What's the Four Price Doji Candlestick

`

X

new posts

-

#1 Collapseٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

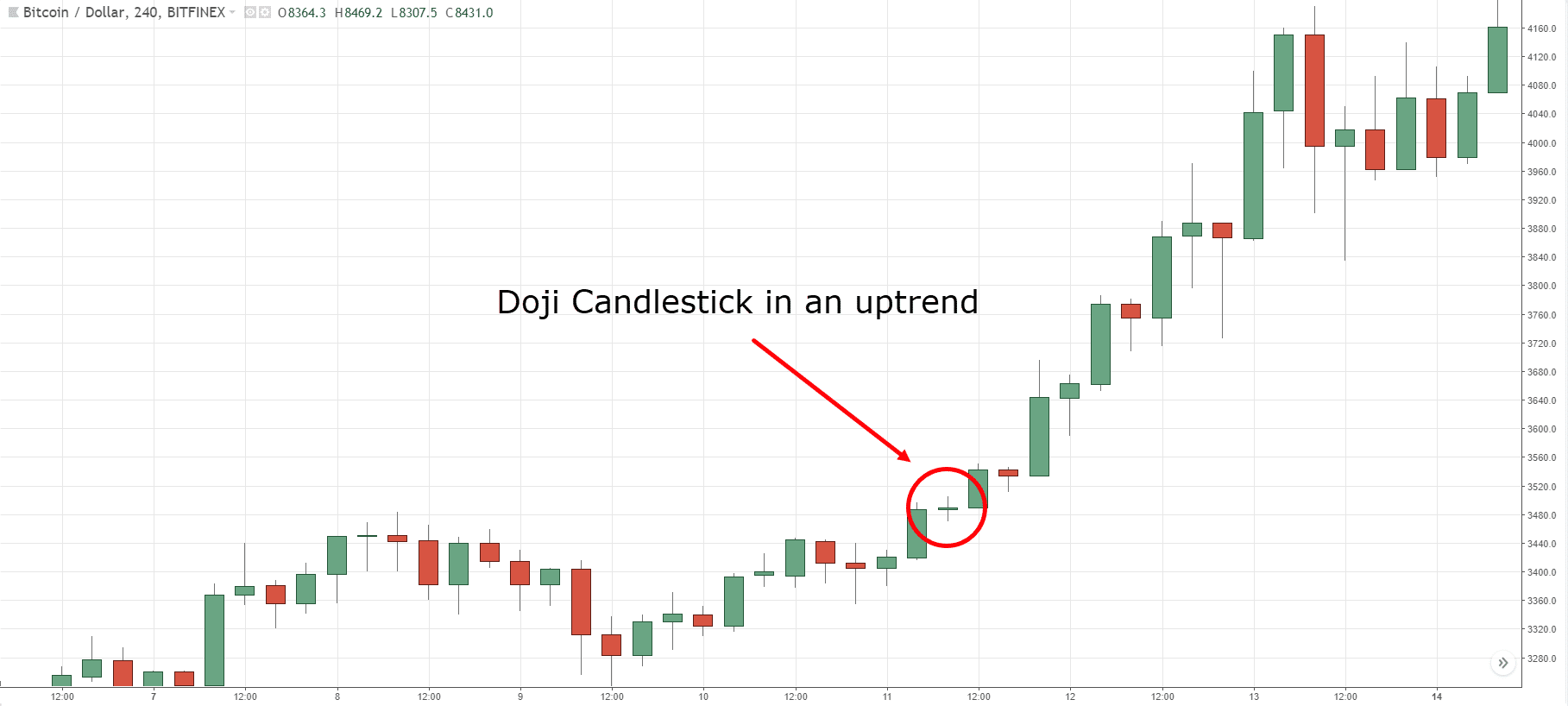

Four price doji candlestick Four Price Doji Candlestick, candlestick chart analysis ka aik important hissa hai jo traders aur investors ke liye valuable information provide karta hai. Ye pattern market mein uncertainty aur reversal ke signs ko indicate kar sakta hai. Four Price Doji Candlestick ek technical analysis tool hai jo stock market aur financial markets mein istemal hota hai. Ye pattern doji candlestick ke andar aata hai, jo market ke sentiment aur price direction ko samajhne mein madadgar hota hai. Is candlestick pattern ko samjhna traders ke liye zaroori hai taaki woh sahi trading decisions le saken. Four Price Doji Candlestick ek aisa pattern hai jismein four prices include hoti hain: opening price, closing price, highest price, aur lowest price. Is pattern ki pehchan karne ke liye, aapko candlestick chart par ek small cross ya plus sign nazar aayega jismein doji ki tarah upper aur lower shadow hongi. Is pattern ki pehchan karne ke baad, traders market direction ko samajhne ke liye iska istemal karte hain. Agar Four Price Doji Candlestick bullish trend ke baad aata hai, to ye bearish reversal signal ho sakta hai, matlab ke market mein price girawat ki sambhavna hai. Is situation mein, traders apne long positions ko close kar sakte hain ya short positions enter kar sakte hain. Waise hi, agar Four Price Doji Candlestick bearish trend ke baad aata hai, to ye bullish reversal signal ho sakta hai, matlab ke market mein price mein izafa hone ki sambhavna hai. Is scenario mein, traders apne short positions ko close kar sakte hain ya long positions enter kar sakte hain. Is pattern ko samajhne ke liye, traders ko candlestick chart analysis ki madad leni chahiye. Candlestick charts par har candlestick ek trading session ko represent karta hai, jo usually ek din ka hota hai. Candlestick chart par har candlestick ke components, jaise ki opening price, closing price, highest price, aur lowest price, ko dikhaya jata hai. Four Price Doji Candlestick ek powerful tool hai agar ise sahi tarah se samjha jaye aur dusre technical indicators ke saath istemal kiya jaye. Traders ko is pattern ko confirm karne ke liye market analysis aur dusre signals ka bhi istemal karna chahiye. In conclusion, Four Price Doji Candlestick ek important candlestick pattern hai jo market ke reversal aur uncertainty ko indicate kar sakta hai. Is pattern ko samajhna traders ke liye zaroori hai taaki woh sahi trading decisions le saken aur market movements ko samajh sake. Candlestick chart analysis ke saath, Four Price Doji Candlestick ka istemal ek powerful trading strategy ban sakta hai.

Four price doji candlestick pattern, technical analysis mein aik mahatva purna concept hai jo traders ko market dynamics aur price action ke hawale se intehai ahem malumat farahem karta hai. Yeh pattern market ke indecision aur potential trend reversal ko darust taur par samajhne mein madadgar hota hai.

Is pattern ki pehchan karne ke liye, traders ko char mukhtalif prices pe barabar ke closing rates dekhne padte hain. Yeh prices typically open, close, high, aur low ko shamil karte hain. Agar yeh char prices barabar ke hain, toh woh ek Four price doji candlestick pattern banta hai.

Is pattern ka pehla application hai market mein indecision ko detect karna. Jab yeh candlestick pattern form hota hai, yeh darust karta hai ke buyers aur sellers mein barabar ka muqabla ho raha hai aur market ka future direction uncertain hai. Is waqt, traders ko savdhan rehna chahiye aur apni trading strategies ko dubara se evaluate karna zaroori hai.

Dusra faida is pattern ka yeh hai ke yeh market reversals ko anticipate karne mein madad karta hai. Agar Four price doji candlestick pattern ek established trend ke baad aata hai, toh yeh darust karta hai ke market mein reversal hone ke chances hain. Traders is signal ko dekh kar apne positions ko adjust kar sakte hain aur market ke new direction ke mutabiq apni strategies ko modify kar sakte hain.

Iske ilawa, yeh pattern trading decisions ko improve karne mein bhi istemal hota hai. Traders is pattern ki madad se market ke sentiment ko samajh sakte hain aur iske mutabiq apni trades ko manage kar sakte hain. Four price doji candlestick pattern ke application se, traders apne risk ko minimize karne aur profit opportunities ko maximize karne ka maqsad hasil kar sakte hain.

Overall, Four price doji candlestick pattern ka sahi taur par istemal karke traders apni technical analysis ko aur bhi mazboot bana sakte hain. Is pattern ki understanding se, market ke complex movements ko samajhna asaan ho jata hai, aur is tarah se traders apne trading decisions ko behtar bana sakte hain.

-

#3 Collapse

Char Qeemat Doji Candlestick: Aik Tafseeli Jaiza Candlestick patterns, forex trading aur stocks ke duniya mein ahem hoti hain. In patterns ka ilm rakhna traders ke liye aik bari raahat hoti hai taake woh market ke hawale se behtar faislay kar saken. Is maqasid mein, aaj hum baat karenge Char Qeemat Doji Candlestick pattern ke bare mein, jo trading mein aik ahem ahmiyat rakhta hai. Is article mein, hum Char Qeemat Doji Candlestick ke baray mein mukhtasar maloomat faraham karenge. Doji Candlestick Kya Hai? Doji Candlestick ek technical analysis tool hai jo market mein buyer aur seller ke darmiyan samjhautay ko darust karne mein madadgar hoti hai. Is pattern ki pehchan asani se hoti hai, kyunke ismein candle ki opening aur closing price aik dosre ke bohat qareeb hoti hain. Doji Candlestick, market mein uncertainty ya indecision ko darust karti hai, aur yeh aksar trend reversal ko bhi darust karti hai. Char Qeemat Doji Candlestick Kya Hai? Char Qeemat Doji Candlestick pattern ek khas tarah ka Doji hai. Is mein candlestick ke chaar hisse ya qeemat hoti hain: opening price, closing price, high price aur low price. Char Qeemat Doji Candlestick pattern mein ye charo qeemat aik dosre ke bohat qareeb hoti hain, jis se candlestick ke darmiyan kisi bhi taraf ki tijarati raay nahi ban sakti. Char Qeemat Doji Ki Tafseelat Char Qeemat Doji Candlestick, market mein bohat zyada uncertainty ya indecision ko darust karti hai. Is pattern ki pehchan karnay ke liye aapko sirf candlestick ko dekhna hota hai. Agar aap dekhtay hain ke aik candle ki opening price, closing price, high price, aur low price bohat qareeb hain, to samjho ke aap Char Qeemat Doji ke saamnay hain. Char Qeemat Doji Ke Isteemaal Char Qeemat Doji Candlestick pattern ka istemal traders market trend ka andaza lagane aur possible reversals ko pehchanne mein karte hain. Jab aapko lagta hai ke market mein indecision hai aur trend badal sakta hai, to Char Qeemat Doji pattern ki tasdeeq karnay ke baad aap apne trading strategy ko adjust kar sakte hain. Is pattern ko doosre technical indicators aur patterns ke saath combine karke aur market analysis ke sath istemal karna behtar hota hai. Yeh pattern aksar aik mazboot reversal signal ke tor par dekha jata hai jab market ek specific trend mein hai aur woh change hone ki soorat mein hai. Char Qeemat Doji Candlestick Char Qeemat Doji Candlestick pattern ek powerful tool hai jo traders ko market mein hone wale changes ko pehchanne mein madadgar hota hai. Lekin yaad rahe ke har ek indicator ki tarah, yeh bhi akela hi kaafi nahi hota. Isko doosre technical analysis tools aur market research ke sath istemal karna behtar hota hai. Isi tarah, trading mein maharat hasil karne ke liye practice aur taaleem ki bhi zarurat hoti hai. Market trading mein safalta hasil karne ke liye, Char Qeemat Doji Candlestick pattern ko samajhna aur uski sahi tarah se istemal karna aik ahem kadam ho sakta hai. Lekin yaad rahe ke market trading mein risk hota hai, aur aapko hamesha apne financial advisor ya expert se mashwara lena behtar hai. Is tarah se, Char Qeemat Doji Candlestick pattern trading ke jazbat aur faislay ko darust karne mein aik ahem zariya ho sakta hai, magar aapko hamesha cautious rehna chahiye aur apni mehnat aur taaleem ko jari rakhna chahiye. -

#4 Collapse

Kya Hai Aur Kaise Kaam Karta Hai Candlestick patterns, ya mombatti ke nishaano ka tajzia, stock market aur forex trading mein ahem hota hai. In patterns se traders ko market ki movement ka andaza lagane mein madad milti hai. Ek aisa pattern hai jo trading mein khaas ahemiyat rakhta hai, aur woh hai "Chaar Price Doji Candlestick." Is article mein hum Chaar Price Doji Candlestick ke baray mein baat karenge, iske characteristics aur iska trading mein istemal kaise kia jata hai. Chaar Price Doji Candlestick Kya Hai? Chaar Price Doji Candlestick, candlestick patterns ki ek khaas qisam hai jo traders ke liye ahem hoti hai. Is pattern ka naam "Doji" se aya hai, jo ek candlestick hai jiska opening price aur closing price aik dosre ke bohat qareeb hoti hain. Lekin Chaar Price Doji Candlestick, ek normal Doji se mukhtalif hoti hai, kyun ke is mein char trading sessions (dinon) ke data shamil hota hai. Is pattern ko pehchane ke liye, apko ek candlestick chart dekhna hoga jahan aapko 4 consecutive candles nazar aayengi, jinmein har candle ki opening aur closing price aik dosre ke bohat kareeb hoti hai. In chaar candles mein wohi price range hoti hai, aur isliye isey "Four Price Doji" kehte hain. Yani ke is pattern mein market mein uncertainty ya indecision hoti hai. Chaar Price Doji Candlestick Ki Khasosiyat:- Indecision Ka Izhar: Chaar Price Doji Candlestick, market mein indecision ya uncertainty ko darust karti hai. Yeh pattern traders ko batati hai ke market mein buyers aur sellers mein barabar ka muqabla ho raha hai aur kisi ek taraf ki jeet ya haar mein khaas tafawat nahi hai.

- Price Range: Is pattern mein chaar candles ke prices ek dosre ke bohat kareeb hoti hain. Iska matlab hai ke chaar sessions mein market mein price kisi ek direction mein barhne ya ghatne mein koi bari tabdeeli nahi aayi.

- Volatility Ka Pata: Chaar Price Doji Candlestick ki madad se traders market ki volatility ka andaza laga sakte hain. Agar is pattern ke baad high volatility ki candle aati hai, to iska matlab hai ke market mein barha hua interest hai aur price mein tafawat anay wali hai.

-

#5 Collapse

Char Qeemat Wali Doji Candlestick Candlestick chart analysis tijarat ke duniya mein aik aham hissa hai. Ye ek aesi technique hai jisay traders aur investors apni trading aur investment strategies banane mein istemal karte hain. Char Qeemat Wali Doji Candlestick ek aesi candlestick pattern hai jo market analysis mein ahem hota hai. Is article mein, hum Char Qeemat Wali Doji Candlestick ke hawale se baat karenge aur samjhenge ke ye kya hai aur iska tijarati grafikon par kya asar hota hai. Candlestick Patterns Ki Ahmiyat Candlestick patterns tijarati grafikon par price action ko darust tarikay se samajhne ka aik zariya hain. Ye patterns traders ko market ki mizaj aur future price direction ke bare mein ahem maloomat faraham karte hain. Char Qeemat Wali Doji Candlestick bhi is tarah ka aik pattern hai jo traders ko price action ke hawale se ahem maloomat deta hai. Char Qeemat Wali Doji Candlestick Kya Hai? Char Qeemat Wali Doji Candlestick, ek aesa pattern hai jahan ek trading session ke doran char mukhtalif prices par trade hoti hain, lekin candlestick ki closing price opening price ke barabar hoti hai. Iska matlab hai ke market mein buyers aur sellers mein kisi aik ki qabliyat zahir nahi hoti, aur ye uncertainty aur indecision ko darust karti hai. Char Qeemat Wali Doji Candlestick ka ye naam is wajah se hai ke iski shape ek doji candlestick ki tarah hoti hai, jahan upper shadow aur lower shadow lambi hoti hain aur candlestick ke darmiyan mein choti si body hoti hai. Is candlestick ke charon qeemat barabar hote hain, jis se iski body ek line ki tarah nazar aati hai. Char Qeemat Wali Doji Candlestick Ki Tijarat Mein Ahmiyat Char Qeemat Wali Doji Candlestick market mein uncertainty aur indecision ko darust karta hai. Jab traders is pattern ko dekhte hain, to unko ye ishara milta hai ke market mein kisi aik direction ki taraf taqat nahi hai aur buyers aur sellers mein barabar ki mizaj hai. Is candlestick pattern ko doosre technical indicators aur chart patterns ke sath istemal kiya jata hai. Isay, RSI (Relative Strength Index) ya MACD (Moving Average Convergence Divergence) jaise indicators ke sath combine karke traders market ke future direction ko samajhne ki koshish karte hain. Char Qeemat Wali Doji Candlestick ek reversal pattern bhi ho sakta hai, jisay agar sahi tarah se samjha jaye to traders ko market mein hone wale trend change ka andaza lagane mein madadgar sabit ho sakta hai. Akhiri Alfaz Char Qeemat Wali Doji Candlestick tijarati grafikon par ek ahem tool hai jo traders aur investors ko market ki mizaj aur future price direction ke hawale se maloomat faraham karta hai. Is pattern ki madad se traders uncertainty aur indecision ko pehchan sakte hain, lekin isay doosre technical indicators aur chart patterns ke sath istemal karna bhi zaroori hai. Is tarah ke candlestick patterns ko samajhna aur unka sahi istemal karna, tijarat ke safar mein kamyabi hasil karne mein madadgar sabit ho sakta hai. -

#6 Collapse

Chaar Price Doji Candlestick Kya Hai Aur Kaise Kaam Karta Hai? Candlestick patterns ek powerful tool hain jo technical analysis mein istemal hoti hain, taa-ke traders aur investors market ke future trends aur reversals ko samajh saken. Ek aisi candlestick pattern hai jo khaas taur par price reversals ko indicate karne ke liye istemal hoti hai, woh hai "Four Price Doji" ya "Chaar Price Doji." Four Price Doji candlestick pattern, market mein uncertainty aur indecision ko darust karti hai. Iska naam "Doji" is liye hai kyunki ye pattern ek chhoti si rectangle ya square shape ko yaad dila deta hai, jo kisi stock ya asset ke opening aur closing prices ko represent karta hai. Is pattern ki pehchan, iske four equal-length lines se hoti hai, jo ek vertical line se mil kar ek cross ya plus sign ki tarah dikhte hain. Ye cross pattern market mein buyers aur sellers ke darmiyan samjhauta darust karne ki samasya ko darust karti hai. Four Price Doji Ki Tafseelat: Chaar Price Doji candlestick pattern mein, chaar lines hoti hain:- Opening Line: Ye line rectangle ke upar hoti hai aur uski left side par start hoti hai. Ye current session ka opening price darust karti hai.

- Closing Line: Ye line rectangle ke neeche hoti hai aur uski right side par end hoti hai. Ye current session ka closing price darust karti hai.

- High Line: Ye line rectangle ke upar hoti hai aur opening line aur closing line ke beech ki maximum price yaani highest price ko darust karti hai.

- Low Line: Ye line rectangle ke neeche hoti hai aur opening line aur closing line ke beech ki minimum price yaani lowest price ko darust karti hai.

- Confirmation: Is pattern ko samjhnay ke baad, aapko confirmation ke liye wait karna chahiye. Yani ke doosre technical indicators aur price action ko bhi dekhein, taki aap sahi decision le saken.

- Stop Loss Aur Target: Har trading strategy ke saath ek stop loss aur target set karna ahem hai. Isse aap apne nuksan ko kam kar sakte hain aur profit maximise kar sakte hain.

- Risk Management: Hamesha yaad rahe ke trading mein risk management bohot ahem hai. Apne trading capital ko protect karna hamesha pehli priority honi chahiye.

-

#7 Collapse

FOUR PRICE DOJI CANDLSTICK PATTERN:-Forex trading me "Four Price Doji" candlestick pattern ek specific candlestick pattern hai jo traders dwara technical analysis me istemal kiya jata hai. Is pattern ka matlab hota hai ki market me uncertainty ya indecision hai, aur yeh traders ko market ke future movement ke bare me hint deta hai. Four Price Doji pattern me, ek candlestick ka pattern hota hai jisme open, close, high, aur low price ek jaisi ya bahut paas hoti hai. Iska matlab hota hai ki market me kisi bhi direction ki clear preference nahi hai, aur buyers aur sellers ke beech ek tarah ka standoff ho raha hai.FOUR PRICE DOJI CANDLSTICK PATTERN KI WAZAHAT::-Four Price Doji Ka Matlab: Four Price Doji ek khaas candlestick pattern hai jo forex trading mein istemal hota hai aur takneeky tajziye ke liye istemal hota hai. Is pattern ka matlab hota hai ke market mein uncertainty aur faisla na kar pana, jisse traders ko aane wale market ki manzil ke bare mein andaza ho sakta hai. Four Price Doji Ki Khasoosiyat: Four Price Doji pattern mein, ek candlestick open, close, high, aur low prices ko dikhata hai jo aik dosre ke bohat qareeb ya aik dosre ke mukarrar hoti hain. Is se ye samjhaya jata hai ke market mein kisi bhi raaste ki wazeh pasandidgi nahi hai, aur khareedne walon aur bechne walon ke darmiyan aik tarah ka standoff (kisi ko pehli raftar per lane ke liye kisi ka muqabla na karna) hai. Four Price Doji Ko Pehchanne Ka Tareeqa: Four Price Doji ko pehchanne ke liye candlestick ka shakal dekhen. Ismein aik chhoti si body hoti hai, jo ke ye dikhata hai ke opening aur closing prices bohat qareeb hain, aur dono taraf lambi wicks hoti hain jo high aur low prices ko darust karti hain. Traders Ke Liye Ahmiyat: Four Price Doji patterns traders ke liye ahmiyat rakhte hain kyun ke ye aane wale market ke raaste ki taraf ishara kar sakte hain. Misal ke tor par, agar aik taqatwar uptrend ke baad Four Price Doji aata hai, to iska matlab ho sakta hai ke trend ruk gaya hai ya trend mein ulta hone ke chances hain. Lekin trading faislay lene se pehle is pattern ko doosre takneeky isharon aur price action patterns ke saath istemal karna zaroori hai aur sirf is par pura bharosa na karen. Hamesha market ki asal surat-e-haal aur doosre factors ko madde nazar rakhen trading faislay karne se pehle. -

#8 Collapse

Four price doji candlestick

Four price doji candlestick pattern, technical analysis mein aik mahatva purna concept hai jo traders ko market dynamics aur price action ke hawale se intehai ahem malumat farahem karta hai. Yeh pattern market ke indecision aur potential trend reversal ko darust taur par samajhne mein madadgar hota hai.

Is pattern ki pehchan karne ke liye, traders ko char mukhtalif prices pe barabar ke closing rates dekhne padte hain. Yeh prices typically open, close, high, aur low ko shamil karte hain. Agar yeh char prices barabar ke hain, toh woh ek Four price doji candlestick pattern banta hai.

Is pattern ka pehla application hai market mein indecision ko detect karna. Jab yeh candlestick pattern form hota hai, yeh darust karta hai ke buyers aur sellers mein barabar ka muqabla ho raha hai aur market ka future direction uncertain hai. Is waqt, traders ko savdhan rehna chahiye aur apni trading strategies ko dubara se evaluate karna zaroori hai.

Dusra faida is pattern ka yeh hai ke yeh market reversals ko anticipate karne mein madad karta hai. Agar Four price doji candlestick pattern ek established trend ke baad aata hai, toh yeh darust karta hai ke market mein reversal hone ke chances hain. Traders is signal ko dekh kar apne positions ko adjust kar sakte hain aur market ke new direction ke mutabiq apni strategies ko modify kar sakte hain.

Iske ilawa, yeh pattern trading decisions ko improve karne mein bhi istemal hota hai. Traders is pattern ki madad se market ke sentiment ko samajh sakte hain aur iske mutabiq apni trades ko manage kar sakte hain. Four price doji candlestick pattern ke application se, traders apne risk ko minimize karne aur profit opportunities ko maximize karne ka maqsad hasil kar sakte hain.

Overall, Four price doji candlestick pattern ka sahi taur par istemal karke traders apni technical analysis ko aur bhi mazboot bana sakte hain. Is pattern ki understanding se, market ke complex movements ko samajhna asaan ho jata hai, aur is tarah se traders apne trading decisions ko behtar bana sakte hain.

-

#9 Collapse

Four Price Doji Candlestick

Four Price Doji candlestick ek unique aur rare candlestick pattern hai jo financial markets mein kabhi kabar nazar aata hai. Yeh candlestick pattern ek specific trading session ke dauran market ke opening price, closing price, highest price, aur lowest price ko represent karta hai aur in teeno prices ka ek hi hona indicate karta hai. Four Price Doji pattern traders aur investors ke liye significant hota hai kyunki yeh market ki uncertainty aur indecision ko represent karta hai.

Four Price Doji Candlestick

Four Price Doji candlestick ek rare candlestick pattern hai jo tab form hota hai jab ek specific trading session mein market ka opening price, closing price, highest price, aur lowest price ek hi level par hota hai. Yeh pattern market ki extreme indecision aur lack of volatility ko indicate karta hai. Four Price Doji candlestick ko charts par as a single horizontal line represent kiya jata hai kyunki opening, closing, highest, aur lowest prices same hote hain.

Four Price Doji Candlestick Ki Characteristics

Four Price Doji candlestick pattern ke kuch unique characteristics hain jo isse dusre candlestick patterns se distinguish karte hain:- Single Horizontal Line: Four Price Doji candlestick ek single horizontal line hoti hai jo opening, closing, highest, aur lowest prices ko same level par indicate karti hai.

- No Real Body: Is candlestick pattern ka koi real body nahi hota kyunki opening aur closing prices same hote hain. Yeh pattern sirf ek line ka form hota hai.

- No Wicks or Shadows: Four Price Doji candlestick ke koi wicks ya shadows nahi hote kyunki highest aur lowest prices bhi same hote hain.

- Indecision and Uncertainty: Yeh pattern market ki extreme indecision aur uncertainty ko represent karta hai. Traders aur investors ko clear direction ya trend nahi milta.

- Rare Occurrence: Four Price Doji candlestick pattern rare hota hai aur financial markets mein kabhi kabar hi nazar aata hai.

Four Price Doji candlestick pattern tab form hota hai jab ek specific trading session mein market ke opening price, closing price, highest price, aur lowest price same level par hote hain. Is pattern ki formation typically low trading volume aur market participants ke beech lack of interest ke karan hoti hai. Yeh pattern tab bhi form ho sakta hai jab market kisi major economic event ya announcement ka wait kar raha hota hai aur traders aur investors ke beech indecision aur hesitation hoti hai.

Importance of Four Price Doji Candlestick

Four Price Doji candlestick pattern ki importance uske ability to indicate market indecision aur potential trend reversals mein hoti hai. Yeh pattern kuch specific scenarios mein significant ho sakta hai:- Indecision Indication: Four Price Doji candlestick pattern market ke participants ke beech extreme indecision aur lack of direction ko indicate karta hai. Yeh pattern batata hai ke traders aur investors ko market ki future direction ke baare mein uncertainty hai.

- Potential Trend Reversal: Yeh pattern kabhi kabar market ke potential trend reversal ko indicate kar sakta hai. Agar yeh pattern ek strong uptrend ya downtrend ke baad form hota hai, to yeh market ke trend reversal ka signal ho sakta hai.

- Market Pause: Four Price Doji candlestick pattern market ke pause ya consolidation period ko indicate kar sakta hai. Yeh pattern batata hai ke market participants ek major move se pehle wait aur observe kar rahe hain.

Four Price Doji candlestick pattern ke kuch advantages hain jo isse traders aur investors ke liye valuable banate hain:- Clear Indication of Indecision: Yeh pattern market ke extreme indecision aur uncertainty ko clearly indicate karta hai, jo traders aur investors ko market ke sentiment ko samajhne mein madadgar hota hai.

- Potential Trend Reversal Signal: Four Price Doji candlestick pattern kabhi kabar potential trend reversal ka signal de sakta hai, jo traders aur investors ko apni trading strategies ko adjust karne mein madadgar hota hai.

- Market Consolidation Indication: Yeh pattern market ke consolidation period ko indicate karta hai, jo traders ko market ke future moves ke liye prepare hone mein madadgar hota hai.

Four Price Doji candlestick pattern ke kuch disadvantages bhi hain jo traders aur investors ko consider karne chahiye:- Rare Occurrence: Yeh pattern financial markets mein rare hota hai aur kabhi kabar hi nazar aata hai, jo isse trading decisions ke liye reliable banata hai.

- Lack of Direction: Four Price Doji candlestick pattern market ke direction ya trend ke baare mein clear indication nahi deta, jo traders ke liye confusing ho sakta hai.

- Dependence on Confirmation: Yeh pattern apne aap mein sufficient nahi hota aur traders ko dusre technical indicators aur confirmation signals ke sath use karna chahiye.

Four Price Doji candlestick pattern ek rare aur unique candlestick pattern hai jo market ki extreme indecision aur uncertainty ko represent karta hai. Yeh pattern ek single horizontal line ka form hota hai jo opening, closing, highest, aur lowest prices ko same level par indicate karta hai. Four Price Doji candlestick pattern traders aur investors ke liye significant ho sakta hai kyunki yeh market ke indecision, potential trend reversals, aur market consolidation periods ko indicate karta hai. Is pattern ke kuch advantages hain, jaise clear indication of indecision, potential trend reversal signal, aur market consolidation indication. Lekin, iske kuch disadvantages bhi hain, jaise rare occurrence, lack of direction, aur dependence on confirmation signals. Traders aur investors ko Four Price Doji candlestick pattern ko dusre technical indicators aur confirmation signals ke sath use karna chahiye taake accurate trading decisions le sakein.

- CL

- Mentions 0

-

سا0 like

-

#10 Collapse

**What's the Four Price Doji Candlestick?**

Forex trading mein technical analysis ka ek aham hissa candlestick patterns hain, jo market ke potential reversals aur trend changes ko identify karne mein madad karte hain. Four Price Doji candlestick pattern bhi aisa hi ek pattern hai jo market ki indecision aur potential reversal points ko indicate karta hai. Is pattern ko samajhkar, traders market trends ko better predict kar sakte hain.

**Four Price Doji Candlestick Pattern** ek unique pattern hai jo tab banta hai jab ek candlestick ke open, high, low, aur close prices sab ek hi level par hon. Ye pattern market ke confusion aur indecision ko show karta hai, aur typically market ke potential reversal points ko signal karta hai.

**Pattern Characteristics:**

1. **Candlestick Shape:** Four Price Doji candlestick ki shape ek cross ya plus sign jaisi hoti hai. Is candlestick mein na to body hoti hai aur na hi upper aur lower shadows. Candlestick ka open, high, low, aur close price ek hi level par hota hai, jo market ke indecision ko represent karta hai.

2. **Pattern Interpretation:** Four Price Doji pattern market ke hesitation aur uncertainty ko indicate karta hai. Jab ye pattern develop hota hai, to ye signal hota hai ke market ki direction ke baare mein clear signal nahi hai aur aane wale moves ke liye caution ki zaroorat hai. Ye pattern bullish ya bearish trend ke end ke baad develop ho sakta hai aur ek potential reversal ka indication ho sakta hai.

3. **Confirmation:** Four Price Doji pattern ko accurately interpret karne ke liye additional confirmation ki zaroorat hoti hai. Volume analysis aur subsequent candlestick patterns is pattern ki credibility ko validate karte hain. High trading volume aur follow-up candlestick patterns, pattern ke reversal signal ko confirm karte hain.

4. **Trading Strategy:** Four Price Doji pattern ka trading strategy mein incorporate karte waqt, traders ko precise entry aur exit points ko define karna chahiye. Pattern ke next candle ki movements ko monitor karna zaroori hai, jisse market ki direction aur potential trend reversal ka signal mil sake. Entry aur stop-loss levels ko carefully set karna chahiye taake risk management effectively kiya ja sake.

In summary, Four Price Doji candlestick pattern ko samajhkar aur iski signals ko accurately interpret karke, aap market trends aur potential reversals ko behtar identify kar sakte hain. Regular practice aur detailed analysis ke sath, aap is pattern ko apni trading strategy mein effectively include kar sakte hain aur trading decisions ko enhance kar sakte hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

### What's the Four Price Doji Candlestick?

Four Price Doji candlestick pattern ek unique aur interesting pattern hai jo market ke indecision ya uncertainty ko darshata hai. Yeh pattern un traders ke liye khaas ahmiyat rakhta hai jo market ki sentiment aur potential reversals ko samajhna chahte hain. Is post mein hum Four Price Doji ki structure, market sentiment, aur trading implications par nazar dalenge.

#### Pattern ka Structure

Four Price Doji pattern ka structure uncha hota hai. Is pattern mein chaar prices ek hi level par band hote hain: opening price, closing price, high, aur low. Is wajah se yeh pattern bilkul horizontal line ki tarah nazar aata hai. Yeh pattern tab banta hai jab market mein koi significant price movement nahi hota, jo yeh darshata hai ke buyers aur sellers dono mein balance hai.

#### Market Sentiment

Four Price Doji pattern market ke indecision aur confusion ko darshata hai. Jab yeh pattern banta hai, to yeh darshata hai ke market mein na to buyers ka pressure hai aur na hi sellers ka. Yeh situation aksar tab hoti hai jab traders kisi important news ya event ka intezar kar rahe hote hain. Is wajah se, yeh pattern market ke future direction ko predict karne mein madadgar hota hai.

#### Trading Implications

Four Price Doji pattern se trade karne ke liye kuch key points hain:

1. **Confirmation**: Is pattern ko trade karte waqt confirmation ka intezar karna zaroori hai. Jab Four Price Doji pattern ban jata hai, to agla candlestick dekhen. Agar agla candlestick bullish close karta hai, to yeh bullish reversal ka signal ho sakta hai. Conversely, agar bearish close hota hai, to yeh bearish trend ki taraf ishara karta hai.

2. **Support and Resistance Levels**: Traders ko is pattern ko support aur resistance levels ke saath analyze karna chahiye. Agar Four Price Doji kisi major support level ke paas banta hai, to yeh bullish reversal ka signal ho sakta hai. Agar yeh resistance level ke paas banta hai, to bearish reversal ki taraf ishara kar sakta hai.

3. **Stop-Loss and Take Profit**: Risk management ke liye, stop-loss orders ka istemal zaroor karein. Stop-loss ko Four Price Doji ke low ya high ke thoda upar ya neeche set karna chahiye. Take profit ko recent swing highs ya lows par set karna behtar hota hai.

#### Conclusion

Four Price Doji candlestick pattern market ke indecision ko darshata hai aur traders ko potential reversals ke baare mein valuable insights deta hai. Is pattern ko samajhne se aap trading decisions ko behtar tarike se le sakte hain. Hamesha yaad rahe ke kisi bhi trading decision se pehle proper analysis aur risk management zaroor karein, taake aap apne trading results ko behtar bana sakein. Is tarah, aap market ke fluctuations ka behtar faida utha kar profitable trades kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:44 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим