Consolidation Pattern Identification and Uses in Forex Trading.

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Consolidation Pattern. Forex market mein jamaat (consolidation) pattern aik ahem tajziati tool hai jo traders ko market ki halat aur future movements samajhne mein madad karta hai. Is article mein hum aap ko forex market mein jamaat pattern ki pehchaan karne ke tarike aur uske faide batayenge. Jamaat pattern jo bhi security ya currency pair ho market mein price ko stable aur sidha hone ki surat hoti hai. Jamaat pattern ki pehchaan karna trading opportunities ke shikhar hone se pehle market volatility aur trend reversal ko samajhne mein madad karta hai. Is pattern mein price range mein movement hota hai aur market volume normal ya kam hoti hai. Identification. Jamaat pattern ko samajhne ke liye aap ko price ko analyze karna hoga. Jaan-ne ke liye kuch tarike hain: Price Range. Jamaat pattern mein price range limit mein rehta hai. Ye range support aur resistance levels ke darmiyan hota hai. Is pattern mein price bar-bar support aur resistance levels ko break nahi karta. Less Volume. Jamaat pattern ke dauran market volume normal ya kam hoti hai. Agar volume low hai toh ye indicate karta hai ke market participants aanay wale changes se cautious hain. Straight Price Movement. Jamaat pattern mein price ek jagah par stable rehta hai. Yani ascend ya descend trend ki surat mein nahi hota hai. Technical Indicators. Jamaat pattern ki pehchaan mein technical indicators bhi madadgar ho sakte hain. Jaise ki Bollinger Bands Moving Average aur RSI (Relative Strength Index). Jamaat pattern ka samajhna forex traders ke liye kafi zaroori hai. Kuch faide is tarah hain.Jamaat pattern trend reversal aur market volatility ko samajhne mein madad karta hai. Ye traders ko trend ki mukammal tabdeeli se pehle trading opportunities mein madad karta hai. Entry aur Exit Points. Jamaat pattern se price range limit support aur resistance levels ka pata lagaya ja sakta hai. Is tarah traders ko entry aur exit points ka sahi intikhab karne mein madad milti hai. Aakhir mein jamaat pattern forex market mein important hai kyunki ye traders ko trend reversal aur entry/exit points ka pata lagane mein madad karta hai. Is pattern ko samajhne ke liye price movement volume aur technical indicators par tawajjo deni hogi. Jamaat pattern ke faide samajh kar traders apni trading strategies aur risk management ko behtar tareeqe se implement kar sakte hain. -

#3 Collapse

### Consolidation Pattern Identification Aur Uses in Forex Trading

Consolidation pattern forex trading ka ek ahem hissa hai, jo market ki stability aur potential breakout points ko darust karta hai. Yeh pattern tab banta hai jab market ek certain price range mein trade karta hai, jahan na to buyers zyada powerful hote hain aur na hi sellers. Aayiye, consolidation pattern ki pehchaan aur iske istemal par nazar dalte hain.

**Consolidation Pattern Ki Pehchaan**

Consolidation pattern ko pehchaanne ke liye, aapko price action par tawajjo deni hoti hai. Jab market kisi specific range mein trade kar raha ho, to is pattern ki nishani hoti hai. Ismein do main elements shamil hote hain:

1. **Support Level**: Yeh wo price level hai jahan buyers market ko support dete hain aur price neeche nahi jaane dete.

2. **Resistance Level**: Yeh wo price level hai jahan sellers price ko neeche laate hain aur market ko control karte hain.

Is pattern ki shakal generally rectangle ya triangle ki hoti hai. Jab price support aur resistance levels ke beech mein fluctuate karti hai, to yeh consolidation pattern ka darust karti hai.

**Market Sentiment**

Consolidation pattern ka matlab yeh hai ke market mein uncertainty hai. Traders ko yeh samajhna chahiye ke market ke fundamentals ya news ke bina price kisi direction mein move nahi kar raha. Yeh consolidation phase market ki stability ka darust karta hai aur potential breakout ya breakdown ke liye tayyari karta hai.

**Uses in Forex Trading**

1. **Breakout Trading**: Jab market consolidation phase se nikalta hai aur resistance level ko cross karta hai, to yeh bullish breakout hota hai. Is waqt traders entry lete hain. Uske baraks, agar price support level se neeche nikalti hai, to yeh bearish breakdown hota hai, jahan traders short position le sakte hain.

2. **Risk Management**: Consolidation patterns ko identify karna risk management mein madadgar hota hai. Aap stop-loss orders ko support ya resistance levels ke aas paas rakh sakte hain, taake aapko unexpected price movements se bachne ka mauqa mile.

3. **Trend Confirmation**: Consolidation ke baad jab market breakout hota hai, to yeh existing trend ki confirmation hoti hai. Agar bullish trend ke baad consolidation hoti hai aur phir breakout aata hai, to yeh trend continuation ka signal hota hai.

**Conclusion**

Consolidation pattern ko samajhna aur identify karna forex trading mein bohot zaroori hai. Yeh aapko market ki stability aur potential price movements ko darust karta hai. Is pattern ka sahi istemal karke aap apni trading strategies ko behter bana sakte hain. Hamesha yaad rakhein ke risk management ka khayal rakhna bohot zaroori hai taake aap market ki uncertainties se bach sakein.

-

#4 Collapse

In Forex trading, a consolidation pattern refers to a period where the price of a currency pair moves within a range, typically between a support and resistance level, without showing a clear trend direction. This occurs when the market is indecisive, often following a strong directional move. Traders use consolidation patterns to prepare for potential breakouts, where the price moves decisively beyond the consolidation range. Understanding these patterns can help traders anticipate price movements and make informed decisions.

Common Consolidation Patterns

1. Rectangle (Range):

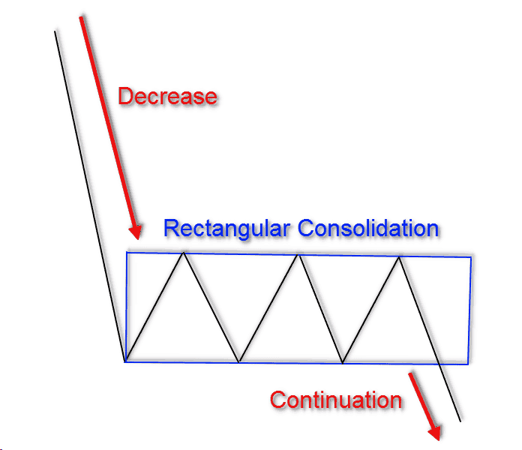

Description: Prices move horizontally between clear support and resistance levels. This pattern often indicates indecision, where buyers and sellers are equally matched.

Use: Traders may buy at support and sell at resistance. Breakouts above or below the range often signal strong price movements.

2. Symmetrical Triangle:

Description: The price moves within converging trendlines, forming a triangle. Both the highs and lows converge towards a point, showing reduced volatility.

Use: Traders anticipate a breakout, which can happen in either direction. The breakout direction often aligns with the preceding trend (continuation pattern).

3. Flag:

Description: This pattern forms after a strong price move (flagpole) and represents a small consolidation against the trend. The price usually stays within parallel lines, sloping slightly against the prevailing trend.

Use: Traders expect the price to continue in the direction of the original trend after the consolidation ends.

4. Pennant:

Description: Similar to the flag but with converging trendlines (like a symmetrical triangle) rather than parallel ones. It forms after a sharp price move.

Use: Traders anticipate the trend will resume after the pennant breakout, often using it as a continuation signal.

5. Ascending/Descending Triangle:

Description: In an ascending triangle, the price has a horizontal resistance level and higher lows, indicating buying pressure. A descending triangle has horizontal support and lower highs, indicating selling pressure.

Use: The breakout direction usually aligns with the triangle's bias—ascending triangles suggest bullish breakouts, while descending triangles suggest bearish breakouts.

Uses of Consolidation Patterns in Forex Trading

1. Breakout Trading:

Traders often look for consolidation patterns to trade breakouts, expecting strong price moves once the consolidation ends. A breakout occurs when the price moves beyond the support or resistance levels of the consolidation pattern. Traders may enter long or short positions based on the direction of the breakout.

2. Range Trading:

When the market is consolidating within a range (e.g., a rectangle pattern), traders can exploit this by buying near support and selling near resistance. Range traders expect the price to remain bounded within the consolidation zone for some time.

3. Risk Management:

Consolidation patterns help define clear entry and exit points, making them useful for setting stop-loss and take-profit levels. For example, in a triangle pattern, traders may place stop-loss orders below the lower trendline in case of a breakout failure.

4. Volatility Compression:

Consolidation periods often lead to volatility compression. When the price consolidates, volatility reduces, and when it breaks out, volatility typically surges. Traders can prepare for the post-consolidation increase in volatility by positioning themselves accordingly.

5. Trend Continuation:

Many consolidation patterns (flags, pennants) are seen as continuation patterns. Traders use these patterns to re-enter the market in the direction of the prevailing trend, expecting the price to resume its earlier momentum.

6. Confirmation of Market Sentiment:

Consolidation patterns allow traders to gauge market sentiment and detect if the buyers or sellers are gaining strength. A breakout from consolidation often confirms the dominant market sentiment.

Key Considerations

False Breakouts: Not all breakouts lead to sustained price movements. False breakouts can occur, where the price briefly moves beyond the consolidation range only to reverse direction. Traders should use other tools, like volume indicators or momentum oscillators, to confirm breakouts.

Patience: Consolidation periods can last for varying lengths of time, and traders must be patient, waiting for a decisive breakout before acting.

Volume Confirmation: In many cases, a breakout with increasing trading volume provides stronger confirmation of a valid move.

By identifying and analyzing consolidation patterns, Forex traders can enhance their trading strategies, improve timing, and reduce risks associated with market uncertainty.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#5 Collapse

Consolidation Pattern

Forex trading mein market ki movement aksar trending hoti hai, lekin kai dafa market consolidation stage se guzarti hai. Consolidation pattern aik aisa phase hai jahan price ek narrow range mein trade karti hai aur market mein uncertainty ya equilibrium nazar aati hai.Consolidation pattern se murad hai woh period jahan market ke buyers aur sellers ke darmiyan balance ho jata hai aur price ek specific range mein confined rehti hai. Is phase mein price swing kam hotay hain aur market trend temporarily mute ho jata hai. Iska matlab yeh hai ke buyers aur sellers ka pressure ek dosray ke barabar ho jata hai. Yeh phase aksar trend ke end ya trend ke continuation se pehle aata hai. Consolidation phase ko sideways movement ya range-bound market bhi kehte hain.

Characteristics of Consolidation Patterns

Consolidation patterns ke kuch khas characteristics hotay hain. Sab se pehla, price ek definite support aur resistance level ke darmiyan trade karti hai. Yeh levels aapko chart par clearly nazar aate hain jahan price baar baar react karti hai. Doosra, consolidation period mein volume aksar kam ho jata hai, kyun ke market participants ke darmiyan indecision hoti hai. Teesra, is phase mein price ki volatility temporarily reduce ho jati hai. Yeh sab characteristics aapko help karte hain ke aap consolidation phase ko asani se identify kar saken.

How to Identify Consolidation Patterns

Consolidation pattern ko identify karne ke liye aapko sab se pehle chart par support aur resistance levels ko mark karna hota hai. Agar price repeatedly in levels ke darmiyan trade kar rahi ho, to yeh consolidation signal hota hai. Aksar, consolidation ke dauran price ke candles chhoti body wali hoti hain aur overall movement restricted rehta hai. Aap technical tools jaise Bollinger Bands ka bhi istemal kar sakte hain; jab Bollinger Bands narrow ho jate hain, to yeh indicate karta hai ke market consolidation mein hai. Trendlines aur horizontal lines draw karna bhi aasan tareeqa hai is phase ko identify karne ka. Agar aap multiple timeframes par analysis karain, to higher timeframes jaise daily ya 4-hour charts par consolidation ka pattern clear nazar aata hai.

Types of Consolidation Patterns

Consolidation patterns kai tareeqon mein hotay hain. Range-bound market aik simple consolidation pattern hai jahan price ek defined range mein move karti hai. Triangle formations bhi consolidation ke forms hain. Symmetrical triangle mein price gradually converge karti hai aur ek point par collapse hone ke chances barh jate hain. Ascending ya descending triangles market ke bullish ya bearish bias ko indicate karte hain, magar in sab ka basic concept consolidation hi hota hai. Rectangle pattern aik aur common consolidation pattern hai jahan price horizontal support aur resistance ke darmiyan move karti hai.

Uses of Consolidation Patterns in Forex Trading

Consolidation patterns traders ko kai useful signals dete hain. Pehla, yeh pattern indicate karta hai ke market temporarily pause le rahi hai. Yeh pause aksar market ke next move ke liye ek base provide karta hai. Jab market consolidation se break out karti hai, to woh ya to upper side ya lower side mein move karti hai. Is breakout ko identify kar ke traders entry points set kar sakte hain. Dusra, consolidation phase risk management ke liye bohat mufeed hota hai. Jab market sideways chal rahi hoti hai, to risk kam hota hai aur traders apni positions ko adjust kar sakte hain. Third, consolidation phase traders ko overbought ya oversold conditions se bachata hai, kyun ke yeh phase indecision ko reflect karta hai.

Breakout Strategies

Ek common strategy yeh hai ke consolidation phase ke breakouts ka intizaar kia jaye. Jab price support ya resistance ko break karti hai, to woh ek new trend start hone ka signal hota hai. Traders breakout ke direction mein position lete hain. Lekin false breakouts se bachne ke liye confirmation zaroori hai, jese ke increased volume ya additional technical indicators (jaise RSI ya MACD) ka signal. Agar breakout ke sath volume significant ho, to yeh confirm karta hai ke market mein naya momentum aaya hai. Is tarah, consolidation patterns aapko precise entry aur exit points set karne mein madad detey hain.

Range Trading Strategies

Consolidation ke dauran jab market ek range-bound phase mein hoti hai, traders range trading ka sahara lete hain. Is strategy mein aap support par buy aur resistance par sell orders place karte hain. Aksar consolidation ke period mein market ke boundaries clear hoti hain, is liye aap apni risk ko limit kar sakte hain. Range trading se aap regular small profits generate kar sakte hain jab market sideways move karti hai. Lekin market agar suddenly breakout ho jaye to aapko apne stop loss orders ko adjust karna zaroori hota hai.

Risk Management During Consolidation

Consolidation phase mein risk management bohat aham hai. Kyun ke consolidation period ke breakouts kabhi kabhi false ho sakte hain, is liye aapko tight stop loss orders lagana chahiye. Apni position sizing ko adjust karna bhi zaroori hai, taake agar breakout false prove ho to aapke losses limited rahen. Risk-reward ratio ko evaluate karna aur proper exit strategy set karna consolidation ke trades mein successful hone ke liye bohat zaroori hai. Aap technical indicators ko combine kar ke, jaise Bollinger Bands, volume analysis, aur trendlines, apne risk ko effectively manage kar sakte hain.

Psychological Aspect of Trading Consolidation Patterns

Consolidation phase mein traders ke liye patience aur discipline bohat zaroori hai. Kyun ke market temporarily sideways move karti hai, aapko apne emotions ko control mein rakhna hota hai. Overtrading se bachna chahiye jab market direction clear nahi hoti. Consolidation patterns ke dauran apne trading journal ko update karna aur past trades ko analyze karna aapko discipline sikhaata hai. Market ki indecision ko samajhna aur phir breakout ke liye sahi waqt ka intizaar karna, trading psychology ke liye bohat mufeed sabit hota hai.

Practical Example and Analysis

Maan lijiye ke aap GBP/USD ka chart dekh rahe hain aur aap notice karte hain ke pichlay kuch dino se price ek narrow range mein trade kar rahi hai. Aap support aur resistance levels ko clearly mark karte hain. Bollinger Bands bhi narrow ho chuke hain, jo indicate karta hai ke volatility kam hai. Yeh sab signals aapko batate hain ke market consolidation phase mein hai. Ab aap intizaar karte hain ke price kis taraf breakout karti hai. Agar price resistance ko break karti hai aur volume sath mein barhta hai, to yeh bullish breakout ka signal hota hai. Is point par aap long position enter kar sakte hain aur apna stop loss resistance level ke thoda neeche set kar sakte hain. Is tarah, consolidation pattern aapko entry aur exit ke liye clear guidelines provide karta hai.

Advantages of Trading Consolidation Patterns

Consolidation patterns trading ke liye kai advantages offer karte hain. Pehla, yeh aapko market ke equilibrium ko samajhne ka mauqa dete hain. Second, breakout ke sath clear entry aur exit points mil jate hain, jis se aapka risk-reward ratio improve hota hai. Teesra, consolidation phase mein market mein volatility comparatively kam hoti hai, jis se aapki trading strategy ko stable environment milta hai. Yeh patterns beginners ke liye bhi asaan hote hain samajhne ke liye, kyun ke support aur resistance levels clearly nazar aate hain. Iske ilawa, consolidation ke dauran technical indicators jaise oscillators aur trendlines ka istemal karke aap signal confirmation hasil kar sakte hain.

Limitations and Considerations

Halaanke consolidation patterns bohat useful hote hain, lekin inke sath kuch limitations bhi hoti hain. Market kabhi kabhi long periods tak consolidation phase mein reh sakta hai, jisse trading opportunities delayed ho sakti hain. False breakouts ka risk bhi hota hai, jis se aap impulsive decisions le sakte hain. Is liye, additional confirmation tools ka istemal bohat zaroori hai. Market ka overall trend aur economic news events bhi consolidation pattern ki reliability par asar dalte hain. Har trade ke sath risk management aur disciplined approach ko maintain karna chahiye taake false signals se bach sakein.Consolidation pattern identification forex trading mein aik bohat aham tool hai jo market ke indecision aur equilibrium ko highlight karta hai. Is phase mein price ek defined range mein trade karti hai, jahan support aur resistance levels clearly nazar aate hain. Consolidation patterns ko identify karke aap breakout ya range trading strategies develop kar sakte hain. In patterns ko effectively use karne ke liye proper chart analysis, additional technical indicators, aur disciplined risk management ka hona bohat zaroori hai. Trading consolidation patterns se aap timely entry aur exit points set kar sakte hain aur apne risk-reward ratio ko optimize kar sakte hain. Market ki consolidation phase ko samajhna aur uske baad aane wale breakouts ko accurately predict karna aapki overall trading performance ko behtar bana sakta hai. Consistency, patience, aur objective analysis se aap consolidation pattern ki signals ko effectively utilize kar sakte hain aur long-term trading success hasil kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 05:21 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим