What is the double top pattern?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

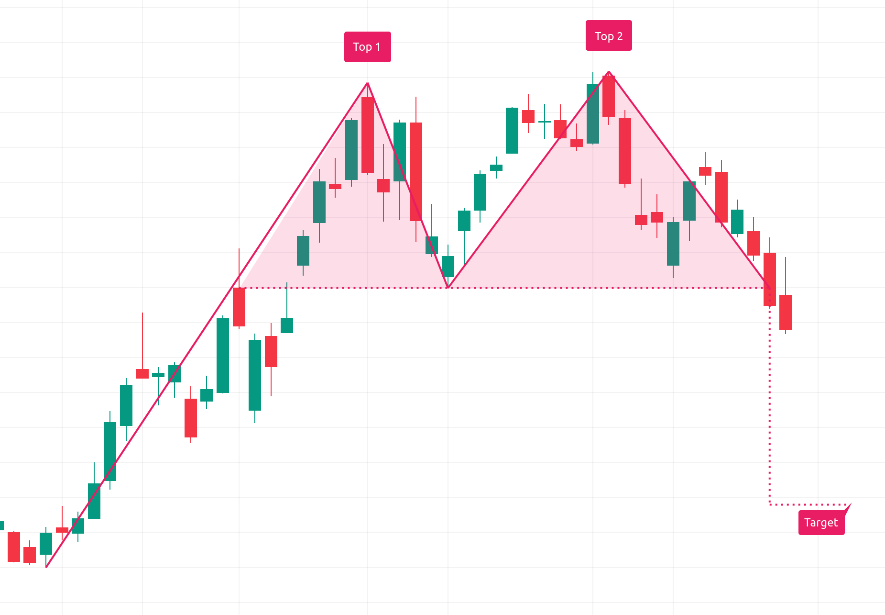

INTRODUCTION TO THE DOUBLE TOP PATTERN : Double top pattern ek ahem reversal pattern hai jo uptrend ki aik nihanish par hota hai. Ye tab banta hai jab kisi suraksha ne buland qeematpahunchi hai, uske baad utarti hui hai aur do chote paharon ya chote chote chote point par do pichhe chamkon par milti hai. Ye pattern "double top" ke naam se jana jata hai kyunki ye do paharon ya chamkon ki shakl ka saman hai. Ye suraksha ke keemat mein bearish reversal ko darshata hai, jiska natija ek downtrend hone ki possibility hai. Double top pattern ko reliable signal samjha jata hai kyunki ye kharidne aur bechne walon ke beech ek jung ko darshata hai. Shuru mein, stock ya asset pahuchne par pehla chamka banata hai, jisse bullish bhavna ka sanket milta hai. Halaanki, jab keemat utarti hai, kuch kharidne wale bechne shuru kar dete hain, jisse ek temporary decline hoti hai. Ye bechne ka dabav aksar profit-kamane ki wajah se ya suraksha ke overvalued hone ka ehsaas hone se hota hai. Double top pattern ka dusra chamka aam taur par tab banta hai jab kharidne wale keemat ko pehle wale uchit par lane ki koshish karte hain. Halaanki, is koshish ko bechne wale resistance ke saath milte hain, jo ise ek uchit mauka samajhte hain jismein unhe ek uchit keemat par bechna hota hai. Is natije mein, keemat pehle wale uchit se guzarne mein asafal hoti hai aur girne lagti hai, double top pattern ko confirm karti hai. IDENTIFYING THE DOUBLE TOP PATTERN : Double top pattern ko pehchanne ke liye, traders khaas pehchan dhundte hain. Sabse pehle, wo do chamkon ko dhundte hain jo ek doosre ke qareeb ya lagbhag ek jaisi keemat par hote hain. Trough aur chamkon ke beech ki doori bhi mustawi honi chahiye. Dusri baat, ye pattern ek uptrend se pahle hona chahiye, jo isey reverse pattern batati hai. Ant tak, traders aksar technical indicators, jaise ki moving averages ya volume analysis, ka istemaal kar sakte hain pattern ko confirm karne ke liye. Double top pattern ko pehchanne ke doran, ye mahatvapurn hai ki pattern hamesha symmetric nahi hota hai. Dusra chamka pehle wale chamke se thoda ooncha ya neecha ho sakta hai. Halaanki, mahatvapurn baat ye hai ki keemat pehle wale uchit se guzarti nahi hai aur girne lagti hai. Traders ko pattern banne ki samay seema ko bhi dhyan mein rakhna chahiye. Ek daily chart par double top pattern ek hourly chart par hone se adhik mahatvapurn ho sakta hai. CONFIRMATION AND ENTRY STRATEGIES OF DOUBLE TOP PATTERN : Double top pattern ki tasdeeq, reversal signal ki sahiyat ko guarantee karne ke liye mahatvapurn hai. Traders aksar aur sanket dhundte hain, jaise ki trough ke neeche se guzarna ya volume mein kami aana, bearish reversal ko confirm karne ke liye. Trough ke neeche se guzarne ki wajah se ye confirm hota hai ki bechne wale ne kabu kar liya hai aur ek downtrend hone ki sambhavna hai. Ek bar double top pattern tasdeek ho jaye, to karobar karne wale alag-alag dakhil-kari strateegiyon ka istemal kar sakte hain. Kuch karobar karne wale log thalay ke neeche se tootne se pehle hi short position mein dakhil hone ka intezaar karte hain. Dusre dhamake se price kaeyne lagte hi unhe position mein dakhil karne ka intikhaab kar sakte hain. Eham hai ke diqqat ka saath den, kyun ke jhoothi tootne ya taalukat pehle bhi ho sakte hain, jab tak niche ki rujhan mukammal tarah se qaim nahi ho jati hai. TARGETS AND STOP LOSSES IN DOUBLE TOP PATTERN : Double top pattern ki karobar karne ke doran, morakab risk ko samhalne aur maqasid ko zyada se zyada munafa hasil karne ke liye, maqbul maqasid aur stop loss tashkeel dena zaroori hai. Karobar karne wale amuman pattern ki unchi point aur thalay ke darmiyan faslay ka istemal karke nichle rujhan ko andaza lagate hain. Woh pattern ki unchi point aur thalay ke darmiyan faslay ko mapte hain aur isko tootne ke point se niche tak tasawwur kartay hain. Stop loss ko doosre dhamake ke neeche rakha jana chahiye, taa ke jhooti tootne ka khatra kam ho. Karobar karne wale ko amuman market ki hallat aur stock ki halchal paida karti hayat aur tawazun ko bhi samajhna chahiye jab un apne stop loss level tay kar rahe hote hain. Yah zaroori hai ke mukammal asar karne ke bajaye tasawwur mein kaaynam hone par saf exit karne ka tareeqa ziada se ziada ho. TRADING STRATEGIES AND CONSIDERATIONS OF DOUBLE TOP PATTERN : Double top pattern ki trading karte waqt, bohat zaroori hai ke hum bara market context ka bhi khayal rakhe aur faislay ko mazboot karneke liye aur technical analysis ke aur tools ka istemal kare. Traders ko overall trend ka jayeza lena chahiye aur potential support levels ko pehchan lena chahiye jo pattern ki tasdeeq par asar kar sakte hain. Woh dusre indicators jaise ke oscillators ya trend lines ka istemal bhi kar sakte hain, taake aur tasdeeq hasil kar sake ya apne entry ko behtar tareeqe se time kar sake. Double top pattern reliable aur powerful reversal pattern mana jata hai, lekin samajhdari se kaam lena bohat zaroori hai aur sirf is signal par pura bhrosa nahi karna chahiye. Trading decisions lene se pehle dusre technical patterns, fundamental analysis, aur market news ko bhi ghor o fikar se sochna chahiye. Iske alawa, sahi tarah se risk management aur position sizing ko hamesha follow karna chahiye jab double top pattern ya kisi aur trading strategy ka istemal kiya jata hai. -

#3 Collapse

Double Top Pattern Assalam O Alaikum Dear friends and fellows Double top pattern trading me kafi help full pattern hai jise follow krky market ke real trend ko define kiya ja sakta hai aur is ki madad se RSI EMA ko bhe check kiya ja sakta hai aur confirm bhe kiya ja sakta hai ke ab trend ki next movement kis taraf hogi hamen hr ek cheez ko apne mind mein rakh kr he kam krna hoga aur different time frame ko bhe dekhna hoga aur ye bhe dekhna hoga ke ye pattern kis time frame mein proper tariky se work kr rahy hain aur double top pattern ko extremely bearish reversal pattern bhe kaha jata hai aur ise high price aur two consecutive time mein bhe moderate bhe kiya jata hai aur ye ek decline bhe banata hai 2 lines ke darmiyan ye support level ke equally bhe work krta hai low aur 2 prior high ke durmiyan hota hai. Double Top Pattern ki Ehmiyat Dear friends ap janty hain ke Candlestick chart pattern mein different patterns banty hain aur daily basis pr unko dekh kr trading manage ki ja sakti hai . Pakistan forex forum mein intellectual responsible market analysis karna hai taky ham log trading market ko jitni importance dety hain utni output le saken maximum output leny ke liye hamen isko samajhne ki zarurat hai. Forex trading market mein sab se important candlestick chart pattern hi hai candlestick chart pattern mein different candles acchi information deti hain laken support and resistance trading ke liye perfect hai trade ko manage karny ka knowledge or experience ke sath lot size select karna capital ke according risk management krna risk reward ratio dekh kar trade open aur close krna Ziyada ahm hain. Trade in Double Top Pattern Friends Agr ap double Top ki complete information aur learning Hasil kr len ge to aap bahot faida Hasil kr sakty hain for example Agr 2nd top position per Ek shootring star pattern banta hai to us mein apko ye confirmation mil jaati hai ki ab market ki next movement bearish trend ki taraf Hony Lagi Hai. Is liye Ham Ko market Mein banny wali different candlesticks ki proper information Hasil Karni chahiye taaky Ham is se achi tarah utilize kr saken aur Forex trading ko apny liye faidemand bana saken. Jab Bhi forex market Mein kam Karty Hain To mukhtalif kism ke patterns hamare samny hoty hain jin Mein Ham apni trade open kr sakty hain or Ham Apna profit hasil kr sakty hain in patterns ko samajhny ke liye hamary pass experience Ka Hona bahot zaruri hai . -

#4 Collapse

What is the double top pattern? Double Top pattern ek technical analysis chart pattern hai, jo stock trading aur financial markets mein aam taur par istemal hota hai. Yeh ek bearish reversal pattern hai, matlab yeh aksar ek uptrend se downtrend ki sambhavna ko darust karne ka ishara deta hai. Yahan par double top pattern kaam kaise karta hai aur iska kya matlab hota hai, uske bare mein jaankari di gayi hai:- Formation (Banawat):

- Double top pattern do unche chhote peaks se bana hota hai jo aapas mein barabar hote hain aur beech mein ek trough (price mein giravat ya dip) ke saath hote hain.

- Pehli peak tab banti hai jab ek aset ki keemat ek certain level tak badhti hai, phir isme giravat aati hai, jo pehla trough banati hai.

- Pehli peak aur trough ke baad, keemat phir se badhti hai aur pehle ki unchai tak (ya uske kareeb) pahunchti hai, doosri peak banati hai, phir giravat aati hai.

- Confirmation (Sanket):

- Double top pattern ki confirmation ke liye traders aksar doosri peak ke baad price ke vyavhaar ko dekhte hain. Agar price trough ke niche breakout karti hai, toh yeh pattern ki confirmation mana jata hai.

- Lakshya aur Trading Strategy (Nishkarsh aur Trading Ranniti):

- Double top pattern ka price target aksar pehli peak se trough tak ki vertical doori ko maap karke aur us doori ko trough ke niche breakout point se ghatakar estimate kiya jata hai.

- Traders aksar is pattern ka istemal short (sell) positions shuru karne ya long (buy) positions ko exit karne ke liye karte hain, kyun ki yeh ek uptrend mein sambhavnaatmak palat jane ki suchna deta hai.

- Volume (Maand):

- Trading volume ko analyze karna pattern ki confirmation mein madadgar ho sakta hai. Aam taur par pehli peak ke bane waqt adhik volume hota hai aur doosri peak aur trough ke bane waqt kam volume hota hai.

- Formation (Banawat):

-

#5 Collapse

Introduction of Double top pattern in Market AOA Dear fellows and also good traders aj me js topic pr baat krne wala ho wo he Double top pattern dekhae ke ye pattern bullish sticks ko zahr krta he aur market ko hmeesha upward lee jata he jb market upward jae liye, traders khaas pehchan dhundte hain. Sabse pehle, wo do chamkon ko dhundte hain jo ek doosre ke qareeb ya lagbhag ek jaisi keemat par hote hain. Trough aur chamkon ke beech ki doori bhi mustawi nalysis toolsen isko samajhne ki zarurat hai. Forex trading market mein sab se important candlestick chart pattern hi hai candlestick chart pattern mein different candles acchi information deti honi chahiye. Dusri baat, ye pattern ek uptrend se pahle hona chahiye, jo isey reverse pattern batati hai. Ant tak, traders aksar technical indicators, jaise ki moving averages ya va istemgye tu ap is se andza laga skte hain ke ye kon sa pattern market ke andr ye pattern easy to identify he aur k6 sign me ap ko bata deta ho js me hm ye jante he ke kis tarh ye upward movement show krta he How to understand it in market? Dekhae brother ap koi bhi kaam kare jb tk ap ko us kaam ke samjh ni ho ge jb market ke andr koi bhi currency ya koi bhi ya koi metal neeche ke tarf jatforum mein intellectual responsible market analysis karna hai taky ham log trading market ko jitni importance dety hain utni output le saken maximum output leny ke liye hamrahe ki har double top pattern mahatvapurna palat ko nahi darust karta hai, aur traolume analysis,Kuch karobar karne wale log thalay ke neeche se tootne se pehle hi short position mein dakhil hone ka intezaar karte hain. Dusre dhamake se price kaeyne lagte hi unhe position mein dakhil karne ka intikhaab kar sakte hain. Eham hai ke diqqat ka saath den, kyun ke jhoothi tootne kders ko signal ko confirm karne aur risk ko prabandhit karne ke liye doosre technical aain laken e he us ke bhi type bearish pattern kehte hain tu market upward ka.trend show krte he jase ke doo double bullish ke lattern strongly nazar aate hain -

#6 Collapse

DOUBLE TOP PATTERN : Double top sample ek ahem reversal sample hai jo uptrend ki aik nihanish par hota hai. Ye tab banta hai jab kisi suraksha ne buland qeematpahunchi hai, uske baad utarti hui hai aur do chote paharon ya chote chote chote point par do pichhe chamkon par milti hai. Ye pattern "double top" ke naam se jana jata hai kyunki ye do paharon ya chamkon ki shakl ka saman hai. Ye suraksha ke keemat mein bearish reversal ko darshata hai, jiska natija ek downtrend hone ki possibility hai. Top sample ko dependable sign samjha jata hai kyunki ye kharidne aur bechne walon ke beech ek jung ko darshata hai. Shuru mein, stock ya asset pahuchne par pehla chamka banata hai, jisse bullish bhavna ka sanket milta hai. Halaanki, jab keemat utarti hai, kuch kharidne wale bechne shuru kar dete hain, jisse ek brief decline hoti hai. Ye bechne ka dabav aksar profit-kamane ki wajah se ya suraksha ke overvalued hone ka ehsaas hone se hota hai.IDENTIFYING THE PATTERN : Double top sample ko pehchanne ke liye, traders khaas pehchan dhundte hain. Sabse pehle, wo do chamkon ko dhundte hain jo ek doosre ke qareeb ya lagbhag ek jaisi keemat par hote hain. Trough aur chamkon ke beech ki doori bhi mustawi honi chahiye. Dusri baat, ye pattern ek uptrend se pahle hona chahiye, jo isey reverse sample batati hai. Ant tak, traders aksar technical indicators, jaise ki transferring averages ya quantity evaluation, ka istemaal kar sakte hain pattern ko verify karne ke liye. Traders aksar aur sanket dhundte hain, jaise ki trough ke neeche se guzarna ya extent mein kami aana, bearish reversal ko confirm karne ke liye. Trough ke neeche se guzarne ki wajah se ye verify hota hai ki bechne wale ne kabu kar liya hai aur ek downtrend hone ki sambhavna hai.Dusre dhamake se fee kaeyne lagte hello unhe function mein dakhil karne ka intikhaab kar sakte hain. Eham hai ke diqqat ka saath den, kyun ke jhoothi tootne ya taalukat pehle bhi ho sakte hain, jab tak area of interest ki rujhan mukammal tarah se qaim nahi ho jati hai.

Pattern in Market; aj me js topic pr baat krne wala ho wo he Double top pattern dekhae ke ye pattern bullish sticks ko zahr krta he aur marketplace ko hmeesha upward lee jata he jb marketplace upward jae liye, buyers khaas pehchan dhundte hain. Sabse pehle, wo do chamkon ko dhundte hain jo ek doosre ke qareeb ya lagbhag ek jaisi keemat par hote hain. Trough aur chamkon ke beech ki doori bhi mustawi nalysis toolsen isko samajhne ki zarurat hai. Forex buying and selling market mein sab se essential candlestick chart sample hello hai candlestick chart sample mein unique candles acchi records deti honi chahiye. Dusri baat, ye sample ek uptrend se pahle hona chahiye, jo isey opposite sample batati hai. Ant tak, traders aksar technical signs, jaise ki shifting averages ya va istemgye tu ap is se andza laga skte hain ke ye kon sa pattern market ke andr ye pattern easy to discover he aur k6 sign me ap ko bata deta ho js me hm ye jante he ke kis tarh ye upward motion show krta he

-

#7 Collapse

"Double Top Pattern" Roman Urdu Mein: Double Top Pattern ek technical analysis ka chart pattern hai jo market analysis mein istemal hota hai. Is pattern mein price chart par do bar similar high points hote hain, jo ek trading instrument ya asset ki value ko represent karte hain. Yeh pattern typically uptrend ke baad aata hai aur bearish reversal signal deta hai. Double Top Pattern ko samajhne ke liye, yeh points yaad rakhein: 1. **Pehla Top:** Pehla high point hota hai jab market mein strong uptrend ho raha hota hai. Is point par traders buyers hote hain aur price high hoti hai. 2. **Pullback:** Pehla top ke baad price thoda gir kar wapas aata hai, lekin generally, uptrend mein rehta hai. 3. **Dusra Top:** Dusra high point hota hai, jo pehle top ke qareeb hota hai. Is point par bhi traders buyers hote hain aur price dobara se high hoti hai. 4. **Confirmation:** Double Top Pattern ko confirm karne ke liye, price ko pehle top ke neeche girna shuru karna chahiye. Isse double top ban jata hai aur yeh bearish reversal signal deta hai. 5. **Price Target:** Pattern ke confirm hone par traders price target tay kar sakte hain, jo pehle top se neeche ki taraf hota hai. Double Top Pattern traders ke liye ek warning signal hota hai ki uptrend khatam ho sakta hai aur market mein bearish momentum aa sakta hai. Is pattern ko samajh kar, traders apne trading decisions ko plan kar sakte hain. -

#8 Collapse

Double Top Pattern:

Double Top Pattern Kya Hai?

Double Top Pattern, ya "do top shakal", ek aham technical analysis pattern hai jo market mein hone wale trend reversals ko darust karta hai. Yeh pattern generally uptrend ke baad paya jata hai aur indicate karta hai ke bullish movement khatam ho kar bearish movement shuru hone wala hai. Yahan Double Top Pattern ke bare mein Roman Urdu mein tafseelat di gayi hai:

Pattern Ki Tafseelat:- Do Top:

Double Top Pattern mein market mein do bar price ek specific level tak pohanchti hai, phir girne lagti hai. Har top ke darmiyan kuch arsa hota hai, jise traders "neckline" kehte hain. Ye neckline support level ki tarah kaam karta hai aur agar ye toot jata hai, toh bearish reversal confirm hoti hai. - Price Levels:

Dono tops ke prices aik doosre ke bilkul qareeb hotay hain aur jab dono tops ke prices ke darmiyan ki line, ya neckline, break hoti hai, toh ye bearish signal hai. - Volume Ki Izafat:

Double Top pattern ko confirm karne ke liye, volume ka bhi dekha jata hai. Agar second top ke doran volume decrease hota hai, toh ye pattern ki authenticity ko barhata hai.

Tijarat Mein Istemal:

Double Top Pattern ko tijarat mein istemal karne ke liye, traders ko kuch zaroori asoolon ka bhi khayal rakhna chahiye:- Confirmation: Pattern ko confirm karne ke liye, traders doosre technical indicators jese ke volume, momentum oscillators, ya trend lines ka istemal kar sakte hain.

- Entry Point: Pattern ko dekhte hue, traders apne entry point ko define karte hain. Jab neckline break hoti hai, traders short positions le sakte hain.

- Risk Management: Har tijarat mein risk management ka khayal rakhna zaroori hai. Stop-loss orders ka istemal karke traders apne nuksan ko control mein rakh sakte hain.

- Target Setting: Pattern ko dekhte hue, traders apne target prices tay karte hain. Ye targets support levels par rakhe jate hain.

Mukhtasar Guftagu:

Double Top Pattern, agar sahi taur par samjha jaye aur dusre indicators ke sath milakar istemal kiya jaye, toh ye traders ke liye ek powerful tool ban sakta hai jo market trends ko samajhne mein madad karta hai. Lekin, hamesha yaad rakhein ke kisi bhi ek indicator par pura bharosa karne se pehle, market ke mukhtalif factors ko bhi tajziya karna zaroori hai.

- Do Top:

-

#9 Collapse

**Double Top Pattern Kya Hai?**

Forex trading aur technical analysis mein Double Top pattern ek important chart pattern hai jo trend reversal ka signal provide karta hai. Yeh pattern generally uptrend ke baad form hota hai aur market ke bearish reversal ke potential ko indicate karta hai. Aaj hum Double Top pattern ki definition, identification, aur trading strategy ko detail mein samjhenge.

### Double Top Pattern Kya Hai?

Double Top pattern ek bearish reversal pattern hai jo ek strong uptrend ke baad market mein form hota hai. Is pattern mein do consecutive peaks hoti hain jo approximately same price level par hoti hain, aur inke beech mein ek dip hota hai. Yeh pattern trend reversal aur price decline ke signal ko indicate karta hai.

### Pattern Ki Identification

**1. Uptrend Context:**

Double Top pattern tab form hota hai jab market ek strong uptrend ke dauran hota hai. Iske baad, price do baar approximately same high points tak pohanchti hai, jisse pattern ki formation hoti hai.

**2. Pehli Top:**

Pehli top ek high point hota hai jo strong buying activity ke baad form hota hai. Yeh point market ki bullish sentiment aur uptrend ko reflect karta hai.

**3. Dips Aur Second Top:**

Pehli top ke baad, price thodi decline karti hai aur ek dip form hota hai. Uske baad, price phir se upar jaati hai aur dusri top ko form karti hai jo pehli top ke sath approximately same level par hoti hai. Dusri top bhi strong selling pressure aur market sentiment ko reflect karti hai.

**4. Neckline:**

Dono tops ke beech jo dip hota hai, usko neckline kehte hain. Pattern ki confirmation ke liye, price ko neckline ke niche break karna zaroori hota hai. Yeh break confirmation signal hota hai ki pattern complete ho chuka hai aur bearish trend reversal shuru ho sakta hai.

### Trading Strategy

**1. Entry Point:**

Double Top pattern ki confirmation ke baad, entry point ko identify karna zaroori hai. Jab price neckline ke niche break karti hai, to yeh bearish signal hota hai. Sell position ko is level ke neeche open kiya jata hai.

**2. Stop-Loss Aur Take-Profit:**

Stop-loss ko second top ke thoda upar place karna chahiye taake agar market unexpected movements dekhe to losses ko control kiya ja sake. Take-profit level ko recent support levels ya predefined targets ke basis par set karna chahiye. Yeh level aapke risk/reward ratio ke hisaab se determine kiya jata hai.

**3. Confirmatory Indicators:**

Double Top pattern ke signals ko confirm karne ke liye additional technical indicators ka use bhi kiya ja sakta hai. For example, Relative Strength Index (RSI) aur Moving Averages se trend confirmation aur market momentum analysis kiya ja sakta hai.

### Benefits Aur Limitations

**1. Benefits:**

- **Trend Reversal Identification:** Double Top pattern market ke potential bearish reversal ko identify karne mein madad karta hai.

- **High Probability Signal:** Yeh pattern generally reliable bearish signal provide karta hai jab confirmation criteria fulfill hoti hai.

**2. Limitations:**

- **False Signals:** Kabhi kabhi Double Top pattern false signals bhi generate kar sakta hai, isliye confirmatory indicators ka use zaroori hai.

- **Market Conditions:** Pattern ki effectiveness market conditions aur volatility ke hisaab se vary kar sakti hai.

### Conclusion

Double Top pattern Forex trading mein ek valuable tool hai jo trend reversal aur bearish signals ko identify karta hai. Accurate pattern identification aur effective trading strategy ke zariye, traders is pattern ko use karke profit earning opportunities ko leverage kar sakte hain. Risk management aur confirmatory indicators ke zariye, traders market trends ko better analyze kar sakte hain aur apne trading decisions ko optimize kar sakte hain. Double Top pattern ki understanding se traders market ke potential changes ko timely identify kar sakte hain aur apni trading strategies ko enhance kar sakte hain.

-

#10 Collapse

Double Top Pattern: Ek Comprehensive Guide

1. Double Top Pattern: Taaruf

Double Top Pattern stock aur forex markets mein ek important technical analysis tool hai. Yeh pattern market ke trend ko reverse karne ki indication deta hai, jo ki trading decisions ke liye crucial hota hai. Jab market ek strong uptrend mein hoti hai aur phir double top pattern develop hota hai, to yeh bearish reversal ka signal hota hai. Is pattern ka formation do peaks ke beech mein hota hai, jo ke lagbhag same level par hoti hain, aur inke beech ek dip hota hai.

Double Top Pattern ko samajhna trading ke liye zaroori hai kyunki yeh pattern market ke future movements ko predict karne mein madad karta hai. Pehli peak ke baad jab market niche aati hai aur dusri peak banati hai, to traders ko market ke change ka signal milta hai. Is pattern ke analysis se traders market ke bearish phase ko anticipate kar sakte hain aur apne trades ko accordingly adjust kar sakte hain.

Is pattern ka use karke, traders price movements aur market trends ko analyse karte hain. Double Top Pattern ko technical analysis mein ek reliable aur effective tool maana jata hai jo ki traders ko market ke potential reversals ko detect karne mein madad karta hai. Yeh pattern, khas taur par un markets mein use hota hai jahan price movements predictable hote hain aur trends clear hote hain.

Technical analysis ke is concept ko samajhne ke liye market trends aur price patterns ka knowledge hona zaroori hai. Traders jo is pattern ko accurately identify karte hain, wo market ke fluctuations ka faida utha sakte hain aur apne trading strategies ko improve kar sakte hain. Double Top Pattern ki identification aur confirmation, dono hi ek disciplined approach aur practice ki zaroorat hoti hai.

2. Pattern Ki Pehchaan

Double Top Pattern ko pehchanana thoda challenging ho sakta hai lekin kuch specific features hain jo is pattern ko identify karne mein madad karte hain. Pehli aur dusri peak dono ka height lagbhag same hota hai aur dono peaks ke beech ek noticeable dip hota hai. Yeh dip market ka temporary correction hota hai jo ki pattern ki confirmation ko support karta hai.

Double Top Pattern ka analysis karte waqt, pehla peak market ke resistance level ko indicate karta hai. Jab price pehla peak achieve karti hai aur phir niche aati hai, to yeh market ki strength aur resistance level ko show karta hai. Dusra peak pehla peak ke level par ya uske thoda upar banta hai, jo ki pattern ko complete karta hai.

Pattern ki pehchaan karte waqt, volume ka bhi dhyan rakhna zaroori hai. Pehli aur dusri peak ke dauran volume high hota hai, lekin jab market breakout hota hai to volume low hota hai. Is pattern ke identify karne ke liye traders ko price movements aur volume trends ko closely monitor karna padta hai.

Double Top Pattern ki pehchaan karne ke liye chart patterns aur technical indicators ka use kiya jata hai. Traders ko chahiye ke wo multiple timeframes ko analyse karein aur pattern ke validity ko confirm karein. Yeh approach traders ko false signals aur inaccurate predictions se bachati hai.

Traders jo Double Top Pattern ko accurately identify kar lete hain, wo market ke reversal points ko timely detect kar sakte hain. Isse unhe profitable trading opportunities milti hain aur risk management strategies ko implement karna aasan hota hai.

3. Pehla Peak

Double Top Pattern ka pehla peak market ke strong uptrend ko indicate karta hai. Jab price is peak ko touch karti hai, to yeh resistance level ko signify karta hai jo market ne achieve kiya hai. Pehla peak banane ke baad, market kuch waqt ke liye niche aati hai, jo ki dip ka formation hota hai.

Pehla peak ka formation market ki strength aur bullish sentiment ko show karta hai. Jab price pehla peak banati hai, to traders ko is level par resistance ka signal milta hai. Pehla peak pattern ke beginning ko define karta hai aur iska analysis subsequent price movements ke liye important hota hai.

Is peak ke analysis se traders ko market ke potential reversal points ka idea milta hai. Jab pehla peak ban jata hai aur market niche aati hai, to yeh ek temporary correction hota hai jo ke market ke overall trend ko impact karta hai. Pehla peak ke baad, traders market ke next moves aur potential reversal points ko monitor karte hain.

Pehla peak ke formation aur market ke response ko analyse karna crucial hota hai. Yeh analysis market ke future trends aur price movements ko predict karne mein madad karta hai. Pehla peak ke baad jab market niche aati hai, to traders ko yeh dekhna hota hai ki kya market ek similar peak banane wali hai ya nahi.

Pehla peak ka accurate identification trading decisions ke liye zaroori hai. Traders jo is peak ko sahi se identify kar lete hain, wo market ke potential reversals ko timely detect kar sakte hain aur apne trading strategies ko accordingly adjust kar sakte hain.

4. Dip

Double Top Pattern ke pehle peak ke baad jo dip banta hai, wo market ki temporary correction ko show karta hai. Yeh dip price ke short-term decline ko indicate karta hai jo ki pattern ke formation ke liye zaroori hota hai. Dip ka size aur duration market ke volatility aur strength ko reflect karta hai.

Dip ke analysis se traders ko market ke reaction aur price movements ka idea milta hai. Jab market pehla peak complete kar leti hai aur niche aati hai, to yeh ek sign hota hai ki market temporary correction ke phase mein hai. Dip ka formation pattern ke overall validity ko confirm karta hai aur traders ko next moves predict karne mein madad karta hai.

Dip ke dauran market ke volume aur price fluctuations ko closely monitor karna zaroori hai. Jab market dip mein hoti hai, to volume kam hota hai aur price movements slow ho sakte hain. Is phase ko analyse karke traders ko yeh samajhna hota hai ki market ki strength aur momentum kaisa hai.

Dip ke baad jab market dusra peak banati hai, to yeh pattern ki confirmation ko indicate karta hai. Traders ko chahiye ke wo is dip ke baad ke price movements ko carefully observe karein aur market ke potential reversals ko detect karein.

Dip ka role pattern ke overall effectiveness aur accuracy ko determine karta hai. Traders jo dip ke analysis ko accurately perform karte hain, wo market ke trend changes ko timely identify kar sakte hain aur profitable trading decisions le sakte hain.

5. Dusra Peak

Double Top Pattern ka dusra peak pehla peak ke similar level par banta hai aur yeh pattern ke completion ko indicate karta hai. Dusra peak ka formation market ke resistance level ko confirm karta hai aur pattern ki validity ko support karta hai. Jab dusra peak ban jata hai, to yeh bearish reversal ka signal hota hai.

Dusra peak market ke resistance level ko confirm karta hai aur iske analysis se traders ko market ke potential reversal points ka idea milta hai. Dusra peak pehla peak ke height ke aspaas hota hai aur isse market ke resistance level ka confirmation hota hai.

Dusra peak ke baad market ke volume aur price movements ko closely monitor karna zaroori hota hai. Volume analysis se traders ko yeh samajhna hota hai ki kya market mein strength aur momentum banayi rakhne ki capacity hai ya nahi. Dusra peak ka role pattern ki confirmation aur accuracy ko determine karta hai.

Dusra peak ke analysis ke baad, traders ko market ke breakout points ko dekhna hota hai. Jab price dusre peak ke level ko break karti hai aur niche aati hai, to yeh bearish signal hota hai jo ki trading decisions ke liye important hota hai.

Dusra peak ki accurate identification aur analysis trading strategies ke liye zaroori hai. Traders jo dusra peak ko sahi se identify kar lete hain, wo market ke reversal points ko timely detect kar sakte hain aur apne trades ko accordingly adjust kar sakte hain.

6. Pattern Ki Confirmation

Double Top Pattern ki confirmation us waqt hoti hai jab market dusre peak ke baad niche aati hai aur dip ke level ko break karti hai. Yeh point pattern ke completion aur bearish signal ka confirmation hota hai. Pattern ki confirmation market ke future movements aur trading decisions ke liye crucial hota hai.

Pattern ki confirmation ke liye price movements aur volume trends ko closely monitor karna zaroori hota hai. Jab price breakout hota hai aur dip ke level ko break karti hai, to yeh bearish reversal ka clear signal hota hai. Traders ko is point ko carefully observe karna chahiye aur apne trading decisions ko accordingly adjust karna chahiye.

Confirmation ke liye traders ko multiple timeframes ko analyse karna chahiye aur pattern ke validity ko check karna chahiye. Yeh approach traders ko false signals aur inaccurate predictions se bachati hai aur trading decisions ko optimize karti hai.

Pattern ki confirmation ke baad, traders ko target price aur stop loss levels ko set karna chahiye. Yeh levels market ke reversal points aur price movements ko consider karke set kiye jate hain aur trading strategies ko implement karne mein madad karte hain.

Pattern ki confirmation aur trading decisions ke beech ka connection market ke overall trends aur price movements ko reflect karta hai. Traders jo pattern ko accurately confirm kar lete hain, wo market ke potential reversals ko timely detect kar sakte hain aur apne trading strategies ko improve kar sakte hain.

7. Volume Ka Role

Double Top Pattern ke analysis mein volume ka role important hota hai. Pehli aur dusri peak ke dauran volume high hota hai, lekin jab market breakout hota hai to volume low hota hai. Volume trends market ke strength aur momentum ko indicate karte hain aur pattern ki confirmation ko support karte hain.

Pehle aur dusre peak ke dauran high volume indicate karta hai ki market mein strength aur interest bana hua hai. Lekin jab price breakout hota hai aur dip ke level ko break karti hai, to volume ka low hona bearish reversal ka signal hota hai. Volume ka analysis pattern ke accuracy aur effectiveness ko determine karta hai.

Volume ka role market ke price movements aur trends ko reflect karta hai. Jab volume high hota hai, to market ke movements zyada significant aur reliable hote hain. Volume analysis se traders ko market ke strength aur momentum ka idea milta hai jo ki trading decisions ke liye crucial hota hai.

Volume ka analysis karte waqt traders ko market ke overall trends aur price movements ko consider karna chahiye. Yeh approach traders ko volume-based trading strategies ko implement karne mein madad karti hai aur market ke fluctuations ko better understand karne mein help karti hai.

Volume ka accurate analysis trading strategies ke effectiveness ko enhance karta hai. Traders jo volume trends ko sahi se analyse karte hain, wo market ke potential reversals aur price movements ko timely detect kar sakte hain aur apne trades ko accordingly adjust kar sakte hain.

8. Target Price Calculation

Double Top Pattern ke breakout ke baad, target price calculate karna important hota hai. Target price usually peak se breakout level tak ke distance ko measure karke nikalte hain aur usse niche subtract karte hain. Yeh calculation market ke potential movements aur trading decisions ke liye crucial hota hai.

Target price calculation ke liye traders ko pattern ke peaks aur dip ke levels ko accurately measure karna padta hai. Yeh measurement market ke future movements aur price levels ko predict karne mein madad karta hai. Target price calculation se traders ko clear trading goals aur objectives set karne mein help milti hai.

Traders ko target price calculation ke dauran market ke volatility aur overall trends ko consider karna chahiye. Yeh approach target price ke accuracy aur effectiveness ko enhance karti hai aur trading decisions ko optimize karti hai. Target price calculation se traders ko risk management strategies ko implement karne mein madad milti hai.

Calculation ke baad, traders ko apne trading strategies ko target price aur stop loss levels ke basis par adjust karna chahiye. Yeh adjustment market ke movements aur price fluctuations ko consider karke kiya jata hai aur trading decisions ko improve karta hai.

Target price calculation aur trading strategies ke beech ka connection market ke future trends aur price movements ko reflect karta hai. Traders jo target price calculation ko accurately perform karte hain, wo market ke potential reversals aur profitable trading opportunities ko timely detect kar sakte hain.

9. Stop Loss Ka Istemaal

Double Top Pattern ke trading mein stop loss ka istemaal zaroori hai. Stop loss ko usually dusre peak ke upar set kiya jata hai, taake agar market galat direction mein chale to losses kam ho sakein. Stop loss ek risk management tool hai jo traders ko unexpected price movements se bachata hai.

Stop loss ka istemaal trading decisions ko optimize karta hai aur market ke fluctuations ko control karta hai. Jab market double top pattern ke breakout ke baad expected direction mein nahi chalti, to stop loss traders ko unnecessary losses se bachata hai. Yeh risk management strategy trading ke success ke liye crucial hoti hai.

Traders ko stop loss levels ko market ke volatility aur price movements ke basis par set karna chahiye. Yeh approach stop loss ke effectiveness aur accuracy ko enhance karti hai aur trading decisions ko improve karti hai. Stop loss ka accurate placement trading strategies ko successful banata hai.

Stop loss ke placement ke dauran traders ko pattern ke peaks aur dip ke levels ko consider karna chahiye. Yeh consideration stop loss ke effectiveness ko determine karta hai aur market ke potential reversals ko timely detect karne mein madad karta hai. Stop loss ka proper use risk management strategies ko optimize karta hai.

Stop loss aur trading strategies ke beech ka connection market ke overall trends aur price movements ko reflect karta hai. Traders jo stop loss ka effective use karte hain, wo market ke fluctuations ko control kar sakte hain aur apne trades ko profitable bana sakte hain.

10. Trading Strategies

Double Top Pattern ke trading strategies mein breakout ke baad entry lena aur target price aur stop loss ke basis par trading karna shamil hai. Yeh strategies market ke potential reversals aur price movements ko consider karte hain aur trading decisions ko optimize karte hain.

Breakout ke baad entry lene se traders ko market ke bearish phase ke opportunities milti hain. Entry points ko accurate identify karna aur market ke trends ko monitor karna zaroori hai. Yeh approach traders ko profitable trading opportunities detect karne mein madad karti hai.

Target price aur stop loss levels ko set karna trading strategies ke liye crucial hota hai. Target price calculation aur stop loss placement ke basis par trading strategies ko adjust kiya jata hai. Yeh adjustment market ke movements aur price fluctuations ko consider karte hain aur trading decisions ko improve karte hain.

Trading strategies ko implement karte waqt traders ko market ke overall trends aur patterns ko monitor karna chahiye. Yeh approach trading strategies ke effectiveness ko enhance karti hai aur market ke fluctuations ko better understand karne mein help karti hai. Trading strategies ko continuously update karna zaroori hai.

Effective trading strategies market ke potential reversals aur price movements ko timely detect karne mein madad karti hain. Traders jo accurate strategies ko implement karte hain, wo market ke bearish phase ka faida utha sakte hain aur apne trades ko profitable bana sakte hain.

11. Common Mistakes

Double Top Pattern ke analysis mein kuch common mistakes hoti hain jo trading decisions ko impact karti hain. Traders aksar pattern ko galat identify kar dete hain ya uski confirmation ko ignore kar dete hain. Yeh mistakes trading strategies ko ineffective bana sakti hain aur market ke reversals ko miss karne ka risk hota hai.

Pattern ke analysis mein common mistakes include incorrect peak identification aur false signals ko ignore karna. Jab traders pehle aur dusre peak ki height ko accurately measure nahi karte, to yeh pattern ki validity ko affect karta hai. Iske alawa, market ke sudden changes aur fluctuations ko bhi nazar andaz kiya jata hai jo galat trades lead kar sakti hain.

Traders ko chahiye ke wo pattern ke formation aur confirmation ko accurately identify karein aur volume trends ko consider karein. Yeh approach common mistakes ko avoid karti hai aur trading decisions ko optimize karti hai. Pattern ke analysis mein discipline aur practice ki zaroorat hoti hai.

Common mistakes ko avoid karne ke liye, traders ko technical analysis aur market trends ka thorough knowledge hona chahiye. Yeh knowledge false signals aur inaccurate predictions se bachati hai aur trading decisions ko improve karti hai. Accurate analysis aur monitoring se trading strategies ko successful banaya ja sakta hai.

Pattern ki identification aur confirmation mein accuracy ko maintain karna zaroori hai. Traders jo common mistakes ko avoid kar lete hain, wo market ke potential reversals ko timely detect kar sakte hain aur apne trades ko profitable bana sakte hain.

12. Market Conditions

Double Top Pattern ka effectiveness market conditions par depend karta hai. Yeh pattern high volatility aur strong uptrend ke baad zyada useful hota hai. Market conditions pattern ke formation aur validity ko impact karti hain aur trading decisions ko influence karti hain.

High volatility markets mein Double Top Pattern zyada effective hota hai kyunki price movements clear aur predictable hote hain. Strong uptrend ke baad pattern ka formation market ke reversal points ko indicate karta hai aur traders ko bearish phase ka signal deta hai. Market conditions ko analyse karke traders accurate predictions kar sakte hain.

Market ke conditions ko consider karte waqt traders ko pattern ke validity aur accuracy ko evaluate karna chahiye. Yeh evaluation market ke fluctuations aur price movements ko reflect karta hai aur trading decisions ko optimize karta hai. Market conditions ke analysis se trading strategies ko adjust kiya ja sakta hai.

Market ke overall trends aur patterns ko monitor karna zaroori hai. Yeh monitoring trading decisions ko improve karti hai aur market ke potential reversals ko timely detect karne mein madad karti hai. Market conditions ke analysis se traders ko effective trading strategies implement karne mein help milti hai.

Market conditions aur Double Top Pattern ke beech ka connection trading strategies aur trading decisions ko reflect karta hai. Traders jo market conditions ko accurately evaluate karte hain, wo market ke bearish phase ka faida utha sakte hain aur apne trades ko profitable bana sakte hain.

13. Alternatives

Double Top Pattern ke alawa, traders aur bhi reversal patterns jaise ke Head and Shoulders pattern ko consider kar sakte hain. Yeh alternatives bhi market ke reversal points aur price movements ko identify karne mein madad karte hain. Alternatives ka analysis traders ko diverse trading strategies ko explore karne mein help karta hai.

Head and Shoulders pattern ek popular reversal pattern hai jo market ke trend changes ko indicate karta hai. Yeh pattern bhi Double Top Pattern ki tarah market ke potential reversals ko detect karta hai aur trading decisions ko optimize karta hai. Alternatives ka use karke traders market ke different scenarios ko handle kar sakte hain.

Trading strategies ko diverse patterns ke basis par develop karna zaroori hai. Yeh diverse patterns trading decisions ko improve karte hain aur market ke fluctuations ko better understand karne mein help karte hain. Alternatives ka analysis market ke overall trends aur price movements ko reflect karta hai.

Alternatives ke use se traders ko market ke different phases aur price movements ka idea milta hai. Yeh idea trading strategies ko optimize karta hai aur market ke potential reversals ko timely detect karne mein madad karta hai. Traders ko chahiye ke wo multiple patterns aur strategies ko explore karein.

Alternatives aur diverse patterns ka analysis trading decisions aur strategies ke effectiveness ko enhance karta hai. Traders jo different patterns ko accurately analyse karte hain, wo market ke potential reversals ko timely detect kar sakte hain aur apne trades ko profitable bana sakte hain.

14. Conclusion

Double Top Pattern ek important technical analysis tool hai jo market ke trend reversal ko identify karne mein madad karta hai. Pattern ko sahi tarike se samajhna aur implement karna zaroori hai taake trading decisions ko optimize kiya ja sake. Pattern ke accurate analysis aur confirmation se traders market ke bearish phase ko anticipate kar sakte hain aur apne trades ko accordingly adjust kar sakte hain.

Double Top Pattern ke analysis mein pehla peak, dip, aur dusra peak ke formation ko accurately identify karna zaroori hai. Pattern ki confirmation aur volume trends ke analysis se traders ko market ke potential reversals ka idea milta hai. Target price aur stop loss levels ko set karna trading strategies ke liye crucial hota hai.

Traders ko common mistakes ko avoid karna chahiye aur market conditions aur alternatives ko consider karna chahiye. Yeh approach trading decisions ko optimize karti hai aur market ke fluctuations ko better understand karne mein help karti hai. Accurate pattern analysis aur effective trading strategies market ke potential reversals ko timely detect karne mein madad karti hain.

Double Top Pattern ke comprehensive analysis se traders ko profitable trading opportunities milti hain aur risk management strategies ko implement karna aasan hota hai. Pattern ko samajhne aur implement karne se trading success ko achieve kiya ja sakta hai aur market ke bearish phase ka faida utha sakte hain. -

#11 Collapse

### Double Top Pattern Kya Hai?

Double top pattern ek bearish reversal pattern hai jo technical analysis mein kaafi important hai. Yeh pattern tab banta hai jab price do baar ek hi resistance level par pahunchti hai aur phir neeche girti hai. Is pattern ko samajhna aur iski pehchan karna traders ke liye crucial hota hai, kyun ke yeh market ke reversal ka signal deta hai.

#### Pattern Ki Pehchan

Double top pattern do peaks ya tops se milkar banta hai, jo ek horizontal resistance line ko touch karte hain. Is pattern ki formation tab hoti hai jab price pehli baar resistance level ko todne ki koshish karti hai, lekin successful nahi hoti. Phir price thoda girti hai aur dusri baar resistance level tak pahunchti hai, lekin yeh bhi failure ka shikaar hoti hai. Is tarah, traders ko is pattern se signal milta hai ke market bullish momentum khatam ho raha hai.

#### Pattern Ki Stages

1. **First Peak (Top)**: Jab price pehli baar resistance level ko touch karti hai, yeh pehli peak hoti hai. Is point par buyers ka pressure hota hai, lekin sellers bhi active hote hain.

2. **Pullback**: Pehli peak ke baad price neeche girti hai. Yeh pullback price ko support level tak le ja sakta hai, jo traders ke liye buying opportunity bana sakta hai.

3. **Second Peak (Top)**: Price phir se upar jaakar same resistance level par pahunchti hai, jo dusri peak hoti hai. Yeh peak pehli peak se thodi kam ya barabar ho sakti hai.

4. **Neckline**: Do peaks ke beech jo support level banta hai, usse neckline kaha jata hai. Jab price is neckline ko todti hai, to yeh bearish confirmation ka signal hota hai.

#### Trading Strategy

Double top pattern ko trade karne ke liye kuch important steps hain:

1. **Pattern Ki Pehchan**: Sab se pehle, aapko pattern ko identify karna hoga. Aapko do clear peaks dekhne chahiye jo ek horizontal resistance line ko touch karte hain.

2. **Confirmation Ka Wait Karna**: Jab price neckline ko todti hai, to yeh ek strong sell signal hota hai. Is point par traders short positions open karte hain.

3. **Stop-Loss Set Karna**: Risk management ke liye, aapko stop-loss order set karna chahiye. Yeh order pehli peak ke thoda upar hona chahiye taake aapko unexpected market movements se bachne mein madad mile.

4. **Profit Targets**: Profit targets set karne ke liye, aap double top pattern ki height ko measure kar sakte hain. Is height ko neckline se ghirne ke baad target price tak le jaakar, aapko potential profit level milta hai.

#### Conclusion

Double top pattern trading mein ek powerful tool hai jo market reversal ka indication deta hai. Is pattern ki sahi pehchan aur trading strategy se, traders profitable trades hasil kar sakte hain. Lekin, hamesha yaad rakhein ke kisi bhi pattern ka istemal karte waqt risk management aur market analysis bohot zaroori hai. Is tarah, aap double top pattern ko apni trading strategy mein shamil karke successful trader ban sakte hain.

-

#12 Collapse

Double top pattern forex trading mein ek bara mashhoor aur effective chart pattern hai jo aksar trend reversal ko indicate karta hai. Yeh pattern tab banta hai jab price ek specific level tak doh dafa pohanchti hai lekin uspe sustain nahi kar paati aur wapis neeche girti hai. Yeh pattern do highs banata hai jo approx same level par hote hain, aur in dono highs ke beech mein ek naya low bhi banta hai. Aksar yeh bearish reversal ka sign hota hai, aur agar sahi tareeke se pehchan liya jaye, toh traders ko ek profitable exit ka mauka mil sakta hai ya phir short-selling ka option milta hai. Double top pattern mein do high points hote hain jo ek doosre ke qareeb hote hain, aur unke beech mein ek neeche ka point hota hai, jisay hum neckline kehte hain. Yeh neckline ek support level ko represent karta hai, aur jab price is support level ko break karti hai toh yeh signal hota hai ke price aur neeche ja sakti hai.

Double top ka pattern usually bullish trend ke baad banta hai, jo indicate karta hai ke market mein buyers ki demand ya momentum ab kam ho rahi hai. Iska matlab yeh hai ke ab buyers market mein itne interested nahi hain, aur sellers ab dominate kar rahe hain.

Double Top Pattern ka Structure

Double top pattern ka structure kuch iss tarah hota hai:- First Peak (Pehla High): Price bullish trend mein upper side ki taraf move karti hai aur pehla high point banati hai. Yeh high point aksar ek resistance level hota hai.

- Pullback (Retracement): Pehla high banne ke baad price niche aati hai aur ek temporary pullback ya retracement karti hai. Yeh pullback neckline ke kareeb pohanchta hai jo support level hai.

- Second Peak (Doosra High): Price dobara move karti hai aur pehle high ke aas paas ka level touch karti hai lekin uspe sustain nahi kar paati aur wapis neeche girti hai. Yeh doosra high banata hai, jo ke almost pehle high ke equal hota hai.

- Neckline Break: Doosre high ke baad price wapas neeche neckline ki taraf move karti hai. Jab price neckline ya support level ko break karti hai, toh yeh confirmation hota hai ke bearish trend start ho sakta hai aur price aur neeche gir sakti hai.

Double top pattern ko pehchan'ne ke liye kuch specific cheezon ka dhyan rakhna chahiye:- Same Level ke Highs: Pehla aur doosra high almost ek hi level par hone chahiyein. Agar in dono highs ke beech mein bara difference ho, toh yeh double top pattern nahi banega.

- Neckline as Support Level: Dono highs ke beech mein jo lowest point hota hai, woh neckline banata hai. Yeh neckline support level hoti hai jo ke price ke neeche jane ki confirmation ke liye zaroori hai.

- Volume Confirmation: Jab price neckline break karti hai toh volume mein bhi ek increase hona chahiye. Yeh confirmation deta hai ke price ab lower trend mein jaa sakti hai.

Double top pattern aksar trend reversal ka indication hota hai, lekin yeh hamesha 100% accurate nahi hota. Market mein kai baar false signals bhi ho sakte hain. Lekin jab yeh pattern sahi tareeke se banta hai, toh yeh indicate karta hai ke bullish trend ab end hone wala hai aur bearish trend start ho sakta hai.

Is pattern ke baad jab price niche neckline ko break karti hai toh traders aksar short position enter karte hain ya apni long positions ko exit karte hain. Yeh isliye ke bearish trend ke start hone ka ek strong signal hota hai, aur price aksar neeche ki taraf move karti hai.

Forex Trading mein Double Top Pattern ka Asar

Forex trading mein double top pattern kaafi useful hai kyunke yeh ek strong resistance level ka indication deta hai. Agar aap dekhein ke koi specific currency pair double top pattern banata hai, toh iska matlab yeh ho sakta hai ke us currency ki demand ab kam ho rahi hai aur price ab neeche ki taraf ja sakti hai.

Double top pattern forex market mein mostly short-term ya medium-term reversals indicate karta hai. Yeh pattern market ke psychology ko bhi show karta hai, kyunke jab pehla high banta hai toh market mein buying pressure hota hai lekin doosre high par market ke participants ko lagta hai ke price aur nahi barh sakti. Yeh sellers ke pressure ko indicate karta hai jo market mein ab dominate kar rahe hain.

Double Top Pattern se Trading Strategies

Double top pattern ko forex trading mein alag alag strategies ke saath use kiya ja sakta hai. Kuch strategies kuch is tarah hain:

1. Entry Point

Entry point ke liye aap neckline ke break hone ka wait kar sakte hain. Jab price neckline ko break karti hai aur neeche close hoti hai, toh yeh confirmation hota hai ke bearish trend start ho gaya hai. Aap is point par short position enter kar sakte hain.

2. Stop Loss Placement

Stop loss lagana trading mein kaafi zaroori hai. Double top pattern ke case mein, aap stop loss ko doosre high ke thoda sa upar place kar sakte hain. Agar price wapas high ko cross kar le toh iska matlab yeh ho sakta hai ke pattern fail ho gaya hai aur trend wapas bullish ho sakta hai.

3. Take Profit Target

Take profit target ke liye aap height of pattern ko measure kar sakte hain, jo pehle high aur neckline ke beech ka difference hota hai. Is distance ko neckline ke break point se neeche measure kar ke aap apna profit target set kar sakte hain.

4. Risk Management

Risk management ko hamesha apni priority mein rakhna chahiye. Forex market mein double top pattern aksar kaam karta hai lekin kabhi kabhar yeh pattern fail bhi ho sakta hai. Isliye apne risk ko hamesha control mein rakhein aur over-leveraged trading na karein.

Double Top Pattern mein Common Mistakes jo Avoid Karni Chahiyein

Double top pattern mein kuch common mistakes bhi hoti hain jo aksar traders karte hain. In mistakes ko avoid karna chahiye:- Confirmation ke Baghair Trade Karna: Aksar traders bina confirmation ke hi trade enter kar lete hain. Jab tak neckline break na ho, tab tak trade nahi karni chahiye.

- Volume ka Dhyan Na Rakhna: Jab price neckline break karti hai, toh volume mein increase hona chahiye. Agar volume increase nahi ho raha toh yeh signal weak ho sakta hai.

- Stop Loss Ka Baghair Trade Karna: Forex market highly volatile hoti hai aur kabhi kabhar unexpected movements bhi ho sakti hain. Isliye hamesha stop loss ke saath trade karein.

Double top pattern forex market mein ek acha reversal signal provide karta hai. Is pattern ka faida yeh hai ke yeh trend ke weak hone ka indication deta hai aur traders ko profitable exit ya new entry ka signal provide karta hai. Forex market mein yeh pattern kaafi useful hai kyunke yeh price ke resistance level aur bearish pressure ko highlight karta hai.

Iska ek aur faida yeh hai ke yeh simple aur visually identifiable pattern hai. Har trader, chaahe woh experienced ho ya beginner, double top pattern ko aasan tareeke se identify kar sakta hai aur apni trading strategy mein use kar sakta hai. Forex trading mein double top pattern ek effective aur kaafi reliable chart pattern hai jo ke bearish reversal ka indication deta hai. Yeh pattern trading ke decisions ko aur behtar banata hai aur traders ko profitable opportunities provide karta hai. Lekin is pattern ko use karte waqt kuch specific rules ka dhyan rakhna chahiye, jaise ke neckline break hone ka wait karna, volume confirmation ka dhyan rakhna, aur risk management. Agar yeh sab cheezen sahi tareeke se apply ki jaayein toh double top pattern ek beneficial tool sabit ho sakta hai forex trading mein.

Is pattern ko identify karna aur apni trading strategy mein use karna asaan hai, lekin hamesha market ke sentiment aur volume ka bhi analysis karna zaroori hai. Double top pattern ke sath sath aur bhi analysis tools aur indicators ko combine karke forex trading mein aur bhi effective strategies banayi ja sakti hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#13 Collapse

Double Top Pattern Kya Hai?

Double Top pattern ek popular price reversal pattern hai jo aksar technical analysis mein use hota hai. Yeh pattern aksar un chart mein dekha jata hai jahan price ek high bana kar phir thoda neeche jata hai, aur phir dusra high bana kar phir se neeche jata hai. Is pattern ko bullish trend ke baad dekha jata hai, jab market mein upward movement hoti hai. Double top pattern market ke reversal ko indicate karta hai, jisme price ka upward trend peak kar ke neeche girta hai.

Double Top Ka Structure

Double Top pattern ka structure do distinct peaks (high points) se bana hota hai. Pehla peak price ka high point hota hai, aur phir price thoda neeche jata hai. Dusra peak pehla peak ke aas paas ya usse thoda neeche hota hai. Dono peaks ke beech mein ek valley (low point) hota hai, jo price ke neeche jata hai. Jab dusra peak ban jata hai aur price uske baad neeche girta hai, to yeh confirm hota hai ke double top pattern complete ho gaya hai. Is pattern ka sabse important element yeh hai ke yeh ek reversal signal hai, jo bullish trend ke baad market ke downward movement ko predict karta hai.

Double Top Ki Identification

Double Top pattern ko identify karna thoda tricky ho sakta hai, lekin agar aap chart ko dhyan se dekhein to yeh easily samajh mein aa jata hai. Pehle, aapko ek strong upward trend dekhna hoga. Jab price apne high ko break karne ke baad neeche jata hai, to phir price dusra high bana kar phir neeche girta hai. Is pattern mein do similar peaks hote hain, jo ek dusre ke aas paas hote hain. Jab price neeche girta hai, to is point ko "neckline" kaha jata hai. Jab price neckline ke neeche girta hai, to yeh pattern confirm hota hai aur yeh sell signal generate karta hai.

Double Top Ke Liye Trading Strategy

Double Top pattern ko trading mein use karne ke liye, traders aksar price ke neckline ke neeche break hone ka wait karte hain. Jab price neckline ke neeche jata hai, to yeh market ka reversal signal hota hai, aur traders apne trades ko short kar lete hain. Stop loss ko pehle peak ke thoda upar rakha jata hai taake market agar galat direction mein jaye to loss na ho. Target price ko pehle peak se neckline tak ke distance ke barabar rakha jata hai, taki price jab tak downward movement mein rahe, tab tak profit kamaya ja sake.

Ek aur strategy yeh hai ke jab price neckline ke neeche break kare, to traders apne entry point ko thoda time ke liye hold kar sakte hain aur phir momentum ke sath trade ko chala sakte hain. Yeh strategy tab kaam karti hai jab market mein strong bearish trend ho.

Double Top Ki Reliability

Double Top pattern ko reliability ke liye assess karte waqt kuch factors ko dhyan mein rakhna zaroori hota hai. Sabse pehle, pattern ka size aur clearity dekhein. Agar dono peaks bohot clear aur equal height ke hote hain, to yeh pattern zyada reliable hota hai. Dusra factor volume hai. Agar volume first peak ke comparison mein dusre peak ke waqt zyada ho, to yeh market mein zyada interest aur confirmation deta hai ke reversal ho sakta hai.

Lekin, kabhi kabhi market mein false breakouts bhi hote hain, jisme price neckline ke neeche jata hai lekin wapas upar chala jata hai. Isliye, risk management kaafi zaroori hai jab aap double top pattern ko trade karte hain. Stop loss ko zaroori jagah par set karein aur apni trade ko monitor karte rahiye.

Double Top Ka Use Kaha Kiya Jata Hai?

Double Top pattern aksar Forex aur stock market trading mein use hota hai. Forex mein, jab kisi currency pair ki price long time tak upward movement kar rahi hoti hai, to traders double top pattern ke through downward reversal ko predict karte hain. Stocks mein bhi jab kisi company ka stock price high level tak pohanchta hai, to yeh pattern signal deta hai ke stock ki price ab neeche gir sakti hai.

Double Top pattern ko commodities aur indices trading mein bhi use kiya jata hai. Jab kisi commodity ki price high level pe pohanchti hai aur phir wo thoda neeche jati hai, to yeh pattern traders ko market ke downward movement ka indication deta hai.

Double Top Pattern Ki Limitations

Jese har pattern ki limitations hoti hain, waise hi double top pattern bhi perfect nahi hota. Kabhi kabhi market mein false signals generate hote hain, aur pattern ko incorrectly identify kiya jata hai. Agar pattern clear nahi hai, ya market mein momentum weak hai, to double top pattern reliable nahi hota. Isliye, is pattern ko trade karte waqt hamesha risk management ka dhyan rakhein aur dusre indicators ka bhi use karein, jaise moving averages, RSI (Relative Strength Index), aur MACD (Moving Average Convergence Divergence), taake aapko trade mein zyada confidence ho.

Conclusion

Double Top pattern ek useful aur effective tool hai jo traders ko market ke reversal ke baare mein bata sakta hai. Yeh pattern typically bullish trend ke baad dekha jata hai, aur jab price second high bana kar neeche girta hai, to yeh market ke downward movement ka signal hota hai. Double top pattern ka use karte waqt, aapko price action, volume, aur risk management ko dhyan mein rakhna hoga taake aapke trades zyada profitable ho sakein. Har pattern ki tarah, double top pattern bhi hamesha 100% accurate nahi hota, isliye aapko apni trading strategies ko continually evaluate karna zaroori hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#14 Collapse

**What Is The Double Top Pattern?**

Trading mein chart patterns ka kaafi important role hota hai, kyunki ye market ke future price movements ko predict karne mein madad karte hain. Ek aisa pattern jo aksar traders ke liye helpful sabit hota hai, woh hai **Double Top Pattern**. Yeh pattern aksar market mein trend reversal ko indicate karta hai, khas taur par jab ek bullish trend change ho kar bearish ho jata hai. Aaj hum jaanenge ke **Double Top Pattern** kya hota hai, isko kaise pehchana jata hai, aur yeh aapke trading strategy mein kaise use kiya ja sakta hai.

### Double Top Pattern Kya Hai?

Double Top ek technical chart pattern hai jo market mein reversal signal deta hai. Yeh pattern tab banta hai jab price do baar ek hi level par pahuchti hai, lekin har baar uspe break nahi kar pati. Is pattern ko "M Pattern" bhi kaha jata hai, kyunki yeh do peaks ki tarah dikhta hai, jo ek doosre ke baad hoti hain.

Double Top pattern tab banta hai jab price pehli baar apna peak banata hai (Top 1), phir thoda niche aati hai, aur phir dubara apni purani high ko touch karne ki koshish karti hai (Top 2). Agar price second time bhi us level ko break nahi kar pati aur neeche gir jati hai, toh yeh pattern complete ho jata hai aur bearish reversal signal deta hai.

### Double Top Pattern Ka Structure

Double Top pattern ke structure ko samajhna zaroori hai:

1. **Top 1**: Pehli baar price market mein high point tak pahuchti hai.

2. **Pullback**: Uske baad price thodi neeche girti hai, aur ek consolidation phase hota hai.

3. **Top 2**: Dusri baar price pehli baar wali high ko test karti hai, lekin agar yeh level break nahi hota, toh price niche girne lagti hai.

4. **Breakdown**: Jab price neeche jati hai aur previous low ko break karti hai, tab pattern complete hota hai aur bearish trend start ho jata hai.

### Double Top Pattern Ka Significance

Double Top pattern ek trend reversal signal deta hai, jo aksar bullish trend ke baad banta hai. Jab yeh pattern complete ho jata hai, toh market mein selling pressure badhne lagta hai aur price neeche girne lagti hai. Yeh pattern traders ko batata hai ke bullish trend khatam ho gaya hai aur bearish trend shuru ho sakta hai. Isliye, double top pattern ko pehchan kar aap timely entry aur exit decisions le sakte hain.

### Double Top Pattern Ko Pehchanna

Double Top pattern ko pehchanne ke liye kuch important factors hain:

1. **Price Resistance**: Pehli baar jab price high point tak pahuchti hai, toh yeh resistance level ban jata hai. Agar second time bhi price us level ko break nahi kar pati, toh yeh confirmation hota hai ke double top pattern ban raha hai.

2. **Volume**: Volume ka analysis bhi zaroori hota hai. Agar second peak (Top 2) pe volume kam hota hai, toh yeh ek strong signal hai ke market mein buying momentum weak ho gaya hai aur price neeche ja sakti hai.

3. **Neckline Break**: Double Top pattern complete hone ke baad, jab price pullback ke baad neckline (jo pehli low level hota hai) ko break karti hai, toh yeh confirmation hota hai ke bearish trend start ho gaya hai.

### Double Top Pattern Ko Trading Mein Kaise Use Karein?

1. **Entry Point**: Jab double top pattern complete ho jata hai, aur price neckline level ko break kar deti hai, toh yeh entry ka acha point hota hai. Aap sell position open kar sakte hain.

2. **Stop Loss**: Aap apni trade ko manage karte waqt, top 2 ke thoda upar stop loss laga sakte hain, taake agar market reverse ho jaaye toh aapka loss limited rahe.

3. **Target Level**: Target price ko calculate karte waqt, aap previous height se neckline tak ka distance measure kar sakte hain. Yeh distance aapke target level ko indicate karta hai.

### Conclusion

Double Top pattern ek powerful bearish reversal pattern hai, jo aapko market mein trend reversal ko pehchanne mein madad karta hai. Jab yeh pattern complete hota hai, toh yeh ek strong signal deta hai ke price ne apna upward trend khatam kar liya hai aur downward move shuru ho sakta hai. Agar aap is pattern ko accurately pehchan kar trading mein apply karte hain, toh aap apni entry aur exit points ko effectively optimize kar sakte hain. Hamesha yaad rakhein ke double top pattern ko volume analysis aur other indicators ke saath combine karke zyada accurate results hasil kiye ja sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:45 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим