Trading Using Motive & Diagonal Waves.

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Explanations. Trading mein motive aur diagonal (daira numa) leharon ka istemal aik aham tareeqa hai. Ye technical analysis ka aik hissa hai jis mein traders aur investors tarjeehat aur trend ka samaynay karne ke liye iska istemal karte hain. Is Thread mein hum motive aur diagonal waves ke baare mein Roman Urdu mein tafseel se batayenge. Motive Waves. Motive waves ya phir tajwiz lehrein Elliott Wave Theory ke hisab se uptrend ya downtrend mein hoti hain. Ye waves 5 impulsive sub-waves se mil kar ban jati hain. In waves ka trend tarjeehat ke liye aik asas hote hain. Agar ye waves tijarat ke kisi tafseel ya shareef mein paida hote hain toh ye aksar strong market trends ki wajah bante hain. Motive waves mein investors aur traders apni trade ki jagah stop loss aur take profit ko samajhte hain. Diagonal Waves. Diagonal waves ya phir daira numa lehrein Elliott Wave Theory ke hisab se corrective waves hote hain. Ye waves market ke counter-trend moves ko darshate hain aur 3 sub-waves se ban jati hain. Diagonal waves mein price ki movement aur volume ke darmiyan correlation hoti hai. Ye waves choti duration ke liye istemal hote hain aur trend ke reversal ya continuation ki indication dete hain. Agar hum motives aur diagonal waves ko samajhte hain toh hum trend ke muhtalif stages aur reversals ko identify kar sakte hain. Ye techniques traders aur investors ke liye helpful hoti hain kyunki unhe market trends aur price movements ke baare mein insights provide karte hain. Is Tarah se ki jaane wali trading maximum successful hoti hai. -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Motive and Diagonal Waves Trading procedure. Trading, jahan par log stocks, currencies, commodities, ya kisi aur asset ki khareed-o-farokht karte hain, aik tijarat hai jo market ki movement aur trends par mabni hoti hai. Motive aur Diagonal Waves, Elliott Wave Theory ki aham hissa hain, jo ke market analysis aur trading ke liye istemal hoti hai. Motive Waves. Motive Waves, market mein ek strong trend ko darust karnay walay patterns hain. Ye aam taur par uptrend (market mein izafa) aur downtrend (market mein kami) ke doran paye jate hain. Motive Waves mein, aksar aik trend line ki madad se market ki movement ko samjha jata hai. Impulse Waves. Impulse Waves, market mein ek strong trend ki pehchan karne mein madadgar hoti hain. Yeh aksar 5 sub-waves se milti hain, jin mein 3 waves uptrend (Bullish) aur 2 waves downtrend (Bearish) hoti hain. Corrective Waves. Corrective Waves, market mein ek temporary reversal ko darust karti hain. In mein aksar 3 sub-waves hoti hain, jo ke trend ke against hoti hain. Ye waves traders ko market ki temporary weakness ya correction ka andaza deti hain. Diagonal Waves. Diagonal Waves, market mein aik specific pattern ko darust karne wale hoti hain. In mein 5 sub-waves hoti hain jo ke aik aik dosray ko follow karte hain, lekin in waves mein aik specific sequence hoti hai. Leading Diagonals. Leading Diagonals, jab market ek naye trend ki taraf ja rahi hoti hai aur yeh naye trend shuru hone wala hota hai, tab paye jate hain. In mein sub-waves mein overlap hota hai, aur yeh aksar peechay jati hai. Ending Diagonals. Ending Diagonals, jab market ek trend khatam ho raha hota hai, tab paye jate hain. In mein sub-waves mein overlap hota hai, aur yeh aksar peechay jati hai. Motive and Diagonal Waves Trading. Trading mein Motive aur Diagonal Waves ka istemal market analysis ke liye kiya jata hai. Ye waves traders ko market ke trends aur reversals ko samajhnay mein madadgar hoti hain. Trend Recognition. Motive Waves, traders ko market mein hone wale trends ko samajhnay mein madadgar hoti hain. Agar aap ek uptrend ya downtrend ko pehchan sakte hain, to aap sahi waqt par trade kar sakte hain. Entry Aur Exit Points. Diagonal Waves, entry aur exit points ka pata lagane mein madadgar hoti hain. Agar aap ek ending diagonal ya leading diagonal ko pehchan sakte hain, to aap apni trades ke liye behtareen entry aur exit points tay kar sakte hain. -

#4 Collapse

Motive in Trading. Forex (Foreign Exchange) mein maqsad ya motive asal mein kisi trader ya investor ka us market mein shamil honay ka maqsad hota hai. Yeh maqsad amuman paisay kamana, nivesh (investment) ko barhna, ya currency exchange kar kay munafa kamana hota hai. Kuch log forex market mein tijarat (trading) kar kay paisay kamana chahtay hain, jab kay doosray log is market mein currency rates mein tabdeel honay walay asrat ko samajhnay aur us par nivesh kar kay lambi muddat tak munafa kamana chahtay hain. Diagonal Pattern in Trading. Forex market mein "diagonal pattern" ya "tircha pattern" ek aam chart pattern hota hai jo kisi currency pair ke price chart par paya jata hai. Yeh pattern kisi bhi currency pair ke price movement mein diagonal lines ya trendlines ki shakal mein hota hai. Aksar, is pattern mein price ka trend ya rukh diagonal tarah se ooper ya neechay chalta hai. Diagonal pattern trading mein ahmiyat rakhta hai kyunki isay traders price ke future movement ko samajhnay mein madadgar samajhtay hain. Is pattern ko samajhnay kay liye traders trendlines ya technical analysis ka istemal kartay hain takay woh currency pair ke future price ki taraf ishara kar saken. Mukhtasar tor par, forex market mein maqsad paisay kamana hota hai aur diagonal pattern ek tarah ka chart pattern hota hai jo traders ko price movement ko samajhnay mein madadgar hota hai.Tircha lahrayan (Diagonal Waves) woh harkat hoti hain jo ek hawala say doosray hawalay ki taraf akasrat barabar inteshar karti hain. Yeh kisi geometric akasray ya pattern mein payi ja sakti hain. Diagonal waves amuman graphs, charts, ya patterns mein payi ja sakti hain, aur woh akasray hoti hain jo seedhay ya horizontal nahin hoti hain, balkay kisi mushkil say nakaratmak ya churahatdar raste par chalti hain. -

#5 Collapse

Motive and diagonal waves in Market Motive ka original mtlb hota he inspiration and ultimately motivation kese bhi kaam ke brothers agr ap market ke andr new hain tu ap ko is baat ke andza lagna chahiyae ke hm ks hdd tk motive aur failure kaise inspirationaya kisi aur asset ki khareed arokht karte hain, aik tijarat hai jo market ki movement aur trends par mabni sis ka aik hissa hai jis mein traders aur investors tarjeehat aur trend ka samaynay karne kee ap ksakte hain, to aap sahi waqt par tradeDiagonal Wave Theory ki aham hissatraders price ke hoti hai. Motive aur samajhnay mein madadgar hoti hain. Agar aap ek uptrend ya downtrend ko pehchan sakte hain, to aap sahi waqt par tradeDiagonal Wave Theory ki aham hissatraders price ke future movement ko samajhnay mein madadgar samajhtay hain. Is pattern ko samajhnay kay liye traders trendlines ya technical analysis ka istemal kartay hain takay woh currenforex market mein maqsad paisay kamana hota hai aur diagonal pattern ek tarah ka chasis aur trading ke liye istemal hoti rehte hain dear ap jahn kahe rhaee ap ko is baat ka andza lagna chahiyae ke ap nerves of steel hain How to use in trading? Market ke andr ap ko sb se ap ko ye jana bhot zaroori kmein motive aur diagonal haron ka istemal aik aham tareeqa hai. Ye technical analysis ka aik hissa hai jis mein traders aur investors tarjeehat aur trend ka samaynay karne kee ap ksakte hain, to aap sahi waqt par tradeDiagonal Wave Theory ki aham hissatraders price ke future movement ko samajhnay mein madadgar samajhtay hain. Is pattern ko samrt pattern hota hai jo traders ko price movement ko samajhnay mein madadgar hota hai.Tircha lahrayan woh harkat hoti hain jo ek hawala say doosray hawalay ki taraf akasrat barabar inteshar karti hain. Yeh kisi geometriccy pair ke future price ki taraf ishara ka hain, jo ke market analyajhnay kay liye traders trendlines ya technical analysis ka istemal kartay hain takay woh currenforex market mein maqsad pais tarah se is se react aur deal krte hain dear market ke andr ap us waqt kamyab hote hain jb ap motive aur souch samjh market ka use krte hain -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Motive waves aur diagonal waves ek concept hain jo Elliott Wave Theory ke antargat aate hain, jo ki stock market aur financial markets mein price patterns ko samajhne ke liye use hoti hai. Elliott Wave Theory ek technical analysis tool hai, jise Ralph Nelson Elliott ne develop kiya tha. 1. Motive Waves: Motive waves, yaani "Impulse waves," market mein ek trend ko represent karte hain. In waves mein price ek particular direction mein move karti hai, either up (bullish) ya down (bearish). Motive waves ko 1, 2, 3, 4, aur 5 numbers se represent kiya jata hai. Wave 1: Pehli motive wave ek initial price move ko darust karta hai, typically trend ki shuruaat hoti hai. Wave 2: Doosri wave ek retracement hoti hai, matlab price mein thoda sa reversal hota hai. Wave 3: Tisri wave usually sabse lambi aur strong hoti hai, jisme price mein significant move hota hai. Wave 4: Chouthi wave ek aur retracement hoti hai, ismein price mein thoda sa reversal hota hai. Wave 5: Panchvi wave mein price ek last push karti hai trend ke direction mein. 2. Diagonal Waves: Diagonal waves, yaani "Ending Diagonals," market mein ek trend ke end ko represent karte hain. In waves mein price ek specific pattern mein move karti hai, jo triangular hota hai. Diagonal waves ko aap "wedges" ke roop mein visualize kar sakte hain. Leading Diagonal: Leading diagonal, ya "Leading Wedge," typically downtrend ke baad dikhta hai aur bearish reversal ko darust karta hai. Ending Diagonal: Ending diagonal, ya "Ending Wedge," typically uptrend ke baad dikhta hai aur bullish reversal ko indicate karta hai. Elliott Wave Theory ka istemal traders aur investors price movements aur trend changes ko predict karne ke liye karte hain. Is theory mein waves ki specific rules aur guidelines hoti hain jo market analysis mein istemal hoti hain. Yeh ek complex theory hai aur uska sahi se samajhna aur istemal karna practice aur study ki zaroorat hai. Yad rahe ki Elliott Wave Theory subjective hoti hai, aur different analysts alag-alag interpretations kar sakte hain. Isliye, is theory ke istemal mein caution aur experience ki zaroorat hoti hai. -

#7 Collapse

Trading Using Motive & Diagonal Waves. Motive waves aur diagonal waves Elliott Wave Theory (EWT) ka hissa hain, jo ke financial markets mein price movement ka ek analytical tool hai. Elliott Wave Theory ek technical analysis approach hai jiska maqsad market trends aur price patterns ko predict karna hota hai. EWT ke mutabiq, financial markets mein price movement mein patterns hoti hain, jo ki 5 motive waves aur 3 corrective waves se mil kar banti hain.- Motive Waves:

- Motive waves trend ke direction mein hoti hain, yani ke upar ya neeche jati hain.

- In waves mein traders usually buy ya sell karte hain, tafseel se analyze karke.

- Motive waves ko further subdivide kiya ja sakta hai into smaller waves, jo ki 1, 2, 3, 4, aur 5-numbered waves hote hain. 1, 3, aur 5 numbered waves impulse waves kehlata hain, jabke 2 aur 4 numbered waves corrective waves hote hain.

- Corrective Waves:

- Corrective waves motive waves ke opposite direction mein hoti hain, yani ke jab market upar jati hai to corrective waves neeche jati hain aur vice versa.

- In waves mein traders usually profit booking ya reversal trades karte hain.

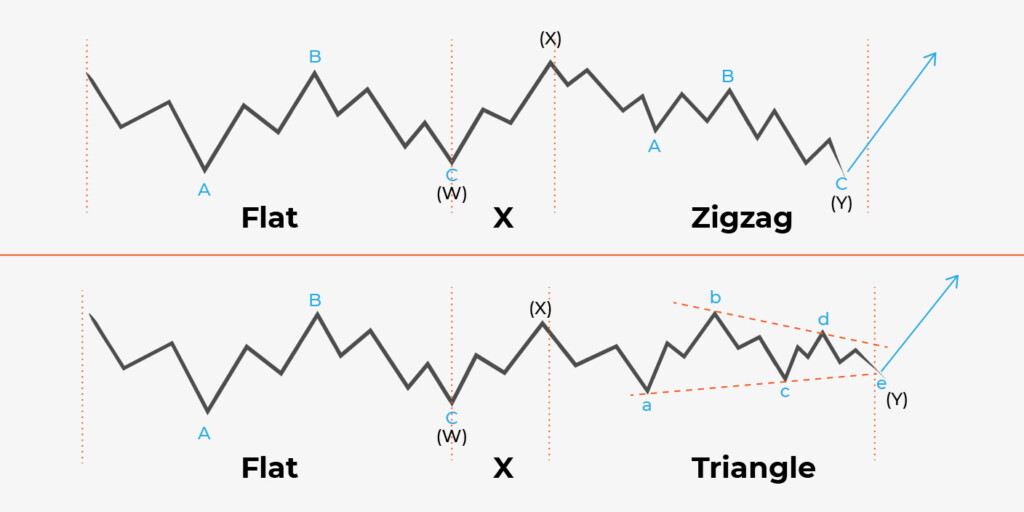

- Corrective waves ko further subdivide kiya ja sakta hai into smaller waves, jaise ke zigzag, flat, aur triangle patterns.

- Diagonal Waves:

- Diagonal waves, motive waves ki ek specific type hoti hain jo price trend ko depict karti hain.

- In mein price ka movement ek diaganol ya wedge shape mein hota hai.

- Diagonal waves 2 types ki hoti hain: leading diagonals (1-2-3-4-5) aur ending diagonals (A-B-C-D-E).

- Motive Waves:

-

#8 Collapse

Trading Using Motive & Diagonal Waves.

Motive Waves (Mutaarif Leherain):

Motive waves market mein directional trend ko represent karte hain. In waves mein 5 sub-waves hoti hain jo trend ko badhane ya ghatane mein madad karti hain. Ye sub-waves impulsive hote hain aur direction mein move karte hain.

Diagonal Waves (Saray Numa Leherain):

Diagonal waves mein market ka trend ek specific pattern mein move karta hai. Ye waves generally corrective hote hain aur trend ke against move karte hain. In waves mein 5 sub-waves hoti hain, lekin structure mein triangle ya wedge formation hoti hai.

Trading Strategies (Trading Strateejain):- Identify the Trend (Trend Ka Pata Lagana): Sab se pehle market ka trend determine karna zaroori hai. Motive waves ke through trend ka direction samajhna asaan hota hai.

- Wave Counting (Wave Ginati): Motive aur diagonal waves ko count karna zaroori hai taake aap sahi entry aur exit points ka faisla kar sakein.

- Fibonacci Analysis (Fibonacci Tehqiqat): Fibonacci retracement aur extension levels ka istemal karke price targets aur stop-loss levels ko set kar sakte hain.

- Risk Management (Khatra Nigrani): Har trade mein apna risk manage karna zaroori hai. Stop-loss orders ka istemal karke risk ko minimize kiya ja sakta hai.

- Practice (Amli Mashq): Trading strategies ko samajhne aur istemal karne ke liye practice zaroori hai. Demo accounts ka istemal karke apni skills ko improve karein.

- Keep Learning (Seekhna Jama Bandi): Market dynamics mein tabdeeliyon ko samajhne ke liye hamesha seekhte rahiye aur apne trading strategies ko update karte rahiye.

- Technical Analysis (Techneekee Tahlil): Motive aur diagonal waves ko samajhne ke liye technical analysis ka istemal kiya ja sakta hai. Price charts, indicators aur oscillators ka istemal karke market trends aur wave patterns ko identify kiya ja sakta hai.

- Psychological Factors (Nafsiyati Asraat): Trading mein nafsiyati asraat bhi ahem hotay hain. Motive aur diagonal waves ke through market sentiment aur investor behavior ko samajhna zaroori hai.

- Trade Execution (Trade Ijra): Sahi entry aur exit points ko identify karne ke baad, trade execution ka tareeqa ehtiyaat se kiya jana chahiye. Slippage aur market volatility ko dhyan mein rakhte hue trade ko

- Technical Analysis (Techneekee Tahlil): Motive aur diagonal waves ko samajhne ke liye technical analysis ka istemal kiya ja sakta hai. Price charts, indicators aur oscillators ka istemal karke market trends aur wave patterns ko identify kiya ja sakta hai.

- Psychological Factors (Nafsiyati Asraat): Trading mein nafsiyati asraat bhi ahem hotay hain. Motive aur diagonal waves ke through market sentiment aur investor behavior ko samajhna zaroori hai.

- Trade Execution (Trade Ijra): Sahi entry aur exit points ko identify karne ke baad, trade execution ka tareeqa ehtiyaat se kiya jana chahiye. Slippage aur market volatility ko dhyan mein rakhte hue trade ko execute karna zaroori hai.

- Portfolio Diversification (Diversification): Trading ke dauran portfolio ko diversify karna ahem hota hai. Motive aur diagonal waves ke through trading opportunities ko dhundhne ke liye alag-alag markets aur instruments mein invest kiya ja sakta hai.

- Risk Assessment (Khatra Ka Andaza): Har trade se pehle risk assessment zaroori hai. Motive aur diagonal waves ke through potential risk factors ko analyze karke risk management strategies ko implement kiya ja sakta hai.

- Market Monitoring (Market Ki Nigraani): Market ko regular basis par monitor karna zaroori hai. Motive aur diagonal waves ke latest developments aur price movements par nazar rakhte hue trading decisions ko adjust kiya ja sakta hai.Continuous Improvement (Mustaqil Behtari): Trading mein mustaqil behtari ke liye hamesha apne trading strategies aur techniques ko improve karte rahiye. Motive aur diagonal waves ke maahir banne ke liye constant learning aur practice ka hona zaroori hai.execute karna zaroori hai.

- Portfolio Diversification (Diversification): Trading ke dauran portfolio ko diversify karna ahem hota hai. Motive aur diagonal waves ke through trading opportunities ko dhundhne ke liye alag-alag markets aur instruments mein invest kiya ja sakta hai.

- Risk Assessment (Khatra Ka Andaza): Har trade se pehle risk assessment zaroori hai. Motive aur diagonal waves ke through potential risk factors ko analyze karke risk management strategies ko implement kiya ja sakta hai.

- Market Monitoring (Market Ki Nigraani): Market ko regular basis par monitor karna zaroori hai. Motive aur diagonal waves ke latest developments aur price movements par nazar rakhte hue trading decisions ko adjust kiya ja sakta hai.

- Continuous Improvement (Mustaqil Behtari): Trading mein mustaqil behtari ke liye hamesha apne trading strategies aur techniques ko improve karte rahiye. Motive aur diagonal waves ke maahir banne ke liye constant learning aur practice ka hona zaroori hai.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduction

Forex trading mein "motive waves" aur "diagonal waves" Elliott Wave Theory ke important concepts hain.

Motive waves bullish (upward) ya bearish (downward) trend ko represent karte hain. Yeh waves price mein significant move ko reflect karte hain jo market ke overall trend ko follow karte hain.

Diagonal waves bhi Elliott Wave Theory ke hisse hote hain jo price structure ko represent karte hain. Yeh waves typically trending markets mein dekhe jaate hain aur unki shape diagonal hoti hai, jaisa ke naam se pata chalta hai. Diagonal waves mein price move karte waqt price structure mein specific pattern hota hai jo Elliott Wave Principle ke rules ko follow karta hai.

Motive waves aur diagonal waves ko samajh kar traders market ke trends aur price movements ko predict karne ki koshish karte hain taki woh trading decisions effectively le sakein. Lekin Elliott Wave Theory complex hai, aur isme proper analysis aur understanding ki zaroorat hoti hai. Isliye traders ko in concepts ko samajhne ke liye time aur practice invest karna chahiye.

Motive and diagonal waves ky faidy

Motive waves aur diagonal waves ki samajh trading ke liye kafi faidayemand ho sakti hain.

Motive waves ko samajh kar traders market ke major trends ko analyze kar sakte hain. Agar aapko pata chal jata hai ke market mein bullish ya bearish sentiment kitna strong hai, to aap apni trading strategies uss ke mutabiq adjust kar sakte hain. Is se aapko trading ke liye direction mil jati hai aur aap market movements ko samajh kar better trading decisions le sakte hain.

Diagonal waves ki samajh se, aap market ke intermediate price movements ko samajh sakte hain. Yeh waves price mein specific patterns aur structures ko represent karte hain, jo traders ko price action aur trend changes ko samajhne mein help karte hain. Agar aap diagonal waves ko effectively interpret kar sakte hain, to aap price reversals aur corrective moves ko identify karne mein mahir ho sakte hain.

Motive aur diagonal waves ki understanding se aap market ke complexities ko samajh sakte hain aur trading ke liye behtar insights gain kar sakte hain. Lekin yeh concepts complex hote hain, aur inko effectively use karne ke liye practice aur knowledge ki zarurat hoti hai. Isliye, in concepts ko samajhne ka time aur effort invest karna traders ke liye fruitful ho sakta hai.

Motive and diagonal waves ky drawback

Motive waves aur diagonal waves ke istemal ke kuch drawbacks bhi hote hain. In waves ko samajhna aur interpret karna complex ho sakta hai, aur unka istemal karne ke kuch challenges hote hain.

Elliott Wave Theory ke principles ko apply karna subjective hota hai, jiska matlab hai ke different traders unhe alag tareekay se interpret kar sakte hain. Isi wajah se, kisi bhi wave pattern ko define karna aur uski implications ko samajhna challenging ho sakta hai.

Motive waves aur diagonal waves ke signals ko samajhna aur unpar rely karna, market volatility aur uncertainty ke dour mein aur bhi mushkil ho jata hai. Market ke quick changes aur unpredictable movements ki wajah se, wave patterns ko accurately identify karna aur unpar trading decisions uthana challenging ho sakta hai.

Saath hi, Elliott Wave Theory ki complexity ki wajah se, beginners ko in concepts ko samajhne mein aur sahi tareeke se apply karne mein mushkilat ho sakti hain. Isi tarah se, incorrect wave counts ya misinterpretations ki wajah se loss ka bhi dar rehta hai.

Overall, although motive waves aur diagonal waves forex trading ke liye valuable tools ho sakte hain, lekin unka istemal karna aur unpar rely karna challenging ho sakta hai, aur traders ko in drawbacks ko samajh kar trading decisions leni chahiye.

-

#10 Collapse

TRADING USING MOTIVE & DIAGONAL WAVES DEFINITION

Theory impulse ki wave ki identifies karti hai Jo Ek pattern and corrective wave establish karti hai jo larger trend ki oppose karti hai Elliot wave theory investor ke sentiment and psychology se related price ke pattern ka technical analysis provide karta hai reversal ki anticipating karte hue trader Iske bad stock ko short kar sakta hai is trading theory ki underlying yah idea hai ke financial market Mein fractal pattern recur Hote Hain mathematical mein trader apne aap ko infinite scale per repeat Karte Hain Upar De Gai theory Ralph Nelson Ne develop ki thi agar koi trader Kisi stock ko impulsive wave per upward moving sees hai to vah apni fifth waves ko completes karne Tak long ho sakta hai

ELLIOT WAVE THEORY VS. OTHER INDICATOR

Oscillator five period and thirty four period moving average ke between difference ki based per future ki price ka predicting karne ka ek computerized method provide karta hai Elliot wave International ka artificial intelligence ka system EWAVES, Elliot wave ke Tamam Rule and guidelines ko data per apply karta hai ta ke automated Elliot wave analysis generate Kiya Ja sake Elliot wave oscillator chart Elliot wave oscillator chart. Other analyst Elliot Wave ke principal se inspire ho kar indicator developed kiye Hai including Elliot wave oscillator chart. technical analysis main Elliot wave theory price ke pattern Mein long term trend ko look karti hai and yah ke voh Kis Tarah investor ki psychology se correspond rakhte Hain

HOW ELLIOT WAVE WORK

Wave ka analysis trend ki movement ke bare mein insight offer karta hai and investor price ki movement ko understand mein help karta hai impulse and collective wave largest pattern banane ke liye self similar FRACTAL MAIN NESTED HAIN for example Ek year ka chart corrective Wave ke between ho sakta hai but thirty day ka chart developing impulse wave show kar sakta hai some technical analysts Elliot wave theory ka using karte hue stock market Mein wave ke pattern se profit Hasil Karte Hain

-

#11 Collapse

Trading Using Motive & Diagonal Waves.

"Motive Waves" aur "Diagonal Waves" Elliott Wave Theory ke concepts hain jo forex trading mein istemal hote hain. Elliott Wave Theory ek technical analysis theory hai jo market ke price movements ko predict karne ke liye istemal hoti hai. Motive Waves: Motive Waves, Elliott Wave Theory ke hisab se, un waves ko represent karte hain jo market ke impulsive movements ko darust karte hain. Yeh waves typically trend ke direction mein move karte hain aur ismein price ki impulsive movements hoti hain. Motive Waves usually kaafi lambi hoti hain aur market mein clear trends ko darust karti hain. In waves mein price ki strong aur directional movements hoti hain, jinse traders ko trading opportunities milte hain. Diagonal Waves: Diagonal Waves bhi Elliott Wave Theory ka ek concept hai. Ye waves typically corrective waves ke roop mein market mein dekhe jaate hain. In waves mein price ki corrective aur overlapping movements hoti hain. Diagonal Waves ko "wedge" ya "triangle" shape mein dekha ja sakta hai, jismein price gradually converge ya diverge hoti hai. Ye waves usually trend ke kisi specific phase mein dekhe jaate hain aur trend reversal ke indications ke taur par consider kiye jaate hain. Trading Using Motive & Diagonal Waves: Traders Elliott Wave Theory ke concepts ko samajh kar aur motive waves aur diagonal waves ko identify karke market ke movements ko analyze karte hain. Motive waves ke samay, traders typically trend ke direction mein trading positions lete hain, jabki diagonal waves ke samay, traders cautious hote hain kyunke ye trend reversal indications ho sakte hain. Trading strategies ko motive waves aur diagonal waves ke according customize kiya ja sakta hai, jisse ki traders market movements ko sahi tareeke se interpret kar sakein aur trading decisions le sakein. Overall, motive waves aur diagonal waves Elliott Wave Theory ke important concepts hain jo traders ko market trends aur reversals ko samajhne mein madad karte hain. Is theory ko samajh kar traders apne trading strategies ko improve kar sakte hain aur market movements ko better predict kar sakte hain.

- CL

- Mentions 0

-

سا0 like

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Trading Using Motive & Diagonal Waves

Introduction Motive aur Diagonal Waves

Motive aur Diagonal Waves ka istemal karke tijarat karna ek aham tareeqa hai jis se log stocks, forex, ya anya markets mein munafa kama sakte hain. Yeh tareeqa Elliot Wave Theory par mabni hai, jis mein market ke patterns aur trends ko samajhne ki koshish ki jati hai.

Elliot Wave Theory ki Bunyadi Baatein

Elliot Wave Theory ke mutabiq, market mein char tarah ke waves hote hain: motive waves, corrective waves, impulse waves, aur diagonal waves. Is theory ke mutabiq, motive waves trend ko follow karte hain jabke corrective waves usko against karte hain.

Motive Waves

Motive waves market ke trend ko follow karte hain. Yeh upward ya downward ho sakte hain aur generally market ke impulse move ko reflect karte hain. In waves ko 1, 3, 5 ke sath label kiya jata hai.

Diagonal Waves

Diagonal waves, ya impulse waves ke sath sath, market mein hone wale trend ko depict karte hain. In waves mein price ek specific direction mein move karta hai, lekin is mein thori si difference hoti hai ki yeh zigzag pattern mein hoti hai. Diagonal waves ko aksar wedge ya triangle formations ke roop mein dekha jata hai.

Motive aur Diagonal Waves ka Use

Motive aur diagonal waves ko samajh kar tijarat karne ke liye kuch mukhtalif steps hote hain.- Trend ki Tafteesh: Sab se pehle, trend ki tafteesh karni hoti hai. Kya market upward ya downward trend mein hai? Yeh samajhna zaroori hai motive aur diagonal waves ko pehchanne ke liye.

- Entry Point ka Intezar: Agar aap motive wave ke entry point par hain, to aapko wait karna hoga jab market mein impulse move ho. Agar diagonal wave ko identify kia gaya hai, to entry point ko confirm karna zaroori hai jab price wedge ya triangle formation ko break kare.

- Stop Loss aur Target Set Karna: Har trade mein stop loss aur target set karna zaroori hai taki nuqsaan se bacha ja sake aur munafa hasil kiya ja sake.

- Risk Management: Har trade mein risk management ka khayal rakhna zaroori hai. Zyada se zyada kitna risk le sakte hain, yeh tay karna ahem hai.

- Market ka Monitor Karna: Trade ke dauran market ko monitor karna zaroori hai taake aapko pata chale ke kya aapka trade sahi direction mein ja raha hai ya nahi.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#13 Collapse

**Trading Using Motive Aur Diagonal Waves**

Forex aur stock trading mein, Elliot Wave Theory ek popular aur effective tool hai jo market ke price movements aur trends ko samajhne ke liye use hota hai. Is theory ke under, motive aur diagonal waves market ke trends aur reversals ko identify karne mein madad karte hain. Is post mein, hum motive aur diagonal waves ke concepts ko detail mein discuss karenge aur trading strategies ko samjhenge.

**Motive Waves Kya Hain?**

Motive waves Elliot Wave Theory ke fundamental elements hain. Yeh waves market ke primary trends ko represent karte hain aur inhe 5 sub-waves mein classify kiya jata hai. Motive waves typically trend ke direction mein move karte hain aur yeh waves trend ke strength aur momentum ko show karte hain.

1. **Formation:** Motive waves ko 5 waves mein classify kiya jata hai:

- **Impulse Waves (1, 3, 5):** Yeh waves trend ke direction mein move karti hain aur market ke main direction ko represent karti hain.

- **Corrective Waves (2, 4):** Yeh waves impulse waves ke beech ke pullbacks ko show karti hain aur trend ke temporary corrections ko represent karti hain.

2. **Trading Strategy:** Motive waves ko identify karne ke liye traders trend analysis aur wave counting ka use karte hain. Impulse waves ke end ke baad, traders correction waves ke entry aur exit points ko plan kar sakte hain. Effective analysis aur accurate wave counting trading decisions ko optimize kar sakte hain.

**Diagonal Waves Kya Hain?**

Diagonal waves bhi Elliot Wave Theory ke key elements hain, lekin yeh waves typically market ke corrective phases ko represent karti hain. Diagonal waves 5 waves ke patterns ke form mein hoti hain aur yeh patterns generally trends ke end phases mein form hote hain.

1. **Formation:** Diagonal waves ko do categories mein classify kiya jata hai:

- **Leading Diagonal:** Yeh waves trend ke beginning phase ko represent karti hain aur typically wave 1 aur wave A ke form mein hoti hain.

- **Ending Diagonal:** Yeh waves trend ke ending phase ko represent karti hain aur typically wave 5 aur wave C ke form mein hoti hain.

2. **Trading Strategy:** Diagonal waves ko identify karne ke liye traders market ke corrective patterns aur wave counts ko analyze karte hain. Yeh waves trend reversals ke signals provide karte hain aur trading decisions ko market ke potential turning points ke around plan kiya ja sakta hai.

**Trading Using Motive Aur Diagonal Waves:**

1. **Trend Identification:**

- **Motive Waves:** Motive waves ko identify karke traders market ke primary trend ko samajh sakte hain. Impulse waves ke end ke baad, traders potential entry aur exit points ko plan kar sakte hain.

- **Diagonal Waves:** Diagonal waves ko identify karke traders market ke corrective phases aur trend reversals ko detect kar sakte hain. Yeh waves market ke potential turning points ko highlight karte hain.

2. **Risk Management:**

- **Stop-Loss Orders:** Effective risk management ke liye stop-loss orders set karna zaroori hai. Yeh orders unexpected price movements ke against protection provide karte hain aur potential losses ko minimize karte hain.

- **Position Sizing:** Position sizing ko proper tarike se manage karna zaroori hai, especially jab motive aur diagonal waves ke patterns identify kiye jate hain. Yeh approach risk management ko enhance karta hai aur trading performance ko optimize karta hai.

3. **Confirmation Indicators:**

- **Technical Indicators:** Motive aur diagonal waves ke signals ko validate karne ke liye additional technical indicators ka use kiya ja sakta hai. Moving Averages, RSI, aur MACD jaise indicators market ke trend aur reversal signals ko confirm karne mein madadgar hote hain.

**Conclusion:**

Motive aur diagonal waves Elliot Wave Theory ke important components hain jo market ke trends aur reversals ko samajhne mein madad karte hain. Accurate wave counting aur analysis ke saath, traders market ke potential entry aur exit points ko identify kar sakte hain. Effective risk management aur confirmation indicators ka use karke, traders apne trading decisions ko enhance kar sakte hain aur market ke trends se maximum benefit utha sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:46 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим