Four price doji candlestick pattern

No announcement yet.

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Four price doji candlestick Four Price Doji Candlestick, candlestick chart analysis ka aik important hissa hai jo traders aur investors ke liye valuable information provide karta hai. Ye pattern market mein uncertainty aur reversal ke signs ko indicate kar sakta hai. Four Price Doji Candlestick ek technical analysis tool hai jo stock market aur financial markets mein istemal hota hai. Ye pattern doji candlestick ke andar aata hai, jo market ke sentiment aur price direction ko samajhne mein madadgar hota hai. Is candlestick pattern ko samjhna traders ke liye zaroori hai taaki woh sahi trading decisions le saken. Four Price Doji Candlestick ek aisa pattern hai jismein four prices include hoti hain: opening price, closing price, highest price, aur lowest price. Is pattern ki pehchan karne ke liye, aapko candlestick chart par ek small cross ya plus sign nazar aayega jismein doji ki tarah upper aur lower shadow hongi. Is pattern ki pehchan karne ke baad, traders market direction ko samajhne ke liye iska istemal karte hain. Agar Four Price Doji Candlestick bullish trend ke baad aata hai, to ye bearish reversal signal ho sakta hai, matlab ke market mein price girawat ki sambhavna hai. Is situation mein, traders apne long positions ko close kar sakte hain ya short positions enter kar sakte hain. Waise hi, agar Four Price Doji Candlestick bearish trend ke baad aata hai, to ye bullish reversal signal ho sakta hai, matlab ke market mein price mein izafa hone ki sambhavna hai. Is scenario mein, traders apne short positions ko close kar sakte hain ya long positions enter kar sakte hain. Is pattern ko samajhne ke liye, traders ko candlestick chart analysis ki madad leni chahiye. Candlestick charts par har candlestick ek trading session ko represent karta hai, jo usually ek din ka hota hai. Candlestick chart par har candlestick ke components, jaise ki opening price, closing price, highest price, aur lowest price, ko dikhaya jata hai. Four Price Doji Candlestick ek powerful tool hai agar ise sahi tarah se samjha jaye aur dusre technical indicators ke saath istemal kiya jaye. Traders ko is pattern ko confirm karne ke liye market analysis aur dusre signals ka bhi istemal karna chahiye. In conclusion, Four Price Doji Candlestick ek important candlestick pattern hai jo market ke reversal aur uncertainty ko indicate kar sakta hai. Is pattern ko samajhna traders ke liye zaroori hai taaki woh sahi trading decisions le saken aur market movements ko samajh sake. Candlestick chart analysis ke saath, Four Price Doji Candlestick ka istemal ek powerful trading strategy ban sakta hai. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Four price doji candlestick pattern

Four Price Doji Candlestick Pattern:

Introduction: Four price doji candlestick pattern ek unique aur interesting candlestick pattern hai jo market analysis mein istemal hota hai. Ye pattern market mein uncertainty ya indecision ko darshata hai aur traders ke liye potential trading opportunities provide karta hai. Is article mein, hum is pattern ke key points aur impli

cations ko detail mein samajhne ki koshish karenge.

Four Price Doji Candlestick Pattern Kya Hai? Four price doji candlestick pattern ek single candlestick pattern hai jo market mein dekha ja sakta hai. Is pattern mein, open, high, low, aur close price ek hi level par hoti hai. Iska matlab hai ke market mein buyers aur sellers ke darmiyan koi decisive movement nahi hai aur price range ek jaisa rehta hai.

Four Price Doji Candlestick Pattern Ki Tafseelat: Four price doji candlestick pattern ke key points include:- Open, High, Low, aur Close Same Level Par: Is pattern mein candle ka open, high, low, aur close price ek hi level par hoti hai.

- Small Body: Candle ki body choti hoti hai, jo indicate karta hai ke price movement mein zyada change nahi hua hai.

- Volume: Volume bhi is pattern mein important hai. Agar is pattern ke sath high volume hai, to ye pattern aur bhi reliable ho sakta hai.

Four Price Doji Candlestick Pattern Ke Istemal Ka Tareeqa: Four price doji candlestick pattern ka istemal karne ke liye, traders ko kuch key points par dhyan dena chahiye:- Confirmation: Pattern ko confirm karne ke liye, traders ko next candle ka action dekhna chahiye. Agar next candle bullish hai aur high volume ke sath aata hai, to pattern ki reliability badh jati hai.

- Support aur Resistance: Pattern ke sath sath support aur resistance levels ka bhi dhyan rakhna important hai. Agar pattern kisi important support level ke near form ho raha hai, to ye uski strength ko aur bhi badha sakta hai.

- Risk Management: Risk management ke liye, traders ko apne positions ke liye stop-loss orders lagana zaroori hai. Agar pattern ki confirmation ke baad market opposite direction mein move karta hai, to stop-loss order losses ko minimize kar sakta hai.

Four Price Doji Candlestick Pattern Ka Istemal Ke Fayde: Four price doji candlestick pattern ka istemal karne ke kuch fayde include:- Trend Reversal Ka Pata: Pattern bullish ya bearish reversal ke liye strong indication deta hai, jo traders ko trend reversal ka pata lagane mein madad karta hai.

- Entry aur Exit Points: Pattern traders ko entry aur exit points ke liye guidelines provide karta hai. Confirmation ke baad, traders positions enter ya exit kar sakte hain.

- Market Sentiment Ka Pata: Pattern market sentiment ko samajhne mein bhi madad karta hai. Is pattern ka appearance market ke indecision ko darshata hai.

Conclusion: Four price doji candlestick pattern ek useful candlestick pattern hai jo traders ko market ke direction ke bare mein information provide karta hai. Is pattern ka istemal karke, traders trend reversal ke signals ko identify kar sakte hain aur apne trading strategies ko improve kar sakte hain. Sahi risk management ke saath, four price doji candlestick pattern traders ke liye ek powerful tool ho sakta hai market analysis mein.

-

#4 Collapse

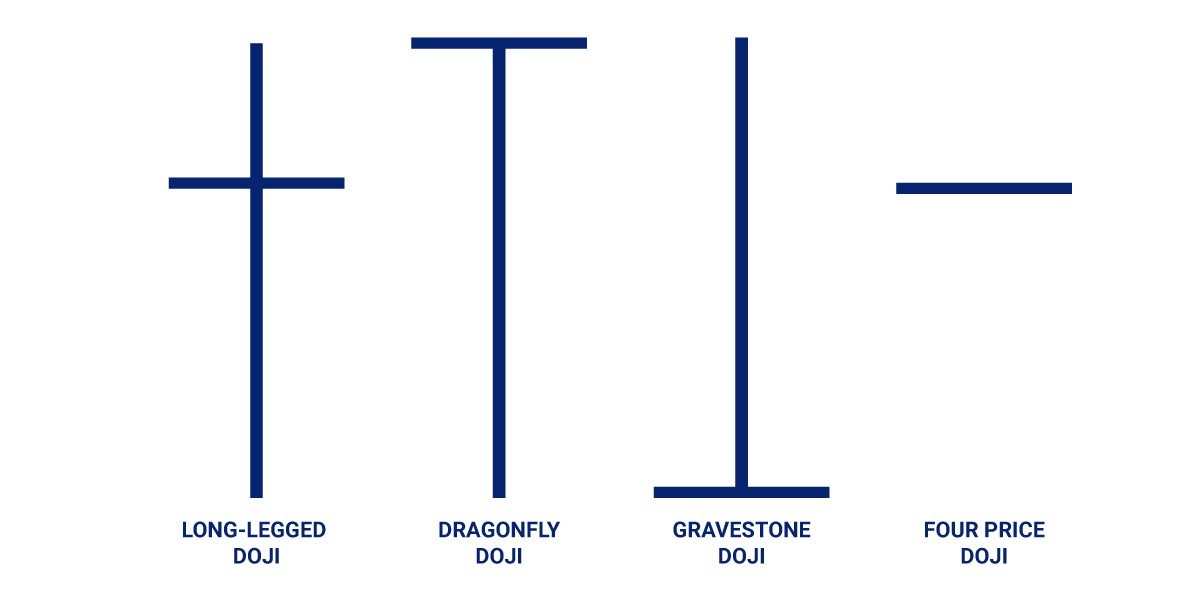

Trading aur technical analysis ke world mein candlestick patterns ka bohot bara role hota hai. Yeh patterns traders ko market sentiment aur price movements ko samajhne mein madad karte hain. Candlestick patterns kai types ke hote hain, jinmein se ek important aur unique pattern hai Four Price Doji. Pehle, Doji candlestick ka samajhna zaroori hai. Doji ek aisa candlestick pattern hai jisme opening aur closing prices almost equal hote hain. Yeh pattern market mein indecision ko represent karta hai, matlab buyers aur sellers dono mein se koi bhi dominate nahi kar raha hota. Doji candlesticks kai types ke hote hain jaise Dragonfly Doji, Gravestone Doji, aur Four Price Doji. Har ek pattern different market conditions aur sentiments ko indicate karta hai.

What is the Four Price Doji

Four Price Doji ek unique aur rare candlestick pattern hai. Is pattern mein opening price, closing price, high price, aur low price sab ek hi level pe hote hain. Iska matlab yeh hai ke trading session ke dauran price movement bilkul nahi hoti aur market complete equilibrium mein hota hai. Is pattern ko ek horizontal line ke shape mein represent kiya jata hai kyunki sab prices equal hote hain.

Characteristics of Four Price Doji- No Price Movement: Four Price Doji ka sab se prominent feature yeh hai ke isme koi price movement nahi hoti. Opening, closing, high, aur low prices sab same hote hain, jo market ki complete indecisiveness ko dikhata hai.

- Rare Occurrence: Yeh pattern bohot kam dekhne ko milta hai kyunki generally market mein kuch na kuch price movement hoti hi rehti hai. Is pattern ka ana indicate karta hai ke market participants bilkul inactive hain.

- Market Equilibrium: Is pattern ka matlab yeh hai ke market complete equilibrium mein hai. Buyers aur sellers dono hi inactive hain aur price kisi bhi direction mein move nahi kar rahi.

Four Price Doji pattern market participants ke liye kuch important signals provide karta hai:- Indecision and Uncertainty: Yeh pattern clear indication hai ke market mein indecision aur uncertainty hai. Traders ko yeh samajh aata hai ke kisi bhi direction mein strong move expect nahi kiya ja sakta.

- Lack of Volume: Is pattern ka matlab yeh bhi hota hai ke trading volume bohot low hai. Jab market mein participation low hoti hai toh prices stagnant rehti hain.

- Potential Reversal: Agar yeh pattern kisi trend ke end pe form hota hai, toh yeh potential reversal ka signal de sakta hai. Market ki lack of movement indicate karti hai ke existing trend weak ho gaya hai aur naya trend form ho sakta hai.

Four Price Doji pattern ko samajhne ke liye kuch practical examples ko dekhte hain:- In an Uptrend: Agar yeh pattern ek strong uptrend ke end pe form hota hai, toh yeh indicate karta hai ke bulls (buyers) ab dominate nahi kar rahe. Yeh pattern ke baad market me consolidation ya reversal ho sakta hai. Traders ko cautious ho jana chahiye aur price action ko closely monitor karna chahiye.

- In a Downtrend: Isi tarah, agar yeh pattern ek downtrend ke end pe form hota hai, toh yeh indicate karta hai ke bears (sellers) ab dominate nahi kar rahe. Yeh pattern ke baad market me reversal ya sideways movement ho sakti hai. Traders ko yeh pattern dekh ke apni short positions reconsider karni chahiye.

- In a Sideways Market: Agar yeh pattern sideways market mein form hota hai, toh yeh ek confirmation hai ke market complete indecision mein hai. Aise mein traders ko wait and watch approach adopt karni chahiye aur kisi clear trend ka intizar karna chahiye.

Four Price Doji pattern ko dekh ke kai trading strategies adopt ki ja sakti hain:- Wait for Confirmation: Four Price Doji pattern dekh ke turant action lena zaroori nahi hai. Traders ko yeh pattern dekh ke subsequent candles ka intizar karna chahiye taake market ki clear direction samajh mein aaye. Confirmation candle ke basis pe trade execute kiya jaye.

- Combine with Other Indicators: Is pattern ko other technical indicators ke sath combine karna helpful hota hai. For instance, moving averages, RSI, aur MACD ke sath combine kar ke ek strong trading signal mil sakta hai. Yeh combination traders ko better entry aur exit points identify karne mein madad karta hai.

- Support and Resistance Levels: Four Price Doji pattern ko support aur resistance levels ke sath dekhna bhi useful hota hai. Agar yeh pattern critical support ya resistance level pe form hota hai, toh yeh potential breakout ya breakdown ka signal de sakta hai.

- Risk Management: Four Price Doji pattern dekh ke trades execute karte waqt risk management strategies ko zaroor adopt karna chahiye. Stop loss aur take profit levels ko clearly define karna chahiye taake potential losses ko minimize kiya ja sake.

Four Price Doji pattern ko samajhne ka ek important aspect market participants ki psychology hai:- Trader Sentiment: Yeh pattern market participants ke sentiment ko reflect karta hai. Indecision ka matlab hai ke traders abhi clear nahi hain ke market kis direction mein move karega. Yeh sentiment change hone pe market me significant moves dekhne ko milte hain.

- Market Psychology: Yeh pattern market psychology ko bhi reflect karta hai. Market mein jab complete indecisiveness hoti hai toh yeh pattern form hota hai, jo indicate karta hai ke koi bhi party (buyers ya sellers) dominate nahi kar rahi. Yeh psychology change hone pe market mein new trends form hote hain.

Limitations of Four Price Doji- False Signals: Kabhi kabhi yeh pattern false signals bhi de sakta hai. Market mein kai baar yeh pattern form hota hai lekin subsequent price action usko validate nahi karta. Isliye, confirmation ka intizar karna zaroori hai.

- Rare Occurrence: Yeh pattern bohot rare hota hai, isliye ispe solely rely karna mushkil hota hai. Traders ko other patterns aur indicators ka bhi use karna chahiye taake comprehensive analysis ho sake.

- Volume Consideration: Four Price Doji pattern dekhte waqt volume ko bhi consider karna chahiye. Low volume market mein yeh pattern zyada common hota hai aur misleading signals de sakta hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#5 Collapse

Four price doji candlestick pattern

Price doji candlestick pattern ka matlab hota hai aik aisi candlestick jo khuli aur band hui ho almost same price par. Yeh pattern indecision ko represent karta hai, matlab ke buyers aur sellers dono ka ikhtilaf hota hai aur market kis direction me jayegi uska koi clear indication nahi hota.

Four price doji pattern aik specific type of doji hai jisme high, low, open aur close price sab same hoti hain. Yeh bohot rare pattern hai aur strong indecision ko show karta hai. Agar aapko kisi chart me yeh pattern nazar aaye, to iska matlab yeh hai ke market participants bilkul unsure hain ke price agay kahan move karegi.

Four Price Doji Candlestick Pattern:- Sabse pehla aur main feature yeh hai ke isme open, close, high aur low price sab aik hi level par hoti hain.

- Yeh pattern usually low volume markets me hota hai jahan buying aur selling pressure balance me hota hai.

- Aik strong indecision signal hota hai aur aagey ki movement uncertain hoti hai.

Interpretation:- Yeh pattern aksar sideways market ya consolidation period ke dauran dekha jata hai.

- Agar kisi trend ke end par yeh pattern dikhe, to yeh trend reversal ka signal ho sakta hai.

- Trade decisions lene se pehle hamesha dusre technical indicators aur market context ko bhi consider karein.

me likhna thoda mushkil ho sakta hai, magar upar di gayi explanation se aapko four price doji candlestick pattern ka matlab aur uski importance samajh aayi hogi.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex Trade Mein Char Qeemat Doji Shama Pattern

Forex trading mein candlestick patterns ka istemal ek ahem hissa hai jis mein "Four Price Doji" shama pattern bhi shamil hai. Ye pattern traders ke liye ahem signals provide karta hai aur market ki movement ko samajhne mein madad deta hai. Is article mein hum Four Price Doji shama pattern ke baray mein mukhtasar tafseelat pesh karenge:

1. Four Price Doji Shama Pattern: Introduction

Four Price Doji shama pattern ek special type ka candlestick pattern hai jo market mein neutrality ya confusion indicate karta hai. Jab is pattern mein ek candle ki open, high, low, aur close prices ek doosre ke qareeb barabar hote hain, to ye ek Four Price Doji form hota hai. Is ka matlab hota hai ke market ke participants ke darmiyan kisi bhi direction mein strong consensus nahi hai aur ye indecision ya equilibrium ko signify karta hai.

2. Kya Hota Hai Four Price Doji?

Four Price Doji pattern tab banta hai jab ek candle ki open, high, low, aur close prices bilkul ya kafi qareeb ek doosre ke barabar hote hain. Is mein price range bohat kam hota hai, jo ke traders ko market ke current sentiment ke baray mein maloomat deta hai. Is tarah ka pattern dekhne par traders ko ye samajhna chahiye ke market mein uncertainty hai aur koi clear trend nahi hai.

3. Four Price Doji Ki Nishandahi

Four Price Doji pattern ki nishandahi market ke current scenario ke mutabiq hoti hai. Agar ye pattern uptrend ke baad form hota hai, to ye ek potential trend reversal signal bhi ho sakta hai. Jabke agar is pattern ke baad market downtrend mein hai, to ye trend continuation ka indication bhi ho sakta hai. Traders ko is pattern ke formation ke context aur market ke overall trend ko samajh kar interpret karna chahiye.

4. Four Price Doji Pattern Ki Khasiyat

Four Price Doji pattern ki khasiyat yeh hai ke is mein price range bohat kam hota hai, jo traders ko market ke current sentiment aur equilibrium ke baray mein maloomat deta hai. Jab market mein volatility kam hoti hai aur price range narrow hota hai, to is se ye samajhna asan ho jata hai ke market mein uncertainty hai aur traders cautious ho jate hain.

5. Four Price Doji Ka Interpretation

Traders is pattern ko interpret kar ke market ke future direction ke baray mein faislay kar sakte hain. Agar Four Price Doji uptrend ke baad form hota hai aur volume bhi kam hota hai, to ye ek potential trend reversal ka sign ho sakta hai. Lekin agar is pattern ke baad market ka volume high hai aur market strong uptrend mein hai, to ye pattern sirf temporary pause ya consolidation ko indicate kar sakta hai.

6. Four Price Doji Ka Istemal Kaise Kiya Jaye?

Traders is pattern ko technical analysis ke liye istemal karte hain aur is ke zariye potential trading opportunities ki pehchan karte hain. Is pattern ko identify karne ke baad, traders ko volume aur market ke overall trend ko bhi consider karna chahiye taake unhe sahi trading decisions lenay mein madad mile.

7. Four Price Doji Aur Price Action

Is pattern ki understanding price action analysis mein ahem hoti hai, jis se traders market ke dynamics ko samajh sakte hain. Price action analysis ke zariye traders candlesticks ke patterns aur unke formations ko analyze karte hain taki unhe market ke sentiment aur price movements ka pata chal sake.

8. Four Price Doji Aur Risk Management

Risk management ke liye Four Price Doji pattern ka istemal traders ko apne trades ko manage karne mein madad deta hai. Jab market mein uncertainty hota hai aur Four Price Doji pattern form hota hai, to traders apni position sizes ko adjust kar sakte hain aur apne stop-loss levels ko define karke apne risk ko manage kar sakte hain.

9. Four Price Doji Ka Historical Performance

Is pattern ka historical performance analyze kar ke traders market ke behavior ko samajhte hain. Jab bhi market mein Four Price Doji pattern form hota hai, traders is ka past performance check karte hain taki unhe pata chale ke is pattern ke formation ke baad market mein kis tarah ka reaction hota hai.

10. Four Price Doji Ki Strategies

Traders is pattern ke istemal se mukhtalif strategies develop karte hain jaise ke breakout ya trend reversal strategies. Agar Four Price Doji pattern ek strong trend ke baad form hota hai aur volume bhi kam hota hai, to traders breakout ka wait kar sakte hain. Lekin agar is pattern ke baad market mein high volume hai aur price range bhi narrow hai, to ye ek potential reversal ka indication ho sakta hai.

11. Four Price Doji Aur Technical Indicators

Is pattern ke sath technical indicators ka istemal kar ke traders apne analysis ko aur bhi mazboot bana sakte hain. Traders Four Price Doji pattern ko confirm karne ke liye volume indicators aur trend following indicators jaise ke Moving Averages ka istemal karte hain taki unhe sahi trading signals mil sake.

12. Four Price Doji Ke Limitations

Is pattern ke limitations ko samajhna bhi ahem hai, jaise ke false signals ya choppy market conditions. Four Price Doji pattern kabhi-kabhi choppy markets mein bhi form ho sakta hai jahan market mein actual indecision nahi hota hai, lekin sirf price range narrow hone ki wajah se ye pattern form ho jata hai.

13. Four Price Doji Aur Market Psychology

Is pattern se market ki psychology ko samajhna traders ke liye zaroori hai, jisse unhe better trading decisions lenay mein madad milti hai. Four Price Doji pattern market ke sentiment aur traders ke behavior ko reflect karta hai aur is ke formation ke baad market ka reaction bhi traders ki psychology par depend karta hai.

14. Four Price Doji Ka Real-Life Example

Ek real-life example ke zariye is pattern ki practical understanding ko demonstrate kiya ja sakta hai. Jab bhi market mein Four Price Doji pattern form hota hai, traders real-life examples ko analyze karte hain taki unhe pata chale ke is pattern ke formation ke baad market mein kis tarah ka movement hota hai.

15. Four Price Doji Ke Advantages

Is pattern ke advantages jaise ke clear entry aur exit points traders ke liye bohat ahem hote hain. Four Price Doji pattern ke formation ke baad traders ko clear entry aur exit points milte hain jinhe follow kar ke wo apne trades ko manage kar sakte hain aur potential profits ko maximize kar sakte hain.

16. Four Price Doji Ke Drawbacks

Is pattern ke drawbacks ko samajhna traders ke liye strategy planning mein zaroori hai. Jab bhi traders Four Price Doji pattern ko analyze karte hain, to unhe is ke drawbacks bhi consider karna chahiye jaise ke false signals ya choppy market conditions.

17. Four Price Doji Ka Backtesting

Is pattern ka backtesting kar ke traders apne trading strategies ko refine kar sakte hain. Four Price Doji pattern ko historical data par test kar ke traders apne trading strategies ko improve kar sakte hain aur is pattern ke formations ke baad market ka reaction analyze kar sakte hain.

18. Four Price Doji Ka Istemal Different Time Frames Par

Is pattern ko different time frames par analyze kar ke traders market ke behavior ke variations ko samajh sakte hain. Jab traders Four Price Doji pattern ko different time frames par analyze karte hain, to unhe market ke short-term aur long-term trends ka pata chalta hai aur wo apne trading strategies ko accordingly adjust kar sakte hain.

19. Four Price Doji Ka Future Scope

Future mein Four Price Doji pattern ka scope aur us ke istemal ke tareeqe mazeed improve ho sakte hain. Jab traders market ke dynamics aur technology ke sath update hote hain, to Four Price Doji pattern ka istemal bhi evolve hota hai aur traders ko better trading opportunities milte hain.

Is article mein humne Four Price Doji shama pattern ke bare mein mukhtasar jayeza kiya hai jo forex traders ke liye ek valuable tool hai. Ye pattern market analysis mein depth aur insight provide karta hai jo trading decisions ko improve karta hai. Traders ko is pattern ki understanding aur us ke practical istemal par focus rakhna chahiye taake wo market ke mukhtalif scenarios ko samajh saken aur better trading outcomes achieve kar saken. -

#7 Collapse

FOUR PRICE DOJI CANDLESTICK PATTERN

Explain Four price doji candlestick pattern

As salam o alaikum Dear forex members, Four Price Doji Candlestick pattern trading ik technical analysis ka tareeqa hy jisme traders candlestick patterns ka istemal karte hain market ke future movements ko predict karne ke liye. Ik aham candlestick pattern Price Doji hy, jo ke market main indecision ko darust karta hy.four Price Doji Candlestick pattern ik specific type ka candle hy jisme open or close price almost equal hoti hy. Iska matlab hy ke market main kisi bhi direction ki khaas tawajjuh nahi hy or traders confuse hote hain ke market ka agla rukh kya hoga. Ye pattern aksar market ke reversals ko indicate karta hy.Four Price Doji candlestick pattern forex trading main ik ahem technical analysis tul hy jo market ke potential reversals or trend changes ko detect karne main madad deta hy. Is pattern main Doji candles ka istemal kiya jata hy jo market ke indecision ko darust karta hy. Is article main hum Four Price Doji candlestick pattern ke bare main tafseelat se baat karenge, uske formation, interpretation, or trading strategies ke hawale se.four Price Doji candlestick pattern forex trading main ik mahatvapurna technical analysis tul hy jo traders ko market ke potential reversals or trend changes ko detect karne main madad deta hy. Is article main humne Four Price Doji candlestick pattern ke bare main tafseelat se baat ki, uske formation, interpretation, or trading strategies ke bare main discuss kiya.

ExplainThree section of Four Price Doji candlestick pattern:

Section 1: Four Price Doji Pattern ki Samajh- Candlestick Patterns ki Ahmiyat: Hello dosto, Candlestick patterns forex trading main price action analysis ka zaruri hissa hain. In patterns ki madad se traders market sentiment or price movements ko samajh sakte hain.

- Four Price Doji Pattern kya hy: Dear friends,Four Price Doji pattern ik special type ka Doji candlestick hy jismain open, high, low, or close prices barabar hote hain. Is pattern main market ke indecision or lack of trend ko darust kiya jata hy.

Section 2: Four Price Doji Pattern ka Formation

Dear traders, Four Price Doji pattern ka formation kuch is tarah hota hy:- Equal Prices: Dear, Sab se pehle, ik Doji candle form hota hy jismain open, high, low, or close prices ik dusre ke barabar hote hain.

- Indecision: Friends, Is Doji candle ki formation se market main indecision or lack of trend ka signal milta hy.

Section 3: Four Price Doji Pattern ki Interpretation

Hello dosto, Four Price Doji pattern ko samajhne ke liye, traders ko kuch points par dhiyan dena chahiye:- Reversal Signal: Dear, Four Price Doji pattern ik potential reversal signal hy jo indicate karta hy ke market direction main change hone ki sambhavna hy.

- Market Indecision: Dear, Is pattern main market ke indecision or lack of trend ko darust kiya jata hy. Traders ko caution or vigilance maintain karna chahiye.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#8 Collapse

Forex Trade Mein Chaar Price Doji Candlestick Pattern

Forex trading mein candlestick patterns ka istemal aam hai, jin mein se ek important pattern "Four Price Doji" hai. Is article mein hum Four Price Doji candlestick pattern ke baare mein detail se baat karenge.

1. Introduction to Candlestick Patterns

Forex trading ka ek mukhtasar introduction diya jaye, jismein candlestick patterns ka importance aur unka basic concept explain kiya jaye. Candlestick patterns ka use price action aur market trends ko analyze karne ke liye hota hai.

2. Understanding Doji Candlesticks

Doji candlesticks ki definition aur unke characteristics explain kiye jaye, jaise ki open aur close prices ka barabar hona. Doji candlesticks market mein indecision aur potential reversals indicate karte hain.

3. What is Four Price Doji?

Four Price Doji ka concept samjhaya jaye, jismein ek candlestick mein high, low, open, aur close prices barabar hote hain. Is pattern ka occurrence rare hota hai, lekin jab hota hai toh significant hota hai.

4. Identifying Four Price Doji

Four Price Doji pattern ko identify karne ke liye specific criteria aur examples diye jaye, jaise ki candle ki body ki absence aur price levels ka similar hona.

5. Significance in Forex Trading

Four Price Doji candlestick pattern ka forex trading mein importance aur uska role reversal signals provide karne mein explain kiya jaye. Is pattern ke signals ko recognize karna traders ke liye critical hota hai.

6. Occurrence and Frequency

Is heading mein Four Price Doji pattern ki occurrence aur frequency par focus kiya jaye. Market conditions aur different timeframes par is pattern ka occurrence vary karta hai.

7. Example of Four Price Doji

Is section mein ek detailed example provide kiya jaye jismein Four Price Doji candlestick pattern ka real-life application demonstrate kiya jaye. Example mein historical chart analysis aur pattern recognition ka use kiya jaye.

8. Types of Four Price Doji

Four Price Doji ke alag-alag types aur unke characteristics explain kiye jaye, jaise ki high volatility aur low volatility ke basis par variations. Har type ke characteristics aur unka market mein impact discuss kiya jaye.

9. Trading Strategies Using Four Price Doji

Is section mein Four Price Doji pattern ko trade karne ke strategies discuss kiye jaye, jaise ki pattern confirmation, entry aur exit points, aur risk management strategies. Practical examples aur trading scenarios ke through strategies ko illustrate kiya jaye.

10. Risk Management with Four Price Doji

Four Price Doji pattern ke use mein risk management ka importance aur effective techniques discuss kiye jaye. Position sizing, stop-loss placement, aur trade management strategies ke upar focus kiya jaye.

11. Importance of Confirmation

Four Price Doji pattern ke signals ko confirm karne ke different methods aur techniques explain kiye jaye, jaise ki volume analysis, technical indicators ka use, aur market context ki analysis.

12. Avoiding False Signals

Is section mein false signals se bachne ke strategies aur techniques discuss kiye jaye, jaise ki pattern validation, additional confirmation signals, aur filtering techniques.

13. Backtesting Four Price Doji

Historical data aur backtesting ka importance Four Price Doji pattern ki effectiveness aur reliability ko evaluate karne mein explain kiya jaye. Different timeframes aur market conditions par pattern ke performance ka analysis kiya jaye.

14. Psychological Aspect

Traders ke psychology aur mindset par Four Price Doji pattern ka impact discuss kiya jaye. Emotional control, decision-making process, aur trading discipline ke importance ko highlight kiya jaye.

15. Real-Life Applications

Real-life trading scenarios aur practical applications mein Four Price Doji pattern ke use ko illustrate kiya jaye. Recent market examples aur case studies ke through pattern ki effectiveness demonstrate kiya jaye.

16. Common Mistakes to Avoid

Four Price Doji pattern ko samajhte waqt hone wali common mistakes aur errors discuss kiye jaye. Beginner traders ke liye specific tips aur guidance provide kiya jaye.

17. Combining Four Price Doji with Other Indicators

Is section mein Four Price Doji pattern ko aur technical indicators ke saath kaise combine kiya jaye, jaise ki moving averages, RSI, aur MACD. Effective trading strategies aur synergies ko explore kiya jaye.

18. Conclusion

Four Price Doji candlestick pattern ka overall summary aur concluding remarks diye jaye, jismein pattern ke benefits, challenges, aur future prospects par focus kiya jaye. Traders ke liye takeaway points aur final thoughts provide kiye jaye.

19. Future Prospects and Research

Is pattern ke future prospects aur further research ke possibilities discuss kiye jaye. Technical advancements, pattern variations, aur market dynamics par focus kiya jaye.

Is tarah se 19 headings ke tahat ek comprehensive article Four Price Doji candlestick pattern par likha ja sakta hai jo Forex traders ke liye informative aur useful hoga. Each heading ke tahat detailed information aur examples provide karke pattern ko samajhna aur effectively use karna traders ke liye beneficial hoga.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:19 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим