What is double top pattern?

"Double Top" ek technical analysis pattern hai jo traders ko market trend reversal ke possible signs ko identify karne mein madad karta hai. Ye pattern typically uptrend ke baad aata hai aur bearish reversal ko indicate karta hai.

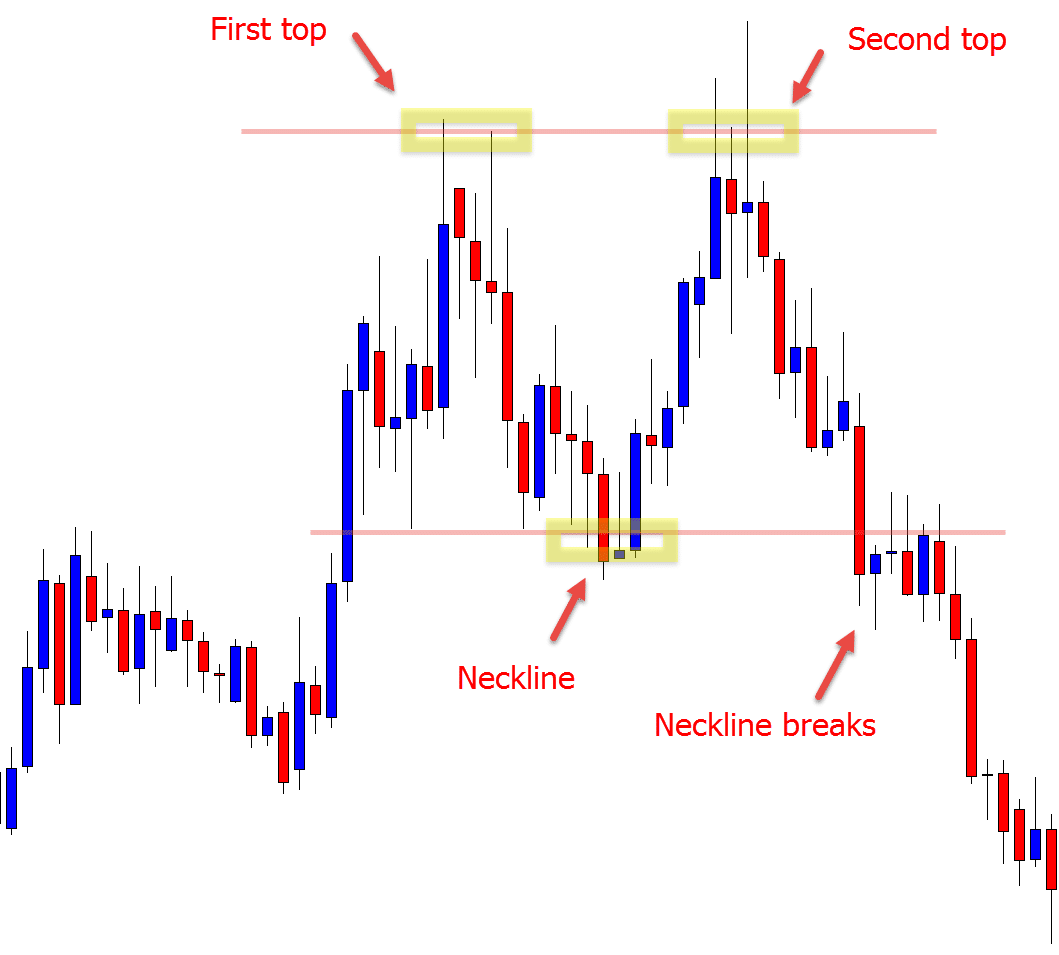

Double Top pattern ka formation do high points ya peaks ke around hota hai jo ek horizontal line, jo neckline ke roop mein jaani jaati hai, se connect hote hain. Visual description ke liye, agar aap price chart dekh rahe hain aur dekhte hain ki price pehle ek peak banata hai, fir gir kar upar aata hai aur doosra similar level par ek aur peak banata hai, toh ye ek Double Top pattern ka indication ho sakta hai.

Double Top pattern ka structure is tarah hota hai:

- First Peak (Left Peak): Pehla peak uptrend ke doran banata hai. Jab price ek certain level tak pahunchta hai aur fir se girne lagta hai, toh ye pehla peak ban sakta hai.

- Valley (Low Between Peaks): Pehle peak ke baad price gir kar ek certain level tak aata hai, lekin phir se upar jaakar doosra peak banata hai. Is valley ya low point ko bhi dekha jaata hai.

- Second Peak (Right Peak): Doosra peak pehle ke barabar ya kareeb hota hai. Is peak ka level bhi pehle ke peak ke barabar hota hai.

- Neckline: Ek horizontal line jo pehle peak aur doosre peak ke bottoms ko connect karti hai, isko neckline kehte hain. Ye level important hota hai kyunki agar price is level ko neeche karta hai, toh ye ek bearish reversal ko indicate karta hai.

Jab price neckline ko break karta hai, toh ye suggest karta hai ke buyers ka control kamzor ho gaya hai aur sellers ka dominance shuru ho gaya hai. Traders is signal ko dekhte huye apne trading strategies ko adjust kar sakte hain, jaise ke short positions enter karke ya existing long positions ko close karke.

Hamesha yaad rahe ke ek single pattern par pura bharosa na karein. Dusre technical indicators aur market analysis tools ka bhi istemal karein taki aapko market ke overall context ka sahi andaza ho. Trading mein risk management ka bhi khayal rakhna zaroori hai.

تبصرہ

Расширенный режим Обычный режим