What's the Hammer bullish candlestick pattern

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What's the Hammer bullish candlestick patternٹیگز: کوئی نہیں

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

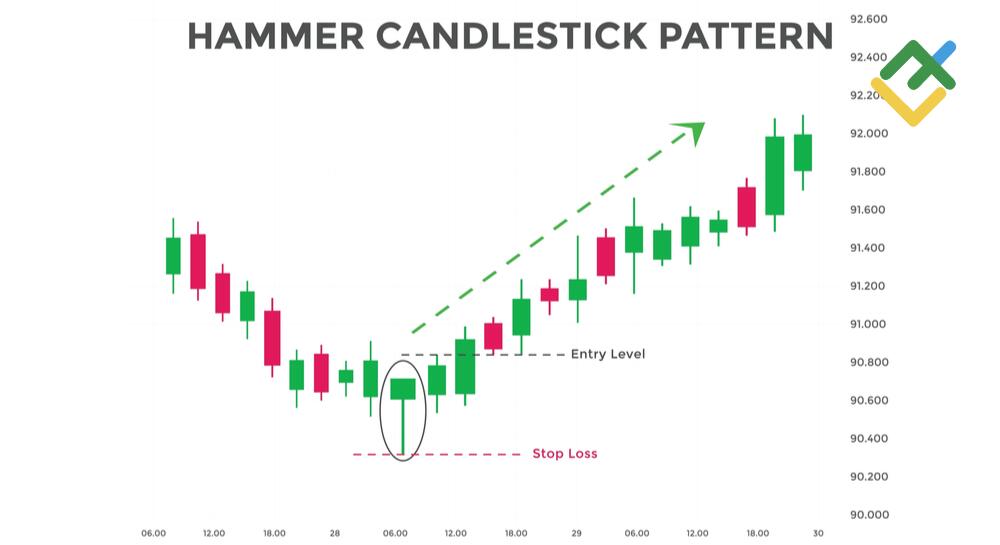

Hammer candlestick pattern ek bullish reversal pattern hai jo trading charts par frequently dekha jata hai. Ye pattern typically downtrend ke baad appear hota hai aur bullish reversal ki possibility ko suggest karta hai. Is pattern ko "Hammer" ke naam se jaana jaata hai kyunki iski shape ek hammer jaisi hoti hai, jismein chhoti body aur lamba lower shadow hota hai. Neeche Hammer bullish candlestick pattern ke baare mein adhik jaankari di gayi hai:

1. Formation:

Hammer pattern ek single candlestick pattern hota hai jo typically downtrend ke ant mein form hota hai. Iski shape ek lambi lower shadow aur chhoti body ke saath hoti hai, jismein open aur close price kafi similar hote hain. Lamba lower shadow body ke neeche extend hota hai.

2. Significance:

Hammer pattern ek bullish reversal signal provide karta hai. Iska appearance downtrend ke end ya support level par hone par ek potential trend reversal ki indication hoti hai. Is pattern ke formation se market mein selling pressure ki decrease aur buying pressure ki increase ki indication milti hai.

3. Interpretation:

Hammer pattern ka interpretation market context par depend karta hai. Agar ek downtrend ke baad Hammer pattern form hota hai, toh yeh bullish reversal signal hota hai. Is situation mein traders ko long positions lena consider kiya ja sakta hai.

4. Confirmation:

Hammer pattern ki validity ke liye, traders ko confirmation ke liye wait karna chahiye. Agar next candle bullish candlestick hai aur iske close price Hammer ke body ke upar hai, toh yeh Hammer pattern ki confirmation ke roop mein consider kiya ja sakta hai.

5. Stop-loss aur Target:

Hammer pattern ke based par trades enter karte samay, traders ko proper risk management ka dhyan rakhna chahiye. Stop-loss order ko thik se set karna important hai taaki unexpected losses se bacha ja sake. Target levels ko bhi properly define kiya jana chahiye.

6. False Signals:

Hammer pattern ko sirf ek part ke roop mein consider karna chahiye aur dusre technical indicators aur price action analysis ke saath confirm kiya jana chahiye. Kabhi-kabhi, Hammer pattern false signals bhi de sakta hai, isliye confirmation ke liye aur ek holistic approach ka istemal kiya jana chahiye.

7. Practical Application:

Hammer pattern ka istemal karke traders potential entry points aur trend reversals ko identify kar sakte hain. Yeh pattern alag-alag timeframes par aur alag-alag market conditions mein bhi effectively kaam karta hai.

Hammer bullish candlestick pattern ek powerful technical analysis tool hai jo traders ko potential trend reversals ko identify karne mein madad karta hai. Lekin, iska istemal karne se pehle traders ko proper analysis aur risk management ka dhyan rakhna chahiye.

- CL

- Mentions 0

-

سا0 like

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

### Hammer Bullish Candlestick Pattern Kya Hai?

Forex aur stock trading mein, candlestick patterns price movements aur market trends ko samajhne mein madadgar hote hain. In patterns mein se ek ahem aur powerful pattern hai "Hammer Bullish Candlestick Pattern." Yeh pattern bullish reversal signal ko indicate karta hai aur market ke downtrend ke baad upward movement ki potential ko darshata hai. Aaiye, is pattern ko detail se samjhte hain.

**Hammer Pattern Ka Concept:**

Hammer Candlestick Pattern ek single candle pattern hai jo market ke downtrend ke baad develop hota hai. Is pattern ko identify karna aasan hota hai, kyunki yeh ek specific shape aur characteristics ke saath aata hai. Hammer pattern ka naam uski appearance se hai, jo ek hammer ke shape ki tarah hoti hai: ek choti body aur ek lambi lower wick ke saath.

**Hammer Pattern Ke Key Features:**

1. **Formation:** Hammer pattern tab develop hota hai jab price market ke low points tak girti hai, lekin close hone par price high level par band hoti hai. Is pattern mein ek choti body hoti hai jo upper half mein hoti hai aur ek lambi lower wick hoti hai jo body se niche extend karti hai. Upper wick ya to chhoti hoti hai ya bilkul nahi hoti.

2. **Bullish Reversal Signal:** Hammer pattern ka main signal bullish reversal hota hai. Jab yeh pattern downtrend ke baad develop hota hai, to yeh indicate karta hai ke bearish momentum kam ho raha hai aur market mein buying pressure increase ho raha hai. Yeh pattern traders ko potential buying opportunities provide karta hai.

3. **Confirmation:** Hammer pattern ko confirm karne ke liye traders follow-up candles aur volume analysis ka use karte hain. Agar hammer ke baad ek strong bullish candle develop hoti hai aur volume bhi increase hota hai, to yeh pattern ki strength ko validate karta hai.

4. **Support and Resistance Levels:** Hammer pattern ko support aur resistance levels ke aas-paas identify karna bhi zaroori hai. Agar yeh pattern ek key support level ke paas develop hota hai, to yeh bullish reversal signal ko aur bhi strong banata hai. Resistance levels ke paas yeh pattern kam effective ho sakta hai.

**Practical Application:**

Traders hammer pattern ko trading strategies mein use karte hain jahan yeh pattern potential entry points aur market reversal ko identify karne mein madad karta hai. Yeh pattern ko other technical indicators aur price action analysis ke saath combine kar ke trading decisions ko enhance kiya jata hai.

In conclusion, Hammer Bullish Candlestick Pattern forex aur stock trading mein ek powerful bullish reversal signal hai. Yeh pattern market ke downtrend ke baad upward movement ke potential ko indicate karta hai aur traders ko buying opportunities provide karta hai. Lekin, kisi bhi trading decision se pehle comprehensive analysis aur risk management zaroori hai.

- CL

- Mentions 0

-

سا0 like

-

#4 Collapse

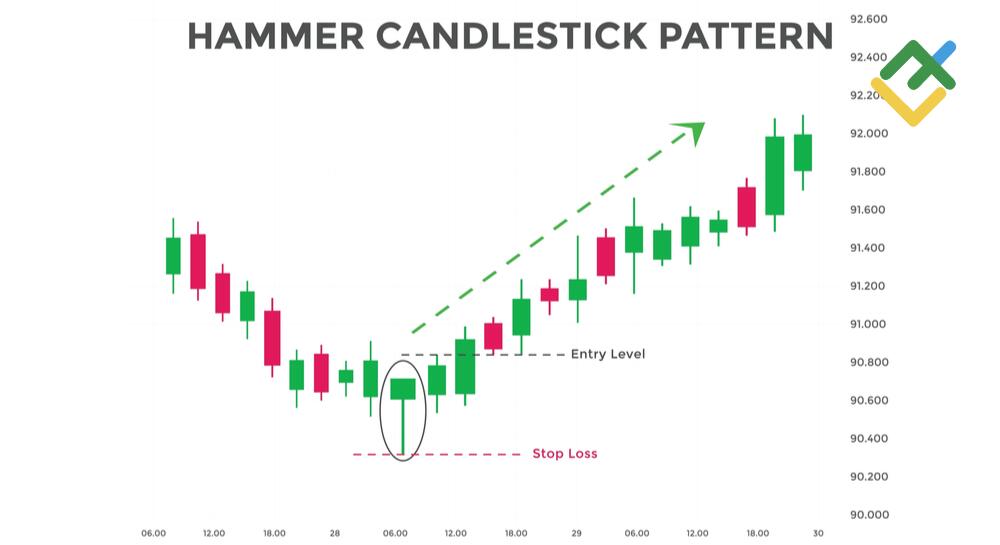

Hammer bullish candlestick pattern aik aisi technical analysis technique hai jo trading aur investing mein use hoti hai, khaas tor par stock market, forex, aur commodities jaisay gold mein. Is pattern ko identify karna market trend reversal ka ek indication hota hai, khas tor par jab market downtrend mein hoti hai aur bullish reversal ki umeed hoti hai.

Hammer candlestick ka shape simple hota hai. Iska upper body chhoti hoti hai aur shadow ya wick lambi hoti hai, jo ke is baat ka pata deti hai ke market ne trading session ke dauran kafi neeche ja kar wapas upar aa kar close kiya. Iska matlab ye hai ke buyers ne control le liya hai jab ke sellers ke paas zyada power nahi thi.

Is candlestick mein upper shadow bohot chhoti hoti hai ya bilkul nahi hoti, jab ke lower shadow kafi lambi hoti hai. Lower shadow ka lamba hona yeh indicate karta hai ke price trading session ke doran neeche gir gaya tha, lekin buyers ne wahan se price ko push kar ke upar kar diya, aur price apni session high ke kareeb close hui.

Is pattern ka bullish hona iss baat ka pata deta hai ke market ab upar jane wala hai. Jab bhi hammer candlestick koi neeche ki taraf strong downtrend mein dekha jaye, toh yeh samjha ja sakta hai ke sellers ab thak gaye hain aur buyers market mein wapas aa rahe hain. Yeh ek reversal signal hota hai, jiska matlab hota hai ke market ab apni direction change kar sakti hai aur upar ki taraf move kar sakti hai.

Hammer candlestick pattern ko effective banane ke liye kuch conditions ka hona zaroori hai. Sabse pehli condition yeh hai ke market ka downtrend mein hona zaroori hai. Agar market already upar ja rahi ho aur hammer pattern nazar aaye, toh uska significance kam ho jata hai. Dusri condition yeh hai ke lower shadow, upper body ke mukable mein kam az kam do ya teen guna lambi honi chahiye. Agar lower shadow zyada lambi nahi hai, toh hammer pattern ka reliability kam ho jata hai.

Yeh pattern akela hi kaafi nahi hota analysis ke liye, isko doosre indicators ke sath confirm karna bhi zaroori hota hai. For example, volume ka analysis bhi kiya jata hai. Agar hammer ke sath sath volume bhi zyada ho, toh iska signal aur bhi strong hota hai. Isi tarah, moving averages aur support/resistance levels ka analysis bhi kiya ja sakta hai.

Hammer pattern ke baad traders ko thoda intizaar karna chahiye confirmation ka. Confirmation ka matlab hai ke agle din ya session mein price upar ki taraf move kare. Agar agle din market bullish close hoti hai, toh yeh confirm karta hai ke hammer pattern ne kaam kiya hai aur market ab bullish trend ki taraf move kar rahi hai.

Is pattern ka use karke traders short-term aur long-term dono trades mein fayda utha sakte hain. Lekin, har pattern ki tarah, yeh bhi 100% accurate nahi hota. Isliye, risk management ka bhi khayal rakhna zaroori hota hai, jese ke stop-loss lagana, taake agar market waisa behave na kare jaisa socha gaya tha, toh nuksan ko kam se kam rakha ja sake.

Aakhir mein, hammer candlestick pattern ek simple lekin powerful tool hai jo market ke reversal signals ko pehchanne mein madad karta hai. Iska use karke traders market mein entry ya exit ka sahi waqt samajh sakte hain, lekin hamesha yaad rahe ke kisi bhi pattern ka analysis complete nahi hota jab tak doosre factors aur indicators ko bhi madad mein na rakha jaye.

-

#5 Collapse

candlestick mein upper shadow bohot chhoti hoti hai ya bilkul nahi hoti, jab ke lower shadow kafi lambi hoti hai. Lower shadow ka lamba hona yeh indicate karta hai ke price trading session ke doran neeche gir gaya tha, lekin buyers ne wahan se price ko push kar ke upar kar diya, aur price apni session high ke kareeb close hui.

Is pattern ka bullish hona iss baat ka pata deta hai ke market ab upar jane wala hai. Jab bhi hammer candlestick koi neeche ki taraf strong downtrend mein dekha jaye, toh yeh samjha ja sakta hai ke sellers ab thak gaye hain aur buyers market mein wapas aa rahe hain. Yeh ek reversal signal hota hai, jiska matlab hota hai ke market ab apni direction change kar sakti hai aur upar ki taraf move kar sakti hai.

hota hai. Iski shape ek lambi lower shadow aur chhoti body ke saath hoti hai, jismein open aur close price kafi similar hote hain. Lamba lower shadow body ke neeche extend hota hai.

2. Significance:

Hammer pattern ek bullish reversal signal provide karta hai. Iska appearance downtrend ke end ya support level par hone par ek potential trend reversal ki indication hoti hai. Is pattern ke formation se market mein selling pressure ki decrease aur buying pressure ki increase ki indication milti hai.

3. Interpretation:

Hammer pattern ka interpretation market context par depend karta hai. Agar ek downtrend ke baad Hammer pattern form hota hai, toh yeh bullish reversal signal hota hai. Is situation mein traders ko long positions lena consider kiya ja sakta hai.

4. Confirmation:

Hammer pattern ki validity ke liye, traders ko confirmation ke liye wait karna chahiye. Agar next candle bullish candlestick hai aur iske close price Hammer ke body ke upar hai, toh yeh Hammer pattern ki confirmation ke roop mein consider kiya ja sakta hai.

5. Stop-loss aur Target:

Hammer candlestick pattern ko effective banane ke liye kuch conditions ka hona zaroori hai. Sabse pehli condition yeh hai ke market ka downtrend mein hona zaroori hai. Agar market already upar ja rahi ho aur hammer pattern nazar aaye, toh uska significance kam ho jata hai. Dusri condition yeh hai ke lower shadow, upper body ke mukable mein kam az kam do ya teen guna lambi honi chahiye. Agar lower shadow zyada lambi nahi hai, toh hammer pattern ka reliability kam ho jata hai.

Yeh pattern akela hi kaafi nahi hota analysis ke liye, isko doosre indicators ke sath confirm karna bhi zaroori hota hai. For example, volume ka analysis bhi kiya jata hai. Agar hammer ke sath sath volume bhi zyada ho, toh iska signal aur bhi strong hota hai. Isi tarah, moving averages aur support/resistance levels ka analysis bhi kiya ja sakta hai.

Hammer pattern ke baad traders ko thoda intizaar karna chahiye confirmation ka. Confirmation ka matlab hai ke agle din ya session mein price upar ki taraf move kare. Agar agle din market bullish close hoti hai, toh yeh confirm karta hai ke hammer pattern ne kaam kiya hai aur market ab bullish trend ki taraf move kar rahi hai.

Is pattern ka use karke traders short-term aur long-term dono trades mein fayda utha sakte hain. Lekin, har pattern ki tarah, yeh bhi 100% accurate nahi hota. Isliye, risk management ka bhi khayal rakhna zaroori hota hai, jese ke stop-loss lagana, taake agar market waisa behave na kare jaisa socha gaya tha, toh nuksan ko kam se kam rakha ja sake.

Aakhir mein, hammer candlestick pattern ek simple lekin powerful tool hai jo market ke reversal signals ko pehchanne mein madad karta hai. Iska use karke traders market mein entry ya exit ka sahi waqt samajh sakte hain, lekin hamesha yaad rahe ke kisi bhi pattern ka analysis complete nahi hota jab tak doosre factors aur indicators ko bhi madad mein na rakha jaye -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Hammer bullish candlestick pattern aik important technical analysis tool hai jo stock aur forex markets mein use hota hai. Yeh pattern khas tor pe price charts par nazar aata hai aur iska maqsad potential reversal points identify karna hota hai. Iska naam "hammer" is liye rakha gaya hai kyunki iski shape ek hammer ki tarah hoti hai. Yeh pattern tab banta hai jab price ki closing price high level par hoti hai aur ek chhoti si body aur long lower shadow create hoti hai.

Hammer pattern tab banata hai jab market downtrend mein hoti hai aur price ek significant low tak gir jati hai, lekin phir se high level par close hoti hai. Is pattern ka sabse important feature yeh hai ke iski body chhoti hoti hai aur lower shadow lambi hoti hai. Upper shadow chhoti ya non-existent hoti hai. Yeh indicate karta hai ke sellers ne day ke doran market ko neeche push kiya, lekin buyers ne strong comeback kiya aur price ko upar le aaya.

Hammer pattern ka bullish signal tab hota hai jab yeh downtrend ke baad aata hai. Iska matlab yeh hai ke market ke bearish trend ke baad ek potential reversal ho sakta hai. Lekin, hammer pattern ko confirm karne ke liye iske baad ek strong bullish candle ka hona zaroori hai. Agar hammer ke baad ek achi bullish candle aati hai, toh yeh confirmation hota hai ke market mein buying pressure badh raha hai aur trend reverse ho sakta hai.

Hammer pattern ki accuracy ko aur behtar banane ke liye, isko support and resistance levels ke sath analyze karna chahiye. Agar hammer pattern kisi major support level ke paas ban raha hai, toh yeh aur bhi strong signal ban jata hai ke price wahan se reverse ho sakti hai. Is pattern ko volume analysis ke sath bhi dekhna chahiye, kyunki agar hammer pattern high volume ke sath bana hai, toh yeh confirmatory signal hota hai.

Aksar, traders hammer pattern ko other technical indicators ke sath combine karte hain jaise ke moving averages aur RSI (Relative Strength Index) taake confirmation mil sake. Moving averages trend direction aur momentum ke baare mein important information dete hain, jabke RSI market ki overbought ya oversold conditions ko indicate karta hai. Yeh combination traders ko zyada reliable signals provide karta hai aur unki trading strategies ko enhance karta hai.

Hammer pattern ka interpretation market conditions ke hisaab se vary kar sakta hai. Jab market choppy aur uncertain ho, toh hammer pattern ki reliability kam ho sakti hai. Isliye, traders ko hamesha risk management aur proper analysis practices follow karni chahiye. Hammer pattern ko as a standalone indicator na samjha jaye; isse market ke overall context aur other indicators ke sath judge karna chahiye.

Overall, hammer bullish candlestick pattern ek useful tool hai jo traders ko market trends aur potential reversals ke bare mein insights provide karta hai. Isko effectively use karne ke liye practice aur market ki understanding zaroori hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:16 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим