What is in neckline candlestick pattern?

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

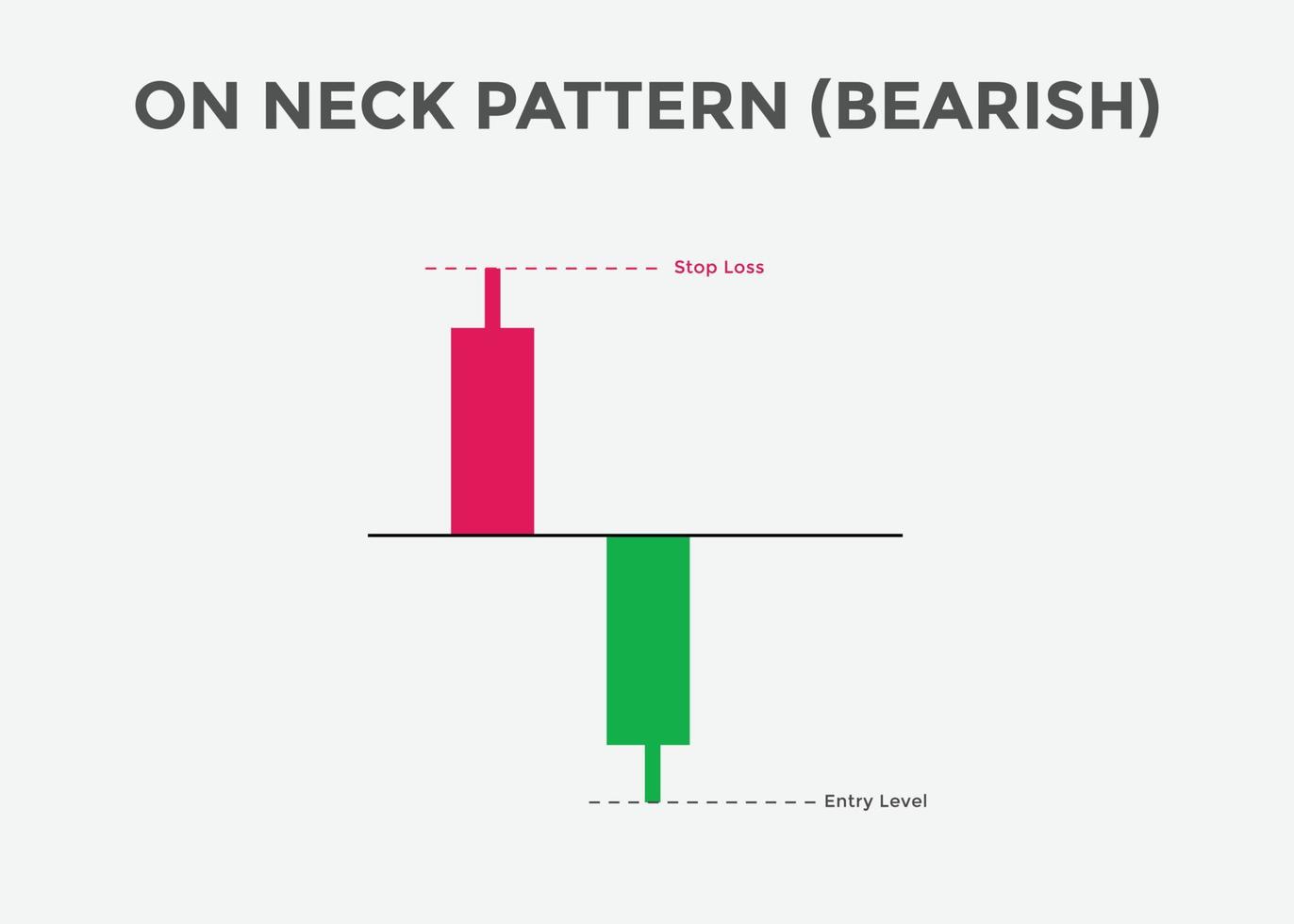

INTRODUCTION TO THE IN NECKLINE CANDLESTICK PATTERN: In Neckline candlestick pattern wo aik do-candlestick bearish reversal pattern hai jo ek uptrend ke aakhir mein banega. Ye trend reversal kisabaq hai aur traders ko ek signal deta hai ki woh long positions se bahar nikal sakte hai ya short positions shuru karne ki soch sakte hai. Ye pattern tab banta hai jab pehli candle pattern ka aik lamba bullish candle ho, jisko ek dusre bearish candle follow karta hai, jo pehle bullish candle ki midpoint ke thoda sa upar close hota hai. ANATOMY OF THE IN NECKLINE PATTERN: In Neckline pattern ko samajhne aur pehchanne ke liye, traders ko is pattern ke mukhya tareeqe ko tajziya karna zaroori hai. Pehla tareeqa lamba bullish candle hai, jo ek majboot kharidne ki dabao aur ek sthapit uptrend ko darshata hai. Dusra tareeqa bullish candle ke peechay wala bearish candle hai. Ye bearish candle pehle candle ke close se oopar khulta hai, lekin pehle bullish candle ke midpoint ke thoda sa upar close hota hai. INTERPRETATION AND SIGNIFICANCE OF THE IN NECKLINE PATTERN: In Neckline pattern batata hai ki bulls apni quwwat kho rahe hain aur bears jald hi market par qabza karne lagenge. Ye baat ki bearish candle pehle bullish candle ke midpoint ke upar close hoti hai, ye ishara karta hai ki kharidne ki dabao abhi bhi maujood hai, lekin upar ki momentum ko barqarar rakhne ke liye is kafi nahi hai. Traders is pattern ko samajh sakte hai ek trend reversal ke sanket ki tarah aur iska matlab hai ki trend palatne wala hai aur ye accha waqt ho sakta hai long positions ko chhodne ya short positions shuru karne ka. CONFIRMATION AND TRADE SETUP: Jaise ki kisi bhi candlestick pattern mein, trading decisions lene se pehle tawdeeq ka intezaar karna bahut zaroori hai. Traders ko dusre technical indicators ya patterns ke saath aur signal ya tawdeeq ke saath tawajaran karni chahiye In Neckline pattern par trading mein jaane se pehle. Kuch traders tawdeeq ke liye ek bearish confirmation candle ko intezaar karte hai, jo dusre bearish candle ke low se neeche close hota hai, isse pattern ko aur bhi maanyata milti hai aur trading set up ko zyada reliable banaane mein madad milti hai. STOP LOSS AND PROFIT TARGET PLACEMENT: Rishtey ko behtareen tareeqe se samjane ke liye, traders ko hamesha ek stop-loss order set karna chahiye, taa ke price asaani se expected behaviour na karne par nuksaaniyon ko had se zyada na hone de. Stop-loss order dusre bearish candle ke high ke upar rakha ja sakta hai, thode se potential volatility ko bhi shaamil karne ke liye. Saath hi, traders ko apne risk-reward ratio aur overall market conditions ke hisaab se ek profit target set karne par vichar karna chahiye. Ye profit target us level par set karna chahiye jo trader ki trading strategy ke sath milti hai aur reasonable profit potential ko darshati hai, saath hi kisi bhi potential support ya resistance levels ko bhi dhyaan mein rakhte hue. Ant mein, In Neckline candlestick pattern ek bearish reversal pattern hai, jo ek uptrend ki ant mein potenial trend reversal ki soochak ho sakti hai. Karobar karne wale ko is pattern ki anatomy, tashrih aur tasdeeq ke signals par gaur karna chahiye, is pattern par amal karne se pehle. Stop-loss aur profit target ki jagah sahi tarah se tay karna bhi mazboot risk management ke liye zaroori hai. Jaise ki har technical pattern ke saath, In Neckline pattern ko dusre technical analysis tools ke saath milakar samjha jana bahut zaroori hai, taaki safal karobar ki sambhavna ko badhaya ja sake. -

#3 Collapse

Neck line candlestick pattern Assalam o Alaikum friends and fellows Forex trading ky analysis ky liye sub sy ziyada use hony waly chart ko candlestick chart pattern kaha jata hai jo bahot easy hai aor japan sy is ka aghaz huwa aor is ma apko bhi ab tk samjh a gia ho ga ky kitna important hai us ko istemal krna is ky bahot se faidy hain. Neckline use krny ka tareeka Apko forex trading chart py jub bhi head and shoulder pattern bnta nazar ay aor usky head ky opposite side py below side jo straight line bnti hai usko neck line kaha jata hai aor yeh zaroori nhi hai ky horizontal he ho wo thori teri bhi ho skti hai apko candlestick chart ko understand krna ana chye candlestick chart ma bajot sari information hoti hain aik single candle bhi market ma apko kafi sari information provide kr skti hai apko market ky bary ma hidden secrets ka ilm hina chye tb he ao achy professional trader bn skty ho. Neck line candlestick pattern ki Ehmiyat Dear Fellows market Mein jitni bhi candlestick hoti hain yeh apko bahot acchy tariky se market ki next movement ko indicate kar rahi hoti hain is liye apko chahiye ki aap in ko properly learn Karen Taky aap market ko aasani ke sath samajhne ki situation Mein a jaen jab tak aap ine ko acchi Tarah Nahin samajh lete aap kabhi bhi acchi trading nahin kar sakte isliye neckline ki importance Se Koi Banda Inkar nahin kar sakta. Ek Baat Ko apany Hamesha Yad Rakhna hai ki Jab neckline pattern ban jata hai to Usky bad Ek baar market Apna gap zarur pura karti hai aur ismein 80% chances Hoty Hain Ki market Apna gap recover karne ke bad apni movement ko continue rakhen Jaise ke aapko Maine bataya hai ki neckline Hamesha continue trend Mein banti hai aur just wo Apna gap recover karny ke liye Thodi Si reversal movement kar sakti hai to is situation Mein apane Koi Bhi wrong decision Nahin lena. -

#4 Collapse

Neckline candlestick pattern ek technical analysis ka hissa hai jo forex trading mein istemal hota hai. Ye pattern reversal signals provide karta hai, jo traders ko market ke future direction ke bare mein idea deta hai. Neckline pattern ko samajhna aur istemal karna traders ke liye ahem hota hai taake woh sahi samay par trade enter karen aur profit earn karen.

Neckline Pattern Ka Matlab aur Tareef- Neckline pattern ek reversal pattern hai jo trend change ke signals provide karta hai.

- Is pattern mein do peaks hote hain jo uptrend ya downtrend mein hote hain.

- Neckline pattern ko confirm karne ke liye, do peaks ke darmiyan ek "neckline" draw ki jati hai, jo price levels ko connect karta hai.

Types of Neckline Patterns- Head and Shoulders: Ye sabse mashhoor neckline pattern hai. Is pattern mein ek central peak ke dono sides pe do smaller peaks hote hain. Neckline head ke niche draw ki jati hai.

- Inverse Head and Shoulders: Ye pattern downtrend ke baad hota hai. Is pattern mein ek central trough (head) ke dono sides pe do smaller troughs (shoulders) hote hain. Neckline head ke upar draw ki jati hai.

Head and Shoulders Pattern- Is pattern mein pehla peak "left shoulder" aur doosra peak "right shoulder" kehte hain.

- Head and shoulders pattern ka matlab hai ke uptrend ki khatam hone ki indication hai aur bearish trend ka shuru hone ka signal hai.

- Neckline ko break hone par, traders short positions enter karte hain ya existing long positions ko close karte hain.

Inverse Head and Shoulders Pattern- Is pattern mein pehla trough "left shoulder" aur doosra trough "right shoulder" kehte hain.

- Inverse head and shoulders pattern ka matlab hai ke downtrend ki khatam hone ki indication hai aur bullish trend ka shuru hone ka signal hai.

- Neckline ko break hone par, traders long positions enter karte hain ya existing short positions ko close karte hain.

Trading Strategy- Neckline pattern ko confirm karne ke liye, traders ko neckline ko break hone ka wait karna hota hai.

- Agar neckline ko upper direction mein break hota hai to ye bullish signal hota hai aur agar lower direction mein break hota hai to ye bearish signal hota hai.

- Neckline break ke baad, traders ko confirmatory signals ki talaash karni chahiye jaise ke volume increase, price action confirmations, aur doosre technical indicators.

Stop Loss aur Target Levels- Neckline pattern ke trading mein stop loss aur target levels ka hona zaroori hai.

- Stop loss levels ko pehle se decide karna chahiye taake nuqsan ko control kiya ja sake.

- Target levels ko bhi pehle se decide karna chahiye taake traders ko pata ho ke kis level tak price move kar sakta hai.

Risk aur Reward Ka Tafseel se Ghor karna- Trading mein risk aur reward ka balance hona zaroori hai.

- Neckline pattern ke trade mein risk reward ratio ko calculate karna aur trade enter karne se pehle ye dekhna zaroori hai ke potential reward kitna hai aur kitna risk lena parega.

Confirmation Signals- Neckline pattern ko confirm karne ke liye, traders ko confirmatory signals ka istemal karna chahiye.

- Confirmatory signals mein volume increase, price action confirmations, aur doosre technical indicators ka istemal shamil hai.

Neckline candlestick pattern ek ahem technical analysis tool hai jo forex trading mein istemal hota hai. Is pattern ki madad se traders market ke reversal points ko identify kar sakte hain aur sahi waqt par trades enter karke profit earn kar sakte hain. Lekin, is pattern ko istemal karne se pehle, traders ko confirmatory signals ka istemal karna chahiye aur risk reward ratio ko bhi samajhna zaroori hai. Muhim aur mehnat se, traders neckline pattern ke istemal se apni trading performance ko behtar bana sakte hain. -

#5 Collapse

Candlestick patterns stock market mein aham hotay hain aur investors ko price action ka acha idea detay hain. Neckline candlestick pattern bhi ek aham pattern hai jo traders aur investors ke liye useful hota hai. Is article mein hum baat karenge ke neckline candlestick pattern kya hai aur iska matlab kya hai.

Neckline candlestick pattern ek reversal pattern hai jo bearish trend ke end ko indicate karta hai. Yeh pattern typically ek downtrend ke baad aata hai aur bullish reversal ko signal karta hai. Is pattern ko samajhne ke liye, pehle humein bearish trend aur bullish reversal ke concepts ko samajhna zaroori hai.

Bearish trend mein prices continuously down ki taraf move karte hain jabke bullish reversal mein prices down hone ke baad up ki taraf move karte hain. Neckline candlestick pattern mein, ek bearish trend ke baad jab prices ek specific level tak girte hain aur phir wahan se upar ki taraf move karte hain, to yeh bullish reversal ko indicate karta hai.

Neckline candlestick pattern mein typically do main candles hote hain. Pehla candle bearish hota hai, jo downtrend ko represent karta hai. Dusra candle, jo ki ek bullish candle hota hai, pehle candle ke neeche se start hota hai aur phir usko cover karta hai. Is bullish candle ka close pehle bearish candle ke close ke upar hota hai, jo ki ek bullish reversal ko darust karti hai.

Yeh pattern traders aur investors ke liye aham hai kyunki iska use karke woh market ke turning points ko identify kar sakte hain aur entry aur exit points ka behtar faisla kar sakte hain. Is pattern ko samajhna aur uska istemal karna zaroori hai taake investors apne trades ko optimize kar sakein.

Toh, neckline candlestick pattern ek aham tool hai jo traders aur investors ke liye useful hota hai. Isko samajh kar aur sahi tareeqe se istemal kar ke, market ke movements ko better analyze kiya ja sakta hai aur trading decisions ko improve kiya ja sakta hai.

-

#6 Collapse

Neckline candlestick pattern ki ahmiyat yeh hoti hai ke ye traders ko market ke trend reversal ya continuation ke potential points ka pata lagane mein madad karta hai. Ye pattern, chart analysis mein head and shoulders jaise aur bhi patterns ke saath juda hota hai aur market ke behavior ko samajhne mein madad deta hai.Is pattern ki ahmiyat kuch mukhtalif pehluon se hoti hai:

Trend Reversals:

Gardan rekha ki break kaafi bar trend reversal ko indicate karta hai. Agar price upar se neeche chali jaati hai gardan rekha se, to ye bearish trend ka indication ho sakta hai, jabke agar price gardan rekha ko upar se break karti hai, to ye bullish trend ka indication ho sakta hai.

Price Targets:

Gardan rekha ko identify kar ke traders price targets tay kar sakte hain. Head and shoulders pattern mein gardan rekha ko shoulders ke bottom se draw kiya jata hai, jo price target ko estimate karne mein madad karta hai jab price neckline ko break karta hai.

Entry aur Exit Points:

Gardan rekha ka hona entry aur exit points tay karne mein bhi madad karta hai. Jab price gardan rekha ko break karta hai, traders apne positions ko enter ya exit kar sakte hain, depending on the direction of the breakout.

Stop Loss Levels:

Gardan rekha traders ko stop loss levels tay karne mein bhi madad karta hai. Agar price gardan rekha ko break karta hai, to ye traders ko signal deta hai ke unki trade ka direction galat ho sakta hai, aur woh apni positions ko protect karne ke liye stop loss lagate hain.Overall, neckline candlestick pattern ki ahmiyat market ke trend reversal aur continuation points ko identify karne mein hoti hai, jo traders ko trading decisions lene mein madad karta hai aur unhe market ke behavior ko samajhne mein madad deta hai.

-

#7 Collapse

What is in neckline candlestick pattern

High-Frequency Trading

High-frequency trading (HFT) modern financial markets, revolutionizing the landscape of trading lightning-fast pace advanced algorithms. article delve intricacies high-frequency trading, exploring mechanisms, impacts, controversies, future prospects.

What high-frequency trading

High-frequency trading refers practice executing large number transactions within extremely short timeframes, often measured milliseconds microseconds. strategy relies powerful computers algorithms analyze market data execute trades speeds far beyond human capacity.

Mechanisms high-frequency trading

- Algorithmic Trading: HFT firms employ complex algorithms identify trading opportunities based market conditions, price movements, relevant factors. algorithms execute trades automatically without human intervention.

- Co-location: minimize latency, HFT firms often locate servers close proximity exchange servers, reducing time takes trade orders reach exchange.

- Market Making: HFT firms engage market-making activities, providing liquidity continuously quoting bid ask prices. profit bid-ask spread aim minimize exposure market risk.

Impacts high-frequency trading

- Market Liquidity: HFT contributes market liquidity providing constant flow buy sell orders, narrowing bid-ask spreads, reducing price volatility.

- Efficiency: speed efficiency HFT help price discovery ensure market prices reflect available information accurately.

- Costs: HFT lower trading costs investors tightening spreads, increase market instability exacerbate flash crashes, leading unforeseen losses.

Controversies Surrounding High-Frequency Trading

- Unfair Advantage: Critics argue HFT firms unfair advantage traditional investors due technological prowess preferential access market data.

- Market Manipulation: Concerns raised potential HFT manipulate markets practices spoofing, layering, quote stuffing, exploiting small price discrepancies profit.

- Systemic Risk: rapid pace interconnected nature HFT systems raise concerns systemic risk, potential single malfunction algorithmic error trigger widespread market disruptions.

Regulatory Responses

- Regulatory Oversight: Regulators implemented measures monitor regulate high-frequency trading, including requirements market surveillance, circuit breakers, risk controls.

- Transparency: Efforts made improve transparency financial markets mandating disclosure HFT activities imposing stricter reporting requirements.

- Market Structure Reforms: proposals advocate structural reforms level playing field HFT firms traditional investors, imposing transaction taxes slowing trading speeds.

Future Outlook

future high-frequency trading likely shaped technological advancements, regulatory developments, shifts market dynamics. HFT continues play significant role financial markets, ongoing debates impact market integrity, fairness, stability underscore need continued scrutiny regulation.

conclusion, high-frequency trading represents paradigm shift world finance, characterized speed, sophistication, controversy. understanding mechanisms, impacts, regulatory challenges, market participants navigate evolving landscape high-frequency trading greater awareness resilience.Firangi.com ❣️

- CL

- Mentions 0

-

سا0 like

-

#8 Collapse

Neckline Candlestick Pattern Kya Hai?

Candlestick patterns chart analysis ka ek ahem hissa hain, jise traders market ki trend aur reversal ko samajhne ke liye istemal karte hain. Ek aham candlestick pattern jo ki aksar traders ki nazar mein aata hai, woh hai "Neckline Candlestick Pattern".

Neckline Candlestick Pattern ek reversal pattern hota hai jo downtrend ke bad bullish trend ki shuruaat ko darust karta hai. Yeh pattern ek series of candlesticks ke through dikhai deta hai, jisme ek specific pattern hota hai jo market ke direction ko badalne ka sanket deta hai.

Is pattern mein, ek series of consecutive downward (bearish) candlesticks ke baad, ek single upward (bullish) candlestick aata hai, jise "neckline" kehte hain. Jab yeh bullish candlestick downtrend ke last bearish candlesticks ke "neckline" ko cross kar leta hai, to yeh ek bullish reversal signal provide karta hai.

Neckline Candlestick Pattern ka mukhya uddeshya hota hai market ke trend reversal ko detect karna aur traders ko uptrend ke shuruaat par alert karna. Is pattern ki madad se traders apne trades ko better timing aur entry points par execute kar sakte hain, jisse unka profit potential badh jata hai.

Yeh pattern kisi bhi time frame par istemal kiya ja sakta hai, lekin zyadatar traders isse short to medium term trades ke liye prefer karte hain. Is pattern ko confirm karne ke liye, traders ko volume aur other technical indicators ka bhi dhyan rakhna hota hai.

Lekin, hamesha yaad rahe ke kisi bhi technical analysis tool ya pattern ki tarah, Neckline Candlestick Pattern bhi 100% accurate nahi hota. Isliye, traders ko hamesha proper risk management ke saath apne trades ko execute karna chahiye.

Overall, Neckline Candlestick Pattern ek powerful aur useful tool hai jo traders ko market trends aur reversals ko samajhne mein madad karta hai. Agar sahi tareeke se istemal kiya jaye, to yeh pattern traders ko profitable trading opportunities provide kar sakta hai.

-

#9 Collapse

What is in neckline candlestick pattern?

"Neckline" ek technical analysis concept hai jo chart patterns, jaise Head and Shoulders ya Double Top ya Double Bottom, ke saath juda hota hai. Ye ek horizontal line hoti hai jo price action ko connect karti hai. Jab market is line ko break karta hai, to ye ek potential trend reversal ya trend continuation ko darust karta hai, depending upon the type of pattern.

Neeche "Neckline" ke mukhtasir tafseelat di gayi hain:

Neckline - Neckline ek horizontal line hai jo chart patterns ke saath associated hoti hai, jaise Head and Shoulders, Double Top ya Double Bottom.- Dharohar:

- Neckline ek straight horizontal line hoti hai jo chart pattern ke parts ko connect karti hai.

- Is line ka location pattern ke type par depend karta hai, jaise ki Head and Shoulders pattern mein yeh shoulders ko connect karta hai ya Double Top/Bottom pattern mein price ke peaks ya lows ko connect karta hai.

- Tafsiliat:

- Jab market neckline ko break karta hai, to ye ek important signal hai. Agar Head and Shoulders pattern hai, to neckline ke break ke baad bearish reversal ho sakti hai. Agar Double Top ya Double Bottom pattern hai, to neckline ke break ke baad trend continuation ya reversal ho sakti hai, depending upon the direction of the breakout.

- Neckline break ke baad, traders price ka movement closely monitor karte hain aur trading decisions lete hain.

- Tijarati Tareeqa:

- Jab neckline break hoti hai, traders trading positions lete hain, depending upon the direction of the breakout aur pattern type ke according.

- Stop loss aur take profit levels ka istemal karte hue, traders apni positions ko manage karte hain.

Neckline chart patterns mein traders ko important levels provide karta hai jo trend reversals ya trend continuations ko identify karne mein madad karta hai. Lekin, iska istemal karne se pehle mukammal analysis aur risk management ka dhyan rakha jana chahiye. - Dharohar:

-

#10 Collapse

What is in neckline candlestick pattern?

"Neckline" ek technical analysis concept hai jo chart patterns, jaise Head and Shoulders ya Double Top ya Double Bottom, ke saath juda hota hai. Ye ek horizontal line hoti hai jo price action ko connect karti hai. Jab market is line ko break karta hai, to ye ek potential trend reversal ya trend continuation ko darust karta hai, depending upon the type of pattern.

Neeche "Neckline" ke mukhtasir tafseelat di gayi hain:

Neckline - Neckline ek horizontal line hai jo chart patterns ke saath associated hoti hai, jaise Head and Shoulders, Double Top ya Double Bottom.

Dharohar:

Neckline ek straight horizontal line hoti hai jo chart pattern ke parts ko connect karti hai.

Is line ka location pattern ke type par depend karta hai, jaise ki Head and Shoulders pattern mein yeh shoulders ko connect karta hai ya Double Top/Bottom pattern mein price ke peaks ya lows ko connect karta hai.

Tafsiliat:

Jab market neckline ko break karta hai, to ye ek important signal hai. Agar Head and Shoulders pattern hai, to neckline ke break ke baad bearish reversal ho sakti hai. Agar Double Top ya Double Bottom pattern hai, to neckline ke break ke baad trend continuation ya reversal ho sakti hai, depending upon the direction of the breakout.

Neckline break ke baad, traders price ka movement closely monitor karte hain aur trading decisions lete hain.

Tijarati Tareeqa:

Jab neckline break hoti hai, traders trading positions lete hain, depending upon the direction of the breakout aur pattern type ke according.

Stop loss aur take profit levels ka istemal karte hue, traders apni positions ko manage karte hain.

Neckline chart patterns mein traders ko important levels provide karta hai jo trend reversals ya trend continuations ko identify karne mein madad karta hai. Lekin, iska istemal karne se pehle mukammal analysis aur risk management ka dhyan rakha jana chahiye.

-

#11 Collapse

What is in neckline candlestick pattern?

Candlestick patterns, ya mumtaz tools hain technical analysis mein jo traders ko market ki raiyat aur qeemat ke muntazimane samajhne mein madad karte hain. In mukhtalif candlestick patterns mein, neckline pattern khas tor par ahmiyat rakhta hai, kyun ke ye qeemat ke trends mein mukhtalif palat ya jari rahne ki dalil faraham karta hai.

Neckline Candlestick Pattern Ka Tafsili Samajh: Neckline pattern aam tor par ek downtrend ke doran banta hai aur is mein ek silsila hota hai candlesticks ka jo lower lows aur lower highs dikhate hain. Magar, ye pattern khas hai is wajah se ke is mein ek ahem low point hota hai jiska bad mein aane wale candlestick ya series of candlesticks us low ko paar nahi kar pate. Ye banaya jata hai ek "neckline," jo ke ek aham sath ke darja ka level hota hai.

Pehechankaar: Neckline pattern ko pehchan'ne ke liye tawajjo aur market ke dynamics ke liye ek tez nazar ki zaroorat hoti hai. Traders ek wazeh downtrend ko dhondte hain jo musalsal lower lows aur lower highs se mushahidah hota hai. Jab ek ahem low muqarrar hota hai, traders ke dorey aane wale candlesticks ko dekhte hain. Agar ye candlesticks us low ko paar karne mein nakam rehte hain aur is ke bajaye ek horizontal ya ascending pattern bana lete hain, to neckline banta hai.

Ahmiyat: Neckline pattern bohot zyada ahmiyat rakhta hai kyun ke ye mojooda downtrend mein palatne ke mumkin nukta ko numainda karta hai. Ye ishara deta hai ke bechnay walay hosle haar rahe hain aur kharidar shayad qeemat ka saath dein. Aane wale candlesticks ka muqarrar low ko paar na karne ka fail ho jana darta hai ke bearish trend kamzor hota ja raha hai aur bullish palat hone ki mumkinat hain.

Trading Strategies: Traders neckline pattern ke samne mukhtalif strategies istemal karte hain. Ek aam tareeqa hai ke neckline resistance ko torne ka saboot hone tak intezar karna, phir long position mein dakhil hone se pehle. Ye tasdeeq ye darta hai ke bullish momentum kaafi mazboot hai ta ke upward movement ko barqarar rakha ja sake. Mazeed, traders doosre technical indicators ko istemal kar sakte hain jese ke volume analysis ya oscillators ta ke neckline pattern dawat dene wali palat ki tasdeeq kar sakein.

Risk Management: Jab ke neckline pattern qeemat ke palat ke mumkin isharaat faraham karta hai, to hushyaar risk management tajweez kiya jata hai jab trades ko is pattern ke buniyad par execute kiya jata hai. Traders ko stop-loss orders qayam karna chahiye ta ke unki position ke khilaaf market ka chalan aaye. Mazeed, ye ahem hai ke chaka chaundh gahraai se samajha jaye aur fundamental factors ko tawajjo di jaye jo qeemat ke harkat ko asar andaaz kar sakte hain.

Nateeja: Ikhtitami taur par, neckline candlestick pattern ek takatwar tool hai traders ke liye jo ke market mein palatne ki mumkinat ko pehchan'ne ki talash mein hain. Is ke banaye, ahmiyat aur trading strategies ko samajh kar, traders apni technical analysis toolkit mein is pattern ko kamyabi se shaamil kar sakte hain. Magar, jese hi koi trading signal hota hai, to zaroori hai ke caution ko amal mein laaya jaye aur market ke complexities ka sahi taur par jawab diya ja sake. -

#12 Collapse

"Neckline" ek technical analysis concept hai jo ki chart patterns mein istemal hota hai, jaise ke head and shoulders pattern aur double top ya double bottom pattern mein. Neckline ek horizontal line hoti hai jo pattern ke do peaks ya bottoms ko connect karti hai.

Neckline Candlestick Pattern koi specific candlestick pattern nahi hai, lekin neckline ko ek key level ke roop mein istemal kiya jata hai jahan se trend reversal ki confirmation hoti hai. Yeh typically head and shoulders pattern ya double top/bottom pattern ke sath dekha jata hai.- Head and Shoulders Pattern: Jab ek head and shoulders pattern form hota hai, toh neckline ek important level ban jata hai jahan se bearish reversal ki confirmation hoti hai. Agar price neckline ko break karta hai, toh yeh bearish reversal ka signal provide karta hai. Traders is breakout ke baad short positions lete hain.

- Double Top/Bottom Pattern: Double top pattern mein, jab do baar price ek specific level par top banata hai aur phir us level ko break karta hai, toh yeh bullish trend ko end karne ka indication hota hai. Double bottom pattern mein, jab do baar price ek specific level par bottom banata hai aur phir us level ko break karta hai, toh yeh bearish trend ko end karne ka indication hota hai. Neckline yahan bhi ek key level hoti hai jahan se trend reversal ki confirmation hoti hai.

Neckline Candlestick Pattern ka istemal karne ke liye traders neckline ko closely monitor karte hain aur jab price usko break karta hai, toh wo trend reversal ka signal samajhte hain aur us direction mein positions lete hain. Iske saath saath, traders typically volume aur doosre technical indicators ka bhi istemal karte hain trend reversal ko confirm karne ke liye.

Is tarah se, neckline candlestick pattern ko istemal karke traders trend reversal ko identify karte hain aur unke trading decisions ko base karte hain. Lekin hamesha yaad rahe ke ek single pattern par na aakar trading decisions lena chahiye, aur confirmatory signals ka bhi dhyan dena chahiye. -

#13 Collapse

What is in neckline candlestick pattern?

"Neckline Candlestick Pattern" ka koi makhsoos naam ya pattern market mein nahi hota. Shayad aap "Head and Shoulders" pattern ke baare mein baat kar rahe hain, jo ek popular technical analysis pattern hai aur neckline uska ek important component hota hai.

Head and Shoulders pattern ek bearish reversal pattern hai jo price chart par dikhta hai. Is pattern ka formation generally uptrend ke baad hota hai aur downtrend ka signal deta hai.

Is pattern mein kuch key components hote hain:

Left Shoulder: Pehla component ek higher high hota hai jo uptrend ke doran ban jata hai.

Head: Doosra component ek higher high hota hai jo left shoulder se bada hota hai. Iske baad price ek sharp dip karta hai, jo pattern ka head kehlata hai.

Right Shoulder: Teesra component ek higher high hota hai jo head ke baad ban jata hai. Iske baad price ek aur dip karta hai, lekin left shoulder ke level tak nahi jaata.

Neckline: Neckline ek horizontal line hoti hai jo left shoulder aur right shoulder ke lows ko connect karti hai.

Neckline ek important level hota hai Head and Shoulders pattern mein. Agar price neckline ko break karke neeche jaata hai, toh yeh bearish reversal ka signal hai aur traders downtrend ke continuation ya reversal ke liye trade kar sakte hain.

Yeh pattern market mein reversal signals ko identify karne mein madadgar hota hai, lekin false signals ko avoid karne ke liye traders ko thorough analysis aur confirmatory signals ka wait karna chahiye.

-

#14 Collapse

Forex Trading Mein Neckline Candlestick Pattern Ki Ahmiyat

Forex trading ek azeem tajurba hai jahan har trader naye tareeqay aur patterns ko samajh kar apne faiday ki taraf rawana hota hai. Candlestick patterns is tajurbe ka aham hissa hain jo traders ko market ki muddaton ko samajhne mein madadgar sabit hote hain. Aik aham candlestick pattern jo khaas tor par neckline candlestick pattern kehte hain, is article mein ham is ke bare mein ghor karenge.

1. Neckline Candlestick Pattern: Ahamiyat aur Tareef

Neckline candlestick pattern forex trading mein aik ahem pattern hai jo trend reversal ya trend continuation ka pata lagane mein madad deta hai. Is pattern mein, aik candle ki closing price doosri candle ki opening price se ziada hoti hai. Ye pattern aksar market mein mukhtalif waqton par nazar ata hai aur traders ko market ki muddaton ko samajhne mein madad deta hai.

2. Neckline Candlestick Pattern Ka Tareeqa Kar

Neckline candlestick pattern ko samajhne ka tareeqa asan hai. Jab ek candle ki closing price doosri candle ki opening price se ziada hoti hai, to ye ek potential neckline candlestick pattern hai. Traders ko is pattern ko recognize karne ke liye market ki movement ko closely observe karna hota hai aur agar ye pattern milti hai to trend ka direction anticipate kiya ja sakta hai.

3. Neckline Candlestick Pattern Aur Trend Reversal

Neckline candlestick pattern aksar trend reversal ko indicate karta hai. Agar market mein ek uptrend ya downtrend ho rahi hai aur neckline candlestick pattern nazar ata hai, to ye ek indication ho sakti hai ke trend ka direction badalne wala hai. Traders ko is pattern ko samajh kar apne trading strategies ko adjust karna chahiye taake wo trend reversal ke faiday utha sakein.

4. Neckline Candlestick Pattern Aur Trend Continuation

Is ke ilawa, neckline candlestick pattern bhi trend continuation ko indicate kar sakta hai. Agar market mein ek strong trend hai aur neckline candlestick pattern nazar ata hai, to ye indicate kar sakta hai ke trend jari hai aur traders ko apni positions ko hold karne ki salahiyat milti hai. Is taur par, traders ko is pattern ko samajh kar market ke muddaton ko better analyze karna chahiye.

5. Neckline Candlestick Pattern: Trading Strategies

Neckline candlestick pattern ko samajh kar traders apni trading strategies ko improve kar sakte hain. Agar trend reversal ka indication hai to traders apni positions ko adjust kar sakte hain ya phir naye positions enter kar sakte hain. Agar trend continuation ka indication hai to traders apni existing positions ko hold kar sakte hain ya phir naye positions enter kar sakte hain.

In conclusion, neckline candlestick pattern forex trading mein ek ahem tool hai jo traders ko market ki muddaton ko samajhne mein madad deta hai. Is pattern ko recognize karke, traders apni trading strategies ko improve kar sakte hain aur market ke muddaton ko behtar taur par anticipate kar sakte hain. Taaleem aur amal ke zariye, traders apni trading journey ko mazeed behtar bana sakte hain. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

What is in neckline candlestick pattern?

Neckline Candlestick Pattern (نیک لائن شمعیں پیٹرن) ka koi makhsoos naam nahi hai forex trading mein. Shayad aap "Head and Shoulders" pattern ki baat kar rahe hain jo ki ek popular technical analysis pattern hai aur neckline uska ek important component hai.

Head and Shoulders pattern ek bearish reversal pattern hai jo price chart par dikhta hai. Is pattern ka formation generally uptrend ke baad hota hai aur downtrend ka signal deta hai.

Is pattern mein kuch key components hote hain:

Left Shoulder (بائیں کندھا): Pehla component ek higher high hota hai jo uptrend ke doran ban jata hai.

Head (سر): Doosra component ek higher high hota hai jo left shoulder se bada hota hai. Iske baad price ek sharp dip karta hai, jo pattern ka head kehlata hai.

Right Shoulder (دائیں کندھا): Teesra component ek higher high hota hai jo head ke baad ban jata hai. Iske baad price ek aur dip karta hai, lekin left shoulder ke level tak nahi jaata.

Neckline (نیک لائن): Neckline ek horizontal line hoti hai jo left shoulder aur right shoulder ke lows ko connect karti hai.

Neckline ek important level hota hai Head and Shoulders pattern mein. Agar price neckline ko break karke neeche jaata hai, toh yeh bearish reversal ka signal hai aur traders downtrend ke continuation ya reversal ke liye trade kar sakte hain.

Yeh pattern market mein reversal signals ko identify karne mein madadgar hota hai, lekin false signals ko avoid karne ke liye traders ko thorough analysis aur confirmatory signals ka wait karna chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:03 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим