What's the Most powerful candlestick patterns

`

X

new posts

-

#1 Collapse

What's the Most powerful candlestick patterns -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Candlestick patterns trading mein aik bohot popular aur effective technique hai jo traders ko market ke movements ko samajhne aur predictions karne mein madad deti hai. Ye patterns pehli martaba Japanese rice traders ne 18th century mein introduce kiye thay, aur aaj bhi ye global financial markets mein extensively use hote hain.

1. Doji

Doji candlestick aik bohot important pattern hai jo market ki uncertainty aur potential reversal ko indicate karta hai. Jab open aur close prices bilkul kareeb ya same hote hain to Doji banta hai, jo ek cross ya plus sign ki tarah dikhayi deta hai. Is pattern ko samajhne ke liye kuch variations hain:- Gravestone Doji: Ye tab banta hai jab open, low aur close prices near the same level hote hain aur high price significantly upar hota hai. Iska matlab ye hai ke bulls ne price ko upar push kiya lekin bears ne usay waapis niche le aya.

- Dragonfly Doji: Is pattern mein open, high aur close prices almost same hote hain aur low price significantly niche hota hai. Ye indicate karta hai ke bears ne price ko niche push kiya lekin bulls ne price ko waapis upar le aya.

- Long-legged Doji: Ye tab banta hai jab prices kaafi high aur low levels tak jaate hain lekin open aur close prices same rahte hain. Iska matlab market mein kaafi confusion aur indecision hai.

Hammer aur Hanging Man patterns bhi reversal patterns hain jo bullish aur bearish trends ko indicate karte hain:- Hammer: Ye bullish reversal pattern hai jo downtrend ke baad banta hai. Iska small body aur long lower shadow hota hai jo ye indicate karta hai ke sellers ne price ko niche push kiya lekin buyers ne control le liya aur price ko upar close kiya.

- Hanging Man: Ye bearish reversal pattern hai jo uptrend ke baad banta hai. Iska small body aur long lower shadow hota hai jo indicate karta hai ke buyers ne price ko upar push kiya lekin sellers ne control le liya aur price ko niche close kiya.

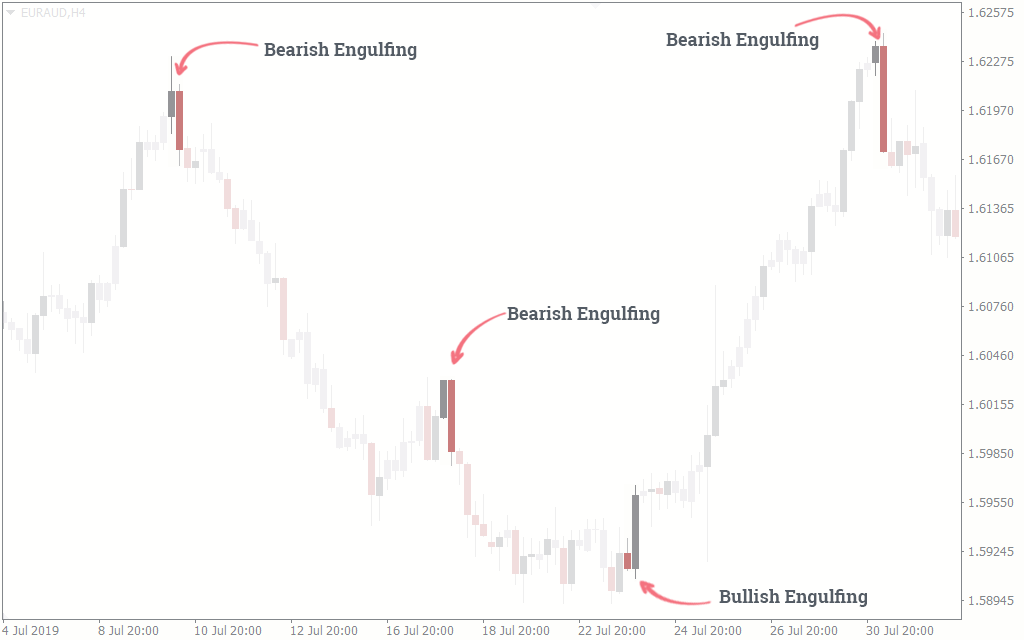

Engulfing patterns bhi powerful reversal patterns hain aur inhein do tarah se classify kiya ja sakta hai:- Bullish Engulfing: Ye pattern downtrend ke baad banta hai aur indicate karta hai ke market mein bullish reversal aane wala hai. Is pattern mein, pehla candle bearish hota hai aur doosra candle bullish hota hai jo pehle candle ke body ko completely engulf karta hai.

- Bearish Engulfing: Ye pattern uptrend ke baad banta hai aur indicate karta hai ke market mein bearish reversal aane wala hai. Is pattern mein, pehla candle bullish hota hai aur doosra candle bearish hota hai jo pehle candle ke body ko completely engulf karta hai.

Morning Star aur Evening Star bhi powerful reversal patterns hain jo three-candle patterns hote hain:- Morning Star: Ye bullish reversal pattern hai jo downtrend ke baad banta hai. Iska pehla candle bearish hota hai, doosra candle small body (bullish ya bearish) hota hai aur teesra candle bullish hota hai jo indicate karta hai ke market mein bullish reversal hone wala hai.

- Evening Star: Ye bearish reversal pattern hai jo uptrend ke baad banta hai. Iska pehla candle bullish hota hai, doosra candle small body (bullish ya bearish) hota hai aur teesra candle bearish hota hai jo indicate karta hai ke market mein bearish reversal hone wala hai.

Shooting Star aur Inverted Hammer patterns bhi important reversal patterns hain jo similar characteristics rakhte hain:- Shooting Star: Ye bearish reversal pattern hai jo uptrend ke baad banta hai. Iska small body aur long upper shadow hota hai jo indicate karta hai ke buyers ne price ko upar push kiya lekin sellers ne control le liya aur price ko niche close kiya.

- Inverted Hammer: Ye bullish reversal pattern hai jo downtrend ke baad banta hai. Iska small body aur long upper shadow hota hai jo indicate karta hai ke sellers ne price ko niche push kiya lekin buyers ne control le liya aur price ko upar close kiya.

Three White Soldiers aur Three Black Crows patterns bhi powerful continuation patterns hain jo trend ki strength ko indicate karte hain:- Three White Soldiers: Ye bullish continuation pattern hai jo uptrend mein banta hai. Is pattern mein, teen consecutive bullish candles hoti hain jo steadily higher close karti hain aur indicate karti hain ke market mein strong bullish sentiment hai.

- Three Black Crows: Ye bearish continuation pattern hai jo downtrend mein banta hai. Is pattern mein, teen consecutive bearish candles hoti hain jo steadily lower close karti hain aur indicate karti hain ke market mein strong bearish sentiment hai.

Tweezer Tops aur Tweezer Bottoms patterns bhi reversal patterns hain jo market ki direction ko change karne ka indication dete hain:- Tweezer Tops: Ye bearish reversal pattern hai jo uptrend ke baad banta hai. Is pattern mein, do consecutive candles hoti hain jinka high almost same hota hai. Ye indicate karta hai ke buyers ka strength khatam ho raha hai aur sellers market mein enter ho rahe hain.

- Tweezer Bottoms: Ye bullish reversal pattern hai jo downtrend ke baad banta hai. Is pattern mein, do consecutive candles hoti hain jinka low almost same hota hai. Ye indicate karta hai ke sellers ka strength khatam ho raha hai aur buyers market mein enter ho rahe hain.

8. Dark Cloud Cover and Piercing Pattern

Dark Cloud Cover aur Piercing Pattern bhi two-candle reversal patterns hain jo market ki trend change hone ka indication dete hain:- Dark Cloud Cover: Ye bearish reversal pattern hai jo uptrend ke baad banta hai. Iska pehla candle bullish hota hai aur doosra candle bearish hota hai jo pehle candle ke midpoint ko cross kar ke close hota hai. Ye indicate karta hai ke market mein bearish sentiment enter ho raha hai.

- Piercing Pattern: Ye bullish reversal pattern hai jo downtrend ke baad banta hai. Iska pehla candle bearish hota hai aur doosra candle bullish hota hai jo pehle candle ke midpoint ko cross kar ke close hota hai. Ye indicate karta hai ke market mein bullish sentiment enter ho raha hai.

Believe in yourself and your abilities. When you fight for your dreams, you can achieve anything.

-

#3 Collapse

Candlestick patterns financial markets mein trading aur investing ke liye bohat important hotay hain. Yeh patterns price action ko represent karte hain aur future price movements ka andaza lagane mein madadgar hote hain. Candlestick patterns bohat si types ke hotay hain, magar kuch patterns aise hain jo sabse zyada taakatwar aur reliable samjhe jate hain. Inmein se kuch ko hum yahan explain karte hain:

1. Doji

Doji candlestick pattern tab banta hai jab opening aur closing price almost barabar hoti hain, jiska matlab hai ke market mein indecision hai. Yeh pattern is baat ka signal hota hai ke trend reversal ho sakta hai. Doji ke kuch types hain:- Gravestone Doji: Jab opening aur closing price lowest point par hoti hain aur high shadow bohat lambi hoti hai.

- Dragonfly Doji: Jab opening aur closing price highest point par hoti hain aur low shadow bohat lambi hoti hai.

- Long-legged Doji: Jab high aur low shadows donon bohat lambi hoti hain.

2. Hammer and Hanging Man

Hammer aur Hanging Man patterns bohat mushabihat rakhte hain, magar unka position aur context different hota hai:- Hammer: Yeh pattern downtrend mein banta hai aur is baat ka signal hota hai ke bullish reversal ho sakta hai. Isme small body hoti hai aur long lower shadow hota hai.

- Hanging Man: Yeh pattern uptrend mein banta hai aur is baat ka signal hota hai ke bearish reversal ho sakta hai. Isme bhi small body aur long lower shadow hota hai.

3. Engulfing Pattern

Engulfing pattern do candlesticks se mil kar banta hai aur bohat taakatwar reversal signal hota hai:- Bullish Engulfing: Yeh pattern downtrend mein banta hai jab pehli candlestick bearish hoti hai aur doosri candlestick bullish hoti hai jo pehli candlestick ko completely engulf kar leti hai.

- Bearish Engulfing: Yeh pattern uptrend mein banta hai jab pehli candlestick bullish hoti hai aur doosri candlestick bearish hoti hai jo pehli candlestick ko completely engulf kar leti hai.

4. Morning Star and Evening Star

Yeh patterns teen candlesticks se mil kar bante hain aur trend reversal ka signal dete hain:- Morning Star: Yeh bullish reversal pattern hai jo downtrend mein banta hai. Pehli candlestick bearish hoti hai, doosri candlestick small hoti hai (bullish ya bearish), aur teesri candlestick bullish hoti hai jo pehli candlestick ke body ke middle point se upar close hoti hai.

- Evening Star: Yeh bearish reversal pattern hai jo uptrend mein banta hai. Pehli candlestick bullish hoti hai, doosri candlestick small hoti hai (bullish ya bearish), aur teesri candlestick bearish hoti hai jo pehli candlestick ke body ke middle point se neeche close hoti hai.

5. Three Black Crows and Three White Soldiers

Yeh patterns continue trends ko indicate karte hain:- Three Black Crows: Yeh pattern bearish continuation ko indicate karta hai. Isme teen consecutive bearish candlesticks hoti hain jo higher high aur lower close ke sath banti hain.

- Three White Soldiers: Yeh pattern bullish continuation ko indicate karta hai. Isme teen consecutive bullish candlesticks hoti hain jo higher high aur higher close ke sath banti hain.

6. Shooting Star

Shooting Star pattern uptrend mein banta hai aur bearish reversal ka signal hota hai. Isme small body hoti hai aur long upper shadow hota hai. Yeh pattern tab reliable hota hai jab price upper shadow ke highest point tak jati hai aur phir wahan se niche girti hai.

7. Inverted Hammer

Inverted Hammer pattern downtrend mein banta hai aur bullish reversal ka signal hota hai. Isme small body hoti hai aur long upper shadow hota hai. Yeh pattern tab reliable hota hai jab price lower shadow ke lowest point tak jati hai aur phir wahan se upar aati hai.

Candlestick patterns trading aur investing ke liye bohat useful tools hain. In patterns ko samajhna aur unka sahi use karna market trends aur price movements ko predict karne mein madadgar hota hai. Magar, sirf candlestick patterns par rely karna enough nahi hota; inhe doosre technical indicators aur analysis ke sath combine karke use karna chahiye. -

#4 Collapse

Forex Trade Mein Sabse Zyada Taquatwar Candlestick Patterns- Muqaddama

- Forex trading mein candlestick patterns ko samajhna bohot zaroori hai. Yeh patterns hamein market ke trends aur price movements ke bare mein valuable information dete hain. Candlestick charts traders ko visually price action samajhne ka tareeqa dete hain. Yeh charts Japan mein 18th century mein develop hue aur aaj bhi duniya bhar ke traders ke liye bohot qeemti hain. Is article mein hum kuch taqatwar candlestick patterns ka tazkra karenge jo Forex trading mein bohot important hain.

Candlestick Patterns Ki Ahmiyat

Candlestick patterns market ka sentiment reflect karte hain aur trader ko aane wale price movements ke bare mein aagaah karte hain. Inhein samajhna har trader ke liye bohot zaroori hai. Yeh patterns price action aur market psychology ko reflect karte hain, jo trading decisions lene mein madadgar hote hain. Har candlestick ek specific time period ka price action dikhata hai aur ismein chaar components hote hain: opening price, closing price, highest price, aur lowest price. Yeh components hamein market ke behavior aur traders ke emotions ke bare mein insights dete hain.

Doji Candlestick Pattern

Doji pattern tab banta hai jab opening aur closing price qareeban barabar hoti hain. Yeh pattern market ke indecision ko reflect karta hai. Doji pattern ka matlab hai ke market mein buyers aur sellers dono he equal power mein hain aur price kisi direction mein move nahi hui. Yeh pattern kisi bhi trend mein aasakta hai aur trend reversal ka indication ho sakta hai agar yeh major support ya resistance level pe banta hai. Doji patterns ke kuch common types hain: Long-Legged Doji, Dragonfly Doji, aur Gravestone Doji.

Hammer Candlestick Pattern

Hammer pattern tab banta hai jab lower shadow bohot lambi hoti hai aur real body choti. Yeh pattern usually downtrend ke baad uptrend ka indication hota hai. Hammer pattern buyers ki strength ko dikhata hai jo price ko niche se upar lekar gaye hain. Is pattern ka lower shadow kam az kam do times real body se lamba hota hai. Hammer pattern ko pehchan kar, traders potential buying opportunities ko identify kar sakte hain. Is pattern ko support level ke qareeb dekhna zyada meaningful hota hai.

Shooting Star Candlestick Pattern

Shooting star pattern hammer pattern ka ulta hota hai. Ismein upper shadow bohot lambi hoti hai aur real body choti. Yeh pattern uptrend ke baad downtrend ka indication hota hai. Shooting star pattern sellers ki strength ko dikhata hai jo price ko upar se niche lekar gaye hain. Is pattern ka upper shadow kam az kam do times real body se lamba hota hai. Shooting star pattern ko resistance level ke qareeb dekhna zyada meaningful hota hai. Yeh pattern selling opportunities ko identify karne mein madadgar hota hai.

Bullish Engulfing Pattern

Bullish engulfing pattern tab banta hai jab choti bearish candle ke baad badi bullish candle banti hai. Yeh pattern trend reversal ka indication hota hai. Bullish engulfing pattern buyers ki strong presence ko dikhata hai jo market ko upar lekar gaye hain. Pehli candle bearish hoti hai jo sellers ki presence ko dikhati hai, magar doosri candle usko poori tarah se engulf kar leti hai. Yeh pattern downtrend ke end aur uptrend ke start ka signal hota hai.

Bearish Engulfing Pattern

Bearish engulfing pattern bullish engulfing ka ulta hota hai. Ismein choti bullish candle ke baad badi bearish candle banti hai. Yeh pattern bhi trend reversal ka indication hota hai. Bearish engulfing pattern sellers ki strong presence ko dikhata hai jo market ko niche lekar gaye hain. Pehli candle bullish hoti hai jo buyers ki presence ko dikhati hai, magar doosri candle usko poori tarah se engulf kar leti hai. Yeh pattern uptrend ke end aur downtrend ke start ka signal hota hai.

Morning Star Pattern

Morning star pattern teen candlesticks se mil kar banta hai aur yeh uptrend ka indication hota hai. Pehli candle bearish, doosri doji ya choti bullish, aur teesri badi bullish hoti hai. Yeh pattern market ke indecision ke baad buyers ki strength ko dikhata hai. Morning star pattern ko support level ke qareeb dekhna zyada meaningful hota hai. Pehli candle sellers ki presence ko dikhati hai, doosri candle market ka indecision dikhati hai, aur teesri candle buyers ki strength ko reflect karti hai. Yeh pattern strong bullish reversal ka indication hota hai.

Evening Star Pattern

Evening star pattern bhi teen candlesticks se mil kar banta hai magar yeh downtrend ka indication hota hai. Pehli candle bullish, doosri doji ya choti bearish, aur teesri badi bearish hoti hai. Yeh pattern market ke indecision ke baad sellers ki strength ko dikhata hai. Evening star pattern ko resistance level ke qareeb dekhna zyada meaningful hota hai. Pehli candle buyers ki presence ko dikhati hai, doosri candle market ka indecision dikhati hai, aur teesri candle sellers ki strength ko reflect karti hai. Yeh pattern strong bearish reversal ka indication hota hai.

Three White Soldiers Pattern

Yeh pattern tab banta hai jab teen consecutive bullish candles banti hain. Yeh strong uptrend ka indication hota hai. Har candle previous candle ki closing price ke upar khulti hai aur iski closing price higher hoti hai. Yeh pattern market mein buyers ki dominance ko dikhata hai aur future mein price ke aur upar jane ka indication deta hai. Three white soldiers pattern ko trend continuation ka strong signal mana jata hai.

Three Black Crows Pattern

Three black crows pattern three consecutive bearish candles se mil kar banta hai. Yeh strong downtrend ka indication hota hai. Har candle previous candle ki closing price ke niche khulti hai aur iski closing price lower hoti hai. Yeh pattern market mein sellers ki dominance ko dikhata hai aur future mein price ke aur niche jane ka indication deta hai. Three black crows pattern ko trend continuation ka strong signal mana jata hai.

Harami Pattern

Harami pattern tab banta hai jab ek badi candle ke baad choti candle banti hai jo pehli candle ke body mein hoti hai. Yeh pattern trend reversal ka indication hota hai. Harami pattern market ke indecision ko dikhata hai. Bullish harami pattern tab banta hai jab badi bearish candle ke baad choti bullish candle banti hai, aur bearish harami pattern tab banta hai jab badi bullish candle ke baad choti bearish candle banti hai. Yeh pattern potential reversal ka signal hota hai.

Piercing Line Pattern

Piercing line pattern tab banta hai jab ek bearish candle ke baad bullish candle banti hai jo pehli candle ke midpoint ko cross karti hai. Yeh pattern bullish reversal ka indication hota hai. Pehli candle sellers ki dominance ko dikhati hai magar doosri candle buyers ki strong presence ko dikhati hai jo price ko upar lekar gaye hain. Piercing line pattern ko support level ke qareeb dekhna zyada meaningful hota hai.- Dark Cloud Cover Pattern

- Dark cloud cover pattern piercing line ka ulta hota hai. Ismein bullish candle ke baad bearish candle banti hai jo pehli candle ke midpoint ko cross karti hai. Yeh bearish reversal ka indication hota hai. Pehli candle buyers ki dominance ko dikhati hai magar doosri candle sellers ki strong presence ko dikhati hai jo price ko niche lekar gaye hain. Dark cloud cover pattern ko resistance level ke qareeb dekhna zyada meaningful hota hai.

Tweezer Tops and Bottoms

Tweezer tops tab banta hai jab do candles ke upper shadows barabar hoti hain. Tweezer bottoms tab banta hai jab do candles ke lower shadows barabar hoti hain. Yeh pattern trend reversal ka indication hota hai. Tweezer tops resistance level pe aur tweezer bottoms support level pe bante hain. Yeh pattern potential reversals ka strong signal hote hain kyun ke yeh market ke extreme price points ko dikhate hain.

Marubozu Candlestick

Marubozu candlestick mein koi shadow nahi hoti, sirf real body hoti hai. Yeh strong trend continuation ka indication hota hai. Bullish marubozu tab banta hai jab opening price lowest point ho aur closing price highest point ho. Bearish marubozu tab banta hai jab opening price highest point ho aur closing price lowest point ho. Yeh pattern market mein strong trend ke continuation ko dikhata hai aur potential entry aur exit points ko identify karne mein madadgar hota hai.

Spinning Top Candlestick

Spinning top candlestick mein choti real body aur lambi upper aur lower shadows hoti hain. Yeh market ke indecision ko reflect karta hai. Spinning top pattern buyers aur sellers ke equal power ko dikhata hai. Yeh pattern kisi bhi trend mein aasakta hai aur market mein aane wale potential reversal ya continuation ka signal ho sakta hai. Yeh pattern market ke pause aur consolidation ka indication deta hai.

Inside Bar Pattern

Inside bar pattern tab banta hai jab current candle pehli candle ke range ke andar hoti hai. Yeh pattern market consolidation aur potential breakout ka indication hota hai. Inside bar pattern usually strong trend ke baad banta hai aur market ke pause ko dikhata hai. Yeh pattern breakout trading strategies ke liye bohot useful hota hai kyun ke yeh future price movement ke direction ko predict karne mein madadgar hota hai.

Conclusion

Forex trading mein candlestick patterns ko samajhna aur unka sahi istemal karna trader ko bohot madad de sakta hai. In patterns ko dekh kar trader behtar decision le sakta hai aur apne profits ko maximize kar sakta hai. Candlestick patterns market sentiment, price action, aur traders ke emotions ko reflect karte hain. Inhein samajh kar aur sahi tarah se interpret kar ke, traders market mein aane wale opportunities ko pehchan sakte hain aur risk ko effectively manage kar sakte hain. Forex trading mein kamiyabi ke liye candlestick patterns ko samajhna bohot zaroori hai aur yeh article is knowledge ko gain karne ka pehla qadam hai. -

#5 Collapse

Sabse Zyada Powerful Candlestick Patterns

Candlestick patterns technical analysis ka ek important hissa hain jo market ke sentiment aur potential price movements ko predict karne mein madadgar hote hain. Trading mein in patterns ka accurate use aapki profitability ko enhance kar sakta hai. Neeche kuch sabse zyada powerful candlestick patterns ki tashreeh ki gayi hai.

1. Doji

Doji candlestick pattern ek neutral pattern hota hai jo market ke indecision ko represent karta hai. Is pattern mein opening aur closing price almost same hoti hai, jiski wajah se ek cross ya plus sign banta hai. Doji ko akser trend reversal ya continuation ke indication ke tor par dekha jata hai, magar iska confirmation zaroori hota hai.

2. Hammer aur Hanging Man

Hammer aur Hanging Man patterns similar structure rakhte hain magar different market conditions ko represent karte hain.- Hammer: Yeh pattern ek bullish reversal signal hota hai jo downtrend ke baad appear hota hai. Ismein choti body hoti hai aur lambi lower shadow, jo indicate karta hai ke buyers ne price ko neeche se push kiya hai.

- Hanging Man: Yeh pattern ek bearish reversal signal hota hai jo uptrend ke baad appear hota hai. Ismein bhi choti body aur lambi lower shadow hoti hai, magar yeh indicate karta hai ke sellers ne price ko neeche push kiya magar buyers ne usse upar close kar diya.

Engulfing patterns bohot strong reversal signals hote hain.- Bullish Engulfing: Yeh pattern downtrend ke baad appear hota hai. Pehla candle bearish hota hai aur doosra bullish candle pehli candle ko poori tarah engulf karta hai. Yeh indicate karta hai ke buyers market mein strong entry kar rahe hain.

- Bearish Engulfing: Yeh pattern uptrend ke baad appear hota hai. Pehla candle bullish hota hai aur doosra bearish candle pehli candle ko poori tarah engulf karta hai. Yeh indicate karta hai ke sellers market mein strong entry kar rahe hain.

Yeh patterns three-candle formations hain jo strong reversal signals provide karte hain.- Morning Star: Yeh pattern downtrend ke baad appear hota hai aur bullish reversal indicate karta hai. Pehla candle bearish hota hai, doosra candle choti body (doji ya spinning top) hota hai, aur teesra candle bullish hota hai jo pehle candle ke body ko significant portion engulf karta hai.

- Evening Star: Yeh pattern uptrend ke baad appear hota hai aur bearish reversal indicate karta hai. Pehla candle bullish hota hai, doosra candle choti body (doji ya spinning top) hota hai, aur teesra candle bearish hota hai jo pehle candle ke body ko significant portion engulf karta hai.

Yeh patterns bhi strong reversal signals provide karte hain.- Shooting Star: Yeh pattern uptrend ke baad appear hota hai aur bearish reversal indicate karta hai. Ismein choti body hoti hai aur lambi upper shadow, jo indicate karta hai ke buyers ne price ko upar push kiya magar sellers ne usse neeche close kar diya.

- Inverted Hammer: Yeh pattern downtrend ke baad appear hota hai aur bullish reversal indicate karta hai. Ismein choti body hoti hai aur lambi upper shadow, jo indicate karta hai ke sellers ne price ko neeche push kiya magar buyers ne usse upar close kar diya.

Yeh powerful candlestick patterns aapki trading strategy ko bohot enhance kar sakte hain agar aap inhe accurately identify aur interpret karen. Har pattern ka context aur confirmation zaroori hai taake aapke trading decisions zyada reliable aur profitable hon. Trading mein success ke liye technical analysis ke sath sath proper risk management bhi bohot zaroori hai.

-

#6 Collapse

What Is The Most Powerful Candlestick Pattern

Candlestick patterns trading ka aik bohot hi qadeem aur maqbool tareeqa hai jise traders price movements ko samajhne aur trade decisions lene ke liye istemal karte hain. Yahan kuch sab se powerful candlestick patterns discuss karenge jo ke traders ke liye bohot madadgar ho sakte hain.

### 1. **Doji**

Doji ek aise candlestick pattern ko kehte hain jahan opening aur closing price almost barabar hoti hai. Yeh pattern market ke indecision ko zahir karta hai aur yeh indicate kar sakta hai ke market trend jaldi hi reverse ho sakta hai. Doji pattern ke bohot se types hain jaise ke Dragonfly Doji, Gravestone Doji, aur Long-legged Doji.

### 2. **Hammer and Hanging Man**

Hammer aur Hanging Man dono hi single candlestick patterns hain jo market trend ke reversal ko indicate karte hain. Hammer bullish reversal ko indicate karta hai jabke Hanging Man bearish reversal ko. Hammer tab banta hai jab price niche jati hai lekin wapas recover kar leti hai, jis se ek chota body aur lamba lower shadow banta hai. Hanging Man isi ka ulta hai aur bearish trend ke end par banta hai.

### 3. **Engulfing Patterns**

Engulfing patterns do candlesticks se bante hain. Bullish Engulfing pattern tab banta hai jab ek choti bearish candlestick ke baad ek badi bullish candlestick aati hai jo pehli candlestick ko completely engulf kar leti hai. Yeh indicate karta hai ke bulls market ko control mein le rahe hain. Bearish Engulfing pattern isi ka ulta hai aur bearish trend reversal ko indicate karta hai.

### 4. **Morning Star and Evening Star**

Morning Star aur Evening Star dono hi three candlestick patterns hain jo market trend reversal ko indicate karte hain. Morning Star bullish reversal pattern hai jo ek bearish candlestick, ek small-bodied candlestick, aur phir ek bullish candlestick par mushtamil hota hai. Evening Star bearish reversal pattern hai jo ek bullish candlestick, ek small-bodied candlestick, aur phir ek bearish candlestick par mushtamil hota hai.

### 5. **Three White Soldiers and Three Black Crows**

Three White Soldiers ek strong bullish reversal pattern hai jo teen continuous bullish candlesticks par mushtamil hota hai jinki closing price har din barhti hai. Yeh pattern indicate karta hai ke bulls market ko control mein le rahe hain. Three Black Crows isi ka ulta hai aur strong bearish reversal pattern hai jo teen continuous bearish candlesticks par mushtamil hota hai.

### 6. **Shooting Star and Inverted Hammer**

Shooting Star aur Inverted Hammer dono hi single candlestick patterns hain jo reversal ko indicate karte hain. Shooting Star bearish reversal pattern hai jo bullish trend ke baad banta hai aur ek choti body aur lambi upper shadow rakhta hai. Inverted Hammer bullish reversal pattern hai jo bearish trend ke baad banta hai aur uski structure Shooting Star jaisi hoti hai.

### 7. **Dark Cloud Cover and Piercing Pattern**

Dark Cloud Cover ek bearish reversal pattern hai jo tab banta hai jab ek bullish candlestick ke baad ek bearish candlestick aati hai jo pehli candlestick ke midpoint se neeche close hoti hai. Piercing Pattern isi ka bullish version hai jo bearish candlestick ke baad bullish candlestick se banta hai jo pehli candlestick ke midpoint se upar close hoti hai.

Yeh kuch powerful candlestick patterns hain jo trading mein bohot kaam aate hain. In patterns ko samajhne aur unhe trading decisions mein istemal karne se aap apne trading results ko improve kar sakte hain. Lekin yaad rahe ke sirf candlestick patterns par rely na karen, balki doosri technical analysis tools aur risk management strategies ko bhi apne trading plan mein shamil karen. -

#7 Collapse

**Title: Forex Trading Mein Sabse Powerful Candlestick Patterns**

Forex trading mein candlestick patterns ka bohot ahm role hota hai. Yeh patterns price movements ka visual representation hoti hain aur traders ko market ke trends aur potential reversals ko identify karne mein madad karti hain. Candlestick patterns ko samajhna aur unhe trading decisions mein implement karna, traders ke liye profitable ho sakta hai. Is article mein, hum kuch sabse powerful candlestick patterns ko discuss karenge jo forex trading mein aapko edge provide kar sakti hain.

1. **Doji Candlestick Pattern**

Definition:

Doji candlestick tab banta hai jab open aur close prices almost equal hoti hain, jiski wajah se candlestick ka body bohot choti hoti hai. Yeh market mein indecision ya potential reversal ka signal hota hai.

Types of Doji:

- **Standard Doji:** Open aur close prices almost same hoti hain.

- **Gravestone Doji:** Upper shadow bohot lambi hoti hai aur lower shadow almost absent hoti hai.

- **Dragonfly Doji:** Lower shadow bohot lambi hoti hai aur upper shadow almost absent hoti hai.

Interpretation:

Doji pattern market mein buyers aur sellers ke darmiyan balance ya uncertainty ko show karta hai. Agar yeh pattern support ya resistance level par banay, to yeh potential reversal ka strong signal ho sakta hai.

2. **Hammer and Hanging Man Candlestick Patterns**

Hammer:

Definition:

Hammer candlestick tab banta hai jab ek lambi lower shadow ke sath chhoti body ho aur upper shadow almost absent ho. Yeh pattern downtrend ke baad form hota hai aur potential bullish reversal ka signal hota hai.

Interpretation:

Hammer pattern indicate karta hai ke sellers ne initially market ko neeche push kiya, lekin buyers ne market ko wapas upar push kar diya. Agar yeh pattern support level par banay, to yeh strong bullish reversal ka signal ho sakta hai.

Hanging Man:

Definition:

Hanging Man pattern hammer ke opposite hota hai. Yeh uptrend ke baad form hota hai aur potential bearish reversal ka signal hota hai.

Interpretation:

Hanging Man pattern indicate karta hai ke buyers ne initially market ko upar push kiya, lekin sellers ne market ko wapas neeche push kar diya. Agar yeh pattern resistance level par banay, to yeh strong bearish reversal ka signal ho sakta hai.

3. **Engulfing Candlestick Pattern**

Bullish Engulfing:

Definition:

Bullish Engulfing pattern tab banta hai jab ek chhoti bearish candle ke baad ek bohot badi bullish candle banay jo previous bearish candle ko completely engulf kar le. Yeh downtrend ke baad form hota hai aur potential bullish reversal ka signal hota hai.

Interpretation:

Yeh pattern indicate karta hai ke buyers ne sellers ko overpower kar diya aur market ko upar push kar rahe hain. Yeh strong bullish signal hota hai, especially agar yeh support level par banay.

Bearish Engulfing:

Definition:

Bearish Engulfing pattern tab banta hai jab ek chhoti bullish candle ke baad ek bohot badi bearish candle banay jo previous bullish candle ko completely engulf kar le. Yeh uptrend ke baad form hota hai aur potential bearish reversal ka signal hota hai.

Interpretation:

Yeh pattern indicate karta hai ke sellers ne buyers ko overpower kar diya aur market ko neeche push kar rahe hain. Yeh strong bearish signal hota hai, especially agar yeh resistance level par banay.

4. **Morning Star and Evening Star Candlestick Patterns**

Morning Star:

Definition:

Morning Star pattern ek three-candle pattern hai jo downtrend ke baad form hota hai. Pehli candle bearish hoti hai, doosri candle chhoti body (bullish ya bearish) hoti hai, aur teesri candle strong bullish hoti hai.

Interpretation:

Morning Star pattern indicate karta hai ke market mein buying pressure barh raha hai aur yeh potential bullish reversal ka strong signal hota hai.

Evening Star:

Definition:

Evening Star pattern morning star ka opposite hota hai. Yeh uptrend ke baad form hota hai aur pehli candle bullish, doosri chhoti body (bullish ya bearish), aur teesri strong bearish hoti hai.

Interpretation:

Evening Star pattern indicate karta hai ke market mein selling pressure barh raha hai aur yeh potential bearish reversal ka strong signal hota hai.

Conclusion

Forex trading mein candlestick patterns ko samajhna aur unhe effectively trading decisions mein implement karna, aapko market trends aur potential reversals ko behtar andaz mein identify karne mein madad karta hai. Doji, Hammer, Hanging Man, Engulfing, aur Morning/Evening Star jese powerful candlestick patterns ko use karke, aap apni trading strategy ko enhance kar sakte hain aur profitable trades execute kar sakte hain. Trading mein hamesha discipline aur risk management ko madde nazar rakhna chahiye taake aap lambe arse tak kamiyabi hasil kar sakein.

- CL

- Mentions 0

-

سا0 like

-

#8 Collapse

**Sabse Powerful Candlestick Patterns**

Forex trading aur stock market analysis mein candlestick patterns ka bohot important role hota hai. Yeh patterns market ki price movements ko visual form mein dikhate hain aur potential trend reversals ya continuations ke signals dete hain. Candlestick patterns ko samajh kar traders apne trading decisions ko enhance kar sakte hain. Is post mein hum kuch sabse powerful candlestick patterns ko discuss karenge.

### 1. Doji

Doji ek neutral candlestick pattern hai jo tab banta hai jab open aur close prices almost equal hoti hain. Yeh pattern market mein uncertainty ya indecision ko indicate karta hai. Doji agar kisi trend ke end mein banta hai to yeh potential trend reversal ka signal ho sakta hai.

### 2. Hammer

Hammer ek bullish reversal pattern hai jo downtrend ke end mein banta hai. Iska small body aur long lower shadow hota hai. Hammer indicate karta hai ke buyers ne control le liya hai aur price ko push kar diya hai. Iska inverse pattern "Hanging Man" hai jo uptrend ke end mein banta hai aur bearish reversal ko indicate karta hai.

### 3. Engulfing Patterns

Bullish Engulfing Pattern tab banta hai jab ek small bearish candle ko ek large bullish candle engulf kar leti hai. Yeh pattern strong bullish reversal ko indicate karta hai. Isi tarah, Bearish Engulfing Pattern tab banta hai jab ek small bullish candle ko ek large bearish candle engulf kar leti hai, jo strong bearish reversal ko indicate karta hai.

### 4. Morning Star aur Evening Star

Morning Star ek bullish reversal pattern hai jo teen candles se mil kar banta hai: ek bearish candle, ek small-bodied candle (jo bullish ya bearish ho sakti hai), aur ek bullish candle. Yeh pattern downtrend ke end mein banta hai aur trend reversal ko indicate karta hai. Evening Star iska opposite pattern hai jo uptrend ke end mein banta hai aur bearish reversal ko indicate karta hai.

### 5. Shooting Star

Shooting Star ek bearish reversal pattern hai jo uptrend ke end mein banta hai. Iska small body aur long upper shadow hota hai. Yeh indicate karta hai ke price high tak chali gayi thi magar sellers ne price ko niche push kar diya. Yeh strong bearish signal hota hai.

### Conclusion

Candlestick patterns trading mein bohot valuable tools hain. Inko sahi tarah se samajh kar aur use kar ke traders market movements ko better predict kar sakte hain aur apne trades ko optimize kar sakte hain. Candlestick patterns ko other technical analysis tools ke saath combine karke apne trading strategy ko aur bhi strong bana sakte hain. Forex ya stock market trading mein success pane ke liye in patterns ko samajhna aur inka sahi istemal karna zaroori hai.

- CL

- Mentions 0

-

سا0 like

-

#9 Collapse

What's the Most powerful candlestick patterns

Introduction

Candlestick patterns are essential tools in technical analysis. They provide visual cues about market sentiment and potential price movements. Let's explore some of the most powerful candlestick patterns used by traders.

Bullish Engulfing

Description:

Bullish Engulfing pattern tab banta hai jab ek choti bearish candle (red) ke baad ek badi bullish candle (green) aati hai jo pehli candle ko poori tarah se engulf kar leti hai.

Significance:

Yeh pattern market mein bullish reversal ka signal hota hai, yani ki price ke upar jaane ki umeed hoti hai.

Example:

Agar ek downtrend mein yeh pattern nazar aaye, toh yeh indicate karta hai ke buyers market mein wapas aa gaye hain aur prices upar jaane ki koshish kar rahe hain.

Bearish Engulfing

Description:

Bearish Engulfing pattern tab banta hai jab ek choti bullish candle (green) ke baad ek badi bearish candle (red) aati hai jo pehli candle ko poori tarah se engulf kar leti hai.

Significance:

Yeh pattern market mein bearish reversal ka signal hota hai, yani ki price ke niche jaane ki umeed hoti hai.

Example:

Agar ek uptrend mein yeh pattern nazar aaye, toh yeh indicate karta hai ke sellers market mein wapas aa gaye hain aur prices niche jaane ki koshish kar rahe hain.

Morning Star

Description:

Morning Star ek three-candle pattern hota hai. Pehli candle ek badi bearish candle hoti hai, doosri candle choti ya doji hoti hai, aur teesri candle ek badi bullish candle hoti hai.

Significance:

Yeh pattern bhi bullish reversal ko indicate karta hai, yani ke market mein niche ke baad ab prices upar jaane wale hain.

Example:

Agar ek strong downtrend ke baad yeh pattern form ho, toh yeh indicate karta hai ke sellers ka pressure khatam ho gaya hai aur buyers ne control le liya hai.

Evening Star

Description:

Evening Star bhi ek three-candle pattern hota hai. Pehli candle ek badi bullish candle hoti hai, doosri candle choti ya doji hoti hai, aur teesri candle ek badi bearish candle hoti hai.

Significance:

Yeh pattern bearish reversal ko indicate karta hai, yani ke market mein upar ke baad ab prices niche jaane wale hain.

Example:

Agar ek strong uptrend ke baad yeh pattern form ho, toh yeh indicate karta hai ke buyers ka pressure khatam ho gaya hai aur sellers ne control le liya hai.

Hammer

Description:

Hammer candle tab banti hai jab ek choti body aur lamba lower shadow ho. Upper shadow bohot choti ya bilkul na ho.

Significance:

Yeh pattern bullish reversal ka signal hota hai jab yeh ek downtrend ke baad form ho.

Example:

Agar downtrend ke baad ek hammer form ho, toh yeh indicate karta hai ke niche ke prices reject ho gaye hain aur prices ab upar jaane wale hain.

Shooting Star

Description:

Shooting Star candle tab banti hai jab ek choti body aur lamba upper shadow ho. Lower shadow bohot choti ya bilkul na ho.

Significance:

Yeh pattern bearish reversal ka signal hota hai jab yeh ek uptrend ke baad form ho.

Example:

Agar uptrend ke baad ek shooting star form ho, toh yeh indicate karta hai ke upar ke prices reject ho gaye hain aur prices ab niche jaane wale hain.

Doji

Description:

Doji candle tab banti hai jab opening aur closing price lagbhag barabar ho, aur shadows lambi ya choti ho sakti hain.

Significance:

Yeh pattern market ke indecision ko show karta hai. Market mein reversal ka potential hota hai agar yeh pattern support ya resistance level pe form ho.

Example:

Agar ek strong trend ke baad doji form ho, toh yeh indicate karta hai ke trend ka momentum khatam ho raha hai aur reversal ho sakta hai.

Dark Cloud Cover

Description:

Dark Cloud Cover pattern tab banta hai jab ek badi bullish candle ke baad ek bearish candle aati hai jo pehli candle ke midpoint se neeche close hoti hai.

Significance:

Yeh pattern bearish reversal ka signal hota hai, yani ki prices niche jaane ki umeed hoti hai.

Example:

Agar uptrend ke baad yeh pattern form ho, toh yeh indicate karta hai ke sellers ne control le liya hai aur prices niche jaane wale hain.

Piercing Line

Description:

Piercing Line pattern tab banta hai jab ek badi bearish candle ke baad ek bullish candle aati hai jo pehli candle ke midpoint se upar close hoti hai.

Significance:

Yeh pattern bullish reversal ka signal hota hai, yani ki prices upar jaane ki umeed hoti hai.

Example:

Agar downtrend ke baad yeh pattern form ho, toh yeh indicate karta hai ke buyers ne control le liya hai aur prices upar jaane wale hain.

Conclusion

Candlestick patterns are a powerful tool for traders. They provide valuable insights into market sentiment and potential price movements. Understanding these patterns can help traders make more informed decisions and increase their chances of success in the market.

-

#10 Collapse

**What's the Most Powerful Candlestick Patterns**

Forex trading mein candlestick patterns ka use kaafi common hai kyunke yeh price action ko samajhne aur trading decisions lene mein madad karte hain. Candlestick patterns price movements ke visual representations hote hain jo traders ko market ke potential reversals aur continuations ke baare mein signals provide karte hain. Kuch candlestick patterns dusron se zyada powerful aur reliable hote hain. Yahaan hum kuch aise powerful candlestick patterns discuss karenge jo forex trading mein kaafi effective hain.

**1. Bullish Engulfing Pattern:**

Yeh pattern tab form hota hai jab ek small bearish candle ke baad ek large bullish candle aati hai jo previous candle ke body ko completely engulf kar leti hai. Yeh pattern bullish reversal ka strong signal hota hai aur aksar downtrend ke baad appear hota hai.

**2. Bearish Engulfing Pattern:**

Yeh pattern bullish engulfing pattern ka opposite hota hai. Yeh tab form hota hai jab ek small bullish candle ke baad ek large bearish candle aati hai jo previous candle ke body ko completely engulf kar leti hai. Yeh pattern bearish reversal ka strong signal hota hai aur aksar uptrend ke baad appear hota hai.

**3. Hammer:**

Hammer candlestick pattern ek single candle pattern hai jo bullish reversal ko indicate karta hai. Is candle ka body chhota hota hai aur long lower shadow hota hai, jo yeh batata hai ke buyers ne price ko recover kar liya hai. Yeh pattern aksar downtrend ke baad appear hota hai.

**4. Shooting Star:**

Shooting star pattern hammer ka opposite hota hai. Yeh bearish reversal pattern hai jo ek single candle se milkar banta hai. Is candle ka body chhota hota hai aur long upper shadow hota hai, jo yeh batata hai ke sellers ne price ko niche push kar diya hai. Yeh pattern aksar uptrend ke baad appear hota hai.

**5. Morning Star:**

Morning star pattern ek three-candle bullish reversal pattern hai. Pehli candle ek long bearish candle hoti hai, doosri candle ek small-bodied candle hoti hai (bullish ya bearish), aur teesri candle ek long bullish candle hoti hai jo pehli candle ke body ke middle se upar close hoti hai. Yeh pattern aksar downtrend ke baad appear hota hai aur strong bullish reversal ko indicate karta hai.

**6. Evening Star:**

Evening star pattern morning star ka opposite hota hai. Yeh ek three-candle bearish reversal pattern hai. Pehli candle ek long bullish candle hoti hai, doosri candle ek small-bodied candle hoti hai (bullish ya bearish), aur teesri candle ek long bearish candle hoti hai jo pehli candle ke body ke middle se niche close hoti hai. Yeh pattern aksar uptrend ke baad appear hota hai aur strong bearish reversal ko indicate karta hai.

**Conclusion:**

Candlestick patterns forex trading mein kaafi powerful aur reliable tools hain jo market ke potential reversals aur continuations ko predict karne mein madad karte hain. Bullish engulfing, bearish engulfing, hammer, shooting star, morning star, aur evening star patterns kuch aise powerful patterns hain jo traders ke liye valuable signals provide karte hain. In patterns ko effectively use karne ke liye aapko market ki understanding aur practice zaroori hai. Aap in powerful candlestick patterns ko apne trading arsenal mein shamil karke apni trading performance ko enhance kar sakte hain.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#11 Collapse

**What's the Most Powerful Candlestick Patterns?**

Candlestick patterns forex trading mein ek ahem role ada karti hain. Yeh patterns price action ko samajhne mein madadgar hoti hain aur traders ko market ke next move ka andaza lagane mein help karti hain. Is post mein, hum kuch most powerful candlestick patterns ka zikar karenge jo trading decisions ko enhance kar sakti hain.

### 1. **Doji Candlestick**

Doji candlestick ek aise pattern ko represent karta hai jahan open aur close price qareeban barabar hoti hain. Yeh pattern market ke indecision ya turning point ka signal ho sakta hai. Agar yeh pattern support ya resistance level par form ho, toh yeh potential reversal ki nishani ho sakta hai.

### 2. **Hammer and Hanging Man**

Hammer aur Hanging Man candlestick patterns ek hi structure share karte hain, magar unka context different hota hai. Hammer bullish reversal ka indicate karta hai jab yeh downtrend ke dauran form hota hai. Iski tail ya shadow long hoti hai, jo price rejection ko highlight karti hai. Hanging Man bearish reversal ka ishara deta hai jab yeh uptrend ke doran form hota hai.

### 3. **Engulfing Patterns**

Engulfing patterns do types ke hote hain: Bullish Engulfing aur Bearish Engulfing. Bullish Engulfing tab hota hai jab ek chhoti bearish candle ko agle din ek bari bullish candle engulf kar leti hai. Yeh upward reversal ka indication hota hai. Bearish Engulfing, iske baraks, tab hota hai jab ek chhoti bullish candle ko ek bari bearish candle engulf kar leti hai, jo downward reversal ka ishara hota hai.

### 4. **Morning Star and Evening Star**

Morning Star ek bullish reversal pattern hai jo teen candles se milkar banta hai. Pehli candle bearish hoti hai, doosri candle chhoti hoti hai (jo possible indecision ko show karti hai), aur teesri candle bullish hoti hai, jo trend reversal ka signal deti hai. Evening Star, iska opposite hai, aur bearish reversal ko indicate karta hai.

### 5. **Shooting Star and Inverted Hammer**

Shooting Star aur Inverted Hammer patterns, ek dusre ke opposite hain magar same structure share karte hain. Shooting Star ek bearish reversal pattern hai jo uptrend mein form hota hai aur iska upper shadow long hota hai. Inverted Hammer ek bullish reversal pattern hai jo downtrend mein form hota hai aur iska upper shadow bhi long hota hai.

### 6. **Three Black Crows and Three White Soldiers**

Three Black Crows pattern teen bearish candles se milkar banta hai, jo strong bearish reversal ka indication hoti hain. Ye pattern jab uptrend ke baad form hota hai, toh yeh trend change ka powerful signal ho sakta hai. Three White Soldiers iske baraks hota hai, aur strong bullish reversal ko represent karta hai, jo uptrend ki shuruaat ki nishani ho sakta hai.

### Conclusion

Yeh powerful candlestick patterns market ki psychology aur price action ko samajhne mein madadgar hain. In patterns ko support aur resistance levels ke sath mila kar dekha jaye, toh yeh trading decisions ko bahut enhance kar sakti hain. Har pattern ko context mein samajhna aur doosri technical indicators ke sath combine karna zaroori hai taake aap behtareen trading strategies develop kar sakein.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 06:13 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим