price movements ka analysis karna bahut zaroori hai. Adaptive Moving Average (AMA) bhi aik aise indicator hai jo trend aur volatility ko account mein le kar price movements ki prediction ko behtar banata hai. Is post mein, hum AMA ki definition aur uske functions par detail se baat karenge.

Adaptive Moving Average indicator, jo ke jise AMA bhi kaha jata hai, ek tarah ka moving average hai jo price data aur market conditions ke mutabiq apne calculations ko adjust karta hai. Yeh indicator Richard J. Dennis aur William Eckhardt ki trading strategies se inspire ho kar develop kiya gaya tha, jisme inhone market ki changing volatility ko track karne ke liye ek flexible moving average ki zaroorat mehsoos ki.

AMA ka basic principle yeh hai ke yeh indicator market ki volatility aur trends ke mutabiq apne smoothing period ko adjust karta hai. Iska matlab yeh hai ke agar market mein high volatility hai, to AMA apne smoothing period ko chhota kar deta hai, jis se ke price movements zyada sensitive aur timely capture kiye ja sakte hain. Agar market stable hai aur low volatility hai, to AMA apne smoothing period ko barha deta hai, jis se long-term trends ko behtar track kiya ja sakta hai.

Iske basic components mein ek smoothing constant aur ek adaptive factor shamil hain. Smoothing constant price movements ko smooth karta hai aur adaptive factor market ki current conditions ko reflect karta hai. Yeh combination AMA ko dynamic aur responsive banata hai, jo ke traditional moving averages se behtar performance dikhata hai.

AMA ka use trading decisions ko behtar banane ke liye kiya jata hai. Traders is indicator ka use entry aur exit points identify karne ke liye karte hain, jahan yeh market trends ke mutabiq signal provide karta hai. Yeh indicator market ki changing dynamics ko quickly capture karta hai, isliye yeh short-term aur long-term trading strategies dono mein useful hai.

Agar aap trading mein accuracy aur timeliness ko enhance karna chahte hain, to AMA ko apni trading toolkit mein zaroor shamil karein. Iska use karke aap apne trading decisions ko aur bhi behtar aur informed bana sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:50 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим