Capital Management In Forex

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Capital Management In Forex -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

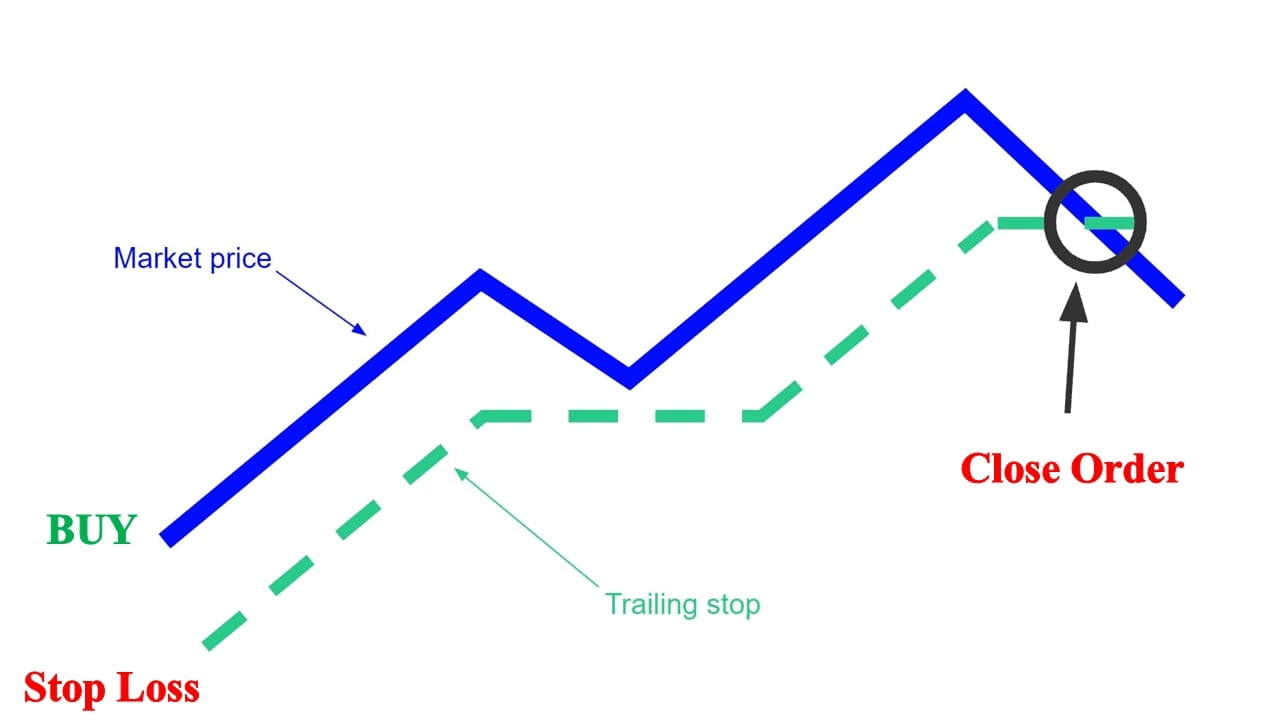

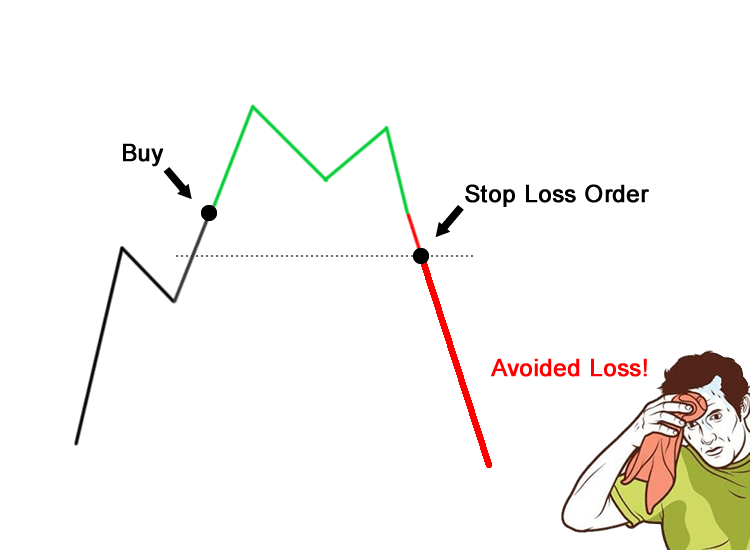

Introduction to Capital Management in Forex Trading Forex trading mein capital idaray ka behtareen intizam lambi muddat tak kamyabi hasil karne aur risk ko kam karne ke liye intihai zaroori hai. Forex, yaani foreign exchange market, dunia bhar mein sab se bara aur sab se liquid capital idara hai, jo kay mukhtalif qisam ke traders aur investors ko apni taraf attract karta hai. Lekin, forex market ki fitri toar par tabdeel hone wali surat-e-haal ki wajah se, agar sahi taur par capital intizam ki strateegiyan nahi istemal ki jati, to traders ko bari nuksanat ka samna karna par sakta hai. Capital intizam mein ahem hissa risk management ka hai. Is mein currency trading ke sath judi jane wali khatraton ko pehchan'ne, qeemat lagane aur kam karne ka aik tarteeb war tareeqa shamil hai. Risk management mein aik ahem tool stop-loss orders ka istemal karna hota hai. Ye orders pehle se tay kardah qeemat hain jahan se traders trade se bahir nikalte hain taake mogheye nuksanat ko had se zyada na hone diya ja sake. Stop-loss orders ko lagane se traders yaqeeni banate hain ke unko aik nuksan daari trade ko bari capital takleef se guzarne nahi dia jaye. Position Sizing in Forex Trading Forex trading mein capital management ka dosra ahem pehlu position sizing hai. Position sizing ka matlab hota hai ke aik khas trade mein lagane ke liyecapital ka munasib hissa tay karna. Aam tor par aik aisi riwayat hai ke har trade par sirf apne trading capital ka aik chota sa hissa risk karna chahiye. Is tareeqe se risk ko mukhtalif trades par taqseem karna hota hai aur aik nuksanat se capital ke aam hisse par asar nahi parta. Forex trading mein leverage aik doosra aham hissa hai. Jahan ye mufaadat pohancha sakti hai, wahan ye nuksanat ko bhi mazeed barha sakti hai. Capital idaray ko behtareen taur par chalane ke liye leverage ko samajhna zaroori hai. Traders ko apne istemal kar rahe leverage aur iske capital par hone wale asar ka wazeh ilm hona chahiye. Ye ahem hai ke zyada leverage se bacha jaye, jo margin calls ko lekar aik trading account ko khatam kar sakta hai. The Psychological Aspect of Capital Management Capital management mein trading psychology ka bara haq ada karne ka bhi aik ahem kirdar hota hai. Khof aur hirs ki tarah jazbat aqal par parde daal sakte hain aur bina soch samajh ke faislay par amal karwa sakte hain. Traders ko riayat aur jazbat ko control karne ki adat dalni chahiye. Apne trading plan ko mazbooti se follow karen, risk management ke qawaid ko taameel karen aur nuksan ke baad badla lene ki bajaye is se bachen. Iske sath hi, apne kaam aur zindagi ka tawazun qaim rakhna aur stress ka intizam bhi aap ko raational faislay karne mein madadgar sabit ho sakta hai. Capital management mein ek aur ahem asool diversification hai. Apni capital ko aik hi currency pair ya trade par puri tarah mabni karne ke bajaye, apne portfolio ko tafreeq dena behtareen hota hai. Diversification se risk taqseem hota hai aur aik hi nuksanat ko kamzor asar par pohnchna hota hai. Traders mukhtalif currency pairs par trading karke, mukhtalif trading strategies istemal karke, ya apne portfolio mein doosre capital idaray shamil karke tafreeq kar sakte hain. Continuous Monitoring and Evaluation Capital management ka asool fauri tor par apni trading performance ko nazar mein rakhna aur tajziyat karna hai. Apni trades, jaise ke har trade ke peechle tareeqe aur natijeyat, ko record karne ke liye aik trading journal maintain karen. Apne journal ko baar-baar tajziyat karke apne trading approach mein pattren, kamzoriyan aur taqat ko pehchanen. Apni tareeqe aur risk management ke qawaid ko zarurat ke mutabiq tabdeel karen takay aap apni overall performance ko behtareen banane mein kamiyab ho saken.

The Psychological Aspect of Capital Management Capital management mein trading psychology ka bara haq ada karne ka bhi aik ahem kirdar hota hai. Khof aur hirs ki tarah jazbat aqal par parde daal sakte hain aur bina soch samajh ke faislay par amal karwa sakte hain. Traders ko riayat aur jazbat ko control karne ki adat dalni chahiye. Apne trading plan ko mazbooti se follow karen, risk management ke qawaid ko taameel karen aur nuksan ke baad badla lene ki bajaye is se bachen. Iske sath hi, apne kaam aur zindagi ka tawazun qaim rakhna aur stress ka intizam bhi aap ko raational faislay karne mein madadgar sabit ho sakta hai. Capital management mein ek aur ahem asool diversification hai. Apni capital ko aik hi currency pair ya trade par puri tarah mabni karne ke bajaye, apne portfolio ko tafreeq dena behtareen hota hai. Diversification se risk taqseem hota hai aur aik hi nuksanat ko kamzor asar par pohnchna hota hai. Traders mukhtalif currency pairs par trading karke, mukhtalif trading strategies istemal karke, ya apne portfolio mein doosre capital idaray shamil karke tafreeq kar sakte hain. Continuous Monitoring and Evaluation Capital management ka asool fauri tor par apni trading performance ko nazar mein rakhna aur tajziyat karna hai. Apni trades, jaise ke har trade ke peechle tareeqe aur natijeyat, ko record karne ke liye aik trading journal maintain karen. Apne journal ko baar-baar tajziyat karke apne trading approach mein pattren, kamzoriyan aur taqat ko pehchanen. Apni tareeqe aur risk management ke qawaid ko zarurat ke mutabiq tabdeel karen takay aap apni overall performance ko behtareen banane mein kamiyab ho saken.  Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex Mein Capital Management Forex, ya Foreign Exchange, aik aesa shobha hai jahan har din karoron dollars, euros, aur aur currencies ke khareed-o-farokht hoti hai. Yeh shobha aik aesa darust aur munafa-khori ka zariya hai jo sahi tarah se istemal karne se traders ko behtareen faiday hasil ho sakte hain. Lekin, is shobhay mein kam karne wale traders ko apni raqam ki hifazat aur zarar se bachne ki bunyadi tajaweezat ko samajhna zaroori hai. Is maqsad mein, capital management Forex trading ka aham hissa hai. Capital management ka matlab hota hai apni mojudgi ko taqseem karna aur trading ke dauran isay hifazat se istemal karna. Yeh aik mohim hai jo traders ke liye aik barri ahmiyat rakhta hai, kyun ke agar aap apni raqam ko theek se nahi manage karte to aap trading mein nuksan utha sakte hain. Is article mein, hum Forex mein capital management ke ahem tareeqay aur us ke faiday par baat karenge.- Stop Loss aur Take Profit Orders Ki Tijarat: Sab se pehla aur aham tareeqa capital management ka yeh hai ke aap stop loss aur take profit orders ka istemal karein. Stop loss order aap ko tabadla ke doraan nuksan se bachata hai jabke take profit order aap ko munafa hasil karne mein madadgar sabit hota hai. In orders ko istemal kar ke aap apni trading ki raqam ko mukarrar hadood mein rakh sakte hain.

- Risk Management Plan Banana: Forex trading mein kam karne se pehle, aap ko aik risk management plan banana chahiye. Is plan mein aap ko yeh tay karna chahiye ke aap har trading position ke liye kitni raqam risk kar sakte hain. Aap apne trading account ki mojudgi ko is plan ke mutabiq taqseem karenge, jis se aap apni raqam ko barbaad hone se bacha sakte hain.

- Leverage Ko Samajhna: Leverage aik qisam ki qarz hai jo aap ko trading mein di jati hai. Is se aap apni trading ki taqat barha sakte hain, lekin is ka istemal bari hoshiyari se karna chahiye. Zyada leverage istemal karne se aap ko zyada faiday ki umeed hai, lekin is ke sath sath zyada nuksan ka bhi khatra hota hai. Capital management mein, leverage ka istemal taqatwar tareeqe se karna zaroori hai.

- Diversification Ki Ahmiyat: Apni mojudgi ko taqseem karte waqt, aap ko mukhtalif currencies aur trading pairs mein invest karne ki soch bhi leni chahiye. Yeh diversification kehlata hai, aur is se aap apni raqam ko ek hi trading position ke zariye par lagane ke nuksan se bacha sakte hain.

- Emotions Se Bachna: Forex trading mein kam karte waqt, aap ko apni emotions ko control mein rakhna zaroori hai. Gham, khushi, ya jazbaat aap ke faislon ko asar andaz nahi karne chahiye. Trading decisions ko hoshiyari aur tajaweez ke sath lena chahiye.

- Regularly Account Ki Tahqiqat Karna: Aap ko regular intervals par apne trading account ki tahqiqat karna chahiye. Is se aap apni mojudgi ko monitor kar sakte hain aur nuksan se bachne ke liye zaroori kadam utha sakte hain.

-

#4 Collapse

Apni Sarmaya Ko Barqarar Rakhne Ka Tariqa Forex (Foreign Exchange) market aik aisa mazloom hai jahan aapka sarmaya tezi se badh sakta hai ya ghayab ho sakta hai. Is market mein trading karna waqai asaan nahi hai, lekin agar aap capital management ka sahi tariqa istemal karain to aap apne nuksanat se bach sakte hain aur apne paisay ko barqarar rakh sakte hain. Is article mein hum Forex mein capital management ke ahem tariqon par baat karenge. 1. Paise Ka Taqseem: Pehli baat to yeh hai ke aapko apne sarmaye ko kis tarah se taqseem karna chahiye. Aapko apne paisay ko aik hissa mein nahi daalna chahiye, balke unko alag-alag lots mein taqseem karna behtar hai. Is tarah, agar aap ek trade mein nuksan uthatay hain, to aapka poora sarmaya tabah nahi hoga. 2. Stop Loss Aur Take Profit Orders: Stop loss aur take profit orders aapke liye aik mehfooz rasta tay karte hain. Stop loss order aapko tabdeel hone se bachata hai jab aapka trade ghata mein ja raha hota hai. Take profit order aapko faida kamane ka mauqa deta hai jab aapka trade aapke target tak pohanch jata hai. In orders ko istemal karna capital management ka aik ahem hissa hai. 3. Leverage Ka Istemal: Leverage Forex trading mein aik aham tool hai, lekin iska istemal behtareen tarah se karna zaroori hai. Leverage aapke trading ki purchasing power ko barha deta hai, lekin yeh aapko ziada nuksanat mein daal sakta hai. Is liye, leverage ka istemal samajhdari se karna chahiye aur zyada risk se bachna chahiye. 4. Risk-Reward Ratio: Har trade ke liye risk-reward ratio tay karna zaroori hai. Aapko yeh faisla karna hoga ke aap kitna nuksan bardasht kar sakte hain agar trade ulta hojaye, aur kitna faida umeed kar sakte hain agar trade sahi ho. Is tariqe se, aap apne trades ko samjhdari se plan kar sakte hain. 5. Demo Trading: Agar aap naye hain Forex trading mein, to demo trading aapke liye behtareen tajwez hai. Is mein aap virtual currency ka istemal karke real-time market conditions ko experience kar sakte hain, lekin bina asal paisay lagaye. Is se aap apni trading skills ko behtar bana sakte hain. 6. Trading Plan Banayein: Har trader ko apna trading plan banana chahiye. Is plan mein aapko yeh tay karna hoga ke aap kis tarah se trading karenge, kab trades karenge, aur kitna risk lenge. Trading plan ko barqarar rakhna capital management ke liye zaroori hai. 7. Emotions Se Bachna: Forex trading mein emotions se bachna aham hai. Ghusse, jazbaat aur greed aapke faislon ko nuksan mein daal sakte hain. Is liye, hamesha tajwez hai ke trading ko behtareen akalmandi aur tawajjo ke sath karen. Forex mein capital management aapke trading career ke liye zaroori hai. Agar aap apne sarmaye ko barqarar rakhna chahte hain, to upar di gayi tajwezon ko amal mein layen. Forex market mein kamyaabi paane ke liye sabr aur mehnat ki zaroorat hoti hai, aur capital management aapko is raaste par sahi tarah se le ja sakta hai -

#5 Collapse

Forex Mein Capital Management: Apni Sarmaya Ko Samajhain Aur Sanjeeda Trading Karain Forex (Foreign Exchange) ek aesa global market hai jahan par duniya bhar ke currencies (mudraayein) khareedi aur bechi jaati hain. Yeh market 24 ghante chalti hai aur aapko dher saari trading maukaat deti hai. Lekin, Forex market mein trading karte waqt apni sarmaya (capital) ka behtareen management karna kisi bhi trader ke liye ahem hota hai. Capital management, trading career ki mool bunavat hoti hai aur Roman Urdu mein is article mein hum aapko Forex mein capital management ke aham pehluon par roshni daalenge.- Risk Ka Tajziya Karain: Trading shuru karte waqt, aapko apne capital ko risk se bachane ke liye ek tajziya (analysis) karna hoga. Har trade ko lagane se pehle, aapko ye sochna hoga ki agar trade ulta chala gaya to aap kitna nuksan bardasht kar sakte hain. Is nuksan ko control karne ke liye, aapko har trade par ek stop-loss order lagana chahiye. Yeh order aapko nuksan se bachane mein madadgar sabit ho sakta hai.

- Trading Plan Banayein: Capital management ka ek ahem hissa ek trading plan banane mein hota hai. Aapko decide karna hoga ki aap kis tarah ke trades karenge, kitna risk lenge, aur kitna profit target karenge. Aap apne trading plan ko likhkar rakh sakte hain takay aap har trade ko disciplined tareeqe se karein.

- Leverage Ka Durust Istemal Karein: Forex trading mein leverage aik powerful tool hai jo aapko zyada paisa banane mein madadgar ho sakta hai. Lekin, iska istemal zyada risky bhi ho sakta hai. Aapko leverage ka durust istemal karke apne capital ko barabar mein baatna chahiye. Kabhi bhi zyada leverage istemal karne se bachein.

- Position Size Ka Khayal Rakhein: Har trade mein position size (kitne lots ya contracts kharidne hain) ka khayal rakhein. Aapka har trade aapke capital ka chhota hissa hona chahiye. Isse aapko nuksan se bachne mein madad milti hai.

- Emotions Ko Control Karein: Trading mein emotions ka bura asar hota hai. Ghamand, jalan, ya fear aapke faislon ko nuksan pahuncha sakte hain. Apne emotions ko control mein rakhkar trading karein aur apne trading plan par amal karein.

- Diversification Ka Faida Uthayein: Apne capital ko alag-alag currency pairs par trade karke diversify karna bhi ek acha tareeqa hai. Isse aap apne nuksan ko kam kar sakte hain agar kisi ek currency pair mein nuksan hota hai.

- Education Aur Practice Se Behtar Baniye: Forex trading mein mahir banna time aur mehnat mangta hai. Aapko forex ki sahi samajh aur skills hasil karne ke liye education aur practice par zor dena hoga. Demo accounts ka istemal karke practice karna bhi ek acha tareeqa hai.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex Capital Management: Trading Ka Ahem Hissa Forex (foreign exchange) trading aaj kal dunia bhar mein bohat ziada maqbul hai. Log isay apni financial aazadi hasil karne ka zariya samajhtay hain. Lekin, forex trading mein kamyabi hasil karne ke liye, capital management (maaliyat ka idara) ka aham hissa hai. Is article mein hum roman Urdu mein forex capital management ki ahmiyat aur tariqay par baat karain gay. Capital Management Kya Hai? Forex trading mein capital management yani maaliyat ka idara bohat ahem hai. Iska matlab hai ke aap apne trading account mein mojood paisay ko smart tariqay se istemal karna seekhain. Capital management ka maqsad aapke nuksanat (losses) ko kam karna aur aapki kamyabi (profits) ko barqarar rakhna hai. Capital Management Ki Ahmiyat Forex market bohat volatile hoti hai, iska matlab hai ke rates aur currency pairs mein tabdeeliyan roz hoti hain. Aapka trading capital is volatility ke samne ek hifazati daryaft (safety net) ki tarah kaam karta hai. Agar aap apna paisa theek se manage nahi karenge, to aapko aasani se nuksanat ka samna karna parega. Capital management aapko nuksanat ko control karne aur trading career ko lambi muddat tak jari rakhne mein madadgar hota hai. Capital Management Ke Tariqay- Risk Management (Khatra Idara): Apne trading capital ko barqarar rakhne ke liye, aapko har trade mein kitna paisa lagana hai, iska faisla akalmandi se karna hoga. Aam taur par, ek trade mein aap apne capital ka 1-2% istemal karna surat-e-haal hota hai. Is tarah se, aapko agar kisi trade mein nuksanat bhi hoti hai, to aapka pura capital tabah nahi hoga.

- Stop-Loss Aur Take-Profit Orders: Har trade mein stop-loss aur take-profit orders lagana zaroori hai. Stop-loss order aapko nuksanat se bachata hai, jabke take-profit order aapko munafa kamane mein madadgar hota hai. In orders ko lagakar aap apne trading positions ko control mein rakh sakte hain.

- Diversification (Mukhtalif Maal): Apne capital ko mukhtalif currency pairs mein taqseem karna bhi aham hai. Ek hi currency pair par zyada paisa lagana risk se bharpoor ho sakta hai. Diversification se aap apne nuksanat ko spread out kar sakte hain.

- Trading Plan (Tijarat Ka Mansuba): Har trader ko apna khud ka trading plan banana chahiye. Ismein aapko trading goals, risk tolerance, aur trading strategy ka taqatwar nakshe (blueprint) tayyar karna hoga. Trading plan aapko trading decisions mein madadgar sabit hota hai.

- Emotional Control (Jazbati Control): Forex trading mein jazbati control bohat ahem hai. Jab aap apne trading decisions ko jazbaat ki buniyad par lete hain, to nuksanat ka khatra barh jata hai. Capital management aapko yeh sikhata hai ke hamesha akalmandi se aur tajaweezat ke bina trading karna chahiye.

-

#7 Collapse

Capital Administration In Forex Defination Capital Management(CM) involves anticipating and overseeing current resources and liabilities to guarantee the organization can meet transient monetary commitments and money future development. Prologue to Capital Administration in Forex Exchanging Forex exchanging mein capital idaray ka behtareen intizam lambi muddat tak kamyabi hasil karne aur risk ko kam karne ke liye intihai zaroori hai. Forex, yaani unfamiliar trade market, dunia bhar mein sab se bara aur sab se fluid capital idara hai, jo kay mukhtalif qisam ke dealers aur financial backers ko apni taraf draw in karta hai. Lekin, forex market ki fitri toar standard tabdeel sharpen wali surat-e-haal ki wajah se, agar sahi taur standard capital intizam ki strateegiyan nahi istemal ki jati, to merchants ko bari nuksanat ka samna karna standard sakta hai. Capital intizam mein ahem hissa risk the executives ka hai. Is mein money exchanging ke sath judi jane wali khatraton ko pehchan'ne, qeemat lagane aur kam karne ka aik tarteeb war tareeqa shamil hai. Risk the board mein aik ahem apparatus stop-misfortune orders ka istemal karna hota hai. Ye orders pehle se tay kardah qeemat hain jahan se brokers exchange se bahir nikalte hain taake mogheye nuksanat ko had se zyada na sharpen diya ja purpose. Stop-misfortune orders ko lagane se brokers yaqeeni banate hain ke unko aik nuksan daari exchange ko bari capital takleef se guzarne nahi dia jaye. Fundamentally cash the board in exchanging is a protective procedure that is intended to safeguard capital. It is a method for choosing the number of offers or parts to exchange at some random time in light of your accessible capital. Fruitful cash the executives can save you from depleting your record when you hit a terrible dash of losing exchanges. Position Measuring in Forex Exchanging Forex exchanging mein capital administration ka dosra ahem pehlu position estimating hai. Position measuring ka matlab hota hai ke aik khas exchange mein lagane ke liyecapital ka munasib hissa tay karna. Aam peak standard aik aisi riwayat hai ke har exchange standard sirf apne exchanging capital ka aik chota sa hissa risk karna chahiye. Is tareeqe se risk ko mukhtalif exchanges standard taqseem karna hota hai aur aik nuksanat se capital ke aam hisse standard asar nahi parta. Forex exchanging mein influence aik doosra aham hissa hai. Jahan ye mufaadat pohancha sakti hai, wahan ye nuksanat ko bhi mazeed barha sakti hai. Capital idaray ko behtareen taur standard chalane ke liye influence ko samajhna zaroori hai. Brokers ko apne istemal kar rahe influence aur iske capital standard sharpen rib asar ka wazeh ilm hona chahiye. Ye ahem hai ke zyada influence se bacha jaye, jo edge calls ko lekar aik exchanging account ko khatam kar sakta hai.The Mental Part of Capital Administration Capital administration mein exchanging brain science ka bara haq ada karne ka bhi aik ahem kirdar hota hai. Khof aur hirs ki tarah jazbat aqal standard parde daal sakte hain aur bina soch samajh ke faislay standard amal karwa sakte hain. Brokers ko riayat aur jazbat ko control karne ki adat dalni chahiye. Apne exchanging plan ko mazbooti se follow karen, risk the executives ke qawaid ko taameel karen aur nuksan ke baad badla lene ki bajaye is se bachen. Iske sath greetings, apne kaam aur zindagi ka tawazun qaim rakhna aur stress ka intizam bhi aap ko raational faislay karne mein madadgar sabit ho sakta hai. Capital administration mein ek aur ahem asool broadening hai. Apni capital ko aik hey money pair ya exchange standard puri tarah mabni karne ke bajaye, apne portfolio ko tafreeq dena behtareen hota hai. Enhancement se risk taqseem hota hai aur aik hello nuksanat ko kamzor asar standard pohnchna hota hai. Merchants mukhtalif money matches standard exchanging karke, mukhtalif exchanging systems istemal karke, ya apne portfolio mein doosre capital idaray shamil karke tafreeq kar sakte hain.

Position Measuring in Forex Exchanging Forex exchanging mein capital administration ka dosra ahem pehlu position estimating hai. Position measuring ka matlab hota hai ke aik khas exchange mein lagane ke liyecapital ka munasib hissa tay karna. Aam peak standard aik aisi riwayat hai ke har exchange standard sirf apne exchanging capital ka aik chota sa hissa risk karna chahiye. Is tareeqe se risk ko mukhtalif exchanges standard taqseem karna hota hai aur aik nuksanat se capital ke aam hisse standard asar nahi parta. Forex exchanging mein influence aik doosra aham hissa hai. Jahan ye mufaadat pohancha sakti hai, wahan ye nuksanat ko bhi mazeed barha sakti hai. Capital idaray ko behtareen taur standard chalane ke liye influence ko samajhna zaroori hai. Brokers ko apne istemal kar rahe influence aur iske capital standard sharpen rib asar ka wazeh ilm hona chahiye. Ye ahem hai ke zyada influence se bacha jaye, jo edge calls ko lekar aik exchanging account ko khatam kar sakta hai.The Mental Part of Capital Administration Capital administration mein exchanging brain science ka bara haq ada karne ka bhi aik ahem kirdar hota hai. Khof aur hirs ki tarah jazbat aqal standard parde daal sakte hain aur bina soch samajh ke faislay standard amal karwa sakte hain. Brokers ko riayat aur jazbat ko control karne ki adat dalni chahiye. Apne exchanging plan ko mazbooti se follow karen, risk the executives ke qawaid ko taameel karen aur nuksan ke baad badla lene ki bajaye is se bachen. Iske sath greetings, apne kaam aur zindagi ka tawazun qaim rakhna aur stress ka intizam bhi aap ko raational faislay karne mein madadgar sabit ho sakta hai. Capital administration mein ek aur ahem asool broadening hai. Apni capital ko aik hey money pair ya exchange standard puri tarah mabni karne ke bajaye, apne portfolio ko tafreeq dena behtareen hota hai. Enhancement se risk taqseem hota hai aur aik hello nuksanat ko kamzor asar standard pohnchna hota hai. Merchants mukhtalif money matches standard exchanging karke, mukhtalif exchanging systems istemal karke, ya apne portfolio mein doosre capital idaray shamil karke tafreeq kar sakte hain.Persistent Checking and AssessmentCapital administration ka asool fauri peak standard apni exchanging execution ko nazar mein rakhna aur tajziyat karna hai. Apni exchanges, jaise ke har exchange ke peechle tareeqe aur natijeyat, ko record karne ke liye aik exchanging diary keep up with karen. Apne diary ko baar tajziyat karke apne exchanging approach mein pattren,Capital Administration Ke Tariqay

Risk The executives (Khatra Idara): Apne exchanging capital ko barqarar rakhne ke liye, aapko har exchange mein kitna paisa lagana hai, iska faisla akalmandi se karna hoga. Aam taur standard, ek exchange mein aap apne capital ka 1-2% istemal karna surat-e-haal hota hai. Is tarah se, aapko agar kisi exchange mein nuksanat bhi hoti hai, to aapka pura capital tabah nahi hoga.Stop-Misfortune Aur Take-Benefit Requests: Har exchange mein stop-misfortune aur take-benefit orders lagana zaroori hai. Stop-misfortune request aapko nuksanat se bachata hai, jabke take-benefit request aapko munafa kamane mein madadgar hota hai. In orders ko lagakar aap apne exchanging positions ko control mein rakh sakte hain.Broning (Mukhtalif Maal)ade: Apne capital ko mukhtalif money matches mein taqseem karna bhi aham hai. Ek hello cash pair standard zyada paisa lagana risk se bharpoor ho sakta hai. Expansion se aap apne nuksanat ko spread out kar sakte hain.Exchanging Plan (Tijarat Ka Mansuba): Har broker ko apna khud ka exchanging plan banana chahiye. Ismein aapko exchanging objectives, risk resistance, aur exchanging technique ka taqatwar nakshe (outline) tayyar karna hoga. Exchanging plan aapko exchanging choices mein madadgar sabit hota hai.

-

#8 Collapse

CAPITAL MANAGENENT IN FOREX DEFINITION forex money management Ammal ka ek Majmu hai jisse ek Forex trader Apne forex trading account mein Money ka management karne ke liye use Karega money management ka underling principal trading capital ko preserve Rakhna hai iska matlab yah Nahin Hai ke Forex Mein trades ko Kabhi Nahin losing hai Kyunke yah impossible hai Forex trading money management ka maksad trading losses ko kam karna hai Taki vah manageable Ho iska matlab hai ke Jab Koi trading loss main Badal Jaati Hai to yah traders ko dusri trade winning se nahin rokaty money management ka idea risk management se close Rakhta Hai Kyunke trade Karte time Tamam risk aapke Money ko zahar Karte Hain how ever definition slightly different hain:max_bytes(150000):strip_icc()/dotdash_INV_final_Forex_Money_Management_Matters_Jan_2021-01-4c8b546882594377abf72a64e7e90f6e.jpg) TOP FOREX MONEY MANAGEMENT RULES TO FOLLOW agar aap MONEY management ke yah five rules right kar lete hain to aapki Forex trade kI success ke imkanat bahut Behtar Ho jaenge in rules ko aapke Apne trading system Banaya Ja sakta hai lekin unke five forex money management rules ke Kuchh version ko Har EK ko trade karne se pahle writing karke read kar lena chahie Idea hey ke trader Ko Kisi Ek trade per Apne account ka sirf ek small risk mein dalna chahie trading monitor Aksar 2 percentage rules Preach karte hain Jahan Ek trader ko her trading per Apna account ka do percentage risk Hona chahiy ek top trading strategy all risk management plan ko ek trader ko time ke sath make Money Mein help Karni chahie lekin aap kabhi bhi is baat ka yakin nahin kar sakte ke next trading ya Yahan Tak ke next 10 trades mein kya hoga WHAT IS FOREX MONEY MANAG

TOP FOREX MONEY MANAGEMENT RULES TO FOLLOW agar aap MONEY management ke yah five rules right kar lete hain to aapki Forex trade kI success ke imkanat bahut Behtar Ho jaenge in rules ko aapke Apne trading system Banaya Ja sakta hai lekin unke five forex money management rules ke Kuchh version ko Har EK ko trade karne se pahle writing karke read kar lena chahie Idea hey ke trader Ko Kisi Ek trade per Apne account ka sirf ek small risk mein dalna chahie trading monitor Aksar 2 percentage rules Preach karte hain Jahan Ek trader ko her trading per Apna account ka do percentage risk Hona chahiy ek top trading strategy all risk management plan ko ek trader ko time ke sath make Money Mein help Karni chahie lekin aap kabhi bhi is baat ka yakin nahin kar sakte ke next trading ya Yahan Tak ke next 10 trades mein kya hoga WHAT IS FOREX MONEY MANAG EMENT Simple put money management self imposed rules ka ek set hai jo successful trader Apne paise ko effectively manage karne ke liye follow karte hain losses ko kam karna profit ko zyada Se zyada karna aur Apne trading account ka size Barhana Hai Forex Money management Aksar aur understandably risk management se confused ho jata hai Kyunke yah Kafi had Tak similar concepts hain

EMENT Simple put money management self imposed rules ka ek set hai jo successful trader Apne paise ko effectively manage karne ke liye follow karte hain losses ko kam karna profit ko zyada Se zyada karna aur Apne trading account ka size Barhana Hai Forex Money management Aksar aur understandably risk management se confused ho jata hai Kyunke yah Kafi had Tak similar concepts hain

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex trading mei capital management ek bahut hi mahatvapurna concept hai. Yeh traders ke liye essential hai kyunki isse aap apne trading account ko protect kar sakte hain aur trading losses ko minimize kar sakte hain. Capital management forex trading mei risk management ka ek bhaag hai, aur iske kuch key aspects hain: Risk Tolerance and Position Sizing (Risk Apni Capacity Ke Anusaar): Aapko apne risk tolerance ke anusaar trading positions size karni chahiye. Yani ki aapko har trade mei kitna risk uthana hai, isko decide karna important hai. Aap position size determine karne ke liye stop-loss orders ka istemal kar sakte hain taki aap predefined risk level par trade karen. Stop-Loss Orders (Nuksan Rokne Ke Liye Order):

Aapko apne risk tolerance ke anusaar trading positions size karni chahiye. Yani ki aapko har trade mei kitna risk uthana hai, isko decide karna important hai. Aap position size determine karne ke liye stop-loss orders ka istemal kar sakte hain taki aap predefined risk level par trade karen. Stop-Loss Orders (Nuksan Rokne Ke Liye Order):  Stop-loss orders forex trading mei bahut mahatvapurna hote hain. Aap stop-loss order set karke specify kar sakte hain ki aap kitna nuksan tolerate karne ke liye taiyar hain. Agar trade aapke stop-loss level tak pahunchti hai, toh trade automatically band ho jati hai aur aapke nuksan ko minimize karte hain. Risk-Reward Ratio (Nuksan-Reward Ratio):

Stop-loss orders forex trading mei bahut mahatvapurna hote hain. Aap stop-loss order set karke specify kar sakte hain ki aap kitna nuksan tolerate karne ke liye taiyar hain. Agar trade aapke stop-loss level tak pahunchti hai, toh trade automatically band ho jati hai aur aapke nuksan ko minimize karte hain. Risk-Reward Ratio (Nuksan-Reward Ratio):  Aapko har trade mei ek risk-reward ratio set karna chahiye. Yani ki aap decide karte hain ki agar trade profit mein jata hai, toh kitna profit lena hai, aur agar nuksan hota hai toh kitna nuksan tolerate karna hai. Risk-reward ratio aapko help karega trades ko assess karne aur profitable trades maximize karne mei. Diversification (Vividhata):

Aapko har trade mei ek risk-reward ratio set karna chahiye. Yani ki aap decide karte hain ki agar trade profit mein jata hai, toh kitna profit lena hai, aur agar nuksan hota hai toh kitna nuksan tolerate karna hai. Risk-reward ratio aapko help karega trades ko assess karne aur profitable trades maximize karne mei. Diversification (Vividhata):  Apne capital ko diversify karna matlab hai ki aap apne trading funds ko alag-alag currencies, currency pairs, ya trading strategies mei invest karenge. Diversification se aap apne risk ko spread karte hain taki ek hi trade ya currency pair ke nuksan se puri capital na lose ho. Emotional Control (Bhavna Nigraani): Trading mei emotions ko control karna mahatvapurna hai. Greed aur fear jaise emotions se bachne ke liye trading plan bana kar us par amal karna chahiye. Agar aap apne emotions ko control nahi kar sakte, toh trading losses ho sakte hain. Capital Preservation (Nivesh Suraksha): Forex trading mei apne capital ko surakshit rakhna bahut mahatvapurna hai. Capital preservation se aap apne trading career ko lamba aur steady bana sakte hain. Jyada risk lene se bache aur apne capital ko protect kare. Regular Monitoring (Niyamit Anusandhan): Aapko apne trading account ko regular basis par monitor karna chahiye. Trading ki performance ko track kare aur agar kuch changes ki zaroorat hai toh unhe implement kare.Yad rahe ki forex trading high risk hoti hai aur isme loss hone ka khatra hota hai. Isliye capital management, risk management, aur disciplined trading approach bahut hi mahatvapurna hai. Aapko trading education aur experience prapt karke hi forex trading mei involve hona chahiye.

Apne capital ko diversify karna matlab hai ki aap apne trading funds ko alag-alag currencies, currency pairs, ya trading strategies mei invest karenge. Diversification se aap apne risk ko spread karte hain taki ek hi trade ya currency pair ke nuksan se puri capital na lose ho. Emotional Control (Bhavna Nigraani): Trading mei emotions ko control karna mahatvapurna hai. Greed aur fear jaise emotions se bachne ke liye trading plan bana kar us par amal karna chahiye. Agar aap apne emotions ko control nahi kar sakte, toh trading losses ho sakte hain. Capital Preservation (Nivesh Suraksha): Forex trading mei apne capital ko surakshit rakhna bahut mahatvapurna hai. Capital preservation se aap apne trading career ko lamba aur steady bana sakte hain. Jyada risk lene se bache aur apne capital ko protect kare. Regular Monitoring (Niyamit Anusandhan): Aapko apne trading account ko regular basis par monitor karna chahiye. Trading ki performance ko track kare aur agar kuch changes ki zaroorat hai toh unhe implement kare.Yad rahe ki forex trading high risk hoti hai aur isme loss hone ka khatra hota hai. Isliye capital management, risk management, aur disciplined trading approach bahut hi mahatvapurna hai. Aapko trading education aur experience prapt karke hi forex trading mei involve hona chahiye.

-

#10 Collapse

FOREX ME CAPITAL MANAGEMENT:-Forex (foreign exchange) trading mein capital management ya paisay ka tawazun rakhna ek bahut ahem hissa hai. Capital management, aapke trading account mein maujood rupaye ko sahi tareekay se istemal karna aur nuksan se bachne ke liye ek tafseelat aur soch samajh kar ki jane wali strateji hai. Yeh kuch ahem principles aur tajaweezat shamil karti hai: FOREX ME CAPITAL MANAGEMENT K PRICIPALS:-Risk Management (Khatra Prabandhan): Aapko hamesha trading account ke ek maqsoos hisse ko risk karne se bachana chahiye. Isme aap decide karte hain ki har trade mein kitna paisa risk karenge. Aam taur par, ek trade mein aapke account ke sirf 1-2% tak ka paisa risk karne ki salahiyat hoti hai. Stop-Loss Orders (Nuksan Rokne ki Aadesh): Stop-loss order ek aisi limit hoti hai jo aap trading platform par set karte hain. Agar trade us limit tak pohanchti hai, to trade automatically band ho jati hai. Yeh aapko nuksan se bachata hai. Position Size (Maujooda Aukaat): Har trade ke liye kitne lot (position size) open karna hai, yeh ek ahem faisla hota hai. Aapko apne trading account ke size aur risk tolerance ke mutabik position size tay karni chahiye. Leverage (Levarij): Leverage ka sahi istemal karna bhi capital management ka hissa hai. Aapko leverage ko samajhna aur samajhdari se istemal karna chahiye, kyun ki yeh aapke nuksan ko bhi barha sakta hai. Diversification (Vividhikaran): Apne paiso ko alag-alag currency pairs mein invest karke risk ko kam karne ka prayaas karen. Ek hi currency pair par puri tarah se dependent na rahein. Trading Plan (Trading Yojna): Har trader ke paas ek trading plan hona chahiye, jismein unka trading strategy, risk management guidelines, aur profit targets shaamil hote hain. Yeh plan aapko disciplined rakhta hai. Emotions Control (Bhavnaon Ka Niyantran): Trading mein bhavnaon ka asar nuksan kar sakta hai. Hamesha rational aur calm rehna important hai. Agar aap ek trade mein nuksan karne ke baad gusse mein aa jate hain, to aap aur bhi nuksan kar sakte hain. Monitoring and Review (Nigraani aur Samiksha): Apne trading performance ko regular basis par monitor karen aur mistakes ko samjhein. Apne trading plan ko update karte rahein, agar zaroorat ho. Capital management ke bina, trading forex market mein risky ho sakta hai. Isliye, is par dhyan dena aur ek disciplined approach maintain karna mahatvapurnn hai.

FOREX ME CAPITAL MANAGEMENT K PRICIPALS:-Risk Management (Khatra Prabandhan): Aapko hamesha trading account ke ek maqsoos hisse ko risk karne se bachana chahiye. Isme aap decide karte hain ki har trade mein kitna paisa risk karenge. Aam taur par, ek trade mein aapke account ke sirf 1-2% tak ka paisa risk karne ki salahiyat hoti hai. Stop-Loss Orders (Nuksan Rokne ki Aadesh): Stop-loss order ek aisi limit hoti hai jo aap trading platform par set karte hain. Agar trade us limit tak pohanchti hai, to trade automatically band ho jati hai. Yeh aapko nuksan se bachata hai. Position Size (Maujooda Aukaat): Har trade ke liye kitne lot (position size) open karna hai, yeh ek ahem faisla hota hai. Aapko apne trading account ke size aur risk tolerance ke mutabik position size tay karni chahiye. Leverage (Levarij): Leverage ka sahi istemal karna bhi capital management ka hissa hai. Aapko leverage ko samajhna aur samajhdari se istemal karna chahiye, kyun ki yeh aapke nuksan ko bhi barha sakta hai. Diversification (Vividhikaran): Apne paiso ko alag-alag currency pairs mein invest karke risk ko kam karne ka prayaas karen. Ek hi currency pair par puri tarah se dependent na rahein. Trading Plan (Trading Yojna): Har trader ke paas ek trading plan hona chahiye, jismein unka trading strategy, risk management guidelines, aur profit targets shaamil hote hain. Yeh plan aapko disciplined rakhta hai. Emotions Control (Bhavnaon Ka Niyantran): Trading mein bhavnaon ka asar nuksan kar sakta hai. Hamesha rational aur calm rehna important hai. Agar aap ek trade mein nuksan karne ke baad gusse mein aa jate hain, to aap aur bhi nuksan kar sakte hain. Monitoring and Review (Nigraani aur Samiksha): Apne trading performance ko regular basis par monitor karen aur mistakes ko samjhein. Apne trading plan ko update karte rahein, agar zaroorat ho. Capital management ke bina, trading forex market mein risky ho sakta hai. Isliye, is par dhyan dena aur ek disciplined approach maintain karna mahatvapurnn hai. -

#11 Collapse

Forex trading mein capital management ek mahatvapurna hissa hai, kyun ki yah aapke trading account ko protect karne aur profit banane mein madad karta hai. Forex market highly volatile hoti hai, aur ismein risk high hota hai, isliye capital management ki sahi prakriya ka palan karna bahut mahatvapurna hota hai. Niche kuch capital management ke mool tatv hain: Risk Management: Sabse mahatvapurna capital management ka tatva hai risk management. Aapko apne trading capital ka ek chhota hissa hi ek trade mein lagana chahiye, taaki ek hi trade ke nuksan se pura account na khota jaye. Ek aam rujhan hai ki ek hi trade mein capital ka 1% ya 2% hi lagana chahiye. Stop-Loss Orders

Sabse mahatvapurna capital management ka tatva hai risk management. Aapko apne trading capital ka ek chhota hissa hi ek trade mein lagana chahiye, taaki ek hi trade ke nuksan se pura account na khota jaye. Ek aam rujhan hai ki ek hi trade mein capital ka 1% ya 2% hi lagana chahiye. Stop-Loss Orders  : Stop-loss order ek aisa order hota hai jo aap apne trade ke sath place karte hain, aur jisse aapne ek nishchit nuksan se bachne ke liye set kiya hota hai. Stop-loss order market price ek certain level tak pahunchne par automatic taur par trade ko close kar deta hai, jisse aapka nuksan control mein rahta hai. Position Sizing:

: Stop-loss order ek aisa order hota hai jo aap apne trade ke sath place karte hain, aur jisse aapne ek nishchit nuksan se bachne ke liye set kiya hota hai. Stop-loss order market price ek certain level tak pahunchne par automatic taur par trade ko close kar deta hai, jisse aapka nuksan control mein rahta hai. Position Sizing:  Position sizing ka arth hota hai ki aap kitne lot size ya contract size mein trade karenge. Aapko position size ko apne trading capital aur risk tolerance ke anurup set karna chahiye. Diversification Capital management mein diversification bhi ek mahatvapurna hissa hai. Aap apne trading capital ko alag-alag currency pairs mein invest karke risk ko spread kar sakte hain. Leverage Ka Prudent Istemal:

Position sizing ka arth hota hai ki aap kitne lot size ya contract size mein trade karenge. Aapko position size ko apne trading capital aur risk tolerance ke anurup set karna chahiye. Diversification Capital management mein diversification bhi ek mahatvapurna hissa hai. Aap apne trading capital ko alag-alag currency pairs mein invest karke risk ko spread kar sakte hain. Leverage Ka Prudent Istemal:  Leverage ka use karne se aap apne capital ko multiply kar sakte hain, lekin iska galat istemal karke aap apne capital ko bhi jyada nuksan me dal sakte hain. Aapko leverage ka prudent aur samajhdari se istemal karna chahiye. Ek trading plan bana kar capital management ko improve kiya ja sakta hai. Trading plan mein entry and exit rules, risk tolerance, stop-loss levels, aur position sizing ke liye guidelines shamil hoti hain. Emotions Ka Control: Emotions se trading decisions na lena bhi capital management ka hissa hai. Aapko hamesha objective rehkar trading karni chahiye aur greed ya fear se bache rehna chahiye. Regular Monitoring : Apne trading account ko regular basis par monitor karna bhi capital management ka hissa hai. Aapko apne performance ko track karna chahiye aur jarurat padne par apne strategies ko adjust karna chahiye.Capital management forex trading mein nuksan se bachne aur consistent profit banane mein madadgar hota hai. Aapko hamesha dhyan mein rakhna chahiye ki forex trading high-risk activity hai aur capital management ke bina trading karna bahut riski ho sakta hai.

Leverage ka use karne se aap apne capital ko multiply kar sakte hain, lekin iska galat istemal karke aap apne capital ko bhi jyada nuksan me dal sakte hain. Aapko leverage ka prudent aur samajhdari se istemal karna chahiye. Ek trading plan bana kar capital management ko improve kiya ja sakta hai. Trading plan mein entry and exit rules, risk tolerance, stop-loss levels, aur position sizing ke liye guidelines shamil hoti hain. Emotions Ka Control: Emotions se trading decisions na lena bhi capital management ka hissa hai. Aapko hamesha objective rehkar trading karni chahiye aur greed ya fear se bache rehna chahiye. Regular Monitoring : Apne trading account ko regular basis par monitor karna bhi capital management ka hissa hai. Aapko apne performance ko track karna chahiye aur jarurat padne par apne strategies ko adjust karna chahiye.Capital management forex trading mein nuksan se bachne aur consistent profit banane mein madadgar hota hai. Aapko hamesha dhyan mein rakhna chahiye ki forex trading high-risk activity hai aur capital management ke bina trading karna bahut riski ho sakta hai.

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex mein paisay ka nigrani ya capital management ek ahem hissa hai jo kisi bhi trader ki kamiyabi ka raaz hai. Yeh amli tor par maliyat ki duniya mein trading ki jaa rahi raqam ko bachane aur barhane ka tareeqa hai. Forex market, jise duniya ka sab se bara aur liquid market kaha jata hai, dharaye ki wajah se intehai muzir aur tabdeeliyaan bharpoor hoti hai. Lekin agar aap sahi taur par apne paisay ka nigrani nahi karte, to aapko nuqsaan uthana par sakta hai.

- Risk ka Nigrani: Sab se pehla asool risk ka nigrani ka hai. Har trade mein nuqsaan ka khatra hota hai, is liye zaroori hai ke aap apne nuqsan ko kam karne ke tareeqon par tawajju dein. Ek aham tareeqa "stop-loss orders" ka istemal hai. Is se traders apne trade ko nuqsan se mehfooz rakhte hain.

- Paisay ki Qeemat ka Tafseel se Ghor karna: Har trade mein kitni raqam lagani chahiye, yeh tajwez ke liye aham hai. Yeh "position sizing" kehte hain. Yeh aapko trading capital ke mawafiq karke tay karna chahiye.

- Tafreeqat: Tafreeqat, ya diversification, ek aham risk management tareeqa hai. Is se traders ek se zyada currency pairs ya assests mein apna capital taqseem karte hain.

- Profit ki Hifazat: Nuqsan ke sath sath faida bhi hifazat ka shikaar hai. Traders ko apne faide ko mehfooz karne ke tareeqon ka istemal karna chahiye, jaise trailing stop-loss orders ka ya hissi tor par trade ko band karna.

- Achi Trading Plan: Achi trading plan banane se pehle apne maqasid, risk tolerance, entry aur exit ke tareeqon ka, aur capital management rules ka theek se ghor karna chahiye.

- Regularly Performance ka Jaiza lena: Apni trading performance ko regular tor par monitor karna aur apne capital management strategies ko evaluate karna zaroori hai. Yeh maqsad ke mutabiq kiya ja sakta hai.

- Markaziyat ko Badalna: Forex market tabdeel hoti rehti hai. Is liye zaroori hai ke traders apni capital management strategies ko badal kar naye halat mein adapt kar sakein.

Capital management forex trading mein aik zaroori hissa hai jo traders ki kamiyabi ka raaz hai. Agar aap in asoolon ko samajh kar aur un par amal karke apne paisay ka behtar nigrani karte hain, to aap apne trading performance ko behtar bana sakte hain. Lekin yaad rakhiye, har trader ki apni apni mizaj, trading style aur maqsad hota hai, is liye zaroori hai ke aap apne strategies ko apni zarooriyat ke mutabiq customize karen. Muhim aur mehnat se, aap forex market ke challenges ko samajh kar aur unka samna kar sakte hain aur trading mein kamiyabi haasil kar sakte hain.

-

#13 Collapse

Capital management in forex

Forex Mein Paisay Ka Intizam:

Forex, ya Foreign Exchange, mein paisay ka intizam karna aik ahem tajziya hai jo har trader ke liye zaroori hai. Paisay ka intizam ya capital management ke baghair, trading mein kamiyabi hasil karna mushkil ho jati hai. Is leye, yeh muzahir hai ke forex trading mein paisay ka intizam kitna zaroori hai aur is ke kuch zaroori asool kya hain.

1. Capital Management Ki Ahmiyat:

Forex trading mein capital management ki ahmiyat ko samajhna bohot zaroori hai. Yeh tabadlay ke samundar mein ek sahil hai, jo trader ko nuksan se bachata hai aur long-term tijarat mein kamiyabi ke raaste ko asaan banata hai. Capital management, trader ko apne maal ke maqsadon ko hasil karne mein madad karta hai aur ghaflat se nuqsan se bachata hai.

2. Risk Ka Intizam:

Capital management ka pehla qadam risk ka intizam karna hai. Trader ko apne har trade ke liye muqararah risk ko samajhna chahiye aur apne trading plan mein is ko shamil karna chahiye. Jismani taur par ya nafsiati tor par zyada stress lene wale traders ko zyada risk se bachne ke liye tight stop-loss aur position sizing ka istemal karna chahiye.

3. Position Sizing:

Position sizing, yaani ke har trade mein kitna paisa lagana hai, capital management ka aham pehlu hai. Zayada bada position lena trader ko zyada risk mein daal sakta hai, jabke zyada chhota position lena trading ke faide ko kam kar sakta hai. Sahi position sizing, trader ko apne risk tolerance ke mutabiq tajawuz se bachata hai.

4. Stop-Loss Orders:

Stop-loss orders, trading mein nuqsan se bachne ka aik aham tareeqa hain. Ye orders trader ko nuqsan hone ki soorat mein automatically trade ko band karne ki ijaazat dete hain. Capital management ka hissa banane ke liye, trader ko hamesha stop-loss order lagana chahiye, taake nuqsan control mein rahe.

5. Profit Ki Maqsadon Ko Tajziye:

Capital management mein profit ki maqsadon ko tajziye karna bhi zaroori hai. Trader ko apne trading plan mein maqsadon ko wazeh kar lena chahiye, jese ke munaqashay aur long-term investments. Is tarah ke maqsadon ko hasil karne ke liye, capital management ka istemal karna zaroori hai.

6. Emotional Control:

Forex trading mein paisay ka intizam karne ka aik ahem hissa zehni control hai. Ghalat faislon se bachne ke liye, trader ko zehni tor par mazboot hona zaroori hai. Zehni control ke baghair, capital management asani se mushkil ho jata hai.

7. Trade Record Keeping:

Har trade ka record rakhna bhi capital management ka ahem hissa hai. Record keeping, trader ko apni trading performance ko samajhne aur behtar karne mein madad karta hai. Is ke zariye, trader apne ghalatiyon ko pehchankar un se seekh sakta hai aur apne trading plan ko behtar bana sakta hai.

Nateeja:

Forex trading mein paisay ka intizam karna asal mein trading ki zindagi line hai. Bina theek intizam ke, trading ek risky aur nuqsaan deh shughal ban jata hai. Is liye, har trader ko capital management ko samajhna aur uska istemal karna zaroori hai. Yeh aik lamba aur mushkil safar hai, lekin sahi rasta chunne se, trading mein kamiyabi haasil ki ja sakti hai.

-

#14 Collapse

Capital management in forex

CapitalManagement Kyun Ahem Hai?

- Risk Control:

- Capital management trading ke risk ko control karne mein madad karta hai. Sahi tarah se paisay ka tawazun rakhna, trading capital ko protect karta hai aur large losses se bachata hai.

- Consistency:

- Capital management trading consistency ko maintain karne mein madadgar sabit hota hai. Agar trader apne capital ko effectively manage karta hai, to woh consistent performance achieve kar sakta hai.

- Emotional Control:

- Sahi capital management emotions ko control karne mein bhi madad deta hai. Jab trader apne paisay ka tawazun theek tareeqay se maintain karta hai, to usay trading ke dauran gusse, greed, ya fear jaise emotions se bachaya ja sakta hai.

- Long-Term Success:

- Capital management long-term success ke liye zaroori hai. Agar trader apne capital ko effectively manage karta hai, to woh sustainable profits generate kar sakta hai aur trading career ko lambay arsay tak chala sakta hai.

- Risk Per Trade:

- Har trade mein risk ko manage karne ke liye traders ko apni investment ka ek fixed percentage tay karna chahiye. Aam tor par, 1% se 3% tak ka risk per trade consider kiya jata hai.

- Stop Loss aur Take Profit Levels:

- Har trade mein stop loss aur take profit levels set karna zaroori hai. Stop loss levels losses ko minimize karte hain jabki take profit levels profits ko lock karte hain.

- Position Sizing:

- Position sizing ka istemal karke traders apni positions ka size control karte hain taki har trade mein barabar ka risk ho.

- Diversification:

- Paisay ko spread karna aur multiple currency pairs ya strategies ka istemal karna bhi capital management ka hissa hai. Isse risk ko diversify kiya ja sakta hai.

- Plan Ahead:

- Trading plan banate waqt capital management ka khayal rakhna zaroori hai. Ek sahi plan banane se pehle risk tolerance aur financial goals ko consider karna chahiye.

- Stick to the Plan:

- Ek baar capital management plan banane ke baad, usay follow karna zaroori hai. Emotions ko control karke aur discipline ke sath plan ko execute karna chahiye.

- Regular Evaluation:

- Capital management plan ko regular intervals par evaluate karna chahiye aur zaroorat parne par adjust karna chahiye. Market conditions aur trading performance ke hisaab se plan ko update karna zaroori hai.

Forex trading mein capital management ek ahem hissa hai jo traders ko consistent aur successful trading karne mein madad deta hai. Sahi tarah se paisay ka tawazun rakhna, risk ko control karna aur profits ko maximize karna har trader ke liye zaroori hai. Capital management strategies ka istemal karke, traders apne trading career ko sustain kar sakte hain aur long-term success achieve kar sakte hain.

- Risk Control:

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Forex Trading Mein Capital Management Kaise Karein?**

Forex trading mein capital management ek ahem aspect hai jo aapki trading success aur long-term profitability ko ensure karta hai. Ye sirf trading strategies aur market analysis ke baray mein nahi, balki aapke trading capital ko efficiently manage karne ke bare mein bhi hai. Effective capital management aapko risk ko control karne aur apni investments ko secure karne mein madad karta hai. Is post mein, hum capital management ke concepts aur strategies ko detail mein discuss karenge.

**1. Capital Management Ka Concept**:

Capital management ka matlab hai aapke trading capital ko aise manage karna ke aap apne risks ko control mein rakh sakein aur potential losses se bachaav kar sakein. Iska goal hai trading capital ko protect karna aur sustainable returns achieve karna. Aapko apni total capital ko carefully allocate karna hota hai, taake market volatility aur unexpected losses se bach sakain.

**2. Risk Management Aur Position Sizing**:

- **Risk Per Trade**: Capital management mein ek important concept hai risk per trade. General rule ke mutabiq, ek trade mein apni capital ka 1-2% se zyada risk nahi uthana chahiye. Iska matlab hai ke agar aapka account balance 10,000 USD hai, to aap ek trade mein maximum 100-200 USD risk kar sakte hain.

- **Position Sizing**: Position sizing ka matlab hai ke aap apni trading capital ko kis tarah se allocate karte hain. Accurate position sizing se aap apne risk ko control kar sakte hain aur overexposure se bach sakte hain. Position size ko calculate karne ke liye, risk per trade aur stop-loss level ko consider karna zaroori hai.

**3. Stop-Loss Orders**:

- **Importance of Stop-Loss**: Stop-loss orders capital management ka ek crucial tool hain. Yeh orders aapko predetermined price level par loss ko limit karne ki suvidha dete hain. Stop-loss orders se aap apne capital ko protect kar sakte hain aur large losses se bach sakte hain.

- **Placement of Stop-Loss**: Stop-loss ko position ki entry aur exit points ke hisaab se place karna chahiye. Yeh ensure karta hai ke agar market aapke against move kare, to aapki losses controlled aur limited rahe.

**4. Diversification Aur Risk Control**:

- **Diversification**: Diversification aapki trading capital ko different assets aur currency pairs mein allocate karne ki strategy hai. Yeh risk ko spread karne aur ek single asset ya currency pair ke bad performance se bachne mein madad karta hai.

- **Risk Control Techniques**: Capital management ke liye risk control techniques, jaise hedging aur using trailing stops, ka bhi use kiya jata hai. Hedging se aap apne positions ko protect kar sakte hain, jabke trailing stops se profits ko lock kar sakte hain aur losses ko minimize kar sakte hain.

**5. Regular Monitoring Aur Review**:

- **Performance Monitoring**: Apne trading capital aur performance ko regularly monitor karna zaroori hai. Regular reviews se aap apni trading strategy ko assess kar sakte hain aur zaroori adjustments kar sakte hain.

- **Adaptation**: Market conditions aur trading performance ke hisaab se capital management strategies ko adjust karna bhi important hai. Aapko apne trading plan ko update karna chahiye aur market trends ke saath align karna chahiye.

In conclusion, forex trading mein effective capital management aapki trading success ke liye fundamental hai. Risk management, position sizing, stop-loss orders, diversification, aur regular monitoring se aap apne capital ko protect kar sakte hain aur trading performance ko improve kar sakte hain. Strategic capital management ke saath, aap sustainable returns aur long-term trading success achieve kar sakte hain.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:09 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим