Morning Doji star candle stick pattern,

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

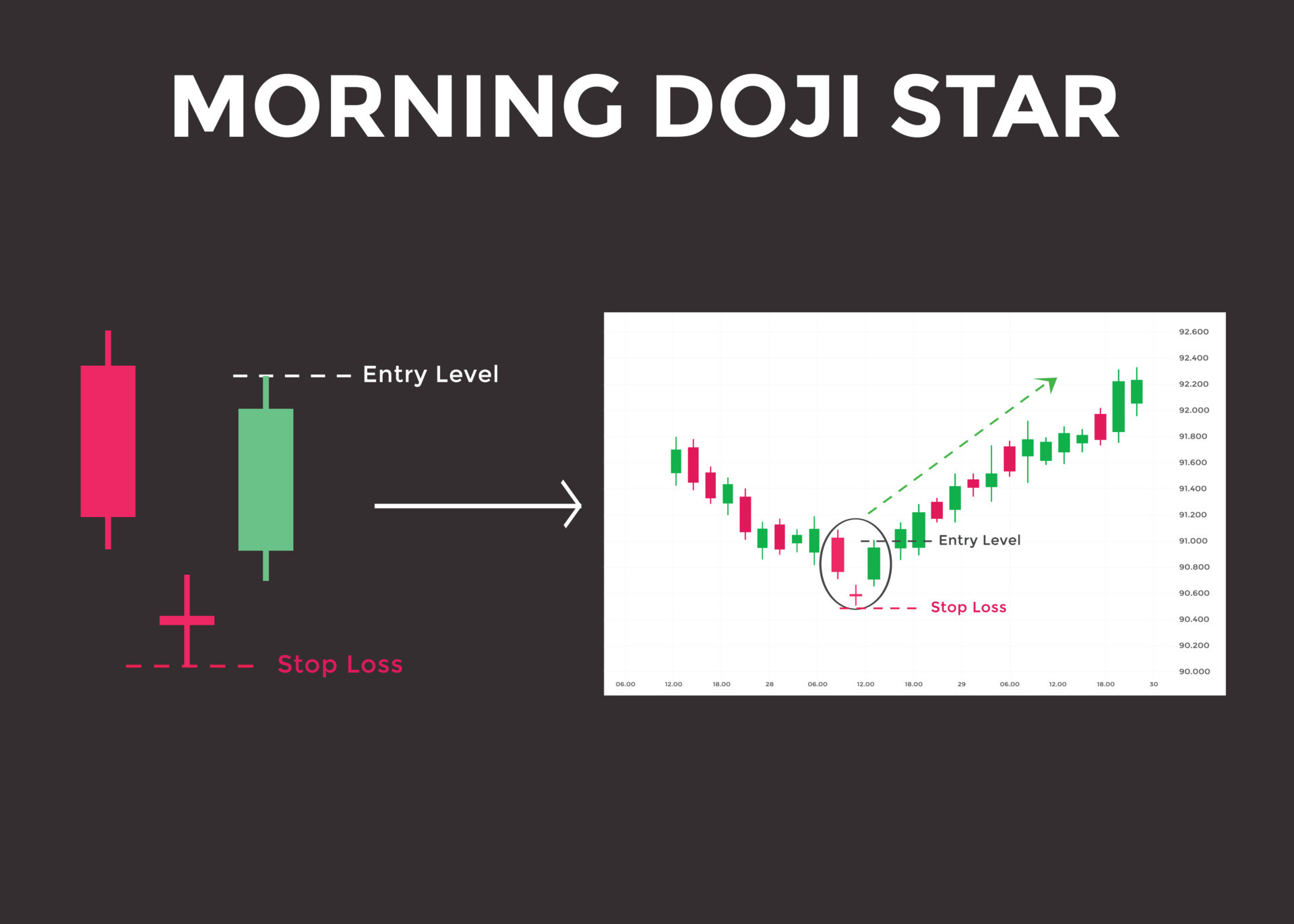

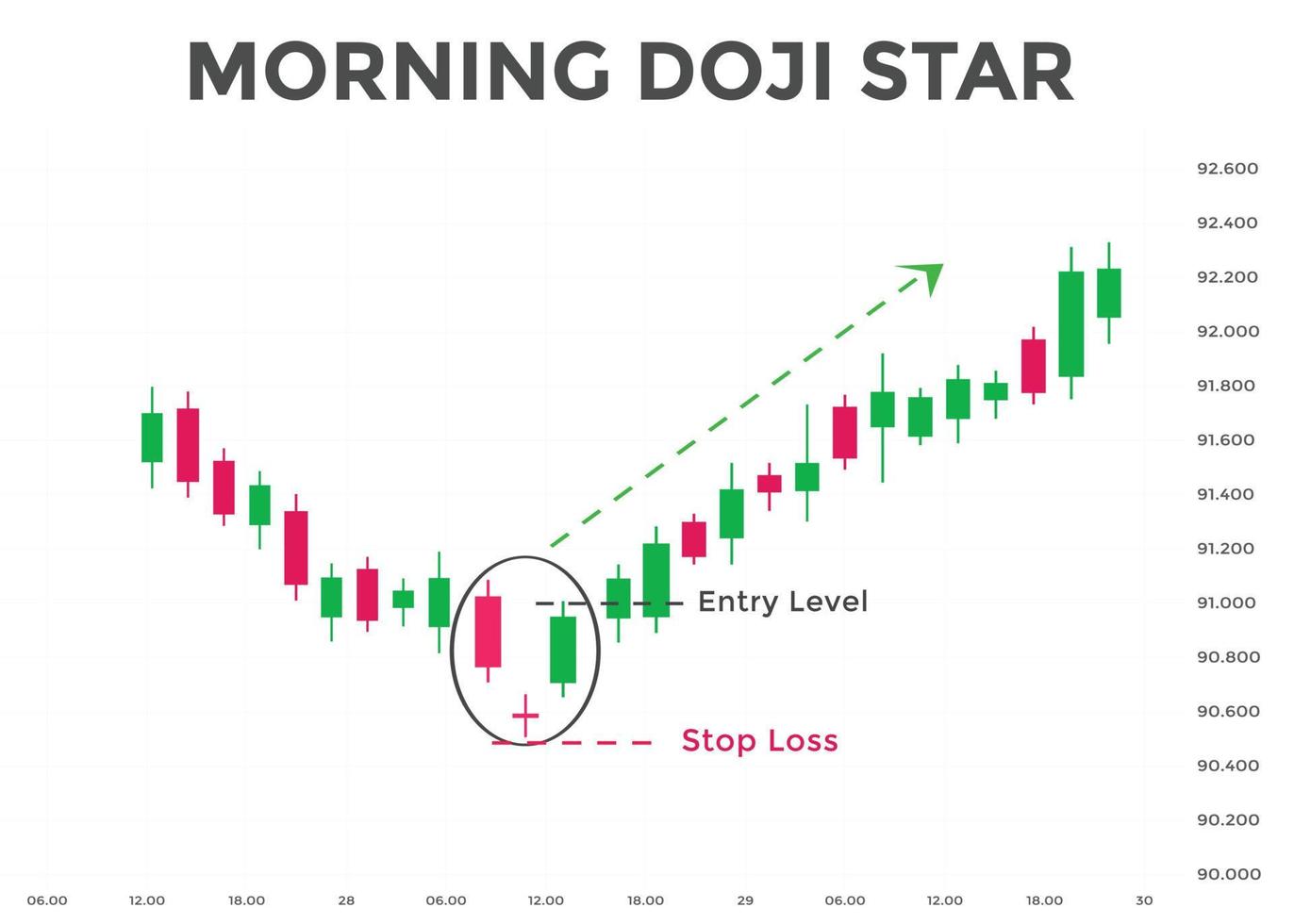

Aslam u alaikum, Dear forex member umeed karta hoon ap sab khairiyat se hoon gy dear members Morning Doji star candle stick pattern three candle stick pattern hota hey jes mein aik bearish candle stick hote hey or aik Doji candle stick hote hey or aik bullish candle stick hote yeh bearish trend ko reversal karnay ka eshara dayta hey yeh aik bearish trend reversal candle stick pattern hota hey jes mein aik bullish candle stick hte heyes say zahair hota hey keh buyer nay market ko control karna start kar deya hey price action trade karnay kay ey har candle stick kay pechay kay mantaq ko samjhna hota hey market ko read karna or sdsamjhna har candle stick pattern kay technical analysis ka amal hey Attachment 119525identification of Morning Doji Star candle stick pattern aik bare bearish candle stick hote hey or aik Doji candle stick hote hey or aik bullish candle stick kay sath mell kar aik morning Doji star candle stick pattern banta hey yeh aik best candle stick pattern hota hey jes ko talash karnay kay kuch criteria hein bearish candle stick ka body ka wick 70% he hona chihay or body aik bare candle stick ko identify karta hey chart aik behtareen candle stick pattern ko identify karnay kay ley seller ke raftar ka behtareen tanasob hota hey Doji candle stick ke start or end price aik jaice hone chihay es candle stick ka size dosree candle say bara hona chihay bullish candle stick ke body 70% ka tanasob hona chihay Attachment 119526 bullish candle stick ke morning Doji starbohut zyada importance rakhte hey mazeed 2 tareekay hotay hein j keh forex mein 2 tareekay kamell hein en pattern kay winning ka tanasob price kay chart par majodah point par depend karta hey Method1 : bullish candle stick bearish candle stick kay 50% level kay opar close hona chihay 50% level aik strong level hota hey es level kay par close hnay ka matlab yeh hey keh price aik strong resistance level ko break kar choke hote hey or ab yeh par janay k ready the Method 2 bulllish candle stick bearish candle stick ke peak kay opar close ho jane chihay yeh aik strong buy signal hota hey or buyer ke bare raftar wazah karte heyjo keh market ko control kar rahay hein

high probability Morning Doji Star candle stick pattern Morning Doji star candle stick pattern ko aik high imkane pattern kaha jata hey ager yeh aik strng level par aik strong demand zone banay trading win kay imkanat ko increase karnay kay ley sungom ko jama karnay kay baray mein hota hey price demand zone ya support zone say kodnay ke salehat rakhte hey ager key leel par morning Doji star bullish candle stick pattern banta hey to bearish say bullish trend mein tabdele kay imkanat barah jain gay Attachment 119527 Morning Doji star trading strategy aik candle stick pattern dosray candle stick pattern kay chart par sungom kay baghair akallay trade kay ley estamal nahe kea ja sakta hey kun keh yeh aik candle stick pattern reversal signal dayte hey laken yeh technical analysis take profit level kay baray mein khordah trade banate hey Attachment 119528 hum moving average kay sungom kay sath morning doji star candle stick pattern ke trading strategy ko wazah karen gay trading strategy

prices kay chart ko zoom out kar kay higher high or higher low label laga kar higher time frame ko indicate karen price ko exponential moving average par wapes jana chihay 21 or 35 period gap EMAs k kam say kam kar dayta hey EMAs par morning Doji star cande stick pattern ko talash karen price ka estarah bartao karna chihay keh moving average line ko reject karna chihay es bat ko barkarar rakhta hey keh moving average lines price ko barkarar rakhnay ke strength rakhta hey or price up jay ge open buy order bullish candle stick ke highs kay opar buy stop order dein fake candle stick pattern ke tashkel kay doran zair e altawa order bhe madad gar sabat ho ga stop loss level: Doji kay lower darjay kay nechay kuch pips par stop loss adjust karna chihay take profit level es trading strategy mein target level ko fix karnay kay ley Fibonacci extension tool ko estamal kar saktay hein take profit 1 ko price ke last peak par he rakhen retestment strat or end bhe high swing kay tor par kaam karay ga risk management morning Doji star candle stick pattern ke strategy kay ley kam say kam risk o reward 1:2 he hey kam risk j ap layna chahtay hein woh ap kay account ka 2 % hona chihay takeh ap ka account save rah sakay

conclusion: es pattern par trade karnay ke best tajweez yeh hey keh dosraay technical price pattern kay sungom kay sath hey ager ap akallay Doji candle stick pattern par trade karnay ka soch rahy hon to ap profit able trader nahe ban saktay hein

Ap Ka aik thanks bohat zrori ha

- Mentions 0

-

سا0 like

-

#3 Collapse

Morning Doji Star Candlestick Pattern Ki Wazahat (Subah Ki Doji Taara)Morning Doji Star candlestick pattern ek technical analysis ka pattern hai jo market mein trend reversal ko darust karnay mein istemal hota hai. Yeh pattern teen candlesticks se bana hota hai aur bullish reversal pattern hota hai, matlab isko dekhtay hue traders ko yeh ishara milta hai ke market ka trend badal sakta hai. Pattern Ki Bunyad:Pehli Candlestick (Bearish Candlestick): Morning Doji Star pattern ki shuruaat hoti hai aik bearish candlestick se. Is candlestick ki wajah se yeh pata chalta hai ke market mein pehlay se hi girawat chal rahi hai. Is candlestick ki real body (jis mein opening price aur closing price hote hain) neeche ki taraf hoti hai, iska matlab hai ke market down trend mein hai. Dusri Candlestick (Doji Candlestick): Dusri candlestick aik Doji candlestick hoti hai. Ismein opening price aur closing price aik dosre ke bohat kareeb hoti hain ya phir woh barabar hoti hain. Is candlestick se samjha jata hai ke market mein traders mein uncertainty hai aur trend ka rukh tay nahi ho raha. Yeh doji candlestick indecision ko darust karti hai. Teisri Candlestick (Bullish Candlestick): Teisri aur akhri candlestick bullish hoti hai, matlab ke yeh market mein trend reversal hone ke chances ko darust karti hai. Is candlestick ki wajah se traders ko signal milta hai ke ab market mein bullish trend shuru ho sakta hai. Iske hone se pehle market mein girawat thi, lekin ab trend change hone ke imkanat hain. Yeh Morning Doji Star pattern traders ko market mein hone wale trend reversal ke liye tayyar hone ka ishara deta hai aur isay samjhnay se traders apni trading strategies ko improve kar sakte hain.

Pattern Ki Bunyad:Pehli Candlestick (Bearish Candlestick): Morning Doji Star pattern ki shuruaat hoti hai aik bearish candlestick se. Is candlestick ki wajah se yeh pata chalta hai ke market mein pehlay se hi girawat chal rahi hai. Is candlestick ki real body (jis mein opening price aur closing price hote hain) neeche ki taraf hoti hai, iska matlab hai ke market down trend mein hai. Dusri Candlestick (Doji Candlestick): Dusri candlestick aik Doji candlestick hoti hai. Ismein opening price aur closing price aik dosre ke bohat kareeb hoti hain ya phir woh barabar hoti hain. Is candlestick se samjha jata hai ke market mein traders mein uncertainty hai aur trend ka rukh tay nahi ho raha. Yeh doji candlestick indecision ko darust karti hai. Teisri Candlestick (Bullish Candlestick): Teisri aur akhri candlestick bullish hoti hai, matlab ke yeh market mein trend reversal hone ke chances ko darust karti hai. Is candlestick ki wajah se traders ko signal milta hai ke ab market mein bullish trend shuru ho sakta hai. Iske hone se pehle market mein girawat thi, lekin ab trend change hone ke imkanat hain. Yeh Morning Doji Star pattern traders ko market mein hone wale trend reversal ke liye tayyar hone ka ishara deta hai aur isay samjhnay se traders apni trading strategies ko improve kar sakte hain. -

#4 Collapse

### Morning Doji Star Candlestick Pattern

Morning Doji Star candlestick pattern ek bullish reversal signal hai jo market ki price action mein significant changes ko darust karta hai. Yeh pattern aksar downtrend ke baad banta hai aur traders ko bullish momentum ka andaza lagane mein madad karta hai. Is post mein, hum Morning Doji Star ki pehchaan, characteristics, aur trading strategies par tafseel se baat karenge.

**Morning Doji Star Ki Pehchaan**

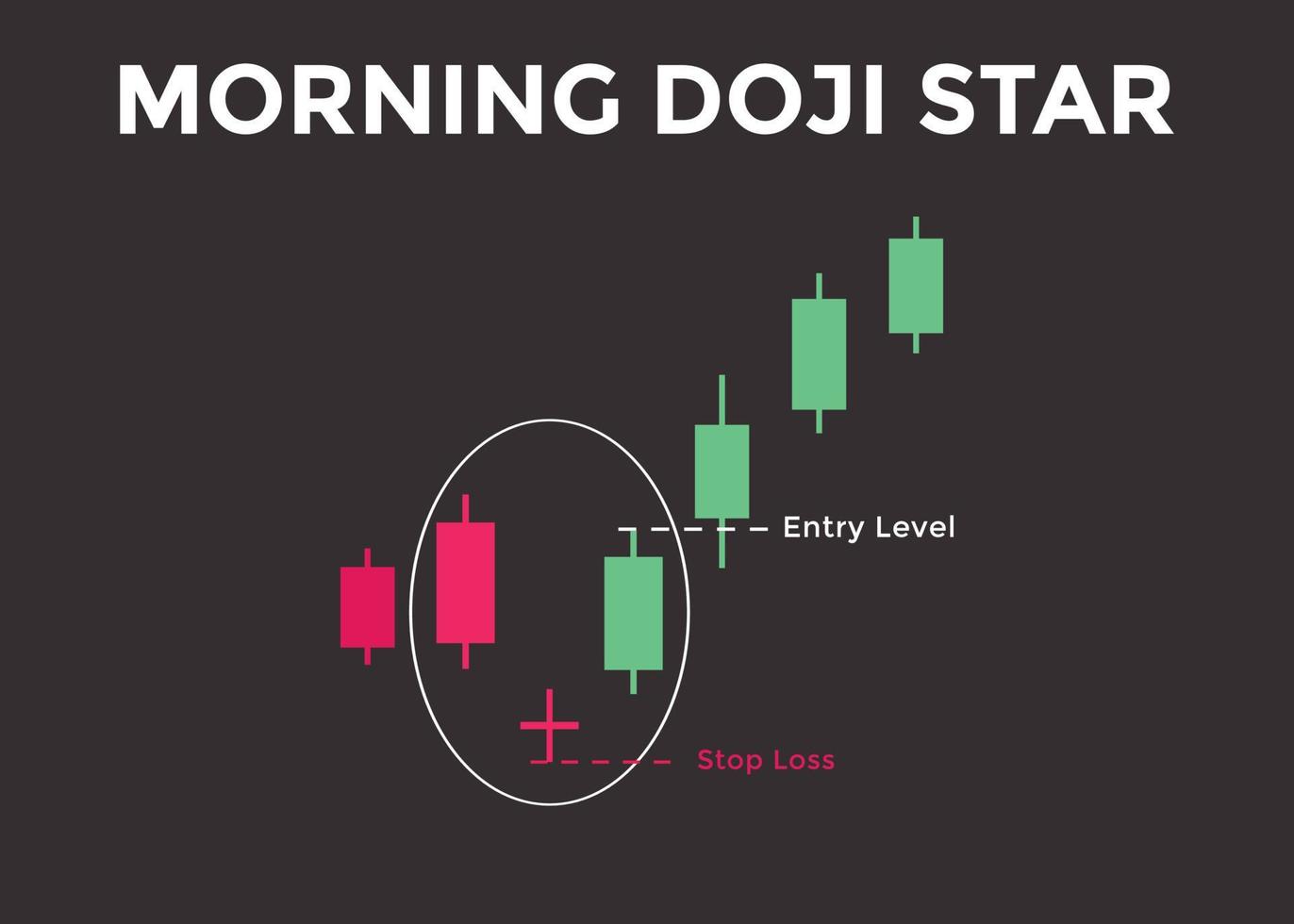

Morning Doji Star pattern teen candlesticks par mabni hota hai:

1. **Pehli Candlestick**: Yeh candlestick ek bearish candle hoti hai, jo downtrend ki tasveer darust karti hai.

2. **Doosri Candlestick**: Yeh ek Doji hoti hai, jisme opening aur closing price ke beech ka farq chhota hota hai. Is candlestick ka upper aur lower shadow hota hai, jo market mein indecision ko darust karta hai.

3. **Teesri Candlestick**: Yeh bullish candle hoti hai, jo pehli bearish candle ke closing price se upar khulti hai, aur buyers ki strength ko darust karti hai.

**Characteristics**

1. **Trend Reversal**: Morning Doji Star pattern tab banta hai jab market ek significant downtrend ke baad hota hai, jo bullish reversal ki nishani hoti hai.

2. **Volume**: Is pattern ki reliability tab barh jati hai jab teesri candlestick ke sath high trading volume ho, jo bullish momentum ko darust karta hai.

3. **Confirmation**: Pattern ka confirmation is waqt hota hai jab teesri candlestick pehli ki closing price ko cross karti hai.

**Market Sentiment**

Morning Doji Star pattern market ki psychology ko samajhne mein madad karta hai. Pehli bearish candle sellers ki dominance ko darust karti hai, lekin jab Doji form hoti hai, to yeh indicate karta hai ke market mein indecision hai. Teesri bullish candle ke sath, yeh dikhata hai ke buyers market par qabza kar rahe hain.

**Trading Signals**

1. **Entry Point**: Morning Doji Star ke formation ke baad jab teesri bullish candle khulti hai aur pehli ki closing price ko break karti hai, to yeh entry ka mauqa hota hai. Traders ko is waqt volume ka bhi dhyan rakhna chahiye.

2. **Exit Point**: Take profit levels ko previous resistance levels ya Fibonacci retracement levels par set karna chahiye. Isse aap profits ko secure kar sakte hain.

**Risk Management**

Morning Doji Star pattern ka istemal karte waqt risk management bohot zaroori hai. Stop-loss ko Doji candle ke low ke neeche rakhna chahiye taake aap unexpected market movements se bach sakein.

**Conclusion**

Morning Doji Star candlestick pattern ek effective tool hai jo bullish reversal signals dene mein madadgar hota hai. Is pattern ka sahi istemal karte hue, traders market ke dynamics ko samajh kar profitable trades le sakte hain. Hamesha risk management ka khayal rakhein aur market ki analysis karte rahein taake behtar results hasil kar sakein.

-

#5 Collapse

Morning Doji Star Candlestick Pattern

Forex aur stocks ke trading mein candlestick patterns aik aham role ada kartay hain kyun ke yeh market ke mood, sentiment aur potential reversal signals ko identify karnay mein madad detay hain. Morning Doji Star candlestick pattern aik special reversal pattern hai jo downtrend ke baad bullish reversal ka signal deta hai. Yeh pattern traders ko batata hai ke market mein uncertainty aur indecision ka phase guzar chuka hai aur ab buyers ka control barh sakta hai.

Morning Doji Star pattern aik three-candle reversal pattern hai jo khas tor par downtrend ke baad nazar aata hai. Is pattern mein pehli candle strong bearish hoti hai jo sellers ke dominant hone ko reflect karti hai. Dusri candle doji hoti hai, jo market mein uncertainty aur indecision ko zahir karti hai. Doji candle indicate karti hai ke buyers aur sellers ke darmiyan balance barqarar hai ya phir energy thori kam ho gayi hai. Teesri candle aik strong bullish candle hoti hai jo buyers ke entry ko darshati hai aur reversal ka confirmation deti hai. Is pattern ka objective yeh hai ke market ke downtrend ke exhaustion ke baad ek naya bullish move shuru ho jaye.

Formation and Characteristics

Morning Doji Star pattern ki formation mein teen candlesticks shamil hoti hain. Pehli candle aik lambi bearish candle hoti hai jiska body significant downward movement ko indicate karti hai. Yeh candle market ke clear downtrend ko confirm karti hai. Dusri candle jo ke doji hoti hai, woh pehli candle ke baad form hoti hai. Doji candle ka matlab hota hai ke open aur close nearly barabar hotay hain, jisse market mein indecision aur confusion zahir hota hai. Is candle ki appearance batati hai ke sellers ne apna force use karna shuru kar diya hai aur buyers abhi tak dominate nahi kar paye. Teesri candle aik lambi bullish candle hoti hai jo doji ke baad form hoti hai aur buyers ke strong entry ko reflect karti hai. Is candle ka close pehli candle ke body ke midpoint ya us se upar hota hai, jisse reversal ka confirmation milta hai. Volume confirmation bhi is pattern mein bohat aham hoti hai; agar teesri candle ke dauran volume significant ho, to yeh aur zyada strong signal deta hai.

Identification of the Pattern

Morning Doji Star pattern ko sahi tareeke se identify karnay ke liye sab se pehle trend context ko samajhna zaroori hai. Yeh pattern aksar downtrend ke dauran nazar aata hai, jab market mein sellers ki dominance hoti hai. Pehli candle ka lamba bearish hona is baat ka saboot hai ke market ne significant selling pressure experience kiya hai. Doji candle ke formation se pata chalta hai ke market mein buyers aur sellers ke darmiyan balance aa gaya hai ya phir sellers ka momentum kam ho raha hai. Teesri bullish candle ke sath agar price pehli candle ke low se upar close karti hai, to yeh reversal ka confirmation deta hai. Agar aap volume ko bhi analyze karain aur dekhain ke teesri candle ke dauran volume barh raha hai, to yeh pattern ki reliability ko further enhance karta hai.

Trading Strategy Using Morning Doji Star

Jab aap Morning Doji Star pattern ko identify kar letay hain to trade entry ke liye kuch specific steps follow karna chahiye. Sab se pehle, pattern ke confirmation ke baad entry point decide karain. Generally, traders teesri candle ke close ke baad long position enter kartay hain. Entry point ke liye aap confirmation candle ke close ya uske break ke thodi der baad entry le sakte hain. Stop loss ko pehli bearish candle ke low se thoda niche set karna chahiye, taake agar market reversal ke bajaye apni downtrend ko continue karti hai to aapka loss limited rahe. Profit target ko set karne ke liye aap previous support levels, pivot points ya Fibonacci extensions ka use kar sakte hain. Iske ilawa, additional confirmation ke liye aap oscillators jaise RSI ya MACD ka bhi sahara le sakte hain. Agar in indicators mein bullish divergence nazar aaye, to yeh entry signal ko aur mazboot banata hai. Morning Doji Star pattern short-term reversal ke liye ek acha setup provide karta hai, lekin iske sath sath overall market context aur trend ko bhi nazar mein rakhna bohat zaroori hai.

Risk Management

Kisi bhi trading strategy ki tarah Morning Doji Star pattern ke sath bhi risk management bohat aham hai. Sab se pehle position sizing ko proper tarah se manage karna chahiye. Apne overall capital ka chhota hissa hi risk mein daalein taake koi single trade aapke portfolio par bohat zyada asar na dalay. Stop loss orders ko hamesha predefined levels par set karain, taake agar reversal false prove ho jaye to aapke losses limited rahein. Agar market unexpectedly volatile ho ya false signals de, to stop loss aapko bacha leta hai. Profit targets ko realistic rakhain aur agar market momentum expected tareeke se shift na kare to partial profit booking ka option bhi consider kar sakte hain. Trading journal maintain karna aur har trade ko detail se analyze karna aapki strategy ko refine karne mein madad karta hai. Emotional discipline aur patience se kaam lein, kyun ke kabhi kabhi market noise ya false breakouts ke sabab impulsive decisions liye jate hain.

Practical Examples

Maan lijiye ke aap EUR/USD chart par downtrend observe kar rahe hain. Pehli candle bohat lambi bearish candle hai jiska body clearly downtrend ko show karta hai. Iske baad ek doji candle form hoti hai jismein open aur close nearly barabar hote hain, jo market mein indecision ko reflect karta hai. Phir teesri candle form hoti hai jo strong bullish move le aati hai aur pehli candle ke midpoint se upar close karti hai. Agar aap volume ko bhi dekhain aur note karain ke teesri candle ke dauran volume significant barh gaya hai, to yeh Morning Doji Star pattern ka clear reversal signal deta hai. Is scenario mein aap long entry consider kar sakte hain. Entry ke liye aap teesri candle ke close ke baad position le sakte hain, stop loss ko pehli candle ke low se thoda niche set kar sakte hain aur profit target ko recent support levels ya Fibonacci extensions ke mutabiq define kar sakte hain.

Psychological Aspect

Trading psychology ka Morning Doji Star pattern ke sath direct taalluq hai. Downtrend ke dauran jab market mein sellers ka pressure hota hai aur phir suddenly buyers ki entry nazar aati hai, to yeh psychological reversal ko bhi darshata hai. Market participants ke liye yeh ek emotional turning point hota hai, jahan pehle fear aur panic dominate kartay thay aur ab confidence barhne lagta hai. Is transition ko samajhna aur analyze karna ek experienced trader ke liye bohat faidemand sabit hota hai. Aapko apne emotions par control rakhna chahiye taake aap timely aur objective decisions le saken.

Additional Considerations

Morning Doji Star pattern ka use sirf ek signal ke taur par nahi balkay market ke broader context ko samajhne ke liye bhi kiya jata hai. Market ka overall trend, economic news, aur geopolitical events is pattern ke interpretation par asar dalte hain. Agar market overall strong downtrend mein ho aur koi major news release ho, to reversal signal ko additional confirmation mil sakta hai. Aksar traders is pattern ko doosray technical analysis tools jaise support/resistance, trendlines aur oscillators ke sath combine karte hain taake signal ki reliability barh jaye. Har trade ke baad apne results ko journal mein record karna aur backtesting se apni strategy ko refine karna bohat zaroori hai.Morning Doji Star candlestick pattern aik powerful reversal indicator hai jo downtrend ke baad bullish recovery ka signal deta hai. Is pattern ki formation teen distinct candles par mabni hoti hai – pehli strong bearish candle, phir ek doji candle jo indecision ko reflect karti hai aur teesri strong bullish candle jo reversal ko confirm karti hai. Is pattern ko sahi tareeke se identify karke, additional confirmation aur proper risk management ke sath trade karnay se aap market ke turning points se faida utha sakte hain. Trading mein consistency, discipline aur continuous learning bohat aham hotay hain. Agar aap Morning Doji Star pattern ko apni overall trading strategy ka hissa bana lein aur sath hi market context, volume confirmation aur risk management techniques par amal karain, to aap apni trading decisions ko behtar bana sakte hain aur long-term success hasil kar sakte hain. Trading psychology ko samajhna bhi zaroori hai kyun ke market ke reversal signals ko objectively analyze karna aur emotions par qaboo paana aapko sustainable profitability ke qareeb le jata hai. Happy Trading, aur yaad rakhein ke har trade aik learning opportunity hai jo aapko future mein behtar decisions lene mein madad deti hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#6 Collapse

Morning Doji Star Candlestick Pattern

Taaruf:

Morning Doji Star ek maqbool candlestick pattern hai jo zabardast bullish reversal ka nishan hota hai. Yeh pattern aksar downtrend ke baad banata hai aur iska chalan market ki bullish mood ki taraf turn hone ki taraf ishara karta hai. Yeh pattern teen candles par mushtamil hota hai:

1. Pehli candle jo ke downtrend se hoti hai (bearish candle).

2. Doosri candle, jo ke Doji hoti hai, jisme khuli aur band hone ki qeemat iqtisaad se barabar hoti hai.

3. Teesri candle jo bullish hoti hai aur iski opening pehli candle ke band hone ki qeemat se upar hoti hai.

Morning Doji Star ka Takhleeq:

- Pehli Candle: Yeh ek long bearish candle hoti hai. Yeh do din ya is se zyada time tak price drop ka nishan hoti hai.

- Doosri Candle (Doji): Yeh candle se do rang hote hain. Is candle ka khula aur band hone ka darja barabar hota hai, jo ke market ka indecisiveness dikhata hai. Yeh dikhata hai ke buyers aur sellers dono ke beech tasavvur hai.

- Teesri Candle: Yeh ek long bullish candle hai. Yeh Doji candle ke baad aata hai aur yeh bullish momentum ko dikhata hai.

Fawaid:

- Trend Reversal: Morning Doji Star aksar ek bearish trend ke baad aata hai aur is ki pehchaan karne se traders ko pata chalta hai ke market bullish hone ki taraf ja raha hai.

- Entry Point: Teesri candle ka higher high par entry lene se traders ko acha fayda hosakta hai kyunki yeh bullish momentum ko confirm karta hai.

Trading Strategy:

- Is pattern ko dekh kar, traders aksar teesri candle ke khulne par buy karte hain.

- Stop loss ko pehli candle ke low par rakha jata hai takay kisi bhi unexpected price movement se bacha ja sake.

Nishkarsh:

Morning Doji Star ek powerful candlestick pattern hai jo bullish reversal ko darust karta hai. Yeh traders ko achi entry points dene me madad karta hai. Lekin, hamesha yeh yad rahe ke kisi bhi trading pattern ke sath risk management hamisha zaroori hai.

Is pattern ko samajhne aur sahi waqt par istemal karne se aap apni trading strategy ko behtar bana sakte hain.

Morning Doji Star Candlestick Pattern

Taaruf:

Morning Doji Star ek maqbool candlestick pattern hai jo zabardast bullish reversal ka nishan hota hai. Yeh pattern aksar downtrend ke baad banata hai aur iska chalan market ki bullish mood ki taraf turn hone ki taraf ishara karta hai. Yeh pattern teen candles par mushtamil hota hai:

1. Pehli candle jo ke downtrend se hoti hai (bearish candle).

2. Doosri candle, jo ke Doji hoti hai, jisme khuli aur band hone ki qeemat iqtisaad se barabar hoti hai.

3. Teesri candle jo bullish hoti hai aur iski opening pehli candle ke band hone ki qeemat se upar hoti hai.

Morning Doji Star ka Takhleeq:

- Pehli Candle: Yeh ek long bearish candle hoti hai. Yeh do din ya is se zyada time tak price drop ka nishan hoti hai.

- Doosri Candle (Doji): Yeh candle se do rang hote hain. Is candle ka khula aur band hone ka darja barabar hota hai, jo ke market ka indecisiveness dikhata hai. Yeh dikhata hai ke buyers aur sellers dono ke beech tasavvur hai.

- Teesri Candle: Yeh ek long bullish candle hai. Yeh Doji candle ke baad aata hai aur yeh bullish momentum ko dikhata hai.

Fawaid:

- Trend Reversal: Morning Doji Star aksar ek bearish trend ke baad aata hai aur is ki pehchaan karne se traders ko pata chalta hai ke market bullish hone ki taraf ja raha hai.

- Entry Point: Teesri candle ka higher high par entry lene se traders ko acha fayda hosakta hai kyunki yeh bullish momentum ko confirm karta hai.

Trading Strategy:

- Is pattern ko dekh kar, traders aksar teesri candle ke khulne par buy karte hain.

- Stop loss ko pehli candle ke low par rakha jata hai takay kisi bhi unexpected price movement se bacha ja sake.

Nishkarsh:

Morning Doji Star ek powerful candlestick pattern hai jo bullish reversal ko darust karta hai. Yeh traders ko achi entry points dene me madad karta hai. Lekin, hamesha yeh yad rahe ke kisi bhi trading pattern ke sath risk management hamisha zaroori hai.

Is pattern ko samajhne aur sahi waqt par istemal karne se aap apni trading strategy ko behtar bana sakte hain.

Morning Doji Star Candlestick Pattern

Taaruf:

Morning Doji Star ek maqbool candlestick pattern hai jo zabardast bullish reversal ka nishan hota hai. Yeh pattern aksar downtrend ke baad banata hai aur iska chalan market ki bullish mood ki taraf turn hone ki taraf ishara karta hai. Yeh pattern teen candles par mushtamil hota hai:

1. Pehli candle jo ke downtrend se hoti hai (bearish candle).

2. Doosri candle, jo ke Doji hoti hai, jisme khuli aur band hone ki qeemat iqtisaad se barabar hoti hai.

3. Teesri candle jo bullish hoti hai aur iski opening pehli candle ke band hone ki qeemat se upar hoti hai.

Morning Doji Star ka Takhleeq:

- Pehli Candle:

Yeh ek long bearish candle hoti hai. Yeh do din ya is se zyada time tak price drop ka nishan hoti hai.

- Doosri Candle (Doji):

Yeh candle se do rang hote hain. Is candle ka khula aur band hone ka darja barabar hota hai, jo ke market ka indecisiveness dikhata hai. Yeh dikhata hai ke buyers aur sellers dono ke beech tasavvur hai.

- Teesri Candle:

Yeh ek long bullish candle hai. Yeh Doji candle ke baad aata hai aur yeh bullish momentum ko dikhata hai.

Fawaid:

- Trend Reversal:

Morning Doji Star aksar ek bearish trend ke baad aata hai aur is ki pehchaan karne se traders ko pata chalta hai ke market bullish hone ki taraf ja raha hai.

- Entry Point:

Teesri candle ka higher high par entry lene se traders ko acha fayda hosakta hai kyunki yeh bullish momentum ko confirm karta hai.

Trading Strategy:

- Is pattern ko dekh kar, traders aksar teesri candle ke khulne par buy karte hain.

- Stop loss ko pehli candle ke low par rakha jata hai takay kisi bhi unexpected price movement se bacha ja sake.

Nishkarsh:

Morning Doji Star ek powerful candlestick pattern hai jo bullish reversal ko darust karta hai. Yeh traders ko achi entry points dene me madad karta hai. Lekin, hamesha yeh yad rahe ke kisi bhi trading pattern ke sath risk management hamisha zaroori hai.

Is pattern ko samajhne aur sahi waqt par istemal karne se aap apni trading strategy ko behtar bana sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:36 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим