Bump & run candlestick pattern explanation

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Bump & Run" candlestick pattern forex trading mein ek chart pattern hai jo market ke potential reversals ko identify karne mein istemal hota hai. Yeh pattern typically uptrend ke baad dekha jata hai aur bearish reversal ka signal deta hai. Neeche di gayi hai "Bump & Run" candlestick pattern ki mukhtasar maloomat roman Urdu mein:

Bump & Run Candlestick Pattern (بمپ اور رن کینڈلسٹک پیٹرن):

Ahmiyat (اہمیت):

"Bump & Run" pattern uptrend ke baad market ke potential bearish reversals ko indicate karta hai.

Yeh pattern traders ko sell opportunities provide karta hai jab market ki uptrend weaken hone lagti hai.

Appearance (ظاہریت):

"Bump & Run" pattern mein typically teen stages hote hain: bump, run, aur drop.

Bump stage mein market mein ek sharp price increase hota hai, jise ek straight trend line (bump line) se represent kiya jata hai.

Run stage mein market ka price ek sustained uptrend follow karta hai.

Drop stage mein market ke prices mein sudden reversal hota hai aur price trend break ho jata hai.

Interpretation (تشریح):

Jab "Bump & Run" pattern ban jata hai, to yeh bearish signal hota hai.

Iska matlab hai ke market ka price ab wapas neeche ja sakta hai aur potential downtrend shuru ho sakta hai.

Trading Strategy (ٹریڈنگ استریٹیجی):

"Bump & Run" pattern ko confirm karne ke liye traders volume aur price action ka analysis karte hain.

Jab yeh pattern confirm ho jaye, traders sell positions enter karte hain.

Stop-loss orders ko set karke aur profit targets ko determine karke risk management ko implement kiya jata hai.

Risk Management (رسک مینجمنٹ):

Har trade ke liye stop-loss orders ka istemal karke risk ko control mein rakha jata hai.

Position sizing aur risk-reward ratio ka dhyan rakhte hue, traders apni risk management ko optimize karte hain.

"Bump & Run" candlestick pattern forex trading mein bearish reversals ko identify karne aur profit earn karne mein madadgar ho sakta hai. Is pattern ko sahi tareeqe se samajh kar aur confirm karke traders apni trading strategies ko improve kar sakte hain.

-

#3 Collapse

Bump & run candlestick pattern explanation

"Bump & Run" candlestick pattern ek technical analysis pattern hai jo market trends ko identify karne aur future price movements ko anticipate karne mein madad karta hai. Yeh pattern price action ko observe karke trading decisions banane mein istemal hota hai. Yahan, "Bump & Run" pattern ki tafseelat roman Urdu mein di gayi hain:

Bump & Run Candlestick Pattern:

1. Bump Phase (First Phase):- Shuruat: Bump & Run pattern ki shuruaat ek uptrend ke saath hoti hai, jismein prices mein tezi hoti hai.

- Bump: Phela phase "Bump" kehlaya jata hai, jismein price ek tezi se upar ki taraf chali jati hai aur ek peak banati hai.

2. Run Phase (Second Phase):- Thori Si Girawat: Bump ke baad aati hai "Run" phase, jismein prices mein thori si girawat hoti hai. Yeh girawat initial bump se shuru hoti hai.

- Susti Aur Horizontal Line: Prices thori der tak sust rehti hain aur ek horizontal line banati hain, jo ke ek support level ki tarah kaam karti hai.

3. Drop Phase (Third Phase):- Tezi Se Girawat: Run phase ke baad aata hai "Drop" phase, jismein prices mein tezi se girawat shuru ho jati hai.

- Support Break: Jab prices ne pehle horizontal support line ko todi aur tezi se neeche gayi, to yeh confirmatory signal hai ke market bearish trend mein ja sakta hai.

4. Kya Dikkat Aa Sakti Hai:- False Signals: Har pattern ki tarah, Bump & Run bhi false signals generate kar sakta hai, is liye traders ko confirmation ke liye aur indicators ka istemal karne ki zarurat hoti hai.

- Market Conditions: Market conditions ke mutabiq, yeh pattern har waqt kaam nahi karta aur sirf specific situations mein hi asar andaz hota hai.

5. Trading Strategies:- Sell Signal: Jab prices ne support line ko todi aur tezi se neeche gayi, to traders ko sell signal milta hai.

- Stop Loss aur Target: Is pattern mein stop-loss level aur target price set karna zaroori hai taki risk control ho sake.

Mehfooz Raaste Par Chalne Ka Tariqa:- Confirmation Ke Liye Intezar: Traders ko yeh yaad rakhna chahiye ke ek pattern pe bharosa karne se pehle, doosre technical indicators aur market conditions ka bhi intezar karna chahiye.

Final Words: Bump & Run candlestick pattern, agar sahi tarike se samjha jaye aur confirmatory signals ke saath istemal kiya jaye, to yeh ek powerful tool ho sakta hai market trends ko identify karne ke liye. Lekin hamesha yaad rahe ke market mein risk hota hai, is liye har trade ko carefully plan karna zaroori hai.

-

#4 Collapse

Bump & Run" candlestick pattern ek technical analysis tool hai jo traders istemal karte hain forex aur stock market mein price movements ko predict karne ke liye. Is pattern mein kuch specific candlestick formations hoti hain jo market ke trend ka signal deti hain. Yeh pattern aam tor par uptrend ke doran dekha jata hai aur aksar reversal points ke liye istemal hota hai.Is pattern ko samajhne ke liye yeh steps follow kiye jate hain:

Bump Phase (Dor Phase):

Pehla step mein, price mein ek tezi dekhi jati hai, jo kayi candlesticks ki series ke zariye express hoti hai. Is dor mein price sudden increase karta hai aur yeh uptrend shuru hota hai.

Lead-in Trend Line (Trend Line ka Ibtidaati Hisa):

Is phase mein, ek trend line draw ki jati hai jo uptrend ko represent karti hai. Yeh trend line price ke consistent increase ko darust karti hai.

Bump (Bachav) Phase:

Phir aata hai "bump" phase, jahan price mein sudden tezi ki wajah se ek bump ya spike dekhi jati hai. Is spike ke baad, price mein thori rukawat ya sideways movement hoti hai.

Bump High (Uchayi):

Is phase mein, price ek specific high point tak pohochti hai, jo ki bump ke peak ko represent karta hai.

Run Phase (Bhaag Phaase):

Yeh phase tab aata hai jab price trend line ko break karke downward move karti hai. Yeh downtrend ka start hota hai jo ki bump phase ke baad ata hai.Bump & Run" pattern ka main objective hota hai uptrend ke reversal points ko identify karna. Jab price trend line ko break karke neeche jaata hai, traders sell positions lete hain ya short positions enter karte hain expecting further downward movement. Yah pattern traders ko market ke future movements ko anticipate karne mein madad karta hai.

-

#5 Collapse

BUMP AND RUN CANDLESTICK PATTERN

Explanation of Bump and run candlestick pattern:

Agar apko chart my bullish bump or run ka formation dikhaye dy raha hy or dono trend angel line ka angel bhi sahi hy to apko ismy kharidari karny ky liye yaha dekhna hy ky price bump pura hona pr pehli trend line ka upar closing dy deta hy to usky bad wali candlestick my apko kahridari karna hy ,or kahridari karny ky foran bad jis candlestick ny trend angel line ka upar closing di hy usky low ka nechy ka stopploss lagana hy ,trade leny ky bad apko trailing stopploss lagana hy ab ismy akhri point yahan hi hamain profit book kahan karna hy ,profit book karny ky liye apko yaha dekhna hy jaha sy bump shuru huwa hy isy ham name dety hy point A or jaha py bump ka lowest low bana hy usy ham name dety A point B, ab point A or point B ka jo difference hoga wo hamara target hoga ,jasy kah point A or point B ka difference 20 point ka hy to hamara target point ka hoga ,or jab price 20 tk ponch jaye hamy foran profit book karna hy.

Trading strategy of Bump and run candlestick pattern:

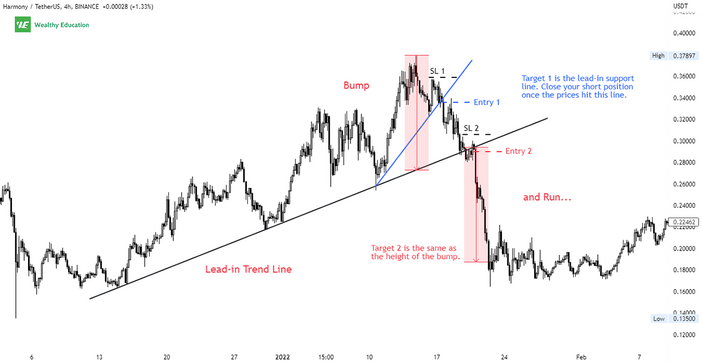

Chart my ham dekhty hain price higher support higher resistance banaty huwy market ma uptrend dikhata hy or bearish bump or run ka banana my yahan zaruri hy ky shuruwati trend uptrend ho jab price uptrend my chalty huwe do support bana dy usky bad dono support ky low ko touch kar ky ik trend angel line khenchni hy, ab yahan ham maan lety hain ky yahan trend angle line 30 degree ka angel bana rahi hy matlab ky tezi ka trend 30 degree ky angel sy chal rha hy,is pahly part ko lead-in kahty hain ismy price line ko respect karty huwe upar ki taraf barhta hy ,isky bad dusra part shuru hota hy usy kahty hain bump ,ismy hota ya hy keh price achanak sy bohat zyada pump hona lagta hy ,jab market my itna zyada pump ata hy to asy lagta hy bazar ma speculative huwa hy or isky sath volume bhi bharta hy lekin yahan tezi zyada dyr nahi chalti or price nechy any lagti hy.

Technical analysis of Bump and run candlesick pattern:

bump or run candlestick chart pattern ik technical analysis chart pattern hy jisy log khareed-o-frokht main mumkin rujhan ki tabdeeli ki nishandahi karny ky liye istemal kr sakty hain. yeh pattern qeemat ki naqal o harkat ki ik series pr mushtamil hota hy jo ik takrana banata hy, is ky baad istehkaam ya tijarti range ki muddat, or phir mukhalif simt main aik taiz harkat, ik run banati hy. is article main, hm dekhen gy ky bump or run candlestick chart pattern ka istemal karty huwe tijarat kaisy ki jaye.

-

#6 Collapse

Bump & run candlestick pattern ko "dhakka aur daur mumil" pattern bhi kehte hain. Ye ek technical analysis formation hai jo maaliyaati markets mein, khaaskar stocks aur forex mein, trend ki mukhtalif morchaon ko pehchaan'ne ke liye istemal hota hai. Ye teen mukhya components par mabni hota hai:- Lead-in Phase: Ye ibtedai daur hota hai jahan qeemat ka trend tezi se barhta ya girta hai, ek rukh ko gehri tezi se barhate hue ya ghate hue trend line banaate hue. Is daur ko taqatwar momentum ke zariye pesh karte hain jab traders trend ka faida uthaane ki jaldi mein faraahmi mein aamadani karte hain.

- Bump Phase: Is daur mein, qeemat ek tezi se trend line se shandar palat ya sudhar ka samna karti hai jo lead-in phase mein qaim trend line se hota hai. Ye palat ya sudhar aksar qeemat ke haraq mein beroni hone se hota hai, jo qeemat ke harkaat ko barhne ya girenne ki soorat mein rok sakta hai ya pehle ke trend ko mu'attal karne wale naye maaliyaati factors ke ubhar se shuru hota hai.

- Run Phase: Bump phase ke baad, qeemat aam tor par ek naye rukh mein consolider hoti hai ya ek kamtey hue range mein trade karti hai, ibtedai trend line ke mukable mein ek naye trend line ko banate hue. Ye daur momentum ka nuqsan aur market ki hissiyat mein ek taqatwar nazar aane ki nishaani hai.

Traders bump and run pattern ka istemal trend ke palat hone ki umeed aur mojooda trades ke liye dakhil ya nikalne ke points ko qabal az aata samajhte hain. Tasdeeqi signals jaise volume analysis, support aur resistance levels, aur mazeed technical indicators aksar pattern ko qaim karne aur trading decisions ko sahi sabit karne ke liye istemal kiye jaate hain.

Yeh yaad rakhna ahem hai keh bump and run pattern technical analysis mein ek kaaragar tool ho sakta hai, magar jaise ke har chart pattern, ye bhi pura-proof nahi hai aur ise doosri tajziyati techniques aur risk management strategies ke saath istemal kiya jaana chahiye.

-

#7 Collapse

Bump & Run Candlestick pattern ek mukhtalif aur popular chart pattern hai jo stock market mein istemal hota hai. Ye pattern prices ki movement ko analyse karne ke liye istemal hota hai aur traders ko potential entry aur exit points provide karta hai.

Is pattern ko dekhne ke liye, traders ko candlestick charts ka istemal karna hota hai. Ye pattern usually bullish trend mein dikhai deta hai, lekin kabhi kabhi bearish trend mein bhi dekha ja sakta hai.

Bump & Run Candlestick Pattern ki Tafseelat

Is pattern ko samajhne ke liye, kuch mukhtalif components hain:- Bump Phase: Pehli stage mein, ek upward trend ya bullish movement hoti hai. Prices mein tezi aati hai aur chart par ek sahih trend line draw ki ja sakti hai jo prices ko track karti hai.

- Bump: Phir ek sudden aur tez rise aata hai, jo trend line se bahar nikal jata hai. Ye rise normal trend se zyada hota hai aur chart par ek "bump" ki tarah dikhta hai.

- Run Phase: Iske baad, prices mein thoda sa retracement hota hai, lekin overall trend ab bhi bullish hota hai. Prices trend line ke neeche chale jaate hain aur phir se uptrend mein aane ki koshish karte hain.

- Run: Yeh woh phase hai jab prices phir se trend line ke upar chale jaate hain aur ek naya high banate hain.

Bump & Run Candlestick Pattern ka Istemal

Bump & Run Candlestick pattern ko samajhne ke baad, traders iska istemal karke entry aur exit points tay kar sakte hain. Agar pattern correctly identify kiya jata hai, toh traders potential high-profit trades kar sakte hain.

Entry Point: Jab prices bump phase mein hote hain aur trend line se bahar nikalne ke qareeb hote hain, tab traders entry ka faisla kar sakte hain. Agar candlestick patterns aur indicators jaise ki volume confirmation dete hain, toh entry point confirm hota hai.

Exit Point: Jab prices run phase mein hote hain aur naye highs banate hain, tab traders apne positions ko close kar sakte hain. Ye ek potential exit point hota hai jahan se traders apne profits secure kar sakte hain.

Bump & Run Candlestick Pattern ke Challenges

Bump & Run Candlestick pattern ko samajhna aur istemal karna challenging ho sakta hai, kyun ke ye pattern kabhi kabhi false signals bhi generate kar sakta hai. Isliye, traders ko is pattern ko confirm karne ke liye dusre technical analysis tools ka bhi istemal karna chahiye.

Nateeja

Bump & Run Candlestick pattern ek powerful tool hai jo traders ko market movement ka ek insight provide karta hai. Lekin isko samajhna aur istemal karna technical analysis aur market understanding ka ek hissa hai. Traders ko hamesha apne trading strategies ko test karna chahiye aur risk management ka dhyaan rakhna chahiye jab bhi ye pattern ka istemal karte hain.

- CL

- Mentions 0

-

سا2 likes

-

#8 Collapse

Bump & Run Candlestick Pattern:

Forex trading mein mukhtalif candlestick patterns ka istemal kiya jata hai taake traders ko market ke movements aur trends ko samajhne mein madad mile. Ek aham aur mufeed candlestick pattern jo traders istemal karte hain, wo hai "Bump & Run Candlestick Pattern". Yeh pattern price trends aur reversals ko identify karne mein madadgar hota hai.

Bump & Run Candlestick Pattern ek bullish reversal pattern hai jo market ke uptrend ke badalne ka indication deta hai. Is pattern ko samajhne ke liye, traders ko niche diye gaye steps ko follow karna chahiye:- Bump Phase: Pehla phase mein, market mein ek strong uptrend hota hai jahan price mein taizi se izafa hota hai. Is uptrend ke doran, ek lambi candlestick formation hoti hai jo upward move ko represent karti hai. Is phase ko "bump" kehte hain.

- Bump & Run Line: Bump ke baad, ek short-term reversal ya consolidation phase hota hai jahan price thori der ke liye stabilize hoti hai. Is phase mein, traders ek straight line draw karte hain jo bump ke highs ko connect karti hai. Is line ko "bump & run line" kehte hain.

- Run Phase: Teesra phase, yaani "run" phase, mein market mein ek sharp decline hota hai jahan price ne bump & run line ko neeche cross kar diya hota hai. Yeh decline pattern ke reversal ka indication hai aur traders ko selling opportunities provide karta hai.

- Confirmation Indicators: Bump & Run Candlestick Pattern ko confirm karne ke liye traders technical indicators ka istemal karte hain jaise ke RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), ya volume analysis. In indicators ki madad se traders determine karte hain ke kya pattern valid hai ya nahi.

- Trading Opportunities: Jab Bump & Run Candlestick Pattern complete hota hai, toh traders ko trading opportunities milte hain. Agar pattern bullish hai, toh traders buy positions lete hain jab price ne bump & run line ko neeche se cross kar liya hai aur reversal ka indication mil raha hai.

Bump & Run Candlestick Pattern ka istemal karke traders market ke trend reversals ko identify kar sakte hain aur trading decisions le sakte hain. Lekin, yaad rahe ke market mein uncertainty hoti hai aur koi bhi pattern ya strategy 100% accurate nahi hoti.

Is tareeqe ko samajhne ke liye, traders ko practice aur experience ki zaroorat hoti hai. Jab traders Bump & Run Candlestick Pattern ko samajh lete hain, toh unhein market mein mukhtalif price movements ko predict karne mein madad milti hai aur wo apni trading strategies ko improve kar sakte hain.

Muqtasid alfazon mein, Bump & Run Candlestick Pattern ek powerful tool hai jo traders ko market ke trend reversals aur price movements ko samajhne mein madad deta hai. Agar is pattern ko sahi tareeqe se samjha jaye aur sahi tarah se istemal kiya jaye, toh traders ko consistent profits hasil karne mein madad milegi.

-

#9 Collapse

Forex mein tijarat karte waqt, aksar traders ko mukhtalif chart patterns par tawajjo deni hoti hai taake wo sahi waqt par trade kar sakein aur munafa hasil kar sakein. Ek aham aur mufeed chart pattern jo traders ke liye madadgar sabit ho sakta hai, woh hai "Bump & Run Candlestick Pattern".

Bump & Run Candlestick Pattern Kya Hai?

Bump & Run Candlestick Pattern ek trend reversal pattern hai jo market mein bullish ya bearish trend ke baad aam hota hai. Is pattern ko pehchanna asan hota hai aur traders iske zariye market ka future direction anticipate kar sakte hain.

Is pattern ko do hisson mein taqseem kiya ja sakta hai: Bump aur Run.- Bump: Yeh pehla hissa hota hai jab market mein tezi ka aghaz hota hai aur price mein achanak izafa hota hai. Yeh izafa normal trend se kafi tezi se hota hai aur price mein vertical move hota hai jo normal trend se mukhtalif hota hai.

- Run: Run hissa woh hota hai jab price mein tezi se izafa hone ke baad ek break ya consolidation phase aata hai. Is phase mein price horizontal line ya kam izafa ke sath move karta hai.

Bump & Run Candlestick Pattern Ki Pehchan Kaise Karein?

Bump & Run Candlestick Pattern ki pehchan karne ke liye kuch ahem pointers hain:- Bump Formation: Price mein sudden aur vertical izafa, jo normal trend se mukhtalif hota hai.

- Run Formation: Price mein consolidation phase jahan horizontal ya kam izafa ke sath price move hoti hai.

- Trendline: Is pattern ke pehle phase mein, traders ek trendline draw kar sakte hain jo price ke vertical izafe ko represent karegi.

- Consolidation Area: Run phase mein, ek horizontal resistance line draw ki ja sakti hai jo price ke movement ko control karti hai.

Bump & Run Candlestick Pattern Ko Trade Kaise Karein?

Bump & Run Candlestick Pattern ko trade karte waqt, traders ko kuch important points yaad rakhne chahiye:- Confirmation: Pattern ko confirm karne ke liye, traders ko price ke horizontal izafe ko dekhna chahiye jo trendline ke upper aur lower side mein hota hai.

- Stop Loss: Trade ko enter karte waqt, traders ko stop loss order rakhna chahiye takay in case price opposite direction mein move kare, nuksan se bacha ja

-

#10 Collapse

BUMP AND RUN CANDLESTICK PATTERN

Explanation of Bump and run candlestick pattern:

Agar apko chart my bullish bump or run ka formation dikhaye dy raha hy or dono trend angel line ka angel bhi sahi hy to apko ismy kharidari karny ky liye yaha dekhna hy ky price bump pura hona pr pehli trend line ka upar closing dy deta hy to usky bad wali candlestick my apko kahridari karna hy ,or kahridari karny ky foran bad jis candlestick ny trend angel line ka upar closing di hy usky low ka nechy ka stopploss lagana hy ,trade leny ky bad apko trailing stopploss lagana hy ab ismy akhri point yahan hi hamain profit book kahan karna hy ,profit book karny ky liye apko yaha dekhna hy jaha sy bump shuru huwa hy isy ham name dety hy point A or jaha py bump ka lowest low bana hy usy ham name dety A point B, ab point A or point B ka jo difference hoga wo hamara target hoga ,jasy kah point A or point B ka difference 20 point ka hy to hamara target point ka hoga ,or jab price 20 tk ponch jaye hamy foran profit book karna hy.

Trading strategy of Bump and run candlestick pattern:

Chart my ham dekhty hain price higher support higher resistance banaty huwy market ma uptrend dikhata hy or bearish bump or run ka banana my yahan zaruri hy ky shuruwati trend uptrend ho jab price uptrend my chalty huwe do support bana dy usky bad dono support ky low ko touch kar ky ik trend angel line khenchni hy, ab yahan ham maan lety hain ky yahan trend angle line 30 degree ka angel bana rahi hy matlab ky tezi ka trend 30 degree ky angel sy chal rha hy,is pahly part ko lead-in kahty hain ismy price line ko respect karty huwe upar ki taraf barhta hy ,isky bad dusra part shuru hota hy usy kahty hain bump ,ismy hota ya hy keh price achanak sy bohat zyada pump hona lagta hy ,jab market my itna zyada pump ata hy to asy lagta hy bazar ma speculative huwa hy or isky sath volume bhi bharta hy lekin yahan tezi zyada dyr nahi chalti or price nechy any lagti hy.

Technical analysis of Bump and run candlesick pattern:

bump or run candlestick chart pattern ik technical analysis chart pattern hy jisy log khareed-o-frokht main mumkin rujhan ki tabdeeli ki nishandahi karny ky liye istemal kr sakty hain. yeh pattern qeemat ki naqal o harkat ki ik series pr mushtamil hota hy jo ik takrana banata hy, is ky baad istehkaam ya tijarti range ki muddat, or phir mukhalif simt main aik taiz harkat, ik run banati hy. is article main, hm dekhen gy ky bump or run candlestick chart pattern ka istemal karty huwe tijarat kaisy ki jaye.

-

#11 Collapse

BUMP AND RUN CANDLESTICK PATTERN

Explanation of Bump and run candlestick pattern:

Agar apko chart my bullish bump or run ka formation dikhaye dy raha hy or dono trend angel line ka angel bhi sahi hy to apko ismy kharidari karny ky liye yaha dekhna hy ky price bump pura hona pr pehli trend line ka upar closing dy deta hy to usky bad wali candlestick my apko kahridari karna hy ,or kahridari karny ky foran bad jis candlestick ny trend angel line ka upar closing di hy usky low ka nechy ka stopploss lagana hy ,trade leny ky bad apko trailing stopploss lagana hy ab ismy akhri point yahan hi hamain profit book kahan karna hy ,profit book karny ky liye apko yaha dekhna hy jaha sy bump shuru huwa hy isy ham name dety hy point A or jaha py bump ka lowest low bana hy usy ham name dety A point B, ab point A or point B ka jo difference hoga wo hamara target hoga ,jasy kah point A or point B ka difference 20 point ka hy to hamara target point ka hoga ,or jab price 20 tk ponch jaye hamy foran profit book karna hy.

Trading strategy of Bump and run candlestick pattern:

Chart my ham dekhty hain price higher support higher resistance banaty huwy market ma uptrend dikhata hy or bearish bump or run ka banana my yahan zaruri hy ky shuruwati trend uptrend ho jab price uptrend my chalty huwe do support bana dy usky bad dono support ky low ko touch kar ky ik trend angel line khenchni hy, ab yahan ham maan lety hain ky yahan trend angle line 30 degree ka angel bana rahi hy matlab ky tezi ka trend 30 degree ky angel sy chal rha hy,is pahly part ko lead-in kahty hain ismy price line ko respect karty huwe upar ki taraf barhta hy ,isky bad dusra part shuru hota hy usy kahty hain bump ,ismy hota ya hy keh price achanak sy bohat zyada pump hona lagta hy ,jab market my itna zyada pump ata hy to asy lagta hy bazar ma speculative huwa hy or isky sath volume bhi bharta hy lekin yahan tezi zyada dyr nahi chalti or price nechy any lagti hy.

Technical analysis of Bump and run candlesick pattern:

bump or run candlestick chart pattern ik technical analysis chart pattern hy jisy log khareed-o-frokht main mumkin rujhan ki tabdeeli ki nishandahi karny ky liye istemal kr sakty hain. yeh pattern qeemat ki naqal o harkat ki ik series pr mushtamil hota hy jo ik takrana banata hy, is ky baad istehkaam ya tijarti range ki muddat, or phir mukhalif simt main aik taiz harkat, ik run banati hy. is article main, hm dekhen gy ky bump or run candlestick chart pattern ka istemal karty huwe tijarat kaisy ki jaye.

- CL

- Mentions 0

-

سا0 like

-

#12 Collapse

Bump & run candlestick pattern explanation kai hy

Bump & Run Candlestick Pattern: Bump aur Run Candlestick Numayish

1. Tareef (Definition):- Bump & Run pattern ek technical analysis pattern hai jo market charts mein dekha ja sakta hai.

- Yeh pattern typically ek uptrend ke doran develop hota hai aur trend reversal ya price correction ko darust karta hai.

2. Kya Hota Hai:- Bump & Run pattern mein, pehle ek sharp price increase hota hai jo ek "bump" ya "bump phase" ko darust karta hai.

- Phir ek consolidation phase aata hai jise "lead-in phase" kehte hain, jisme price range tight hoti hai aur ek slanting trend line banati hai.

- Iske baad, ek sharp price decline hoti hai jo trend reversal ya price correction ko darust karti hai, aur ise "run" ya "run phase" kehte hain.

3. Kaise Pehchana Jaye:- Bump & Run pattern ko pehchane ke liye, pehle ek sharp price increase ya uptrend ko dekhein jo ek "bump" phase ko indicate karta hai.

- Phir ek consolidation phase dekhein jisme price range tight hoti hai aur ek slanting trend line form hoti hai.

- Ek sharp price decline ya downtrend ko dekhein jo "run" phase ko darust karta hai.

4. Matlab (Interpretation):- Bump & Run pattern ek trend reversal ya price correction ko indicate karta hai, typically ek uptrend ke doran.

- Bump & Run pattern ka appearance bullish momentum ki kamzori ya trend reversal ko darust karta hai.

5. Trading Strategy:- Entry Point: Traders entry point tab tay karte hain jab Bump & Run pattern confirm hota hai, typically "run" phase ke doran.

- Stop Loss: Protective stop-loss order ko set karna important hai, taki unexpected reversals se bacha ja sake.

- Target: Traders target levels tay karte hain, typically previous support levels ke paas.

6. Dhyaan Dein:- Confirmatory signals aur dusre technical indicators ka istemal karein.

- Pattern ke confirm hone ke liye price ka behavior closely monitor karein.

- Har trading decision se pehle thorough analysis karein.

Bump & Run pattern, trend reversal ya price correction ke indication ke saath ek potential trading opportunity provide karta hai, lekin hamesha yaad rahe ke har trading decision ke liye thorough analysis aur risk management zaroori hai.

-

#13 Collapse

Bump & run candlestick pattern explanation

bump-and-run-2.webp

Bump & Run candlestick pattern, jo ki technical analysis mein ek continuation pattern hai, typically price charts par dekha jaata hai aur market trend ka continuation indicate karta hai. Is pattern mein kuch key characteristics hote hain jo traders ko identify karne mein madad karte hain:

Key Characteristics:- Initial Uptrend (Bump): Pattern ka naam "Bump" se liya gaya hai kyunki yeh ek initial uptrend ke saath shuru hota hai. Is uptrend mein price steady growth dikhata hai.

- Sideways Consolidation (Bump): Uptrend ke baad, price sideways movement ya consolidation phase mein enter karta hai. Is phase mein price range-bound hota hai aur koi clear trend nahi hota hai.

- Rapid Uptrend (Run): Sideways consolidation phase ke baad, sudden aur rapid uptrend dekha jaata hai, jise "Run" phase kehte hain. Is phase mein price ek strong bullish momentum ke saath move karta hai.

- Breakout Confirmation: Run phase ke baad, price ek key resistance level ko break karta hai, confirming the continuation of the uptrend.

- Volume Confirmation: Ideal scenario mein, breakout ke saath saath volume bhi increase hota hai, indicating strong buying pressure aur confirmation of the pattern.

Interpretation:

Bump & Run pattern bullish continuation pattern hai, indicating ki uptrend jo already establish ho chuka hai, uska continuation hone wala hai. Is pattern ko dekh kar traders expect karte hain ki uptrend continue hoga aur price further up move karega.

Trading Strategy:- Entry Point: Traders entry points ko typically breakout ke baad set karte hain, jab price key resistance level ko break karta hai. Entry point ke liye stop-buy orders ka istemal kiya ja sakta hai.

- Stop Loss: Stop-loss order ko typically pattern ke opposite side (key support level) ke just neeche set kiya jaata hai, taki traders apne positions ko protect kar sakein agar market unexpected direction mein move kare.

- Take Profit: Take-profit orders ko traders key resistance levels ya phir price targets ke paas set karte hain, jahan wo expect karte hain ki price upar jaake wapas aayega.

Risk Management:

Bump & Run pattern ko trade karte samay, proper risk management ka dhyaan rakhna bahut zaroori hai. Stop-loss orders ka istemal karke traders apne losses ko minimize kar sakte hain aur profit targets set karke apne profits ko lock kar sakte hain.

Overall, Bump & Run candlestick pattern ek powerful bullish continuation pattern hai, jo traders ko uptrend ka continuation identify karne mein madad karta hai. Lekin, jaise har trading pattern ke saath hota hai, is pattern ko bhi proper confirmation aur risk management ke saath trade karna

- CL

- Mentions 0

-

سا7 likes

-

#14 Collapse

Bump & run candlestick pattern explanation.

Bump & Run Candlestick Pattern: Explanation

Candlestick patterns, jinhe chart analysis mein istemal kia jata hai, traders ko market trends aur price movements ke baray mein maloomat faraham karte hain. Bump & Run candlestick pattern ek aham pattern hai jo market mein price ka major reversal ya continuation indicate karta hai.

1. Pattern Ka Naam: Bump & Run candlestick pattern ka naam us ke appearance se liya gaya hai, jahan price ek "bump" ya spike dikhata hai phir ek "run" ya flat phase aata hai.

2. Pehla Stage (Bump): Yeh pattern shuru hota hai jab price mein sudden aur significant increase hota hai, jise hum "bump" kehte hain. Yeh bump existing trend ke against hota hai aur price ke sudden rise ko represent karta hai.

3. Dusra Stage (Run): Dusra stage mein, price mein ek period aata hai jahan price kaam karna band kar deta hai ya sidha rehta hai, jise hum "run" kehte hain. Is stage mein, price ka movement slow ho jata hai aur consolidation ka phase shuru ho jata hai.

4. Teesra Stage (Breakdown or Breakout): Teeno stages ke baad, ek significant event hota hai. Agar existing trend opposite direction mein tha, toh price mein breakdown hota hai, jismein price neeche ki taraf jaata hai. Agar existing trend ke saath tha, toh price mein breakout hota hai, jismein price upar jaata hai.

5. Pattern Ka Confirmation: Pattern ka confirmation tab hota hai jab price ke breakout ya breakdown ke sath significant volume ka sath ho. Yeh volume traders ki activity ko reflect karta hai aur pattern ki authenticity ko confirm karta hai.

6. Trade Entry aur Exit: Agar pattern ka confirmation mil gaya hai, toh traders entry aur exit points tay karte hain, jisse woh market mein sahi samay par enter aur exit kar sakein.

Bump & Run candlestick pattern ek powerful tool hai jo traders ko market trends aur price movements ke baray mein maloomat faraham karta hai. Iski samajh se traders apne trading strategies ko improve kar sakte hain aur profit generate kar sakte hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 Collapse

What is bump and run candlestick pattern in forex trading.

Agar apko chart my bullish bump or run ka formation dikhaye dy raha hy or dono trend angel line ka angel bhi sahi hy to apko ismy kharidari karny ky liye yaha dekhna hy ky price bump pura hona pr pehli trend line ka upar closing dy deta hy to usky bad wali candlestick my apko kahridari karna hy ,or kahridari karny ky foran bad jis candlestick ny trend angel line ka upar closing di hy usky low ka nechy ka stopploss lagana hy ,trade leny ky bad apko trailing stopploss lagana hy ab ismy akhri point yahan hi hamain profit book kahan karna hy ,profit book karny ky liye apko yaha dekhna hy jaha sy bump shuru huwa hy isy ham name dety hy point A or jaha py bump ka lowest low bana hy usy ham name dety A point B, ab point A or point B ka jo difference hoga wo hamara target hoga ,jasy kah point A or point B ka difference 20 point ka hy to hamara target point ka hoga ,or jab price 20 tk ponch jaye hamy foran profit book karna hy.

Trading strategy with bump and run candlestick pattern in forex trading.

Chart my ham dekhty hain price higher support higher resistance banaty huwy market ma uptrend dikhata hy or bearish bump or run ka banana my yahan zaruri hy ky shuruwati trend uptrend ho jab price uptrend my chalty huwe do support bana dy usky bad dono support ky low ko touch kar ky ik trend angel line khenchni hy, ab yahan ham maan lety hain ky yahan trend angle line 30 degree ka angel bana rahi hy matlab ky tezi ka trend 30 degree ky angel sy chal rha hy,is pahly part ko lead-in kahty hain ismy price line ko respect karty huwe upar ki taraf barhta hy ,isky bad dusra part shuru hota hy usy kahty hain bump ,ismy hota ya hy keh price achanak sy bohat zyada pump hona lagta hy ,jab market my itna zyada pump ata hy to asy lagta hy bazar ma speculative huwa hy or isky sath volume bhi bharta hy lekin yahan tezi zyada dyr nahi chalti or price nechy any lagti hy.

Technical analysis of bump and run candlestick pattern.

bump or run candlestick chart pattern ik technical analysis chart pattern hy jisy log khareed-o-frokht main mulestick imkin rujhan ki tabdeeli ki nishandahi karny ky liye istemal kr sakty hain. yeh pattern qeemat ki naqal o harkat ki ik series pr mushtamil hota hy jo ik takrana banata hy, is ky baad istehkaam ya tijarti range ki muddat, or phir mukhalif simt main aik taiz harkat, ik run banati hy. is article main, hm dekhen gy ky bump or run candlestick chart pattern ka istemal karty huwe tijarat kaisy ki jaye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:43 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим