Discussion about Most powerful candle stick patterns

No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Discussion about Most powerful candle stick patterns -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Candlestick patterns play a crucial role in technical analysis and are widely used by traders to identify potential market reversals, continuations, and trend changes. While there are numerous candlestick patterns, some are considered more powerful due to their reliability and significance in predicting price movements. In this discussion, we will explore some of the most powerful candlestick patterns and their implications in trading.

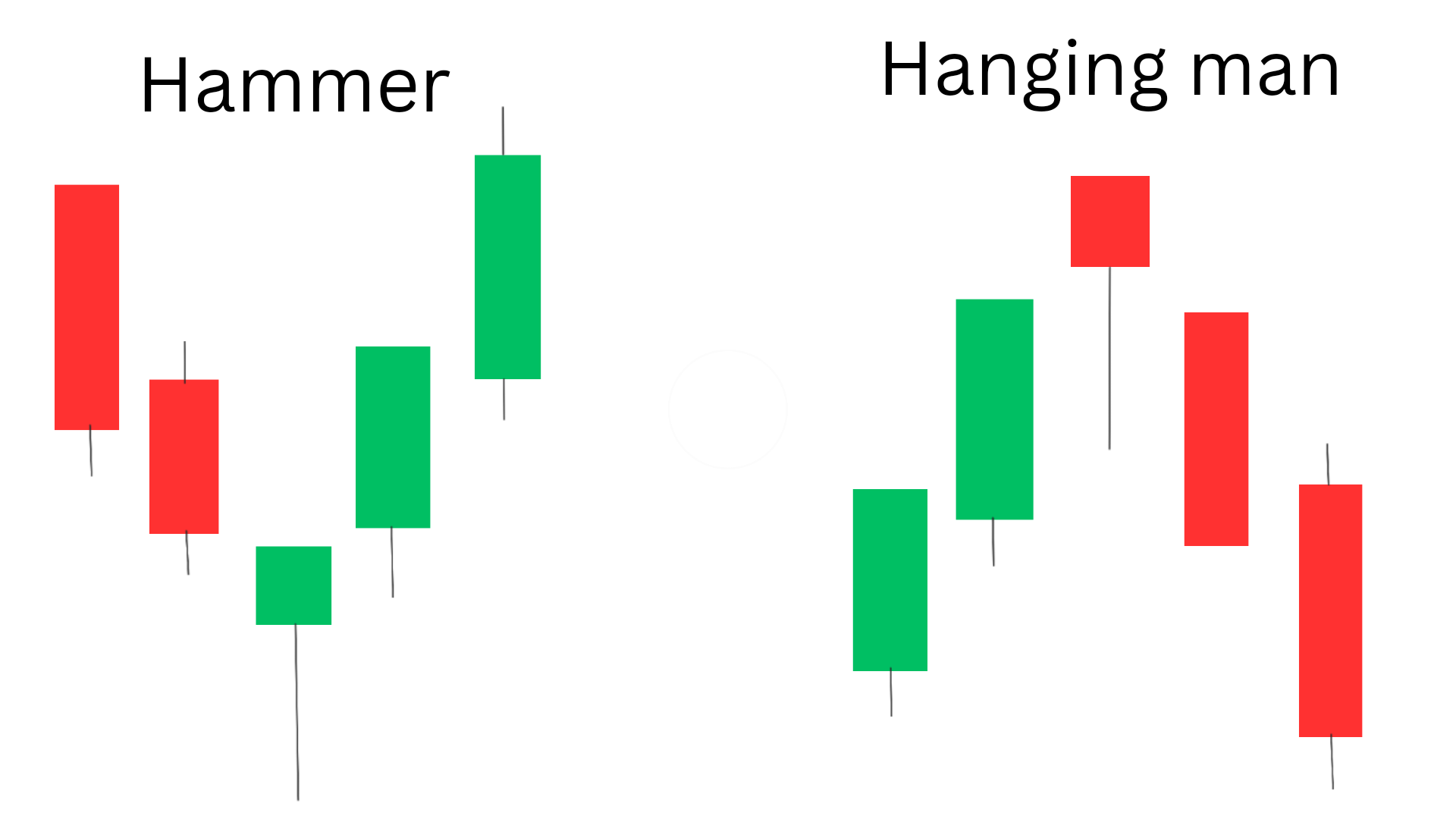

1. Hammer and Hanging Man:

The Hammer and Hanging Man patterns are characterized by small bodies and long lower shadows. A Hammer forms at the bottom of a downtrend, indicating potential bullish reversal, while a Hanging Man forms at the top of an uptrend, signaling a bearish reversal. These patterns suggest market indecision and potential trend shifts.

2. Bullish and Bearish Engulfing Patterns:

Bullish Engulfing occurs when a large bullish candle completely engulfs the previous smaller bearish candle, indicating a shift from selling pressure to buying pressure. Conversely, Bearish Engulfing occurs when a large bearish candle engulfs the previous smaller bullish candle, signaling a shift from buying pressure to selling pressure.

3. Morning and Evening Star Patterns:

Morning Star is a bullish reversal pattern consisting of three candles: a long bearish candle, a small-bodied candle, and a long bullish candle. It signifies a potential trend reversal from bearish to bullish. Conversely, Evening Star is a bearish reversal pattern indicating a potential trend reversal from bullish to bearish.

4. Bullish and Bearish Harami Patterns:

Bullish Harami forms when a small bullish candle is engulfed by a larger bearish candle. It suggests a potential bullish reversal after a downtrend. Bearish Harami forms when a small bearish candle is engulfed by a larger bullish candle, signaling a potential bearish reversal after an uptrend.

5. Piercing Line and Dark Cloud Cover Patterns:

Piercing Line is a bullish reversal pattern occurring after a downtrend, where a bullish candle closes above the midpoint of the previous bearish candle. It suggests a potential bullish reversal. Dark Cloud Cover is a bearish reversal pattern occurring after an uptrend, where a bearish candle closes below the midpoint of the previous bullish candle, indicating a potential bearish reversal.

[IMG]https://miro.medium.com/v2/0*nYNGGKL06u4oQFvT[/IMG]

6. Three Inside Up and Three Inside Down Patterns:

Three Inside Up is a bullish reversal pattern formed by three candles where the third bullish candle closes above the first bearish candle's high. Three Inside Down is a bearish reversal pattern where the third bearish candle closes below the first bullish candle's low. These patterns suggest potential trend reversals.

7. Doji Candlesticks:

Doji candlesticks have equal open and close prices, indicating market indecision. Depending on their location within the trend, Doji candles can signal potential reversals or continuations. Long-legged Doji, Dragonfly Doji, and Gravestone Doji are variations with specific implications based on their shape and position.

In conclusion, these are some of the most powerful candlestick patterns that traders often rely on for making informed trading decisions. However, it's essential to remember that no pattern guarantees success, and traders should always use candlestick patterns in conjunction with other technical analysis tools and risk management strategies for effective trading.

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

### Sabse Powerful Candlestick Patterns Ka Discussion

Forex aur stock trading mein, candlestick patterns market ki price movements aur trends ko samajhne ke liye ek important tool hain. In patterns ko samajhkar traders market ke future movements ko predict kar sakte hain. Aaiye, kuch sabse powerful candlestick patterns par discussion karte hain jo trading decisions ko enhance karne mein madadgar hote hain.

**1. Doji Pattern:**

Doji candlestick pattern market ke indecision aur uncertainty ko reflect karta hai. Yeh pattern tab develop hota hai jab open aur close prices ek dusre ke kareeb hote hain aur ek choti body ke saath long wicks hoti hain. Doji pattern ek potential reversal signal hota hai, especially agar yeh ek strong trend ke baad develop hota hai. Yeh pattern market ke direction ke change ka indication ho sakta hai.

**2. Hammer and Hanging Man:**

Hammer aur Hanging Man patterns do similar patterns hain jo price action ke context mein use hote hain. Hammer pattern bullish reversal ka signal hota hai aur yeh tab develop hota hai jab price lower levels tak girti hai lekin close hone par high level pe band hoti hai. Hanging Man bearish reversal ka signal hota hai aur yeh trend ke top par develop hota hai. Dono patterns ki effectiveness ko confirm karne ke liye volume aur market context zaroori hota hai.

**3. Engulfing Pattern:**

Engulfing pattern ek two-candle pattern hai jo market ke trend reversals ko signal karta hai. Bullish Engulfing pattern tab banta hai jab ek choti bearish candle ko ek larger bullish candle completely cover karti hai. Bearish Engulfing pattern ka opposite hota hai; ek choti bullish candle ko ek larger bearish candle cover karti hai. Yeh patterns market ke reversal points ko identify karne mein madadgar hote hain.

**4. Shooting Star:**

Shooting Star ek bearish reversal pattern hai jo market ke uptrend ke baad develop hota hai. Yeh pattern ek long upper wick aur choti body ke saath banata hai. Shooting Star pattern market ke bullish trend ko reverse karne aur bearish trend shuru karne ka signal hota hai. Is pattern ki effectiveness ko volume aur follow-up candles ke analysis se validate kiya jata hai.

**5. Morning Star and Evening Star:**

Morning Star ek bullish reversal pattern hai jo ek downtrend ke baad develop hota hai. Yeh pattern teen candles se mil kar banta hai: ek bearish candle, ek small body candle, aur ek bullish candle. Evening Star ka opposite hota hai aur yeh bullish trend ke baad bearish reversal ko indicate karta hai. Morning Star aur Evening Star patterns market ke reversal points ko identify karne mein madadgar hote hain.

**Practical Application:**

In powerful candlestick patterns ko trading strategies mein integrate karte waqt, traders in patterns ko other technical indicators aur market context ke saath combine karte hain. Yeh patterns potential entry aur exit points ko identify karne mein madad karte hain aur trading decisions ko refine karte hain.

In conclusion, candlestick patterns jaise Doji, Hammer, Engulfing, Shooting Star, aur Morning/Eveing Star forex aur stock trading mein market trends aur reversals ko samajhne ke liye powerful tools hain. In patterns ko effectively use karne se traders ko accurate trading signals aur informed decisions milte hain. Lekin, kisi bhi trading strategy ko implement karne se pehle comprehensive analysis aur risk management zaroori hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#4 Collapse

Candlestick patterns aik ahem tool hain jo technical analysis mein istemal hotay hain, khas tor par jab hum stock market, forex ya crypto markets ka analysis kar rahay hotay hain. Yeh patterns price action ko asaan andaaz mein samajhne ka tareeqa dete hain aur market ke direction ke mutabiq future movement ke barey mein andaza lagane mein madad karte hain.

Candlestick patterns ki shuruaat Japan mein hui thi jab traders ne rice market ka analysis kiya. Yeh har candle ek time period ka price movement dikhata hai jisme opening, closing, high aur low prices shamil hoti hain. Bohat se candlestick patterns hain, lekin kuch buhat hi powerful aur reliable patterns hain jo traders ke liye zyada faidemand sabit hote hain.

Sab se pehle baat karte hain bullish engulfing pattern ki. Jab yeh pattern samnay aata hai toh iska matlab hai ke market ne niche se upar ki taraf turn lena shuru kiya hai. Is pattern mein do candles hoti hain; pehli candle choti hoti hai jo bearish hoti hai aur doosri candle pehli candle ke range ko poori tarah engulf kar leti hai aur bullish hoti hai. Iska matlab hota hai ke buyers market mein control le chuke hain aur price upar jaane ke chances barh gaye hain.

Doosra powerful pattern hai bearish engulfing pattern. Yeh bullish engulfing ka ulta hai aur iska matlab hota hai ke market upar se niche ki taraf turn le raha hai. Pehli candle bullish hoti hai, lekin doosri candle, jo pehli se badi hoti hai, bearish hoti hai aur poori pehli candle ko engulf kar leti hai. Is se andaza hota hai ke sellers ne control le liya hai aur price neeche jaane ke chances barh gaye hain.

Phir hum dekhte hain hammer aur hanging man patterns ko. Hammer pattern tab banta hai jab market niche ja raha ho lekin ek candle neeche se bullish reversal signal dey rahi ho. Candle ka lower shadow lamba hota hai aur body chhoti hoti hai, jo yeh dikhata hai ke niche wale levels par buyers ne market ko support dia aur price wapas upar aa gaya. Hanging man is ka ulta hota hai. Is pattern mein candle ka upper shadow lamba hota hai jo yeh dikhata hai ke price upar jaane ki koshish karta hai, lekin sellers ne phir se control le liya aur market neeche aane ke chances barh gaye.

Aur ek buhat ahem pattern jo traders ko dekhna chahiye wo hai doji. Doji ka matlab hota hai ke market mein indecision hai, yani buyers aur sellers dono confuse hain ke price kis taraf jaye. Doji pattern mein candle ki body buhat chhoti hoti hai ya bilkul nahi hoti. Yeh pattern aksar trend reversal ka signal deta hai jab market ek direction mein overextended hoti hai.

Isi tarah ek aur important pattern hai morning star aur evening star. Morning star ek bullish reversal pattern hota hai jab market neeche ja rahi hoti hai. Is mein teen candles hoti hain; pehli bearish candle hoti hai, doosri chhoti body ke sath hoti hai jo ek transition phase ko dikhati hai, aur teesri candle bullish hoti hai jo yeh indicate karti hai ke buyers ne market ko control mein le liya hai. Evening star iska ulta hota hai aur yeh bearish reversal ko dikhata hai.

Yeh kuch candlestick patterns hain jo market ke trends ko samajhne mein madadgar hotay hain. Har pattern ki apni strength aur significance hoti hai aur traders inko price action aur market context ke sath milakar istemal karte hain. Lekin yad rahe, candlestick patterns ka analysis aksar aur indicators ke sath milakar karna chahiye taake zyada accurate signals mil sakein

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 07:35 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим