Gap in Forex Trading Market and Its Types , Details.

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Gap in Forex. Forex market mein gap ek bohat ahem masla hai. Gap jab hota hai toh price chart par price level mein aik jump ya chhoot ho jati hai. Gap ki wajah se traders ko problem ho sakti hai kyun ke issey trading strategies aur risk management ki planning mein farq parh sakta hai. Gap ki wajah se traders ko kuch samay ki lack of liquidity ka samna karna parta hai. Isse liquidity gap ke wajah se price volatility badh jati hai jiski wajah se traders ke orders execute hone mein dair ho sakti hai. Yeh gap market opening ke samay economic news ke announce hone ke samay ya phir unexpected market events ke wajah se ho sakti hai. Forex market mein mainly do types ke gap paye jate hain: Common Gap. Common gap hota hai jab price chart mein koi significant price level skip hota hai. Yeh gap normal chart movement ke hissab se hota hai aur generally market congestion ya consolidation phases mein paya jata hai. Common gap aksar weekend ke bad market opening par dekhe jate hain jab market kayi ghanton ke liye band hoti hai. Is gap ka size normally chota hota hai aur price chart mein asani se fill ho jata hai. Isliye is gap ka impact usually temporary hota hai. Breakaway Gap. Breakaway gap jab hota hai toh yeh trend reversal ke indication deta hai. Breakaway gap typically price consolidation phase ke baad paya jata hai jab market mein new trend ban raha hota hay or gapes k baad market ki move or bhi fast hoti hay. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex Trading Market Mein Khudai Aur Us Ki Iqsaam Forex trading market, jise Forex bhi kaha jata hai, duniya ki sab se bari aur active trading markets mein se ek hai . Is market mein har din billions dollars ke transactions hotay hain, jo mukhtalif currencies (mudraayein) mein kiye jatay hain. Yeh market traders ke liye aik bohot bara potential rukhta hai, lekin is mein gap aik ahem cheez hai jo traders ke liye aik challenge ho sakti hai. Aaj is article mein ham Forex trading market mein gap aur us ki qisamoon par baat karenge. Forex Market Mein Gap Kya Hai? Gap aik aisi situation hai jab do consecutive trading sessions mein currency pair ki price mein aik significant farq hota hai. Yani kisi mudra ki trading price ek din ke band hone ke baad doosre din ke opening price se kuch had tak different hoti hai. Iska matlab hai ke market mein achanak se kisi mudra ki qeemat mein tezi ya mandi aati hai, jo traders ke liye surprise ho sakti hai. Gap Ki Iqsaam: Forex market mein gap mukhtalif qisamoon mein aati hai, aur har aik ki alag wajah hoti hai. Niche kuch aham types of gaps diye gaye hain:- Common Gap (Aam Gap): Ye gap sab se common hota hai aur usually market ke normal functioning ka hissa hota hai. Ye gap market ke daily opening aur closing times ke darmiyan ya weekends ke baad aksar aata hai. Is gap mein koi khaas news ya event ki wajah se price mein farq nahi hota, balkay yeh routine market dynamics ka hissa hota hai.

- Breakaway Gap (Phutne Wala Gap): Is gap mein price mein aik significant change hota hai aur isay kisi important technical ya fundamental level ki todne ki wajah se aata hai. Traders is gap ko trend reversal indicator ke tor par dekhte hain, aur isay trading opportunities ke liye istemal kar sakte hain.

- Exhaustion Gap (Thakan Ka Gap): Ye gap market mein aik trend ki khatma hone ya revers honay ki nishani hota hai. Is gap mein price mein tezi ya mandi aati hai jab market mein exhaustion (thakan) hoti hai aur traders aik naye trend ki shuruaat ki umeed rakhte hain.

- Runaway Gap (Tezi Ka Gap): Is gap mein price mein tezi aati hai aur ye ek existing trend ko confirm karne ki nishani ho sakti hai. Isay "measuring gap" bhi kaha jata hai, kyun ke ye trend ki tezi ko measure karne mein madadgar hota hai.

- Island Reversal Gap (Jazeera Reversal Gap): Ye gap aksar trend reversal ko darust karti hai. Is gap mein price mein aik significant change hoti hai, aur isay traders nayi trend ki shuruaat ki ishara samajhte hain.

-

#4 Collapse

Forex Trading Market Mein Chhaai Gap aur Iske Aqsaam Forex trading market dunia ke sab se bade aur sab se shauqeen traders ki tijarat hai. Yeh market 24 ghanton mein chalti hai aur traders ko aik maheenay mein kai lakh dollar tak ki kamai karne ka mauka deta hai. Lekin, jab hum forex trading market ki dunia mein dakhil hote hain, to hamain "gap" ke bare mein bhi maloom hona chahiye. Gap, forex trading market mein aik aham aur common phenomenon hai jo traders ke liye khatarnak ho sakta hai ya unke liye aik mauka bhi ban sakta hai. Is article mein, ham gap ke mutaliq mukhtalif aqsam aur unke asal wajood ki tafseelat par gour karenge. Gap Kya Hai? Gap ek aisi situation hai jab forex market ke opening price aur previous day's closing price mein farq ho jata hai. Yani market khulne par, current price pehle din ke closing price se zyada ya kam hoti hai. Gap usually weekends ya holidays ke bad hota hai jab market band hoti hai aur phir khulti hai. Gap Ki Aqsaam:- Common Gap (Sada Gap): Ye gap market mein aam taur par paya jata hai. Isme koi khaas news ya events ka asar nahi hota aur ye aksar market ki normal fluctuation ke natije mein hota hai. Common gap ko fill hone mein aksar kam waqt lagta hai.

- Breakaway Gap: Breakaway gap aik powerful signal hota hai jo market trend ko confirm karta hai. Jab market mein trend change hota hai, to breakaway gap hota hai. Isme kisi khaas news ya events ka bhi asar hota hai.

- Runaway Gap (Meelon Ka Gap): Runaway gap, market trend ko mazboot karne wala gap hota hai. Isme market ki existing trend mein mazeed tezi aati hai aur isay trend continuation ka aik signal samjha jata hai.

- Exhaustion Gap (Thakawat Ka Gap): Exhaustion gap aik trend reversal signal hota hai. Jab market mein ek lambi bullish ya bearish rally ke baad gap paida hota hai, to ye trend ki exhaustion ya thakawat ko darust karta hai.

-

#5 Collapse

Forex Trading Market Mai Khulaai Ka Khumaar Forex, yaani Foreign Exchange market, duniya bhar mai sabse bara aur sabse liquidity wala financial market hai. Yeh ek aisa market hai jahan currencies exchange hoti hain. Forex trading mai ek aham tareeqa hai, jo traders ko mazeed faida kamane ka mauqa deta hai. Lekin is market mai bhi gaps (khulaai) aksar paai jaati hain, jo traders ke liye challenges bhi laa sakte hain. Gaps, jab ek currency pair ke price mein sudden aur significant change hota hai, bina kisi trading activity ke, ko kehte hain. Yeh aksar weekend ke baad ya kisi important event ke baad hota hai. Forex market mai teen prakar ke gaps paaye jaate hain: 1. Common Gap: Yeh gap price chart par choti lines ke roop mai dikhta hai aur aksar jaldi bharta hai. 2. Breakaway Gap: Breakaway gap ek trend reversal indicator ho sakta hai. Isme price ek important support ya resistance level ko todti hai. 3. Continuation Gap: Continuation gap existing trend ke saath hota hai aur bataata hai ki trend mein sthirta hai. In gaps ka dhyaan rakhkar, traders risk management aur strategy planning mein sudhar kar sakte hain, taki forex trading mai acha return ho. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex Trading Market Mein Khala Forex trading market, jise aam taur par Forex ya FX market ke naam se jaana jaata hai, duniya ke sabse bade aur sabse active financial markets mein se ek hai. Ye market 24 ghante khula rehta hai aur traders ko duniya bhar ke currencies ke beech mein exchange karne ka mauka deta hai. Lekin, Forex trading market mein bhi khala (gap) ek aham aur mudda hai jo traders ke liye samajhna zaroori hai. Is article mein, hum Forex market mein khala ke bare mein baat karenge aur iske alag alag types aur unke details ko samajhne ki koshish karenge. Forex Market Mein Khala Kya Hai? Khala (gap) ek aesi sthiti hai jab currency pairs ya anya financial instruments ke prices mein achanak se significant aur unexpected tabdeelion ka sabab banti hai. Khala, traders ke liye ek acha ya bura surprise ho sakta hai, aur ye market volatility aur risk ko darust karta hai. Forex Market Mein Khala Ke Prakar:- Common Gap (Aam Khala): Ye khala aksar market ki normal trading activities ke natije mein paida hoti hai. Isme prices mein kuch minor tabdeelion hoti hain jo trading hours ke baad ya weekend ke baad hoti hain. Aam taur par, ye khala choti hoti hai aur traders ke liye adhik khatarnak nahi hoti.

- Breakaway Gap (Breakaway Khala): Breakaway gap ek important aur zor daar khala hoti hai jo ek trend ke ant mein ya naye trend ki shuruaat mein aati hai. Isme prices mein bada tabdeel aata hai, jo trend ke mukhable mein hota hai. Traders is khale ko trend reversal ya trend continuation ke roop mein samajhte hain.

- Runaway Gap (Runaway Khala): Runaway gap, trend ke beech mein aati hai aur trend ke continuity ko darust karti hai. Ye gap traders ke liye trend ki strength ko dikhata hai. Isme prices mein tezi se badlav hota hai, aur ye trend ko accelerate kar sakta hai.

- Exhaustion Gap (Exhaustion Khala): Exhaustion gap, trend ke ant mein hoti hai aur reversal ko signify karti hai. Isme prices mein bada tabdeel hota hai, jise traders trend exhaustion ya reversal ke roop mein samajhte hain.

-

#7 Collapse

Forex Trading Market Mein Khala Forex trading market, jise aam taur par Forex ya FX market ke naam se jaana jaata hai, duniya ke sabse bade aur sabse active financial markets mein se ek hai. Ye market 24 ghante khula rehta hai aur traders ko duniya bhar ke currencies ke beech mein exchange karne ka mauka deta hai. Lekin, Forex trading market mein bhi khala (gap) ek aham aur mudda hai jo traders ke liye samajhna zaroori hai. Is article mein, hum Forex market mein khala ke bare mein baat karenge aur iske alag alag types aur unke details ko samajhne ki koshish karenge. Forex Market Mein Khala Kya Hai? Khala (gap) ek aesi sthiti hai jab currency pairs ya anya financial instruments ke prices mein achanak se significant aur unexpected tabdeelion ka sabab banti hai. Khala, traders ke liye ek acha ya bura surprise ho sakta hai, aur ye market volatility aur risk ko darust karta hai. Forex Market Mein Khala Ke Prakar:- Common Gap (Aam Khala): Ye khala aksar market ki normal trading activities ke natije mein paida hoti hai. Isme prices mein kuch minor tabdeelion hoti hain jo trading hours ke baad ya weekend ke baad hoti hain. Aam taur par, ye khala choti hoti hai aur traders ke liye adhik khatarnak nahi hoti.

- Breakaway Gap (Breakaway Khala): Breakaway gap ek important aur zor daar khala hoti hai jo ek trend ke ant mein ya naye trend ki shuruaat mein aati hai. Isme prices mein bada tabdeel aata hai, jo trend ke mukhable mein hota hai. Traders is khale ko trend reversal ya trend continuation ke roop mein samajhte hain.

- Runaway Gap (Runaway Khala): Runaway gap, trend ke beech mein aati hai aur trend ke continuity ko darust karti hai. Ye gap traders ke liye trend ki strength ko dikhata hai. Isme prices mein tezi se badlav hota hai, aur ye trend ko accelerate kar sakta hai.

- Exhaustion Gap (Exhaustion Khala): Exhaustion gap, trend ke ant mein hoti hai aur reversal ko signify karti hai. Isme prices mein bada tabdeel hota hai, jise traders trend exhaustion ya reversal ke roop mein samajhte hain.

-

#8 Collapse

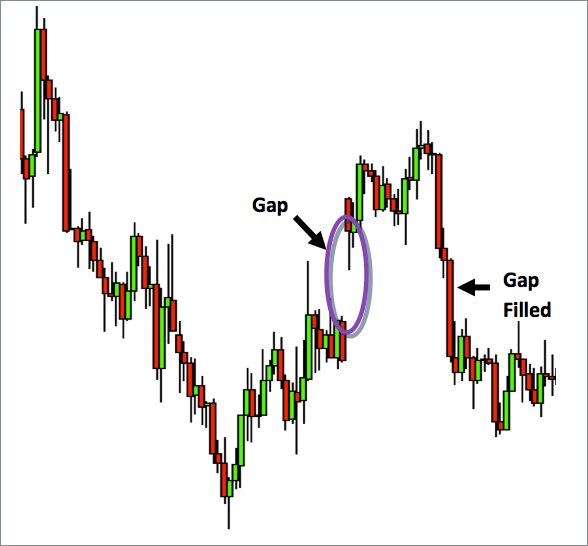

FOREX TRADING MARKET ME GAP OR ES KI TYPES:-Forex (Foreign Exchange) Market mein "gap" ek common phenomenon hai, jo market mein sudden price movement ko describe karta hai, jahan par ek security ka price ek particular level se dusre level par achanak change ho jata hai. Gaps typically weekends ya important news events ke baad develop hote hain jab market close hoti hai aur phir open hoti hai. Gaps market analysis mein important hote hain, kyunki ye trading opportunities ya risks create kar sakte hain. FOREX TRADING MARKET ME GAP KI TYPES:-Exhaustion Gap: Ye gap market mein ek trend ki exhaustion ya kamzori ko darust karta hai. Jab ek trend zyada lamba ya zyada strong hota hai aur traders mein exhaustion ya profit booking shuru ho jati hai, to exhaustion gap develop hota hai. Is gap ko reversal signal ke roop mein dekha jata hai, yaani ki trend ki ulat chalne ki sambhavna hoti hai. Runaway Gap (Continuation Gap): Ye gap existing trend ko confirm karta hai. Jab market ek strong trend mein hoti hai aur phir bhi ek gap develop hota hai jo trend ke direction mein hota hai, to ise runaway gap kehte hain. Ye gap trend ki strength aur momentum ko highlight karta hai. Island Reversal Gap: Ye gap ek reversal signal hota hai aur market mein trend change ko indicate karta hai. Island reversal gap tab hota hai jab ek gap market mein ek trend ke beech mein develop hota hai, phir ek aur gap opposite direction mein develop hota hai. Yeh pattern trend change ke indication ke roop mein dekha jata hai. Gaps trading strategy mein, traders gap type aur market conditions ko consider karte hain. Gap fill (jab market gap ko wapas fill kar leti hai) aur gap continuation (jab market gap ke direction mein trend continue karta hai) strategies common hote hain. Aapko market analysis, technical indicators, aur fundamental factors ka bhi istemal karna hoga gaps ko samajhne aur trading decisions lene mein. Ek zaruri baat hai ki gaps trading risk aur reward dono hoti hain, isliye traders ko ek sound risk management plan banakar us par amal karne ki salahiyat rakhni chahiye. Aapka trading strategy aur risk tolerance gaps trading ke liye mahatvapurna hai.

FOREX TRADING MARKET ME GAP KI TYPES:-Exhaustion Gap: Ye gap market mein ek trend ki exhaustion ya kamzori ko darust karta hai. Jab ek trend zyada lamba ya zyada strong hota hai aur traders mein exhaustion ya profit booking shuru ho jati hai, to exhaustion gap develop hota hai. Is gap ko reversal signal ke roop mein dekha jata hai, yaani ki trend ki ulat chalne ki sambhavna hoti hai. Runaway Gap (Continuation Gap): Ye gap existing trend ko confirm karta hai. Jab market ek strong trend mein hoti hai aur phir bhi ek gap develop hota hai jo trend ke direction mein hota hai, to ise runaway gap kehte hain. Ye gap trend ki strength aur momentum ko highlight karta hai. Island Reversal Gap: Ye gap ek reversal signal hota hai aur market mein trend change ko indicate karta hai. Island reversal gap tab hota hai jab ek gap market mein ek trend ke beech mein develop hota hai, phir ek aur gap opposite direction mein develop hota hai. Yeh pattern trend change ke indication ke roop mein dekha jata hai. Gaps trading strategy mein, traders gap type aur market conditions ko consider karte hain. Gap fill (jab market gap ko wapas fill kar leti hai) aur gap continuation (jab market gap ke direction mein trend continue karta hai) strategies common hote hain. Aapko market analysis, technical indicators, aur fundamental factors ka bhi istemal karna hoga gaps ko samajhne aur trading decisions lene mein. Ek zaruri baat hai ki gaps trading risk aur reward dono hoti hain, isliye traders ko ek sound risk management plan banakar us par amal karne ki salahiyat rakhni chahiye. Aapka trading strategy aur risk tolerance gaps trading ke liye mahatvapurna hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex Trading Market Gap. Gap Explanation. Gap ka matlab hota hai kisi market mein ek din se agle din ke beech mein price ka farq. Jab market band hoti hai toh kuch events ya news ki wajah se price mein difference hojata hai jisay hum gap kehtay hain. Types of Gaps. Common Gap. Jab price chart par gap horizontal trend line ke against move karta hai toh usay common gap kehtay hain. Breakaway Gap. Jab price chart par gap trend line ko break karke move karta hai toh usay breakaway gap kehtay hain. Yeh price action ke liye strong signal hai. Runaway Gap. Jab price chart par gap trend line ke sath move karta hai toh usay runaway gap kehtay hain. Yeh price action ke liye weak signal hai. Reasons for Gaps. Economic Data. Agar koi country ka economic data unexpected release hojaye toh market mein gap aasakti hai. News. Koi bhi positive ya negative news aane se price mein gap aasakti hai. Market Closure. Market close hone se pehle ya market open hone se pehle koi event ya news aaye toh gap aasakti hai. Impact of Gaps: 1. Koi bhi gap aapke trading plan ko affect kar sakti hai. 2. Kuch traders gap ko opportunity ke roop mein bhi dekhte hain aur usay trade karte hain. 3. Gap aapki stop loss order ko bhi affect kar sakti hai. Main Points. Gap forex trading market mein ek common phenomenon hai. Aapko gap ke baare mein knowledge hona chahiye aur usay apne trading plan mein include karna chahiye. Agar aap gap ko ignore karte hain toh aapka trading plan fail hojaye ga.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:59 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим