Trade ATR Indicator

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

-

سا0 like

-

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

ATR (Average True Range) Indicator ek volatility indicator hai jo price movement ko measure karne ke liye istemal hota hai. ATR ka calculation daily price range par based hota hai. Ye indicator traders ko volatility levels aur stop loss levels ke determination mein madad karta hai. ATR Indicator ke kuch major points aur unke fayde aur nuksan niche diye gaye hain: 1. Volatility Measurements: ATR Indicator volatility levels ko measure karne mein madad karta hai. Ye indicator traders ko market ki current volatility ko samajhne mein madad karta hai. High ATR values indicate high volatility, jabki low ATR values indicate low volatility. Isse traders ko market conditions aur price movements ke samajhne mein help milti hai. 2. Stop Loss Placement: ATR Indicator traders ko stop loss levels ke determination mein madad karta hai. Stop loss levels ko ATR multiples par set karne se, traders apne trades ko volatility ke samne protect kar sakte hain. ATR Indicator ki madad se, traders stop loss levels ko market conditions ke hisaab se adjust kar sakte hain. 3. Trend Strength: ATR Indicator trend strength ko bhi measure karne mein madad karta hai. Agar ATR values high hain, toh ye indicate karta hai ki trend strong hai. Jab ATR values low hote hain, toh ye indicate karta hai ki trend weak ho sakta hai. Isse traders ko trend ke strength aur weakness ke bare mein pata chalta hai. 4. Entry and Exit Points: ATR Indicator traders ko entry aur exit points ke determination mein madad karta hai. Jab ATR values high hote hain, toh ye indicate karta hai ki price movements bhi strong honge. Isse traders ko potential entry points ke bare mein idea milta hai. Jab ATR values low hote hain, toh ye indicate karta hai ki price movements weak honge. Isse traders ko potential exit points ke bare mein idea milta hai. Fayde ke saath, kuch nuksan bhi hote hain: 1. Lagging Indicator: ATR Indicator price ke peechey rehta hai aur lagging indicator ke taur par kaam karta hai. Iska matlab hai ki ATR Indicator price movements ke baad hi react karta hai. Isliye, ye indicator immediate price reversals ya trend changes ko predict karne mein kam kar sakta hai. 2. Subjective Interpretation: ATR Indicator ki interpretation subjective hoti hai aur traders ki discretion par depend karti hai. Different traders ATR values ko different ways mein interpret kar sakte hain, jisse confusion ho sakta hai.ATR Indicator ek useful tool hai, lekin iska istemal karne se pehle, traders ko iske fayde aur nuksan ko samajhna chahiye. Iske saath, dusre technical indicators aur analysis tools ka bhi istemal kiya ja sakta hai trading decisions lene ke liye. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Trade ATR Indicator

ATR (Average True Range) ek technical indicator hai jo traders use karte hain price volatility ko measure karne ke liye. ATR ka main purpose hota hai market me current price movement ki volatility ko quantify karna takay traders apni trading strategies ko better understand aur adjust kar saken. ATR ek numeric value hota hai jo typically price ke units me measure hota hai (for example, pips in the forex market). Is indicator ka use mainly volatility ke samajhne aur stop-loss levels aur position sizes ke liye kiya jata hai. Yahan kuch key points hain ATR ke bare me:- Volatility Measure: ATR market ke recent price movements ko dekhta hai aur ek average volatility value provide karta hai. Isse traders ko ye idea milta hai ki market kitni volatile hai aur price ke kitne fluctuations ho sakte hain.

- Stop-Loss Placement: Traders ATR ka use karke apne trades ke liye stop-loss levels set karte hain. Higher ATR values usually indicate greater volatility, so traders might set wider stop-loss levels in more volatile markets.

- Position Size: ATR can also be used to determine the size of a position. Traders may adjust their position sizes based on the current ATR value to account for market volatility.

- Trend Confirmation: ATR can help traders confirm the strength of a trend. If ATR is rising, it may indicate an increase in trend strength, while a falling ATR might suggest a weakening trend.

-

#4 Collapse

Forex trading main market ki volatility ko samajhna aur analyze karna inform kiye hue trading decisions banane ke liye ahem hai. Aik aise tool jo traders dwara istemal kiya jata hai volatility aur potential price movements ko samajhne ke liye wo hai Average True Range (ATR) indicator. ATR aik versatile tool hai jo market ki volatility dynamics mein qeemti insights faraham karta hai, jisse traders risk ko effectively manage kar sakte hain aur munasib dakhli aur nikalne ke points ko pehchan sakte hain.

Understanding ATR

J. Welles Wilder Jr. ne apni kitaab New Concepts in Technical Trading Systems mein 1978 mein tayyar kiya, Average True Range (ATR) ek technical analysis indicator hai jo market ki volatility ko napta hai. Dosri indicators ki nisbat jo sirf price ki direction par tawajjo dete hain, ATR price movements ka range mad nazar rakhta hai, dono upward aur downward movements ko capture karte hue.

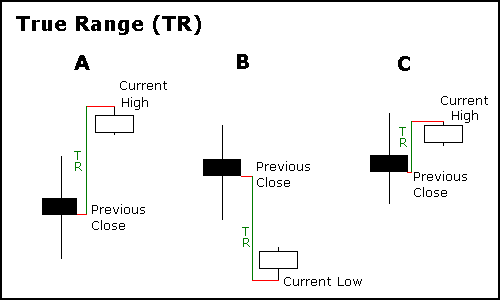

ATR ek muqarar arsay ke dauran true price ranges ka average calculate karta hai, aksar 14 periods ke default taur par. True range ko ye mukarar kiya jata hai:- Abhi ke high se abhi ke low ka farq.

- Abhi ke high se pehle ke close ka mutaghayyar qeemat ka absolute farq.

- Abhi ke low se pehle ke close ka mutaghayyar qeemat ka absolute farq. Ye factors shamil kar ke, ATR volatility ka zyada mufassal samajh faraham karta hai, fluctuations ko smooth karta hai aur market sentiment ka wazeh tasveer faraham karta hai.

Volatility Assessment

ATR market ki volatility ka aik mustaqil scale ka kaam karta hai. Zyada ATR values zyada volatility ko darust karte hain, jo zyada price movements aur mumkinah zyada munafa ke imkanat ki nishandahi karte hain. Mutasarfi taur par, kam ATR values kam volatility ko darust karte hain, consolidation ya price fluctuations mein kami ka ishara dete hain. Traders apni strategies ko is mutabiq adjust kar sakte hain, zyada volatility ke mahol mein zyada aggressive tactics ko ikhtiyar kar ke aur kam volatility ke doran ehtiyaat barat kar ke.

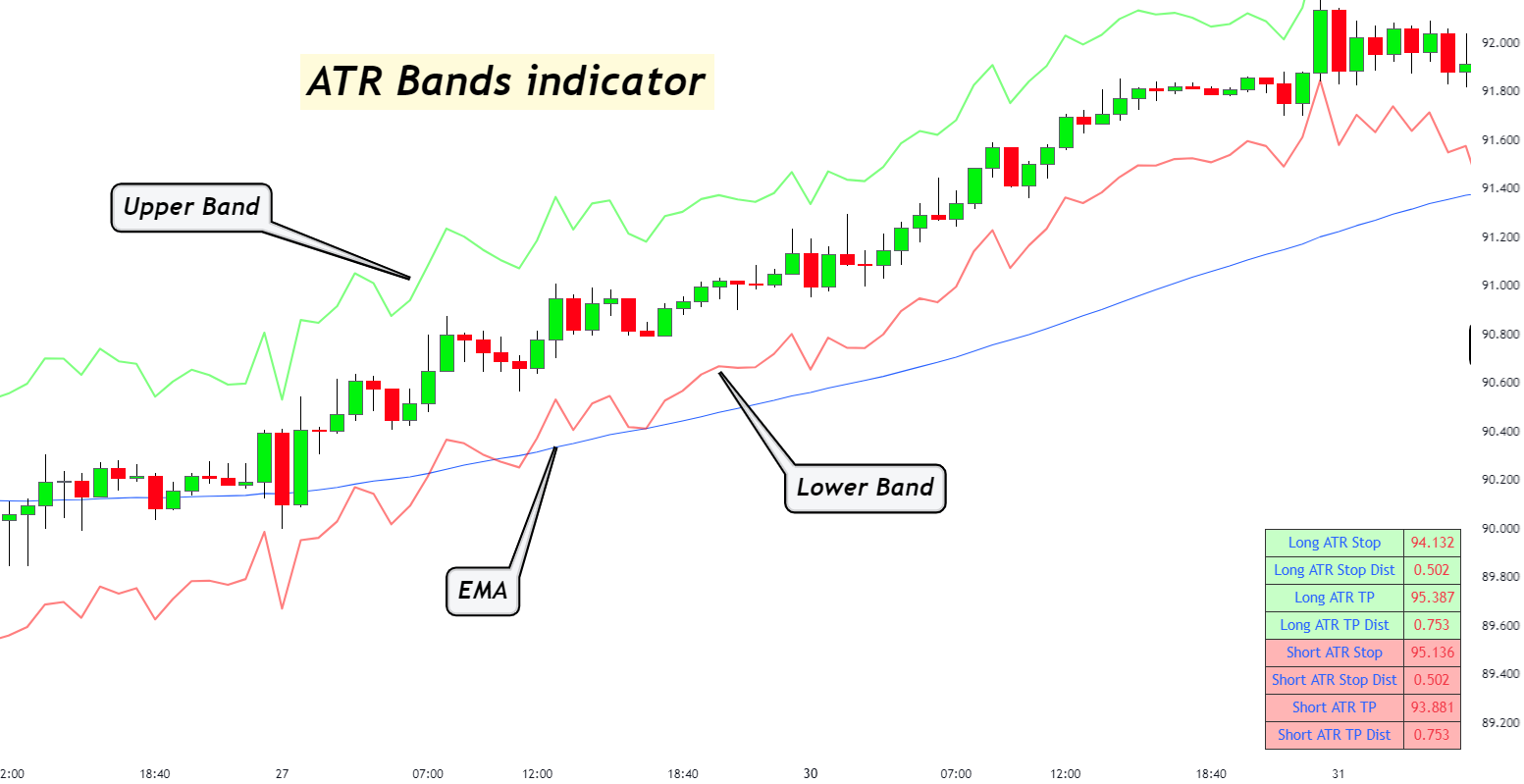

Setting Stop Loss and Take Profit Levels

ATR ka aik aham istemal stop loss aur take profit levels ka tayyar karna mein hota hai. Market volatility ko shamil karte hue, ATR traders ko munasib levels tayyar karne mein madad karta hai jo potential price swings ko mad nazar rakhte hain. Maslan, aik bohot zyada volatile market mein, zyada wide stop loss aur take profit margins zaroori ho sakti hain taakey zyada fluctuations ko sametein aur pehle se exits ya nuqsanat se bach sakein. Mutasarfi taur par, zyada qareebi market shuruaat mein, tight stop loss aur take profit levels ko capture karne ke liye kafi ho sakte hain.

Identifying Breakouts and Trend Strength

ATR breakouts ko pehchane mein bhi madad kar sakta hai aur trend ki taqat ka andaza lagane mein. Breakouts woh waqt hote hain jab price kisi ahem support ya resistance levels ko todta hai, market ke rukh mein tabdili ki ishara dete hue. ATR values ko breakouts se pehle aur baad mein mawafiq karte hue, traders breakout ki taqat ka andaza laga sakte hain aur ye tasdeeq kar sakte hain ke ye zyada volatility ke sath hai ya nahi. Mazboot breakouts aam tor par zyada ATR readings ke saath hotay hain, zyada momentum ki dalil dete hain aur breakout signal ko mustaqil karte hain.

Confirming Reversals

Breakouts ko pehchane ke ilawa, ATR market mein potential reversals ki tasdeeq karne mein madad kar sakta hai. Jab prices kisi ahem support ya resistance levels ke qareeb aate hain, ATR mein izafa trend ki nisbat zyada volatility aur nazdeeki trend ke tasveer ka ishara deta hai. ATR signals ko doosre technical indicators ya chart patterns ke saath mila kar, traders apni reversal predictions ki darusti ko barha sakte hain aur zyada informed trading decisions le sakte hain.

Practical Implementation of ATR in Forex

Volatility-Based Trading Strategies

Traders ATR ko markazi aik hissa ke taur par istemal kar ke volatility-based trading strategies tayar kar sakte hain. Maslan, a breakout strategy positions mein dakhil hone ko shamil kar sakta hai jab ATR kisi khaas had tak pohanchta hai, zyada volatility aur potential price movements ki dalil dete hue. Mutabiq taur par, range-bound strategy mukarar price ranges ke andar trading ko shamil kar sakti hai aur ATR levels par based position sizes ko adjust karna mumkin hai taakey volatility ke conditions ko mad nazar rakha jaye.

Trend Following Strategies

ATR trend-following strategies ko bhi behtar banane mein madad kar sakta hai, traders ko optimal dakhli aur nikalne ke points pehchanne mein. Jab trend trading hoti hai, traders long positions mein dakhil ho sakte hain jab ATR pehle ke highs ko par kar ke uptrend ko tasdeeq karta hai, zyada volatility aur trend ka mustaqil rehne ka ishara dete hue. Mutabiq taur par, short positions shuru ki ja sakti hain jab ATR downtrend ko tasdeeq karta hai, tafuzzi ki raftar aur bearish trades ke liye favorable conditions ki dalil dete hue.

Risk Management Techniques

Mumkinah risk ko minimize karne ke liye ATR ka istemal bhi zaroori hai, effective risk management forex trading mein ahem hai. ATR ko risk management calculations mein shamil kar ke, jaise position sizing aur stop loss placement, traders apni risk profiles ko prevailing market conditions ke mutabiq tailor kar sakte hain aur adverse price movements ka asar kam kar sakte hain. Ye proactive approach risk management mein madad faraham karta hai jo capital ko preserve karta hai aur lambay arsay tak trading ka kamiyabi faraham karta hai.

Multi-Timeframe Analysis

Traders ATR ko mukhtalif timeframes par istemal kar ke volatility dynamics aur trading opportunities ko samajh sakte hain. Mutasir ATR values ko mukhtalif timeframes par mawafiq karte hue, traders volatility trends ki consistency ko taein kar sakte hain aur broad market context par based more informed decisions le sakte hain. Maslan, trades ko higher timeframes par prevailing trend ke saath milate hue lower timeframes ko dakhli aur nikalne ke waqt par istemal karna trading efficiency aur profitability ko behtar banata hai.

Average True Range (ATR) indicator forex traders ke liye ahem tool hai jo market volatility ke complexities mein safar karna chahte hain. Price range dynamics aur volatility fluctuations ko samajhne ke zariye, ATR traders ko informed decisions lene, risk ko effectively manage karne aur trading strategies ko behtar banane ki taqat deta hai. Chahe ye volatility ka andaza lagane ke liye istemal ho, stop loss aur take profit levels tayyar karne ke liye, breakouts aur trend ki taqat ko pehchanne ke liye, ya risk management techniques ko refine karne ke liye, ATR trader's toolkit mein ek behtareen asasat banata hai, jo forex trading ke dynamic duniya mein naye opportunities ko khulta hai aur potential risks ko kam karta hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#5 Collapse

**ATR Indicator: Forex Trading Mein Iska Kya Role Hai?**

ATR (Average True Range) indicator ek popular technical analysis tool hai jo market volatility ko measure karta hai. Is indicator ko primarily trading decisions ko enhance karne ke liye use kiya jata hai, khaaskar jab aapko market ke potential price movements aur risks ko samajhna hota hai. Aaiye, ATR indicator ki definition, functioning, aur trading strategies ko detail mein samjhte hain.

**ATR Indicator Ki Definition:**

ATR indicator ko J. Welles Wilder ne 1978 mein introduce kiya tha. Yeh indicator market ke price range aur volatility ko measure karta hai. ATR ka basic idea yeh hai ke higher ATR values indicate karte hain higher market volatility, jabke lower ATR values indicate karte hain lower volatility. ATR indicator price movements ke average range ko calculate karta hai ek specified period ke dauran.

**ATR Indicator Kaise Kaam Karta Hai?**

1. **Calculation:**

ATR ko calculate karne ke liye, pehle True Range (TR) ko find kiya jata hai. True Range ko market ke high, low, aur previous close prices se calculate kiya jata hai. Uske baad, TR values ka average liya jata hai ek defined period (jaise 14 days) ke liye, jo ATR value ko provide karta hai.

2. **Volatility Measurement:**

ATR market ki volatility ko measure karta hai. Agar ATR value high hai, to market mein zyada volatility hoti hai, jo bade price swings aur movements ko indicate karta hai. Agar ATR value low hai, to market mein low volatility hoti hai aur price movements relatively stable hote hain.

**ATR Indicator Ki Trading Strategies:**

1. **Stop-Loss Placement:**

ATR indicator ko stop-loss levels determine karne ke liye use kiya jata hai. High ATR values ke dauran, stop-loss ko market ki volatility ke mutabiq adjust kiya jata hai, taake price swings ko handle kiya ja sake aur premature stop-outs se bacha ja sake.

2. **Position Sizing:**

ATR indicator ko position sizing decisions mein bhi use kiya jata hai. Higher ATR values ke sath, traders apne positions ko size karte hain taake volatility ke impact ko accommodate kiya ja sake. Yeh strategy risk management ko enhance karti hai aur losses ko limit karti hai.

3. **Volatility Breakouts:**

ATR ko volatility breakouts identify karne ke liye bhi use kiya jata hai. Jab ATR value suddenly increase hoti hai, to yeh market ke breakout aur significant price movements ka signal ho sakta hai. Traders ATR ke changes ko monitor karte hain aur potential breakout trades execute karte hain.

4. **Trend Confirmation:**

ATR indicator trend strength aur continuation ko confirm karne ke liye bhi use hota hai. High ATR values trend ki strength ko indicate karte hain aur low ATR values trend ki weakness ko. Traders ATR ke saath trend indicators ko combine karke market trends ko analyze karte hain.

**Conclusion:**

ATR indicator forex trading mein market volatility aur price movements ko measure karne ka ek effective tool hai. Iske through traders stop-loss placement, position sizing, volatility breakouts, aur trend confirmation jaise important trading decisions le sakte hain. ATR indicator ke accurate interpretation aur application se, traders apne trading strategies ko enhance kar sakte hain aur risk management ko optimize kar sakte hain. Market volatility ko samajhne aur handle karne ke liye ATR ka use karna aapki trading performance ko improve kar sakta hai aur profitable trading opportunities ko identify karne mein madadgar ho sakta hai.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**ATR Indicator Trading ka Tareeqa - Roman Urdu Main Guide**

ATR (Average True Range) indicator ek technical tool hai jo trading mein price ki volatility ko measure karta hai. Iska maksad yeh hota hai ke aapko market ke andr price movement ka andaza ho. Jab market zyada volatile ho, toh ATR ka value bhi zyada hoti hai, aur jab market calm ho, toh ATR ki value kam hoti hai.

### ATR Ka Taaruf

ATR ko 1978 mein Welles Wilder ne introduce kiya tha, aur yeh indicator ab bhi traders mein kaafi popular hai. Yeh aapko batata hai ke kisi asset ki price kitni range mein move karti hai. Yeh range us asset ki true range ke calculation ke zariye hoti hai, jo ke current high aur low ko compare karke nikali jati hai. ATR ko aap kisi bhi time frame par use kar sakte hain, lekin short-term trading ke liye yeh zyada mufeed hota hai.

### ATR Ka Calculation

ATR ka calculation 14-period par hota hai, magar aap isay apni strategy ke mutabiq adjust kar sakte hain. ATR ki value price ki movements ka average nikalti hai, jo pichlay periods ki volatility ko reflect karti hai. Higher ATR ka matlab hota hai ke market zyada volatile hai, aur lower ATR ka matlab hai ke market calm hai.

### ATR Ko Trading Mein Kaise Use Kiya Jaaye?

ATR ka istimaal karte waqt aap yeh dekhte hain ke market kitni volatility dikha raha hai. Jab ATR ki value high hoti hai, toh iska matlab hai ke price zyada move kar raha hai, aur jab value low hoti hai, toh price kam move karta hai. ATR ko aap stop loss aur take profit ke liye bhi use kar sakte hain.

For example, agar ATR ki value 50 hai, toh aap stop loss ko price se 50 points door set kar sakte hain. Yeh aapko risk manage karne mein madad deta hai. ATR ka istemal breakout trading strategies ke sath bhi kiya ja sakta hai, kyun ke jab ATR ki value high hoti hai, toh yeh indicate karta hai ke breakout hone wala hai.

### ATR Ki Limitations

ATR indicator sirf price ki range batata hai, lekin yeh nahi batata ke price upar ya neeche jayegi. Is liye ATR ko doosre indicators ke sath combine karna zaroori hota hai taake aapko behtareen results mil saken.

### Conclusion

ATR indicator trading mein ek powerful tool hai jo market volatility ko measure karta hai. Iska sahih istemal karte hue aap risk manage kar sakte hain aur apni trading strategy ko improve kar sakte hain. Hamesha yaad rakhein ke ATR ko doosre technical tools ke sath combine karna zyada effective hota hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#7 Collapse

ATR (Average True Range) Indicator:

Assalam o Alaikum Dear Friends and Fellows, ATR (Average True Range) indicator ko Roman Urdu main samjhana thoda mushkil ho sakta hey, lekin main koshish karta hoon ke asan tareeqe se batata hoon.

ATR ek technical analysis tool hey jo market ki volatility ko measure karta hey. Yeh indicator apko yeh batata hey ke kisi particular asset ki price kitni fluctuate ho rahi hey. Zyada ATR value ka matlab hey ke market zyada volatile hey, aur kam ATR value ka matlab hey ke market relatively stable hey.

ATR Indicator kesy Kam karta hey:- Volatility Measure Karna: ATR apko yeh batata hey ke asset ki price ek specific time period ke dauran kitni fluctuate karti hey.

- Stop-Loss Aur Take-Profit Levels: ATR ko use karke ap apne stop-loss aur take-profit levels ko adjust kar sakty hein. Zyada ATR ke sath apko zyada wide stop-loss set karna par sakta hey, jabke kam ATR ke sath ap chhoti range ke stop-loss set kar sakty hein.

- Trading Strategy: ATR ko trend-following strategies aur range-bound strategies main use kiya ja sakta hey.

ATR ko calculate karny ke liye pehle True Range (TR) calculate karna hota hey, jo ki teen cheezon ka maximum hota hey:- Current High - Current Low

- Current High - Previous Close

- Previous Close - Current Low

ATR Indicator ka Istemal:- Trend Analysis: Agar ATR badh raha hey, to market main zyada volatility hey aur shayad ek strong trend develop ho raha hey.

- Trade Entry/Exit: High ATR values ko trade entry aur exit points decide karny ke liye use kiya ja sakta hey.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 09:50 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим