Three Black Crows candlestick pattern

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔ٹیگز: کوئی نہیں

-

سا0 like

-

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

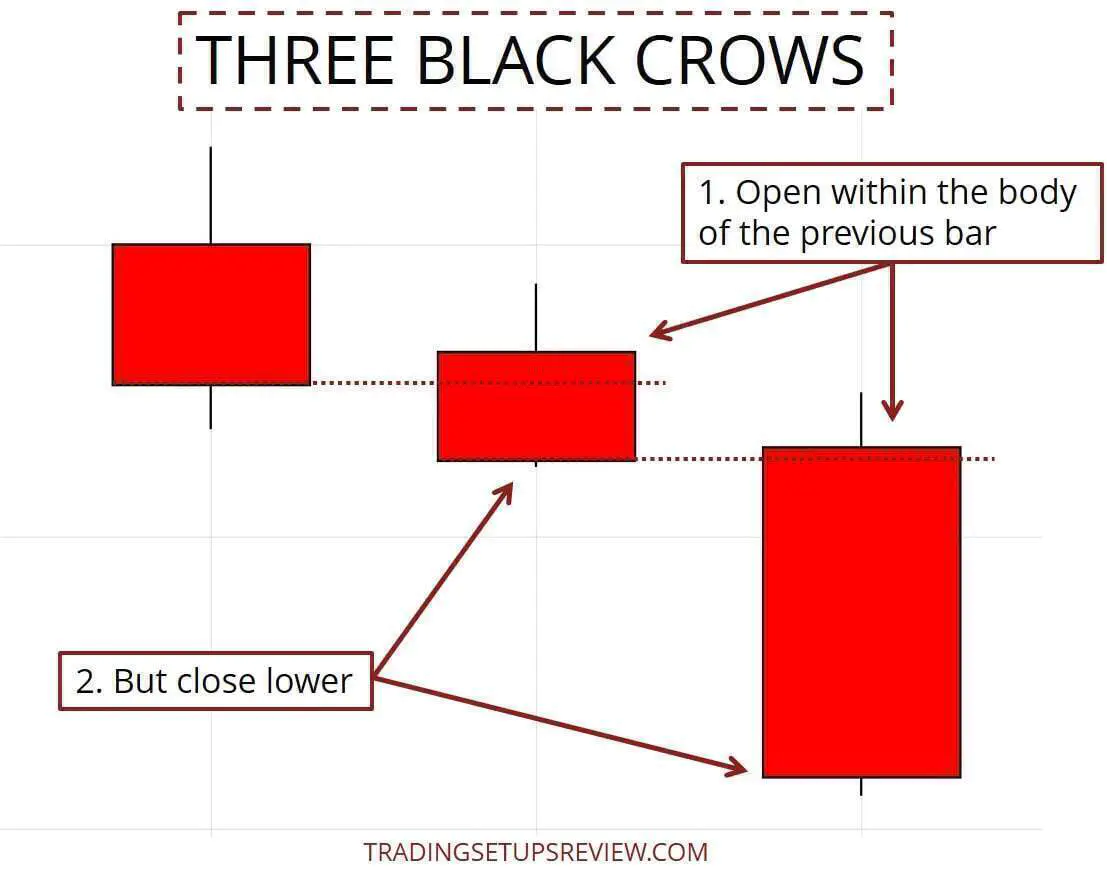

Three Black Crows candlestick pattern Three Black Crows candlestick pattern ek ahem technical indicator hai jo stock market mein istemal hota hai. Yeh pattern typically ek downtrend ke baad aata hai aur bearish trend ki continuation ko darust karta hai. Is article mein, hum Three Black Crows candlestick pattern ke bare mein Roman Urdu mein baat karenge. Is pattern mein teen alag-alag bearish candlesticks hoti hain, jo market mein bearish pressure ko darust karte hain. Pehli candle bearish trend mein ati hai aur isay bearish candle kehte hain. Is candle ki body lambi hoti hai aur iski closing price opening price se kam hoti hai, isse yeh pata chalta hai ke sellers market mein dominant hain. Three Black Crows candlestick pattern ki Tafseel Three Black Crows candlestick pattern ki Doosri candle bhi bearish hoti hai aur isay bhi bearish candle kehte hain. Is candle ki body pehli candle ki body ke andar hoti hai, aur iski closing price opening price se ziada hoti hai. Yeh dikhata hai ke sellers aur buyers ke darmiyan indecision hai. Teesri candle bhi bearish candle hoti hai aur isay bhi bearish candle kehte hain. Is candle ki body doosri candle ki body ke andar hoti hai, aur iski closing price opening price se ziada hoti hai. Yeh confirm karta hai ke bearish trend jari hai aur price mein further drop hone ki possibility hai.Three Black Crows candlestick pattern ek powerful technical indicator hai jo bearish trend ki continuation ko pehchanne mein madadgar sabit ho sakta hai. Traders ko is pattern ko samajhna aur istemal karna chahiye lekin hamesha yaad rahe ke market mein risk hota hai aur prudent trading practices ka bhi khayal rakha jana chahiye. Three Black Crows candlestick pattern Ki Pehchan Three Black Crows candlestick pattern ko samajhna traders ke liye ahem hai taake woh bearish trend ko pehchan saken. Jab yeh pattern sahi tarah se confirm hota hai, to yeh ek strong bearish reversal signal deta hai aur traders ko sell karna consider kar sakte hain. Lekin yaad rahe ke kisi bhi technical indicator ki tarah, Three Black Crows pattern bhi 100% confirm nahin hota aur market mein risk hamesha hota hai. Isliye, is pattern ko istemal karte waqt proper risk management ka bhi khayal rakhna zaroori hai. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

"Three Black Crows" ek bearish reversal candlestick pattern hai jo market analysis mein use hota hai. Is pattern mein three consecutive bearish (downward) candlesticks hote hain, jo ki ek uptrend ke baad aate hain aur trend reversal ko indicate karte hain. Three Black Crows Candlestick Pattern ki key characteristics: Formation: Three Black Crows pattern uptrend ke baad aata hai aur bearish trend ko indicate karta hai. Ismein three consecutive bearish candlesticks hote hain, jinmein se har ek candlestick ke open price pehle candlestick ke close price ke neeche hota hai aur close price bhi pehle candlestick ke close price ke neeche hota hai. Candlestick Bodies: Har ek candlestick ki body, yaani open aur close price ke beech ka area, chhoti hoti hai aur typically bearish color hoti hai (traditionally black or red). Volume: Volume bhi dekha jata hai. Agar Three Black Crows pattern ke saath high volume aa rahi hai, to yeh bearish reversal ko confirm karta hai. Three Black Crows pattern ke interpret karte samay kuch points hote hain: Trend: Three Black Crows pattern typically uptrend ke baad dikhta hai aur bearish reversal ko suggest karta hai. Iska arth hai ki jab market mein uptrend tha aur Three Black Crows pattern dikhta hai, to ye ek possible trend reversal signal ho sakta hai. Confirmation: Three Black Crows pattern ke baad, traders wait karte hain ki confirmatory price action aaye. Agar next candlestick bhi bearish hai aur price neeche ja raha hai, to ye Three Black Crows pattern ka confirmation ho sakta hai. Volume: Volume ka bhi dhyan rakhna mahatvapurna hota hai, kyunki high volume ke sath Three Black Crows pattern bearish reversal ko confirm karta hai.Is pattern ko identify karne ke baad bhi, risk management, stop-loss orders, aur position sizing ka dhyan rakhna mahatvapurna hota hai, kyunki market mein hamesha uncertainty hoti hai. Traders is pattern ko aur bhi powerful banane ke liye dusre technical indicators aur patterns ka istemal karte hain. -

#4 Collapse

Three Black Crows ek bearish candlestick pattern hai jo stock market aur financial markets mei price reversal ko indicate karne ke liye istemal hota hai. Is pattern ko dekhkar traders and investors anticipate karte hain ki ek uptrend ke bad ek downtrend shuru hone wala hai. Yeh pattern generally trend reversal signal deta hai aur bearish sentiment ko represent karta hai. Three Black Crows pattern ek series of three consecutive bearish (downward) candles se banta hai, jo kuch important characteristics follow karte hain: Three Consecutive Bearish Candles: Yeh pattern tab banta hai jab ek security ke price mei three consecutive days tak continuous decline hota hai. Har candlestick red (or black) hoti hai, jisse price decline ko indicate kiya jata hai. Each Candle Opens Lower Than the Previous Close: Har candle apne previous candle ke closing price se lower open hoti hai, yani har din ka trading lower than the previous day's close start hota hai. Each Candle Closes Near the Low: Har candle apne daily range ke bottom (low) ke kareeb close hoti hai. Isse show hota hai ki sellers control mei hain aur price close to the day's low par hoti hai. Three Black Crows pattern ki visual representation mei yeh lagbhag aisa dikhta hai:Is pattern ka matlab hota hai ki market sentiment bearish hai aur sellers dominate kar rahe hain. Traders is pattern ko dekhte hain toh wo samajh jate hain ki ek possible trend reversal hone wala hai aur wo short (sell) positions le sakte hain ya existing long (buy) positions ko close kar sakte hain. However, bear in mind that no single candlestick pattern is foolproof, and it's important to use Three Black Crows in conjunction with other technical indicators and analysis to make informed trading decisions. Additionally, market conditions and context are crucial in interpreting any candlestick pattern.

Yeh pattern tab banta hai jab ek security ke price mei three consecutive days tak continuous decline hota hai. Har candlestick red (or black) hoti hai, jisse price decline ko indicate kiya jata hai. Each Candle Opens Lower Than the Previous Close: Har candle apne previous candle ke closing price se lower open hoti hai, yani har din ka trading lower than the previous day's close start hota hai. Each Candle Closes Near the Low: Har candle apne daily range ke bottom (low) ke kareeb close hoti hai. Isse show hota hai ki sellers control mei hain aur price close to the day's low par hoti hai. Three Black Crows pattern ki visual representation mei yeh lagbhag aisa dikhta hai:Is pattern ka matlab hota hai ki market sentiment bearish hai aur sellers dominate kar rahe hain. Traders is pattern ko dekhte hain toh wo samajh jate hain ki ek possible trend reversal hone wala hai aur wo short (sell) positions le sakte hain ya existing long (buy) positions ko close kar sakte hain. However, bear in mind that no single candlestick pattern is foolproof, and it's important to use Three Black Crows in conjunction with other technical indicators and analysis to make informed trading decisions. Additionally, market conditions and context are crucial in interpreting any candlestick pattern.

-

#5 Collapse

Three Black Crows Chart pattern: Three Dark Crows candle Example ik Negative pattern inversion candle design hai jo market k long upswing k awful banta hai aur iska terrible market tazi sa nichy move krti ha aur ye broker ko medium aur long haul exchange signals deti hai. Is design man 3 musalsal long genuine body negative candles banti han jis man her light ka open past candle ki genuine body me hota ha aur iska close past flame k close k nicha close hota ha. Ager is design k sath specialized marker ko consolidated use kiya ja to showcase diagram man exchange passage aur exchange leave point zayada precision sa find kiya ja sakta ha. three dark crows candle design man poke teesri light b long genuine body negative flame bany aur Relative strength record pointer b overbought locale sa cross underneath kary to is affirmed per dealer ko "Sell ki exchange open kerni chahiye aur Stop Misfortune ko second candle k high per place kerna chaheye aur Take Benefit ko next help levels per Tp-1, Tp-2 aur Tp-3 ker place kerna chaheye. Forex exchanging promoting Mei Three dark crows design aksar bullish pattern inversion principal costs ko bohut teezi k sath negative push karti hai. Ye design resources k costs standard purchasers k strain ki kami hit k market areas of strength for primary tension ki waja se banta hai. Resources k interest fundamental kami se aksar costs teezi k sath negative move karna shoro karti hai, jiss k nateejay principal three dark crows design wajood primary ata hai. Ye design high schooler successive solid negative candles standard mushtamil hota hai, jiss principal har aik flame apne se pechli candle k lower side standard close hoti hai. Design ki teeno candles ka shadows nahi sharpen chaheye, lekin agar aik little wick little wicks bante hen, to bhi satisfactory hai, punch k bagher shadow k Marubozu candles ka hona design se ziada mutabeqat tradings kar sakty hen our effective in the forex exchanging showcasing Mei throbbing tareky sy appropriate reaction ky sath work karty hen our fruitful hoty hein our profite hasil karty hen. Chart Types In Black Crows Candles Pattern: Design costs primary asani se pehchana ja sakta hai, jiss standard market fundamental sell ki passage ki ja sakti hai. Lekin design k leye long time period ka hona zarori hai, punch k candles major areas of strength for ka body principal aur aik dosre k lower side standard close hona chaheye. Design ki negative affirmation flame k baad passage karen, lekin design k teeno candles major areas of strength for ka standard marker jaise CCI pointer ya Stochastic oscillator se affirmation ki ja sakti hai. Hotel dono markers ki esteem overbought zone fundamental hona chaheye. Design k baad bullish candle banne standard exchange ki section nahi karni hotyi hello our yeh Pattren mukhtalif pannal standard mushtamil hotaa hai design costs k top standard high schooler customary Negative candles ka aik solid negative pattern inversion design hai, jiss fundamental banne wali teeno negative candles aik doasre k baad mutawater lower side standard banti hai. Design fundamental shamil candles ki development say greetings Three dark crows design ki pehli light areas of strength for aik candles hoti hai, jo k costs k top standard ya bullish pattern k baad banti hai. Ye light areas of strength for aik body principal banti hai, jiss k upper aur lower sides standard Shadow nahi hona chaheye, poke aik little si wick OK hai. Ye flame variety primary dark ya red hoti hai. Three dark crows Example ki dosri light bhi same pehli negative flame ki tarah aik solid negative candle hoti hai, jo k ziada tar aik marubozu candle hoti hai

Forex exchanging promoting Mei Three dark crows design aksar bullish pattern inversion principal costs ko bohut teezi k sath negative push karti hai. Ye design resources k costs standard purchasers k strain ki kami hit k market areas of strength for primary tension ki waja se banta hai. Resources k interest fundamental kami se aksar costs teezi k sath negative move karna shoro karti hai, jiss k nateejay principal three dark crows design wajood primary ata hai. Ye design high schooler successive solid negative candles standard mushtamil hota hai, jiss principal har aik flame apne se pechli candle k lower side standard close hoti hai. Design ki teeno candles ka shadows nahi sharpen chaheye, lekin agar aik little wick little wicks bante hen, to bhi satisfactory hai, punch k bagher shadow k Marubozu candles ka hona design se ziada mutabeqat tradings kar sakty hen our effective in the forex exchanging showcasing Mei throbbing tareky sy appropriate reaction ky sath work karty hen our fruitful hoty hein our profite hasil karty hen. Chart Types In Black Crows Candles Pattern: Design costs primary asani se pehchana ja sakta hai, jiss standard market fundamental sell ki passage ki ja sakti hai. Lekin design k leye long time period ka hona zarori hai, punch k candles major areas of strength for ka body principal aur aik dosre k lower side standard close hona chaheye. Design ki negative affirmation flame k baad passage karen, lekin design k teeno candles major areas of strength for ka standard marker jaise CCI pointer ya Stochastic oscillator se affirmation ki ja sakti hai. Hotel dono markers ki esteem overbought zone fundamental hona chaheye. Design k baad bullish candle banne standard exchange ki section nahi karni hotyi hello our yeh Pattren mukhtalif pannal standard mushtamil hotaa hai design costs k top standard high schooler customary Negative candles ka aik solid negative pattern inversion design hai, jiss fundamental banne wali teeno negative candles aik doasre k baad mutawater lower side standard banti hai. Design fundamental shamil candles ki development say greetings Three dark crows design ki pehli light areas of strength for aik candles hoti hai, jo k costs k top standard ya bullish pattern k baad banti hai. Ye light areas of strength for aik body principal banti hai, jiss k upper aur lower sides standard Shadow nahi hona chaheye, poke aik little si wick OK hai. Ye flame variety primary dark ya red hoti hai. Three dark crows Example ki dosri light bhi same pehli negative flame ki tarah aik solid negative candle hoti hai, jo k ziada tar aik marubozu candle hoti hai  Candle k upper ya lower sode standard long shadow nahi hona chaheye, punch k ye candles bhi Sath Trad Len gy aor Three Dark Crows Example aksar bullish pattern inversion primary costs ko bohut teezi k sath negative push karti hai. Ye design resources k costs standard purchasers k strain ki kami poke k market Major areas of strength for fundamental tension ki waja se banta hai. Resource's k interest fundamental kami se aksar costs teezi k sath negative move karna shoro karti hai, jiss k nateejay principal three dark crows design wajood primary ata hai. Ye design high schooler back to major areas of strength for back candles standard mushtamil hota hai, jiss principal har aik candles apne se pechli candles k brought down side standard close hoti hai. Design ki teeno CANDLES ka shadows nahi sharpen chaheye, lekin agar aik little wick little wicks bante hen, to bhi adequate hai, poke k bagher shadow k Marubozu CANDLES ka hona design se hello there exchange karengen Formation Of Chart Pattern: Design costs k top standard adolescent musalsal negative candles ka aik solid negative pattern inversion design hai, jiss primary banne wali teeno negative candles aik doasre k baad mutawater lower side standard banti hai. Three dark crows design ki pehli light areas of strength for aik flame hoti hai, jo k costs k top standard ya bullish pattern k baad banti hai. Ye candle areas of strength for aik body fundamental banti hai, jiss k upper aur lower sides standard shadow nahi hona chaheye, poke aik little si wick adequate hai. Ye flame variety principal dark ya red hoti hai. Three dark crows design ki dosri flame bhi same pehli negative candle ki tarah aik solid negative light hoti hai, jo k ziada tar aik marubozu candle hoti hai. Candle k upper ya lower sode standard long shadow nahi hona chaheye, punch k ye flame bhi pehli light k lower side standard close honi chaheye.Three dark crows design ki last ya third candle bhi design ki pehli do candles ki tarah aik negative candle hoti hai, jiss k close open ki nibsbat lower sides standard hona chaheye. Design ki ye candle areas of strength for aik body wali hoti hai, jiss k upper ya lower side standard bohut kam shadow hota hai.

Candle k upper ya lower sode standard long shadow nahi hona chaheye, punch k ye candles bhi Sath Trad Len gy aor Three Dark Crows Example aksar bullish pattern inversion primary costs ko bohut teezi k sath negative push karti hai. Ye design resources k costs standard purchasers k strain ki kami poke k market Major areas of strength for fundamental tension ki waja se banta hai. Resource's k interest fundamental kami se aksar costs teezi k sath negative move karna shoro karti hai, jiss k nateejay principal three dark crows design wajood primary ata hai. Ye design high schooler back to major areas of strength for back candles standard mushtamil hota hai, jiss principal har aik candles apne se pechli candles k brought down side standard close hoti hai. Design ki teeno CANDLES ka shadows nahi sharpen chaheye, lekin agar aik little wick little wicks bante hen, to bhi adequate hai, poke k bagher shadow k Marubozu CANDLES ka hona design se hello there exchange karengen Formation Of Chart Pattern: Design costs k top standard adolescent musalsal negative candles ka aik solid negative pattern inversion design hai, jiss primary banne wali teeno negative candles aik doasre k baad mutawater lower side standard banti hai. Three dark crows design ki pehli light areas of strength for aik flame hoti hai, jo k costs k top standard ya bullish pattern k baad banti hai. Ye candle areas of strength for aik body fundamental banti hai, jiss k upper aur lower sides standard shadow nahi hona chaheye, poke aik little si wick adequate hai. Ye flame variety principal dark ya red hoti hai. Three dark crows design ki dosri flame bhi same pehli negative candle ki tarah aik solid negative light hoti hai, jo k ziada tar aik marubozu candle hoti hai. Candle k upper ya lower sode standard long shadow nahi hona chaheye, punch k ye flame bhi pehli light k lower side standard close honi chaheye.Three dark crows design ki last ya third candle bhi design ki pehli do candles ki tarah aik negative candle hoti hai, jiss k close open ki nibsbat lower sides standard hona chaheye. Design ki ye candle areas of strength for aik body wali hoti hai, jiss k upper ya lower side standard bohut kam shadow hota hai.  Candle design mein, three dark crow design bhi bogus signs create kar sakta hai. Isliye, brokers ko affirmation aur market setting ko observe intently karna chahiye aur dusre specialized investigation devices ka istemal karke Three Dark Crow design ko affirm karna chahiye.2. Reliance available setting: The example of the three dark crows ki the adequacy of the market setting standard relies upon karti hai. Agar design solid obstruction level to the presence of the card hai, inversion potential toh iska high hota hai. Lekin agar design currently descending pattern ke buku seem karta hai, toh iski adequacy kam ho sakti hai.3. Risk The board: Three Dark Crow design ke saath sahi risk the executives zaruri hai. Dealers ko stop misfortune levels aur position size if consider card conceal apne risk ko drive karna chahiye.Three Dark Crow design ko samajhne ke liye, brokers ko candle investigation aur specialized examination ke ideas ko study karna chahiye.

Candle design mein, three dark crow design bhi bogus signs create kar sakta hai. Isliye, brokers ko affirmation aur market setting ko observe intently karna chahiye aur dusre specialized investigation devices ka istemal karke Three Dark Crow design ko affirm karna chahiye.2. Reliance available setting: The example of the three dark crows ki the adequacy of the market setting standard relies upon karti hai. Agar design solid obstruction level to the presence of the card hai, inversion potential toh iska high hota hai. Lekin agar design currently descending pattern ke buku seem karta hai, toh iski adequacy kam ho sakti hai.3. Risk The board: Three Dark Crow design ke saath sahi risk the executives zaruri hai. Dealers ko stop misfortune levels aur position size if consider card conceal apne risk ko drive karna chahiye.Three Dark Crow design ko samajhne ke liye, brokers ko candle investigation aur specialized examination ke ideas ko study karna chahiye.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

"Teen Kaley Kauwon" Candlestick Pattern Yeh candlestick pattern bearish market trend ko darust karti hai. Is mein teen consecutive long red candles hoti hain, jo market mein sellers ki strong control aur downtrend ko represent karti hain. Yadi aap is pattern ko spot karte hain, to aapko samjhdari se trading karna chahiye kyunki yeh bearish reversal signal ho sakta hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 12:20 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим