Risk-Reward Ratio In Forex

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Risk-Reward Ratio In Forex -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Understanding Risk-Reward Ratio Forex trading mein risk-reward ratio ko safaltapoorvak manage karna trading ka aik ahem pehlu hai. Ye ratio traders ko maqool faislay karne aur potential nuksan ko control karne mein madadgar hota hai. Forex trading mein risk-reward ratio ek trade mein hone wale potential munafa aur potential nuksan ka aik measurement hota hai. Aam taur par isay aik ratio ke tor par bayan kiya jata hai, jaisay 1:2 ya 1:3, jahan pehla number potential risk ko darust karta hai, aur doosra number potential munafa ko. Misal ke tor par, aik 1:2 risk-reward ratio ka matlab hai ke aap taiyar hain apne trading capital ka 1% risk lene ke liye taa'qub me 2% munafa hasil karne ke liye. Importance of a Balanced Ratio Aik barabar risk-reward ratio qaim rakhna kai wajahat se ahem hai. Pehli bat, ye risk management ke liye ahem hai. Forex trading mein risk apne aap mein shamil hoti hai, aur nuksan to lazmi hai. Aik faida-mand risk-reward ratio ye tagheer karta hai ke aapke potential nuksan ko had se zyada hone se bachata hai aur control mein rakhta hai. Ye khaas tor par ahem hai kyun ke aik aik bara nuksan aapke trading capital ko bari had tak mutasir kar sakta hai aur aapke phir se qayam hasil karne ki salahiyat ko mad-e-nazar rakta hai. Dosri taraf, aik barabar risk-reward ratio aapke trading mein mustawazan hone ke liye ahem hai. Safaltapoorvak trading har trade jeetne ke barabar nahi hai, balkay lambay arsay mein ek aikri faida hasil karne ke barabar hai. Aik behtar risk-reward ratio ahem liye madadgar hota hai taake lambi muddat mein mustawazan rahein. Agar aap aik se aik kamyabi ke bajaye ek se doosre trade mein nuksan uthate hain, to acha risk-reward ratio aapko apne nuksanat ko zyada taveel arsay mein bhi wapas hasil karne mein madadgar hota hai.

Importance of a Balanced Ratio Aik barabar risk-reward ratio qaim rakhna kai wajahat se ahem hai. Pehli bat, ye risk management ke liye ahem hai. Forex trading mein risk apne aap mein shamil hoti hai, aur nuksan to lazmi hai. Aik faida-mand risk-reward ratio ye tagheer karta hai ke aapke potential nuksan ko had se zyada hone se bachata hai aur control mein rakhta hai. Ye khaas tor par ahem hai kyun ke aik aik bara nuksan aapke trading capital ko bari had tak mutasir kar sakta hai aur aapke phir se qayam hasil karne ki salahiyat ko mad-e-nazar rakta hai. Dosri taraf, aik barabar risk-reward ratio aapke trading mein mustawazan hone ke liye ahem hai. Safaltapoorvak trading har trade jeetne ke barabar nahi hai, balkay lambay arsay mein ek aikri faida hasil karne ke barabar hai. Aik behtar risk-reward ratio ahem liye madadgar hota hai taake lambi muddat mein mustawazan rahein. Agar aap aik se aik kamyabi ke bajaye ek se doosre trade mein nuksan uthate hain, to acha risk-reward ratio aapko apne nuksanat ko zyada taveel arsay mein bhi wapas hasil karne mein madadgar hota hai.  Emotional Control Iske ilawa aik barabar risk-reward ratio aapke jazbat ko control karne mein madadgar hota hai. Jazbat ek trader ke burre dushman ho sakte hain, jo feslon mein tabdeel hone aur zyada trading karne ki taraf le ja sakte hain. Ye jante hue ke aapke potential nuksan had se kam hain, aap asal mein tazgi aur mantiki rehne mein madadgar ho sakte hain market mein hareef mawqeon ke doran. Ye mantiki discipline trading ke liye ahem hai aur aapke trading ke liye ek manhaji aur manzoori approach ko barqarar rakhne mein madadgar hai. Yahan kuch strategies hain jo aapke forex trading mein risk-reward ratio ko safaltapoorvak manage karne mein madadgar sabit ho sakti hain:

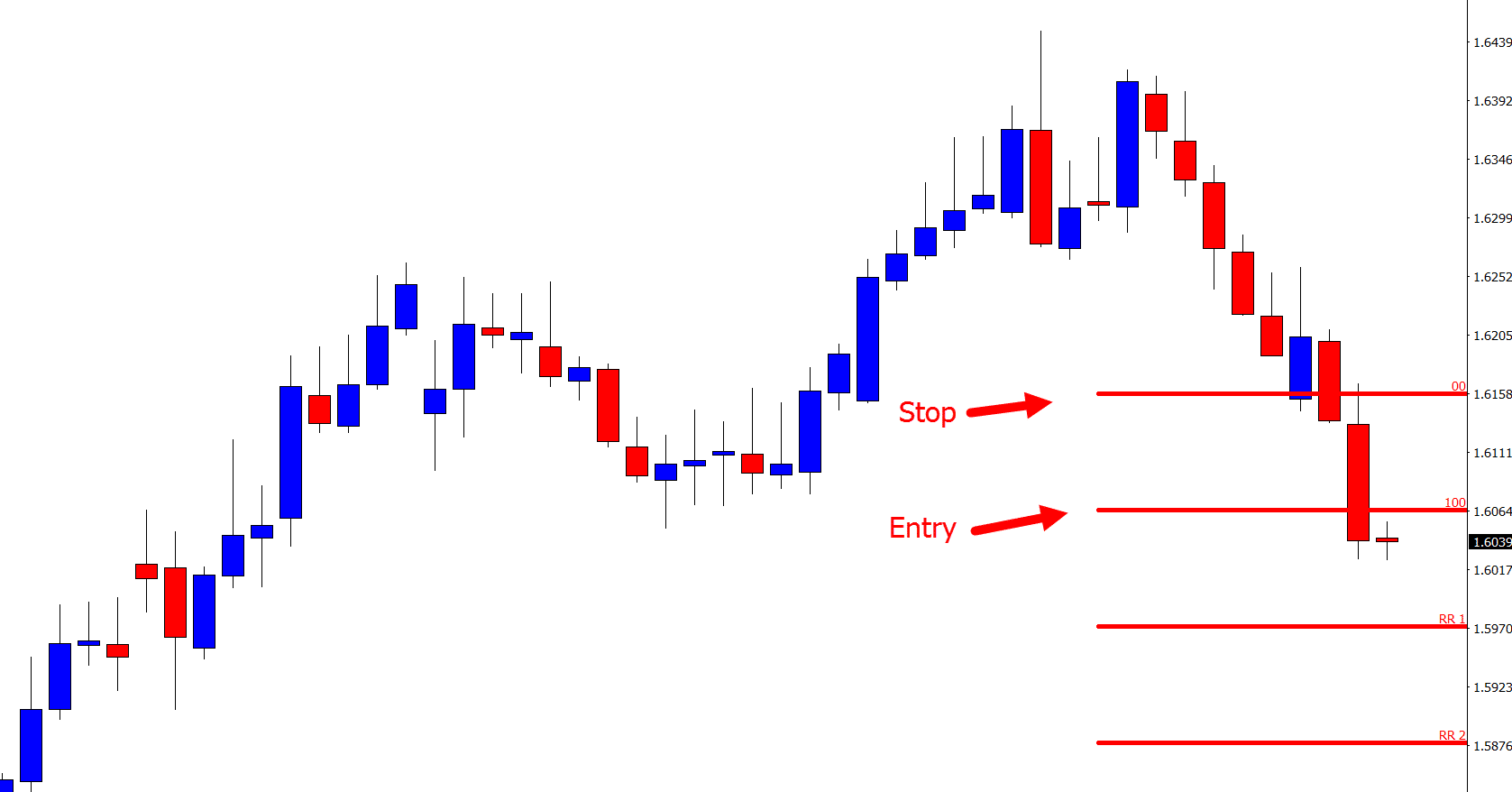

Emotional Control Iske ilawa aik barabar risk-reward ratio aapke jazbat ko control karne mein madadgar hota hai. Jazbat ek trader ke burre dushman ho sakte hain, jo feslon mein tabdeel hone aur zyada trading karne ki taraf le ja sakte hain. Ye jante hue ke aapke potential nuksan had se kam hain, aap asal mein tazgi aur mantiki rehne mein madadgar ho sakte hain market mein hareef mawqeon ke doran. Ye mantiki discipline trading ke liye ahem hai aur aapke trading ke liye ek manhaji aur manzoori approach ko barqarar rakhne mein madadgar hai. Yahan kuch strategies hain jo aapke forex trading mein risk-reward ratio ko safaltapoorvak manage karne mein madadgar sabit ho sakti hain:- Set Clear Stop-Loss and Take-Profit Levels: Trade mein dakhil hone se pehle, faisla karen ke aap apna stop-loss aur take-profit order kahan rakhenge. Aap ka stop-loss order aapke risk ko darust karta hai, aur take-profit order aapke munafa ko darust karta hai. Yakeen bana kar rahein ke aapka take-profit level aapke dakhil hone ke mukhtalif level se kam az kam utna door ho jitna ke aapka stop-loss level hai taake aap aik barabar risk-reward ratio qaim rakh saken.

- Use Position Sizing: Apne dakhil hone aur stop-loss level ke darmiyan fasle ke hisab se apna position size calculate karen. Apne position size ko adjust kar ke aap her trade mein aapke capital ka percentage control kar sakte hain. Ye aapko ye allow karta hai ke aap trade ke currency pair ya trade size ke bawajood aik barabar risk level ko barqarar rakhen.

- Risk Percentage Management: Faisla karen ke aap aik single trade pe apne trading capital ka kitna percentage risk karne ke liye tayyar hain. Aik aam tajwez ye hota hai ke her trade pe sirf 1-2% apne capital ka risk liya jaye. Is se ye bana rahata hai ke agar aap aik sari series mein nuksan uthate hain to aapka account ko bari had tak tabah nahi kiya jaye ga.

- Adapt to Market Conditions: Apne risk-reward ratio ko market ke halat ke mutabiq adjust karen. Ziyada taizi se tabdeel hone wale market mein, aap apne stop-loss aur take-profit level ko barqarar rakhne ke liye unhein door karne ke liye zaroorat mehsoos kar sakte hain. Thandi market mein, aap kam ratio istemal kar sakte hain.

- Review and Analyze: Apne trading performance ko regular basis pe tafseel se tahlil karen aur dekhein ke aapke risk-reward ratios kamyabi hasil kar rahe hain ya nahi. Agar aap payein ke aik ratio hamesha nuksan mein mubtila hota hai, to consider karen ke usay adjust karen ya apni trading strategy ko dobara tajwez den.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

1. Introduction:- Risk-Reward Ratio (R-R ratio) ek tijarat strategy hai jo Forex trading mein istemal hoti hai. Iska maqsad hai trading mein nuksan se bachna aur munafa kamana. Yeh ratio trader ke liye aik maqsood (target) aur nuksan (stop-loss) tay karte waqt istemal hota hai. 2. TargetAnd Stop-Loss Maqsod (Target): Maqsod woh level hai jahan trader apni trading position ko band karke munafa hasil karna chahta hai. Nuksan (Stop-Loss): Nuksan woh level hai jahan trader apni trading position ko band karke nuksan se bachna chahta hai. 3. Risk-Reward Ratio work:- Trader apni trading position mein maqsod aur nuksan tay karta hai. Risk-Reward ratio ko tay karte waqt, trader decide karta hai ke kitna nuksan woh bardasht kar sakta hai (risk) aur kitna munafa hasil karna chahta hai (reward). Agar trader ka maqsod 50 pips ka munafa hai aur woh 20 pips ke nuksan ko bardasht kar sakta hai, to uska R-R ratio 50/20 = 2.5 hoga. 4. R-R Ratio Importantance:- Risk-Reward ratio ki ahmiyat yeh hai ke woh trader ko pata chal jata hai ke uski trading strategy kitni successful hai. Isse trader apne trading decisions ko optimize kar sakte hain aur jyada munafa kamane ki koshish kar sakte hain. R-R ratio se trader ko nuksan se bachne ka mauqa milta hai. 5. R-R Ratio Uses:- Trading position ko enter karte waqt, trader ko apna R-R ratio tay karna chahiye. Is ratio ke mutabik maqsod aur nuksan ke levels tay karein. Trading position ko manage karte waqt, stop-loss aur target levels ko follow karein. 6. R-R Ratio Example:- Agar aapka maqsod $100 ka munafa hai aur aap nuksan se bachne ke liye $30 ka stop-loss rakhte hain, to aapka R-R ratio hoga 100/30 = 3.3. 7. R-R Ratio Trading Plan:- Har trading plan mein R-R ratio ko shamil karein. Trading plan ko follow karte waqt, R-R ratio ke hisab se trading decisions lein. 8. Conclusion:- Risk-Reward ratio Forex trading mein ek aham tijarat strategy hai jo trader ko nuksan se bachata hai aur munafa kamane mein madadgar hota hai. Is ratio ko istemal karke, aap apne trading performance ko optimize kar sakte hain aur consistent munafa hasil kar sakte hain. -

#4 Collapse

Forex Main Risk-Reward Ratio

Forex mein kaam karne wale shakhs ko apne mudaraba-e-khatra ka aik ahem hisaab rakhna chahiye. Yeh ek tajziyah hai jo uski trading strategy ko samajhne aur us par amal karne mein madadgar sabit ho sakti hai.

Risk-Reward Ratio Ki Tafseelat

Risk-Reward Ratio, ya RRR, ek aham tool hai jo traders ko unki trading decisions ko assess karne mein madad deta hai. Yeh ratio unko batata hai ke har trade mein kitna khatra uthana hai muqabla mien kitna munafa mil sakta hai.

RRR Ki Ahmiyat

Risk-Reward Ratio ki ehmiyat yeh hai ke yeh traders ko unki trading strategies ko optimize karne mein madad deta hai. Iske zariye, woh zyada se zyada munafa kamane ke liye kam se kam khatra utha sakte hain.

Munafa Ka Husool

Forex trading mein munafa ka husool aksar RRR ke sahi istemal par mabni hota hai. Agar koi trader apne trades mein zyada risk le raha hai aur kam reward hasil kar raha hai, to uska net munafa kam ho sakta hai.

Khatra Uthana

Trading mein khatra uthana zaroori hai, lekin zyada khatra uthana nuqsaan ka sabab bhi ban sakta hai. RRR ki madad se traders apne trades ko samajh sakte hain aur munafa kamane ke liye munasib khatra utha sakte hain.

Khasiyat-e-RRR

Risk-Reward Ratio ki khasiyat yeh hai ke yeh traders ko unki trade ki muddat aur target munafa ko samajhne mein madad deta hai. Iske zariye, woh apne trades ko behtar tariqe se manage kar sakte hain.

Tehqeeqat aur Tadbeer

Trading mein kamiyabi hasil karne ke liye, tehqeeqat aur tadbeer zaroori hain. RRR, traders ko apne trades ko analyze karne aur unki performance ko behtar banane mein madad deta hai.

Nakaamiyon Se Bachao

Risk-Reward Ratio ko samajhna traders ko nakaamiyon se bachane mein madad deta hai. Agar kisi trade mein zyada risk hai aur kam reward, to trader ko us trade se bachne ki salahiyat hoti hai.

Sarmaya Ko Mehfooz Karna

RRR ke istemal se traders apne sarmayay ko mehfooz rakh sakte hain. Yeh unko nuqsaan se bachane mein madad deta hai aur unki trading portfolio ko stable rakhta hai.

Tajarba aur Ilm Ki Ahmiyat

Forex trading mein kamiyabi hasil karne ke liye tajarba aur ilm ki zarurat hoti hai. RRR ke zariye, traders apne trading experiences se sikhte hain aur apni strategies ko behtar banate hain.

RRR Ki Tasdeeq

Risk-Reward Ratio ki tasdeeq ke liye, traders ko apne trades ki performance ka jayeza lena chahiye. Yeh unko pata lagane mein madad karta hai ke kya unki trades unke RRR ke mutabiq thay ya nahi.

Zehni Tafreeq

Forex trading mein zehni tafreeq ka hona bhi ahem hai. RRR ke istemal se, traders apne decisions ko tafreeqi nazar se dekh sakte hain aur behtar intikhabat le sakte hain.

Muqami Aur Aghlabi RRR

Muqami aur aghlabi RRR ke darmiyan tarteeb, traders ke liye aik ahem maamla hai. Har trade mein, unko apne RRR ki tehqeeq aur tajziyah karna chahiye taake woh apne trading approach ko mazbooti se nipta sakein.

Nigrani aur Isteshaarat

Risk-Reward Ratio ko nigrani mein rakhna, traders ko apne trades ki isteshaarat aur nigrani mein madad deta hai. Yeh unko apni trading strategy ko barqarar rakhne mein madadgar sabit hota hai.

Aik Sangeen Suaal

Aik sangeen suaal jo har trader ke samne hota hai, woh yeh hai ke kis had tak risk uthana chahiye aur kis had tak reward talash karni chahiye. RRR, is suaal ka jawab dene mein madadgar sabit hota hai.

Zameen aur Asman Ke Beech

Forex trading mein, zameen aur asman ke darmiyan aksar ek balande ki talash hoti hai. Risk-Reward Ratio, traders ko yeh balance maintain karne mein madad deta hai taake woh apne trades ko behtar tariqe se handle kar sakein.

Muqabla aur Mawaafiqat

Forex trading mein, muqabla aur mawaafiqat aham hote hain. RRR ke zariye, traders apne competitors se behtar strategies tayar kar sakte hain aur mawaafiqat mein aage barh sakte hain.

Mustaqbil Ki Tadabeer

Forex trading mein mustaqbil ki tadabeer karna zaroori hai. RRR ke istemal se, traders apne mustaqbil ki strategies ko tay karte hain aur apne aane wale trades ko behtar tariqe se handle karte hain.

Sabar aur Saheeh Irada

Forex trading mein sabar aur saheeh irada ka hona zaroori hai. RRR, traders ko sabar aur discipline banaye rakhne mein madad deta hai taake woh apne trading goals ko hasil kar sakein.

-

#5 Collapse

Forex Mein Risk-Reward Ratio (Khatra-Mafaad Ratio)

Ta'aruf (Introduction):

Risk-Reward Ratio forex trading mein ek ahem tajziya hai jo traders ko unke trades ke liye sahi samay aur entry point decide karne mein madad karta hai. Ye ratio trading strategy ka ek moolya-karak hissa hai aur traders ko apne trades ko manage karne mein madad karta hai.

Risk-Reward Ratio Kya Hai?

Risk-Reward Ratio woh proportion hai jo trade ke potential profit ko trade ke potential loss ke sath compare karta hai. Ye ratio traders ko ye batata hai ke unka risk kitna hai compared to unka expected reward.

Risk-Reward Ratio Ka Hissa Kaise Hota Hai?- Risk:

- Risk ka matlab hai kitna nuksan aap tayyar hain apne trade mein uthane ke liye. Ye normally stop-loss level ke through express kiya jata hai aur ye percentage ya pips mein ho sakta hai.

- Reward:

- Reward ka matlab hai kitna profit aap tayyar hain apne trade se uthane ke liye. Ye aapke target level ke through express kiya jata hai aur ye bhi percentage ya pips mein ho sakta hai.

Risk-Reward Ratio Ka Hissa Kaise Calculate Kiya Jata Hai?

Risk-Reward Ratio ko calculate karne ke liye aap apne expected profit ko apne potential loss se divide karte hain. Agar aapka expected profit aapke potential loss se zyada hai, toh aapka Risk-Reward Ratio positive hoga, jo ki traders ke liye desirable hota hai.

Risk-Reward Ratio Ke Fayde:- Trading Decisions Ke Liye Guidance:

- Risk-Reward Ratio traders ko sahi entry aur exit points decide karne mein madad karta hai. Ye unhein ye batata hai ke kis trade mein kitna risk lena chahiye aur kitna profit expect kiya ja sakta hai.

- Risk Ko Control Karna:

- Risk-Reward Ratio ki madad se traders apne trades ke risk ko control kar sakte hain. Ye unhein allow karta hai ki unke trades ko unke risk tolerance ke according manage karein.

- Consistency aur Long-Term Success:

- Ek consistent aur balanced Risk-Reward Ratio trading mein long-term success aur profitability ko badhata hai. Ye traders ko disciplined aur focused rakhta hai.

Naseehat (Conclusion):

Forex trading mein Risk-Reward Ratio ek moolya-karak concept hai jo traders ko unke trades ke liye sahi samay aur entry point decide karne mein madad karta hai. Is ratio ko samajhna aur effectively use karna trading success ke liye zaroori hai. Lekin, har trade ke liye ek suitable Risk-Reward Ratio decide karna aur proper risk management techniques ka istemal karna hamesha zaroori hai.

- Risk:

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Risk-Reward Ratio (Risk-Azadi Rasio) forexRisk-Reward Ratio (Risk-Azadi Rasio) forex trading mein ek ahem concept hai jo traders ke liye profitability aur risk management mein madad karta hai. Ye ratio batata hai ke kitna profit aap expect kar rahe hain ek trade se, compared to kitna risk aap ready hain lena. Neeche diye gaye hain kuch ahem tafseelat is concept ke bare mein:

1. Kya Hai Risk-Reward Ratio?- Risk-Reward Ratio ek numerical ratio hai jo traders ko batata hai ke kitna unka potential profit hai compared to kitna unka potential loss hai.

- Is ratio ko typically ek trading setup ya trade ke entry point se stop loss aur take profit levels ke beech ka distance calculate karke determine kiya jata hai.

2. Kaise Calculate Kiya Jata Hai?- Risk-Reward Ratio ko calculate karne ke liye, traders ko pehle apne trade ke entry point par stop loss level aur target profit level set karna hota hai.

- Phir, unhein entry point se stop loss level tak ka distance aur entry point se target profit level tak ka distance calculate karna hota hai.

- Yeh distances phir ek dusre se divide kiye jate hain, jisse ratio milta hai. For example, agar aapka stop loss 20 pips door hai aur target profit 40 pips door hai, toh aapka Risk-Reward Ratio 1:2 hoga.

3. Kyun Zaroori Hai?- Risk-Reward Ratio ka istemal karke traders apne trades ki risk ko quantify kar sakte hain aur apne trading strategy ko manage kar sakte hain.

- Ye ratio traders ko trades ko select karne mein madad karta hai jahan unka potential profit unke potential loss se zyada hota hai.

- Is ratio ka istemal karke traders apne trades ko evaluate kar sakte hain aur unhein unke trading plan ke mutabiq adjust kar sakte hain.

4. Zaroorat aur Ahmiyat:- Risk-Reward Ratio ko samajhna aur istemal karna zaroori hai kyunki ye traders ko unke trades ki profitability aur risk ko samajhne mein madad karta hai.

- Is ratio ke istemal se traders apne trading decisions ko objectivity ke sath lena seekhte hain aur emotional trading se bachte hain.

Ek behtar Risk-Reward Ratio ka hona trading mein successful hone ke liye zaroori hai. Traders ko apne trades ko select karte waqt is ratio ka dhyan rakhna chahiye aur unhein apne risk management plan ke mutabiq trades ko manage karna chahiye.

-

#7 Collapse

Forex Mein Risk-Reward Ratio (Khatra-Azadi Nisbat)

Forex trading mein, risk-reward ratio (khatra-azadi nisbat) ek ahem concept hai jo traders ke liye khaas ahmiyat rakhta hai. Is concept ka istemal karke traders apni trading strategies ko evaluate karte hain aur sahi trading decisions lene mein madad milti hai.

Risk-Reward Ratio Kya Hai?

Risk-reward ratio woh ratio hai jo trader ko batata hai ke har trade mein kitna khatra uthana hai aur kitna munafa hasil karna hai. Ye ratio trading ki planning aur risk management mein madadgar hota hai.

Khatra (Risk)

Khatra, ya risk, wo amount hai jo trader ko haarne ke liye tayyar hona chahiye. Har trade mein khatra hota hai, aur ye trader ke dwara trade ki gayi amount aur stop loss level par depend karta hai. Agar trade loss mein chali gayi, to khatra woh nuqsaan hai jo trader bardasht karna tayyar hota hai.

Azadi (Reward)

Azadi, ya reward, woh amount hai jo trader ko munafa hasil karne ka expectation hota hai. Har trade mein munafa hasil karne ka potential hota hai, aur ye trader ke dawra set kiye gaye profit target par depend karta hai. Agar trade munafa mein chali gayi, to azadi woh munafa hai jo trader hasil karta hai.

Risk-Reward Ratio ka Istemal

Risk-reward ratio ka istemal karke traders apni trading strategies ko evaluate karte hain aur sahi trading decisions lete hain. Ek achha risk-reward ratio hone se traders ko zyada munafa hasil karne ka mauqa milta hai aur nuqsaan ko minimize karne ka tareeqa milta hai.

Kaise Calculate Karein?

Risk-reward ratio calculate karne ke liye, trader ko apne entry point, stop loss level aur profit target ko tay karna hota hai. Phir, trader apne risk aur reward ke amounts ko calculate karta hai. Ratio ko calculate karne ke liye, risk amount ko reward amount se divide kiya jata hai.

Ikhtitami Alfaz

Forex trading mein risk-reward ratio ka istemal trading strategies ko improve karne aur trading decisions lene mein madad deta hai. Ek achha risk-reward ratio hone se traders apne trades ko manage karne mein asani hoti hai aur apne trading accounts ko protect karne mein madad milti hai.

Conclusion

Risk-reward ratio, Forex trading mein ek ahem concept hai jo traders ko apne trading decisions ko evaluate karne aur improve karne mein madad deta hai. Is concept ko samajh kar traders apni risk management ko behtar banate hain aur zyada munafa hasil karne ka tareeqa tajjub karte hain.

- CL

- Mentions 0

-

سا0 like

-

#8 Collapse

Forex market ka jadoo har trader ko apni taraf kheenchta hai. Is mein mukhtalif currencies ki khareed o farokht hoti hai, jis se logo ko faida kamana hota hai. Lekin, is shauq mein shirakat ek mukhtalif duniya hai jahan har qadam par khatra hai. Is khatar se bachne ka ek tareeqa hai "Risk-Reward Ratio."

Risk-Reward Ratio Kya Hai?

Risk-Reward Ratio (R-R Ratio) forex trading mein aik ahem hissa hai jo traders ke liye maamooli tor par mukhtalif hota hai. Ye ek nisab hai jo maloom karta hai ke kis had tak khatra lena aur kis had tak munafa haasil karna chahiye.

Kyun Hai Ye Ahem?

Forex market mein, jahan paisa barhakar mehsool hota hai, wahan khatra bhi hota hai. Agar aap trading karte hain, to aap apne paisay ka khatra lenge, lekin is khatray ko control karna zaroori hai. Risk-Reward Ratio is liye ahem hai kyunki ye aapko ye samajhne mein madad karta hai ke aap kitna khatra le rahe hain, aur kitna munafa haasil kar sakte hain.

Kaise Calculate Kiya Jata Hai?

Risk-Reward Ratio ko calculate karne ke liye, aapko do asal cheezen maloom honi chahiye:- Stop Loss Level: Ye woh level hai jahan aap apni trade ko band kar lenge agar market aapke khilaaf chalne lagti hai.

- Target Profit Level: Ye woh level hai jahan aap apni trade ko band karna chahte hain agar market aapke haq mein chalne lagti hai.

R-R Ratio ka calculation simple hai: Target Profit Level se Stop Loss Level ko divide karen. Agar aapka target profit $100 hai aur aapka stop loss $50 hai, to aapka R-R Ratio 2:1 hoga.

Kyun Hai Ye Zaroori?

Risk-Reward Ratio ka maqsad aapko ye batana hai ke aapko kitna khatra lena hai agar aapko kitna munafa haasil karna hai. Agar aapka R-R Ratio zyada hai, jaise 3:1 ya 4:1, to aapko kam trading mein bhi acha munafa haasil ho sakta hai agar aapke trades sahi hoti hain. Is tarah, aap apne nuqsanat ko control kar sakte hain aur apni trading ko zyada safe bana sakte hain.

Nateeja

Forex trading mein kamyabi haasil karne ka raaz Risk-Reward Ratio mein chhupa hai. Ye aapko nishchit karta hai ke aap kitna khatra utha sakte hain, aur kitna munafa haasil kar sakte hain. Agar aap is nisab ko samajh lete hain aur us par amal karte hain, to aap apni trading ko behtareen tareeqe se manage kar sakte hain aur zyada munafa haasil kar sakte hain. -

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex (foreign exchange) trading ek aham aur popular tarika hai paisa kamane ka, lekin yeh bhi ek risk se bhara shobha hai. Har trader ko apne trades ko samajhne aur control karne ke liye kuch moolyavanh concepts ko samajhna zaroori hai, aur ek aham concept jo har trader ko samajhna chahiye wo hai "Risk-Reward Ratio".

Risk-Reward Ratio, ya RRR, trading mein ek mukhya strategy hai jo traders ke liye important hai. Yeh ratio uss risk aur reward ke darmiyan ka tay karta hai jo har trade ke sath juda hota hai. Ek acchi Risk-Reward Ratio se traders apne trading plan ko optimize kar sakte hain aur apne losses ko minimize aur profits ko maximize kar sakte hain.

Risk-Reward Ratio ka maqsad hai yeh dekhna hai ke har trade mein kitna risk lena chahiye compared to expected reward. Ek acha RRR select karne se traders apne trades ko analyze kar sakte hain aur samajh sakte hain ke kya trade lena unke liye munasib hai ya nahi.

Jab ek trader trade karta hai, wo ek stop loss aur target level set karta hai. Stop loss level wo level hota hai jahan par trader apni trade ko band karne ke liye tay karta hai agar market against direction mein chala gaya. Target level wo level hota hai jahan par trader apni trade ko band karne ke liye tay karta hai agar market uss ki favor mein chali gayi.

Ek acchi Risk-Reward Ratio select karne ke liye, trader ko apne entry point se stop loss level tak ka distance aur entry point se target level tak ka distance calculate karna hota hai. Phir, trader ko yeh dekhna hota hai ke stop loss level ko kitna risk lena hai compared to target level se kitna reward mil sakta hai.

Ek common approach hai ke traders kam se kam 1:2 ya zyada ka Risk-Reward Ratio select karte hain, matlab ke agar trader ne 1 pip ka risk liya hai to wo kam se kam 2 pips ka reward expect karta hai.

Yeh important hai ke traders apne Risk-Reward Ratio ko apne trading style, risk tolerance aur market conditions ke hisab se customize karein. Har ek trade alag hota hai, is liye har ek trade ke liye bhi Risk-Reward Ratio alag hona chahiye.

To conclude, Risk-Reward Ratio ek aham concept hai forex trading mein jo har trader ko samajhna chahiye. Ek acchi RRR select karke traders apne trades ko analyze kar sakte hain aur apne trading plan ko optimize kar sakte hain, jo unhe zyada consistent aur profitable banata hai. -

#10 Collapse

Forex (yaani Foreign Exchange) duniya bhar mein maqami aur bein-ul-aqwami mudaraba ke liye ek ahem maqam rakhta hai. Is market mein paisay tabdeel karna aur qeemat barhna ya ghatna aam baat hai. Is shorat mein, ek maharatmand aur zimmedar tajwez ke sath, "Khatra-Azadi Nisbat" (Risk-Reward Ratio) ka mudda ahem hai. Ye tadween tijarat ke safar mein hamen saath le jata hai, aur agar isay theek tareeqay se istemal kiya jaye, to ye humein kamiyabi ki rah dikha sakta hai.

Khatra-Azadi Nisbat Kya Hai?

Khatra-Azadi Nisbat (RRR) tijarat ke tajurbaat mein ek ahem tajziya hai jo humein batata hai ke hum kis had tak khatra utha rahe hain muqablay mein kitna munafa haasil karne ke liye. Ye nisbat aam taur par ek number ya rasio ke roop mein bayan ki jati hai. Jese ke, agar kisi tijarat mein aap 1:2 Khatra-Azadi Nisbat istemal karte hain, to iska matlab hai ke har ek rupiya nuqsaan hone ki surat mein aap ko do rupaye ka munafa haasil hoga.

Kyun Hai Ye Zaroori?

Forex tijarat mein khatra-azadi nisbat ka istemal karne ki zaroorat isliye hoti hai ke ye humein tajurbaat mein madad deta hai aise tijarat ke intikhab mein jo hamare maqasid ke mutabiq hon. Agar hum sirf munafa ki taraf dekhte hain aur khatra ko nazar andaz karte hain, to nuqsaan ka khatra barh jata hai. Lekin agar hum munafa aur nuqsaan ki nisbat ko barabar rakhte hain, to hamare liye tijarat mein kamiyabi haasil karne ka imkaan barh jata hai.

Kis Tarah Se Ye Kaam Karta Hai?

Khatra-Azadi Nisbat ko istemal karne ke liye, sab se pehle aap ko apne maqsad aur tijarat ke imkaanat ka tajziya karna hoga. Phir aap ko apne intikhab ka size aur stop loss ka faisla karna hoga. Ek bar jab aap apne stop loss aur munafa ka maqam tay kar lein, to aap Khatra-Azadi Nisbat tay kar sakte hain.

Misaal

Agar aap ek tijarat mein $1000 invest karte hain aur aap ka stop loss $50 hai aur munafa $100, to aap ka Khatra-Azadi Nisbat 1:2 hoga. Iska matlab hai ke aap 1 rupiya nuqsaan hone ki surat mein 2 rupaye ka munafa haasil kar sakte hain.

Akhri Alfaaz

Khatra-Azadi Nisbat ek aham tajwez hai jo forex tijarat mein kamiyabi haasil karne ke liye istemal kiya ja sakta hai. Isko istemal karne se pehle, maharatmand tajurbaat aur maqasid ke mutabiq tay kar lena zaroori hai. Jab sahi tareeqay se istemal kiya jaye, to ye hamen tajurbaat mein madadgar sabit ho sakta hai aur hamen ziada kamiyabi ki raah dikhata hai.

-

#11 Collapse

Forex trading ek volatile aur risky market hai jahan har trader ko apne trades ko manage karne ke liye mukhtalif strategies aur tools ka istemal karna hota hai. Ek aham hissa of trading strategy risk-reward ratio hai, jo trading decisions ko optimize karne aur profit potential ko maximize karne mein madad karta hai. Is article mein, hum Forex mein risk-reward ratio ke fawaid aur nuksanat ke bare mein tafseel se baat karenge.

Fawaid:- Risk Management: Risk-reward ratio ka istemal karke traders apne trades ko manage kar sakte hain aur apne risk ko control kar sakte hain. Ek achha risk-reward ratio set karne se traders apne trading capital ko protect kar sakte hain aur apne losses ko minimize kar sakte hain.

- Trade Optimization: Risk-reward ratio ka istemal karke traders apne trades ko optimize kar sakte hain aur behtar trading opportunities ko pehchan sakte hain. Agar ek trade ka risk-reward ratio favorable hai, matlab ke potential profit potential loss se zyada hai, to traders us trade ko le sakte hain.

- Psychological Comfort: Ek sahi risk-reward ratio set karne se traders ka confidence badh jata hai aur unhe psychological comfort milti hai. Jab traders ko pata hota hai ke unka risk-reward ratio sahi hai, to woh apne trading decisions par zyada confident hote hain aur emotional decisions se bach sakte hain.

- Profit Maximization: Risk-reward ratio ka istemal karke traders apne profit ko maximize kar sakte hain. Agar ek trader consistently achhe risk-reward ratio ke sath trades leta hai, to unhe zyada profits milte hain aur unka trading account grow karta hai.

- Trade Consistency: Ek achha risk-reward ratio set karne se traders apne trades ko consistent bana sakte hain. Agar har trade ka risk-reward ratio similar hai, to traders apne trading plan ko follow karke consistent results achieve kar sakte hain.

Nuksanat:- Trade Selection: Ek strict risk-reward ratio set karne se traders ko kuch trades ko chhodna pad sakta hai jo high risk lekin high reward wale hote hain. Agar ek trade ka risk-reward ratio thik nahi hai, lekin trader ko lagta hai ke usme potential hai, to woh us trade ko miss kar sakta hai.

- Market Volatility: Market volatility ke doran risk-reward ratio change ho sakta hai. Agar market mein zyada volatility hai, to potential profit aur loss dono badh sakte hain, jisse risk-reward ratio affect hota hai.

- Over-Optimization: Kuch traders apne trades ko optimize karne ke liye risk-reward ratio ka istemal karte hain, lekin kabhi kabhi yeh over-optimization ka shikar ho jata hai. Jab ek trader apne risk-reward ratio ko itna optimize karta hai ke uska trading strategy unrealistic ban jata hai, to woh asal market conditions mein kam nahi karta hai.

- False Sense of Security: Kabhi kabhi traders ko ek achha risk-reward ratio set karne se false sense of security milta hai. Agar ek trader apne risk-reward ratio par zyada dhyan deta hai, to woh apne trades par over-confident ho sakta hai aur apne risk ko underestimate kar sakta hai.

- Emotional Impact: Agar ek trader ka trade unka risk-reward ratio ke according nahi chal raha hai, to unhe emotional stress ho sakta hai. Jab traders ko pata hota hai ke unka trade unke expectations ke khilaf ja raha hai, to woh panic mein aa sakte hain aur galat decisions le sakte hain.

In conclusion, Forex trading mein risk-reward ratio ek aham tool hai jo traders ko apne trades ko manage karne aur optimize karne mein madad karta hai. Lekin, iska istemal karne se pehle traders ko apne trading style, risk tolerance aur market conditions ka bhi dhyan dena zaroori hai. Ek achha risk-reward ratio set karne se traders apne trading results ko improve kar sakte hain aur apne trading journey ko successful bana sakte hain.

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Risk-Reward Ratio in Forex: Kya Hai Aur Kaise Kaam Karta Hai?**

Forex trading mein risk-reward ratio aik ahem concept hai jo traders ko apne trades ki profitability aur risk ko manage karne mein madad karta hai. Yeh ratio trade ke potential rewards ko trade ke risks ke saath compare karta hai aur aapko behtar trading decisions lene mein help karta hai. Is post mein hum is ratio ki importance aur ise effectively use karne ke tareeqon ko samjhenge.

**Risk-Reward Ratio Ki Pehchaan:**

Risk-reward ratio ko calculate karne ke liye, aapko do cheezon ki zaroorat hoti hai:

1. **Risk:** Yeh wo amount hai jo aap trade me lose karne ke liye tayyar hain. Risk ko generally stop loss ke distance ke zariye measure kiya jata hai. Misaal ke taur par, agar aapne stop loss ko 50 pips ke distance par set kiya hai aur aapka trade size 1 lot hai, to aapka risk $500 ho sakta hai.

2. **Reward:** Yeh wo potential profit hai jo aap trade se hasil kar sakte hain. Reward ko target price ke distance ke zariye measure kiya jata hai. Misaal ke taur par, agar aapka target price 100 pips ke distance par hai aur aapka trade size 1 lot hai, to aapka potential reward $1000 ho sakta hai.

**Risk-Reward Ratio Ka Calculation:**

Risk-reward ratio ko calculate karne ka formula yeh hai:

\[ \text{Risk-Reward Ratio} = \frac{\text{Potential Risk}}{\text{Potential Reward}} \]

Agar aapka potential risk $500 hai aur potential reward $1000 hai, to aapka risk-reward ratio 1:2 hoga. Iska matlab hai ke har dollar risk par aap do dollar reward expect kar rahe hain.

**Importance Aur Strategy:**

1. **Trade Selection:** Risk-reward ratio aapko trade selection me madad karta hai. Ideal risk-reward ratio 1:2 ya usse zyada hota hai. Yeh aapko assurance deta hai ke aapke profitable trades ka potential losses se zyada hoga.

2. **Risk Management:** Is ratio ko use karke aap apne trading capital ko efficiently manage kar sakte hain. High risk-reward ratio ke sath trades select karke aap apne capital ko bacha sakte hain aur long-term trading success ko ensure kar sakte hain.

3. **Profitability Analysis:** Risk-reward ratio ko analyze karna aapko yeh samajhne me madad karta hai ke aapki trading strategy kitni profitable hai. Agar aapka average risk-reward ratio positive hai, to aapki trading strategy successful ho sakti hai.

**Conclusion:**

Risk-reward ratio forex trading ka ek fundamental aspect hai jo traders ko risks aur rewards ko manage karne me madad karta hai. Iska effective use aapko better trading decisions lene, apne capital ko protect karne, aur long-term trading success ko achieve karne me madadgar ho sakta hai. Continuous practice aur analysis se aap is ratio ko apni trading strategy me behtar integrate kar sakte hain.

-

#13 Collapse

### Risk-Reward Ratio in Forex

Forex trading mein risk-reward ratio ek ahem concept hai jo traders ko potential profits aur losses ka estimation dene mein madad karta hai. Ye ratio traders ko decision-making process mein madad deti hai, taake wo apne trades ko zyada strategic aur calculated bana sakein. Is post mein hum risk-reward ratio ko detail se samjhenge aur ye dekhenge ke isse apni trading strategy ko kaise improve kar sakte hain.

**Risk-Reward Ratio Kya Hai?**

Risk-reward ratio ek mathematical formula hai jo aapko trade ki potential risk aur reward ke beech ka ratio batata hai. Ye ratio calculate karne ke liye, aapko apne potential loss (risk) aur potential gain (reward) ko compare karna hota hai. Misal ke taur par, agar aapki trading strategy mein aapka potential loss 50 pips hai aur potential gain 150 pips hai, to aapka risk-reward ratio 1:3 hoga. Iska matlab hai ke aap har 1 pip ke risk ke badle mein 3 pips ka reward expect kar rahe hain.

**Risk-Reward Ratio Ka Importance**

1. **Trade Selection:** Risk-reward ratio aapko trade select karne mein madad karta hai. High risk-reward ratio waale trades zyada attractive hote hain kyunki inme potential rewards zyada hote hain. Traders ko chahiye ke wo sirf unhi trades ko select karein jahan risk-reward ratio favorable ho.

2. **Money Management:** Risk-reward ratio money management ke liye bhi critical hai. Ye aapko batata hai ke ek trade mein kitna capital risk mein dalna chahiye aur kitna capital potential reward ke liye allocate karna chahiye. Ye aapko apne overall trading capital ko protect karne mein madad karta hai.

3. **Trade Evaluation:** Risk-reward ratio ko evaluate karke aap apne trades ki effectiveness ko measure kar sakte hain. Agar aapke trades consistently high risk-reward ratio ke sath hain, to aapka trading strategy profitable hone ke chances zyada hain.

**Risk-Reward Ratio Kaise Calculate Karein?**

Risk-reward ratio calculate karne ke liye, pehle aapko apne trade ka risk aur reward define karna hoga. Risk wo amount hai jo aap trade ke hone ke doran lose kar sakte hain, jabke reward wo amount hai jo aap expect karte hain. Example ke taur par, agar aap ek trade mein 100 pips ka stop loss set karte hain aur 300 pips ka target set karte hain, to aapka risk-reward ratio 1:3 hoga.

**Practical Tips**

1. **Set Realistic Targets:** Trade ke targets ko realistic set karein. Overly ambitious targets se bachne ki koshish karein kyunki wo aapko unrealistic expectations de sakte hain.

2. **Avoid Low Ratios:** Aise trades se bachne ki koshish karein jahan risk-reward ratio 1:1 ya usse kam ho. Low risk-reward ratios generally less profitable hote hain aur long-term mein aapko losses ka samna karna pad sakta hai.

3. **Use Multiple Time Frames:** Different time frames par risk-reward ratio analyze karne se aapko better perspective milta hai. Larger time frames mein zyada accurate risk-reward ratios mil sakte hain.

**Conclusion**

Forex trading mein risk-reward ratio ko samajhna aur effectively use karna ek successful trading strategy ka hissa hai. Ye ratio aapko apne trades ko better manage karne aur profitable trading decisions lene mein madad karta hai. Hamesha apne risk-reward ratio ko carefully analyze karein aur ensure karein ke wo aapki trading goals ke sath align karta hai. Is tarah, aap apne trading performance ko improve kar sakte hain aur apne financial goals achieve karne mein madad mil sakti hai.

- CL

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#14 Collapse

Risk-Reward Ratio In Forex

Forex trading mein Risk-Reward Ratio ka concept bohot important hai. Yeh ratio aapko yeh samajhne mein madad karta hai ke aap apne trades mein kitna risk le rahe hain aur uss risk ke muqable mein aapko kitna reward mil sakta hai. Aaj hum is topic par detail mein baat karenge.

Risk-Reward Ratio Kya Hai?

Risk-Reward Ratio, jaise ke naam se hi zahir hai, risk aur reward ke darmiyan ka ratio hota hai. Forex trading mein, yeh ratio aapko yeh batata hai ke agar aap ek trade mein x amount ka risk le rahe hain, to aapko kis amount ka reward milne ki umeed hai. Is ratio ko calculate karna bohot zaroori hai taake aap apne trading strategy ko behtar bana sakein aur loss ke chances ko kam kar sakein.

Risk-Reward Ratio Kaise Calculate Karein?

Risk-Reward Ratio calculate karna kaafi straightforward hai. Aapko pehle apne potential loss aur potential profit ko determine karna hota hai. Example ke taur par, agar aap ek trade mein 50 pips ka risk le rahe hain aur 150 pips ka reward expect kar rahe hain, to aapka Risk-Reward Ratio 1:3 hoga. Yeh ratio is baat ka indication hota hai ke aap apne potential profit ko apne potential loss ke muqable mein kitna zyada expect kar rahe hain.

Risk-Reward Ratio Ki Importance- Trade Selection: Risk-Reward Ratio aapko yeh decide karne mein madad karta hai ke aapko kisi trade ko enter karna chahiye ya nahi. Agar ratio aapke favour mein nahi hai, to trade ko avoid karna behtar hai.

- Risk Management: Is ratio ke zariye aap apne risk management strategy ko behtar bana sakte hain. Agar aapka ratio 1:2 ya usse zyada hai, to aapko apne trading decisions mein confidence zyada hota hai.

- Profitability: High Risk-Reward Ratio wale trades aapko zyada profitable bana sakte hain, kyunke aap kam losses aur zyada profits ke saath trade kar rahe hote hain.

Forex trading mein effective Risk-Reward Ratio use karna zaroori hai. Aapko yeh samajhna hoga ke har trade ki risk aur reward ko analyze karna hoga. Agar aap 1:2 ya 1:3 ratio ko maintain karte hain, to aapka overall profitability improve ho sakta hai. Yeh aapke trading strategy ko systematic aur disciplined banata hai.

Risk-Reward Ratio Ki Limitations

Halaanki Risk-Reward Ratio trading mein bohot useful hai, lekin yeh alone sufficient nahi hai. Aapko technical analysis, market trends aur economic indicators ko bhi consider karna chahiye. Risk-Reward Ratio sirf ek tool hai, aur aapko apni trading strategy mein isse complementary tools ke sath use karna chahiye.

Conclusion

Forex trading mein Risk-Reward Ratio ka concept samajhna aur uska use karna aapki trading strategy ko behtar bana sakta hai. Yeh aapko apne trades mein risk aur reward ka balance maintain karne mein madad karta hai aur aapke overall trading performance ko improve kar sakta hai. Hamesha yaad rakhein ke yeh ratio ek important factor hai, lekin trading decisions ko balanced aur well-informed decisions ke sath lena zaroori hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:19 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим