Higher High and Lower Low Patterns in Forex Trading

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Higher High and Lower Low Patterns in Forex Trading -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

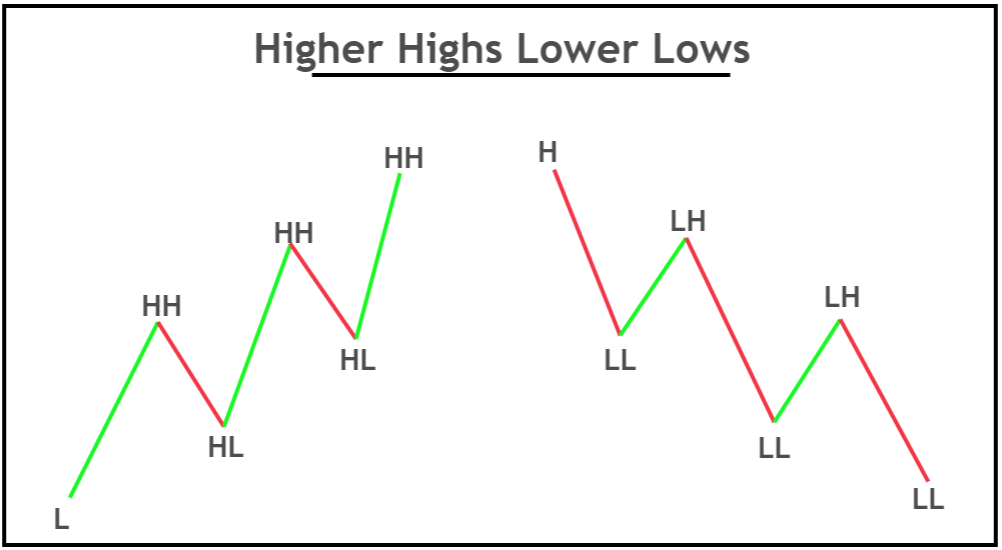

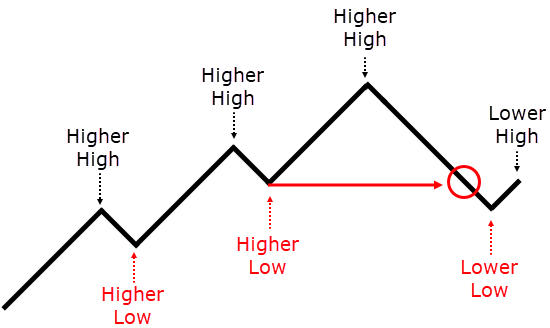

Forex trading mein Higher High aur Lower Low pattern, currency pairs ki keemat mein hone wale taqatwar aur kamzor tabdeeliyon ko samajhne mein madadgar concepts hain. Ye patterns is liye ahem hain kyunki ye traders ko trends ki pehchan karnay aur unki trading decisions ko behtar bananay mein madad kartay hain. Higher High and Lower Low Patterns in Forex Trading Forex trading, currency pairs ki keemat ke hone wale tabdeeliyon ko analyze aur predict karne ke baray mein hoti hai. Is kaam ko karne ke liye, traders mukhtalif technical analysis tools, patterns, aur indicators ka istemal karte hain. Higher highs aur lower lows aise do patterns hain jo traders ko trend ki raah aur uski potenti strength ko samajhne mein madadgar hotay hain. Higher High Higher high ek uptrend ka ahem hissa hota hai. Is ka waqt aata hai jab kisi mukhtalif muddat mein, jaise ke trading day ya week mein, sab se zyada price jo hasil kiya gaya ho, usse pehle muddat mein hasil ki gayi sab se zyada price se zyada ho. Dosray alfaz mein, ye price chart mein naye unchaai ko darust karti hai, is se maloom hota hai ke khareednay wale currency pair ke liye zyada paise dene ke liye tayyar hain. Misal ke tor par, agar EUR/USD currency pair ne pichli week mein 1.1500 ki bulandi tak pohnchay aur phir is week mein 1.1550 ki bulandi tak pohnchay, to jari bulandi 1.1550 higher high hai. Is se ye ishara milta hai ke uptrend jari reh sakta hai ya taqat hasil kar sakta hai kyun ke khareednay walay price ko barhane mein amadani bana rahe hain. Lower Low Lower low ek downtrend ka ahem hissa hota hai. Is ka waqt aata hai jab kisi mukhtalif muddat mein sab se kam price jo hasil kiya gaya ho, usse pehle muddat mein hasil ki gayi sab se kam price se kam ho. Is se ye maloom hota hai ke bechnay walay currency pair ke liye kam price qubool karne ke liye tayyar hain. EUR/USD misal ko jari rakhte hue, agar currency pair ne pichli week mein 1.1400 ki kamzori tak pohnchay aur phir is week mein 1.1350 ki kamzori tak pohnchay, to jari kamzori 1.1350 lower low hai. Is se ye ishara milta hai ke downtrend jari reh sakta hai ya taqat hasil kar sakta hai kyun ke bechnay walay price ko nicha kar rahe hain.

Higher High Higher high ek uptrend ka ahem hissa hota hai. Is ka waqt aata hai jab kisi mukhtalif muddat mein, jaise ke trading day ya week mein, sab se zyada price jo hasil kiya gaya ho, usse pehle muddat mein hasil ki gayi sab se zyada price se zyada ho. Dosray alfaz mein, ye price chart mein naye unchaai ko darust karti hai, is se maloom hota hai ke khareednay wale currency pair ke liye zyada paise dene ke liye tayyar hain. Misal ke tor par, agar EUR/USD currency pair ne pichli week mein 1.1500 ki bulandi tak pohnchay aur phir is week mein 1.1550 ki bulandi tak pohnchay, to jari bulandi 1.1550 higher high hai. Is se ye ishara milta hai ke uptrend jari reh sakta hai ya taqat hasil kar sakta hai kyun ke khareednay walay price ko barhane mein amadani bana rahe hain. Lower Low Lower low ek downtrend ka ahem hissa hota hai. Is ka waqt aata hai jab kisi mukhtalif muddat mein sab se kam price jo hasil kiya gaya ho, usse pehle muddat mein hasil ki gayi sab se kam price se kam ho. Is se ye maloom hota hai ke bechnay walay currency pair ke liye kam price qubool karne ke liye tayyar hain. EUR/USD misal ko jari rakhte hue, agar currency pair ne pichli week mein 1.1400 ki kamzori tak pohnchay aur phir is week mein 1.1350 ki kamzori tak pohnchay, to jari kamzori 1.1350 lower low hai. Is se ye ishara milta hai ke downtrend jari reh sakta hai ya taqat hasil kar sakta hai kyun ke bechnay walay price ko nicha kar rahe hain.  Significance of Higher Highs and Lower Lows Higher highs aur lower lows ki ahmiyat ko samajhna forex traders ke liye ahem hai kyun ke ye qeemati maloomat faraham karte hain market sentiment aur potential future price movements ke baray mein:

Significance of Higher Highs and Lower Lows Higher highs aur lower lows ki ahmiyat ko samajhna forex traders ke liye ahem hai kyun ke ye qeemati maloomat faraham karte hain market sentiment aur potential future price movements ke baray mein:- Trend Identification: Higher highs aur lower lows traders ko trend ki pehchan karne mein madad kartay hain. Ek uptrend higher highs aur higher lows ki ek series se nazar aata hai, jabke ek downtrend lower highs aur lower lows ki series se milta hai. In patterns ko pehchan karke traders apni strategies ko mojooda market direction ke saath milana asaan hota hai.

- Market Sentiment: Ye patterns market mein mojood sentiment ko reflect karte hain. Ek uptrend mein barhte hue higher highs bullish sentiment ko darust karte hain, jabke ek downtrend mein girte hue lower lows bearish sentiment ko darust karte hain. Traders is maloomat ka istemal market psychology ko samajhne aur inform trading decisions banane ke liye kar saktay hain.

- Entry aur Exit Points: Higher highs aur lower lows traders ke liye entry aur exit points ka kaam kar saktay hain. Misal ke tor par, ek trader jo long position mein dakhil hona chahta hai, woh higher high ko confirm karne ke liye wait kar sakta hai taakay uptrend ki taqat ko maloom karne ke baad khareeday. Ulta, ek trader jo short position mein hai, woh apne bearish stance ko reinforce karne ke liye lower lows ki talash kar sakta hai taakay bechne se pehle apne position ko confirm karay.

- Risk Management: Hamesha stop-loss orders set karen takay mogheeb nuksan ko had mein rakha ja sake. Apne risk tolerance aur entry point aur qareebi higher high ya lower low ke darmiyan faslay ke mutabiq apna position size calculate karen.

- Practice and Analysis: Tarekhi price charts par higher highs aur lower lows pehchanay aur analyze karne mein mustaqil practice karen. Apni strategies ko backtest karna aur trading journal banane se aap apne skills ko behtar banane mein madadgar ho sakti hai.

- Market Context: Higher highs aur lower lows istemal karte waqt bari market context, jaise ke economic news, geopolitical events, aur central bank policies, ko bhi madaynazar rakhen. Bahari factors currency markets ko mutasir kar saktay hain.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:37 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим