Long Term Trading aur Short Term Trading Mein Farq

`

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Long Term Trading aur Short Term Trading Mein Farq -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Long Term Trading aur Short Term Trading dono forex market mein istemal hone wale do mukhya tarah ke trading approaches hain. In dono mein kafi farq hota hai, jo neeche diye gaye points mein samjha gaya hai:

1. Time Horizon:

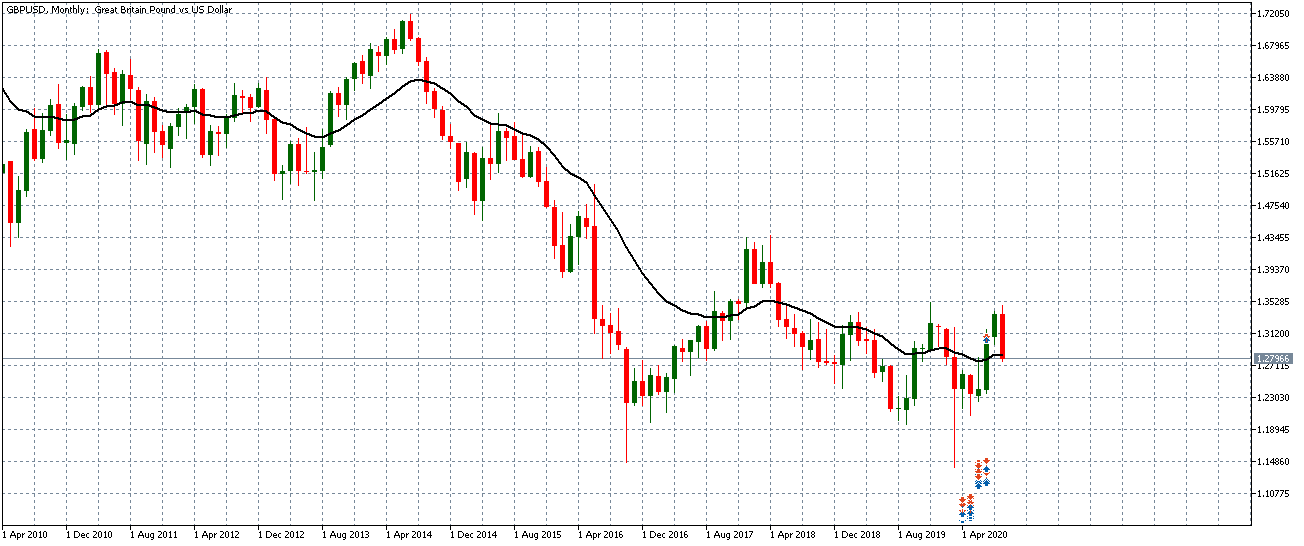

Long Term Trading mein traders apne positions ko kuch mahino ya saalon tak hold karte hain, jabki Short Term Trading mein traders apne positions ko kuch ghanton ya dinon tak hold karte hain. Long Term Trading mein positions ko hold karne ka mudda zyada hota hai, jabki Short Term Trading mein positions ko chhodne ka mudda chhota hota hai.

2. Trading Strategy:

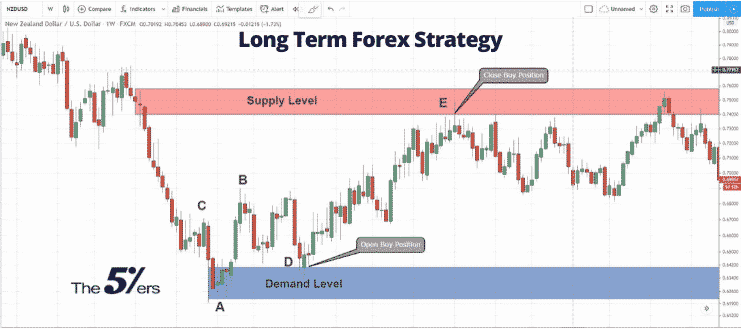

Long Term Trading mein fundamental analysis aur macroeconomic factors par zyada dhyan diya jata hai. Traders long term trends ko identify karte hain aur unmein invest karte hain. Short Term Trading mein technical analysis aur price movements par zyada dhyan diya jata hai. Traders short term price fluctuations ko capture karne ki koshish karte hain.

3. Risk aur Reward:

Long Term Trading mein risk aur reward ka ratio zyada hota hai. Traders long term trends par trade karte hain, jismein unhein zyada potential profit mil sakta hai, lekin iske saath saath zyada risk bhi hota hai. Short Term Trading mein risk aur reward ka ratio kam hota hai, lekin traders ko zyada trading opportunities milte hain.

4. Trading Psychology:

Long Term Trading mein patience aur discipline zyada important hoti hai. Traders ko apne positions ko hold karne ke liye patience rakhni padti hai, aur emotional decisions se bachna hota hai. Short Term Trading mein quick decision making aur active trading ki zarurat hoti hai. Traders ko market ke chhote movements par focus rakhna padta hai.

5. Capital Requirement:

Long Term Trading mein zyada capital ki zarurat hoti hai, kyunki positions ko hold karne ke liye zyada margin aur leverage ki zarurat padti hai. Short Term Trading mein kam capital ki zarurat hoti hai, kyunki positions ko chhodne ka mudda chhota hota hai aur leverage ka istemal kam hota hai.

6. Monitoring:

Long Term Trading mein positions ko regular basis par monitor karna kam hota hai. Traders ko market trends ko observe karna hota hai, lekin positions ko regularly check karne ki zarurat nahi hoti hai. Short Term Trading mein positions ko regularly monitor karna zaruri hota hai. Traders ko market ke chhote movements par focus rakhna padta hai aur positions ko timely exit karna hota hai.

In summary, Long Term Trading aur Short Term Trading dono apne apne tareekon mein mukhtalif hote hain aur har trader apne trading style ke according in mein se kisi ek ko chunta hai. Har approach ke apne fayde aur challenges hote hain, aur traders ko apne trading goals aur risk tolerance ke hisab se sahi approach chunna chahiye.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Long Term Trading aur Short Term Trading Mein Farq.

Long Term Trading aur Short Term Trading Mein Farq

1. Muddat:- Long Term Trading: Muddat zyada hoti hai, aksar saalon ya mahinon tak.

- Short Term Trading: Muddat chhoti hoti hai, aksar dinon ya hafton tak.

- Long Term Trading: Lambi muddat mein behtareen nateeja haasil karne ki koshish ki jati hai.

- Short Term Trading: Chhoti muddat mein tezi se faida hasil karne ki koshish ki jati hai.

- Long Term Trading: Risks kam hote hain, kyun ke waqt ki lambai ko le kar tajziya kiya jata hai.

- Short Term Trading: Risks zyada hote hain, kyun ke market ki choti choti tabdeeliyon par tezi se react kiya jata hai.

- Long Term Trading: Dheere dheere aur detailed tajziya kiya jata hai.

- Short Term Trading: Jaldi aur zyada reactive tajziya kiya jata hai.

- Long Term Trading: Strategic approach ki zarurat hoti hai, jo aksar fundamental analysis par mabni hoti hai.

- Short Term Trading: Tactical approach ki zarurat hoti hai, jo aksar technical analysis aur market trends par mabni hoti hai.

- Long Term Trading: Ghata karne ki ya investments ko grow karne ki mansha hoti hai.

- Short Term Trading: Jald profit kamane ki mansha hoti hai.

- Long Term Trading: Kam dhyan aur kam waqt ki zarurat hoti hai.

- Short Term Trading: Zyada dhyan aur zyada waqt ki zarurat hoti hai, kyun ke market ki har chhoti tabdeeli par react karna padta hai.

- Long Term Trading: Regular monitoring ki zarurat nahi hoti hai.

- Short Term Trading: Regular monitoring ki zarurat hoti hai, aksar din bhar.

- Long Term Trading: Long term investments se passive income stream generate ki ja sakti hai.

- Short Term Trading: Short term trades se active income stream generate ki ja sakti hai.

- Long Term Trading: Kam stress hota hai, kyun ke long term trends par focus hota hai.

- Short Term Trading: Zyada stress hota hai, kyun ke choti muddat mein zyada volatility hoti hai.

- Long Term Trading: Bardasht aur sabr ki zarurat hoti hai, kyun ke results dair se nazar aate hain.

- Short Term Trading: Jald baazi ki zarurat hoti hai, kyun ke results jaldi chahiye hote hain.

- Long Term Trading: Zyada paisay ki zarurat hoti hai, kyun ke investments lambi muddat tak rakhi jati hain.

- Short Term Trading: Kam paisay ki zarurat hoti hai, kyun ke trades choti muddat ke liye hoti hain.

- Long Term Trading: Fundamental aur macroeconomic factors par focus hota hai.

- Short Term Trading: Technical analysis aur market momentum par focus hota hai.

- Long Term Trading: Tax implications kam hote hain, agar investments ko lambi muddat tak rakha jaye.

- Short Term Trading: Tax implications zyada hote hain, kyun ke short term capital gains tax zyada hoti hai.

- Long Term Trading: Emotionally stable rehna zaruri hai, kyun ke market mein ups aur downs aate rehte hain.

- Short Term Trading: Emotions ko control karna mushkil hota hai, kyun ke choti muddat mein tezi se react karna padta hai.

- Long Term Trading: Diversification ko encourage kiya jata hai, taki risk spread ho sake.

- Short Term Trading: Diversification kam hoti hai, kyun ke trades choti muddat ke liye hoti hain.

- Long Term Trading: In-depth knowledge aur research ki zarurat hoti hai.

- Short Term Trading: Quick decision making aur trading skills ki zarurat hoti hai.

- Long Term Trading: Opportunities ko dhundhne mein dheere pan aur tajziya ki zarurat hoti hai.

- Short Term Trading: Opportunities ko jaldi pehchane aur utilize karne ki zarurat hoti hai.

- Long Term Trading: Portfolio ko regularly review aur adjust kiya jata hai.

- Short Term Trading: Portfolio ko frequently monitor aur adjust kiya jata hai.

- Long Term Trading: Long term financial goals ko achieve karne ke liye istemal kiya jata hai.

- Short Term Trading: Short term financial goals ko achieve karne ke liye istemal kiya jata hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

Long Term Trading aur Short Term Trading dono forex trading strategies hain, lekin in dono mein kuch farq hai. Is article mein hum Long Term aur Short Term Trading ke fawaid aur nuksanat ke bare mein tafseel se baat karenge.

Long Term Trading:

Long Term Trading mein traders ko positions ko kafi dair tak hold karna hota hai, jo ki weeks, months ya saalon tak ho sakta hai. Is trading strategy mein traders ko market ki long term trends ko capture karne ka maqsad hota hai.

Fawaid:- Kam Stress: Long Term Trading mein positions ko hold karne ke liye traders ko regular market monitoring ki zaroorat nahi hoti hai, jisse unka stress kam hota hai.

- Fundamental Analysis: Long Term Trading mein traders ko market ki long term trends ko capture karne ke liye fundamental analysis ka istemal karna hota hai. Isse traders ko market ke fundamental factors ka better understanding hota hai.

- Charges ka Kam Hona: Long Term Trading mein traders ko kam trading charges ka samna karna padta hai, kyun ke wo kam transactions karte hain.

- Big Profit Potential: Long Term Trading mein traders ko big profit potential milta hai, kyun ke wo market ke long term trends ko capture kar sakte hain.

- Emotional Control: Long Term Trading mein traders ko apni emotions ko control karna aasan hota hai, kyun ke wo positions ko hold karte hain aur short term price fluctuations par zyada dhyan nahi dete.

Nuksanat:- Slow Returns: Long Term Trading mein returns ko dekhne mein waqt lagta hai, kyun ke positions ko hold karne ke liye kafi dair tak wait karna padta hai.

- Large Capital Requirement: Long Term Trading mein bade positions ko hold karne ke liye zyada capital ki zaroorat hoti hai.

- Market Uncertainty: Long Term Trading mein market ki uncertainty ke liye zyada exposure hota hai, kyun ke positions ko hold karne ke dauraan market conditions mein changes ho sakte hain.

Short Term Trading:

Short Term Trading mein traders positions ko chand minutes, ghante ya dinon tak hold karte hain. Is trading strategy mein traders ko market ki short term price movements ko capture karne ka maqsad hota hai.

Fawaid:- Quick Profits: Short Term Trading mein traders ko quick profits mil sakte hain, kyun ke wo market ki short term price movements ko capture kar sakte hain.

- Market Flexibility: Short Term Trading mein traders ko market ki flexibility milti hai, kyun ke wo apni positions ko jaldi change kar sakte hain market conditions ke mutabiq.

- Technical Analysis: Short Term Trading mein traders zyada tar technical analysis ka istemal karte hain, jo ki unhe short term price movements ko samajhne mein madad karta hai.

- Liquidity: Short Term Trading mein traders ko zyada liquidity milti hai, kyun ke wo frequently transactions karte hain.

- Learning Opportunities: Short Term Trading mein traders ko zyada learning opportunities milti hain, kyun ke wo frequently market movements ko analyze karte hain.

Nuksanat:- High Stress: Short Term Trading mein traders ko high stress ka samna karna padta hai, kyun ke wo frequently market movements ko monitor karte rehte hain.

- High Trading Charges: Short Term Trading mein traders ko zyada trading charges ka samna karna padta hai, kyun ke wo frequently transactions karte hain.

- Emotional Control: Short Term Trading mein traders ko apni emotions ko control karna mushkil hota hai, kyun ke wo short term price fluctuations par zyada dhyan dete hain.

- Market Noise: Short Term Trading mein traders ko market noise ka samna karna padta hai, jo ki unke trading decisions par asar daal sakta hai.

In conclusion, dono hi trading strategies apne apne fawaid aur nuksanat ke saath aati hain. Traders ko apni trading style ko choose karte waqt apne risk tolerance, financial goals aur market conditions ka dhyan rakhna chahiye.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:26 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим