Swing Trading Strategy

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Swing Trading Strategy -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Assalamu Alaikum Dosto!

Swing Trading

Swing trading ka mtlb hai market swings se munafa kamana. Yeh aik maqbool speculative strategy hai jahan traders apni assets ko khareedte aur hold karte hain, ummed hai ke market movement se munafa hoga. Swing trading se gap risk ka samna hota hai, magar yeh technical analysis ko istemal karte hue entry aur exit points ko tafreeq dene me madadgar hai. Asal me, swing trading din bhar ke trading aur trend trading ke darmiyan aata hai.

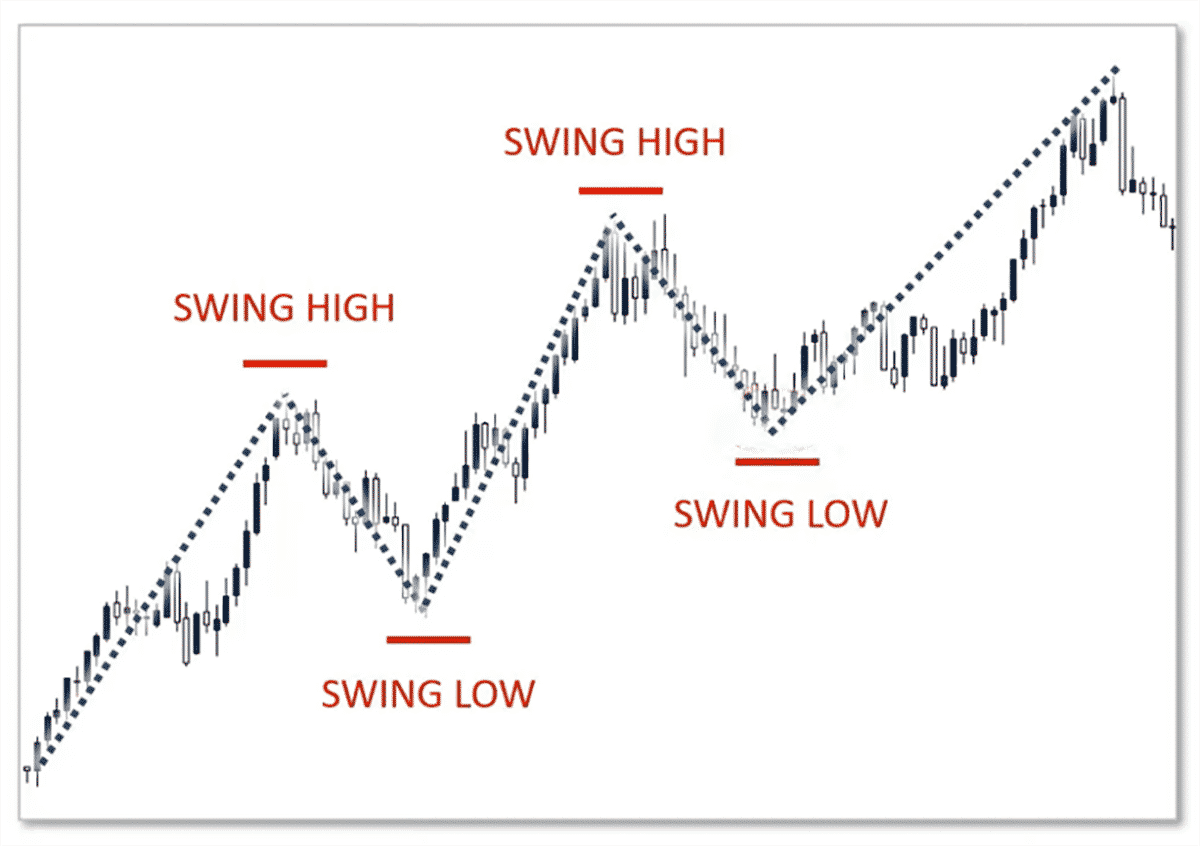

Swing trading me, aap apni position ko aik din se zyada ya weeks tak hold karte hain taake Forex market me price swings se munafa kama sakein. Yeh trading style un traders ke liye behtareen hai jo rozana currency pair price charts ko monitor nahi karna chahte aur jinke paas itna sabr hai ke wo kam az kam 2 din se kuch weeks tak hold karke rakhein.- Traders zyada currency pair khareedte hain swing lows par (jo aik steep decline hoti hai price me pehle ke sharp rise se pehle).

- Traders zyada currency pair bechte hain swing highs par (jo aik sharp increase hoti hai price me pehle ke steep decline se pehle).

Example:

Agar aap USD/EUR ko weekly uptrend ke dauran trade karna chahte hain, to aap pehle week ke aghaz se USD/EUR currency pair ke price swings ka tajziya aur monitoring karenge aur dekhenge ke market trend kab se mojood hai.

Agar USD/EUR prices moving average prices ke kareeb hain aur pehle bhi aisa raha hai, to aap moving average price se thoda neeche currency pair khareedne ka order de sakte hain.

Misal k tawar par current USD/EUR price 2 hai, aur average price 2.2 hai. Aap 1.98 par buy order place kar sakte hain. Jab uptrend ke dauran swing low ho, to aapka order execute hoga aur aap is level par khareedenge, jo aapke munafa ka potential barhata hai.

Jab aap 1.98 par khareed lete hain, to aap currency pair ko tab tak hold kar sakte hain jab tak ke currency pair prices barhna shuru na ho jayein. Yeh kuch weeks le sakta hai, aur har raat kuch ghanton ke liye prices ko monitor karna aapko market me informed decisions lene me madadgar hoga. Maan lijiye ke do weeks me market significantly barh gaya, aur ab USD/EUR 3 par trade ho raha hai. Aap is level par sell order place karke har unit par 1.02 ka munafa kama sakte hain.

Swing Trading ke Top Benefits- Minimal time commitment

- Swing traders ko trading system ke samne zyada waqt guzarna nahi padta. Kyunki wo currency pairs ko kuch din tak hold karte hain, unka daily trading ka time kam hota hai. Currency pairs ke technical analysis ko har kuch din me kuch ghanton me perform kiya ja sakta hai, aur sirf din ke aakhir me kuch minute lagenge daily market movements ko analyze karne me. - Capital doesn’t get locked for long

- Swing trading me amount ko zyada dinon tak invest karne ki zaroorat hoti hai, lekin yeh aapka capital long term me lock nahi karta. Kyunki swing trading ek medium-term trading style hai, yeh aapko zyada flexibility deta hai apne funds ko manage karne ke liye bina unhe future me tie down kiye. - Increased profits

- Aik proper strategy aur risk management plan aapke trades ko profitable bana sakte hain aur aap kuch dinon me hi kama sakte hain. On average, swing traders 10% har week aur 50% tak capital investment kama sakte hain agar wo apni strategies ko sahi se apply karein. Iske liye bas patience aur consistency chahiye. - Small position sizes for significant returns

- Forex market me choti position sizes le sakte hain taake large price moves se multiple days me significant returns kama sakein. Kyunki percentage gain zyada hota hai, trader ko kam capital lagta hai. Yeh aapke capital ko kam risk me rakhta hai magar aapke trades ko meaningful banata hai large swings ke zariye.

Top Swing Trading Indicators- Ease of movement

- Currency pair ke volume ka price se reaction samajhne ke liye zero baseline ka istemal hota hai. Jab currency pair prices is line se upar hoti hain, yeh buy signal hota hai. Aur jab yeh baseline se neeche hoti hain, yeh sell signal hota hai. - Moving averages

- Market me ek given period ke liye average price calculate karne me madadgar hoti hai. Swing traders moving averages ka istemal karte hain market trends ko confirm karne ke liye. Market bullish hota hai jab short-term moving average, long-term moving average ko neeche se cross karti hai. Market bearish hota hai jab short-term moving average, long-term moving average ko upar se cross karti hai. - Volume

- High volume ke saath trading trend ko strong banata hai. Upward direction me, buy karna aur downward direction me, sell karna advisable hota hai. Low volumes ke saath trading weak trend ko signal karti hai, market direction ke against trade karna advisable hota hai. - Relative strength index (RSI)

- Market ke oversold ya overbought hone ka pata chalata hai. RSI 70 se upar ho to sell signal aur 30 se neeche ho to buy signal hota hai.

Top Swing Trading Strategies for Forex Traders- Fibonacci Retracement trading strategy

- Resistance aur support levels identify karne me madadgar hoti hai. Accurate Fibonacci retracement levels market reversals ko dikhate hain: 23.6%, 38.2%, aur 61.8%. - MACD crossovers trading strategy

- Bullish aur bearish market trends identify karne ke liye do moving averages plot ki jaati hain. MACD line jab signal line ko neeche se cross karti hai to bullish signal aur upar se cross karti hai to bearish signal hota hai. - Support and Resistance trading strategy

- Accurate buy aur sell decisions lene me madadgar hoti hai. Support level par uptrend me buy aur resistance level par downtrend me sell karna advisable hota hai. - T-line trading strategy

- Profitable entry aur exit levels identify karne me madadgar hoti hai. T-line 8-day exponential moving average hota hai. Long trade me currency pair price ko t-line ke upar close karna aur short trade me neeche close karna dekha jata hai. - Japanese Candlesticks trading strategy

- Opening, closing, low aur high prices ko samajhne me madadgar hoti hai. Green candlesticks upward direction aur red candlesticks downward direction ko show karti hain.

Top Swing Trading Strategies for Forex Traders

Swing trading aapko Forex market me kam stress ke saath trade karne aur profit potential badhane ka mauka deti hai. Aap technical analysis ka istemal har din ke aakhir me karke strong market trends ko identify kar sakte hain aur accordingly trade orders place kar sakte hain. Blueberry Markets ke saath trading karna aapko kai swing trading strategies apply karne ka mauka deta hai taake trading opportunities maximize ho sakein.

Forex market high liquidity aur margin opportunities offer karta hai jisse aap exchange rates of currencies se potentially munafa kama sakte hain. 2019 me, $6.6 trillion se zyada ka daily volume ke saath, yeh duniya ka sabse bara financial market hai.

Aik advanced trading platform, MT4 seasoned Forex traders ke liye norm ban chuka hai kyunki yeh unhe unke machine off hone par bhi trades execute karne me madad karta hai. Isme user-friendly interface, numerous technical analysis tools for forecasting market patterns, real-time currency price data, aur bahut kuch shamil hai.

Bahut se log Forex trading me aana chahte hain aur jaldi munafa kamaana chahte hain, magar kuch hi log jante hain ke shuruat kaise karein. Forex trading online ab powerful platforms jaise ke Blueberry Markets ke wajah se asaan ho gayi hai, lekin phir bhi isme shuru karna daunting lag sakta hai.

Forex trading usually stocks jaise financial instruments ke muqablay me zyada leverage provide karta hai. Yeh primary reason hai ke itne log Forex trading ki taraf attract hote hain, aur zyada se zyada log Forex trading market me enter karte hain.

Forex me apna pehla trade successfully karne ke liye trading basics aur Forex trading strategies ka gehra ilm zaroori hai. Trading currencies ka learning curve overwhelming aur complex lag sakta hai, magar jab aapke paas sahi information ho, to yeh process aur bhi asaan ban jata hai.

Jab aap ek currency spot position ko raat bhar hold karte hain, to aap jo interest kamate hain ya dete hain usse rollover amount kehte hain. Har currency ka alag overnight interbank interest rate hota hai, aur kyunki aap Forex pairs me trade karte hain, to aapko do alag interest rates se deal karna padta hai.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

### Pivot Point Ka Taaruf 1. **Pivot Point Ka Taaruf** - Pivot Point ek technical analysis tool hai jo traders ko market ke potential support aur resistance levels identify karne mein madad karta hai. Yeh levels market ki previous day ki high, low, aur closing prices ko consider karke calculate kiye jate hain. 2. **Pivot Point Ki Importance** - **Trend Direction**: Pivot Points ko use karke traders trend direction ko determine kar sakte hain. Agar price pivot point ke upar trade kar rahi ho, to yeh bullish signal hota hai, aur agar neeche ho, to yeh bearish signal hota hai. - **Support aur Resistance**: Pivot Point ke aas-paas ke levels as support aur resistance ka kaam karte hain. Yeh levels price ke bounce ya breakout hone ke liye critical hote hain. 3. **Pivot Point Levels** - **Main Pivot Point (P)**: Yeh central point hota hai jo previous day ki high, low, aur close prices ka average hota hai. Iske around market ki movement ko analyze kiya jata hai. - **Support Levels (S1, S2, S3)**: Yeh levels market ke neeche support areas ko indicate karte hain. Price in levels tak jaane par often bounce karti hai. - **Resistance Levels (R1, R2, R3)**: Yeh levels market ke upar resistance areas ko indicate karte hain. Price in levels tak jaane par often retrace hoti hai. 4. **Pivot Points Ka Calculation** - **Formula**: Main pivot point (P) ko calculate karne ke liye formula use hota hai: - P = (High + Low + Close) / 3 - Support 1 (S1) = (2 * P) - High - Resistance 1 (R1) = (2 * P) - Low - Support 2 (S2) = P - (High - Low) - Resistance 2 (R2) = P + (High - Low) 5. **Trading Strategies** - **Pivot Point Bounce**: Is strategy mein traders pivot point ya support/resistance levels par price ke bounce hone par trade enter karte hain. Yeh strategy trend reversal ko capture karne mein madad karti hai. - **Pivot Point Breakout**: Is strategy mein traders pivot point ya support/resistance levels ke breakout hone par trade enter karte hain. Breakout strategy market ke strong trends ko capitalize karne ke liye use hoti hai. 6. **Market Conditions** - **Trending Markets**: Trending markets mein pivot points support aur resistance levels ko identify karne mein effective hote hain, jahan price trends ko follow karta hai. - **Range-Bound Markets**: Range-bound markets mein pivot points range ke boundaries ko identify karne mein madad karte hain, jahan price in boundaries ke andar move karta hai. 7. **Risk Management** - **Stop-Loss Placement**: Pivot points ko use karke traders stop-loss levels ko accurately place kar sakte hain. Isse risk control hota hai aur unexpected market movements se protection milti hai. - **Target Setting**: Traders pivot point levels ko use karke apne profit targets set kar sakte hain, jo price movements ke potential reversal points ko indicate karte hain. 8. **Summary** - Pivot Point ek powerful tool hai jo traders ko market ke key support aur resistance levels ko identify karne mein madad karta hai. Isse trading decisions ko accurately plan kiya ja sakta hai, chahe market trending ho ya range-bound. Effective use ke liye pivot points ko risk management aur trading strategy ke saath align karna zaroori hai. -

#4 Collapse

Swing tradingSwing trading ki ehmiyat

As salam o alaikum mere aziz dosto, Forex swing trading ek popular trading strategy hy jisme traders market ke short to medium-term price movements ka faida uthane ki koshish karte hein. Yeh approach un traders ke liye hoti hy jo long-term trends ko dekhte hein, lekin short-term price swings ko bhi utilize karna chahte hein. Swing trading main traders aam tor par ek position ko ek se do hafton ke liye hold karte hein, jo ki daily or weekly charts ke analysis ke zariye kiya jata hy.Swing trading main, traders price swings or reversals ka faida uthate hein. Iska matlab hy ke woh market ke fluctuation ko analyze kar ke decide karte hein ke kab entry or exit leni chahiye. Yeh strategy un logon ke liye bhi ideal hy jo full-time trading nahi kar sakte lekin market ke major moves se faida uthana chahte hein.Swing trading ke liye accurate analysis or patience dono zaroori hein. Traders ko market ki overall direction or trend changes ko samajhna padta hy. Yeh trading style un traders ke liye bhi suitable hy jo technical analysis or chart patterns ko use kar ke trading decisions lete hein. Forex swing trading ke liye sahi time frame ka intekhab bohot important hy. Time frame aapki trading strategy, goals, or market conditions ko define karta hy. Daily, 4-hour, hourly, or weekly charts ko analyze karke, traders market ke short-term or long-term trends ko identify kar sakte hein. Har time frame ka apna unique role or benefits hote hein, or traders ko apni trading style or preferences ke mutabiq sahi time frame ko select karna chahiye. Forex swing trading main time frame selection ka proper understanding or implementation traders ko market ke trends or signals ko accurately analyze karny main madad karta hy. Effective time frame selection or risk management se traders market ke uncertainties or fluctuations ko manage kar sakte hein, jo ke trading performance or overall success ko enhance karta hy.

Importance of Swing trading

Market Sentiment

Double top pattern market ke sentiment ko behter samjhne main madad karta hy. Jab traders do baar ek hi level par resistance dekhte hein, to ye indicate karta hy ke buyers ka momentum kam ho raha hy. Iska matlab hy ke market bearish hone ke liye tayar ho raha hy. Is signal ko samajhne se traders ko unhe decisive action leni ki ahemiyat samajh aati hy.

Risk Management

Double top pattern ke istemal se traders apne risk management strategies ko behtar kar sakte hein. Jab ye pattern banta hy, traders potential sell opportunities ko dekh sakte hein. Is pattern ke zariye wo apne stop-loss or take-profit levels ko bhi behtar tareeqe se set kar sakte hein.

Double Top ki Trading Strategy

Ek effective trading strategy jo double top pattern par based hoti hy, wo kuch is tarah se hoti hy:- Identification: Doubt top ko pehchanein or confirm karein ke ye pattern sahih hy.

- Entry Point: Trough level ke neeche entry karna.

- Stop-Loss: Pehli resistance peak ke upar stop-loss set karein, taake agar market galat ho to losses minimize ho sakein.

- Take-Profit: Pehli trough ke neeche ya market ke support level par take-profit set karein.

-

#5 Collapse

### Swing Trading Strategy

Swing trading forex aur stocks market mein ek popular strategy hai, jo short to medium-term price movements ko capture karne ke liye use hoti hai. Is strategy ka maksad yeh hota hai ke market ke short-term trends ka faida utha kar profit kamaya jaye, baghair market ke har choti-moti movement ke peeche bhagne ke. Is post mein hum swing trading strategy ke basic concepts aur usko follow karne ke tareeqe ko discuss karenge.

**Swing Trading Kya Hai?**

Swing trading ek aisi strategy hai jisme traders market mein 2 din se lekar kuch weeks tak positions hold karte hain. Is strategy ka maksad market ke short-term trends aur reversals ko capture karna hota hai. Swing traders aksar market ke significant highs aur lows ko identify karke, unke beech mein buy aur sell karte hain. Is strategy mein day trading ki tarah har roz trade karna zaroori nahi hota, balki wo trades liye jate hain jo substantial price movements dikhate hain.

**Swing Trading ke Liye Best Indicators**

Swing trading mein technical analysis bohot important hota hai. Aapko price trends, support aur resistance levels, aur technical indicators ko samajhna hota hai taake sahi trades li ja sakein. Kuch popular indicators jo swing traders use karte hain:

1. **Moving Averages**: Moving averages ko use karna trend direction aur potential reversal points ko identify karne ke liye helpful hota hai. 50-day aur 200-day moving averages zyada tar swing traders use karte hain.

2. **Relative Strength Index (RSI)**: RSI ek momentum oscillator hai jo overbought aur oversold conditions ko identify karne mein madad deta hai. Jab RSI 70 ke upar ho, to market overbought aur 30 ke neeche ho to oversold consider ki jati hai. Yeh points swing trading ke liye ideal entry aur exit points provide karte hain.

3. **Fibonacci Retracement**: Fibonacci levels ka use market ke pullbacks aur potential reversal points ko identify karne ke liye hota hai. Swing traders in levels par focus karte hain jahan se market reversal kar sakti hai.

**Swing Trading ka Faida**

Swing trading ka sabse bada faida yeh hai ke yeh time-consuming nahi hoti. Aapko har roz trading desk pe ghanton bethe rehne ki zaroorat nahi hoti. Is strategy mein, aap apne trades ko plan kar sakte hain, aur phir market ko observe karte hain taake sahi entry aur exit points identify ho sakein.

Iske alawa, swing trading zyada flexible hoti hai aur risk management ke liye behtareen options provide karti hai. Kyunki trades kuch dino se lekar weeks tak hold ki jati hain, isliye aapko har small price movement ke liye pareshaan hone ki zaroorat nahi hoti.

**Risk Management**

Jahan swing trading profitable ho sakti hai, wahan risk management ka dhyan rakhna bohot zaroori hai. Stop-loss orders ka istimal zaroor karein taake unexpected market reversals se bach sakein. Aapko apne position size ko bhi carefully manage karna chahiye taake kisi ek trade se aapke capital pe zyada asar na pade.

**Conclusion**

Swing trading ek balanced approach hai jo traders ko market ke short to medium-term opportunities ka faida uthane ka moka deti hai. Is strategy mein patience, technical analysis, aur strong risk management skills ka hona zaroori hai. Agar sahi tarah se ki jaye, to swing trading aapko consistent profits dilwa sakti hai, aur aapke trading journey ko successful bana sakti hai.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

**Swing Trading Strategy**

Swing trading aik aisi trading technique hai jisme trader short-term price movements se faida uthane ki koshish karta hai. Yeh strategy un logon ke liye zyada munasib hoti hai jo na to din bhar trading karna chahte hain aur na hi long-term investments mein interested hain. Swing trading ka maqsad price ke chhote cycles ko capture karna hota hai, jo kay aik ya do din se lekar kuch hafton tak ho sakti hain.

**Swing Trading Ki Buniyadi Soch**

Swing traders market ke trend ko dekhte hain aur usmein aane wale changes ko samajhne ki koshish karte hain. Unka maqasad price ke peak (top) aur trough (bottom) points ko identify karna hota hai, taake woh un points par buy ya sell kar sakein. Yeh traders mostly technical analysis par rely karte hain, jisme charts, indicators aur patterns ka istemal kiya jata hai.

**Technical Indicators Ka Istemaal**

Swing trading mein kai technical indicators ka use hota hai, jaise kay Moving Averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), aur Fibonacci Retracement. Moving Averages se traders ko yeh pata chalta hai ke market ka trend kis direction mein hai. RSI overbought aur oversold conditions ko identify karne mein madad deta hai, jabke MACD trend ki strength ko measure karta hai.

**Risk Management**

Swing trading mein risk management bohot zaroori hai. Stop-loss orders ka istemal karna chahiye taake agar market aapke against jaye to aapka nuksan limited ho. Iske alawa, position size ka dhyan rakhna bhi zaroori hai taake aapki ek galat trade aapke portfolio ko poori tarah se na nuksan pohncha sake. Proper risk management ke baghair swing trading mein successful hona mushkil ho sakta hai.

**Time Commitment**

Swing trading ki khas baat yeh hai ke ismein full-time commitment ki zaroorat nahi hoti. Aap din bhar charts dekhne ke bajaye bas important times par market ko monitor kar sakte hain, jaise ke market open ya close hotay waqt. Is technique mein aapko patience aur discipline ka bhi hona zaroori hai, kyunke kabhi kabhi trades mein waqt lag sakta hai aur impulsive decisions se aapko nuksan ho sakta hai.

**Conclusion**

Swing trading aik effective strategy hai un logon ke liye jo price ke short-term movements ko capture karna chahte hain lekin din bhar trading nahi karna chahte. Is technique mein technical analysis, proper risk management aur discipline bohot zaroori hai. Agar in cheezon ka dhyan rakha jaye, to swing trading se consistent profits hasil kiye ja sakte hain.

-

#7 Collapse

**Swing Trading Strategy**

Swing trading ek aisi trading strategy hai jisme traders short to medium-term price swings se faida uthate hain. Is strategy ka maqsad hai market ki temporary fluctuations ka faida uthana, jo ke ek ya do hafton ke dauran hota hai. Swing traders usually technical analysis par zyada rely karte hain aur unka focus hota hai price patterns aur trends par. Yahan kuch key aspects hain jo swing trading strategy ko samajhne mein madadgar sabit ho sakte hain.

**1. Market Analysis**

Swing trading ke liye market analysis bohot zaroori hai. Traders technical analysis tools ka istemal karke market trends aur potential entry aur exit points identify karte hain. Yeh analysis indicators jese Moving Averages, Relative Strength Index (RSI), aur MACD (Moving Average Convergence Divergence) ke zariye kiya jata hai. Chart patterns aur candlestick patterns ko bhi analyze kiya jata hai jo market ke future movements ka signal dete hain.

**2. Entry and Exit Points**

Swing trading me, entry aur exit points ko sahi waqt par identify karna zaroori hai. Entry point wo waqt hota hai jab trader market me position enter karta hai, jab price trend ki direction me moving hoti hai. Exit point wo waqt hota hai jab trader apni position ko close karta hai, jab price swing complete hota hai ya trend reversal ka signal milta hai. Yeh points technical indicators aur chart patterns ke zariye identify kiye jate hain.

**3. Risk Management**

Swing trading me risk management bhi important hota hai. Traders apni trades ke liye stop-loss orders set karte hain taake agar market unke against chale to losses ko control kiya ja sake. Risk-reward ratio bhi consider kiya jata hai, jo trade me potential profit ko potential loss ke sath compare karta hai. Achi risk management strategy se traders apni overall performance improve kar sakte hain aur large losses se bach sakte hain.

**4. Position Sizing**

Position sizing ka matlab hai trade me invest kiye gaye amount ka tay karna. Swing traders ko yeh decide karna hota hai ke woh ek trade me kitna risk le sakte hain aur kitna capital allocate karna hai. Yeh depend karta hai trader ke risk tolerance aur account size par. Achi position sizing strategy se traders apni capital ko efficiently utilize kar sakte hain aur long-term profitability achieve kar sakte hain.

**5. Market Conditions**

Swing trading ki success largely market conditions par depend karti hai. Traders ko market ki volatility aur liquidity ko assess karna hota hai. High volatility aur high liquidity markets me swing trading zyada profitable ho sakti hai. Iske ilawa, economic events aur news releases bhi market movements ko affect karte hain, jo traders ko apni strategies ko adjust karne me madad deti hain.

**6. Continuous Learning**

Swing trading me success ke liye continuous learning aur improvement zaroori hai. Traders apni past trades ko review karte hain aur unse seekhte hain. Market trends aur trading strategies me changes ko monitor karna bhi important hai.

Swing trading ek flexible aur potentially profitable strategy hai agar sahi tools aur techniques ka istemal kiya jaye. Traders ko market ki movements ko accurately predict karna hota hai aur apne trading decisions ko disciplined aur informed rakhna hota hai.

-

#8 Collapse

Swing trading

Swing trading ek tarikiba hai jisme trader ek trading position ko kuch dinon ya hafton tak hold karte hain, ummeed kartay hain ki usmein kuch pip ka faida hoga. Yeh tarikiba short-term trading aur long-term investing ke beech mein aata hai.

Swing trading mein trader market ki direction ko samajhne ki koshish karte hain aur phir usse mutabiq apna trade set karte hain. Woh kuch dinon ya hafton tak apna trade hold karte hain aur phir usse bech dete hain jab unko lagta hai ki market ne apni direction badli hai.

Swing trading ki kuch khubiyan hain:

- Trader ko market ki direction ko samajhne ki zaroorat nahin hoti hai, woh sirf apni trade ko sahi time par set karna hota hai.

- Trader ko apna trade hold karne ki zaroorat nahin hoti hai, woh kuch dinon ya hafton tak apna trade hold kar sakta hai.

- Swing trading mein risk kam hota hai kyunki trader apna trade hold karne ki zaroorat nahin hoti hai.

Lekin swing trading ki kuch kamiyan bhi hain:

- Trader ko market ki direction ko samajhne ki zaroorat hoti hai, agar woh galat direction mein trade set karte hain toh woh nuksan kar sakte hain.

- Swing trading mein trader ko apna trade hold karne ki zaroorat hoti hai, agar woh apna trade hold nahin karte hain toh woh nuksan kar sakte hain

Importance of Swing trading

Market Sentiment

Double top pattern market ke sentiment ko behter samjhne main madad karta hy. Jab traders do baar ek hi level par resistance dekhte hein, to ye indicate karta hy ke buyers ka momentum kam ho raha hy. Iska matlab hy ke market bearish hone ke liye tayar ho raha hy. Is signal ko samajhne se traders ko unhe decisive action leni ki ahemiyat samajh aati hy.

Risk Management

Double top pattern ke istemal se traders apne risk management strategies ko behtar kar sakte hein. Jab ye pattern banta hy, traders potential sell opportunities ko dekh sakte hein. Is pattern ke zariye wo apne stop-loss or take-profit levels ko bhi behtar tareeqe se set kar sakte hein.

Double Top ki Trading Strategy

Ek effective trading strategy jo double top pattern par based hoti hy, wo kuch is tarah se hoti hy:- Identification: Doubt top ko pehchanein or confirm karein ke ye pattern sahih hy.

- Entry Point: Trough level ke neeche entry karna.

- Stop-Loss: Pehli resistance peak ke upar stop-loss set karein, taake agar market galat ho to losses minimize ho sakein.

- Take-Profit: Pehli trough ke neeche ya market ke support level ..

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

### Swing Trading Strategy

Swing trading ek popular trading strategy hai jo traders ko short-term price movements se faida uthane ka moka deti hai. Is strategy mein traders zyada tar kuch din se lekar kuch hafton tak position rakhte hain, jo unhein market ke short to medium-term trends ka faida uthane mein madad deti hai.

**Swing Trading Ka Maqsad:**

Swing trading ka maqsad hai market ke temporary swings ka faida uthana. Traders price trends ke short-term swings ko identify karte hain aur in par buy ya sell karte hain. Yeh strategy trend-following aur contrarian approaches ka combination hoti hai.

**Swing Trading Ke Liye Tools:**

1. **Technical Analysis:** Swing traders zyada tar technical analysis ka use karte hain. Isme chart patterns, technical indicators jaise moving averages, RSI (Relative Strength Index), aur MACD (Moving Average Convergence Divergence) shamil hain. Yeh tools traders ko entry aur exit points determine karne mein madad dete hain.

2. **Chart Patterns:** Popular chart patterns jaise Head and Shoulders, Double Top, aur Flags ko analyse karna bhi zaroori hota hai. In patterns se traders ko market ke potential reversals aur continuations ke baare mein idea milta hai.

3. **Support aur Resistance Levels:** Market ke support aur resistance levels ko identify karna bhi zaroori hai. In levels ke around price movements ko observe karke traders apne entry aur exit points decide karte hain.

**Swing Trading Ke Faide:**

1. **Short-Term Profits:** Swing trading se traders ko short-term price swings se faida mil sakta hai. Yeh strategy un logon ke liye behtareen hai jo daily trading ka time nahi rakhte lekin market ke chote trends se fayda uthane mein interested hain.

2. **Flexibility:** Swing trading me traders ko har din actively trade nahi karna padta. Yeh un logon ke liye suitable hai jo ek flexible schedule maintain kar sakte hain aur market trends ko dekh kar decisions le sakte hain.

**Swing Trading Ke Challenges:**

1. **Market Volatility:** Swing trading me market volatility ko handle karna padta hai. Kabhi kabhi market ka sudden movement traders ke profits ko affect kar sakta hai. Isliye risk management bahut zaroori hai.

2. **Emotional Discipline:** Swing trading me traders ko emotional discipline maintain karna padta hai. Market ke swings ko dekh kar panic ya overconfidence se bachna zaroori hai.

**Conclusion:**

Swing trading ek effective strategy hai jo traders ko short to medium-term trends se faida uthane ka moka deti hai. Technical analysis, chart patterns, aur support-resistance levels ke saath proper risk management ke zariye traders apni trading strategy ko improve kar sakte hain. Yeh strategy un logon ke liye suitable hai jo trading me active participation aur strategic approach dono ko balance karna chahte hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#10 Collapse

INTRODUCTION

Dear fellows forex business mein differenet trading strategies use ki jati hein jo mikhtalif time per traders ko market ki direction ko predict kerny mein help kerti hein. Swing trading bi aesi hee aik strong indication wali strategy hay. Swing trading eik trading approach hay jis mein traders short term price movements par focus karte hain, jo kuch din ya weeks ke dauran hoti hain. Yeh traders market kay short to medium term trends ko capture karne ka aim rakhte hain, aur is mein unn logon ko shamil karta hain jo long term investment karne ke bajaye short term price fluctuations sey profit earning ko like kerty hain.

DESCRIPTION

Swing trading, market ki volatility ke liye sensitive hoti hay. Sudden price fluctuations, jo ke market mein common hote hain, traders ke liye nuksan ka reason ban sakte hain. Long term ki analysis mein overtrading sey bachna zaroori hay. Agar traders zyada se zyada positions lete hain, to unka risk barh jata hay aur control kho jata hay. Unexpected news ya events ka sudden impact market trends par hota hay, jo kay swing traders ke liye a challenge ho sakta hay. Aise situations mein traders ko flexible rehna zaroori hay. Long term ki analysis mein successful honay kay liye traders ko apne emotions per control hona chahiye. Greed aur fear factor sey bachne kay liye emotional stability ka hona zaroori hay. Taa kay small movements ko final movement imagine na kiya jaye aur complete trend kay change hony tak wait kerna trading ko impactful bana sakta hay.

HISTORICAL FACTORS

Market mein kisi bi pattern ya rechnique ko final nahi samajna chehye but oss pattern ya strategy ki historical data ko study ker kay traders oss ki reliability ko calculate ker kay apni trading per apply ker sakty hein. Jis ki waja sey trading bi improve ho sakti hay aur sath data ki availability ki waja sey analysis kerkay jo trade place ki jaye ge oss sey better results produce ho sakty hein.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:38 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим